1.The Most Hated Bull Market Ever Continues….January Redemptions in Domestic Equities.

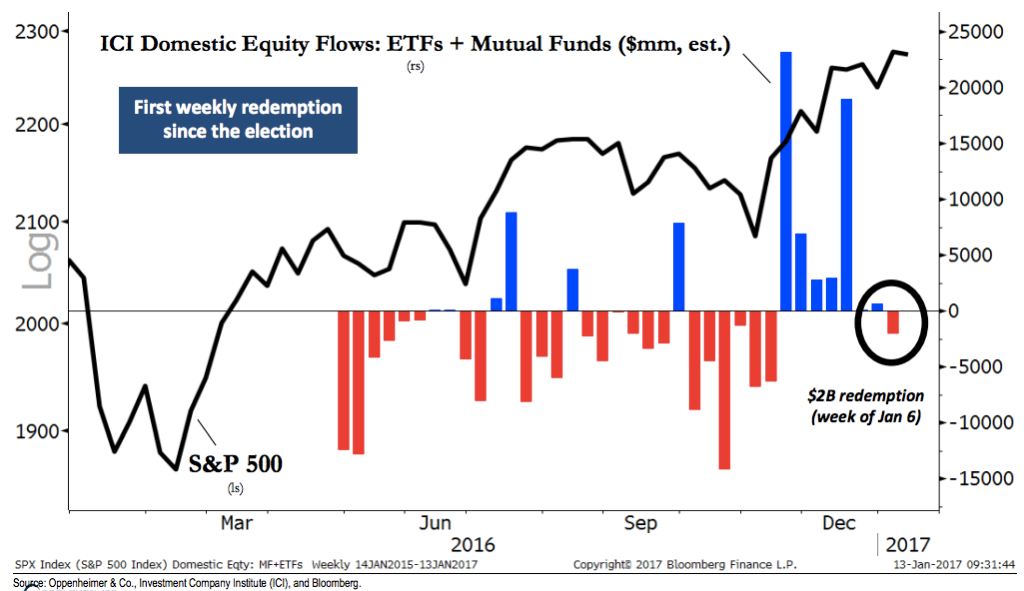

Euphoria? Okay, sure. Maybe in word, but not in deed. Here’s Oppenheimer’s Ari Wald highlighting a divergence that merits attention…

While newsletter surveys are signaling optimism, recent fund flow data suggests that investor skepticism still lingers. For instance, ICI estimated a $2B net outflow from domestic equity ETFs and mutual funds for the week of Jan 6 which marks the first redemption since the US election. What investors are doing is often more important than what they’re saying, and we therefore view this lack of euphoria as a positive for the overall equity cycle.

From Josh Brown Blog

http://thereformedbroker.com/2017/01/17/chart-o-the-day-bullish-but-selling/

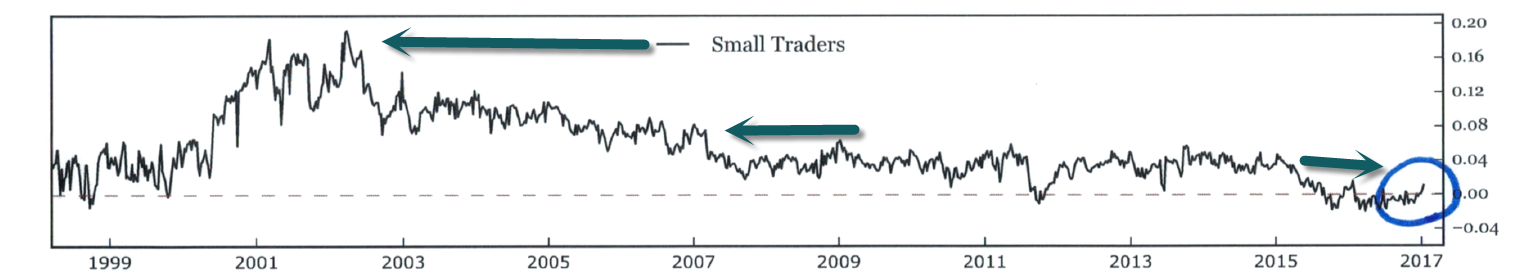

2.Contra Indicator–This Chart Shows Underweight or Overweight by Small Traders…..They are Just Moving to Overweight.

Not sure how many small traders are still around compared to first arrow internet online trading bubble days

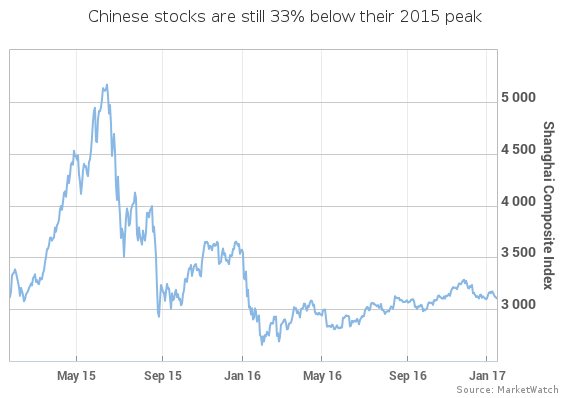

3.Follow up to Yesterday’s China Charts….Chinese stocks P/E 11.8 vs. U.S. 17.6

“We are not overall concerned, but I think a lot of the time, fund managers only look at the headline debt number. They don’t look at the details and see that corporate borrowing is slowing down, deleveraging is happening, and nonperforming loans are falling,” he told MarketWatch.

“These are all things that investors need to realize. Expectations are very low for China right now. Equity valuations are also very low, and that’s a perfect recipe for markets to recover,” he added.

The index still hasn’t recovered, and is trading 33% below its 2015 peak. And with corporate profit expected to grow by 11% to 12% in 2017, China’s companies have started to look very cheap, Wong said. For Chinese stocks, the forward price/earnings ratio is 11.8, compared with 17.6 for U.S. stocks and 14.7 for European equities.

Read full story by Sara Sjolin at Marketwatch

http://www.marketwatch.com/story/what-investors-are-getting-wrong-about-china-says-a-top-asian-fund-manager-2017-01-16

4.Where do International Markets Stand Post 2007 Crisis? China has the Lowest Return.

CHART OF THE DAY

For some perspective on the post-financial crisis rally, today’s chart illustrates how much of the downturn that occurred as a result of the financial crisis has been retraced by several major international stock market indices. For example, the S&P 500 peaked at 1,565.15 back in October 9, 2007 and troughed at 676.53 back on March 9, 2009. The most recent close for the S&P 500 is 2,267.89 — it has retraced 179.1% of its financial crisis bear market decline. As today’s chart illustrates, China (Shanghai Composite), Japan (Nikkei 225), India (S&P BSE Sensex), Germany (DAX), France (CAC 40) and the UK (FTSE 100) are all above their financial crisis lows (i.e. above 0% on today’s chart) and five of the aforementioned countries (USA, Japan, India, Germany and the UK) are currently trading above their respective pre-financial crisis peak (i.e. are above 100% on today’s chart). It is interesting to note that the US (epicenter of the financial crisis) has outperformed the other major stock market indices (* keep in mind that the German DAX is unique in that it includes for the reinvestment of dividends) while China has lagged to the point where it only trades 32% above its financial crisis lows — not that impressive of a performance considering that the financial crisis occurred eight years ago.

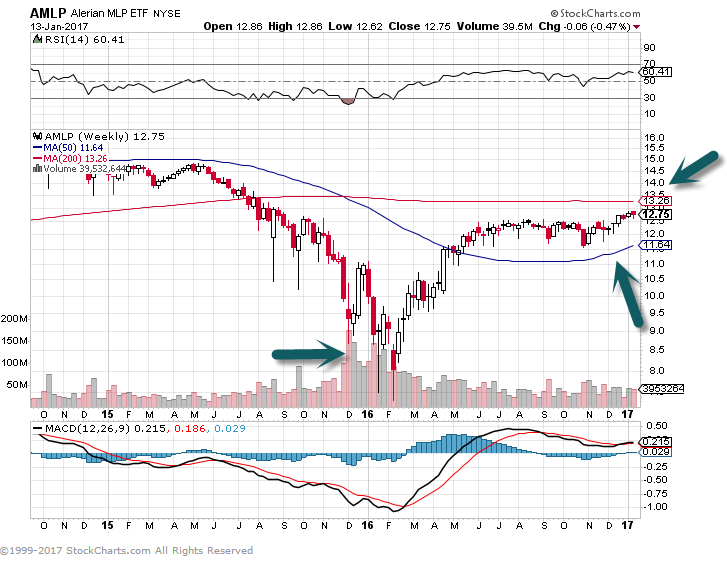

5.Did We See Capitulation in MLPs in Jan. 2016?

5.Did We See Capitulation in MLPs in Jan. 2016?

AMLP ETF—See High Volume at Bottom in First Arrow….50day turning up and about to move above 200day on weekly chart.

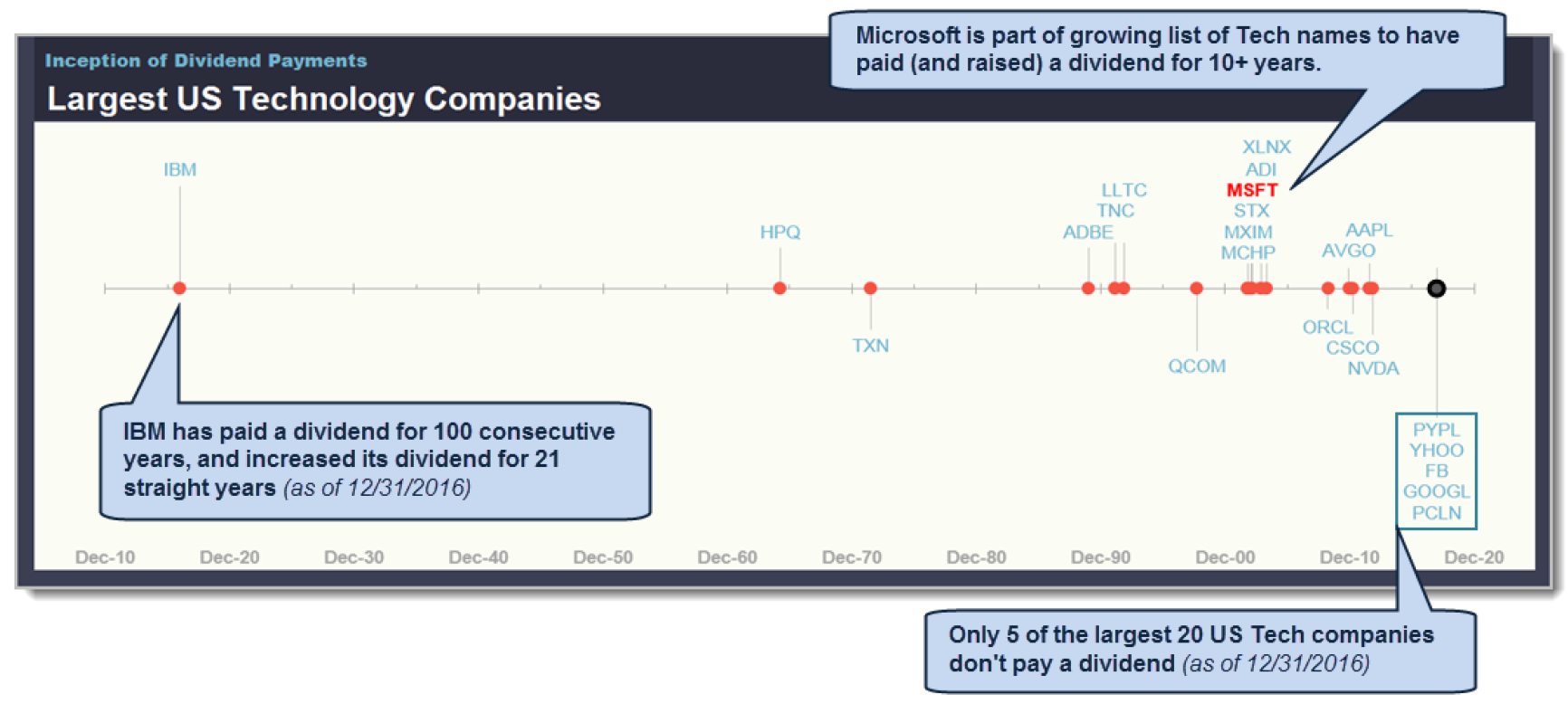

6. Tech Companies Moving to Become Dividend Payers.

International Business Machines IBM was incorporated in 1911 and shortly thereafter began paying dividends to its shareholders. For the past 21 years IBM has also consistently raised its dividend, earning its way into many “Dividend Achiever” portfolios as a result. Consistently paying a dividend over the last 100 years makes IBM a bit of an anomaly. Not only can very few companies point to such a long, unbroken track record of dividend payments, but certainly none have done so while maintaining their reputation as a “Tech stock.”

For many years, Tech companies like IBM and Microsoft MSFT were expected to put cash toward R&D or share buybacks rather than dividend payments to shareholders. During that time IBM stood out as one of the only Tech stocks to pay a dividend. However, in January 2003, MSFT followed suit, putting itself among the early “blue chips” in the Tech sector to declare a dividend, and taking advantage of what became preferential tax treatment of qualified dividends. MSFT was joined by Seagate STX and Xilinx XLNX, and then followed by Oracle ORCL and Cisco CSCO. Now, here we are, well over a decade since the tax incentive was put into place, and 15 of the 20 largest US Tech companies now pay a dividend!

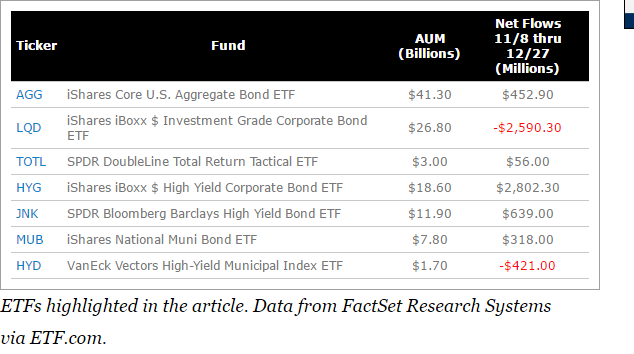

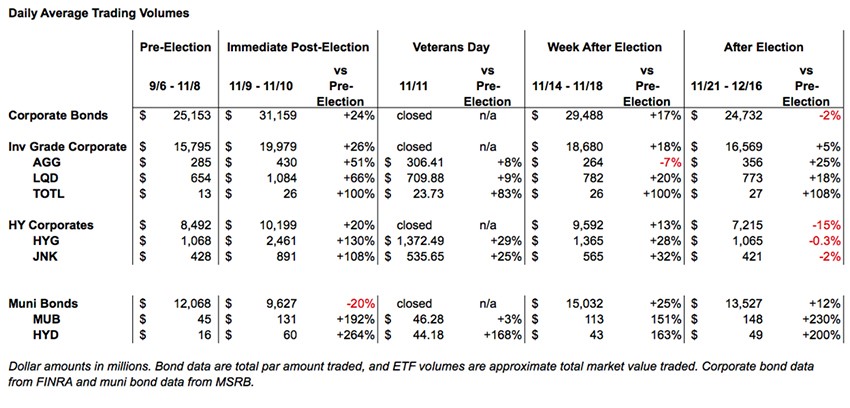

7.Fixed Income ETF Liquidity? No Issues During Post-Election Bond Sell Off.

Fixed Income ETF Liquidity: The Nonstory

Amidst the turmoil of the post-election bond market—with rates rising, trade volumes surging and reduced dealer support of the over-the-counter bond market, how did the market for fixed-income ETFs do?

One of the most interesting takeaways from the data is that there is no story here. In spite of all the concerns about the lack of liquidity in the fixed-income markets, the market for fixed-income ETFs appears to have functioned smoothly throughout the recent volatility.

Using a few of the largest taxable bond ETFs and municipal bond ETFs as proxies for the universe of fixed-income ETFs shows that trading volumes rose across the board—in the over-the-counter market for bonds as well as in the listed market for fixed-income ETFs. Of particular interest was the Friday after the election, which was Veterans Day—one of the few market holidays when stocks are open but bonds are closed. Note that the trade volumes for the ETFs that day were higher than the pre-election averages.

Patrick Luby

http://www.etf.com/sections/features-and-news/fixed-income-etf-liquidity-nonstory/page/0/1

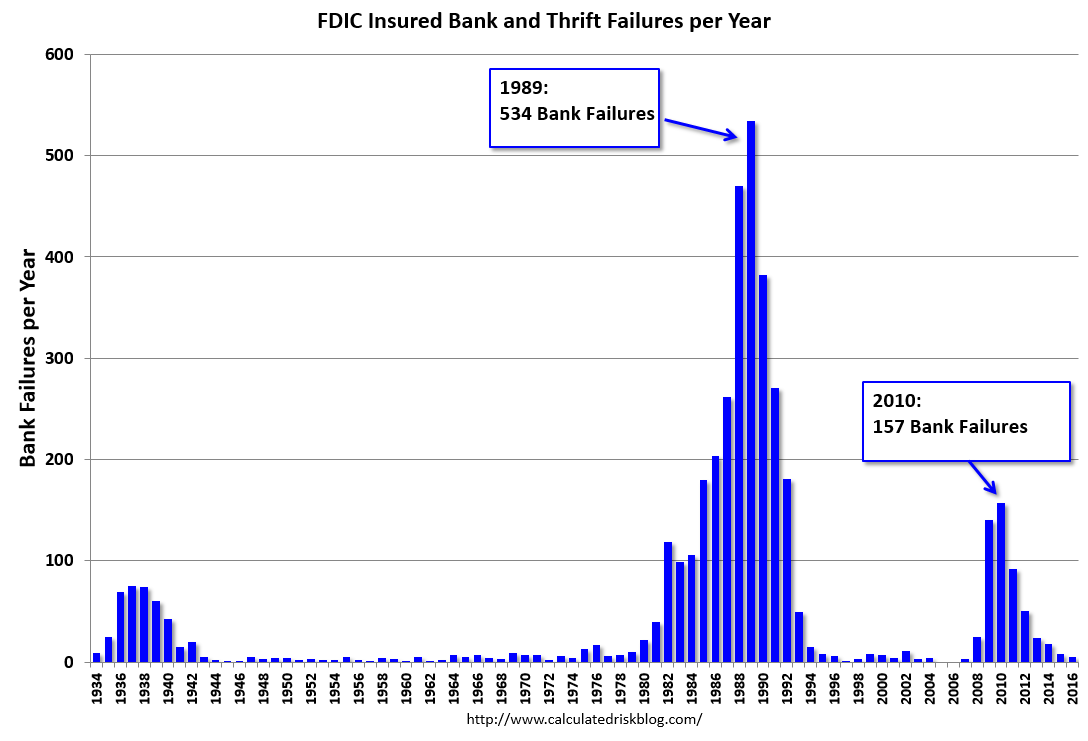

8.In 2016, five FDIC insured banks failed. This was the lowest level since 2007.

Most of the great recession / housing bust / financial crisis related failures are behind us. The first graph shows the number of bank failures per year since the FDIC was founded in 1933.

Note: There were a large number of failures in the ’80s and early ’90s. Many of these failures were related to loose lending, especially for commercial real estate. A large number of the failures in the ’80s and ’90s were in Texas with loose regulation. Even though there were more failures in the ’80s and early ’90s then during the recent crisis, the recent financial crisis was much worse (large banks failed and were bailed out).

From Bill McBride Read more at http://www.calculatedriskblog.com/#DKjJUeHIvjdq5Xym.99

9.Read of the Day…The Amount of U.S. Bonds has Ballooned to $47 Trillion, up 24% from Ten Years Ago.

How Bad Will the “Bond Massacre” Get?

by Wolf Richter • Jan 4, 2017

Worse “than the 1994 ‘Bond Massacre,’” with “sustained double-digit losses on bonds, subpar growth in developed markets, and balance sheet risks for banking systems….”

The backdrop: after 36 years of bond bull market, the amount of US bonds has ballooned to $47 trillion, up 24% from just ten years ago:

- US Treasurys ($19.8 trillion),

- Municipal bonds ($3.8 trillion)

- Mortgage related bonds ($8.9 trillion)

- Corporate bonds ($8.6 trillion)

- Federal Agency bonds ($2 trillion)

- Money Markets ($2.6 trillion)

- Asset backed Securities ($1.3 trillion)

Bonds dwarfs the US stock market capitalization ($27 trillion). Bonds are a global phenomenon with even bigger bubbles elsewhere, particularly in NIRP countries, such as those in Europe, and in Japan. That’s why bonds matter. They’re enormous. And the damage they can do to investors is huge.

So how bad might the next bond bear market get? Paul Schmelzing, a visiting scholar at the Bank of England and an academic at Harvard where he concentrates on 20th century financial history, published an unpleasant scenario on the Bank of England’s blog. He doesn’t mince words:

[A]s rates reached their lowest level ever in 2016, investors rather worried about the “biggest bond market bubble in history” coming to a violent end. The sharp sell-off in global bonds following the US election seems to confirm their fears. Looking back over eight centuries of data, I find that the 2016 bull market was indeed one of the largest ever recorded. History suggests this reversal will be driven by inflation fundamentals, and leave investors worse off than the 1994 “bond massacre.”

To arrive at his conclusion, he classifies bond bear markets into three types:

- The inflation reversal of 1967-1971

- The sharp reversal or “Bond Massacre” of 1994

- The steepening yield curve or “value-at-risk shock” in Japan in 2003.

He explains that “historically, inflation acceleration has been a solid predictor of sharp bond selloffs.” But other “prominent episodes appear less correlated with fundamentals, and can inflict similar levels of losses.”

Read Full Story

10. 5 Benefits You Will Experience Once You Become Comfortable With Being Uncomfortable

As human beings, we often view “stress” as a dirty word. We try to avoid it at all costs. But sometimes a little bit of healthy stress can push us forward out of our comfort zones and into extreme success.

One of the most detrimental things you can do for your career, business or life is stay too long in a place where you are comfortable. Personal and professional growth will inevitably make you uncomfortable, but that discomfort shouldn’t stop you. After all, a certain amount of stress and discomfort is required if you want to reach your full potential.

Here are five key benefits you will experience once you become comfortable being uncomfortable:

1. You will let go of perfection

No one is perfect. Once you embrace the power of feeling uncomfortable in life, you will let go of all the unnecessary pressure to be something you cannot be. You will lose the fear that has been holding you back from trying something new.

You will no longer be a prisoner to the fear of failure because you are ok with failing from time to time. Failure and rejection are a given, but once you accept and embrace it, you will welcome imperfection and all of the life lessons it brings with it.

“Beauty and ingenuity beat perfection hands down, every time.” – Nalo Hopkinson

2. The risks you take will teach you about yourself

The more comfortable you are with feeling uncomfortable, the more aware you will become of what you are truly capable of. You never know how strong you actually are if you never try anything new.

You will want to reach new heights and will be more willing to take risks at something without knowing whether you will succeed. It will not matter if the result turns out good or bad. You will learn because you took the risk and bet on yourself, and you will improve for next time.

3. You will be more productive

When it comes to productivity, comfort is the enemy. Without a sense of discomfort, it is human nature to procrastinate or do the least amount we can to get by. Inside of our comfort zones, all of our drive and ambition is stalled. Pushing beyond personal boundaries will help you get more done in less time because it motivates you to succeed.

4. You will harness your creativity

Seeking new life experiences and learning new skills inspires us to learn more and challenge our old ideas. Creativity is intrinsically risky, but risks will no longer scare you. Uncomfortable experiences will push you to see problems from a new perspective and tackle challenges with a new and fresh energy.

5. Uncomfortable eventually becomes comfortable

Stepping out of your comfort zone and getting uncomfortable in life ultimately helps you deal with sudden and unexpected change. You will become accustomed to a certain level of productive discomfort, and it will become easier to challenge yourself because you now look at things differently.

Change will no longer frighten you. In fact, you will embrace change because you know that it improves you. Your comfort zone will expand, and the number of things that cause you fear will diminish.

How to get comfortable with being uncomfortable

If you continue to operate as you are right now, you will continue to get the same results you currently get. If you want more from life, the only solution is to do something you have never done. It is time to get uncomfortable. Here is how to start today:

1. Determine what makes you uncomfortable

What are the things that you are afraid to do because of a fear of failure? What is driving your fear of that situation? Identify the boundaries of your comfort zone so that you recognize situations that fall outside of it.

2. Set goals

In order to achieve goals, you have to step outside your comfort zone. Figure out what it is you want out of life. Visualize yourself there. How does it feel? What steps do you need to take to get to your end goal? What new skills will you require? Write it all down. Your goals are what will ultimately motivate you to take a chance on yourself.

“What you get by achieving your goals is not as important as what you become by achieving your goals.” – Zig Ziglar

3. Take steps towards the uncomfortable

Make a decision to never run away from discomfort again. Take steps to stay uncomfortable a little longer each time until eventually those uncomfortable situations become comfortable. The first step is always the toughest. As you continue taking steps, you will build momentum, and it will become easier to continue forward movement. So seek opportunities to reach out beyond your personal boundaries every day.

Everything amazing about life happens outside of your comfort zone. When you push yourself beyond that safety net, you can achieve goals in life that you never thought you were capable of.

Becoming comfortable with being uncomfortable can help you conquer your world and get everything you want in life. Refuse to settle for what you have and continuously push the limits in order to achieve immense success and happiness. The only thing standing in your way is yourself.

http://www.startofhappiness.com/personal-development-blogs/