1. ETFs to Watch Post Debate…Here are the Top ETFs to Track after Tonight’s 100m Viewer Debate

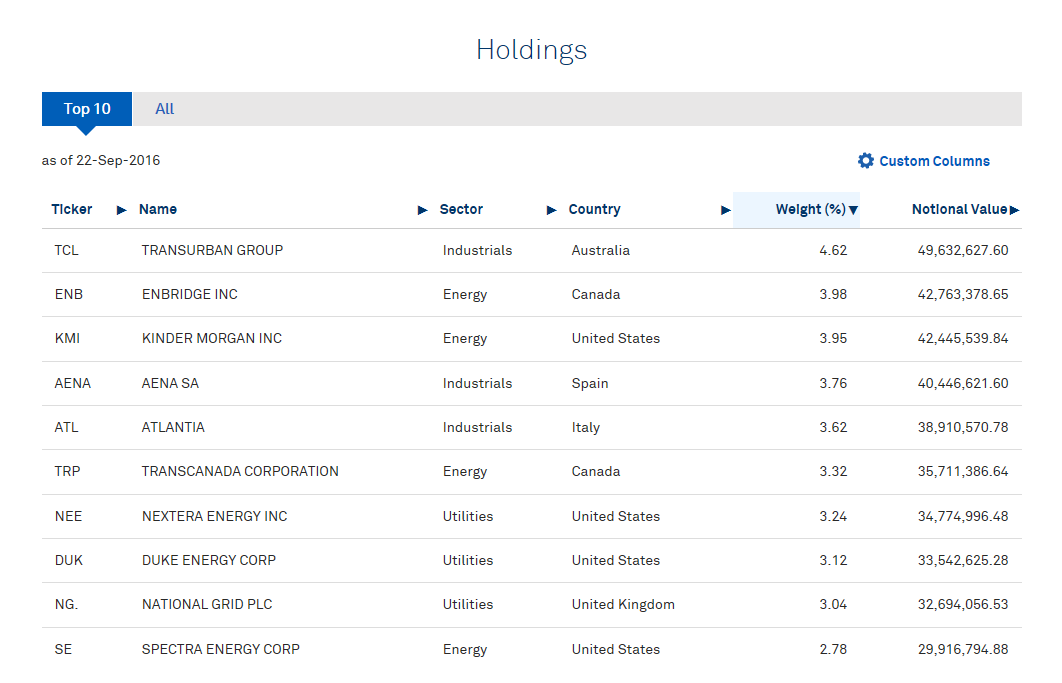

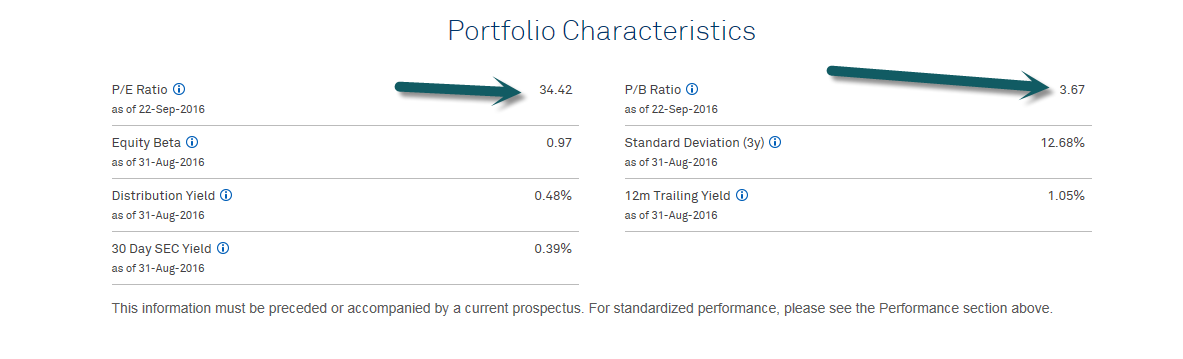

Infrastructure ETF — Close to New All-Time Highs. Both Candidates Advertising Big Infrasturcture Spending.

Plenty of Politically Connected Heavy Hitters in Top Holdings List…KMI, DUK, SE.

https://www.ishares.com/us/products/239746/ishares-global-infrastructure-etf

2. Aerospace and Defense +94% Since Jan. 2013

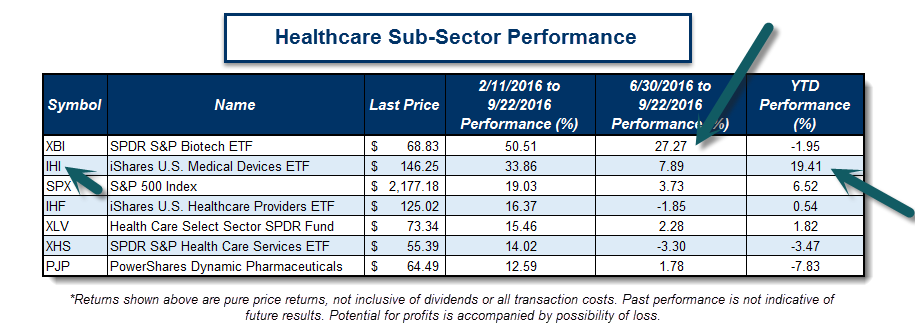

Biotech on a 23% Run Since end of June…Watching Hillary Comments on Healthcare…Bitoech trading at 13.2x earnings 20% discount to Pharma.

3. Another Healthcare Sub-Sector Showing Relative Strength in 2016 is Healthcare Device. +19% vs. S&P +6.53%

IHI Healthcare Device ETF

https://www.ishares.com/us/products/239516/ishares-us-medical-devices-etf

4. Interesting Chart from Torsten Slok

I’m getting questions from clients today about the ongoing divergence between ISM and the IFO, see chart below. Happy to discuss, let your DB sales contact know.

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief International Economist

Managing Director

Deutsche Bank Securities

60 Wall Street

New York, New York 10005

Tel: 212 250 2155

Mixed Picture.

5. 100M Tonight Trump vs.Clinton…Some Comparisons…

Super Bowl Viewership

700m Watch FIFA World Cup….That is Nuts!

Highest Watch T.V. Finales.

https://en.wikipedia.org/wiki/List_of_most_watched_television_broadcasts#United_States

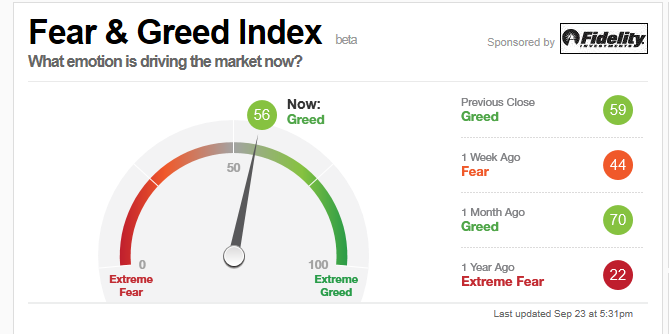

6. Insider Transaction Ratio Bullish Territory…Fear and Greed Index Neutral.

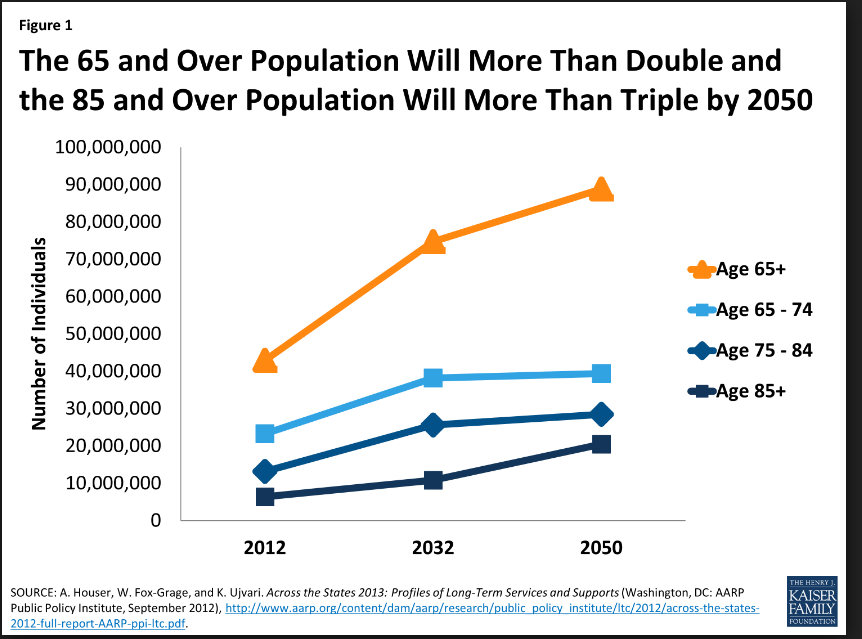

7. Follow up to my Centenarian Hockey Stick Chart from Last Week.

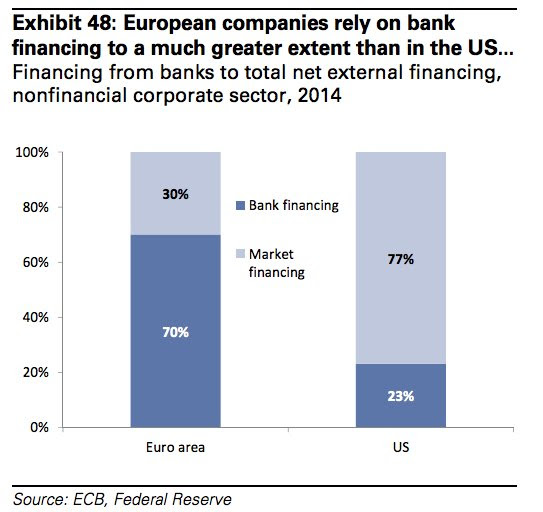

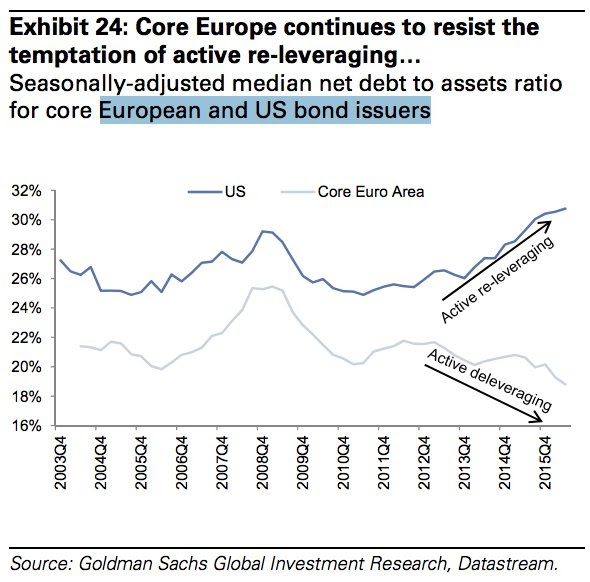

8. Corporations in Europe Rely on Banks…The Banks Continue to De-Lever vs. U.S. Relever.

Given Eurozone-based corporations’ reliance on bank financing (as opposed to capital markets in the US), all this bank deleveraging resulted in the corporate sector deleveraging as well (second chart below).

Source: Goldman Sachs, @joshdigga

Source: Goldman Sachs, @joshdigga

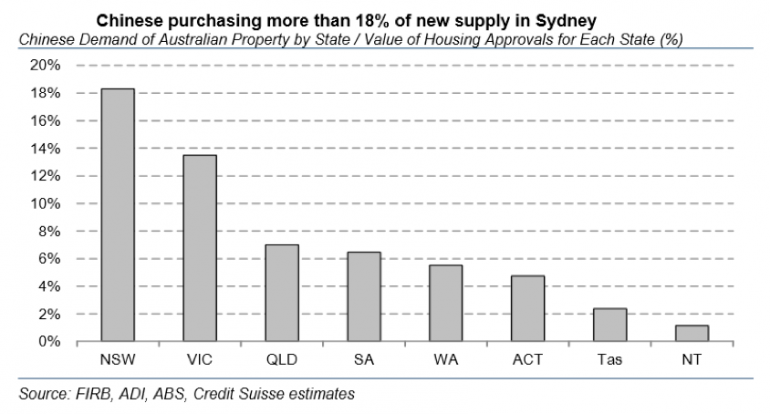

9. Read of Day…In Australia, China’s Appetite Shifts From Rocks to Real Estate…Chinese Investment in Aussie Real Estate Grew 10x Since 2010…Buying half of all new apartments in Sydney and Melbourne.

China’s breakneck growth fueled an iron ore boom in Western Australia. Now, Chinese investors are fleeing a cooling economy by investing in Australian homes. Attracted by clean air, a strong education system and worries about China’s future, more Chinese are spending their money in Australia. Thousands of Chinese families have sent their children to study at costly Australian universities, and Australian food exports to China have boomed. Chinese investment in Australian real estate has increased at least tenfold since 2010; Chinese investors have purchased up to half the new apartments in downtown Melbourne and Sydney.

That has led to some soul-searching about the role of Chinese money in the country’s political and economic life. Businesses linked to China have become sizable donors to Australian political parties, and a company said to have links to the Chinese military obtained a 99-year lease last year for a port next to a base that often houses United States Marines.

Interesting read on collapse of mining industry and growth of real estate.

10. Five steps to creativity

by AdamHGrimes | Sep 20, 2016 | Psychology | 3 Comments

Our culture has an interesting relationship with creativity. On one hand, we hold creative artists in high regard, but many people secretly laugh at the arts as a career choice. We know that sometimes the solution to an impasse requires some out of the box thinking, business schools offer courses and seminars in creativity, yet we’re also likely to tell someone “don’t get creative with this.” What’s going on here? Before I was a trader I was a musician. Specifically, I was a classically trained composer before I was a trader; I spent tens of thousands of hours over more than two decades training and working in that field. I think I have a pretty good perspective on the idea of creativity, and I’ve also learned a bit about teaching others to bring some creativity to their work.

- Creativity draws from knowledge and experience. Maybe you wake up in the middle of the night with a voice telling you to be a painter. Do you grab a brush and create masterpieces? Does someone with a heart full of song pick up a guitar and start a recording career? Does a chef just throw whatever random and different ideas he comes up with on a plate? No. The best creative work–the enduring creative work–comes from people with deep foundations in their discipline. We might be a little misled by a casual reading of history, because many of the great artists were iconoclasts and innovators. It seems that they threw out everything that came before them and forged their own brave, new path. In reality, they knew the classics; they knew the body of work. Picasso understood something about perspective. Dali could paint a straight line. Beethoven understood the rules of harmony that he was stretching. I’m guessing Ferran Adria can probably make a pretty decent fried egg. All of these people changed the world, but they did so with a deep understanding of their field and with everything that came before.

- Creativity needs rules and structure. This one is a stumbling block to many an aspiring artist who wants to break all those rules, but his work is likely to be pretty meaningless unless he understands structure. Robert Frost didn’t write free verse because he said it was like playing “tennis without a net.” Prokofiev said that the more restrictions a composer had, the more creative he could be. Some of these restrictions are imposed by time and space, while others we create for ourselves, but creativity thrives within the discipline of structure, just like a grape vine grows on a trellis. Now, perhaps we wish to break some of those boundaries and restrictions, but we do it with a firm place to stand.

- Technique serves creativity. Craft serves art. We could get into a semantic argument here (oh, how Twitter loves that…), but what I mean here is that we need to have a basic tool kit and draw from that. Where a beginning artist might have to figure out every step, the experienced artist can do much without conscious thought because technique has been integrated below the level of conscious thought. There’s plenty of time to develop those skills, and they are essential. Sharpen your knives. Work on your scales. Learn your statistics and market microstructure. Learn color theory and perspective. No one is above the basics because those are the foundation of creativity. The stronger your background in basic technique is, the easier it will be to express your ideas.

- Creativity requires a new perspective. It is so easy to get into a rut, to think about problems in the same way, and to come up with the same types of solutions. In fact, you might argue that points 1, 2, and 33 above aren’t all that creative–all I’m telling you to do is to learn a field deeply and develop skills in that field. You’d be justified in asking if this is really a path to creativity (it is) or simply a plan to get stuck in the orthodox way off seeing things. Once you have that foundation, and only once you have that foundation, can we look for that spark.

Many tools that are designed to foster creativity have, at their core, techniques that force us to see things from a new perspective. Want some concrete ideas? Look for sayings or ideas that appear to be illogical, and force us to think of opposites as the same. For instance, Zen koans are one source. (Think of the classic “what is the sound of one hand clapping?”) Another might be the fragments of Heraclitus, for instance “the way up and the way down are one and the same.” Take one of these ideas, perhaps randomly selected, and apply it to a problem you are working on. This just might be some of the value behind traditional divination techniques–make a cup of tea and spend a few minutes looking for patterns and shapes in the leaves left in the cup. Now, apply something, anything, from those shapes to a problem you are trying to solve. (Yes, I just wrote a blog about reading tea leaves…) Perhaps tarot cards, astrology, bibliomancy, or other techniques could have value, essentially as a random input to shake up our perspective on a problem?

- The more of these you have the deeper your bag of tricks, the more creative you can be. For traders and investors, I think one more thought is important: there’s a time to be creative and there’s a time to follow the rules. Good problem solving might require some creativity, but a lot of what we do requires structure and focus. What’s the right answer? I think it varies, but you need to think about when and where you want to invite creativity into the process–probably not in risk management, and probably not in position sizing, but very likely in research and idea generation. Last–if you’ve done the work and truly walk a creative path, you don’t always have a choice. Sometimes insight will hit you out of the blue, and you need to seize it. Evaluate it and understand it. (Some creative ideas are exceedingly bad ideas, but your attention to the points above will help you weed those out. Also, even a bad idea might offer something new in another area.)

Spend a few moments this week thinking about how you can foster your creativity and build a new perspective on problems. In the right context, this can be a powerful new skill and can bring growth and progress in leaps and bounds.

(I also did a podcast on this subject a while back. It might be worth a listen if you want to dig deeper.)