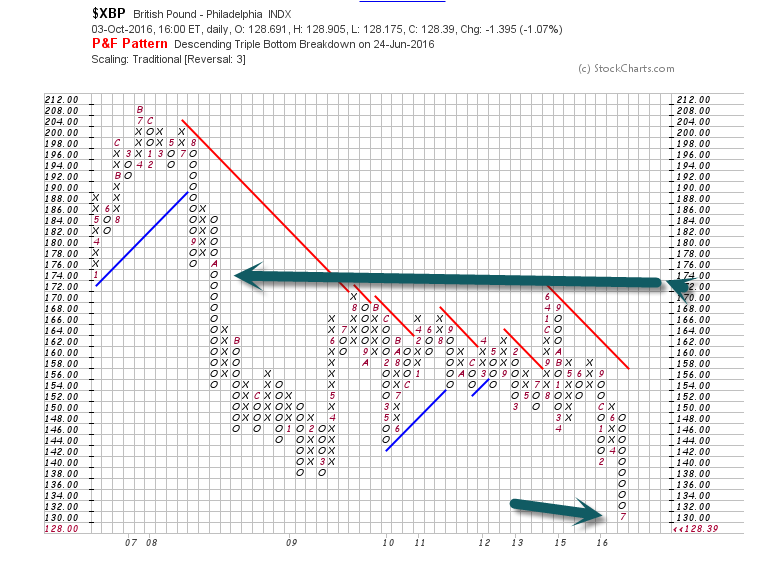

1. British Pound Falls to 31 Year Low Versus U.S. Dollar.

Pound Falls Below Crisis Low, breaks below 7 Year Range.

This Chart is British Pound Versus U.S. Dollar…See Big Drop Off Post Brexit.

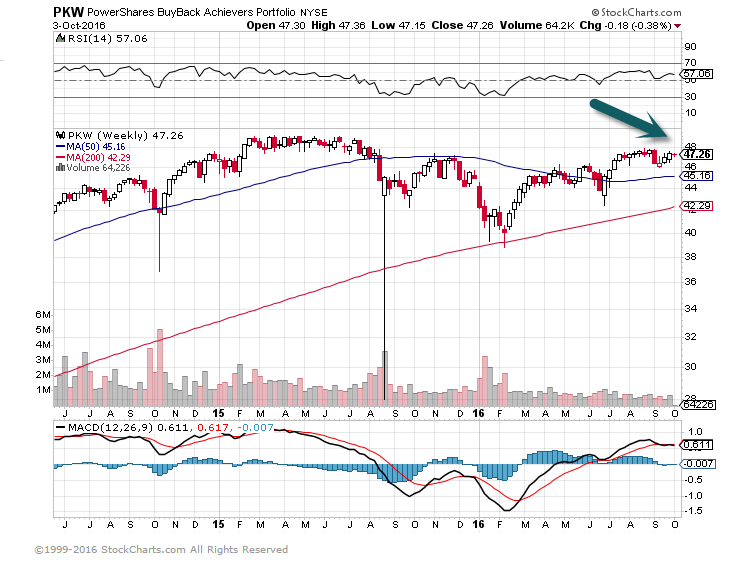

2. Stock Buybacks on Track to be $111 Billion Below 2015.

David Kostin, chief U.S. strategist at Goldman Sachs, on Monday predicted that corporate buybacks — a key source of support for stock prices – will wane in the second half of the year given the decline in the number of authorizations in the third quarter.

“Our buyback desk estimates that gross share buybacks in third quarter 2016 will be 15% lower than in second quarter 2016,” said Kostin in a report.

Companies bought $154 billion worth of stocks in the first quarter and $174 billion in the second quarter while authorizations have lagged behind at $335 billion this year versus $454 billion at the same time last year.

As a result, corporate buybacks are expected to fall to $450 billion this year from $561 billion in 2015.

Buyback ETF has not Made New Highs.

3. German Market is not Telling DB Fear Story…+11% in 3 Months.

German DAX 3 Month Chart.

http://finance.yahoo.com/quote/DAX?p=DAX

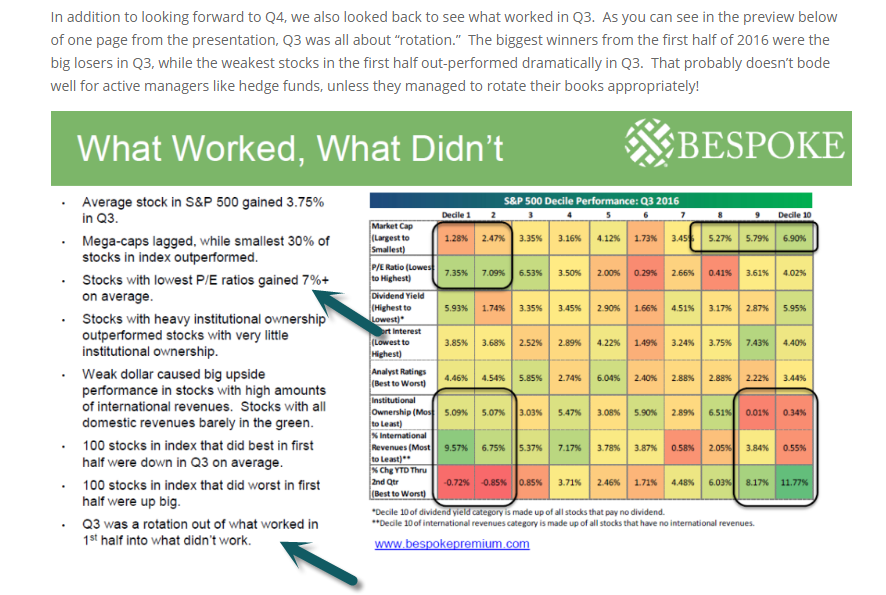

4. What Worked and What Didn’t in 3rd Quarter.

https://www.bespokepremium.com/think-big-blog/

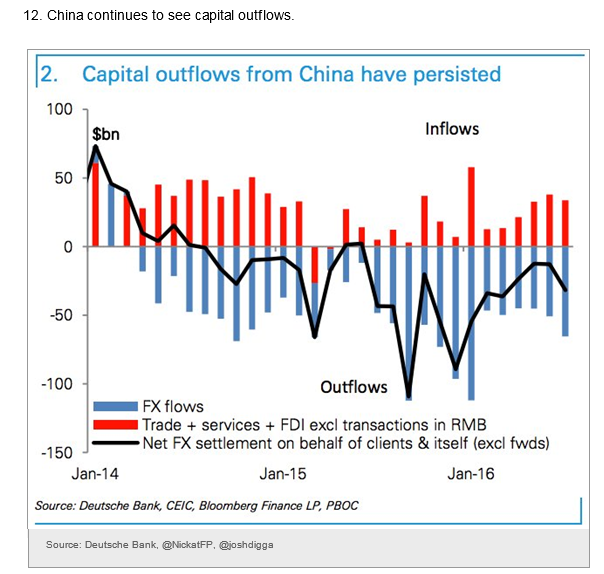

5. China Continues to See Capital Outflows.

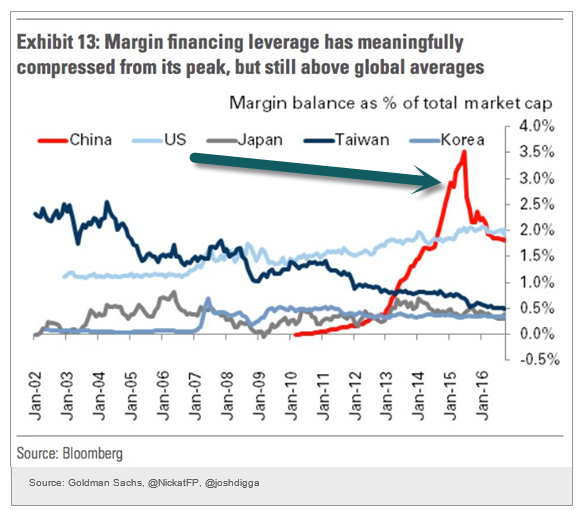

The Average Chinese Investor is No Longer Day Trading on Margin.

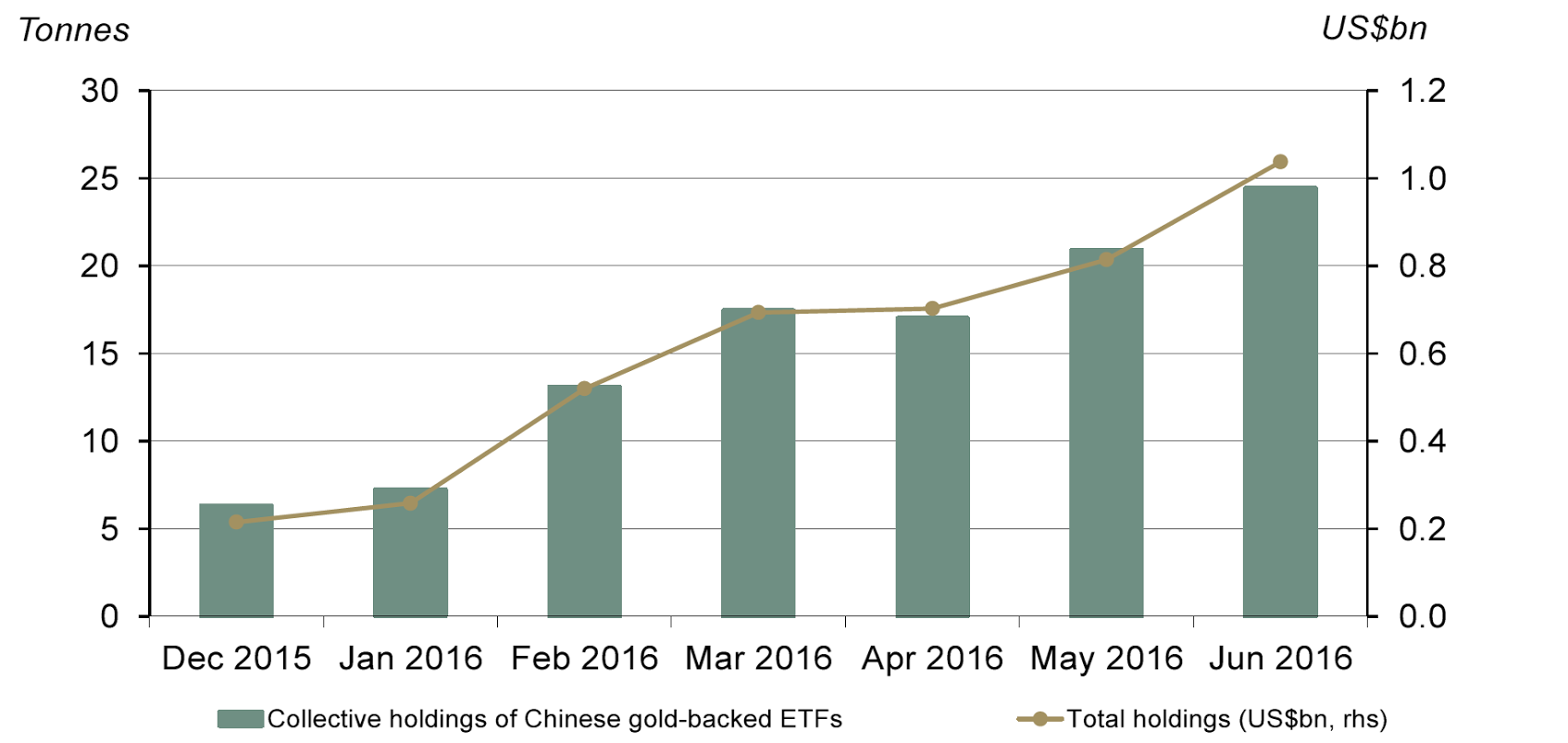

6. Meanwhile…Holdings in Chinese Gold-Backed ETFs have seen a Near Four-Fold Increase in First Half.

7. What is Behind the Surge in the Corporate Debt

Profits are inadequate to fund capital expenditures.

Pressure to Increase Dividends

Rising Operating Costs.

Corporate Stock Buybacks are all the Rage.

Guest post by Norman Mogil

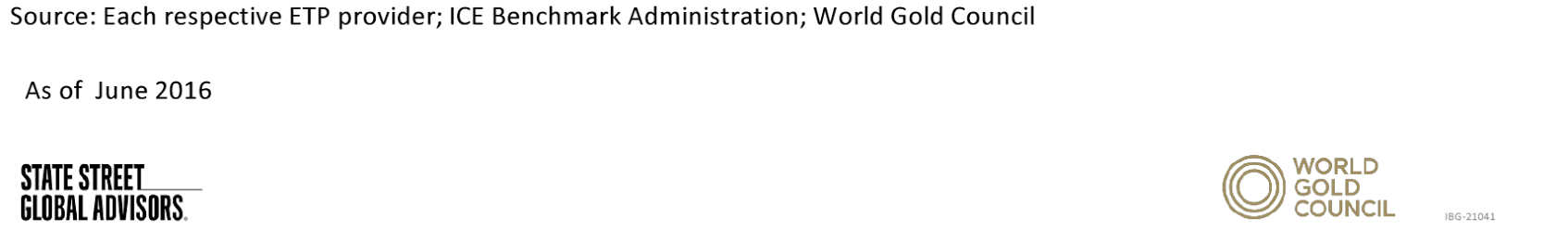

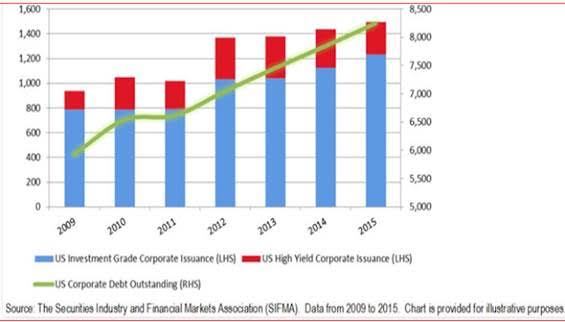

Just as governments are cutting back on issuing new debt, the corporate sector has taken up the role of being the largest source of new debt in the United States. This shift in debt issuance is readily apparent in Chart 1. Since the crisis of 2008, the growth in government debt has dramatically decreased from nearly 20 per cent annually to less than 5 per cent, more in line with the nominal growth in the economy. Consumers continue to remain wary of increasing their debt load . On the other hand, the corporate bond market has been on a bit of a tear in recent years .That segment of the debt market now outpaces all other debt issuers. The U.S. corporate bond market is valued at nearly US $9 trillion; by comparison, it is larger than the GDP of Germany, France and the U.K. combined. No longer are governments the leaders in generating new debt, it has ceded that title to corporate America.

As investors search for yield, corporate bonds are viewed as the darlings of the debt market, principally due to higher yields offered. As the demand for corporates grows, the spread in yields between corporates and U.S. Treasuries has narrowed, a further sign of the strength of the corporate bond market, thus encouraging more companies to issue debt. The rise in corporate debt is supplied mainly by investment-grade corporations i.e. from corporations with excellent credit ratings. High yielding debt (so-called junk bonds) is not as responsible for the burst in corporate debt as is often portrayed in the media . Well-heeled corporations have turned to corporate debt, rather than issuing additional equity, to meet their business needs.What lies behind the surge in new corporate debt?

Read Full Explanation

8. Janus to Be Acquired by U.K. Fund Giant Henderson Group

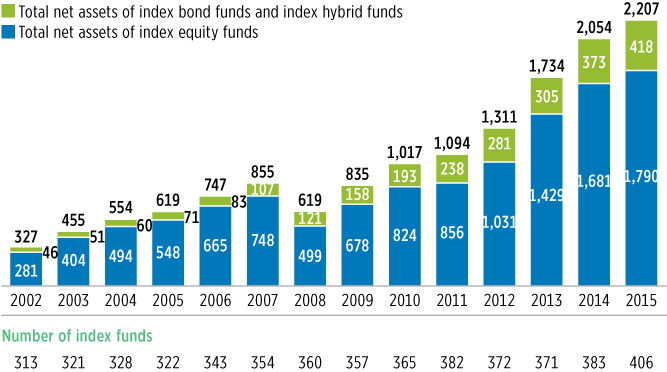

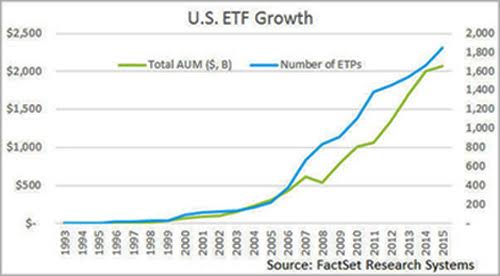

Expect More Active Management Mergers to Gain Scale and Lower Fees…See Rise of Index Funds and ETFs Below.

http://www.icifactbook.org/ch5/16_fb_ch5

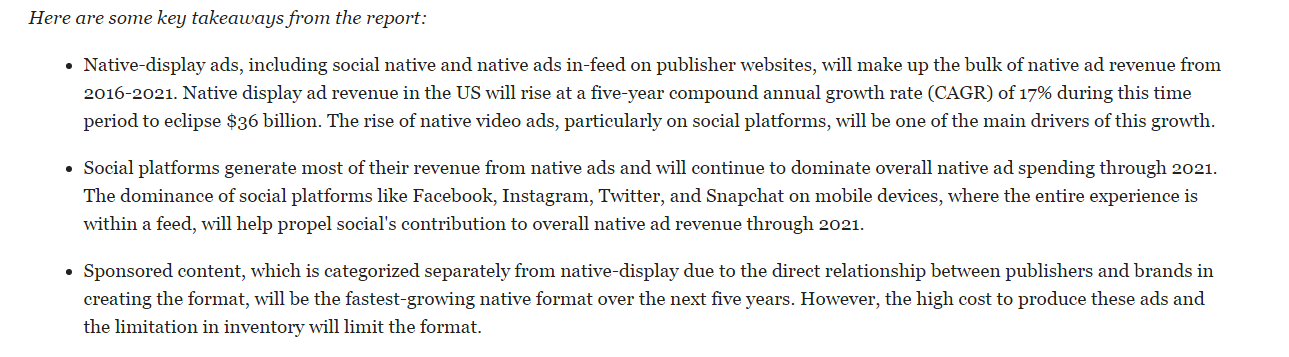

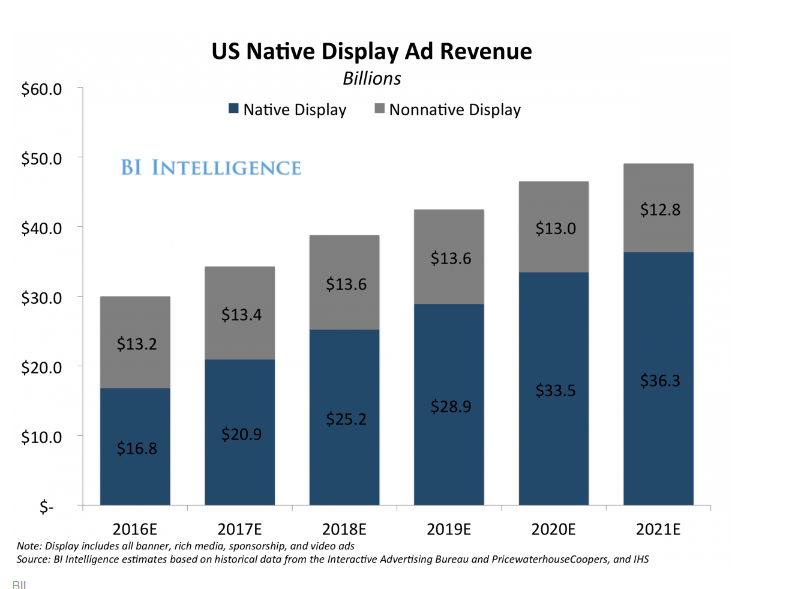

9. By 2021 Native Ad Displays will Make up 74% of Total U.S. Display and Revenue.

Native ads — or ads that take on the look and feel of the content surrounding them — are taking over digital advertising.

Get Full Report at BI.

http://www.businessinsider.com/the-native-ad-report-forecasts-2016-5

10. 10 Mindful Life Lessons From a World-Class Triathlete

A women’s adventure retreat taught me so much more than just biking and hiking.

Posted Oct 03, 2016

Source: unsplash.com

I recently had the good fortune of joining Colleen Cannon, former world champion triathlete and founder of Women’s Quest, and an enthusiastic group of women for an adventure retreat in beautiful Vermont. The camaraderie was wonderful, the hosts top-notch, and the surroundings sublime — the perfect combination for some learning, reflection, and lively reminders of what matters most in life.

Here are my Top 10:

- Although comfortable on two wheels, I had never mountain biked down winding, root- and rock-covered single track trails. Challenging myself was simultaneously frightening and exhilarating. I came home feeling like a warrior, ready to tackle any hurdles along my path. The life lesson: Stepping out of our comfort zone in new, novel ways is empowering and automatically translates into confidence in other areas of our lives.

- Where you look, your body (and bike) will follow. Don’t want to run smack-dab into that tree? You’d better not look directly at it. The life lesson: None of us knows what will appear right around the next corner. Take the time to recognize in which general direction you want your life to head, then keep your eyes focused on that. It is always possible (and sometimes wise) to change course, but barreling ahead blindly or concentrating solely on all of the obstacles in our path is a surefire way to become discouraged (or injured!) or defeated.

- Positivity is infectious. Our retreat leaders are some of the most sanguine people I have ever met, their sense of optimism immediately influencing the rest of us. This beneficial effect can be explained by our brain cells, called mirror neurons, which are activated when we see someone else performing an action or exhibiting an emotion. These neurons actually “mirror” what they observe in others. The life lesson: Our minds are incredibly powerful. Positive thinking does require a dose of wisdom and is not the same as ignoring difficulties or a polyannaish attitude, but we are capable of so much more than we know. Since mood is indeed contagious, we might as well help each other out by searching for the good in each situation and spreading that cheer around.

- When you are single-mindedly focused on pushing yourself out of your comfort zone (say, perhaps careening down a black diamond mountain bike trail) and someone in front (say, perhaps your intrepid guide who happens to be a retired world-champion triathlete) exclaims, “Wheeeeeee!!” it is strangely comforting and grounding, allowing shoulders to literally relax and drop. The life lesson: A brilliantly delivered reminder to have fun (while simultaneously fearing for your life) is often necessary during the intense concentration of learning a new skill.

- When we play outside — hiking or biking or kayaking or fly-fishing — our inner child shows up and age slips away, which is precisely why our fearless leaders appear at least a decade younger than their chronological ages. The life lesson: Nature is healing. It is necessary for our emotional and physical wellbeing to make time for play outdoors — whatever form that takes for you.

- The gift of natural beauty is all around, we just need to be looking for it. Waking to the sight of mountains rising from a mist-covered lake while the birds sing was effortless. Bringing our awareness to the daily beauty we often take for granted requires a bit more effort and intention, but is always accessible. The life lesson: A mindful reminder to pause, look up, and take in the infinite delightful sights and sounds.

- My body wants to rise at dawn. Without the presence of my usual four-year-old (in the form of a child) alarm clock I had anticipated sleeping in, but my body is entirely too conditioned to wake early. The life lesson: There is something to be said for the still silence experienced only at daybreak. Ultimately, I do love quiet mornings and apparently my internal alarm clock does, too.

- Physically challenging ourselves is fantastic but there is such a thing as too much. Especially in our intensely busy culture, the message is to press on without heeding the body’s warnings. There is a sweet spot of effort and challenge, however, that is optimal and energy-enhancing. Push too hard or rest too little and burnout, injury, or illness inevitably ensues. The life lesson: Life is a marathon, not a sprint. Find your sweet spot. Go for ongoing vitality rather than utter fatigue.

- In matters of overall exhaustion, intense physical activity is no match for the constant chattering and demands of a four-year-old. I love my little guy, but he wears me out. The life lesson: Incessant interruption is depleting. Silence is re-energizing. Create time for small bits of silence in your life. Teach your children the value of this as well.

- There is more power in groups than going solo. Throw a diverse group of women together in a safe environmentand magic happens. With a pervasive attitude of support and mutual respect, the sum total of awesomeness is much greater than its parts. The life lesson: If possible, find your tribe or perhaps that one person with whom you can be vulnerable, real, and empowered. Not sure where to look? Start with an interest, a hobby, an item from your bucket list (aka your “life list”). Then revisit life lesson # 1.