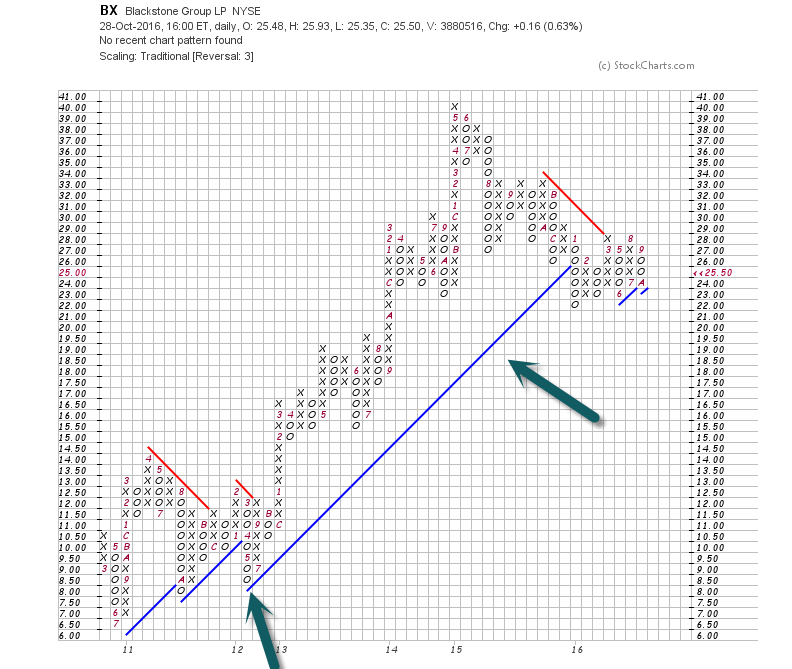

1. What is Blackstone Stock Telling Us About Private Equity Bull Market? Tell on Interest Rates? Leverage? Election?

BX-36% off highs…50day thru 200day to Downside on Weekly Chart.

Trend Line from 2012 Broken.

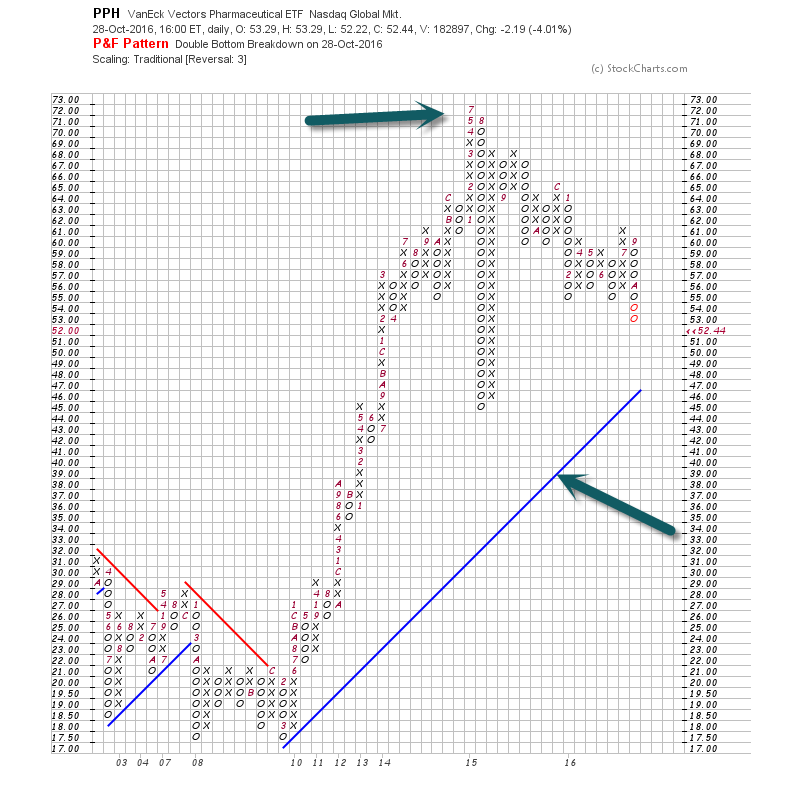

2. The 2 H’s—Hillary and Healthcare.

PPH-Pharma ETF Closes Below red 200day on Long-Term Weekly Chart.

PPH-How much is priced in?? 26% off highs…Still well above blue uptrend line going back to 2010…Can the President trump aging demographics?

BBH Biotech ETF—Even with 30% Correction…The ETF is holding above red 200day for third time this year.

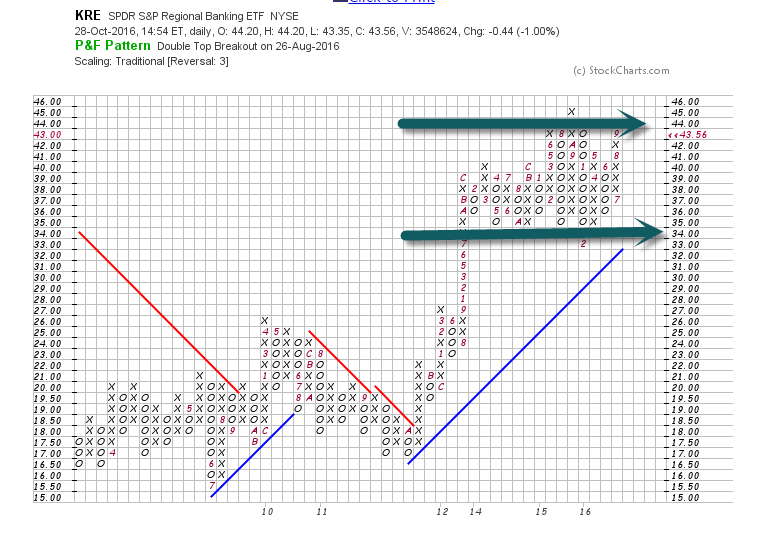

3. Banks are Having Another Run on Interest Rates Rising…Let’s See if they Break Out of this 5 Year Box.

KRE Regional Bank Index.

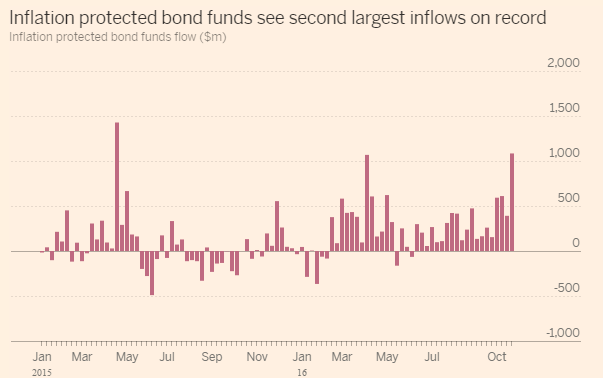

4. Tips are Also Making Run…Bet on Inflation?

Investors pour $1.1bn into inflation-protected bond funds – The inflow is the second-largest since the start of 2007, according to EPFR

Thanks to Dave Lutz at Jones for chart.

TIP ETF Weekly Long-Term Chart—50Day thru 200day.

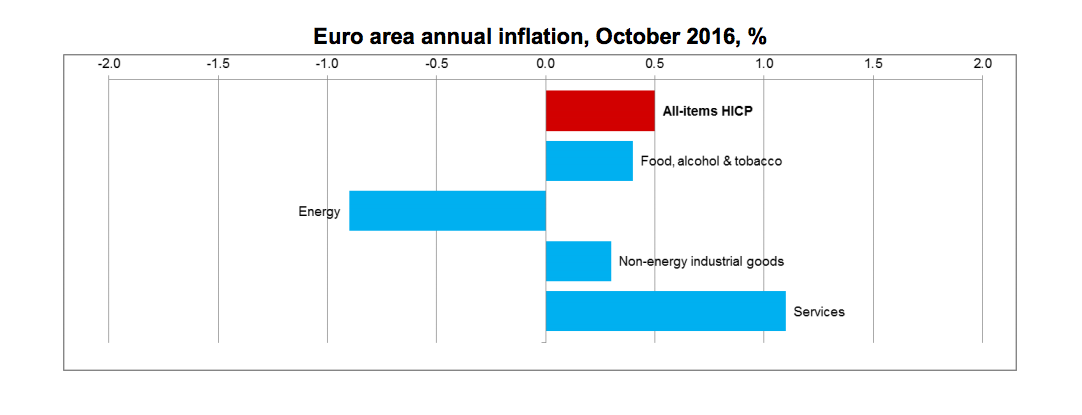

5. EU Central Bank Enacted Zero Interest Rates and $1Trillion in Quantitative Easing with One Goal—Spark Inflation. Is it Finally Working?

Eurozone inflation just hit its highest level in more than 2 years

On a year-to-year basis core consumer prices grew by 0.8%, against a forecast of 0.8%, and a previous reading of the same number.

Core prices are an important measure because they strip out the most volatile items — things like fuel and food prices, which are subject to massive variations.

“Looking at the main components of euro area inflation, services is expected to have the highest annual rate in October (1.1%, stable compared with September), followed by food, alcohol & tobacco (0.4%, compared with 0.7% in September), non-energy industrial goods (0.3%, stable compared with September) and energy (-0.9%, compared with -3.0% in September),” a statement released by Eurostat said.

Here’s the chart showing that breakdown:

Eurostat

http://www.businessinsider.com/eurozone-preliminary-inflation-data-for-october-2016-10

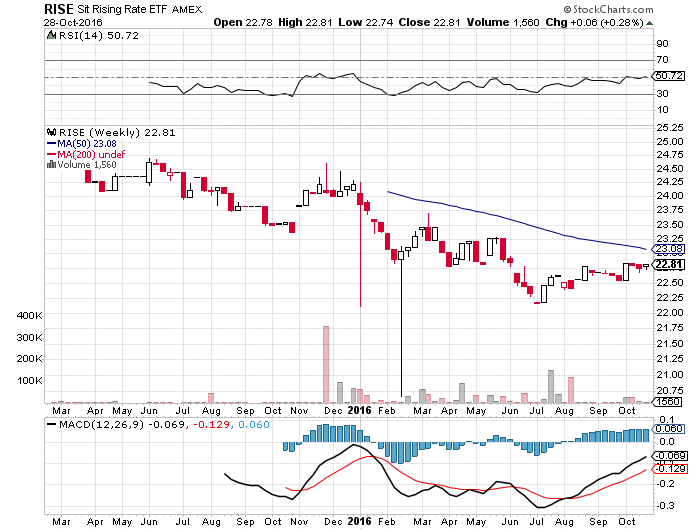

6. Rising Rate ETF.

Sit Rising Rate ETF

RISE is a strategic interest rate-hedging tool that gives investors the opportunity to benefit from the rise in the interest rates of U.S. Treasury notes. The portfolio targets a negative 10-year duration using futures and options on 2, 5 and 10-year maturity Treasury futures contracts.

Fund Holdings as of 10/28/2016

| Name | Ticker | Contracts Held | Market Value USD |

| UNITED STATES TREAS BILLS | 912796JY6 | 9,000,000 | 8998119 |

| US 5YR NOTE (CBT) Dec16 | FVZ6 Comdty | -50 | -6036718.75 |

| US 5YR FUTR OPTN Dec16C120.75 | FVZ6C 120.75 COMDTY | -75 | -24609.38 |

| US 2YR NOTE (CBT) Dec16 | TUZ6 COMDTY | -98 | -21373187.5 |

| US 10YR FUT OPTN Dec16P 130 | TYZ6P 130 COMDTY | 36 | 30937.5 |

| Cash & Other | Cash | 10,275,325 | 10275325.01 |

Holdings subject to change.

http://www.risingrateetf.com/sit-rising-rate-etf.aspx

7. Coal is not Dead Yet…

Early this year, China’s decision to reform its massive coal-mining industry lit a match under the depressed market, cutting output and lifting prices around the world.

However, higher coal prices have backfired in China. As winter approaches, the government is worried that utilities won’t have enough supply. Inflation is another problem, as surging coal prices trickle down to electricity bills for households and factories. “It’s a source of concern for them now,” says Tom Price, a commodity analyst with Morgan Stanley.

In recent weeks, the NDRC has convened state-run coal producers and removed some of the supply constraints, stoking fears that increased production will cause prices to fall again. China’s coal imports fell in September from a month earlier. And in the futures market, Newcastle coal prices are deeply backwardated, with the fourth-quarter contract for 2017 trading at $70 per ton, a 30% discount compared with the spot market. That suggests the market expects lower prices in the future. “The concern is that this price rally isn’t going to be sustainable, because China may just as easily reverse its mandate to cut production,” says Andrew Moore, managing editor of Platts Coal Trader.

Those worries will keep a lid on prices near term, but some analysts are more optimistic about coal’s long-term outlook, betting that the Chinese government will have to consolidate its fragmented and inefficient coal industry—which currently accounts for half of the global supply. “This is such a huge industry that the NDRC has no choice but to return to carrying out the reform program through 2017, and maybe into 2018,” says Price.

http://www.barrons.com/articles/coal-prices-will-cool-down-1477714706?mod=BOL_hp_we_columns

Coal ETF-KOL +110% 2016.

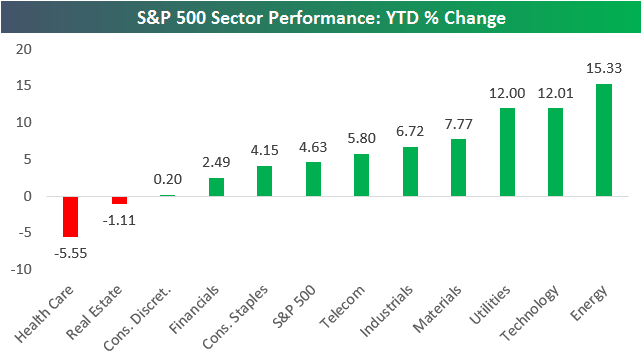

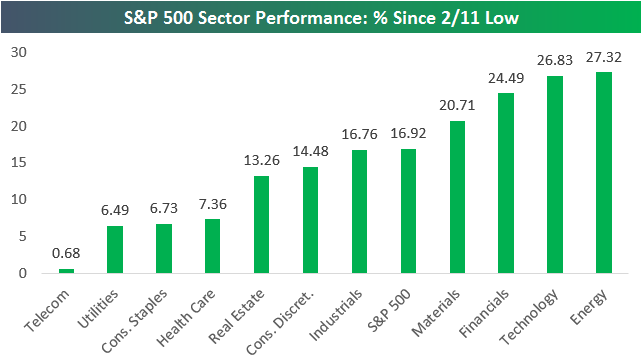

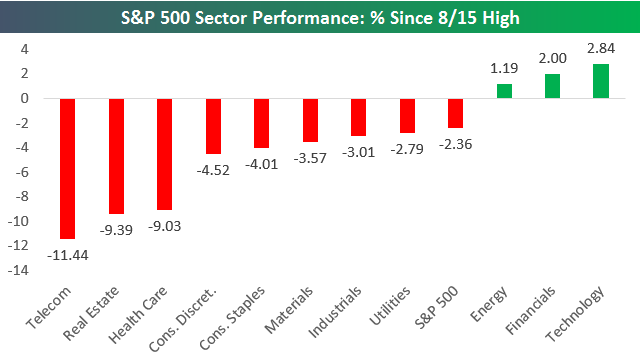

8. Sector Performance Off Feb. Lows…Is this Telling Us a Story for 2017 Leadership?

Oct 28, 2016

Below are three charts highlighting sector performance so far in 2016. The first shows year-to-date performance, where you can see that Health Care has been the clear laggard with a decline of 5.55%. Real Estate is the only other sector that’s down year-to-date, while Utilities, Technology, and Energy are all up more than 10%.

Since the S&P 500 made its 2016 low on February 11th, the index is up 16.92%. Those gains have primarily been driven by Energy, Technology and Financials. Energy is up 27.32%, Tech is up 26.83%, and Financials is up 24.49%. Four sectors have lagged significantly — Telecom, Utilities, Consumer Staples, and Health Care.

Our final chart shows sector performance since the S&P 500 made its year-to-date (and all-time) high on August 15th. As shown, the S&P as a whole is down 2.36%, but eight of eleven sectors are down more than that, which shows how weak breadth has been. If it weren’t for Tech, Financials, and Energy posting gains over this time period, the S&P would be down a lot more. Tech is by far the biggest sector of the market with a weighting of 21%, and its gain of 2.84% since 8/15 is what has kept the market from completely breaking down. The biggest areas of weakness have been Health Care, Real Estate, and Telecom, which are all down more than 9%.

https://www.bespokepremium.com/think-big-blog/

9. Read of the Day…Cullen Roche.

Chart of the Day: Golden Era of Low and Stable Growth

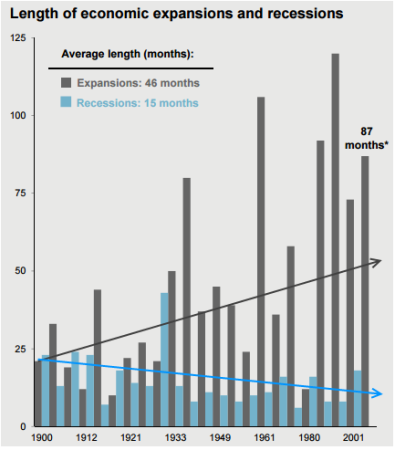

One of the dominant themes in economics these days is that low growth means we are worse off. Some people call this “secular stagnation” or something similar. I’ve challenged this view and say this doesn’t account for how stable our economy has become. In other words, it doesn’t adjust for the risks we face.

You see, in portfolio management low growth isn’t necessarily bad. After all, would you rather earn 8% on a rollercoaster ride of volatility or would you rather earn 6% in an incredibly smooth and predictable trajectory? The point is, it’s not just about how high your returns are. It’s about how you achieve those returns. Most people would sacrifice some growth in exchange for greater stability. Likewise, in our economic growth we should be happy to see lower growth if it comes with greater stability.

>global growth has only averaged about 2% per year since 1700 so those 3-4% growth rates of the late 1800’s and 1900’s were a secular boom). And at the same time we’re achieving that lower growth rate with much greater stability as our expansions become longer and our recessions become shorter. Even when you adjust for the depth of downturns, our economy is becoming much more stable (including the 2008 crisis) as the depth of these recessions become less dramatic over time.

(Edited Chart – I added those pretty arrows – via JP Morgan)

This doesn’t mean everything is hunky-dory. Low growth could coincide with other bad effects like greater inequality. But it also highlights the fact that things might not be quite as bad as many seem to believe…

http://www.pragcap.com/chart-of-the-day-golden-era-of-low-and-stable-growth/

10. 8 Things to Remember When You Fail

Changing the way you think about failure is key to bouncing back.

Posted Oct 30, 2016

Source: Fotolia.com

Why does failure cause some people to give up on their dreams while others bounce back even better than before? It has to do with the way they think about failure. Failure can be part of the long road to success—but only if you think about it in a way that’s productive.

Beating yourself up for your lack of success or declaring yourself a hopeless cause leads to unhelpful feelings, like shame or resentment. And it can lead to unproductive behavior, like staying inside your comfort zone.

The key to recovering from failure is changing the way you think. When you think about failure differently, you’ll be able to turn your biggest setbacks into your best comebacks. Here are eight healthy ways to think about failure:

-

“Even though things didn’t work out the way I wanted, I’m still OK.”

Catastrophizing failure isn’t helpful. Keep failure in proper perspective and choose to be grateful for what you have. Whether you still have your health or you have a roof over your head, there are always things to be grateful for. - “Failure is proof I’m pushing myself to my limits.”

You could probably live a safe and boring life that is relatively free of failure if you wanted. But, if you want to become a better version of yourself, you’re going to need to do things that could cause you to fail. Falling down is evidence that you’re trying to do something hard. - “I will focus on the things I can control.”

Failure isn’t always personal. Just because you didn’t get that promotion doesn’t mean you’re not good enough. Instead, it might mean you were simply competing against someone more qualified. Focus on the things you can control—like doing your best—and focus less on the outcomes that you can’t control—like whether you’ll get hired. -

“Failing feels uncomfortable, but I can handle it.”

Doubting your ability to handle embarrassment, shame, or regret makes the pain of failure last longer. Remind yourself that you can handle failure, and you’ll be more likely to deal with the discomfort in a productive manner. - “Failure is a verb, not a noun.”

Just because you fail doesn’t mean you’re a failure. Everyone succeeds at some things and not at others. Remind yourself of the success that you have had in other areas of your life. -

“Failure is an opportunity to sharpen my skills.”

If everything came easy, you wouldn’t have an opportunity to learn new things. Each time you fail, you can learn something new. Whether you discover new solutions or you gain more insight, failure can help you do better next time. -

“Recovering from failure can make me stronger.”

Each time you bounce back from problems and rise above obstacles, you can grow mentally stronger. Failure can show you that you’re stronger than you think and you can handle more than you imagine. Each time you fail, you can build mental muscle. -

“I’ve overcome tough things before. I can do it again.”

Recalling on the times when you’ve rebounded before can help you feel equipped to deal with failure again. Draw upon the knowledge, tools, and talents you’ve used before and remind yourself that you can bounce back again.