1.Where we Stand on Inaguration Day?

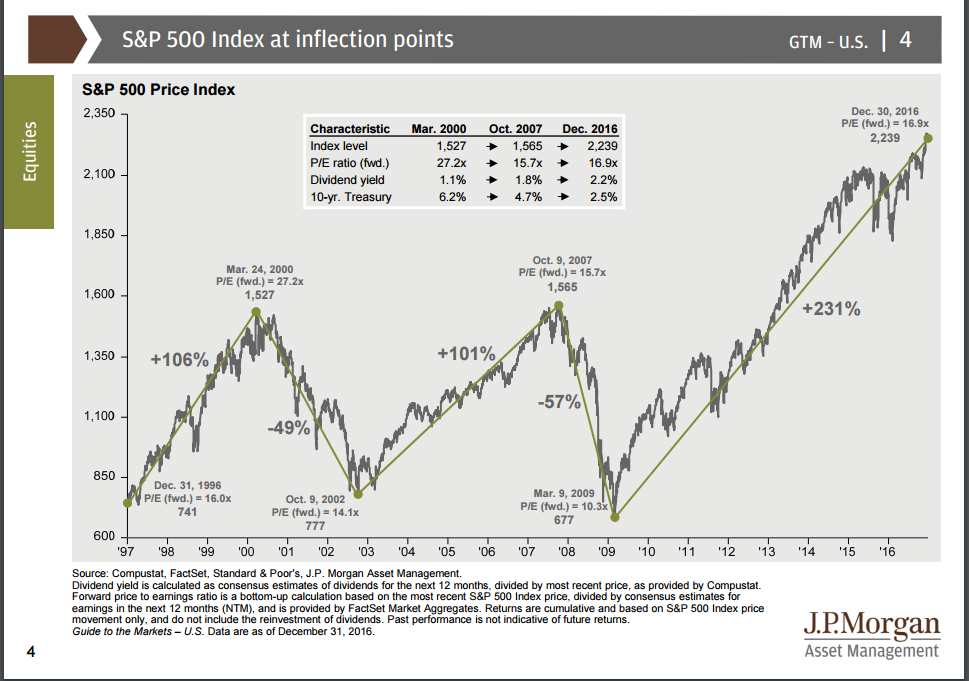

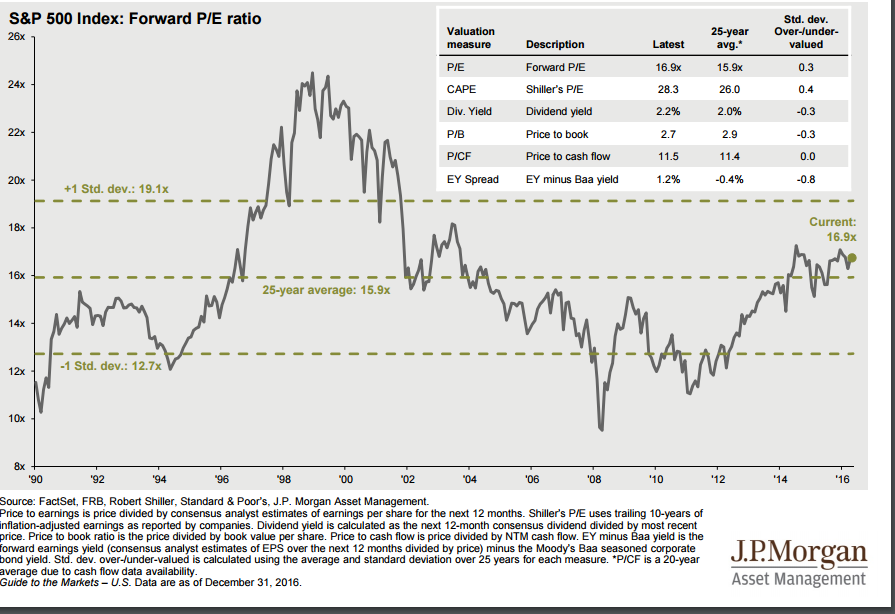

https://am.jpmorgan.com/blob-gim/1383280028969/83456/jp-littlebook.pdf

2.Crazy Stat of Week….Bank of Japan Now Owns 66% of ETF Assets in Japan. Wine and Art Next?

Follow

Eric Balchunas@EricBalchunas

BOJ now owns 66% of ETF assets in Japan and is planning more buying, even as analysts say slow your roll. Great chart, h/t Toru Fujioka

Found at Abnormal Returns blog.

Found at Abnormal Returns blog.

www.abnormalreturns.com

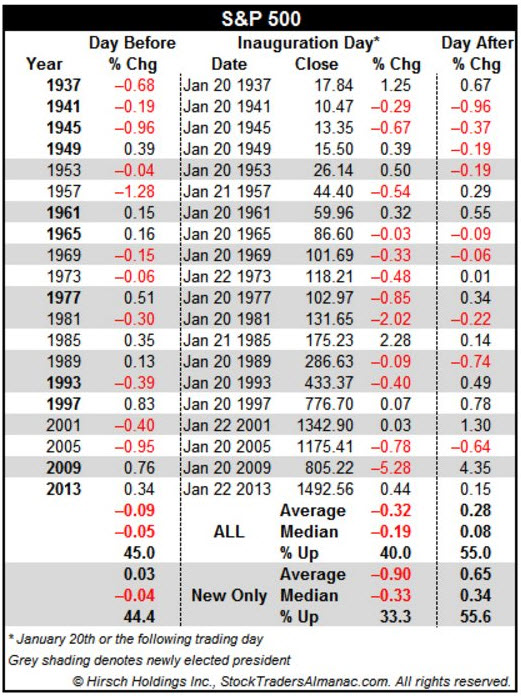

3.Trading Inauguration Day

by Tyler Durden

Jan 19, 2017 3:35 PM

While president-elect Donald Trump’s post-election stock market gains are among the greatest in US History, he faces an uphill battle tomorrow as he steps to dais for inauguration. In the last 80 years, newly-elected presidents have seen inauguration-day-losses, two-thirds of the time.

But faces a problem tomorrow in maintaining that exuberance as the following table shows only 33.3% of newly-elected inauguration days were winners, losing on average 0.9%…

Source: @AlmanacTrader

(NOTE: the 5.28% plunge on the day of Obama’s first inauguration)

http://www.zerohedge.com/news/2017-01-19/trading-inauguration-day

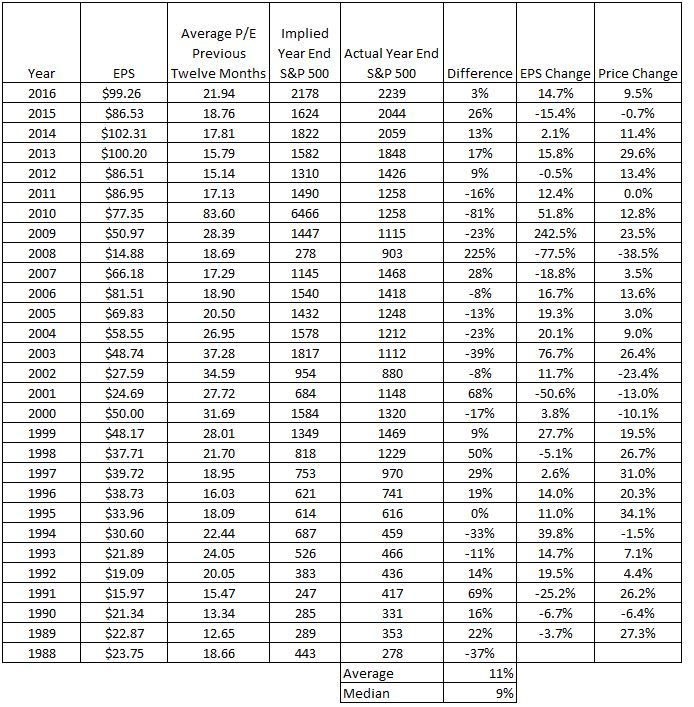

4.More Proof on the Futility of Predictions.

The Ignorance of The Future

Posted January 16, 2017 by Michael Batnick

“Three causes especially have excited the discontent of mankind; and, by impelling us to seek remedies for the irremediable, have bewildered us in a maze of madness and error. These are death, toil, and the ignorance of the future” – Charles Mackay

People spend a lot of time thinking about the future, it’s part of what makes us human. The problem is we’re not very good at dealing with uncertainty. We assume too many constants and not enough change. We underestimate progress and we overestimate failure. The way that this manifests itself in many investors is thinking about how much companies will earn and how much the market will pay for them.

In general (hedging my words), earnings are what drive stocks. But knowing them ahead of time would not necessarily help us make money, at least not in the short-term. Take a look at the table below. The second column shows the full year earnings for the S&P 500 and the third column shows the average price-to-earnings ratio over the previous twelve months. The fourth column is the product of these two; what we would expect the S&P 500 to be at year-end if we knew how much it will earn and assuming that investors moods (P/E) are roughly constant.

Read Full Story at Irrelevant Investor Blog

Read Full Story at Irrelevant Investor Blog

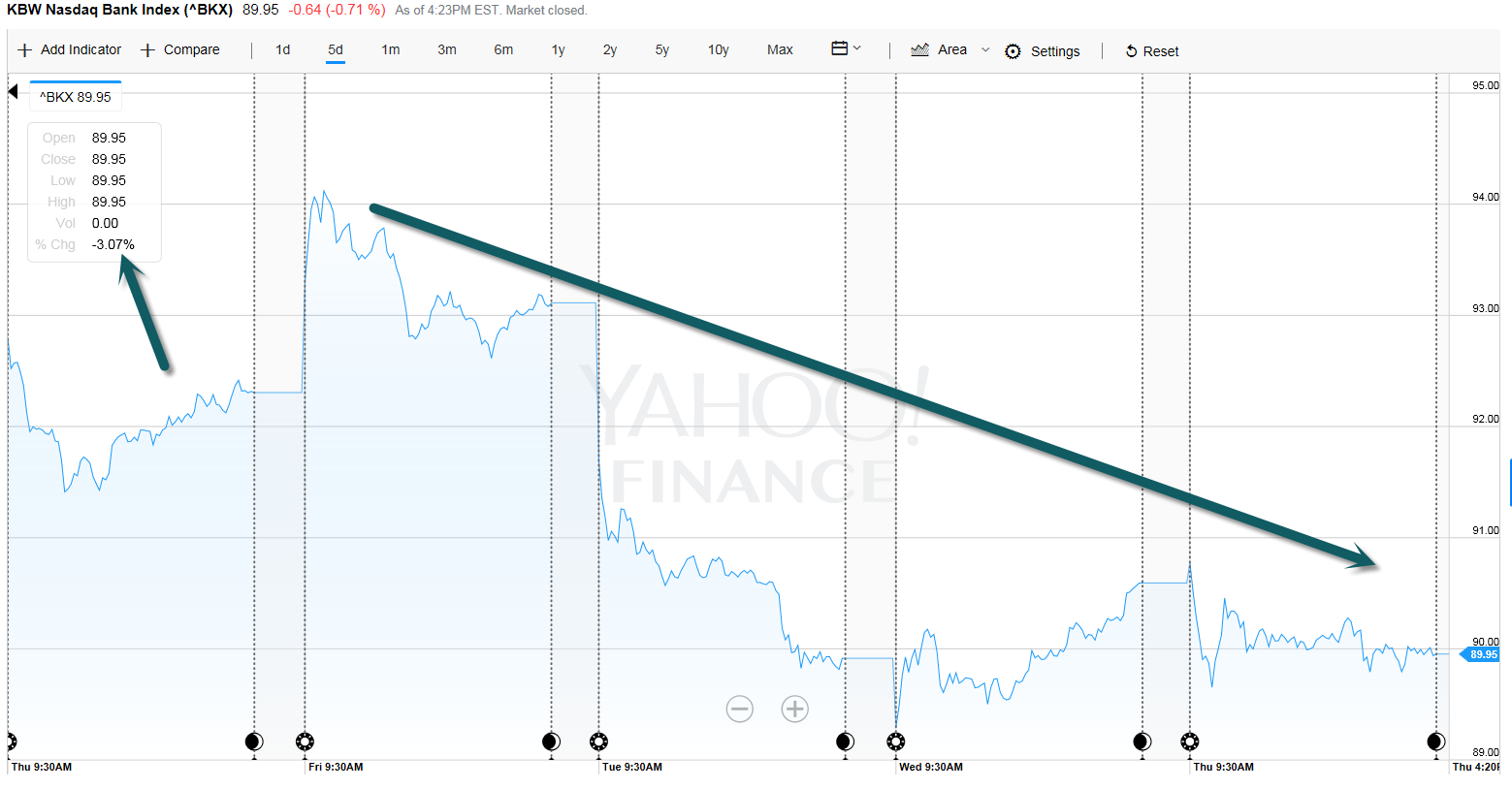

5.Banks saw Massive Flows Post Election…Pulling Back from Short-Term Overbought.

Bank ETF Flow got Excessive vs. Historical….Jeff Degraff chart on financials etf flow.

www.renmac.com

www.renmac.com

KBW Bank Index gives 3% back in last 5 days.

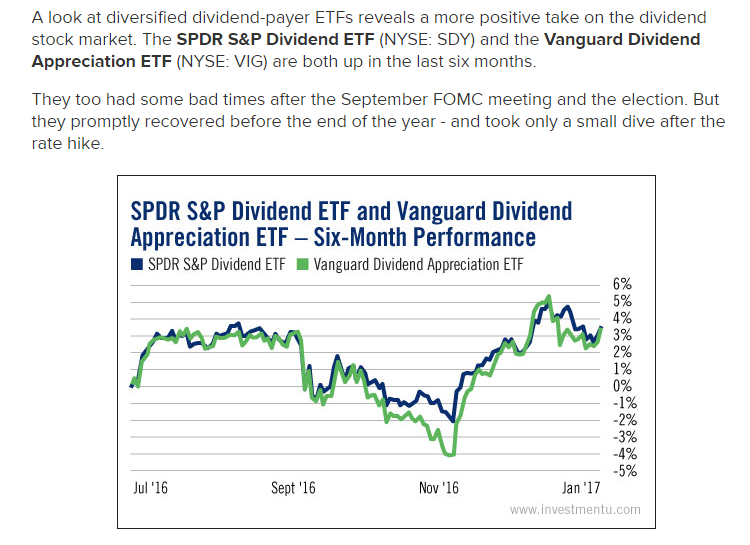

6.Dividend Payers Recovering from Rate Rise Pullback.

http://www.investmentu.com/article/detail/53248/dividend-stocks-bursting-bubble-buy-opportunity#.WIHobFUrLIU

http://www.investmentu.com/article/detail/53248/dividend-stocks-bursting-bubble-buy-opportunity#.WIHobFUrLIU

7.Greg Valliere on Trump

10 Things We’ve Learned About Donald Trump

The president-elect is detail-oriented, has a vision for the job, and is dead serious about tariffs.

GREG VALLIERE

Jan. 18, 2017 11:51 a.m. ET

Donald J. Trump likes surprises and can’t be pigeon-holed; he’ll be the most unique president in American history. Like everyone in our industry, we’re trying to get a handle on the president-elect. After talking with sources, here are ten key observations:

1. He’s incredibly detail-oriented: This is quite a surprise. Trump doesn’t delegate well; he’s planning virtually every detail of the Inauguration, and he’s getting into the weeds on legislation. He understands the incredibly complicated “border adjustability” tax provisions, which only hard-core wonks fully grasp.

2. Trump has no great affinity – or loyalty – to the GOP leadership: Trump will never have warm relations with Paul Ryan, and he has no reluctance to blindside his own party. Senate Republicans are still dumbfounded by Trump’s assertion that universal health insurance will pass quickly. They weren’t consulted – and they’d better get used to that.

3. Surprise!! Trump doesn’t like a strong dollar: The financial markets were stunned yesterday by Trump’s declaration that the dollar is too strong; no president – or Treasury Secretary – has ever waded explicitly into currency policy. If Trump really believes in a weaker dollar, that’s a very big deal.

4. He’s deadly serious about tariffs: For decades, Trump has asserted that the U.S. was getting ripped off by trading partners. He will not be dissuaded on this issue; he’s adamant that the U.S. has been fleeced by countries like China. Trump will talk tough, hoping for concessions, but he’s fully prepared to raise tariffs and pull out of trade deals.

5. He listens to Pence and Priebus: Maybe it’s wishful thinking, but Congressional Republicans we talk with are convinced that Trump’s rough edges will get smoothed over by Mike Pence and Reince Priebus, who are essentially pragmatists. “Trump likes to sound like a provocateur, but at the end of the day, Pence and Priebus will run policy,” says one insider.

6. Impulse control issues: This is a great worry, even in his inner circle. Trump’s remarks often are aimed at his adoring base, so he has no reluctance to differ with his Cabinet nominees on NATO, climate change, deficit spending, etc. He also has a vengeful streak and can be easily provoked – as North Korea and Iran surely must realize.

7. The tweets will continue: Get used to this; everyone we talk with is convinced that no one will take Trump’s Twitter away; he’s a huge fan of this new bully pulpit. The first thing we do, very early in the morning, is check what Trump tweeted overnight, because obviously he can move stocks and markets.

8. His bark is worse than his bite: One day Trump blasts the press, the next day he’s complimenting the New York Times. He’s a genius at generating publicity, he masterfully manipulated the press in 2015. He starts negotiations with something outrageous (it’s in his DNA), then he looks for a deal. After the election, he essentially said many of his broadsides – such as locking up Hillary Clinton – were just theater.

9. He has a vision: Ronald Reagan had three major goals – diminish the clout of the Soviet Union, reduce the role of government, and lower taxes. That was basically it. Same with Trump – he wants to make the country more secure, he wants to reduce taxes and regulations, and he wants to reverse the economic malaise in the Rust Belt. Trump does have a vision; his opponent, Hillary Clinton, did not.

10. Trump has blind spots: Everyone we talk with proclaims that Trump doesn’t care about the deficit; he’s remarkably comfortable with the concept of debt. He’s tone-deaf on race and many social issues. And he has no reluctance to meddle in the private sector, intimidating companies that displease him.

BOTTOM LINE: Our main focus is whether Trump is good for the markets and the economy – we still think the answer is yes – but he’s a novice in a brand new arena, with little margin for error. The great presidents, and even the good ones, had the ability to grow on the job, so here’s hoping that Trump will as well.

Valliere is the Washington-based chief global strategist with Horizon Investments.

8.Read of Day…Investors Pull $100B From Hedge Funds in 2016

Last year was the third time on record that investors redeemed more capital than they allocated, eVestment reports.

Hedge funds lost more capital in 2016 than in any year since 2009, according to research from eVestment.

Over the last 12 months, investors withdrew nearly $180 billion from hedge funds while allocating roughly $70 billion, for total net redemptions of $106 billion, the report said.

This was only the third time on record that withdrawals outnumbered new investments in hedge funds, according to eVestment. The negative flows came in a year when multiple prominent investors, including pension funds and insurers, announced decisions to cut their hedge fund allocations.

“Throughout 2016, investors clearly reacted to widespread underperformance from 2015, but at the same time showed a willingness to allocate to products which performed well,” the report stated.

Despite outflows, the hedge fund industry still ended the year with slightly higher assets under management, as performance gains of $119.9 billion offset investor withdrawals.

According to another eVestment report, hedge funds on average returned 5.34% last year, with distressed funds performing the best.

Investors may have “missed the boat” on hedge funds in 2016, Peter Laurelli, the firm’s global head of research, wrote in an accompanying blog.

“Since many institutional decisions take a long time to make (and unmake), results from 2015 caused many institutions to back away from hedge funds,” he wrote. “While some high-profile hedge funds stumbled badly in 2015 and 2016, overall, all major hedge fund segments produced positive returns in 2016.”

http://www.ai-cio.com/channel/Manager-Selection/Investors-Pull-$100B-From-Hedge-Funds-in-2016/

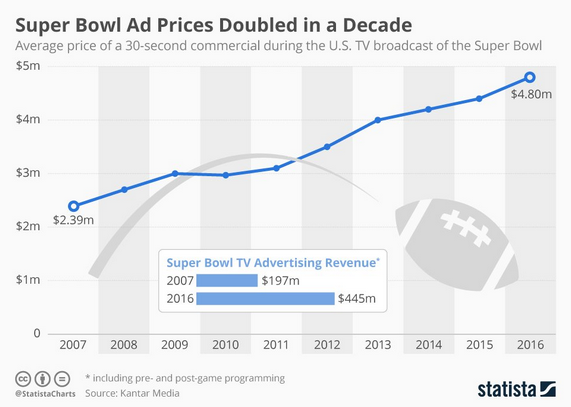

9.Now $5Million for 30 Second Superbowl Ad

Food for Thought™: It now costs almost $5 million dollars for a 30 second ad during the Superbowl.

Source: @StatistaCharts, @Tmp_Research; Read Article

www.thedailyshot.com

10.What I Learned From Complete Burnout At Work

Tomasz Tunguz

Venture Capitalist at Redpoint

During my first few weeks at Google, I read through the internal resumes of my new colleagues, which detailed their work and promotion paths. Google promoted people quickly. Some college graduates who had distinguished themselves had been promoted every quarter for more than a year, and were managers, senior managers, even directors. And I wanted the same type of trajectory.

So I resolved to work as much as possible to achieve it. At the outset, I began to take on other projects. Small things like an extra research project. Or helping a friend with a presentation.

One day, when I thought we needed a basic CRM for our team, I stayed up late into the morning building one, called Toothpaste.

Pretty soon, the extra work began to consume a lot more time. I began to sleep less, going to bed on consistently after midnight, sometimes sleeping only a few hours.

I doubled down on productivity tools looking to do more in less time. I began to focus on reducing interruptions and tallied each time someone interrupted me.

Amidst the growing workload, I wanted to keep up an exercise regimen similar to the one I had on the crew team at school. The earliest San Francisco to Mountain View bus arrived too late to work out for more than an hour to be in the office before 730.

So when I happened to meet Marty, who ran the Google bus program, I asked if there might be an earlier shuttle. The next week, a bus began arriving at my Google bus stop around 4am. I would climb aboard and fall asleep in the back row. Somewhere along the way, we would stop to pick up one of the Google chefs, rising early to prepare breakfast. I might arrive around 5, workout for about 90-120 minutes and then back to my desk.

Weekends I tried to catch up on sleep, but often, I worked most of Saturday and Sunday too. I was a flywheel spinning out of control.

On Christmas Eve 2005, my family admitted me to the emergency room. Bacterial pneumonia. Everyone told me my lifestyle was unsustainable and it had to change. Especially my manager. This was the fourth time in four quarters that I had been to the ER.

Since then, I’ve learned a few things about how to avoid burnout:

1. I am responsible for setting boundaries. Work time, sleep time, family time, you time. If I don’t set them properly, things get unbalanced very quickly.

2. Being productive isn’t about doing more and more in the same amount of time. It’s about doing only the most important things well. And either saying no to the other things or finding another way for them to get done.

3. I can’t win a marathon by thinking of it as 26 mile long sprints, or a week as 5 day-long sprints.

4. Loved ones are good judges of when things are in and out of balance, and in my case, my wife helped me find more balance.

5. Taking time off is essential. Vacations, yes, but also nights and weekends.

At the beginning of each year, I try to remember that feeling of being out of balance, of being in the hospital with pneumonia, to reflect on how I should be spending time this year.

Which are the most important things I need to do well in 2017? And which things just aren’t?

https://www.linkedin.com/pulse/what-i-learned-from-complete-burnout-work-tomasz-tunguz?trk=eml-email_feed_ecosystem_digest_01-hero-0-null&midToken=AQFjhnSMpoKQvw&fromEmail=fromEmail&ut=3eI3O1Eqv6D7A