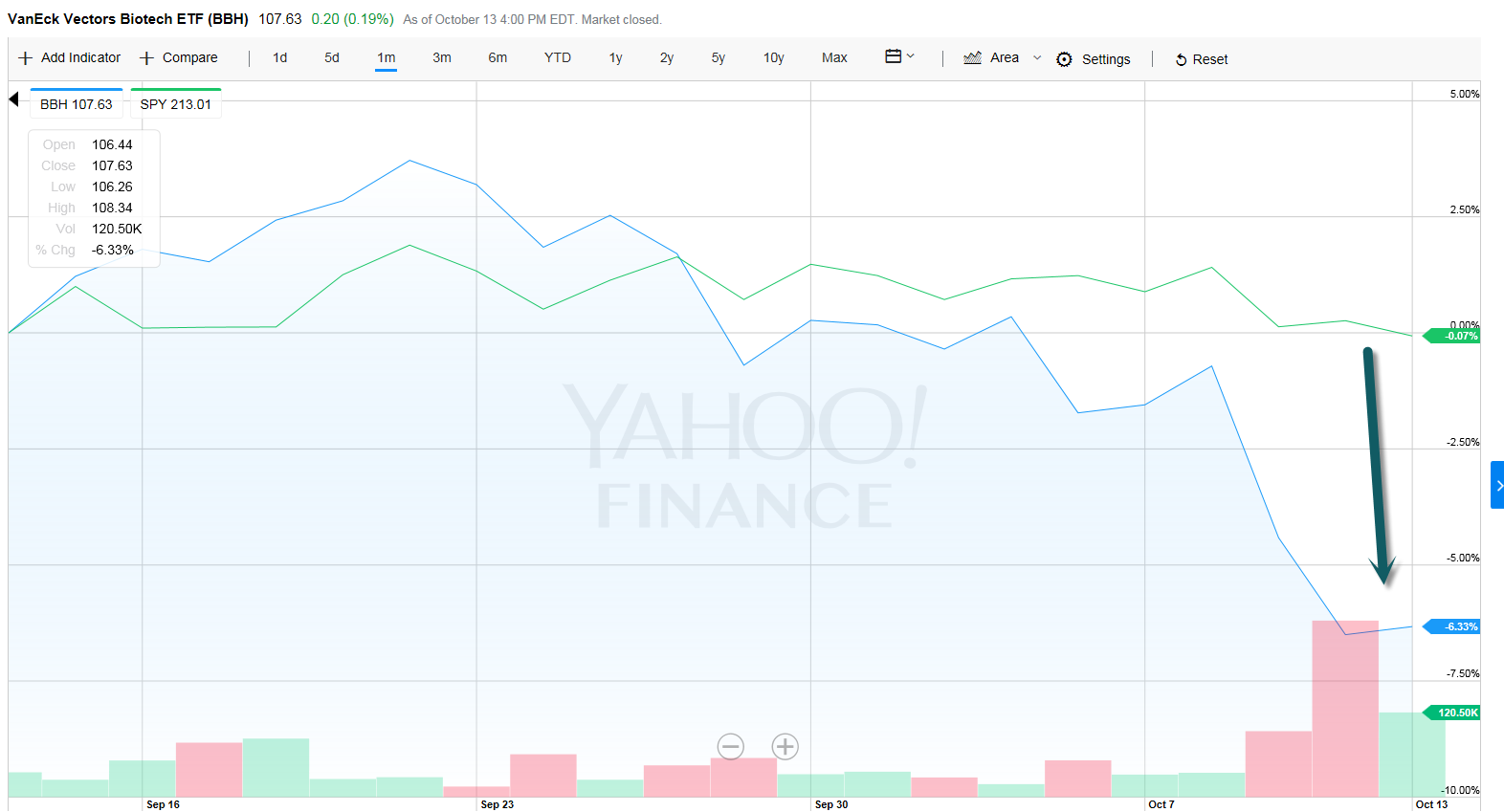

1. Biotech Takes a Beat Down.

Biotech -6% vs. S&P Flat in Last Month.

Biotech Closes Below 200day.

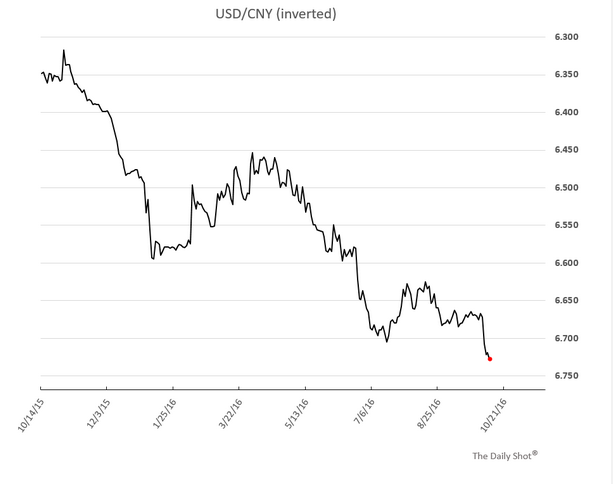

2. My Chart of Year-Chinese Yuan is Making New Lows vs. U.S. Dollar.

Yuan is still a controlled currency, with the Chinese heavily dependent on its export market, the recent weak economic numbers may point to further weakening of the currency.

Yuan vs. Dollar.

Chinese Yuan ETF making new lows for year.

3. Chinese Neighbor Singapore had Poor Economic Numbers…GDP -4% for Qt.

After two quarters of lacklustre nothingness, Singapore’s economy finally collapsed in Q3. Against expectations of no change, GDP QoQ SAAR crashed 4.1% – the worst quarter since Q3 2012. MAS added that it did not expect GDP growth to pick up “significantly” in 2017.

http://www.zerohedge.com/news/2016-10-13/singapore-economy-crashes-q3

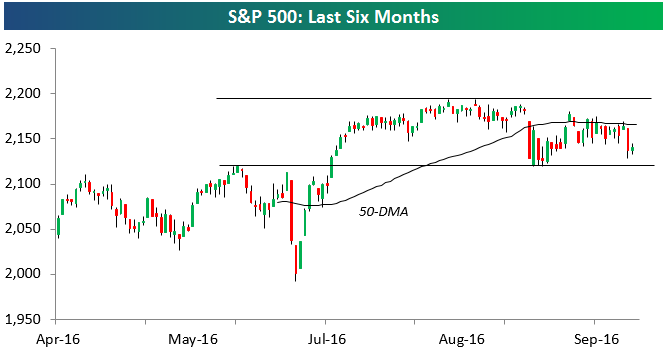

4. Flat Market with Big Sector Moves

Oct 12, 2016

As shown in the six-month chart of the S&P 500 below, the index has basically traded sideways since it broke to new highs in early July. Since closing at new highs on July 8th, the S&P 500 is up just 50 basis points. So far, support levels have held, but it’s been a sideways market.

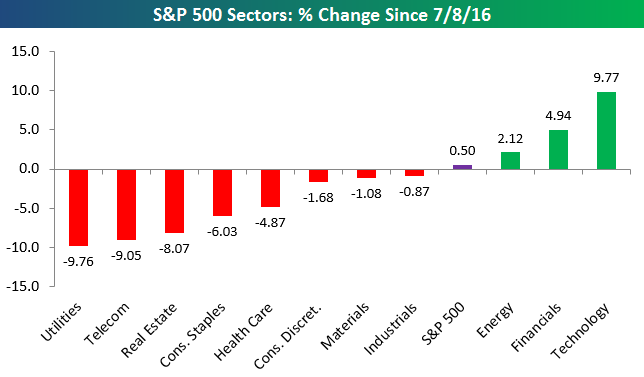

While the broad market has been sideways, we’ve seen big performance disparities among the eleven S&P 500 sectors. We’ve been highlighting this quite a bit for clients over the last couple of months, but we wanted to point it out to our Think B.I.G. readers as well. As shown below, Technology, Financials and Energy are the only sectors that are up, and Technology is up nearly 10%. On the downside, Utilities, Telecom, Real Estate, and Consumer Staples are all off more than 5%.

https://www.bespokepremium.com/

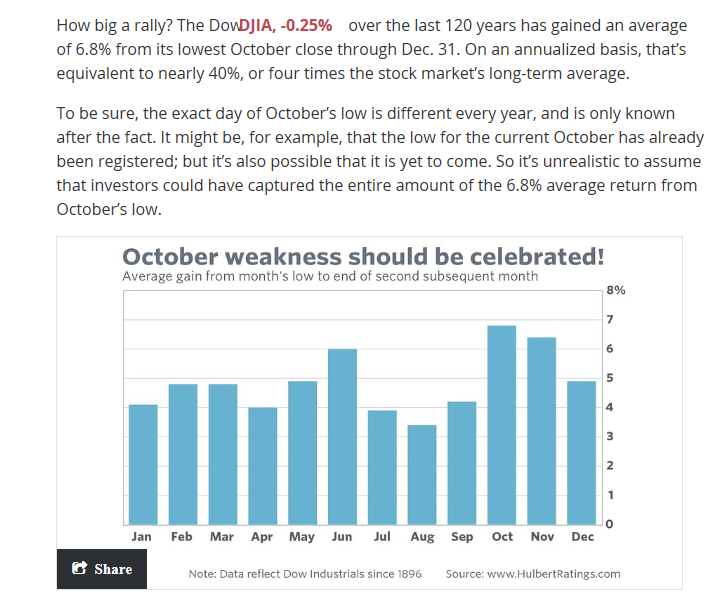

5. The Dow Over the Last 120 Years has Gained an Average of 6.8% from its Lowest October Close thru Dec. 31.

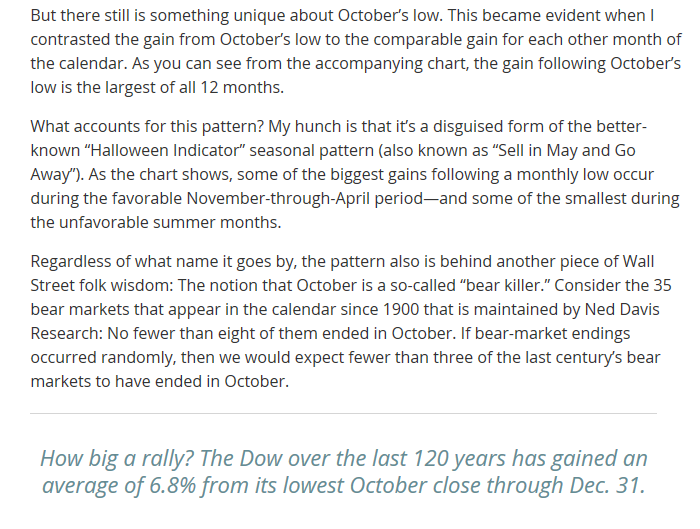

6. Banks See First Drop in Commercial and Industrial Loans in 6 Years.

For some time, business loans, also known as commercial and industrial loans, have been one bright spot for otherwise growth-starved banks, both large and small. But such lending fell by 0.1% in the third quarter, Federal Reserve data show.

Although small, the contraction from the prior quarter is the first such drop in six years, according to Morgan Stanley. MS -0.56 % That could drag on third-quarter bank earnings growth. Bank results are generally expected to be solid if not exciting. The biggest banks, such as J.P. Morgan Chase JPM -0.57 % & Co., begin reporting Friday and into early next week; regional banks will report results over the next few weeks.

Possibly offsetting the drop-off: Other types of loans—including commercial real estate, mortgages and credit cards—grew in the quarter from the prior quarter, according to Fed data.

http://www.wsj.com/articles/will-business-spending-spoil-bank-earnings-season-1476367932

What is a ‘Commercial and Industrial (C&I) Loan’

A commercial and industrial (C&I) loan is any type of loan made to a business or corporation and not to an individual. Commercial and industrial loans can be made in order to provide either working capital or to finance major capital expenditures. This type of loan is usually short-term in nature and is almost always backed with some sort of collateral.

Read more: Commercial and Industrial (C&I) Loan Definition | Investopedia http://www.investopedia.com/terms/commercial-and-industrial-ci-loan.asp#ixzz4N3LELjjI

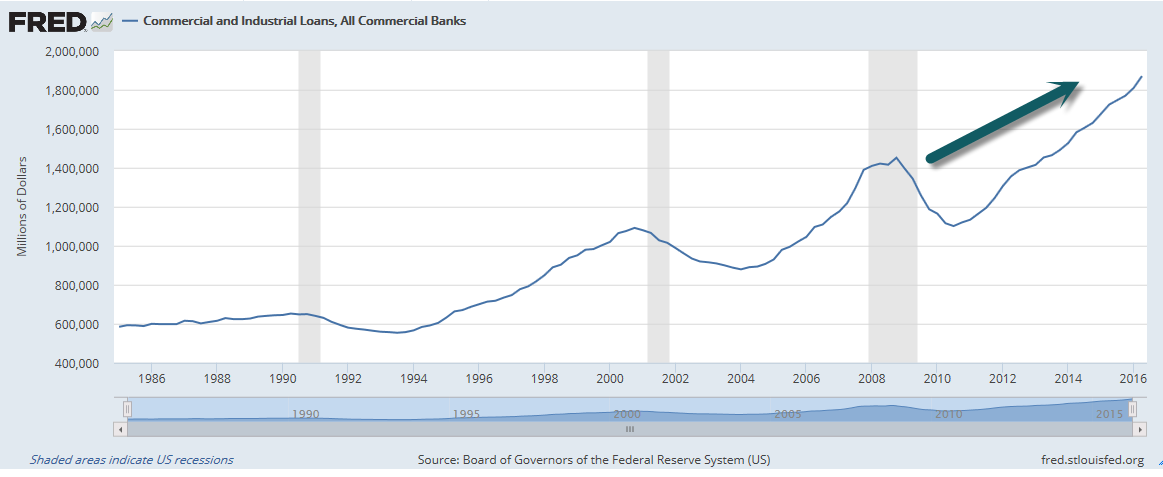

7. What’s Behind the Surge in Corporate Debt?

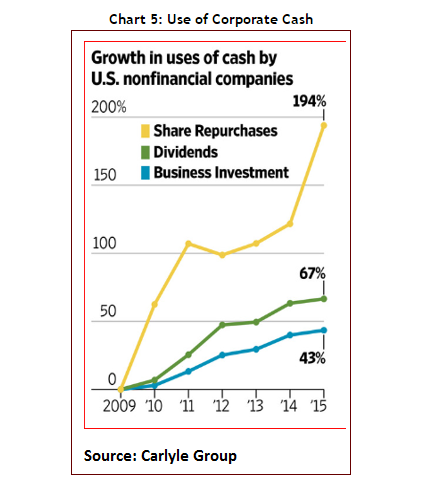

The Carlyle Group summarizes the use of corporate cash in Chart 5. Since 2009, share buybacks have increased at enormous rate of 194% ; dividends have grown by 67%; and, business investment expanded a modest 43%. Rewarding shareholders with higher dividends and propping up share prices at the expense of investment in new plant, equipment and technology is a serious misallocation of resources at a time when the economy is experiencing slow growth and very poor productivity performance. It also represents serious short-sightedness on the part of management who feel so beholden to shareholders that they risk the longer term health of their companies.

You might also like:

Good Full Read from Sober Look…Click

http://soberlook.com/2016/08/what-is-behind-surge-in-corporate-debt.html

8. Housing Does Not Resemble 2006

Cullen Roche.

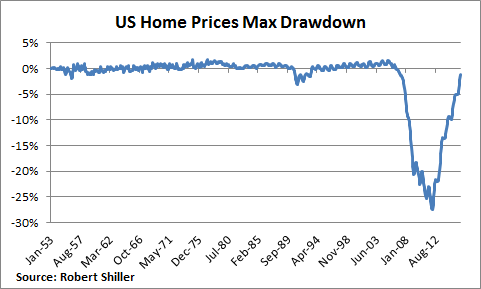

Housing Does Not Resemble 2006. One of the main reasons this blog exists is because I was very bearish about the economy from about 2006-2010. The main driver of that was my view on housing and private debt. The main assumption in most risk assessment models that created the housing bubble was that housing was a historically stable asset that would not experience a lot of downside. So, you could package lower risk mortgages up into wrapper products and these higher risk assets would become lower risk assets because you’re diversifying across a historically safe asset. A lot of that was based on the following chart which, as you can see now, looks a little different to someone in 2016 than it might have in 2006:

But here’s the thing we need to ask ourselves – now that we know house prices can fall significantly we can’t necessarily think of them as the super safe assets that went into so many of those pre-crisis risk models. So, if you’re buying a house to live in it (thinking of it as a 10 year+ dwelling) then you have to ask yourself if you’re buying an asset that can expose you to such a significant decline that even a long time horizon can expose you to permanent loss risk? I would argue that today’s environment does not resemble 2006 in any way that makes housing as risky as it was back then. In essence, household debt trends are far improved, debt service ratios are far sustainable and most importantly, we haven’t had the housing boom that precedes a bust.

http://www.pragcap.com/three-reasons-i-bought-a-new-home/

9. Is My Uber Driver Holding Back the Housing Market?

by John Burns October 11, 2016

Co-authored by Mikaela Sharp, Research Analyst

Why are so many young adults today willing to make perhaps the biggest commitment of all—having a child together—before getting married? Does this recent societal shift tell us anything about young adults’ willingness to commit to a 30-year mortgage? I recently had a conversation with an Uber driver who shed light on the younger generation’s choices.

Gaming the System to Save Money

My Uber driver told me that he and his girlfriend were about to have their third child together. (Uber drivers have become a great source for researching social shifts, as they are right in the middle of the new Sharing Economy.) He said it made no financial sense for them to marry. Her modest income qualified her for all sorts of benefits, including free medical care for the kids. As long as she was not associated with his income, they could live a good life together while getting the government to cover many of their expenses. I didn’t ask if this was legal.

Playing the Game Prevents Homeownership

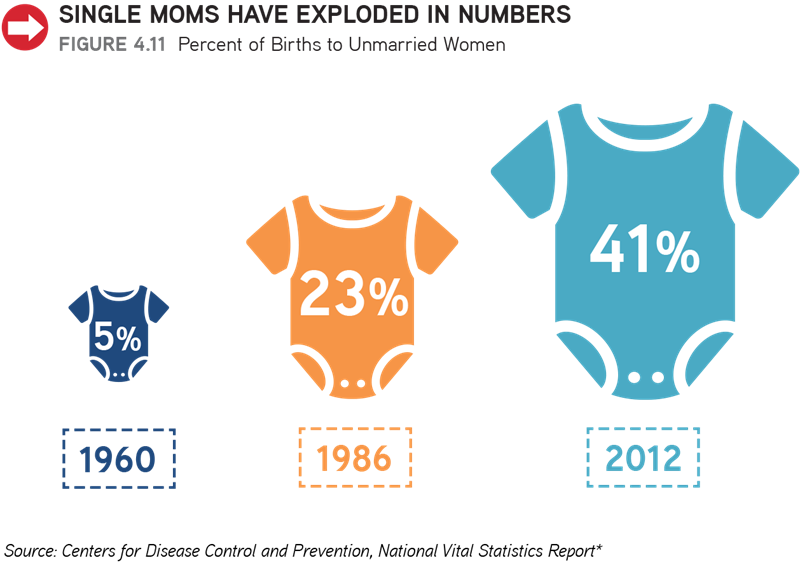

This got me thinking. Our research has shown that today’s young adults born in the 1980s and 1990s are quite thrifty, taking advantage of technology to save money and very willing to share expenses with each other. The Uber driver and his girlfriend will clearly not become homeowners any time soon because to do so they would have to declare that they live together. I assume doing so would cause them to lose free health insurance for their kids as well as other benefits. How many 1980s Sharers have figured out how to have a family and still receive maximum government assistance? We already know that the number of children born to unwed mothers has exploded to 41%.

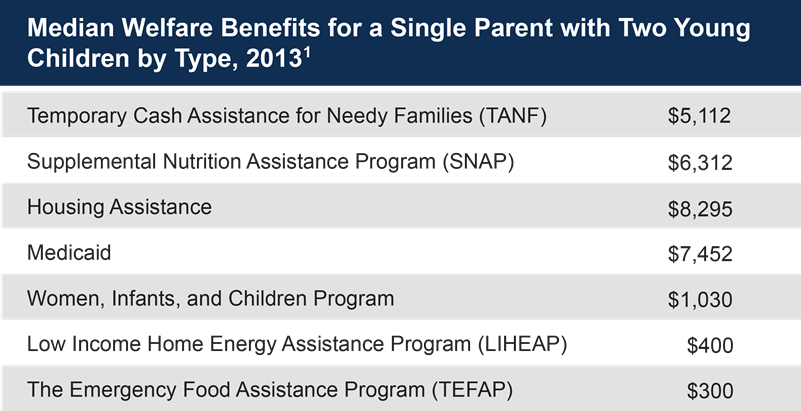

We call the higher taxes or fewer benefits that a married couple encounters in comparison to two single people with an equal combined income a “marriage penalty.” This new marriage penalty could easily be enough of an incentive for an unmarried parent to keep their relationship “off the books.” The following table shows the median benefit amount for a nonworking single parent with two young children. Don’t add these up because it is highly unlikely that a recipient would receive all of these benefits simultaneously.

Here is some more information we learned:

- Food stamps: A single parent of two children earning $15,000 per year would typically be eligible to receive about $5,200 per year in food stamp benefits. If married to a partner with equal earnings, their food stamp benefit amount would be cut to zero.2

- Section 8 housing: On average, an unemployed single parent would be eligible to receive $11,000 per year of public housing or Section 8 benefits. If married to a partner earning $20,000 per year, their benefits would be cut by almost one-half.2

- Welfare benefits: A single parent earning $20,000 per year who married a partner earning the same amount would stand to lose about $12,000 per year in welfare benefits.2

- Income taxes: Unmarried parents could face a penalty as large as 12% of their combined income by filing their taxes as a married couple. For lower-income households with children, these penalties result from a smaller Earned Income Tax Credit (EITC), as combining the parents’ incomes could easily phase them out of the eligible range3. An unmarried couple from California, each making $25,000, with two children would pay about $3,450 more in taxes if they got married and filed jointly because they would no longer be eligible for EITC. (With two children, combined income for a married couple must be under $49,974.)

Government Influences Demographics

I don’t want to get into the pros and cons of these specific government policies, nor hear anyone’s political views, please. I am not suggesting that these are good or bad policies. My goal is to help building industry executives recognize that these policies clearly have some unintended consequences that are likely holding back the housing market.

In Big Shifts Ahead: Demographic Clarity for Businesses (on sale now, finally!), we developed something we call the 4-5-6 Rule, where 4 stands for the Four Big Influencers that have impacted demographic behavior over time. Government is one of the four influencers. It has had huge impacts over time, from establishing and eventually running the mortgage industry we have today to investing in the infrastructure that created suburbia in the 1950s and 1960s. Government has also made many changes to immigration law over the years. All forecasts for the housing market need to consider current and likely future government policies.

P.S. As an interesting side note, it turns out that it makes financial sense for this same couple to get married much later in life. The lower earner can receive much higher Social Security benefits, and the survivor will receive estate tax benefits.

https://www.realestateconsulting.com/is-my-uber-driver-holding-back-the-housing-market/

10. Self-Improvement Strategies For Becoming A More Authentic Leader

Along with fearless passion and courage, becoming an authentic leader takes mental discipline. Here are 9 principles to get you started.

Our deepest fear is not that we are inadequate. Our deepest fear is that we are powerful beyond measure. It is our light, not our darkness, that most frightens us. We ask ourselves, who am I to be brilliant, gorgeous, talented, and fabulous? Actually, who are you not to be? You are a child of God. Your playing small doesn’t serve the world…As we are liberated from our own fear, our presence automatically liberates others. — Marriane Williamson, A Return to Love

I believe authentic leadership does not come from title, social stature, or the size of one’s paycheck but rather from how you live and the impact you make around you.

Harvard Business School professor, former Medtronic CEO, and author Bill George popularized the concept of “authentic leadership” in his 2003 best-selling book Authentic Leadership, which was developed further in his later book True North. “First you will have to understand yourself, because the hardest person you will ever have to lead is yourself. Second, to be an effective leader, you must take responsibility for your own development,” writes George.

The word “authenticity” comes from the Greek root authentikos, meaning “original, genuine, principal.” Genuine leaders are not just the usual suspects we conjure up—the business chieftains, historic figures, and mega technology innovators. They are all around us, I believe. Each one of us is born to make an authentic contribution. Truly authentic leaders lead with their soul. Along with fearless passion and courage, they possess relentless mental discipline.

In this post, I want to explore some approaches to mental discipline derived from my own experience, observations, and Eastern philosophy studies that may help you in your own authentic journey:

FOSTERING INNER ENERGY

To be authentic one must be “awake,” meaning you have the ability to understand who you are, what you want to be, and how you want to fit in the world. From Aristotle to Buddha, Rumi to Steve Jobs, Kahlil Gibran to Paulo Coelho, many revered thinkers and talents have said that the path to an authentic journey is to know thyself, guided by an inner voice.

But creating our thoughts, making the journey, ignoring the skeptics, and dusting ourselves off every time we fall requires disciplining our inner energy and drive. Often that energy solely comes from within.

Here are a few suggestions to foster inner energy:

Intend your destiny: Destiny results from “intention”—our spiritual will; something that drives us to do what seems impossible. It nurtures us with hope in our darkest moments, enables us to dream of better days, and resides in a place where we are destined to find our fulfillment. We need to intend to “go somewhere” and make a difference.

Be in the moment: In college, at my janitorial graveyard shift, I had a supervisor who used to remind me every night to “be kind to the floor, buff her carefully—and then see how well she shines.” At those particular moments, nothing else mattered—only the shine on the buffed floor. It taught me to lose myself completely in an utterly mundane task. Being in the moment allows us to escape from adversity and conserve our inner energy.

Develop rituals: Mastering an authentic craft comes from uncompromising daily practice. Developing the discipline to practice the same thing over and over again requires ritualistic hard work. Observe a musician, athlete, or better yet a Japanese Zen monk who recreates his sand garden every morning. Rituals teach us to be disciplined, deliberate, and meditative. Create rituals for daily life that provide a path to practice mastery with positive energy.

LEARNING TO SUFFER WELL

Authentic leaders of any kind drive change. Change often involves traveling uncharted territories, challenging conventional paths, and ignoring the traditional need for safety and comfort. This inherently invokes pain, suffering, and disappointments. Accepting and growing through our pain is part of our personal growth. This is anything but easy. Like any other skill, learning to suffer well requires conscious practice and learning.

Here are some fundamentals to consider:

Keep an eye on the bigger picture: A new day always comes. A new door always opens. It is important to recognize that the future is full of promise. Meeting our goals requires constantly imagining and crafting our journey despite the present situation. It is okay not to have all answers right away. They will come. We can’t control everything, however, we can control ourselves: how we choose to respond, our own attitudes, how we let go, and our outlook—moving forward by keeping our eyes on the bigger picture.

Learn from bad times: In bad times it’s easy to think that fate is unkind and unfair in its approach to teaching us harsh lessons. It hurts, but sadly it is often only through hardship that we discover our inner strengths and capabilities. Despite our darkest moments, it is our duty to stay connected to our core intention. We can leverage newfound strengths and capabilities to proceed with complete commitment, believing in our own intuition and ourselves.

Spend time with people who are uplifting: The people we surround ourselves with make the difference between failure and success. It’s not only whom we surround ourselves with that matters, but also how we interact with them that make the difference. It’s important to be reminded of the people who believe in and support us and to cultivate those relationships. Spending time with people who make you stronger requires intentional effort, and is a key component in being able to move forward.

Equally important is to avoid people who bring us down, waste our time, take us backward, and have no interest in our suffering. A close friend constantly reminds me to “get rid of toxic people from your daily life.” While we cannot always avoid them, at a minimum we can choose to not allow them to weaken us.

LEADING FROM THE LEDGE

Authentic leaders reach their highest potential by taking risks that are consistent with their ethos and values. They lead by constantly standing on an uncomfortable ledge.

Leading from the ledge requires:

Excellence, not perfection: We live in a diverse and imperfect world. Every single one of us is a work in progress. In many ways, perfection implies something has come to its end. Authentic leaders commit themselves to excellence in everything they do. They are constantly pushing the envelope and raising their standards. And they have the wisdom to know the difference between excellence and perfection.

Flexibility: Lao Tzu said, “Water is fluid, soft, and yielding. But water will wear away rock, which is rigid and cannot yield. As a rule, whatever is fluid, soft, and yielding will overcome whatever is rigid and hard. This is another paradox: What is soft is strong.”

Our ability to effectively survive, thrive, and lead comes from flexibly riding out our ups and downs. An authentic journey does not always come from blasting through rocks and impediments, rather from having the faith, resilience, and adaptability to cope with the harsh realities of life.

Comfort in uncertainty: I often refer back to Comfortable with Uncertainty by Pema Chödrön. She writes:

This path has one very distinct characteristic: it is not prefabricated. It doesn’t already exist. The path that we’re talking about is the moment-by-moment evolution of our experience, the moment-by-moment evolution of the world of phenomena, the moment-by-moment evolution of our thoughts and emotions. The path is uncharted. It comes into existence moment-by-moment and at the same time drops away behind us. When we realize that the path is the goal, there’s a sense of workability. Everything that occurs in our confused mind we can regard as the path. Everything is workable.

This is the mantra of an authentic leader who does not follow someone else’s footsteps. It is his/her comfort with all the uncertainties that drives his/her soul to make an impact, a difference, a legacy for greater good.

https://www.fastcompany.com/3004785/self-improvement-strategies-becoming-more-authentic-leader