1.CME Group Daily Volume +25%….Energy Trading +27% and Metals Trading +49%

CME Group

Driving Global Growth and Commerce

CME Group is the world’s leading and most diverse derivatives marketplace, handling 3 billion contracts worth approximately $1 quadrillion annually (on average). The company provides a marketplace for buyers and sellers, bringing together individuals, companies and institutions that need to manage risk or that want to profit by accepting risk.

Our exchanges – CME, CBOT, NYMEX and COMEX – offer the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural commodities, metals, weather and real estate. As part of our commitment to providing innovative risk-management solutions to the marketplace, CME Group also offers a growing slate of cleared OTC products and services.

Through our CME Globex electronic trading platform, users worldwide are able to access the broadest array of the most liquid financial derivatives markets available anywhere. Additionally, CME Group operates CME Clearing, one of the world’s leading central counterparty clearing providers. By serving as the counterparty to every trade that happens in our markets, we protect the integrity of our markets, virtually eliminating third-party credit risk.

For the global economy, this unparalleled access translates into opportunity.

http://www.cmegroup.com/company/history/

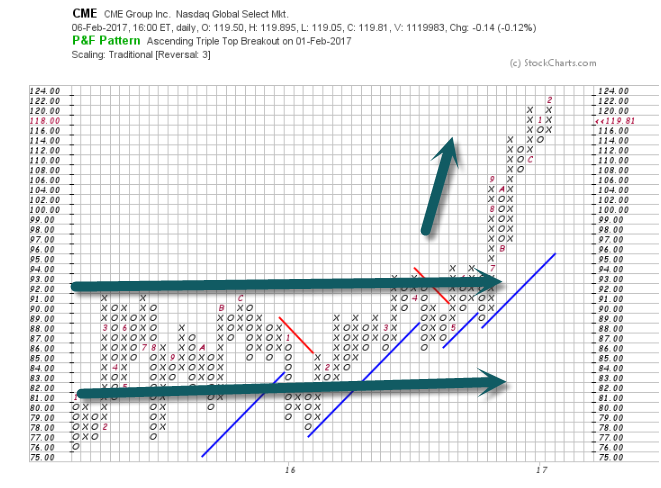

CME Group Breaks Out of a Long Sideways Channel.

CME 20% Move After Election…Trump Inflationary Policies Positive for Commodities Trading?

www.stockcharts.com

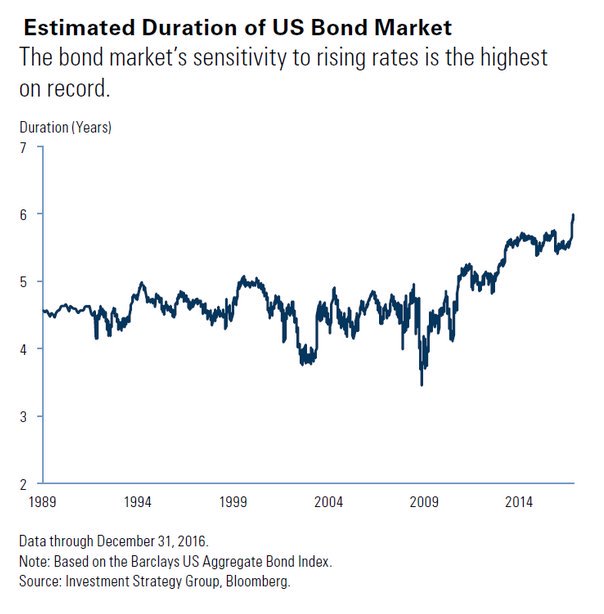

2.The Bond Market’s Sensitivity to Rates is the Highest on Record.

https://twitter.com/jessefelder

https://twitter.com/jessefelder

3.I-Shares Euro Government Bond 7-10 Year Down 10% Since U.S. Election

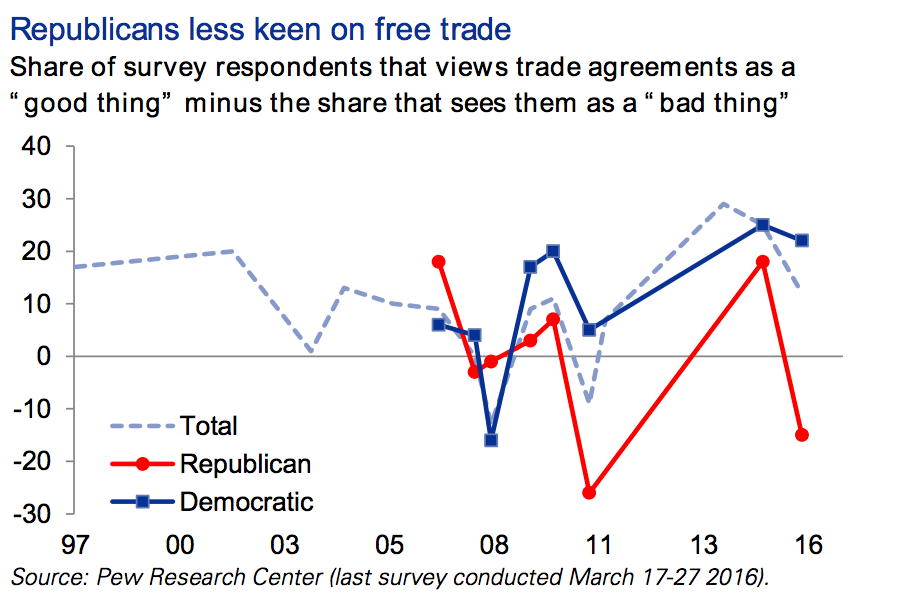

4.Free Trade is Losing Support from Republicans.

The analysts pointed to the changing political “atmosphere” on trade, which would ease opposition to anti-China protectionist measures. Republican voters are becoming more sceptical about free-trade, paving the way for tariffs.

Here is the chart:

Goldman Sachs

Despite this, the Trump administration is unlikely to go straight to blanket tariffs. “Our expectation is that near-term activity is likely to be limited to targeted actions, with blanket tariffs held out as an additional tool that might be used later,” the analysts said.

That 45% tariff plan won’t go down well among Chinese policymakers. In an interview with Goldman Sachs, Chinese trade expert Tu Xinqan, said it would start a full-blown trade-war almost instantly.

“Of course, if a 45% tariff were imposed, it would trigger a trade war. China would definitely retaliate and would likely go above and beyond the US measures, potentially imposing tariffs as high as 80- 90% on imports from the US,” he said.

From Business Insider..Read Full Article Below.

http://www.businessinsider.com/goldman-sachs-how-donald-trump-will-escalate-a-trade-war-with-china-2017-2

5.Significant Decline in Employment Growth for S&P 500 Companies.

The uptrend in wage growth observed since 2014 is slowing, not only average hourly earnings but also the Atlanta Fed wage growth measures, unit labor costs, and wages measured across the income distribution, see also the first seven charts in our attached labor market chart book. This is a puzzle given most other labor market indicators are signaling that we are at full employment. The slowdown in wage growth allows the FOMC to remain dovish and this is bullish for equities and credit spreads.

———————————————–

———————————————–

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief International Economist

Managing Director

Deutsche Bank Securities

60 Wall Street

New York, New York 10005

Tel: 212 250 2155

6.Surprising Little Link Between Strong Dollar and Manufacturing Jobs.

The Confused, Mixed-Up World of Donald Trump’s Weaker Dollar

Unfortunately for fans of plain speaking, any push for a weak currency conflicts both with history and Mr. Trump’s own policies.

Start with a seminal moment in trading history. China kept its currency artificially weak after its entry into the World Trade Organization in 2001, helping its exports. But the dollar weakened so much against other currencies over the next six years that it more than offset China’s manipulation.

For every factory job lost to China, more ought to have been won from elsewhere, if it was all about the currency. Yet, 2.1 million U.S. manufacturing jobs disappeared between December 2001 and April 2008, by when the real trade-weighted dollar had declined 24%—which was more than offset by the addition of 7 million other new jobs. The currency isn’t irrelevant, but it isn’t the most important thing that affected American factories, let alone the only thing.

Then there is Italy. If the euro has given Germany too weak a currency, it has also given struggling Italy too strong a currency. Yet the U.S. imported goods from Italy worth $26 billion more than it sold in the year to November, according to the latest figures from the U.S. Census Bureau. Germany had a surplus of $60 billion, a little more than twice Italy’s, with an economy about twice as big as Italy’s. If the euro is rigged in favor of Germany, it is rigged against Italy, but that hasn’t stopped Italy from selling a lot more to the U.S. than it buys. America’s trade gap with Germany isn’t about the euro so much as German suppression of its domestic consumption and investment.

Mr. Trump’s economic policies conflict with his words, too. The looser fiscal policy he has promised in the form of tax cuts and infrastructure spending should help growth—although how much and how quickly is debatable—while also pushing up inflation. Stronger growth and higher inflation mean higher interest rates, which in turn mean a stronger dollar.

Mr. Trump’s trade policy also helps the dollar. Verbal assaults on Mexico and the threat of tariffs pushed the peso to record lows after the election, ironically making Mexican exports more competitive. If tariffs were to be imposed on China, as Mr. Trump warned, they would deter investment in the country, weakening its currency. They would also encourage capital flight, a danger to the yuan’s value that Beijing is already struggling with.

Finally, the corporate tax plan being pushed by Republicans in Congress would give the dollar a further boost by favoring exports over imports, although Mr. Trump described the plan as “too complicated” in an interview with The Wall Street Journal last month and its fate remains unclear.

https://www.wsj.com/articles/the-confused-mixed-up-world-of-donald-trumps-weaker-dollar-1486049327?tesla=y

7.The U.S. is at Full Employment but Labor Market Participation Rate is at 30 Year Low.

The Concerning Drop In Workforce Participation

Aparna Mathur and Abby McCloskey

Aparna Mathur is an economist at the American Enterprise Institute. Abby M. McCloskey is founder of McCloskey Policy LLC.

One of the biggest challenges facing America’s economy is low workforce participation. While the latest jobs report showed the private sector adding over 150,000 jobs for seven consecutive months, the labor force participation rate keeps declining. The civilian labor force participation rate has dipped to 62.8%, the lowest level in nearly 30 years. Excluding the unemployed who are looking for work, the share of the population that is actually employed is an even lower 59.7%. Far from a temporary blip, the decline is projected to continue. A recent Federal Reserve study predicts labor force participation will drop to 61% by 2022 – a low not seen since the 1970s.

The drop in labor force participation rates concerns economists for several reasons. First, it depresses economic growth, which is already at anemic levels of 0.5%. Second, it puts pressure on the federal budget at a time when we are facing historic fiscal constraints. The less workers there are, the more the tax base shrinks. And third, any time out of the labor force impacts workers’ future earnings trajectories should they return to work, due to lost training and on-the-job experience.

While part of the decline in workforce participation is the result of an aging population and increased schooling for young adults, this is far from the full story. The employment rate of 25 to 54 year olds has also dropped since 2000. This suggests that other factors – such as low wages or work disincentives in government benefits – are also responsible.

http://www.forbes.com/sites/aparnamathur/2016/05/25/the-concerning-drop-in-workforce-participation-and-role-of-family-friendly-policies/#20042f092c44

Full Employment

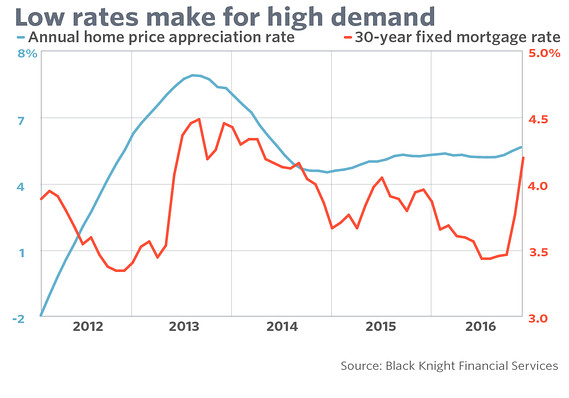

8.Rising Rates and Housing

Housing demand may keep market afloat, even if rates rise

By Andrea Riquier

Lower rates have helped bolster demand in the past, but now it may have a life of its own.

How will the housing market handle rising rates?

Ever since the November election, when the unexpected Trump victory sent bond yields flying and mortgage rates following closely behind, analysts have been preoccupied with that question. From overly cautious lending standards to extremely tight inventory, the housing market has plenty of challenges, and any additional constraint won’t help.

But new data from Black Knight Financial Services suggests that demand might be resilient enough to withstand higher borrowing costs in 2017.

The last time mortgage rates spiked was in mid-2013, when then-Fed Chairman Ben Bernanke warned markets that the central bank would shortly begin to unwind its extraordinary stimulus programs. Rates jumped a full percentage point between April and September, and mortgage applications plunged.

So did home price appreciation.

In an illiquid market like housing, it takes time for prices to respond – in this case, until August, when they were rising at an annual rate of 9%. Then appreciation fell every month for over a year until hitting bottom.

When price gains finally starting rising, in early 2015, they kept going. Lower rates helped boost demand, and that was reflected in stronger pricing, said Ben Graboske, Black Knight’s vice president of data and analytics.

It’s worth noting that there’s another factor driving prices up: extremely tight supply. Inventory of previously-owned homes fell to a 17-year low last month, and choices of both existing and new homes have been so scarce that analysts have assumed it will quench demand at some point.

But prices even spiked a bit in the last months of 2016 – even after rates surged post-election. Black Knight doesn’t have December home price data yet, and Graboske cautioned that it’s hard to predict the path of mortgage rates from here on, with so much uncertainty around policy and markets.

If rates go up enough, price appreciation could slow – and possibly even reverse, he told MarketWatch.

But there’s another big question mark hanging over the housing market: the path of regulatory reform. If there are big changes to the 2010 Dodd-Frank law, Graboske said, it could open up lending to far more Americans.

Also read: Carson aced his confirmation hearing — get ready for less government in housing

“If you really tap into that new population of potential borrowers that have been renting and paying increasing rents for years that could get really interesting,” Graboske said.

One thing is clear: there’s strong and durable demand for homes to purchase.

http://www.marketwatch.com/story/housing-demand-may-keep-market-afloat-even-if-rates-rise-2017-02-06

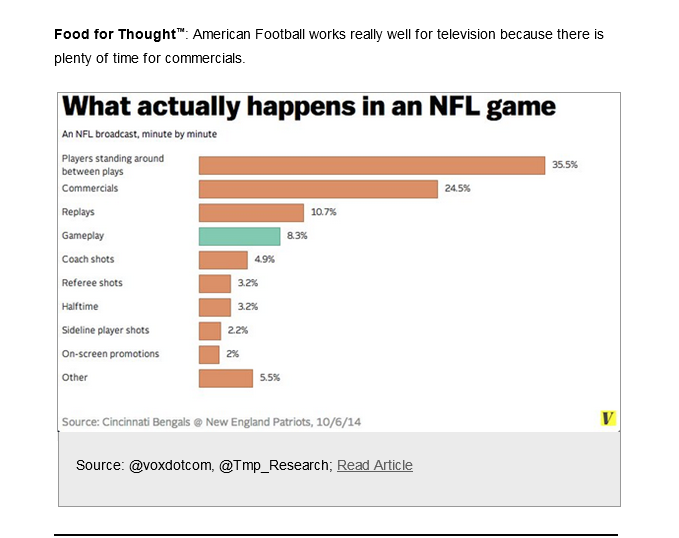

9.You are Really Seeing Football on TV About 8.3% of Time.

www.thedailyshot.com

10.The Most Common Mistakes Young People Make

I lied, stole from my parents, cheated, scammed, humiliated others and laughed, threw rocks at people with the intent to kill. All by the time I was 10 years old.

Later it got much worse. Later I actually thought I was smart.

This is the great thing about being young: you’re so arrogant and stupid and unreasonably confident that you have 100% confidence that everything you do will fit right into the picture.

A million piece jigsaw puzzle where you never pick up the wrong piece as you try to put it in the right position.

But this part is good: you have no money, so it’s really hard to blow it. And if you destroy a relationship, then good for you — you were too young anyway.

This I can say from my experience. I proposed to a girl when I was 19. Then when I was 21, 22, 23, and 24. All to different women.

And they all said yes. That’s how stupid we all were then. It was like the convention of stupid. StupaCon.

Fortunately we were all so stupid and broke that nothing ever happened.

Here’s the truth: you can’t fail as a kid. I sometimes get messages like, “I’m 23 and I failed and now I don’t know what to do.”

A) No, you didn’t fail.

B) Yes, you do know what to do.

Just do the next thing. That’s all you have to do. Regret of the past or anxiety of the future are the thieves of the present.

And don’t do “failure pornography.” You don’t get to succeed now because you failed. You’re not Luke Skywalker.

You get to succeed because if you do enough bad things in a row with the intention of doing a good thing, then eventually you get lucky and a good thing happens.

You don’t meet the love of your life until you’re lonely and looking. You don’t invent “hand washing” until you realize that people are dying in hospitals when doctors don’t wash their hands.

You don’t get to be a brilliant musician until you’ve spent many hours being a bad one and trying to improve.

Every good creation in history was the child of really ugly parents.

So don’t do failure porn. And don’t say you don’t know what to do.

Do the next thing. And the next thing might simply be “improve the old thing.”

Oh, and don’t make any of the mistakes in the attached infographic.

I wish I had this graphic when I was 18. I wish my kids would listen to this infographic.

Kids, if you ever listen to your father: print out this infographic, make it poster-size, hang it on your wall, and look at it every day. And say, “I love you, Daddy.”

I can say that because I know you won’t listen. How come?

Because you’re going to do many bad, stupid things and then, just by luck, good things will start to happen.

I hope so. I hope they will. If they don’t, then just do the next thing with hope and verve and that same zest you had before the arrogance was beaten out of you.

Oh. Don’t die though. Let me die first. I deserve at least that.

Tell me a mistake or two you made before age 25. Help my kids and others learn from you.

www.earlytorise.com