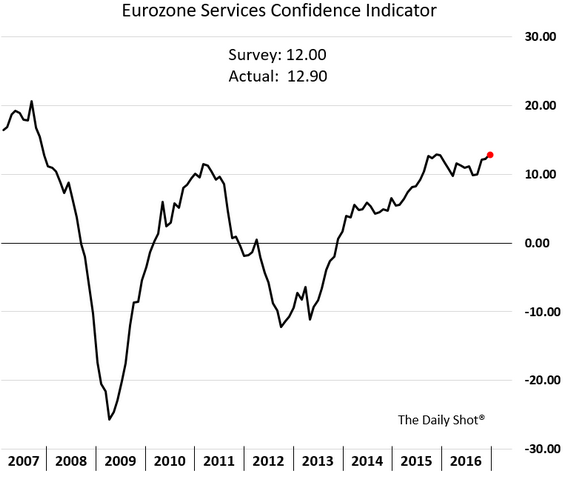

1.Munis See Big Outflows in 2016

Credit: The muni market capital outflows have been substantial, resulting in a rare loss for intermediate-maturity bonds.

Source: Barclays, @NickatFP, @joshdigga

See Huge Volume on Sell Off….Bars at Second Arrow. Big Picture 5% Off Highs.

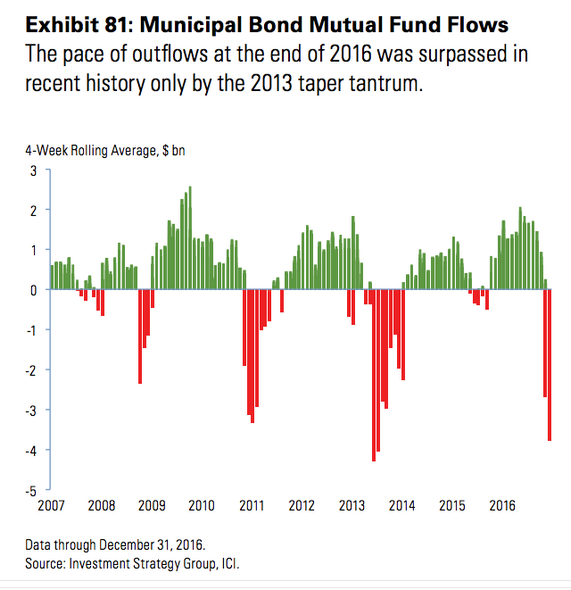

2.European ETFs Lost 35-50% of Assets in 2016 as Investors Pulled from the Region.

Ned Davis Research

http://www.ndr.com/

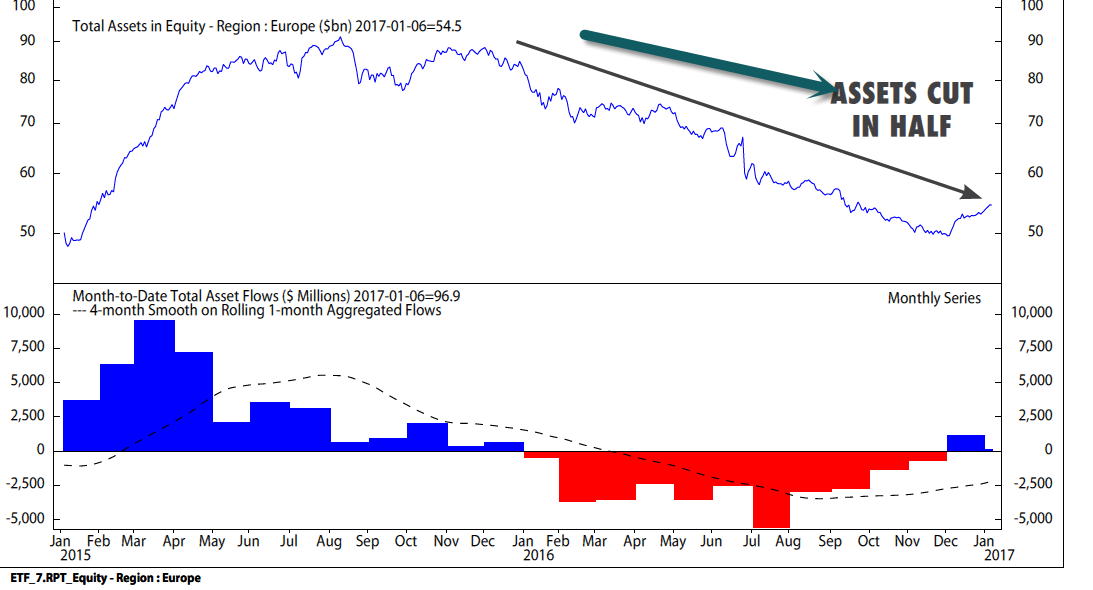

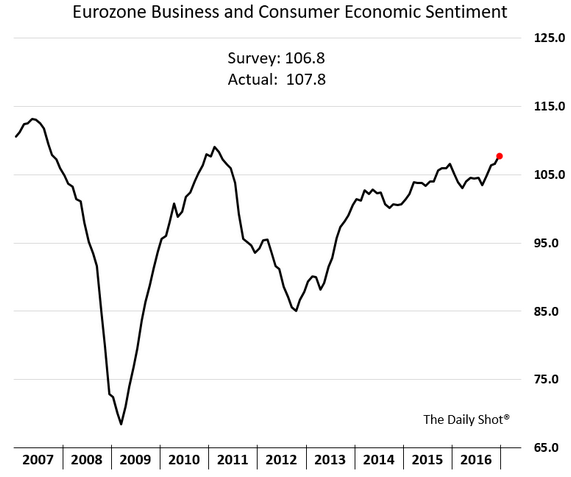

Eurozone Economic Data Getting Better.

Eurozone: Economic data from the euro area points to a continuing recovery. Here is business and consumer economic sentiment, and service sector sentiment.

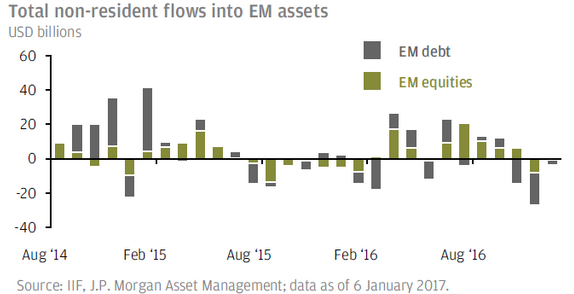

3.Follow up to Yesterday’s Emerging Market Chart…..Emerging market portfolios suffered their largest three-month outflows in seven years in the fourth quarter, JPM reports

Thanks to Dave Lutz at Jones for Chart.

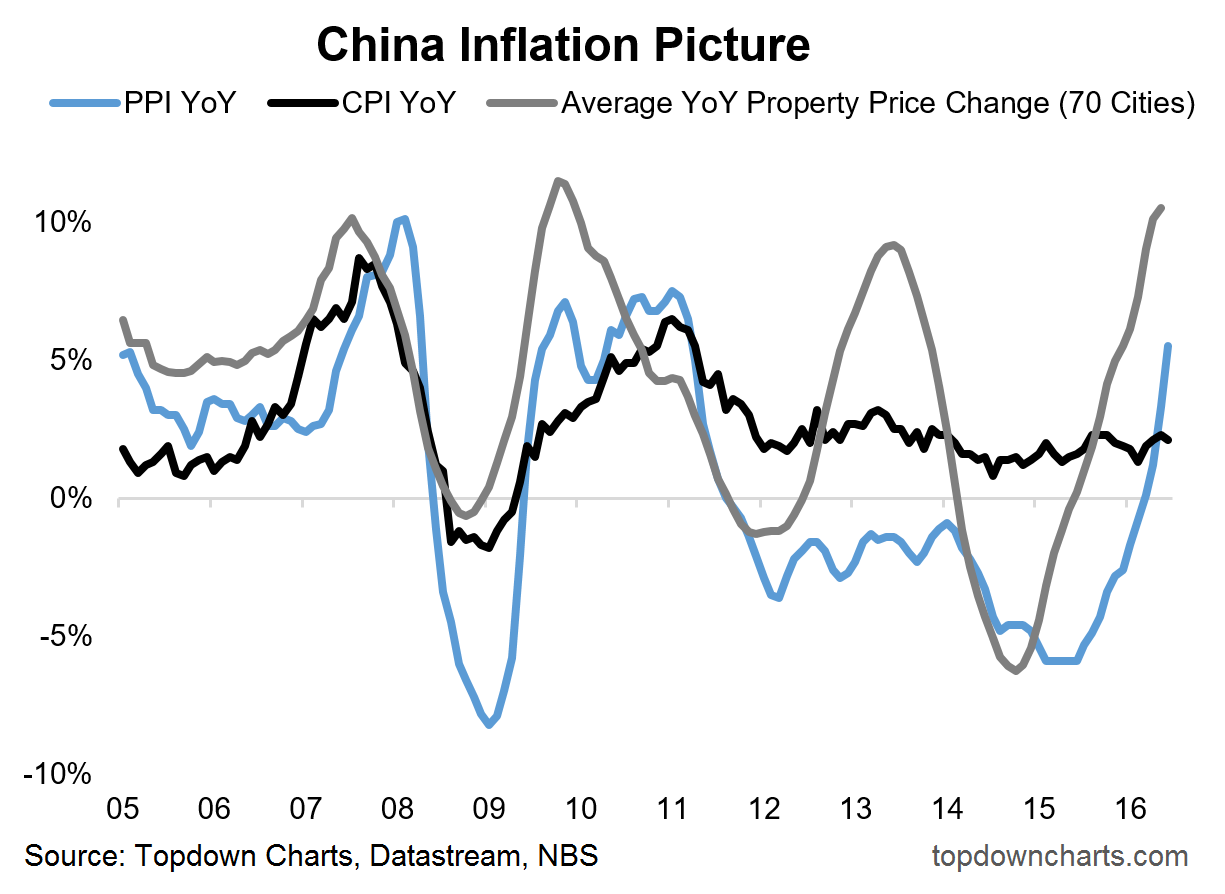

4.China Inflation Picking Up….Good for Emerging Markets?

The chart below shows the trends in consumer, producer, and property price inflation. While consumer price inflation has been fairly steady, it’s when you look at property price and PPI inflation that things get interesting. China’s property prices have been surging (on the back of rate cuts, tax cuts, and regulatory changes introduces in 2015 and early 2016), and partly as a result there has been a massive turnaround inproducer price inflation. Indeed, the two often track each other as higher property prices often ends up flowing through to increased aggregate demand. Whatever way you look at it, the inflation picture in China right now is very different from a year ago, and soon the PBOC may need to stop thinking about stimulus and start thinking about interest rate hikes.

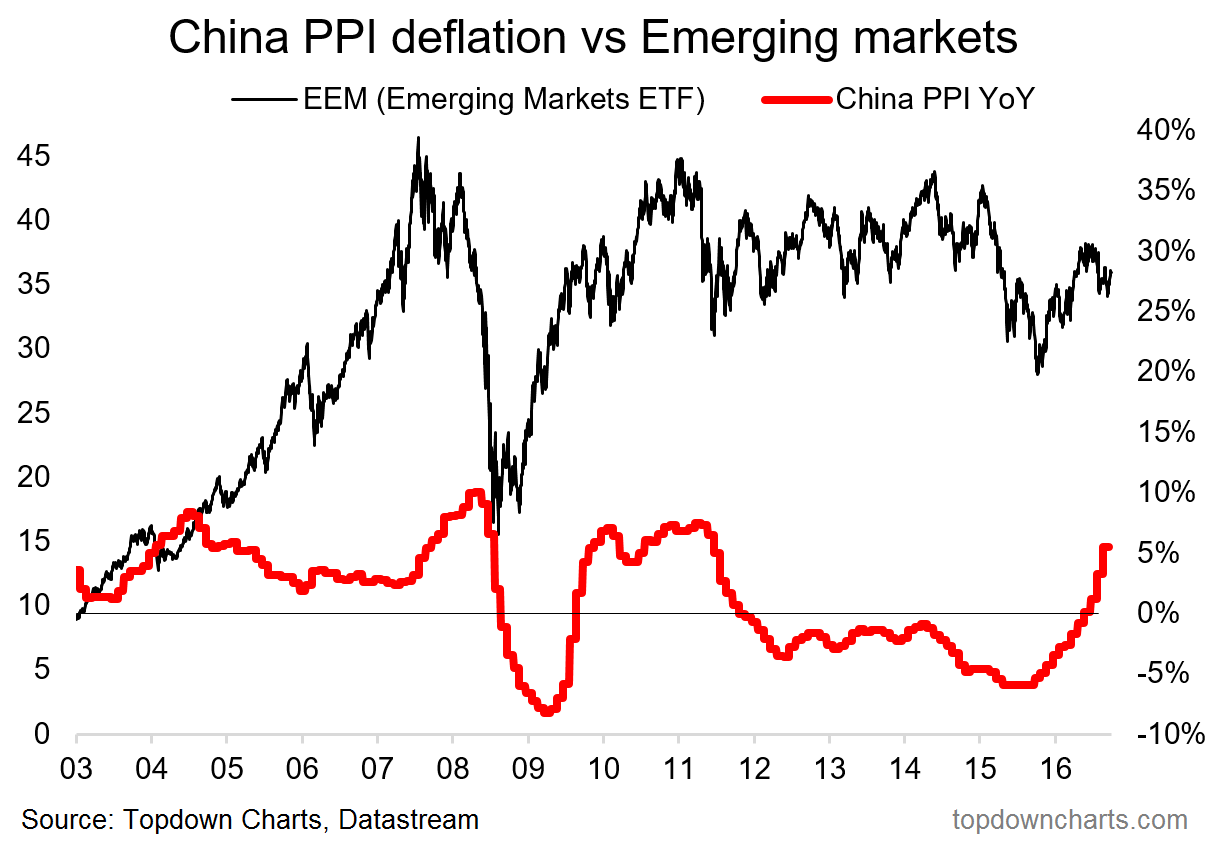

Upside For Emerging Markets?

One potential implication of rising PPI inflation in China is the seeming link it has with emerging market equity performance, as shown in the graph below. This could make sense from a couple of angles: part of the reason for the lift is due to rebounding commodity prices (good for those within EM exposed to commodities), similarly China PPI often rises when theglobal economyis performing well, and PPI often responds to stimulus in China (good for China driven demand). So while it could be different this time, if the trend continues there could be more upside in store for emerging market equities.

http://www.valuewalk.com/2017/01/china-inflation-big-picture-big-beneficiary-big-surprise/

5.Biotech Gained 5% in Opening Week…..For Technical Junkies.

BBH Biotech ETF after almost 50% correction from highs…..Held long-term weekly chart 200day moving average

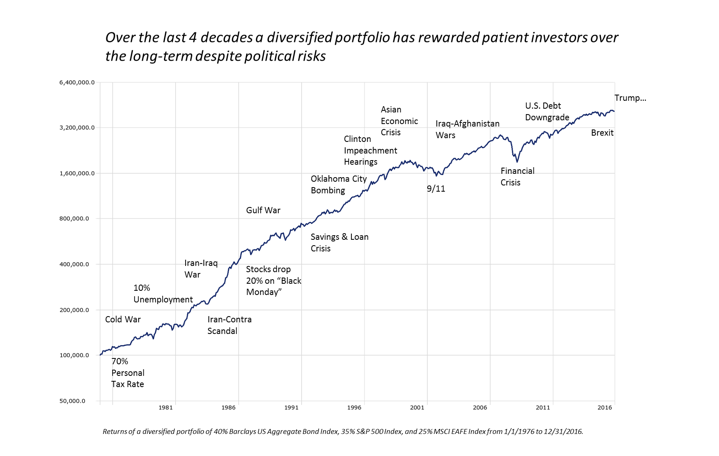

6.Investing Based on Political Risk Might be a Bad Idea.

Thanks to Tim Hussar at Sage for Chart.

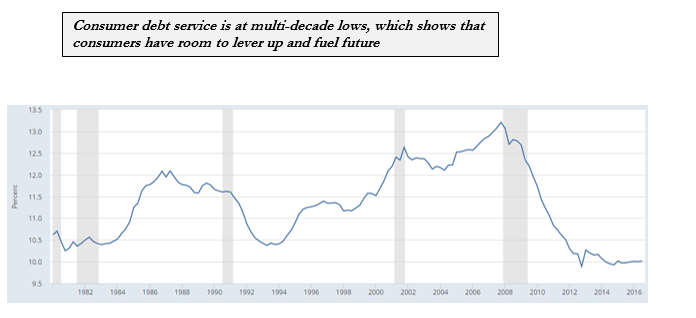

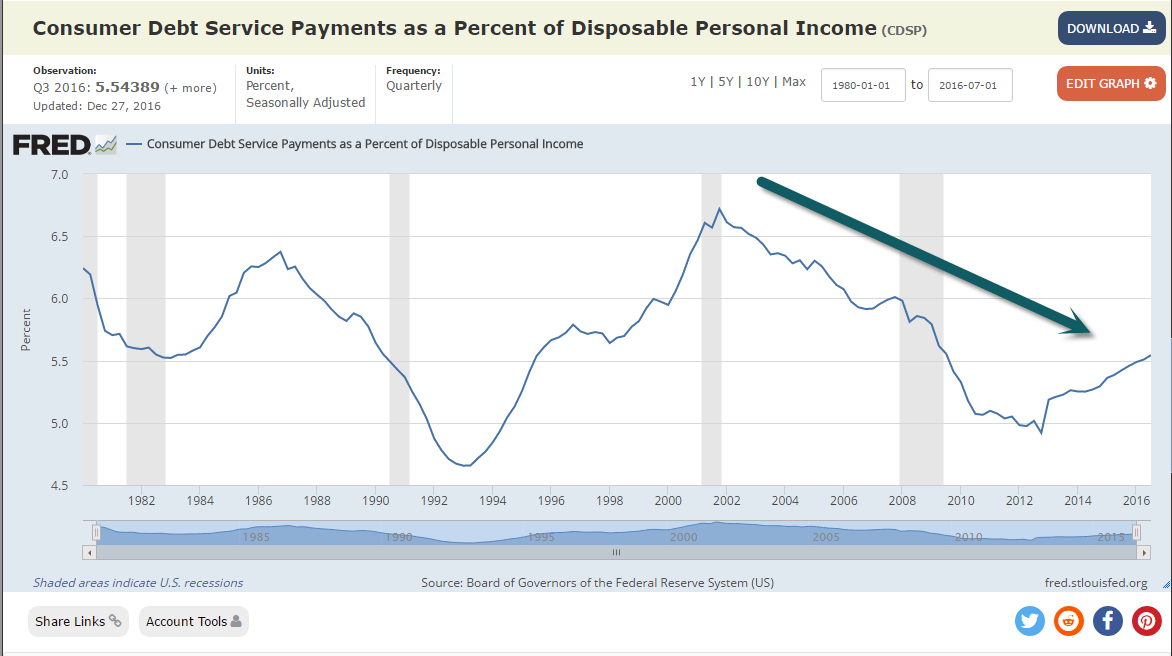

7.Consumers are not Over Leveraged and the U.S. is Creating More Jobs than Workers.

https://fred.stlouisfed.org/series/CDSP

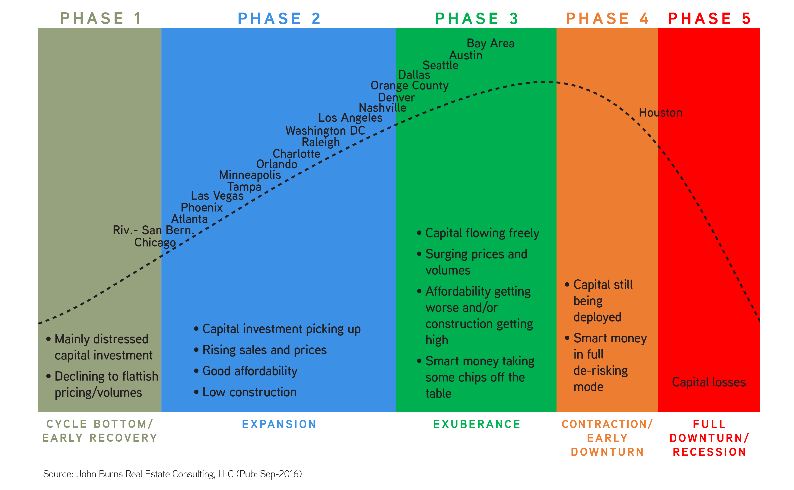

8. The Housing Cycle: Market by Market

Where are we in the housing cycle? This, by far, is the question we get asked the most. It’s often framed with the metaphor of a nine-inning baseball game: What inning are we in? This question implies that markets move in unison, driven by similar factors. In reality, every market has its own unique set of industry influences, supply impediments (or lack thereof), and demographic drivers. While some markets took it on the chin during the last cycle, many others were left relatively unscathed. To better answer the cycle question, we examined all of these influences across the 20 largest new home volume markets. I break down our findings below.

Phase 1: Cycle Bottom / Early Recovery

Declining to flattish home price and sales trends remain the norm, and investors can still find distressed opportunities. Only Chicago remains in the Early Recovery phase. Home values there are 23% below prior peak, and new home sales lag a whopping 85% below prior peak. Chicago’s economy continues to underperform, hampered by underperforming sectors such as manufacturing, financial services, and government. Lastly, budget and pension problems increase the likelihood of tax increases down the road—a risk many local builders/developers/homebuyers aren’t interested in taking. x

Phase 2: Expansion

Capital investment picks up in the Expansion phase, accompanied by rising home values and sales trends. Affordability is good, and construction activity has reached healthy levels. Many of our clients today are laser-focused on these geographies, continuously adding to their investments in these markets. Job growth has come back nicely, with the lion’s share of Expansion markets recovering all of the jobs lost during the Great Recession. Prices have yet to rebound massively, with home values roughly 20%–30% below prior peak in markets such as Las Vegas, Riverside-San Bernardino, Phoenix, Orlando, and Tampa. Investment risk also remains fairly muted. Our Housing Cycle Risk Index™ (measuring demand/supply/affordability within each market) indicates low to very low risk levels in all Phase 2 markets except Denver, Nashville, and Orange County. All three markets have nearly reached the Exuberance phase. x

Phase 3: Exuberance

Capital has flowed freely for several years now in these markets. Prices and sales volumes have surged, and smart money is now investing more cautiously. Austin, Dallas, the Bay Area, and Seattle all fit this description. It’s important to note that Texas markets never shot up to the extent that Phase 1 and Phase 2 markets did during the mid-2000s. Home values in both Austin and Dallas barely budged during the Great Recession, falling a modest 3%. Since then, prices have been on a tear, rising almost 50%. Job growth has also been phenomenal, with Dallas and Austin now possessing roughly 20% and 30% more jobs than during their prior peaks. Higher-paying jobs in tech, health care, and construction have driven this increase. Other Phase 3 markets, such as the Bay Area and Seattle, didn’t quite experience the run-up that other markets did during the subprime heyday. Rather, their economies were still recovering from the dot-com bust, with job losses stretching from 2001–2004. Tech has since entered a renaissance: surging job growth, booming construction activity, and sky-high home prices have become the norm in these markets. Along with a possible tech slowdown, our biggest concern in all Phase 3 markets is lack of affordability. Already we are beginning to see signs that look eerily familiar to prior boom/bust cycles. Builders in more affordable spillover markets such as Sacramento note a surge in transplants. Bay Area buyers are cashing out or are simply priced out of buying close to where they work. x

Phase 4: Contraction / Early Downturn

Only Houston has entered the Contraction phase. Oil’s move from $100+/barrel to just $45 has resulted in job growth falling from 100,000 jobs per year to less than 10,000. Construction activity has pulled back, particularly in apartments. Higher price point homes have felt the brunt of the downturn, while lower price points have held up remarkably well. We believe Houston will remain in Phase 4 through 2017 and will most likely avoid the full-fledged downturn/recession associated with Phase 5. x

Phase 5: Full Downturn / Recession

Capital losses are the norm and are typically unavoidable at this point in the cycle. At the moment, none of the major new home markets are in recession. x

Takeaways

Our job is to help our clients decide when and where to place their investment chips throughout the cycle. We do this by objectively assessing risk/return profiles in housing markets throughout the country. We believe that the vast majority of markets remain in the Expansion phase. Plenty of innings are left to be played this recovery in these markets. There are a handful of markets that appear long in the tooth based on our market-specific definition of the housing cycle. In baseball terms, we’re pretty close to the 7th-inning stretch in Austin, Dallas, the Bay Area, and Seattle. These four markets are currently some of the strongest and most profitable markets in the country for our clients—and could very well remain so for quite some time, especially if rates stay low and tech avoids a major correction.

https://www.realestateconsulting.com/the-housing-cycle-market-by-market/

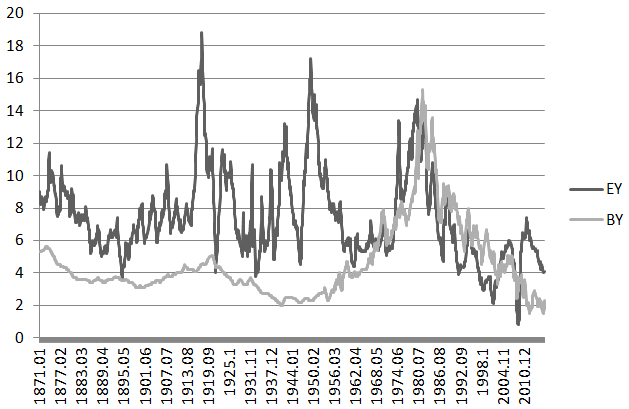

9.Earnings Yield and Bonds Yield.

Bonds Down, Stocks Up!

So bonds are ‘crashing’ and stocks are going up. Some say that this can’t continue; you can’t have stocks and bonds go in opposite directions for long before something snaps. Well, this is true to some extent. But it sort of depends on which way the ‘snap’ is happening. What if bonds were way overvalued versus stocks? In that case, bonds can tank a lot before stocks have to correct. Bears have been saying forever that once the bond market turns and interest rates start to go up, the stock market will crash. Maybe so. Let’s take a step back and look at what’s going on. How can bonds go down and stocks go up? Here is a look at the earnings yield versus 10-year bond yields since 1871. The data is from Shiller’s website:

Earnings yield and bond yields have sort of tracked each other closely since the 1960’s or so. Recently, bond yields went down a lot while earnings yield refused to follow it down. This spread is sort of a cushion for the stock market. Since the spread is so wide, it’s not unnatural for both of them to go in opposite directions.

S&P 500 Earnings Yield versus 10-year Bond Yield (1871-November 2016)

http://brooklyninvestor.blogspot.com/

10.Planning Your Day

Let’s face it. As someone who wants extraordinary results in every area of your life, there are always going to be obstacles in your way. Two of the most common are overcoming procrastination and keeping control of your daily schedule.

The good news is that we conquer both with one solution. And that’s simply by planning your day.

So let’s allay your fears and stresses about the seemingly complex task at hand. Planning makes success simple.

Don’t get me wrong, it doesn’t make success easy, but it makes it simple. There is a big difference between the two.

Easy means little effort. And we both know that success takes hard work. Simple means that the path to success has already been tread, and we just need to follow that path. But, of course, there’s a path that has been tread to the top of Mount Everest, too, and we know that isn’t easy.

All paths to success take planning. In our recent discussions about “Operation 2X,” our plan to help you achieve twice the results over the rest of the year, ETR Publisher Matt Smith said, “You cannot have a 2X day when you don’t plan. That includes planning kids/family activities. 2X happens only when you lead. It only happens when you’re proactive and are actually pushing things forward. 2X only happens when there is intention.”

So what does that mean?

You need to:

- Plan your day/schedule

- Block out your time for specific tasks

- Get ONE big thing done first thing in the morning for momentum

- Prioritize your to-do list

- Make a commitment to contacting the right people

- Eliminate unnecessary communication

- Avoid getting sucked into emails

- Set daily deadlines

- Stick to your schedule (this is where things often go wrong)

- Set up your environment for maximum productivity.

- Institute a strict sleeping schedule

- Surround yourself with competent people who can do some work for you.

Or you can say, “Oh, I don’t want to be that rigid. I want a flexible, spontaneous lifestyle.”

And that’s fine, but the fact is you’ll fail at almost everything you want to do in life. PERIOD.

Your choice.

You must have total control over your working conditions and those that can interrupt it. It must be made known that your work time is do-not-disturb time.

This will disappoint others but it will protect your time and is essential to your success. Make this decision. Separate work from play. Commit. Stay focused.

Remember… you get freedom from structure.

You don’t get freedom from a 4-hour work week. That’s false freedom, or as your parents described it, “Laziness.”

So listen…

If you’re struggling with your schedule, go back and do a “time journal.” Then ruthlessly plan your work day.

The more work you can get done during work hours, the less time you’ll have to steal from your family, friends, fitness, and fun hobbies by working when it’s not “work time.”

That’s what is meant by getting more freedom from structure.

You can work hard a good many hours and still have a life. Most people don’t have a balance problem, they have a time-wasting problem.

You must find your Magic Time to get more done in less time.

You must also set an end to your day. Do a brain dump and then shut your working mind down. Go spend time with your family. Don’t answer email at all hours of the day. Set limits. Know what you should be doing at all times, and do it.

The more structure you have in your work day, the more you plan, the more you will accomplish — and the closer you will get to achieving a 2X day — and life.

Remember these words of wisdom from Dave Kekich:

“Cherish time, your most valuable resource. You can never make up the time you lose. It’s the most important value for any productive happy individual and is the only limitation to all accomplishment. To waste time is to waste your life. The most important choices you’ll ever make are how you use your time.”

So always be prepared. Plan ahead. If you do, and if you get focused, you can dominate your days and own your life in 2017.

If you need help, I’m your man.