Happy New Year! Thanks for Reading Top 10 in 2016.

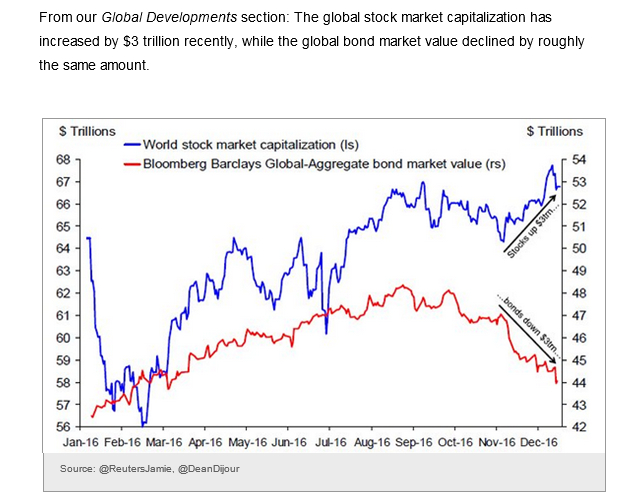

1.Out of Bonds and into Stocks in One Chart

Stock Market Capitalization Up $3 Trillion…Bond Market Capitalization Down $3 Trillion.

2.Oil Volatility Closes Below 200day on Weekly Chart for First Time in 2 Years…..60% Off Highs.

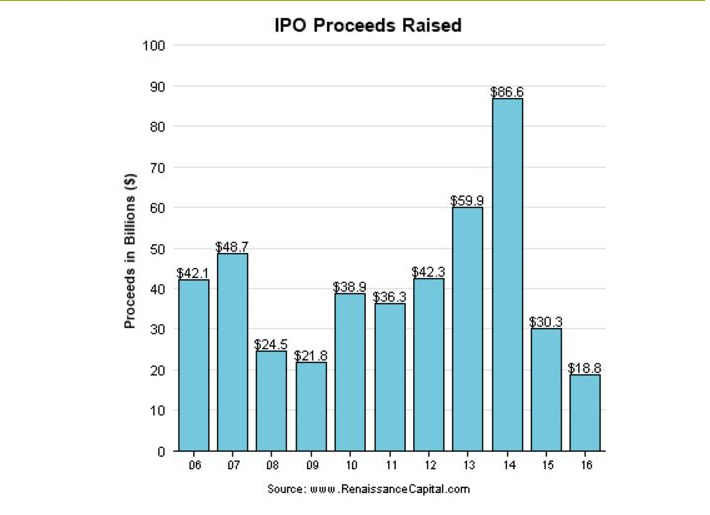

3.2016-The Slowest IPO Market in 13 Years….Private Valuations Coming Down in Big Way.

It helps that the private market is correcting: Venture-capital-backed technology valuations went from about 5.3 times sales in 2014 to 4.1 times in 2015 to 3.5 times this year, Smith notes. Meanwhile, rallying stocks have lifted the Nasdaq Composite Index from about 1.9 times sales to 2.5 times within 11 months, and the chasm between private and public valuations is narrowing.

http://www.barrons.com/articles/for-u-s-stocks-alls-calm-alls-brightfor-now-1482555937

Snap Inc. is expected to be 2017’s savior from a depressing market for initial public offerings, but the ridiculously high valuations of other so-called unicorns, as well as a market still seen as unsteady, could make the chances for a revival disappear as fast as a Snapchat message.

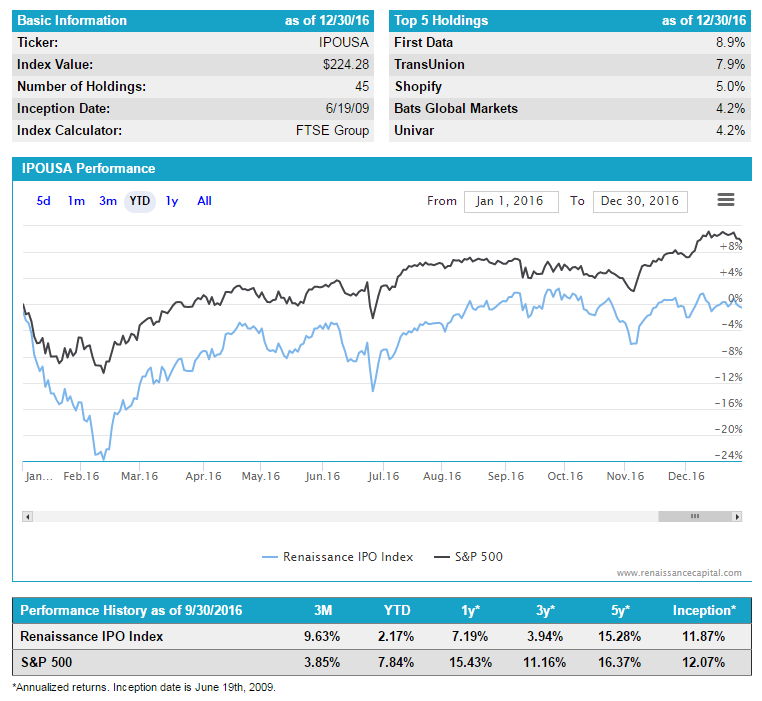

2016 is expected to go down as the worst year for IPO returns since 2003, according to global IPO investment adviser Renaissance Capital, and the technology startups that have garnered so much ink in the past few years were a major reason. There were only 21 U.S. tech IPOs in 2016, according to Renaissance, which also manages IPO-focused exchange-traded funds.

Renaissance IPO Index vs. S&P

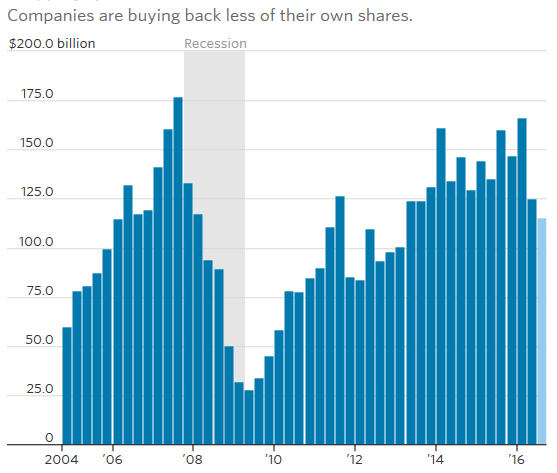

4.Buybacks Huge Fuel for the Bull Market…. S&P 500 firms repurchased $115.6 billion worth of their own stock in the third quarter of this year, down 28% from the same quarter a year earlier

S&P 500 firms repurchased $115.6 billion worth of their own stock in the third quarter of this year, down 28% from the same quarter a year earlier, according to FactSet calculations. That’s the largest year-over-year decline since 2009, and follows a sharp drop-off in the second quarter. Buybacks tend to ramp into Year End..

Thanks to Dave Lutz at Jones for Chart.

PKW Buyback ETF—Still Made All Time Highs Post Election… YTD.+12.63% vs. S&P +11.20%

5. 70% if Money that Flowed into Europe in 2015 Left by Dec. 2016.

As of early December, 70% of the money that had flown into Europe in 2015 had left the region again, mainly due to political concerns, according to Credit Suisse.

And that’s why investors should consider diving back into Europe now while the region’s equities are still being punished for political fears. Even if those jitters persist, strategists note that a combination of fiscal easing, stronger economic growth and solid corporate profits should send stocks from the continent higher in coming years.

“After declining for five years, we believe European earnings have now troughed and will grow 12% in 2017. This reflects a moderate improvement in global GDP grow

th, higher margins, a strong recovery in commodity earnings and a moderate rebound in financials’ profitability,” Morgan Stanley strategists said in a note. They also noted that European earnings have fallen by 30% since 2011 and remain 44% below their all-time high in 2007.

http://www.marketwatch.com/story/why-european-stocks-are-set-for-a-solid-2017-2016-12-28

2016 ETF Flows.

6.Bond Returns in Real (inflation adjusted) Terms.

6.Bond Returns in Real (inflation adjusted) Terms.

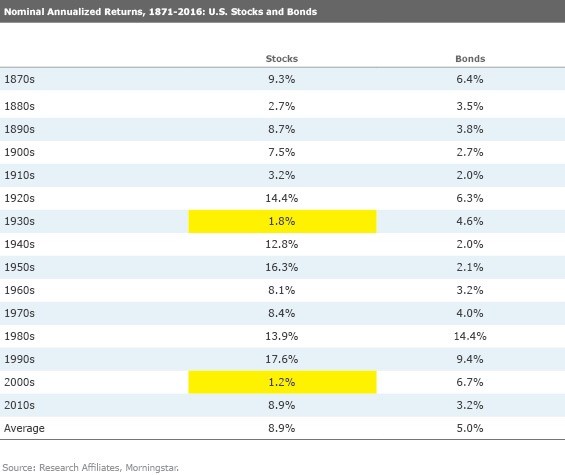

Bonds are typically the portion of the allocation that investors worry least about, especially over the past 35 years. Fixed Income tends to have lower volatility than most other asset classes and if you just look at the nominal returns of bonds over time, you would probably be reassured. After all, as shown in the first table below, nominal Fixed Income returns have been positive in every single decade since the 1870s. In the tables below, losing performances are shaded in red, those with annualized gains of 0% to 1.9% in yellow, and left unshaded are any gains of 2% or higher.

Source: Morningstar, Research Affiliates

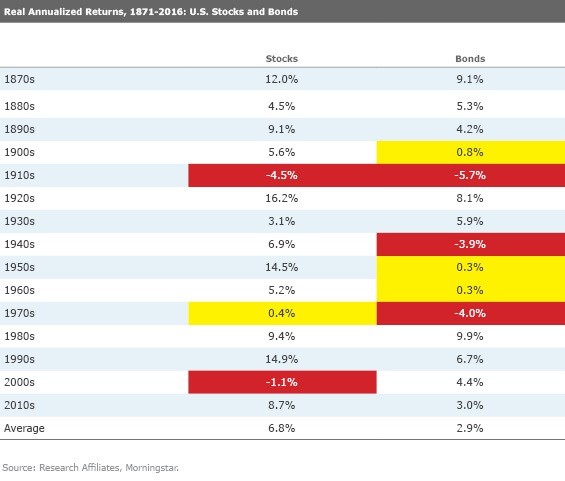

However, real annualized returns show a very different story. After accounting for inflation, bonds have not always been so stellar.

Source: Morningstar, Research Affiliates

What action should be taken if fixed income were to enter into another extended period where its real returns weren’t so favorable? That will depend on each client’s circumstances, but DALI is a good way to determine where strength resides both among and within this very important asset class.

The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value.

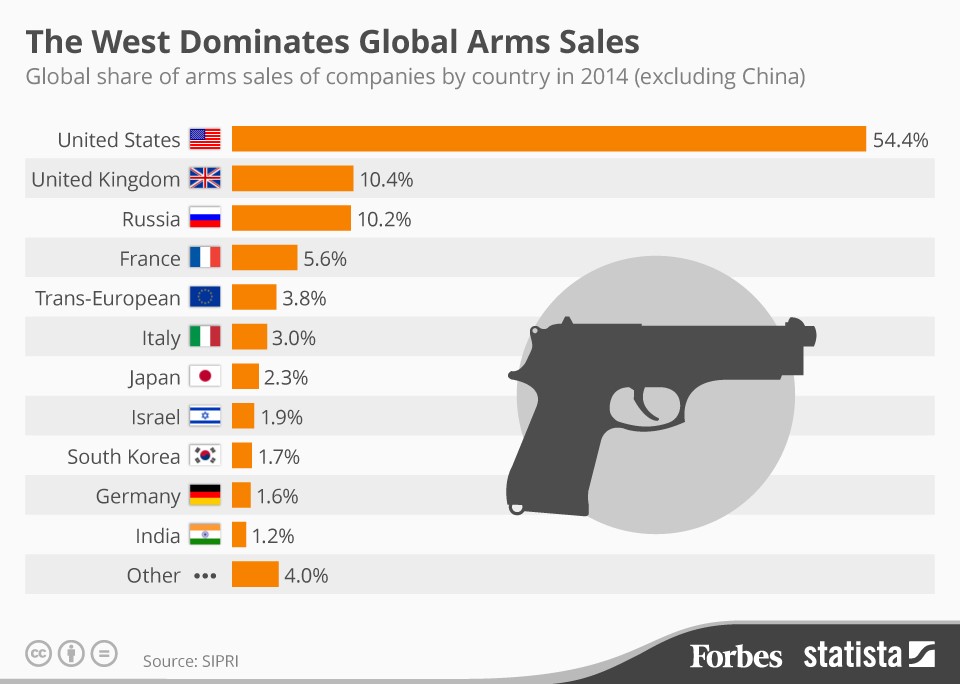

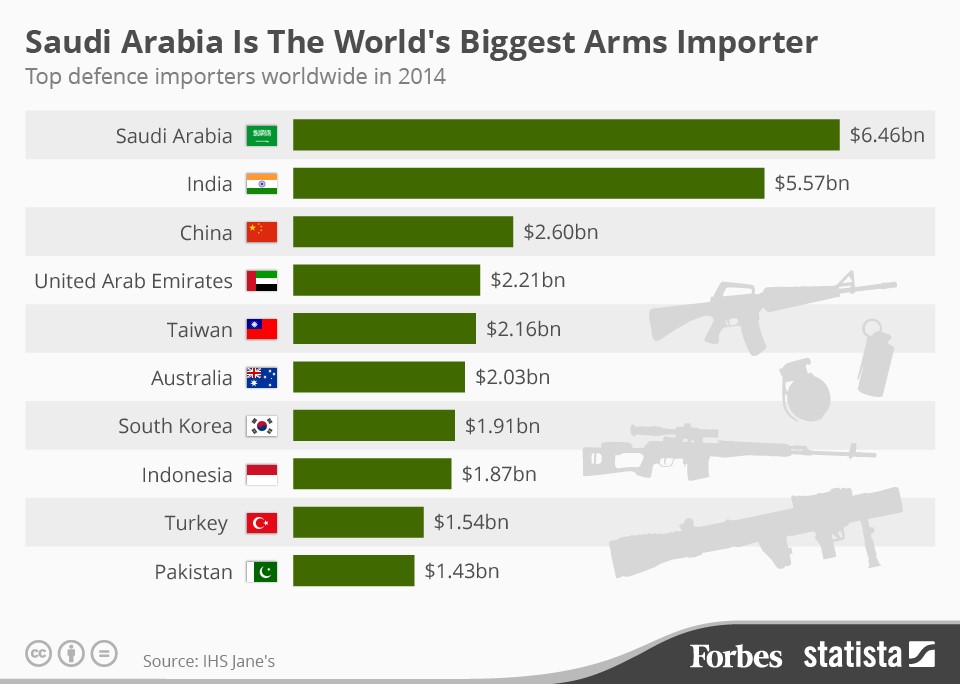

7.Global Weapons Market.

The United States again ranked first in global weapons sales last year, signing deals for about $40B, although the total size of the worldwide arms bazaar dropped to around $80B in 2015 from $89B a year earlier. The study, “Conventional Arms Transfers to Developing Nations, 2008-2015,” was prepared by the nonpartisan Congressional Research Service, a division of the Library of Congress. Related tickers: LMT, RTN, GD, NOC, OA, HII, HON, UTX, ITT, TXT, LLL, COL

www.seekingalpha.com

The Real Number…U.S. Military Budget as a Percentage of GDP as Opposed to Press Headlines on Raw Numbers.

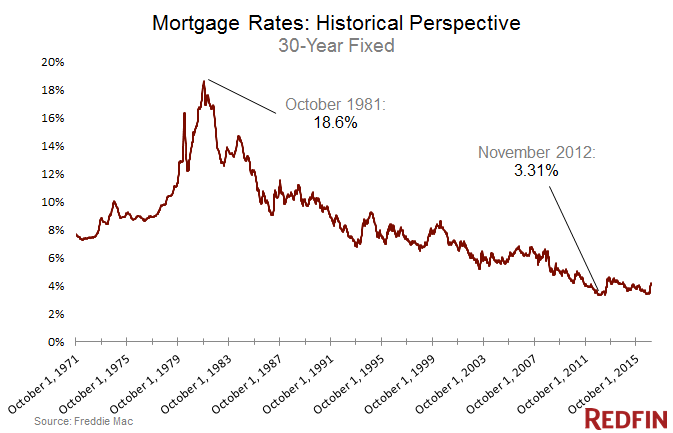

8.Rising Mortgage Rates: Homebuyers Are More Resilient Than You Might Think

Written by Alex Starace on December 20, 2016

Last week, the average 30-year fixed-rate mortgage rose to 4.16 percent, while the Federal Reserve raised the federal funds rate for the first time in a year, and only the second time this decade.

How does this affect homebuyers? Redfin is on the record predicting that in 2017, rates won’t average above 4.3 percent for the year, as Redfin chief economist Nela Richardson explained in detail in a recent post on rates.

But what if rates were to continue to rise? Very few homebuyers would stop their search, according to a recent Redfin-commissioned survey of people planning to buy a home in the next year. When asked “If mortgage rates were to rise above the current 4%, what effect would it have on your home-buying plans?” only 2.6 percent of respondents said they’d cancel their search.

If Mortgage Rates Rose Above the Current 4%, What Effect Would it Have on Your Homebuying Plans?

| I’d increase my urgency to buy before rates went up further | 23.80% |

| My urgency wouldn’t change, but I’d have to look in other areas or buy a smaller home due to increased payments | 22.60% |

| No impact | 25.30% |

| I’d slow down my search and see if rates come back down again | 25.80% |

| I’d cancel my plan to buy a home | 2.60% |

One in four buyers said the increase would have no impact on their plans. Others said the rise would affect their plans, but they wouldn’t give up: 22.6 percent said they’d look in other areas or buy a smaller home to account for rising payments, while 23.8 percent said they’d increase their urgency to buy before further increases. Lastly, 25.8 percent said they’d slow down their search, to see if rates would go back down.

Why are homebuyers so resilient? While there’s no definitive answer, often homebuyers are searching for a new home because of a major life event, such as a birth or a marriage or a job relocation, which can’t easily be timed to the market — but which still motivates a purchase along its own timeline.

And while rates have climbed, they’re still historically low, which many homebuyers realize.

Methodology

Redfin commissioned SurveyGizmo to field a study of 3,300 people who bought or sold a home in the past year, tried to buy or sell in the past year, or plan to buy or sell in the next year across 11 major markets. These respondents were sourced from SurveyGizmo’s panel sample partners. SurveyGizmo set quotas to reach 300 people per market.

Of the 3,300 respondents, 934 said they were planning to buy in the next year, and were asked the question above. The survey was conducted between December 2nd and 14th.

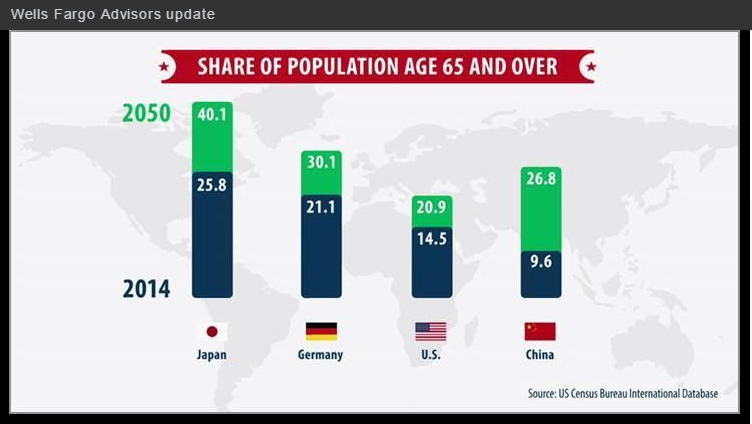

9.Demographics is Destiny….The U.S. Looks Good Relative.

10.Strict dads, your future self, and 3 more psychological theories why you put things off until the last minute

Shana Lebowitz

Procrastination is rarely just about laziness — that would be too easy to fix.

Instead, it tends to result from deeper psychological issues — think a fraught relationship with your parents or a skewed perception of time.

We dug into the growing body of research on procrastination and highlighted some of the least obvious explanations for why you push things off … and off and off.

So don’t, well, delay. Read on and see which of those theories most resonate with you.

- Your dad was really strict when you were a kid

Research led by procrastion expert Timothy Pychl found that women who grew up with authoritarian fathers (those who place a high value on obedience and aren’t particularly warm) are more likely to procrastinate as adults.

Writing in Psychology Today, Pychl says that’s possibly because procrastination is a passive aggressive way to rebel against external agents of control — something they weren’t able to do when they were young.

- You need to adjust your perception of time

One recent study found that people who think a deadline falls in a time like the present will be less likely to procrastinate than people who think a deadline falls in a time unlike the present.

In other words, if it’s July 2017 and you find out a project is due in January 2018, you’ll be more likely to procrastinate than if it’s June 2017 and you find out the project is due in December 2017. That’s because we categorize time in terms of years, and a same-year deadline seems sooner than a next-year deadline, even if they’re both six months away.

The next time you find out an assignment is due the following week, try reframing the deadline as “like the present.” In the study, participants achieved this by looking at a calendar in which the current date and the due date were the same color.

- You have an ‘all-or-nothing’ mindset

Losing 20 pounds might seem like a tremendous undertaking, so it’s tempting to put it off endlessly.

People with this mentality “think of the 20 pounds rather than the day-to-day struggle of chipping off the weight and gradually reaching a goal,” Judith Belmont, Ph.D., told Today Health.

One way to combat this type of thinking is to break things up into smaller tasks. As Belmont suggests, think about cutting out a few hundred calories every day (or whatever your doctor suggests) to make the goal seem more manageable.

who are kind to themselves are better at controlling their impulses. Flickr/Patty

- You don’t practice self-compassion

Procrastinators tend to be more stressed than other people — even before they start procrastinating.

According to a recent study, that’s possibly because they have self-defeating thoughts like, “I’m simply too stupid to benefit from more studying, so I’ll just hang out on Facebook.”

On the other hand, people who are kind to themselves during difficult times are better at self-regulating, which involves the capacity to control your impulses.

- You don’t feel that connected to your future self

Other research by Pychyl found that undergrads who felt less similar to their future self — whether 10 years or two months down the road — were more likely to procrastinate on their school work. And an earlier review of studies suggests that procrastinators are less likely to think about and plan for the future.

Fortunately, as The Washington Post reports, it might be possible to cultivate a greater sense of connection with your future self. In one study led by Hal E. Hershfeld, people who looked at digitally aged photos of their faces were more likely to say they’d invest money in a retirement account.

The Post also reported that some insurance companies are applying this research and starting to offer digital tools that show you what you’ll look like when you’re older.