“Indeed it has been said that democracy is the worst form of Government except all those other forms that have been tried from time to time”

– Churchill.

VOTE

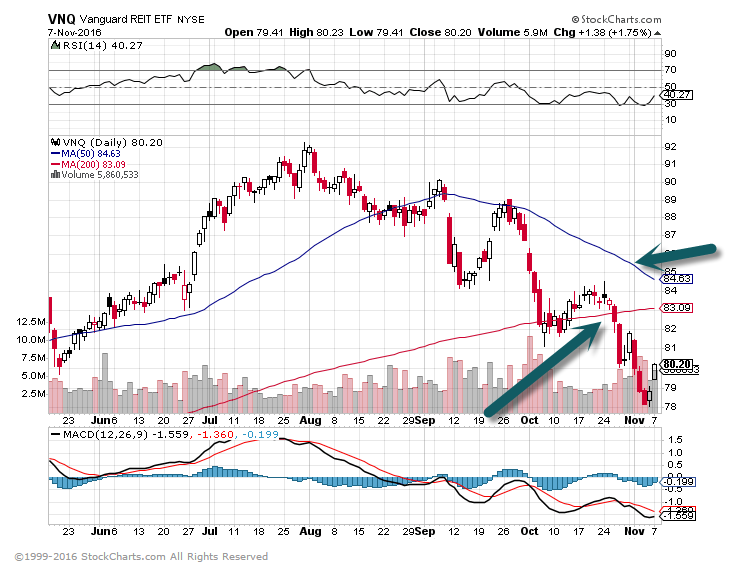

1.Real Estate Became the Official 11th GICS Sector in 2016….It is the Worst Performer so far this Year.

VNQ Vanguard REIT Index Closes Below 200day…50 day sloping downward.

Last 3 Months VNQ Vanguard Reit Index -11% vs. S&P -2.25%

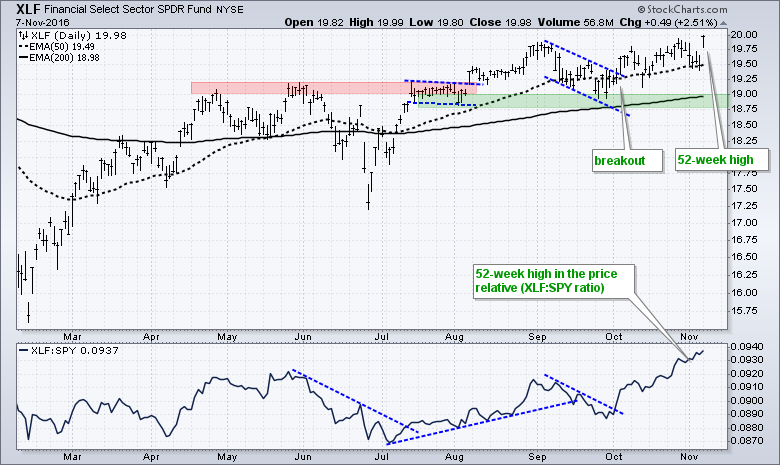

2.Rates Higher? REITS Lowest Performing Sector, Financials Highest Performing Sector? XLF (Finance ETF) New 52 Week High.

The Finance SPDR (XLF) is leading the sector SPDRs with a new 52-week high on the price chart and with the price relative. On the price chart, XLF triggered its first breakout in early August with a move above the red resistance zone. Even though the ETF did not seem to move much from early August to early November, XLF did hit 52-week highs in early September and late October. These highs confirm that the bulls were always in charge. With today’s fresh 52-week high, XLF becomes the only sector SPDR to record a new high. This means it is the chart leader among the sectors. The indicator window shows the price relative (XLF:SPY ratio) also hitting another new high on Monday. This indicator measures the performance of XLF relative to SPY. The ratio rises when XLF outperforms and falls when XLF underperforms. XLF has been outperforming since the early October breakout and the new high simply confirms relative strength.

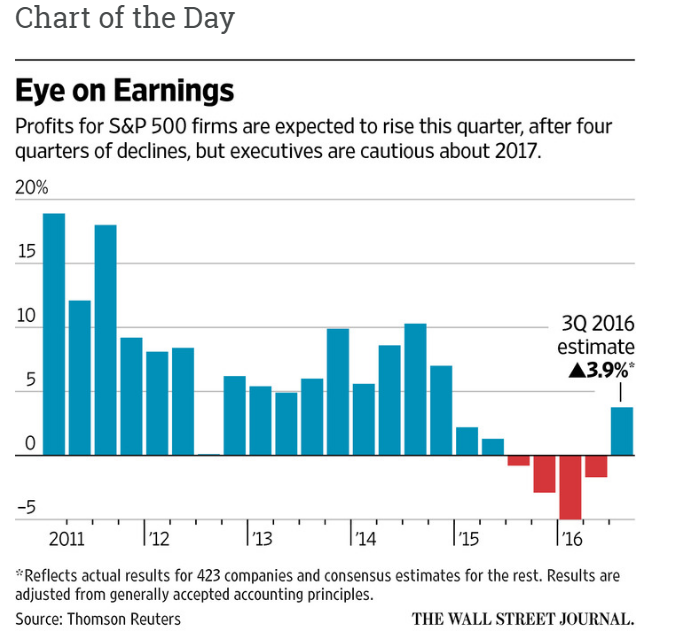

3.Earnings Recession Over?

EARNINGS ENDGAME– “In terms of earnings season – with 85% of it behind us, 71% are beating on EPS, 55% are beating on revenues. The blended earnings growth rate for the S&P500 is 2.7% – much better than the expected 2.2% decline. Further, this marks the first quarter of y/y earnings growth since Q1 2015.” (Yousef, Jones) From Dave Lutz at Jones.

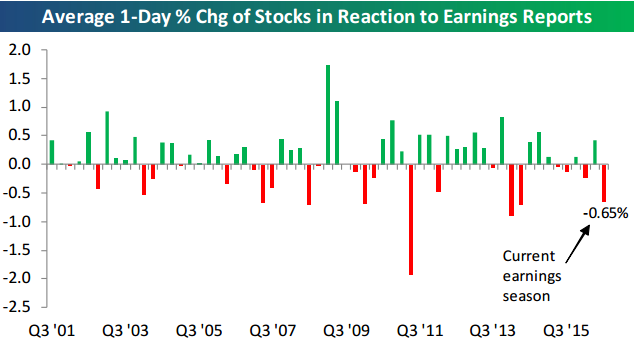

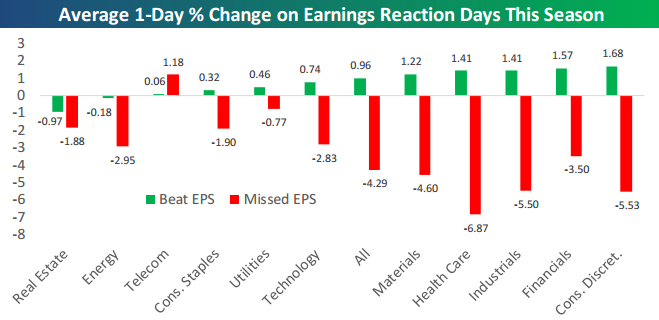

4. The Average Stock that Missed Earnings This Quarter -4.29%…Misses Punished.

Little Love for Beats, Misses Crushed

Nov 7, 2016

In various reports for Bespoke subscribers over the last couple of weeks, we’ve been highlighting the extreme weakness that stocks reporting earnings have experienced this earnings season. Below is a chart showing the average one-day price change for stocks reporting earnings by quarter going back 15 years to 2001. As shown, stocks that have reported this earnings season have averaged a decline of 0.65% on their earnings reaction days. (For stocks reporting before the open, their earnings reaction day is that trading day. For stocks reporting after the close, its earnings reaction day is the next trading day.)

Investors are clearly selling first and asking questions later in response to earnings this season. Should the average one-day change of -0.65% hold through the remainder of the reporting period, it will be the worst season in nine quarters.

Below we’ve broken down the one-day price reaction to earnings by sector and whether or not the stock beat or missed consensus earnings per share estimates. For all stocks that have reported, the average stock that has beaten earnings estimates has risen just 0.96% on its earnings reaction day. Conversely, the average stock that has missed estimates has fallen -4.29%. That’s a huge gap. The winners this season have not been rewarded, while the losers have gotten slaughtered.

Looking at individual sectors, Real Estate and Energy stocks that have beaten estimates have averaged declines on their earnings reaction days! And while Health Care, Consumer Discretionary, and Industrials stocks that have beaten estimates have averaged gains of more than 1%, stocks that have missed in these sectors have fallen more than 5.5%.

https://www.bespokepremium.com/think-big-blog/

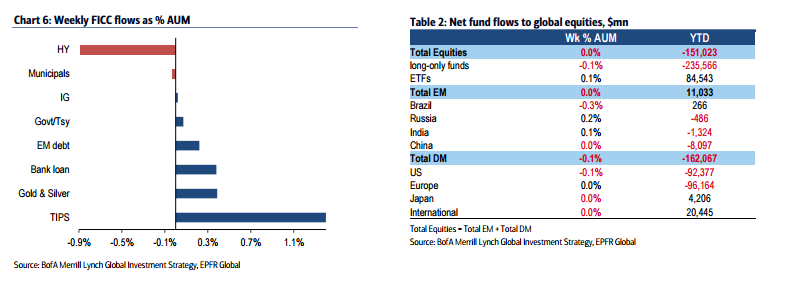

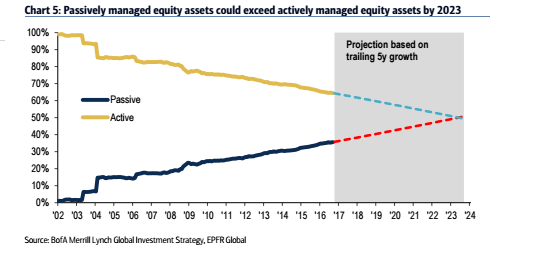

5.Active Mutual Funds Lose 4.4% of Industry Assets so Far in 2016….At this Rate Passive will Exceed Active by 2023.

The most significant theme this year has been the volume of funds flowing away from actively managed equity focused funds. Global long only equity funds recorded yet another week of outflows with $3.8 billion leaving the sector. Year-to-date $236 billion has been pulled from long-only equity mutual funds 4.4% of industry assets under management. At the same time, investors have plowed money into equity ETFs. $85 billion has found its way into equity focused ETFs this year, increasing industry assets under management by 3.8%. Last week $1.3 billion flowed into equity ETFs, while $5.1 billion left mutual funds for a net flow of -$3.8 billion. Year-to-date outflows from long-only equity mutual funds have exceeded inflows into equity ETFs by $151 billion.

Finally one more shocking stat from BAML that should have every fund manager shacking:

Radioactive “active” trend continues: another week of outflows from equities ($3.8bn) split between big outflows from mutual funds ($5.1bn), smaller inflows to ETFs ($1.3bn); based on projection of trailing 5-year growth rates, passively managed equity assets could exceed actively managed equity assets by 2023

http://www.valuewalk.com/wp-content/uploads/2016/11/Flows-equities.png

6.Not Only are Investors Pouring into ETFs, they are Buying Big Vanilla ETFs.

Top Gainers (October 2016)

| Ticker | Name | Issuer | Net Flows ($,mm) | AUM ($M) | % of AUM | YTD 2016 Net Flows($,M) |

| QQQ | PowerShares QQQ Trust | Invesco PowerShares | 2,000.30 | 40,745.11 | 5.16% | -2,609.20 |

| IVV | iShares Core S&P 500 ETF | BlackRock | 1,759.02 | 79,884.38 | 2.25% | 6,692.57 |

| SPY | SPDR S&P 500 ETF Trust | State Street Global Advisors | 1,627.75 | 195,851.02 | 0.84% | 1,269.88 |

| VEA | Vanguard FTSE Developed Markets ETF | Vanguard | 1,419.73 | 37,899.16 | 3.89% | 8,552.20 |

| VWO | Vanguard FTSE Emerging Markets ETF | Vanguard | 1,222.49 | 44,471.69 | 2.83% | 5,197.73 |

| IEFA | iShares Core MSCI EAFE ETF | BlackRock | 985.57 | 13,643.15 | 7.79% | 4,143.18 |

| IEMG | iShares Core MSCI Emerging Markets ETF | BlackRock | 960.23 | 17,836.38 | 5.69% | 6,471.11 |

| AGG | iShares Core U.S. Aggregate Bond ETF | BlackRock | 815.13 | 42,019.15 | 1.98% | 10,589.06 |

| XLF | Financial Select Sector SPDR Fund | State Street Global Advisors | 756.57 | 13,129.34 | 6.11% | -3,717.21 |

| XLE | Energy Select Sector SPDR Fund | State Street Global Advisors | 752.46 | 15,265.90 | 5.18% | 1,909.43 |

Top Gainers (Year-to-Date)

| Ticker | Name | Issuer | Net Flows ($,mm) | AUM ($M) | % of AUM | October 2016 Net Flows($,M) |

| GLD | SPDR Gold Trust | State Street Global Advisors | 11,884.57 | 38,566.56 | 44.54% | -215.88 |

| AGG | iShares Core U.S. Aggregate Bond ETF | BlackRock | 10,589.06 | 42,019.15 | 33.69% | 815.13 |

| VOO | Vanguard S&P 500 Index Fund | Vanguard | 9,100.61 | 51,334.38 | 21.55% | 708.04 |

| VEA | Vanguard FTSE Developed Markets ETF | Vanguard | 8,552.20 | 37,899.16 | 29.14% | 1,419.73 |

| EEM | iShares MSCI Emerging Markets ETF | BlackRock | 6,720.12 | 31,264.77 | 27.38% | 0.00 |

| IVV | iShares Core S&P 500 ETF | BlackRock | 6,692.57 | 79,884.38 | 9.14% | 1,759.02 |

| IEMG | iShares Core MSCI Emerging Markets ETF | BlackRock | 6,471.11 | 17,836.38 | 56.94% | 960.23 |

| LQD | iShares iBoxx $ Investment Grade Corporate Bond ETF | BlackRock | 5,504.61 | 30,899.97 | 21.68% | -1,682.58 |

| USMV | iShares Edge MSCI Min Vol USA ETF | BlackRock | 5,427.52 | 13,140.27 | 70.37% | -889.73 |

| VWO | Vanguard FTSE Emerging Markets ETF | Vanguard | 5,197.73 | 44,471.69 | 13.23% | 1,222.49 |

Biggest Losers (October 2016)

| Ticker | Name | Issuer | Net Flows ($,mm) | AUM ($M) | % of AUM | YTD 2016 Net Flows($,M) |

| LQD | iShares iBoxx $ Investment Grade Corporate Bond ETF | BlackRock | -1,682.58 | 30,899.97 | -5.16% | 5,504.61 |

| USMV | iShares Edge MSCI Min Vol USA ETF | BlackRock | -889.73 | 13,140.27 | -6.34% | 5,427.52 |

| IYR | iShares U.S. Real Estate ETF | BlackRock | -765.41 | 3,893.93 | -16.43% | -446.25 |

| VNQ | Vanguard REIT Index Fund | Vanguard | -692.65 | 31,728.39 | -2.14% | 4,332.88 |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF | BlackRock | -641.94 | 16,365.76 | -3.77% | 634.76 |

| JNK | SPDR Barclays High Yield Bond ETF | State Street Global Advisors | -619.31 | 11,822.51 | -4.98% | 1,385.55 |

| XLP | Consumer Staples Select Sector SPDR Fund | State Street Global Advisors | -618.19 | 8,118.17 | -7.08% | -438.50 |

| IWB | iShares Russell 1000 ETF | BlackRock | -506.70 | 15,501.34 | -3.17% | -139.31 |

| TLT | iShares 20+ Year Treasury Bond ETF | BlackRock | -491.91 | 6,440.96 | -7.10% | -161.02 |

| EZU | iShares MSCI Eurozone ETF | BlackRock | -479.43 | 7,044.85 | -6.37% | -6,768.46 |

Biggest Losers (Year-to-Date)

| Ticker | Name | Issuer | Net Flows ($,mm) | AUM ($M) | % of AUM | October 2016 Net Flows($,M) |

| HEDJ | WisdomTree Europe Hedged Equity Fund | WisdomTree | -7,600.69 | 9,022.72 | -45.72% | -261.68 |

| EZU | iShares MSCI Eurozone ETF | BlackRock | -6,768.46 | 7,044.85 | -49.00% | -479.43 |

| DXJ | WisdomTree Japan Hedged Equity Fund | WisdomTree | -5,829.14 | 7,139.11 | -44.95% | -33.94 |

| EWJ | iShares MSCI Japan ETF | BlackRock | -5,552.64 | 14,307.54 | -27.96% | 148.69 |

| DBEF | Deutsche X-trackers MSCI EAFE Hedged Equity ETF | Deutsche Bank | -5,046.13 | 7,633.92 | -39.80% | -308.64 |

| XLF | Financial Select Sector SPDR Fund | State Street Global Advisors | -3,717.21 | 13,129.34 | -22.07% | 756.57 |

| VGK | Vanguard FTSE Europe ETF | Vanguard | -3,549.33 | 10,559.63 | -25.16% | -208.24 |

| QQQ | PowerShares QQQ Trust | Invesco PowerShares | -2,609.20 | 40,745.11 | -6.02% | 2,000.30 |

| EWG | iShares MSCI Germany ETF | BlackRock | -2,306.62 | 3,481.93 | -39.85% | -102.16 |

| IWF | iShares Russell 1000 Growth ETF | BlackRock | -2,293.83 | 29,867.22 | -7.13% | 144.44 |

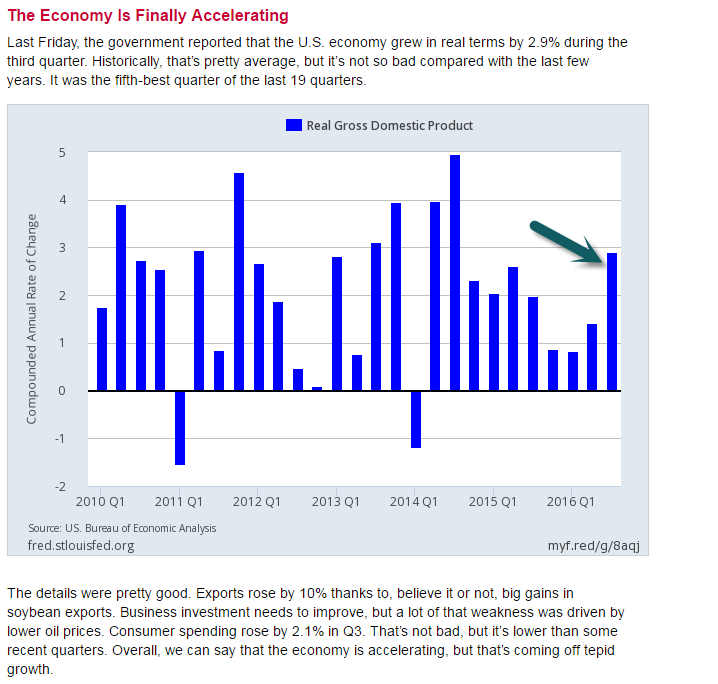

7.Real GDP 5th Best of Last 19 Quarters.

http://www.crossingwallstreet.com/

8. 7 Impossible Trading Rules To Follow

The 7 Impossible Trading Rules To Follow:

Here are the rules – they are not unique or new. They are time tested and successful investor approved. Like Mom’s chicken soup for a cold – the rules are the rules. If you follow them you succeed – if you don’t, you don’t.

1) Sell Losers Short: Let Winners Run: It seems like a simple thing to do but when it comes down to it the average investor sells their winners and keeps their losers hoping they will come back to even.

2) Buy Cheap And Sell Expensive: You haggle, negotiate and shop extensively for the best deals on cars and flat screen televisions. However, you will pay any price for a stock because someone on television told you too. Insist on making investments when you are getting a “good deal” on it. If it isn’t – it isn’t, don’t try and come up with an excuse to justify overpaying for an investment. In the long run – overpaying will end in misery.

3) This Time Is Never Different: As much as our emotions and psychological makeup want to always hope and pray for the best – this time is never different than the past. History may not repeat exactly but it surely rhymes awfully well.

4) Be Patient: As with item number 2; there is never a rush to make an investment and there is NOTHING WRONG with sitting on cash until a good deal, a real bargain, comes along. Being patient is not only a virtue – it is a good way to keep yourself out of trouble.

5) Turn Off The Television: Any good investment is NEVER dictated by day to day movements of the market which is merely nothing more than noise. If you have done your homework, made a good investment at a good price and have confirmed your analysis to correct – then the day to day market actions will have little, if any, bearing on the longer-term success of your investment. The only thing you achieve by watching the television from one minute to the next is increasing your blood pressure.

6) Risk Is Not Equal To Your Return: Taking RISK in an investment or strategy is not equivalent to how much money you will make. It only relates to the permanent loss of capital that will be incurred when you are wrong. Invest conservatively and grow your money over time with the LEAST amount of risk possible.

7) Go Against The Herd: The populous is generally right in the middle of a move up in the markets but they are seldom right at major turning points. When everyone agrees on the direction of the market due to any given set of reasons – generally something else happens. However, this also cedes to points 2) and 4); in order to buy something cheap or sell something at the best price – you are generally buying when everyone is selling and selling when everyone else is buying.

http://www.zerohedge.com/news/2016-11-07/7-impossible-trading-rules-follow

9.Read of the Day….What Is Democracy?

Posted November 7, 2016 by Michael Batnick

Will Durant answered this question so eloquently in The Lessons of History- I though tonight would be an appropriate time to review the words he wrote half a century ago.

“Democracy is the most difficult of all forms of government, since it requires the widest spread of intelligence, and we forgot to make ourselves intelligent when we made ourselves sovereign. Education has spread, but intelligence is perpetually retarded by the fertility of the simple. A cynic remarked that “you mustn’t enthrone ignorance just because there is so much of it.” However, ignorance is not long enthroned, for it lends itself to manipulation by the forces that mold public opinion. It may be true, as Lincoln supposed, that “you can’t fool all the people all the time,” but you can fool enough of them to rule a large country.”

“All deductions having been made, democracy has done less harm and more good, than any other form of government. It gave to human existence a zest and camaraderie that outweighed its pitfalls and defects. It gave to thought and science and enterprise the freedom essential to their operation and growth. It broke down the walls of privilege and class, and in each generation it raised up ability from every rank and place.”

“If race or class war divides us into hostile camps, changing political argument into blind hate, one side or the other may overturn the hustings with the rule of the sword. If our economy of freedom fails to distribute wealth as ably as it has created it, the road to dictatorship will be open to any man who can persuasively promise security to all; and a martial government, under whatever charming phrases, will engulf the democratic world.”

Source:

The Lessons of History

http://theirrelevantinvestor.com/2016/11/07/what-is-democracy/

10.How to Change Your Course in Life

You’re about to discover how to get more done, make more money, and still get home on time for dinner. Today you’re going to walk away with 5 personal rules for your life that will make you a better business owner and parent.

But before I do that, I want you to think about what’s been keeping you up at night. What are those pains and pinches causing you stress and anxiety?

Everyone has them. Even me. In fact, I once had stress so bad that it sent me to the hospital twice. The year was 2006 and that was when I hit rock bottom. Back then I was still a part-time personal trainer and my online business was just beginning to take off.

Things were going well. Too well. I ended up becoming so successful (thanks to Tom Venuto’s coaching!) that I was able to quit my job as a personal trainer and now I had ALL the freedom in the world. I had the freedom to get up when I wanted… to stay out late… to chase girls every night of the week… And it brought me to my knees.

That’s the Paradox of Freedom – too much freedom often leads to stress and anxiety.

Look at the Johnny Depps of the world, the rich kids of Instagram, the rock stars that OD on pills, the Internet Marketing gurus making tons of money but with home lives in shambles because they lack structure and discipline in their personal life…

Too Much Money + No Rules = A Disaster Waiting to Happen

Back in 2006, the paradox of freedom gave me severe anxiety and panic attacks. For six weeks straight, 24 hours a day and 7 days a week, I felt as if I was having a heart attack. There were tingles from the top of my head down to my fingertips. I had a tight chest, elevated heart rate, and I couldn’t breathe.

It was so intense that twice during those six weeks, at the start and at the end, I walked into an emergency room in Toronto and said, “I think I’m having a heart attack.”

(And let me tell you, if ever walk into a busy emergency room and want to get to the front of the line, just say you’re having a heart attack. They’ll take you to the back right away!)

It was the LOWEST point of my life. There I was, a 30-year old world-famous personal trainer, an exercise guru with his workouts featured in Men’s Health magazine each month, and I thought I was going to die. It was the LOWEST point of my life.

I tried everything to get healthy again. I did meditation, Qi Gong, and Yoga…I even bought a puppy because I read that petting a dog reduced anxiety. But the dog I bought, old Bally, didn’t want to play fetch, didn’t want to walk around the block, and cried every time I left him at home because he was so anxious.

And suddenly I realized that I had bought the dog version of me!

Fortunately, by turning over every rock and investigating every natural therapy, I was finally able to overcome my anxiety in May of 2006. And what I discovered during my struggles was the importance of having STRUCTURE in your life.

Here’s the Paradox of Structure: The more structure and discipline you have in your life, the more freedom you will earn and enjoy.

Now you might be thinking, “Craig, that just doesn’t make any sense.”

Hear me out. Or at least listen to Paulo Coelho, the famous author of The Alchemist, who said it much more eloquently than me when he wrote:

“Discipline and freedom are not mutually exclusive, but mutually dependent, because without discipline you would sink into chaos.”

Think about how this applies to your every day life. It doesn’t matter where you live, your city has red lights and stop signs, and you obey them. Why? Those are the rules of the road, and when you follow these rules, you get to your destination safely, and you can enjoy the freedom of being there. The rules of the road give you freedom and security.

That’s the perfect analogy for having rules for your life. Besides, you already live by personal rules, you just haven’t taken the time to think about them and write them down.

If you follow the Paleo diet (or any kind of diet), you have nutrition rules. If you do Cross-Fit or bodybuilding, you have exercise rules. If you’re a parent and you enforce a bedtime on your children, you have rules for their life. So yes, everyone follows rules.

Now it’s a matter of building the best rules for you so that you get better results.

There are 5 rules you need for your life:

Rule #1: Be Consistent to Bed and Getting Up in the Morning

Establishing a consistent bedtime and wake-up time seven days a week is the best thing you can do for consistent all-day energy levels. Of course, there will be a couple of nights per week when you stay up late. That’s fine. But you must never stray too far from your wake-up time. Don’t sleep in. That sets off a vicious cycle of not being able to fall asleep the next night and feeling tired for the following two or three days. Instead, wake up on time and compensate with a mid-day nap or go to bed earlier the next night.

Rule #2: Focus on Your #1 Priority for 15 Minutes in the Morning

To get ahead in life you need to focus on what matters. The best time to do that is in the morning when you are without distractions. Set a rule that you work on your number one priority in life for at least fifteen minutes after you wake-up. That could be Bible study, fixing your finances, figuring out a marketing plan to make more sales, or spending that time in exercise to regain your health. Fifteen minutes might sound insignificant, but done six (or seven days) a week for months on end brings incredible results.

Rule #3: Have One Health Habit that Makes a Major Impact On Your Wellbeing

Everyone should have a health rule that sets the foundation of all other habits for your health and wellbeing. It might describe your eating philosophy (Paleo, vegan, etc.) or perhaps the type and frequency of exercise or stress reduction you do (“I take a one-hour hike in the fresh air three times per week” or “I lift weights three times per week for twenty minutes” or “I never miss a morning meditation session of 10 minutes”).

Rule #4: Do One Wealth Building Action Step Each Day

ETR’s founder, Mark Ford, taught us to become wealthier every day, even if it is just by a few dollars. And so we should all have a rule that helps us do so. For example, a sales professional might have a rule that “I make 5 sales calls before lunch every work day.” A writer might choose to “write 1,500 words before 2 p.m. each day” (Stephen King follows a similar rule, for example). Whatever your role, there is a way to structure a wealth building rule that gets you closer to your financial freedom.

Rule #5: Have a NOT To Do to Keep You Out of Trouble!

It’s important to know and act on your number one priority in life. It’s almost equally as important to know — and avoid — the things you should not do. If you don’t believe me, just ask one of the world’s wealthiest men.

“The difference between successful people and really successful people,” Warren Buffett once said, “is that really successful people say no to almost everything.”

Your rule might be “No drinking alcohol during the work week” or “I don’t check personal email until after 7 p.m.” or a rule like mine that says, “I do not engage in confrontations with anyone, in-person or online. This is a waste of time and energy. If I have caused harm, I apologize and fix the situation. And then I take a deep breath, relax, breathe out, and re-focus my efforts back on my work and goals.”

Create your rules. Print them out. Keep them in front of you at all times.

Your rules will bring you structure. Your structure will bring you TRUE freedom.

But without structure, you’ll suffer from “too much freedom.”

Yes, too much freedom is a 1st World Problem, but listen, you live in the 1st world. This is your reality. Forget about the criticisms of others. These 1st world problems are holding you back, and it’s time to fix this, otherwise it will only get worse if you wait to take care of it. Without the right structure in your life you’ll miss out on the true freedom and independence you should be enjoying. You’ll be working too hard, sacrificing too much, and harming yourself in your never-ending quest to help others.

This can’t go on. Your days of martyring yourself for others are over. You’ve done the work, paid your dues, and you deserve a life. Don’t fool yourself into thinking that you’re not letting money and time slip through your hands, because being overwhelmed and anxious causing exactly this to happen. I know. Trust me.

When you lose time, it’s gone forever… your idea of success must change… It’s not about money… You must treat time, not money, as your ultimate prize in life.