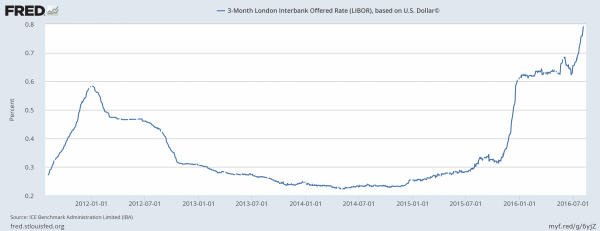

1. Three Month Libor at Highest Since 2009.

Heading Higher

While most benchmarks have remained low this year, Libor has climbed because of new money-market rules

Source: Bloomberg

Libor has risen to the highest level since 2009, even though the Fed’s benchmark has stayed constant. Given this discrepancy, it would be logical for companies to rely less on markets that are pegged to Libor and instead issue debt in fixed-rate markets that are more influenced by the fed funds rate.

THREE-MONTH LIBOR0.881%

But that’s not happening. In fact, companies have only accelerated their issuance of floating-rate debt. For example, new U.S. leveraged-loan sales have steadily ticked up in recent months.

BREAKING DOWN ‘LIBOR’

LIBOR (or ICE LIBOR) is the world’s most widely-used benchmark for short-term interest rates. It serves as the primary indicator for the average rate at which banks that contribute to the determination of LIBOR may obtain short-term loans in the London interbank market. Currently there are 11 to 18 contributor banks for five major currencies (US$, EUR, GBP, JPY, CHF), giving rates for seven different maturities. A total of 35 rates are posted every business day (number of currencies x number of different maturities) with the 3-month U.S. dollar rate being the most common one (usually referred to as the “current LIBOR rate”).

Read more: LIBOR Definition | Investopedia http://www.investopedia.com/terms/l/libor.asp#ixzz4NQk726SH

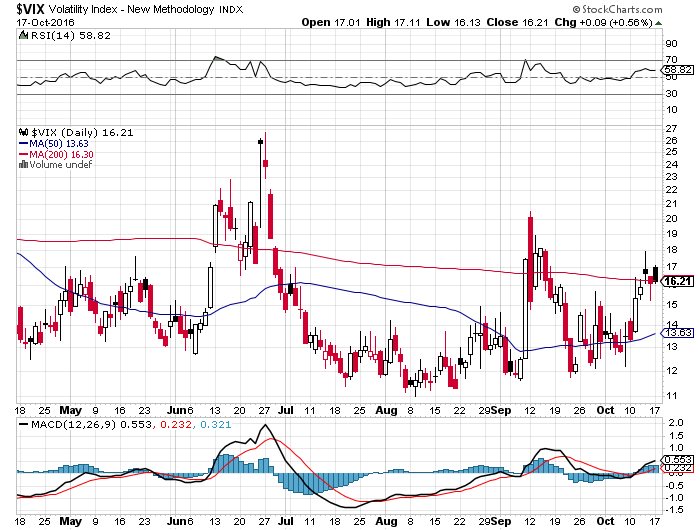

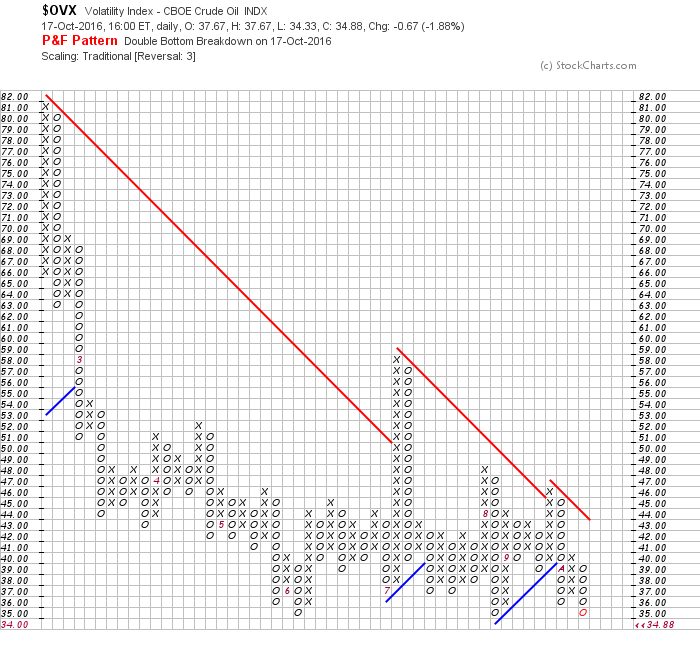

2.Market Volatility and Energy Volatility…..

Stock Market Volatility moves out of low channel, but still below $20.

More interesting…Oil volatility about to break to new lows—A 57% drop from Jan.of this year.

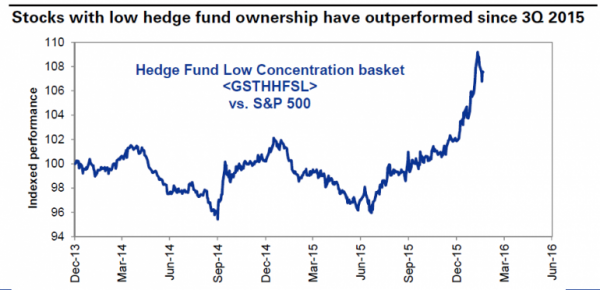

3.Stocks with Low Hedge Fund Ownership Outperform.

4.M&A Continues to be Strong—On pace to set record in small caps:

- M&A is touching nearly 100 deals inside of small caps and set to break 2007’s record of 120 transactions.

- Balance sheets are flush with cash, capital markets are wide open, and larger companies need to buy SMID-Cap companies for growth.

- When the market is nearing all-time highs and valuations well above average, M&A activity is strong.

Steven G. DeSanctis, CFA *, Equity Strategist

(212) 284-2056 sdesanctis@jefferies.com

M&A deals at record high!

The upward trends of consulting deal volumes, values and a number of high profile deals indicate a return to pre-crisis levels; Ending 2015 on an 8 year high. We predict this positive momentum will continue in 2016, making it the best year to sell since 2007.

5. If Rates Bottomed….Look to Japan?

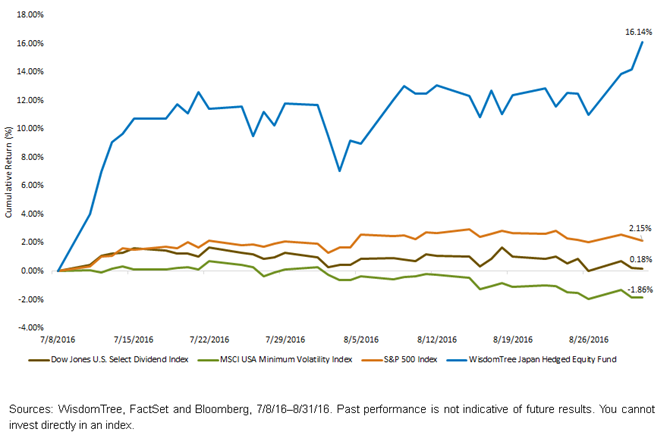

Since that bottom of interest rates and the upper house victory on July 8, low-volatility and high-dividend stocks have reversed their year-to-date strong performance and started to underperform the S&P 500, and Japan has outperformed significantly, by more than 10 percentage points from July 8 to August 31.

Reversal of Low-Volatility and High-Dividend Stocks Paired with Strong Outperformance of Japan

How Much Interest Rate Risk Do You Have in Your Equity Portfolio?

Investors who have been embracing the low-volatility/high-dividend/utilities sector trade should be aware of how much “bond duration” or interest rate risk they may have added to their portfolios. If interest rates continue to rise, these three areas of the market could face a tough period of performance and compound poor returns from bond-like allocations, in our view.

One of the best hedges for rising interest rates in the U.S. is Japanese equity exposure. Japanese companies are very exposed to the U.S. economy—it is one of their biggest profit centers. A strengthening U.S. economy that supports rising U.S. interest rates is one of most supportive fundamental drivers of Japan. A strengthening U.S. economy also hurts these lower-volatility and utilities-oriented equity exposures in U.S. markets, which are fairly interest-rate-sensitive and more expensive than normal today.

For those investors like me who think the low-volatility trade of 2016 ended on July 8, I would add positions to Japanese equities, particularly on a currency-hedged basis, as that also may have marked the bottoming of Japanese equities’ underperformance. Again, I view these as two sides of the same interest rate coin. If rates bottomed, so too did Japan.

https://www.wisdomtree.com/blog/index.php/the-other-side-of-the-low-volatility-trade/

6. Read of Day….Flash Boys Trading with Each Other….Revenue Shrinks.

The company is a member of Wall Street’s new guard, a group of market-making upstarts that are changing the nature of trading. GTS and its peers, such as Virtu Financial, Jump Trading, DRW Holdings, and Hudson River Trading, were among the first to dedicate all their resources and energy to the singular goal of being the fastest, most effective traders, period. As markets rapidly went electronic, getting ahead of the curve paid off. By 2009 high-frequency-trading firms were earning more than $7 billion in U.S. equities annually, according to Tabb Group research.

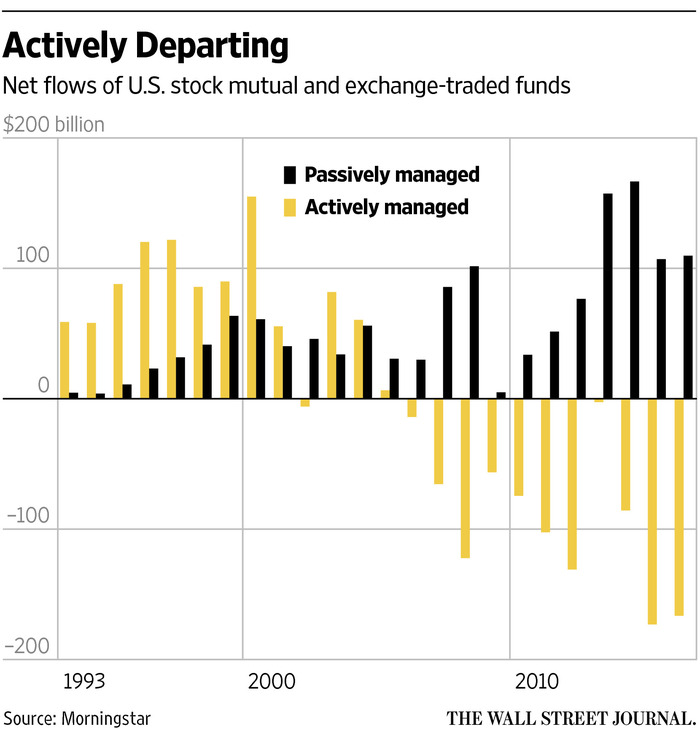

7. Post 2010 Flows ETF vs. Active.

Employer-sponsored 401(k)-style retirement plans have 25% of their assets in index funds, up from 19% in 2012, according to investment-consulting firm Callan Associates Inc. Public pension plans had 60% of their U.S. stock allocations in index funds in 2015, up from 38% in 2012, according to research firm Greenwich Associates. At endowments and foundations, the index-fund share rose to 63% from 40% in that time period.

http://www.wsj.com/articles/the-dying-business-of-picking-stocks-1476714749

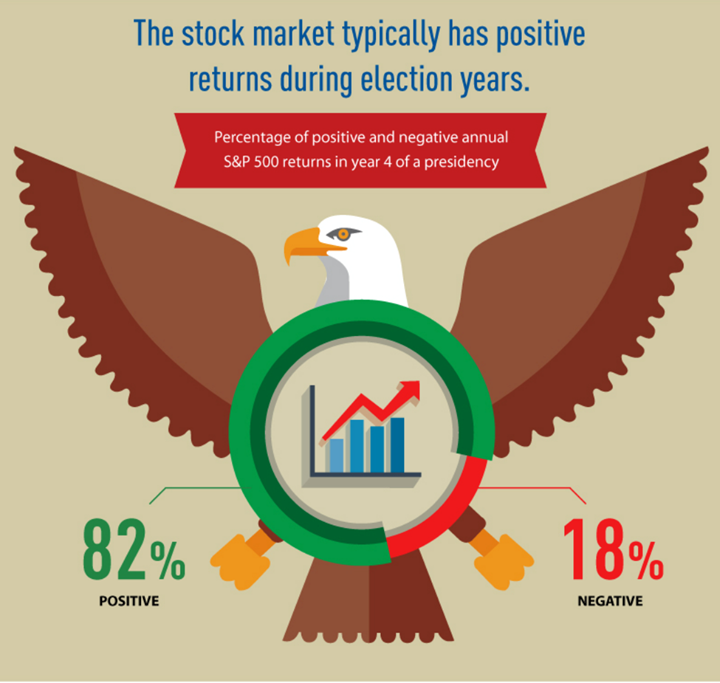

8. Elections and Market Outcomes

October 17, 2016 8:00pm by Barry Ritholtz

Click for the full, ginormous infographic with info by presidency.

Source: Visual Capitalist

http://www.visualcapitalist.com/u-s-stock-market-perform-election-years/

The aggregate data is clear – here’s how the S&P 500 does in different years of the presidency:

|

Year of Term |

Positive Returns |

Negative Returns |

|

1 |

57% |

43% |

|

2 |

65% |

35% |

|

3 |

91% |

9% |

|

4 |

82% |

18% |

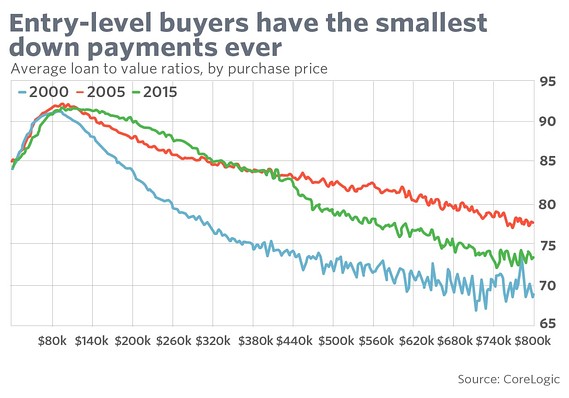

9. At the low end, homeowners are even more leveraged than they were during the bubble

Published: Oct 17, 2016 12:35 p.m. E

Ever since the shock of the financial crisis ebbed and buyers began to return to the housing market, one truth has dominated: mortgage lending is tight.

Ever since the shock of the financial crisis ebbed and buyers began to return to the housing market, one truth has dominated: mortgage lending is tight.

But is it?

It’s true that only the borrowers with the highest credit scores get home loans now. So much lending to people with higher credit scores and so little to those on the lower end of the spectrum has shifted the average FICO score up about 40 pointssince before the bubble burst.

But measured in another way, lending is shockingly loose. And, according to one economist, that tells us a lot not just about the housing market, but about the economy as a whole.

The 20% down payment may linger in Americans’ imagination, but it’s even less real today than Jimmy Stewart’s small-town banker from 1946. American homeowners, particularly those at the lower end of the market, are increasingly leveraged to pay for their houses, says Sam Khater, deputy chief economist at data provider CoreLogic.

In fact, owners of entry-level homes, those in the $150,000 to $300,000 range — have more debt and less equity now than they did in 2005, at the height of mortgage mania.

For Khater, that says less about credit markets and more about another defining feature of the post-recession housing market — its lack of affordability.

“We have our eye on the wrong ball,” he told MarketWatch. “What I worry about is the leverage not from a default perspective but from an affordability perspective. Demand for credit has been weak. But the much bigger issue is the supply of housing, not supply of credit.”

There’s been a lot of discussion about the affordability crunch, how rent is too high, and how home builders have targeted the higher end of the market since the end of the recession. But that hasn’t resulted in any new inventory.

Home builders are selling fewer and fewer homes in the lower-end categories as the recovery drags on. They built more than four times as many homes in the $750,000 and above price range in the first half of this year than those priced under $125,000.

10. Why Smart Investors Apply Next-Level Thinking

Being ignorant of your ignorance is fatal in the world of investing. You could be taking on far more risk than you know.

Recently, I was asked at a social function about the volatility of the share market. My distilled response was “The market is reacting to deflation and there’s a better-than-even chance we will have a depression.”

A lovely lady in the group then asked me if it’s better to have debt in that situation. I must admit, I wasn’t expecting that one.

A little later, we spoke privately. She told me she and her partner were considering borrowing to buy a home. I wasn’t expecting that either; they’re in their mid-50s, and I assumed they already owned their own home.

Long story short, she lost her first home (with her ex-husband) in the 1987 share crash. She lost her second home (with her current partner) in the dot-com bust.

Not knowing the extent of her own financial ignorance led her to take risks she was ill-prepared for. These decisions have cost her dearly. Consequently, there is no wealth to pass on to her family.

I’m a firm believer that our lives are the sum total of the choices we have made. Obviously, there can be exceptions to this rule, but, by and large, we end up where we are because of the decisions we have made in our lives.

If you choose to eat fatty food, smoke, and drink heavily, then you can hardly complain about having poor health. If you marry a liar, womanizer, and gambler, then there’s a fair chance you’ll end up broke and divorced.

Become a Second-Level Thinker

Based on this simple principle, my goal has been to educate my family to make informed choices when it comes to their lives and finances.

My book, A Parent’s Gift of Knowledge was a practical way for me to impart to my daughters some of what I’ve learned in life and the investment business. But it was by no means the start and end of their education. It was merely an introduction and a future reference guide for some old-fashioned, basic principles.

Their education must continue, or they run the risk of being ignorant.

One of the books I recommended to them was The Most Important Thing: Uncommon Sense for the Thoughtful Investor. The author, Howard Marks, is the multibillionaire chairman and co-founder of Oaktree Capital Management, the world’s largest distressed-debt investment firm. Marks wrote the book in 2011.

This excerpt from the book is one that I have emphasized on numerous occasions during our family discussions (emphasis is mine):

For your performance to diverge from the norm, your expectations – and thus your portfolio – have to diverge from the norm, and you have to be more right than the consensus. Different and better: that’s a pretty good description of second-level thinking.

This is another way of saying, “When everyone is thinking the same, it shows no one is thinking at all.”

To be a successful investor, you have to think differently from the crowd. Marks says the crowd applies “first-level thinking” with comments such as, “You can’t go wrong buying XYZ,” or, “The market has lost so much value; it is just too risky.”

“Second-level thinking” asks questions like “If everyone thinks you can’t go wrong buying XYZ, then surely this is the greatest time for things to go wrong” or, “If the market has fallen so significantly, then shouldn’t it be less risky than it was at its peak?”

According to Marks, second-level thinking is deep, complex, and convoluted. The second-level thinker takes many things into account:

- What is the range of likely future outcomes?

- Which outcome do I think will occur?

- What’s the probability I’m right?

- What does the consensus think?

- How does my expectation differ from the consensus?

- How does the current price for the asset comport with the consensus view of the future, and with mine?

- Is the consensus psychology that’s incorporated in the price too bullish or bearish?

- What will happen to the asset’s price if the consensus turns out to be right, and what if I’m right?

When you are dealing with family wealth, you cannot afford to have a generation of first-level thinkers.

You have to educate your children to be second-level thinkers, and to act on those decisions.

The lovely lady I met is, even after her previous experiences, still a novice first-level thinker. She will continuously make bad financial choices because there is no critical thought applied to her decisions. But she is far from alone.

I can tell you from experience that most people are first-level thinkers.

After the deposing of Australia’s prime minister, Tony Abbott, a friend said to me, “We’ve had five PMs in five years. The rest of the world is laughing at us.” To which I said, “Really? Which countries are the ones laughing?”

He replied, “I don’t know. But they are.”

OK then, next subject.

My friend was repeating what he’d read in the newspaper or heard on TV. All critical judgment was abandoned. This was his rock-solid opinion. No, make that a fact.

Why? Because it was a popular viewpoint and it sounded like “they” knew what they were talking about. The reality is, I don’t think anyone in the Northern Hemisphere or much of the Southern Hemisphere could care less about Australia’s revolving prime ministerial door. They all have their own local issues to deal with.

I use this as an example of how most people grab a kernel of truth and let it make up the sum total of their knowledge.

Therefore, I recommend to you and your family the book written by Howard Marks. At times it can be a little heavy, but at least it forms a basis for you to begin the discussion with your family.

You can use real-life situations — as I did with my friend’s comment on the five PMs — to illustrate how you can apply second-level thinking to a nu ber of facets of your life and the lives of your loved ones.

They can apply second-level thinking to choosing a mate – rather than falling in “love” with looks, muscles, or big boobs.

Second-level thinking hopefully assists people in making better decisions and, in turn, creating a better life.

Another good book I passed on to my children is by financial theorist and neurologist William Bernstein, titled If You Can: How Millennials Can Get Rich Slowly.

Bernstein keeps it pretty simple. He warns about falling victim to the Five Horsemen of Personal Finance Apocalypse:

9. Failure to save

10. Ignorance of financial theory

11. Unawareness of financial history

12. Dysfunctional psychology

13. The rapacity of the investment industry

These are all good points that help reinforce the message of being aware and being prudent. This is a relatively easy read, and, again, one I recommend you pass on to your family. My strategy for generational wealth is straightforward. Provide the ability to acquire knowledge, provide an environment for continued education (family discussions, lessons you’ve learned, experiences others have had and what can be learned from them), and teach by example.

Eventually I hope that all this exposure to constructive learning sinks into the subconscious and my daughters and themselves applying the principles without consciously thinking about why. That is what we hope and live for. Then, we’ve been successful.

(Editor’s note: This is an excerpt of an article that originally appeared in Bonner & Partners Family Office Strategic Review Newsletter.)

About the Author: Vern Gowdie is the editor of Gowdie Family Wealth and The Gowdie Letter. He is also the author of The Parent’s Gift of Knowledge.

http://www.earlytorise.com/smart-investors-apply-next-level-thinking/