1.Banks Lead Yesterday

KRE Bank ETF 50% Rise Since Election

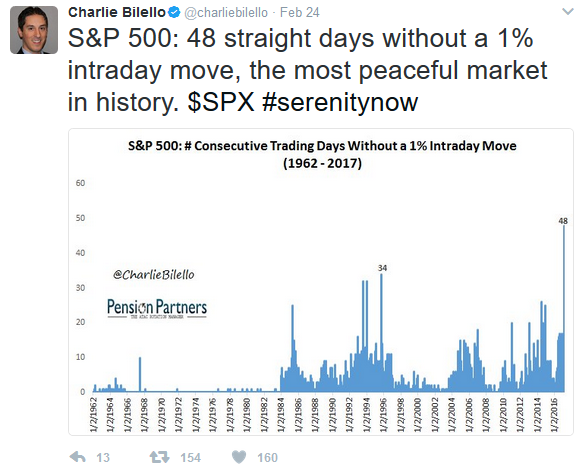

2.48 Days Without a 1% Intraday Move—“The Most Peaceful Market in History”

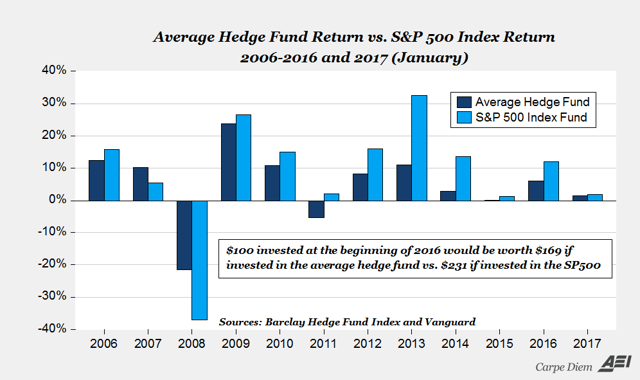

3.Peace Not Helping Hedgies…Will we get Shakeout? 500 Hedge Funds in 2000—10,000 in 2016.

http://seekingalpha.com/article/4049862-investment-advice-warren-buffett-invest-low-cost-index-funds-advice-ignored-elites

4.Oil Volatility is Collapsing to 2015 Levels.

Oil volatility chart $80 to $24

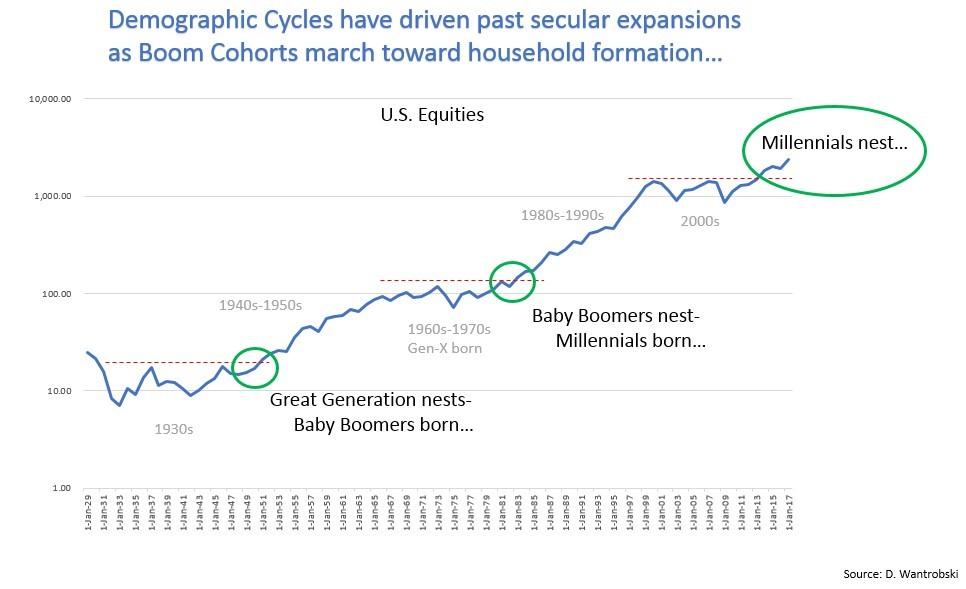

5.Investors May be Worried About Bubble But U.S. Demographics Very Positive.

GEN Y Just Hitting Household Formation Years

https://www.linkedin.com/in/daniel-wantrobski-7b29096/

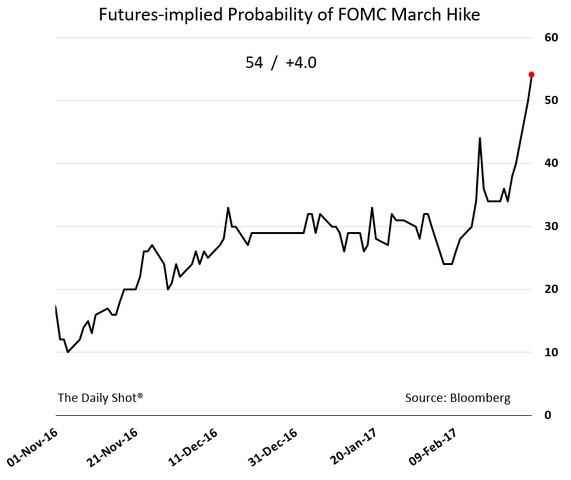

6.FED Rate Hike Probabilities Rise Above 50%

These comments have pushed the probability of a hike next month above 50%.

www.thedailyshot.com

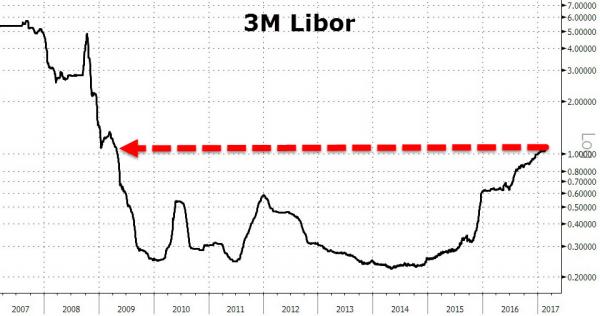

7.Follow Up to Last Weeks Comments on LIBOR….3 Month Libor Hits 8 Year High.

U.S. 3-month Libor was set near an eight-year high early on Wednesday at 1.09278 percent compared with 1.064 percent on Tuesday. The 2.878 basis point rise was the largest since Dec 17, 2015, the day after the Fed’s first rate hike following the financial crisis and the Great Recession.

The jump comes as short-term rate markets are rapidly repricing the risk that the U.S. central bank may deliver another rate increase as early as mid-March, when its monetary policy committee next meets.

In recent days a clutch of Fed policymakers have spoken about the case for a near-term rate hike becoming more compelling in the aftermath of the election of Donald Trump as president and a Republican-controlled Congress intent on pursuing an aggressive pro-growth economic agenda.

The latest voices to argue that case came on Tuesday, when both the influential heads of the New York and San Francisco Federal Reserve banks signaled they are concerned about waiting too long to press rates higher.

http://www.zerohedge.com/news/2017-03-01/libor-spikes-most-15-months-8-year-highs

http://www.zerohedge.com/news/2017-03-01/libor-spikes-most-15-months-8-year-highs

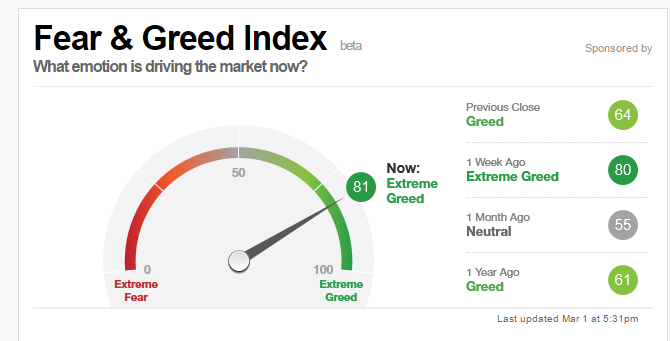

8.Fear and Greed Index Hits “Extreme Greed”

Read description and components here

Read description and components here

http://money.cnn.com/data/fear-and-greed/

9.Read of Day….Trump Faces the Tyranny of High Expectations

Every day stocks go up, investors are pricing in greater success for president’s agenda

JUSTIN LAHART

March 1, 2017 3:57 p.m. ET

2 COMMENTS

The stock market is setting the bar higher and higher for President Donald Trump. Investors had better hope he clears it.

With stocks rocketing to new highs on Wednesday in the wake of Mr. Trump’s speech before Congress Tuesday night, it is worth recounting what has happened this week to spur the rally.

There was a big shift in perceptions about when the Federal Reserve will raise rates after New York Fed President William Dudley said in a television interview that the case for tightening “has become a lot more compelling.” That carries a lot of weight, since Mr. Dudley’s views on the economy are closely allied with Fed Chairwoman Janet Yellen’s. The chances futures markets assign to a rate increase at this month’s Fed meeting jumped to about 70% from about 35% before Mr. Dudley’s interview aired.

But even as the Fed looks more likely to raise rates, the economic data are looking a little less inspiring. February spending figures and January construction figures released Wednesday morning were weaker than expected. While the stock market soared, economists were cutting their expectations for first-quarter growth in gross domestic product. J.P. Morgan Chase cut its estimate from 2% to a 1.5% annual rate.

A more hawkish Fed plus a softer economy hardly seem like the recipe for a rally, but then there was Mr. Trump’s speech. Even though he remained light on policy specifics, the president’s less combative rhetoric was seen as making it easier for him to push through his spending and tax-cut plans. If he succeeds, the profits boost for companies might be big enough to justify the high prices investors are now paying for stocks.

But each time stocks go higher, investors are raising the stakes on what Mr. Trump must accomplish. The policy he and congressional Republicans hammer out will have to offer companies substantial benefits. And moves that could damage profits, such as tariffs and trade restrictions, will have to be held in check.

If Mr. Trump’s eventual policies aren’t the stuff of investors’ dreams, or don’t get passed at all, the stock market could become a nightmare.

10.What Navy SEAL Team 6 can teach us about how to succeed at work

By Jamie Wheal and Steven Kotler

Published: Mar 2, 2017 3:24 a.m. ET

SEALs go against most default approaches to leadership, training and execution to excel under adversity

Images

Prospective Navy SEALS participate in a land navigation training exercise in 2010.

There may not be another organization on the planet that routinely faces such adversity and instability as SEAL Team 6 (officially known as the U.S. Naval Special Warfare Development Group, or DEVGRU). But the methods these special operators use to excel under those conditions are surprisingly straightforward.

The catch? They go against most default approaches to leadership, training and execution. If business leaders facing turbulent conditions of their own can adapt three of these techniques, they can bring some of that elite teamwork into their own organizations.

Prevailing through chaotic combat conditions requires an astounding level of cognitive dexterity and almost superhuman teamwork. SEALs have to be able to stop acting like individuals, and start operating as a single entity, almost on demand. As DEVGRU Commander Rich Davis explains: “More than any other skill, SEALs rely on a merger of consciousness—‘flipping the switch,’ that’s the real secret to being a SEAL.” (Davis’s name has been changed by the authors for security purposes.)

Contemporary scientists have slightly different terms and descriptions. They call the experience: “group flow.” “[It’s] a peak state,” explains University of North Carolina psychologist Keith Sawyer in his book “Group Genius,” “a group performing at its top level of ability. In situations of rapid change, it’s more important than ever for a group to be able to merge action and awareness, to adjust immediately by improvising.” And it’s prioritizing that adaptive, collective intelligence that is the first step in decoding how these teams accomplish what they do.

Of course, this isn’t how we normally think of SEALs. What we know best about these special operators is how hard they train their bodies, not their minds. Hell Week, for example, the kickoff to their infamous selection process, is 5½ days of nonstop physical exertion and radical sleep deprivation that routinely breaks world-class athletes. But even this crucible is more about brain than body. “At every step of the training,” says Davis, “from the first day of BUD/S (Basic Underwater Demolition/SEALs) through their last day in DEVGRU, we are weeding out candidates who cannot shift their [mental] state and merge with the team.”

For typical organizations, training is either a necessary evil endured by new hires, a perk reserved for executives or “high potentials” or, come crunch time, an expense to be cut.

When most companies hire new talent, they go off resumes—where someone went to school, what positions they’ve held in the past, what their individual accomplishments have been. And while that kind of initial screening might establish baseline capability, it in no way diagnoses or predicts the likelihood of being able to merge with teammates in high-stress situations.

To get to that level of elite coordination, where teammates “flip the switch” on demand and do the near-impossible, DEVGRU deploys a couple of specific techniques: overtraining and dynamic subordination. Neither of them is necessarily complicated, but for any organization looking to emulate them, both require serious commitment.

The first is an obvious prerequisite: invest in excellence. Archilochus, the classical Greek poet (and originator of Jim Collins’ hedgehog concept) coined another phrase adapted by the Navy teams: “Under pressure, you don’t rise to the occasion, you sink to the level of your training.” So the SEALs commit to training nearly every scenario imaginable, under all conditions. That investment adds up fast: it costs over a million dollars a year to keep a member of DEVGRU in the field, while in ammunition alone, they spend as much as the entire U.S. Marine Corps.

For typical organizations, training is either a necessary evil endured by new hires, a perk reserved for executives or “high potentials” or, come crunch time, an expense to be cut. By allocating the time and resources toward continuous high-quality practice across all levels of their organization, DEVGRU creates conditions where the level of their training routinely exceeds the real-world conditions they face. And it doesn’t have to involve big budgets or executive signoff. Even on a small team, the ability to plan regularly and to debrief projects with an “After Action Review” can help foster what Harvard Business School’s Chris Argyris calls “double-loop learning”—where employees learn to reflect on their approach and not just the results.

Street Books

The next technique is easy to understand intellectually but harder to implement culturally: dynamic subordination.

“When SEALs sweep a building,” explains Commander Davis, “slow is dangerous. We want to move as fast as possible. To do this, there are only two rules. The first is do the exact opposite of what the guy in front of you is doing—so if he looks left, then you look right. The second is trickier: the person who knows what to do next is the leader. We’re entirely non-hierarchical in that way. But in a combat environment, when split-seconds make all the difference, there’s no time for second-guessing. When someone steps up to become the new leader, everyone, immediately, automatically, moves with him. It’s the only way we win.”

This “dynamic subordination,” where leadership is fluid and defined by conditions on the ground, is the foundation of accessing the performance gains of group flow. But to ingrain it in their operational culture, the SEALs have had to break with strict naval protocols, forego standard dress codes and deliberately blur divisions between ranks. It’s a stark meritocracy, where a veteran chief petty officer (the senior-most enlisted position) carries far more authority than a new officer fresh from Annapolis.

In egalitarian startups, where CEOs and coders all share the same folding tables and eat from the same pizza boxes, this kind of structural flexibility comes naturally. But as soon as companies become more established, corner offices, preferred parking spaces, seating charts, dress norms, and a host of other signs and signifiers of organizational power calcify the flexibility of “the person who knows what to do next is in charge.”

What SEALS do to support that high-performance culture is straightforward: they screen for group flow as much as for individual skills.

To fully experience the power of dynamic subordination, you have to be willing to constantly deconstruct static hierarchies. From the subtle things, like varying who facilitates meetings or sends out calendar invites, to the bigger things, like who claims airtime in strategy sessions or participates in hiring and review processes, you have to repeatedly upend the comfortable conventions of company culture. And while a large amount of this responsibility to set cultural norms rests with the leaders of the company, middle managers and newer employees can “manage up” to offer insights and take initiative.

While the last decade has seen an explosion of popular interest in the biographies and mission accounts of individual SEALs, the real power of special operations culture comes from what they achieve together. At their best, they are always an anonymous team. “I do not seek recognition for my actions . . .,” reads the SEAL code, “I expect to lead and be led . . . my teammates steady my resolve and silently guide my every deed.” And this ethos is reinforced every time they flip that switch, when egos disappear and they perform together in ways that are just not possible alone.

What they do to support that high-performance culture is straightforward: they screen for group flow as much as for individual skills. They over-invest in rigorous training. They enforce dynamic subordination. As with all things these operators do, just because it’s simple doesn’t mean it’s easy.

But that provides a competitive advantage for any organization willing to emulate their methods. And if you’re unsure whether your entire organization would be willing or able to make changes such as these, you can always start small—with your immediate team. Perform so well they can’t ignore you. Then share some of the insights that inspired you.

Jamie Wheal and Steven Kotler are the authors of “Stealing Fire: How Silicon Valley, the Navy SEALs and Maverick Scientists are Reinventing the Way We Live and Work”, published in February.

http://www.marketwatch.com/story/what-navy-seal-team-6-can-teach-us-about-how-to-succeed-at-work-2017-03-01