1.Yield Curve Steepening and Showing No Signs of Recession.

The Yield Curve Reflects Good News

I find more reason for optimism in the yield curve – the plot of the yields on 3-month through 30-year Treasury securities. The yield curve has steepened since the election, and this is good news.

The slope of the yield curve has borne a consistent relationship with economic activity. The yield curve has predicted all U.S. recessions except one since 1950. Recessions, as you would expect, correlate positively with bear markets. When the yield curve flattens, or inverts, a recession usually looms and so does a bear market.

That’s not the case today. The yield curve is just the way we should like it – progressively higher with each maturity and upward sloping to the right. When the yield curve steepens, economic growth usually follows.

Yield Curve Slope

http://etfdailynews.com/2017/01/04/dow-20k-is-just-the-beginning-of-a-massive-rally-in-2017/

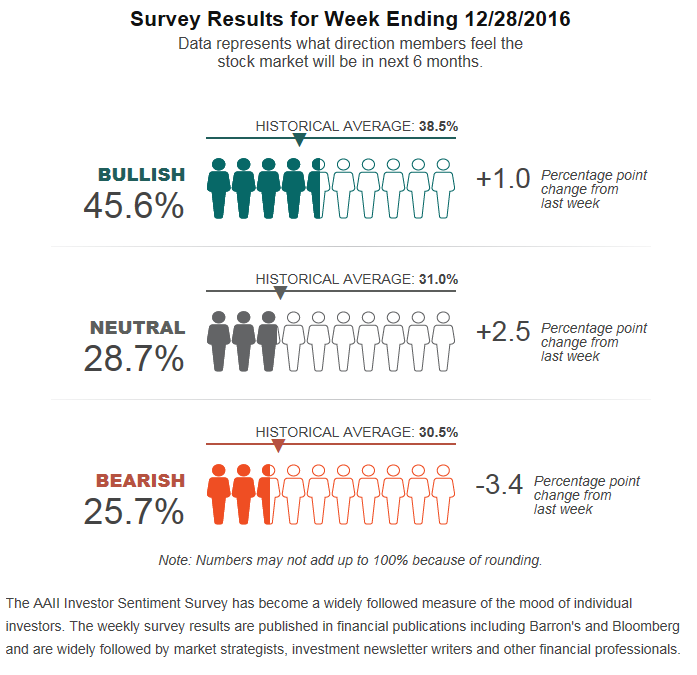

2.Short Term Sentiment –AAII Poll…The Historical Average is 38.5% Bullish and 30.5% Bearish. …45.6% Now.

A month ago, these figures were flipped, with a plurality of investors being bearish.

Fear and Greed Index Aggressive but not Extreme.

http://money.cnn.com/data/fear-and-greed/

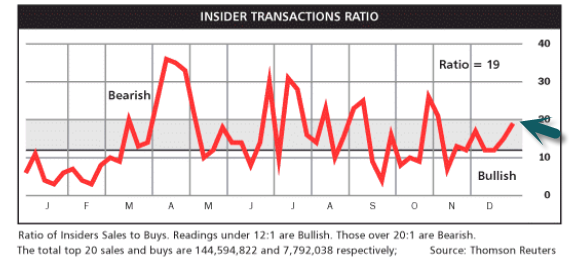

Barrons Insider Transaction Ratio-Not Near Previous Highs.

http://www.barrons.com/public/page/9_0210-instrans.html

3.Ford Cancels Mexican Plant for Michigan.

Canceling plans to build a new $1.6B plant in Mexico, Ford (NYSE:F) said it will invest $700M in Michigan instead, creating 700 new U.S. jobs. CEO Mark Fields said the investment is a “vote of confidence” in the pro-business environment being created by Donald Trump, but stressed Ford didn’t cut a special deal with the President-elect. The automaker was a frequent target of Trump’s election campaign for its “south of the border” manufacturing and payment of low tariffs. www.seekingalpha.com

Technology to Build a Truck in One Minute.

http://www.slideshare.net/chitsbull/ford-operations-management

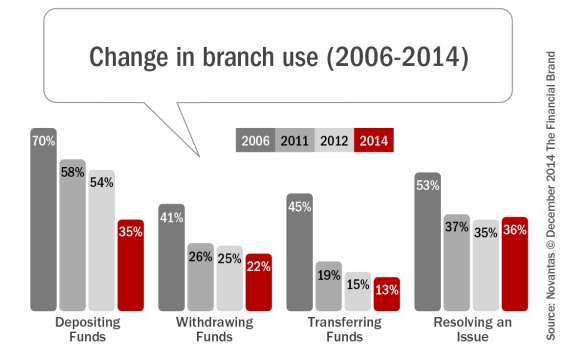

4.Bank Branches and Millennials.

HOWARD MASON, BANKS, THEME- The Millennials. While the prospect for a steeper curve and rising short rates, along with regulatory and tax reform, has given a cyclical lift to bank stocks the more strategic significance of 2017 is likely to be a broad re-evaluation of the role of branches for customer sales and service.

The digital erosion of branch traffic has now made ~one-third of US bank branches economically non-viable on service alone and the opportunity for make-up through in-branch cross-sell will be limited by regulatory scrutiny of sales practices and by the potential to use the location-based and real-time capabilities of customer mobile devices to deliver more needs-based marketing solutions.

Over the next decade, we expect branch-density in the US to fall by one-third from the current level of just over 30 branches per 100,000 adults, and the shift from branch to direct-channels will disproportionately advantage large players as it did for card-lending in the 1990s. Specifically, national scale and brand, along with customer lock-in to bank apps, will encroach on the network effects of local branch-systems as digital platforms change increase industry fixed-costs and catalyze investment in “test-and-learn” behavioral technology.

One measure of the advantage of large-banks is provided by their disproportionate share of millennial customers who tend to be more mobile-oriented: JPM and BAC each have ~20% share of the segment with WFC at ~15%. Howard continues to be overweight BAC and C with above consensus estimates.

5.Wall Street Strategists Playing it Safe in 2017…That Means it will be Big Upside or Downside Year?

HERD MENTAILITY– Wall Street strategists are abiding by a new motto these days: When in doubt, copy everyone else – A group of 15 Wall Street strategists expect the S&P 500, on average, to finish the year at 2356 – That is good for only about a 5% gain, the least optimistic this bunch has been since 2005, according to Bespoke.

At the high end is RBC’s Jonathan Golub, who forecasts 2500 by year-end. On the other side, David Kostin at Goldman Sachs Group Inc. and Bank of America Merrill Lynch’s Savita Subramanian are among several strategists with targets of 2300, just a slight rise from the end of 2016 – The gap between the most optimistic and pessimistic forecasts is just 9%, the smallest on record dating back to 1999, according to Jason Goepfert, founder of Sundial Capital Research.

Thanks to Dave Lutz at Jones.

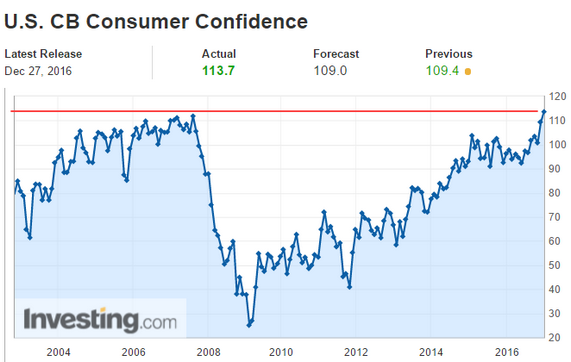

6.Consumer Spending at 15 Year High.

United States: According to the Conference Board, US consumer confidence is now at the highest level since 2001 (right before 9/11). Will this trend translate into spending?

7.Unleaded Gasoline Jumps 27% Since November Lows.

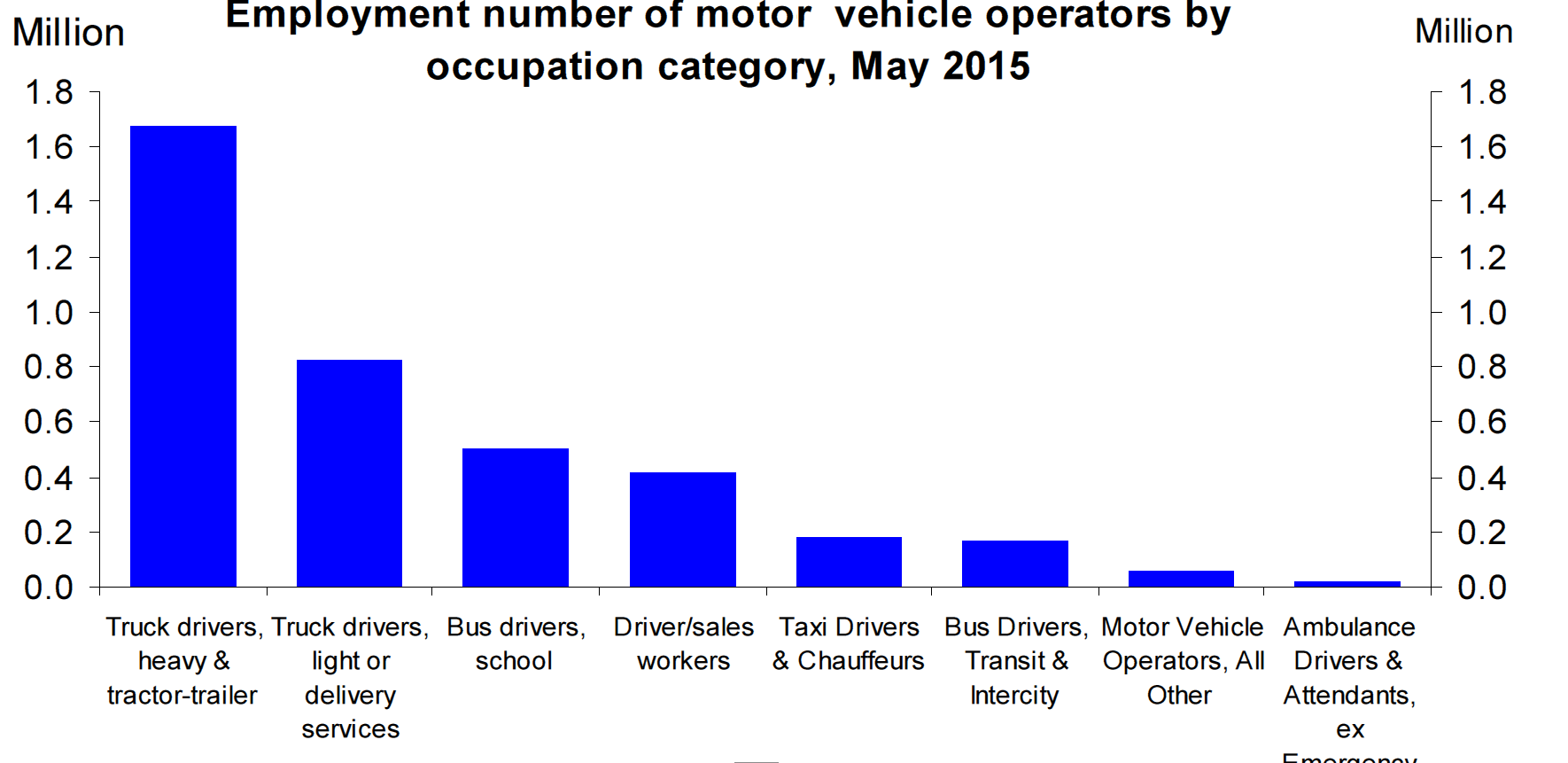

8. 3.8 Million People in the U.S. Drive for a Living.

Torsten Sløk, Ph.D.

Chief International Economist

Managing Director

Deutsche Bank Securities

60 Wall Street

New York, New York 10005

Tel: 212 250 2155

9. 250 New ETFs Launched in 2016.

Investors funneled a record $375B into exchange-traded funds in 2016, according to BlackRock (NYSE:BLK), compared with $348B in 2015. Best and worst non-leveraged perfomers: SILJ +150.6%, XME +112.5% RSXJ +105%, VXX -68.9%, VIIX -68.9%, VIXY -68.7%. Nearly 250 new ETFs were also launched during the year, with the dominant category being U.S. equities, representing 36% of new funds.

The following ETFs and ETNs have been launched in 2016:

| Launch | Fund | Ticker | Exchange | ||||||||||

| 12/21/2016 | WBI Power Factor High Dividend ETF | WBIY | NYSE Arca | 5/12/2016 | iShares Edge MSCI Multifactor Financials ETF | FNCF | Bats | ||||||

| 12/20/2016 | NuShares Short-Term REIT ETF | NURE | Bats | 5/12/2016 | iShares Edge MSCI Multifactor Energy ETF | ERGF | Bats | ||||||

| 12/20/2016 | BMO Elkhorn DWA MLP Select Index ETN | BMLP | Nasdaq | 5/12/2016 | JPMorgan Diversified Return U.S. Mid Cap Equity ETF | JPME | NYSE Arca | ||||||

| 12/19/2016 | Pacer US Cash Cows 100 ETF | COWZ | Bats | 5/10/2016 | Global X Health & Wellness Thematic ETF | BFIT | Nasdaq | ||||||

| 12/16/2016 | John Hancock Multifactor Developed International ETF | JHMD | NYSE Arca | 5/10/2016 | Global X Longevity Thematic ETF | LNGR | Nasdaq | ||||||

| 12/16/2016 | NuShares ESG Large-Cap Growth ETF | NULG | Bats | 5/10/2016 | IQ Enhanced Core Bond U.S. ETF | AGGE | NYSE Arca | ||||||

| 12/16/2016 | NuShares ESG Large-Cap Value ETF | NULV | Bats | 5/10/2016 | IQ Enhanced Core Plus Bond U.S. ETF | AGGP | NYSE Arca | ||||||

| 12/16/2016 | NuShares ESG Mid-Cap Growth ETF | NUMG | Bats | 5/10/2016 | Guggenheim U.S. Large Cap Optimized Volatility ETF | OVLC | NYSE Arca | ||||||

| 12/16/2016 | NuShares ESG Mid-Cap Value ETF | NUMV | Bats | 5/05/2016 | Global X Millennials Thematic ETF | MILN | Nasdaq | ||||||

| 12/16/2016 | NuShares ESG Small-Cap ETF | NUSC | Bats | 5/03/2016 | REX VolMAXX Long VIX Weekly Futures Strategy ETF | VMAX | Bats | ||||||

| 12/9/2016 | WEAR ETF | WEAR | Bats | 5/03/2016 | REX VolMAXX Inverse VIX Weekly Futures Strategy ETF | VMIN | Bats | ||||||

| 12/9/2016 | VelocityShares 3x Inverse Crude Oil ETN | DWT | NYSE Arca | 4/27/2016 | WisdomTree Fundamental U.S. Corporate Bond Fund | WFIG | BATS | ||||||

| 12/9/2016 | VelocityShares 3x Long Crude Oil ETN | UWT | NYSE Arca | 4/27/2016 | WisdomTree Fundamental U.S. Short-Term Corporate Bond Fund | SFIG | BATS | ||||||

| 12/8/2016 | Janus SG Global Quality Income ETF | SGQI | Nasdaq | 4/27/2016 | WisdomTree Fundamental U.S. High Yield Corporate Bond Fund | WFHY | BATS | ||||||

| 12/7/2016 | Deutsch X-trackers USD High Yield Corporate Bond ETF | HLYB | NYSE Arca | 4/27/2016 | WisdomTree Fundamental U.S. Short-Term High Yield Corporate Bond Fund | SFHY | BATS | ||||||

| 12/6/2016 | Virtus Newfleet Dynamic Credit ETF | BLHY | NYSE Arca | 4/26/2016 | CrowdInvest Wisdom ETF | WIZE | NYSE Arca | ||||||

| 12/2/2016 | iShares MSCI USA ESG Optimized ETF | ESGU | Nasdaq | 4/22/2016 | iShares Sustainable MSCI Global Impact ETF | MPCT | Nasdaq | ||||||

| 12/1/2016 | PowerShares S&P International Developed High Dividend Low Volatility Portfolio | IDHD | Bats | 4/20/2016 | Amplify Online Retail ETF | IBUY | Nasdaq | ||||||

| 12/1/2016 | PowerShares S&P SmallCap High Dividend Low Volatility Portfolio | XSHD | Bats | 4/19/2016 | Guggenheim Large Cap Optimized Diversification ETF | OPD | NYSE Arca | ||||||

| 11/21/2016 | FlexShares Core Select Bond Fund | BNDC | NYSE Arca | 4/19/2016 | Sprott BUZZ Social Media Insights ETF | BUZ | NYSE Arca | ||||||

| 11/18/2016 | Legg Mason Emerging Markets Low Volatility High Dividend ETF | LVHE | Bats | 4/19/2016 | Deutsche X-trackers FTSE Emerging Comprehensive Factor ETF | DEMG | NYSE Arca | ||||||

| 11/18/2016 | iPath Series B S&P GSCI Crude Oil ETN | OILB | NYSE Arca | 4/19/2016 | Global X Catholic Values ETF | CATH | Nasdaq | ||||||

| 11/17/2016 | Janus Short Duration Income ETF | VNLA | NYSE Arca | 4/14/2016 | SPDR DoubleLine Emerging Markets Fixed Income ETF | EMTL | Bats | ||||||

| 11/16/2016 | JPMorgan Diversified Return U.S. Small Cap Equity ETF | JPSE | NYSE Arca | 4/14/2016 | SPDR DoubleLine Short Duration Total Return Tactical ETF | STOT | Bats | ||||||

| 11/15/2016 | Global X MSCI SuperDividend EAFE ETF | EFAS | Nasdaq | 4/14/2016 | First Trust RiverFront Dynamic Developed International ETF | RFDI | Nasdaq | ||||||

| 11/08/2016 | USCF Restaurant Leaders Fund | MENU | NYSE Arca | 4/14/2016 | First Trust RiverFront Dynamic Asia Pacific ETF | RFAP | Nasdaq | ||||||

| 11/03/2016 | WisdomTree Dynamic Currency Hedged International Quality Dividend Growth Fund | DHDG | Bats | 4/14/2016 | First Trust RiverFront Dynamic Europe ETF | RFEU | Nasdaq | ||||||

| 11/03/2016 | iShares Core 5-10 Year USD Bond ETF | IMTB | NYSE Arca | 4/07/2016 | WisdomTree Emerging Markets Dividend Fund | DVEM | Bats | ||||||

| 11/03/2016 | Goldman Sachs Hedge Industry VIP ETF | GVIP | NYSE Arca | 4/07/2016 | WisdomTree International Quality Dividend Growth Fund | IQDG | Bats | ||||||

| 11/03/2016 | Barclays ETN+FI Enhanced Europe 50 ETN, Series B | FLEU | NYSE Arca | 4/07/2016 | Direxion Daily Energy Bear 1X Shares | ERYY | NYSE Arca | ||||||

| 11/02/2016 | Direxion Daily CSI China Internet Index Bull 2X Shares (CWEB) | CWEB | NYSE Arca | 4/07/2016 | Direxion Daily Financial Bear 1X Shares | FAZZ | NYSE Arca | ||||||

| 11/01/2016 | American Customer Satisfaction Core Alpha ETF | ACSI | Bats | 4/07/2016 | Direxion Daily Technology Bear 1X Shares | TECZ | NYSE Arca | ||||||

| 10/31/2016 | Oppenheimer ESG Revenue ETF | ESGL | NYSE Arca | 4/05/2016 | REX Gold Hedged FTSE Emerging Markets ETF | GHE | NYSE Arca | ||||||

| 10/31/2016 | Oppenheimer Global ESG Revenue ETF | ESGF | NYSE Arca | 4/05/2016 | REX Gold Hedged S&P 500 ETF | GHS | NYSE Arca | ||||||

| 10/31/2016 | Oppenheimer ESG Revenue ETF | ESGL | NYSE Arca | 4/04/2016 | JPMorgan Diversified Return International Currency Hedged ETF | JPIH | NYSE Arca | ||||||

| 10/31/2016 | Oppenheimer Global ESG Revenue ETF | ESGF | NYSE Arca | 4/04/2016 | JPMorgan Diversified Return Europe Currency Hedged ETF | JPEH | NYSE Arca | ||||||

| 10/28/2016 | Premise Capital Frontier Advantage Diversified Tactical ETF | TCTL | Bats | 4/04/2016 | Dhandho Junoon ETF | JUNE | NYSE Arca | ||||||

| 10/27/2016 | Natixis Seeyond International Minimum Volatility ETF | MVIN | NYSE Arca | 3/29/2016 | John Hancock Multifactor Consumer Staples ETF | JHMS | NYSE Arca | ||||||

| 10/25/2016 | Deutsche X-trackers Barclays International Corporate Bond Hedged ETF | IFIX | Bats | 3/29/2016 | John Hancock Multifactor Energy ETF | JHME | NYSE Arca | ||||||

| 10/25/2016 | Deutsche X-trackers Barclays International Treasury Bond Hedged ETF | IGVT | Bats | 3/29/2016 | John Hancock Multifactor Industrials ETF | JHMI | NYSE Arca | ||||||

| 10/25/2016 | SPDR MSCI Emerging Markets Fossil Fuel Reserves Free ETF | EEMX | NYSE Arca | 3/29/2016 | John Hancock Multifactor Materials ETF | JHMA | NYSE Arca | ||||||

| 10/25/2016 | SPDR MSCI EAFE Fossil Fuel Reserves Free ETF | EFAX | NYSE Arca | 3/29/2016 | John Hancock Multifactor Utilities ETF | JHMU | NYSE Arca | ||||||

| 10/20/2016 | Elkhorn Lunt Low Vol/High Beta Tactical ETF | LVHB | Bats | 3/23/2016 | Victory CEMP Emerging Market Volatility Wtd ETF | CEZ | Nasdaq | ||||||

| 10/12/2016 | Spirited Funds/ETFMG Whiskey & Spirits ETF | WSKY | NYSE Arca | 3/22/2016 | Principal Price Setters Index ETF | PSET | Nasdaq | ||||||

| 10/05/2016 | Franklin Liberty Investment Grade Corporate ETF | FLCO | NYSE Arca | 3/22/2016 | Principal Shareholder Yield Index ETF | PY | Nasdaq | ||||||

| 10/04/2016 | Lattice Real Estate Strategy ETF | RORE | NYSE Arca | 3/18/2016 | First Trust Dorsey Wright Dynamic Focus 5 ETF | FVC | Nasdaq | ||||||

| 9/30/2016 | AdvisorShares KIM Korea Equity ETF | KOR | NYSE Arca | 3/10/2016 | PowerShares DWA Tactical Multi-Asset Income Portfolio | DWIN | Nasdaq | ||||||

| 9/29/2016 | First Trust CEF Income Opportunity ETF | FCEF | Nasdaq | 3/09/2016 | PureFunds Drone Economy Strategy ETF | IFLY | NYSE Arca | ||||||

| 9/29/2016 | First Trust Municipal CEF Income Opportunity ETF | MCEF | Nasdaq | 3/09/2016 | PureFunds Video Game Tech ETF | GAMR | NYSE Arca | ||||||

| 9/28/2016 | TrimTabs Float Shrink ETF | TTAC | Bats | 3/08/2016 | SPDR SSgA Gender Diversity Index ETF | SHE | NYSE Arca | ||||||

| 9/28/2016 | ProShares K-1 Free Crude Oil Strategy ETF | OILK | Bats | 3/04/2016 | Goldman Sachs ActiveBeta Europe Equity ETF | GSEU | NYSE Arca | ||||||

| 9/22/2016 | Franklin Liberty U.S. Low Volatility ETF | FLLV | NYSE Arca | 3/04/2016 | Goldman Sachs ActiveBeta Japan Equity ETF | GSJY | NYSE Arca | ||||||

| 9/22/2016 | Principal U.S. Small Cap Index ETF | PSC | Nasdaq | 3/02/2016 | Vanguard International Dividend Appreciation ETF | VIGI | Nasdaq | ||||||

| 9/22/2016 | PowerShares Variable Rate Investment Grade Portfolio | VRIG | Nasdaq | 3/02/2016 | Vanguard International High Dividend Yield ETF | VYMI | Nasdaq | ||||||

| 9/21/2016 | AdvisorShares Focused Equity ETF | CWS | NYSE Arca | 2/25/2016 | Janus Small Cap Growth Alpha ETF | JSML | Nasdaq | ||||||

| 9/21/2016 | Elkhorn Fundamental Commodity Strategy ETF | RCOM | Bats | 2/25/2016 | Janus Small/Mid Cap Growth Alpha ETF | JSMD | Nasdaq | ||||||

| 9/21/2016 | First Trust Nasdaq Transportation ETF | FTXD | Nasdaq | 2/24/2016 | WisdomTree CBOE S&P 500 PutWrite Strategy Fund | PUTW | NYSE Arca | ||||||

| 9/21/2016 | First Trust Nasdaq Food & Beverage ETF | FTXG | Nasdaq | 2/23/2016 | Pacer Global High Dividend ETF | PGHD | BATS | ||||||

| 9/21/2016 | First Trust Nasdaq Pharmaceuticals ETF | FTXH | Nasdaq | 2/23/2016 | Cambria Sovereign High Yield Bond ETF | SOVB | NYSE Arca | ||||||

| 9/21/2016 | First Trust Nasdaq Semiconductor ETF | FTXL | Nasdaq | 2/22/2016 | UBS AG FI Enhanced Global High Yield ETN | FIHD | NYSE Arca | ||||||

| 9/21/2016 | First Trust Nasdaq Oil & Gas ETF | FTXN | Nasdaq | 2/18/2016 | Etracs S&P GSCI Crude Oil ETN | OILX | NYSE Arca | ||||||

| 9/21/2016 | First Trust Nasdaq Bank ETF | FTXO | Nasdaq | 2/18/2016 | ProShares Managed Futures Strategy ETF | FUT | BATS | ||||||

| 9/21/2016 | First Trust Nasdaq Transportation ETF | FTXR | Nasdaq | 2/16/2016 | UBS AG FI Enhanced Europe 50 ETN | FIEE | NYSE Arca | ||||||

| 9/21/2016 | Amplify YieldShares Prime 5 Dividend ETF | PFV | Bats | 2/10/2016 | Guggenheim Total Return Bond ETF | GTO | NYSE Arca | ||||||

| 9/21/2016 | Elkhorn Commodity Rotation Strategy ETF | DWAC | Nasdaq | 2/09/2016 | Etracs 2xMonthly Leveraged Alerian MLP Infrastructure ETN Series B | MLPQ | NYSE Arca | ||||||

| 9/20/2016 | VanEck Vectors AMT-Free 6-8 Year Municipal Index ETF | ITMS | Bats | 2/09/2016 | Etracs 2xMonthly Leveraged S&P MLP Index ETN Series B | MLPZ | NYSE Arca | ||||||

| 9/20/2016 | VanEck Vectors AMT-Free 12-17 Year Municipal Index ETF | ITML | Bats | 2/09/2016 | Credit Suisse X-Links WTI Crude Oil Index ETN | OIIL | NYSE Arca | ||||||

| 9/20/2016 | Recon Capital USA Managed Risk ETF | USMR | NYSE Arca | 1/27/2016 | ProShares MSCI Emerging Markets Dividend Growers ETF | EMDV | BATS | ||||||

| 9/15/2016 | NuShares Enhanced Yield U.S. Aggregate Bond ETF | NUAG | NYSE Arca | 1/14/2016 | SPDR FactSet Innovative Technology ETF | XITK | NYSE Arca | ||||||

| 9/15/2016 | iShares iBonds Dec 2026 Term Corporate ETF | IBDR | NYSE Arca | 1/14/2016 | Reality Shares DIVCON Dividend Defender ETF | DFND | BATS | ||||||

| 9/15/2016 | Fidelity Core Dividend ETF | FDVV | NYSE Arca | 1/14/2016 | Reality Shares DIVCON Dividend Guard ETF | GARD | BATS | ||||||

| 9/15/2016 | Fidelity Dividend ETF for Rising Rates ETF | FDVV | NYSE Arca | 1/13/2016 | Market Vectors Generic Drugs ETF | GNRX | Nasdaq | ||||||

| 9/15/2016 | Fidelity Low Volatility Factor ETF | FDLO | NYSE Arca | 1/7/2016 | iShares Adaptive Currency Hedged MSCI Japan ETF | DEWJ | BATS | ||||||

| 9/15/2016 | Fidelity Momentum Factor ETF | FDMO | NYSE Arca | 1/7/2016 | iShares Adaptive Currency Hedged MSCI Eurozone ETF | DEZU | BATS | ||||||

| 9/15/2016 | Fidelity Quality Factor ETF | FQAL | NYSE Arca | 1/7/2016 | iShares Adaptive Currency Hedged MSCI EAFE ETF | DEFA | BATS | ||||||

| 9/15/2016 | Fidelity Value Factor ETF | FVAL | NYSE Arca | 1/7/2016 | WisdomTree Dynamic Currency Hedged Europe Equity Fund | DDEZ | BATS | 1/7/2016 | WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund | DDLS | BATS | ||

| 9/15/2016 | JPMorgan Disciplined High Yield ETF | JPHY | Bats | 1/7/2016 | WisdomTree Dynamic Currency Hedged Japan Equity Fund | DDJP | BATS | ||||||

| 9/14/2016 | Guggenheim BulletShares 2026 Corporate Bond ETF | BSCQ | NYSE Arca | 1/7/2016 | WisdomTree Dynamic Currency Hedged International Equity Fund | DDWM | BATS | ||||||

| 9/14/2016 | Guggenheim BulletShares 2024 High Yield Corporate Bond ETF | BSJO | NYSE Arca | 1/7/2016 | WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund | DDLS | BATS | ||||||

10. A 4 Step Guide to Mental Toughness

In the 1930’s FBI agents needed mental toughness to hunt bank robbers like John Dillinger and mobsters like Al Capone.

As the world became more complex, FBI agents started working complex and sophisticated cases like terrorism, organized crime, cyber, and counterintelligence to better address the threats to American lives and interests.

It’s no secret that business and life are not as simple as they were, either—even a few years ago. It is no longer just a matter of knowledge, ability, and skill to succeed.

As entrepreneurs and business owners you need to be psychologically prepared to deal with strong competition, recover from mistakes and failure quickly, tackle tough situations, devise strategies, and collaborate with others.

In other words, you need mental toughness to manage the emotions, thoughts, and behavior that will set you up for success in business and life.

People define mental toughness in different ways. Often, they think it is plowing through obstacles and roadblocks. While that mindset might work in football, it is not an effective way to succeed in business and life.

Here is a complete beginner’s guide to mental toughness:

SKILL #1: MENTAL TOUGHNESS REQUIRES EMOTIONAL COMPETENCY

Most of the FBI agents I worked alongside would never sputter the phrase emotional intelligence—much less attribute their success to it. While they considered themselves mentally tough, they preferred words like competence and alertness to describe the skills they carefully honed over the years.

I prefer the term emotional competency rather than emotional intelligence. I know of lots of people who are intelligent but not necessarily competent. Competency requires more than just information; it requires the practical wisdom to put that knowledge to work in real life situations.

Let’s break emotional competency down:

- Self-Awareness—know what fuels you. I am not talking about fluffy ideals or stuff that gives you the warm fuzzies. Training at the FBI Academy at Quantico is constructed to filter out those who do not feel deeply attached to upholding our federal judicial system.

To be mentally tough, you must know what you feel down deep in your bones. If you are not pursuing something that really holds value and meaning for you, you will not have what it takes to keep going when the going gets tough.

If you are self-aware, you have clarity about your values, operate from a place of authenticity, and go after the things in life that are hard-wired to give you a purpose.

- Communication—you know how to interpret the words and body language of others. This means you are a good listener and know how to build genuine trust with others. An essential element of mental toughness is the ability to accurately read the emotions of others and then adapt your behavior accordingly.

To be successful, match your personality to your boss, employee, or client. Assess whether they are introverts or extraverts, analytical or a visionary, purpose-driven or security-driven, goal-oriented or people-oriented. If you’ve been a good listener, you will be able to make these distinctions.

- Empathy—it’s not feeling sorry for the other person; it is feeling their sorrow. If you can understand the emotions of others, it is easier to create empathy.

Sometimes we don’t really want to hear what other people have to say! We love our own opinions and thoughts and would prefer to shut out those of others.

Once we close down, however, we risk becoming judgmental and opinionated. More importantly, we miss out on what others have to share with us.

SKILL #2: RESILIENCE — MENTAL TOUGHNESS MEANS WE ADAPT TO OVERCOME

The ability to pick ourselves up when life knocks us down is called resilience. In today’s competitive culture, resilience has become a critical skill because it takes more than talent to succeed.

Resilient people do not blame others, whine, or complain about how unfair life is. Yes, life can be unfair but that is no excuse to give up.

As a new FBI agent, I learned to be bold, take risks, move into my discomfort zone, and put myself out there, even when scared to death of what I might face. The way in which we adapt to overcome our adversity determines how we will achieve success.

More than talent, more than education, more than experience, the ability to bounce back from setbacks determines who will succeed and who will fail. That is true in the classroom, in sports, and in the boardroom.

Here’s a breakdown of resilience:

- Confidence—if you don’t believe in yourself, how can others believe in you? When you’re knocked down in life, you must have enough confidence in yourself to get back up, find a way to move forward, and adapt to overcome.

Lack of confidence can rear its ugly head at any time. No one is immune because we are most vulnerable any time we’re out of our comfort zone or experience change in our life. We must face our fears. If we have confidence in ourselves we are not afraid of how others perceive us, afraid of commitment, or afraid of failure.

Confidence is a critical building block for a successful career because it is the one mindset that will take you where you want to go.

- Take Risks—most of us don’t know what we’re capable of until we’re truly challenged. And most of do not want to be truly challenged because we don’t want to fail.

But failure can be very beneficial for building confidence because it allows you a perfect opportunity to 1) learn why things went wrong, and 2) see how you can make adjustments next time.

When learning how to make an arrest or interview a terrorist I needed to take risks, fail, and learn from my mistakes as much as possible before I found myself in the actual situation.

If you think you never make mistakes, you are a narcissist—either that or stupid. But if you are humble and self-aware, you recognize that taking risks, making mistakes, and failing will help you understand that there is always something you can do to be better.

- Self-Limiting Beliefs—as children we think we can conquer the world, but somewhere between childhood and adulthood, our enthusiasm and natural inclinations to dream big are squashed. Parents and teachers start imposing their own beliefs—about what we can and can’t do in life—upon us.

It’s tempting to give up and not try for anything beyond the predictions and admonitions of others. While many of these people are well-intentioned, they feed negative, limiting, and inaccurate narratives about what it possible once you put your mind to it.

If the instructors at the FBI Academy were not pushing us past our self-limiting beliefs, they weren’t doing their job.

http://www.iris.xyz/leadership/4-step-guide-mental-toughness