1. Warm Weather…Natural Gas 13.5% Pullback in 7 Days.

UNG Natural Gas ETF…See High Volume on Second Arrow.

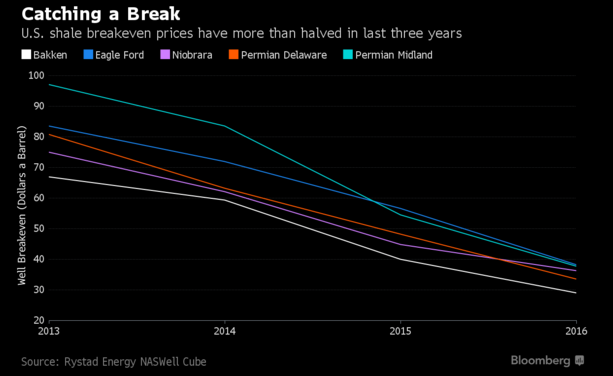

The wildcatters of the US shale patch successfully cut costs and consolidated operations to weather the storm of $40 oil, leaving behind a leaner more resilient industry that should benefit as prices recover. In the US, the price fall arguably helped speed the repeal of 40-year-old curbs on crude exports, allowing the country’s oil to be shipped to customers in Asia and Europe on the largest scale since before the Arab oil embargoes of the 1970s.

2. Please, Give Me a Break

Posted October 26, 2016 by Michael Batnick

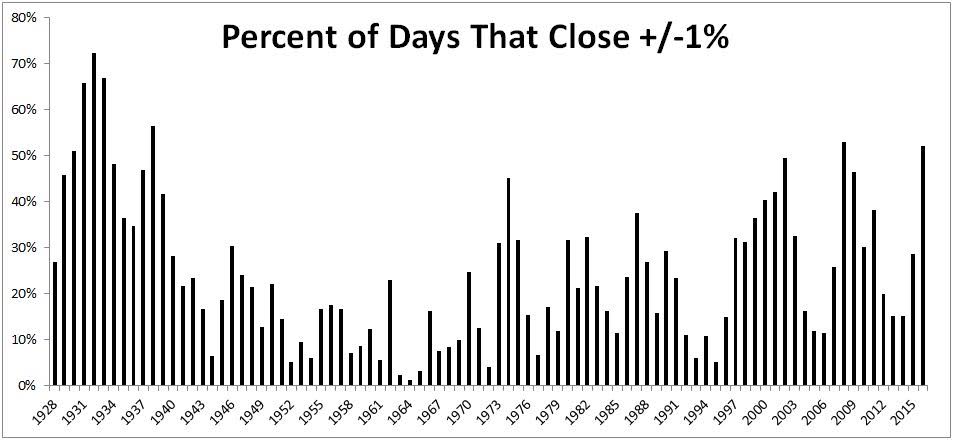

2016 got off to a volatile start, it felt like every day was either up or down one percent. In fact, when I made this chart on March 11th, 28 of the first 46 days of the year fit this criteria.

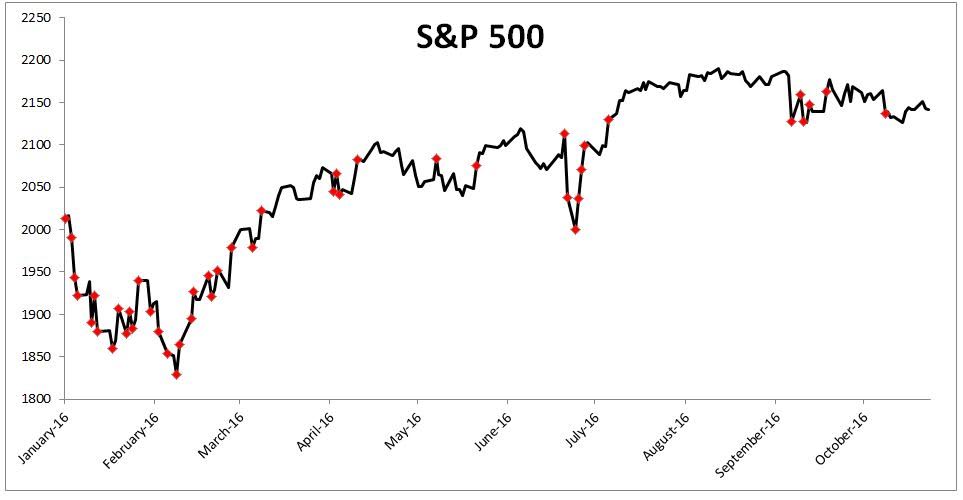

Now seven months later, that number has fallen off a cliff, collapsing to just 22%. And just as we all thought would happen, volatility vanished as we got closer to the election. The chart below with the red diamonds is a good visual of the volatility tapering.

It turns out that election years aren’t more volatile than normal, at least looking at the number of one percent moves. The average of all years going back to the election in 1928 shows that 24% of all days move one percent, versus just 22% of the days for election years.

The idea that the election would cause volatility is another example of linear, if then thinking. It’s never that easy. And now the narrative has shifted from stocks are volatile because of the upcoming election to stocks aren’t going anywhere because nobody wants to do anything before the election. Please, give me a break.

http://theirrelevantinvestor.com/2016/10/26/please-give-me-a-break/

3. Intermediete Term Volatility not Even a Blip Up for Election Season.

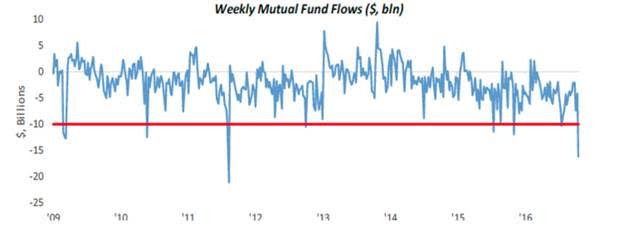

4. Over the 12 Months Through Sept. Mutual Fund Investors have Withdrawn a Net $238 Billion from U.S. and International Equity Mutual Funds…The Last 7 Days was the Biggest Exodus in 5 Years.

– “Largest exodus in five years hits U.S.-based stock mutual funds: ICI” – The investors pulled $16.9 billion from stock mutual funds in the seven days through Oct. 19, more than in any other week since August 2011, the trade group’s data showed – By contrast, stock exchange-traded funds took in $2.4 billion.

The latest data is another somber development for stock mutual funds which, despite strong markets, are on pace to record a year of withdrawals comparable with the 2008 peak of the global financial crisis.

Thanks to Dave Lutz at Jones for Chart.

5. Is the Quarterly Earnings Rig Ending with Mutual Fund Outflows?

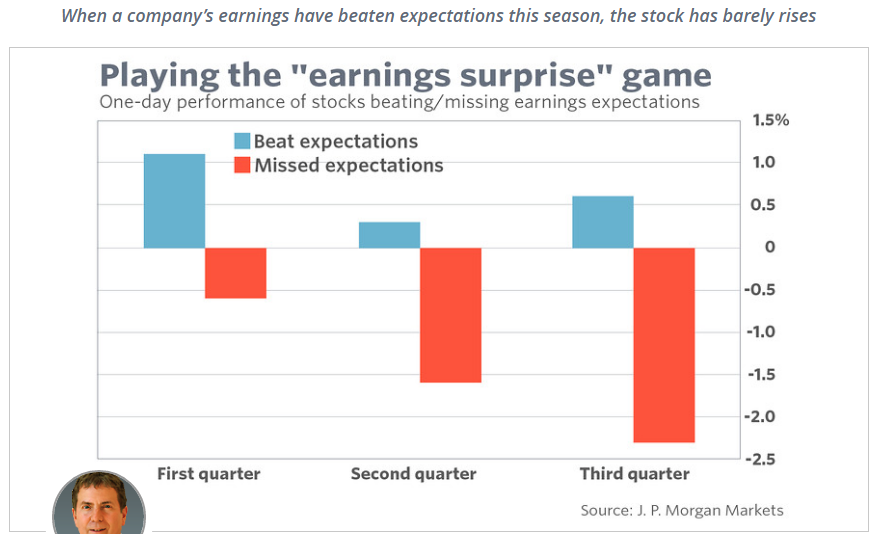

This asymmetry is evident in the performance of a company’s stock immediately after reporting its earnings. During the current earnings season, the stocks of companies’ missing expectations fell 2.3% following their earnings reports, versus just a 0.6% average gain among companies that beat. (Data is from J. P. Morgan Markets.)

Furthermore, as you can see from the accompanying chart, this penalty for missing the analyst consensus has been steadily growing this year.

These developments have implications not just for investors who focus on earnings surprises and earnings revisions. All of us need to cultivate a healthy dose of cynicism about analysts’ earnings estimates.

Perhaps the best way to immunize yourself from the expectations game is to focus on long-term growth rather than quarter-to-quarter results. That’s because the longer-term trends can’t be manipulated in the way in which quarterly results can.

Another reason to focus on long-term growth is that companies that expend enormous amounts of energy on manipulating short-term results may very well be sacrificing their long-term growth in the process.

For more information, including descriptions of the Hulbert Sentiment Indices, go to www.hulbertratings.com or email mark@hulbertratings.com

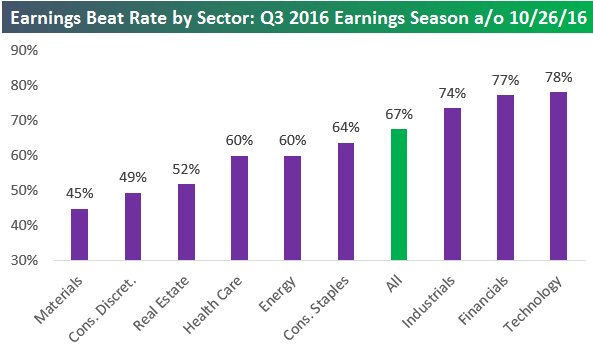

6. 67% of Companies have Beaten Earnings so far this Quarter.

B.I.G. Tips – Beats Get Beaten

Oct 27, 2016

So far this earnings season, 67% of the companies that have reported their quarterly numbers have beaten consensus analyst earnings per share estimates. That’s actually a very strong reading relative to the historical average earnings beat rate. As shown below, sectors like Technology, Financials, and Industrials have posted even stronger beat rates this season. A whopping 78% of Tech stocks have beaten estimates.

Unfortunately for market bulls, the strong beat rate has not translated into higher stock prices. In a B.I.G. Tips report just published for Premium and Institutional subscribers, we look into this phenomenon — explaining why it’s happening and what it might mean for the market and the individual stocks that are getting hit after they report earnings.

https://www.bespokepremium.com/think-big-blog/

7. Healthcare CPI Growing 5% Rate.

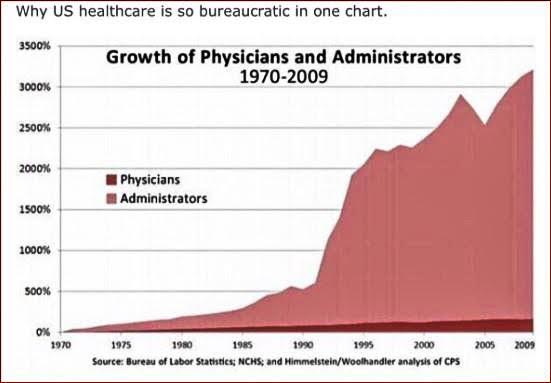

Sen chooses “the CPI medical care index measures price growth in consumer out-of-pocket healthcare expenses. It’s now growing at almost a 5 percent rate. Wage growth for workers is finally accelerating, but if that additional income all gets eaten up by healthcare costs it’s going to hold back a more robust economic expansion.”

Conor Sen, portfolio manager at New River Investments.

http://www.bloomberg.com/news/articles/2016-10-27/these-are-the-charts-that-scare-wall-street

https://hbr.org/2013/09/the-downside-of-health-care-job-growth

8. Follow up to my 6000 ETF Piece Earlier this Week…200 ETFs Launched this Year.

ETF Watch:

October 27, 2016

200 New Funds Launched This Year

The year 2015 was a record-breaker when it comes to ETF launches, with 284 ETFs entering the market, the most ETFs to launch in a single year since 2011. This year is unlikely to break that record, but as 2016 verges on 200 launches, with two months left to go until 2017, it looks like 2016 will at least see a respectable finish.

In 2015, nearly 45 funds launched during November and December, so we could be in for a very active few months, even if we see half that number of rollouts. Closures are likely the bigger story, with the current tally well past 100 shutdowns, a significant number, even if it isn’t necessarily a record.

Still, 2016 hasn’t been unextraordinary: Some 40 ETFs shut down in August, with almost 25 more closing in September. Those are rather staggering numbers for closures, which usually only number a few every month.

However, September also saw 41 launches, making it the most prolific month for ETF debuts in recent memory. Even in 2015, with its record number of total launches, the month with the highest number of launches was July, with 37 rolling out in the U.S.

In general though, the increase in closures, and the slight slowdown in launches, suggests that the ETF industry is reaching a new stage of maturity.

Contact Heather Bell at hbell@etf.com.

http://www.etf.com/sections/daily-etf-watch/etf-watch-etfs-almost-200-launches-ytd?

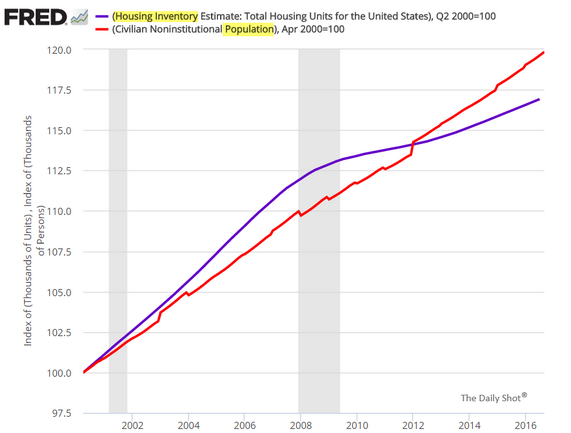

9. We are a Few Years Away from Housing Shortage.

As discussed before, the US is facing a housing shortage, which will become acute in the next few years. This chart shows the total housing stock vs. the population over time.

10. A Surprising Thing I Learned About Setting Goals

Why is it, I kept asking myself, that nobody follows my advice on personal productivity?

Every January, I write an essay bragging about all the things I got done the previous year, urging readers to use my personal productivity program.

But it seems like I convince no one. We get no emails from readers saying they are going to get on board. Nor do we get notes at the end of the year about all they’ve accomplished.

I’ve pitched it at business meetings, dinners, and family reunions, but I have yet to convince a colleague, friend, or family member to do it. What the heck am I doing wrong?

I got tired of asking those questions last month and decided to find out. I invited a small group of people to participate in a year-long project, during which I would teach them my system and coach them to follow it.

We just had our first meeting. And I have already discovered something important.

An idea I had about goal setting was wrong.

I began the meeting by talking about how my life changed when I decided to get rich. I always use that phrase — decided to get rich — to emphasize what was for me the most important part of that experience. I spent 30 years wanting to get rich and never did.

And then, one day, I decided that getting rich was going to be my top priority, and that’s when the money started piling up.

So, that’s one thing: the difference between wanting and deciding.

Deciding implies intention and purpose, not just volition. (That was not my discovery. I’ll come to that now. But keep that thought in mind.)

Next, I told them that when I retired for the second time and began writing Early to Rise, I had the opportunity to think about that experience and assess what was good and bad about it.

I came to the conclusion that making one goal your only goal is very powerful. It changes the way you think dramatically. Your mind becomes shark-like in its ability to make both big and small decisions. Such clarity means the likelihood you will achieve that goal becomes a near certainty.

That is good. But there is another effect of having only one goal that is bad. It means you will inevitably sacrifice other wants you have listed on your mental desiderata. In my case, for example, I sacrificed my health, my hopes of writing fiction, and my desire to be happy.

So, in developing a goal-setting strategy for Early to Rise readers, I offered a choice: If you want the best possible chance of achieving one goal, make it your only goal. But if you want a well-balanced life, create four goals: one financial, one health, one personal, and one social.

That’s what we did at last week’s meeting. I asked everyone to think about whether they wanted to choose one goal or four. And then I asked if anyone wanted to share a major goal. Bob Irish (a friend and colleague) said that after he retired, he decided he would get into the best shape of his life. And then Joe shared his goal: having passive income of $150,000 in five years.

Now, if you have read anything about goal setting, you are already thinking that Joe’s goal was better than Bob’s because Joe’s goal was very specific. It was specific in two ways: a particular objective in terms of how rich ($150,000 in passive income) and a particular time frame (five years). Bob’s goal, in contrast, was vague on both counts.

In writing about goal setting in the past, I had, like most others, advocated specificity. And yet, I knew in my gut that Bob’s vague goal was actually a good and achievable goal, whereas Joe’s was not.

Because of commitment bias, I felt like I should commend Joe for making his goal so specific. But I knew, because I knew his personal situation, that it was a badly designed goal and that it would lead to frustration and self-doubt rather than success.

And then it hit me: The goal I set for myself 30-odd years ago, the goal of “being rich,” was a vague goal, just as vague as Bob’s.

So, I’m writing to you now to tell you that I think this whole idea of being very specific when setting big goals is wrong. I do believe in specificity when it comes to identifying shorter-term objectives. But when it comes to the big goals, I’m now saying make them vague.

There are two big benefits in doing this.

First, when you make your big goals doubly specific (quantifying the objective and setting a time frame), you may be setting yourself up for failure. In Joe’s case, as I mentioned, there was no way I could imagine him achieving that goal unless he quit his job immediately and took the risk of becoming an entrepreneur. But to do that, he would have to put the financial security of his family at risk. And knowing him and his core values, I was certain that was a bad idea.

Now, if Joe’s goals were considerably more modest — say, doubling his salary in five years — then his chances of success would have been very good. But that would be a small goal, not a big goal. To set and accomplish big goals, you should make them vague.

Second, the true reward you get by setting and accomplishing goals is not in the final accomplishment, but in the process of moving forward. In Bob’s case, he would begin to feel better about himself the very first day he began to get into better shape.

And that good feeling would motivate him to continue working toward the goal. And all the while he’d be feeling that goodness.

That’s what happened to me with my vague “get rich” goal. I began to feel “richer” the very next day when I was making decisions at work that I knew would eventually make me richer. I then felt good about every step I took along the way: when my salary doubled from $35,000 to $70,000, when I paid off my debts, when I made my first million, and so on. But the pleasure of achieving that goal came mostly from the process of moving forward, not from the accomplishment of it, which would only have come once at the very end.

Do you see what I’m saying?

Your big, long-term goals should be vague or at least somewhat vague (if you want to make the objective specific, leave the date out, or put the date in and make the objective unspecific), because that vagueness will allow you to enjoy every day along the path, not just the final day when you reach the destination.

And enjoying the process is about living well and happily in the here and now. And that’s really the most important thing, isn’t it?

I feel very strongly about this core idea of setting and attaining goals — and the goal-setting project I’ve begun to that end. In fact, I’ve tentatively named the group “The Goaltenders.” I’ll continue mentoring the participants, and we’ll meet monthly to track everyone’s progress. Look for updates about how the Goaltenders are doing in future issues of The Palm Beach Letter.

http://www.earlytorise.com/surprising-thing-learned-setting-goals/