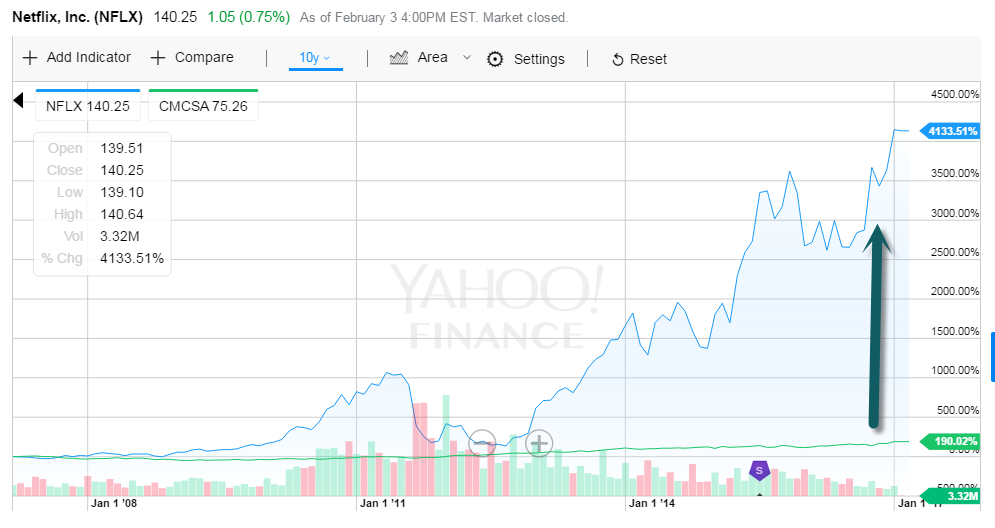

1.HYG High Yield ETF +13.5% in Last Year…1500 Basis Points Over AGG

Chart Shows High Yield vs. AGG Total Bond Index

HYG +13% vs. AGG (Barclays Aggregate Bond) -1.20

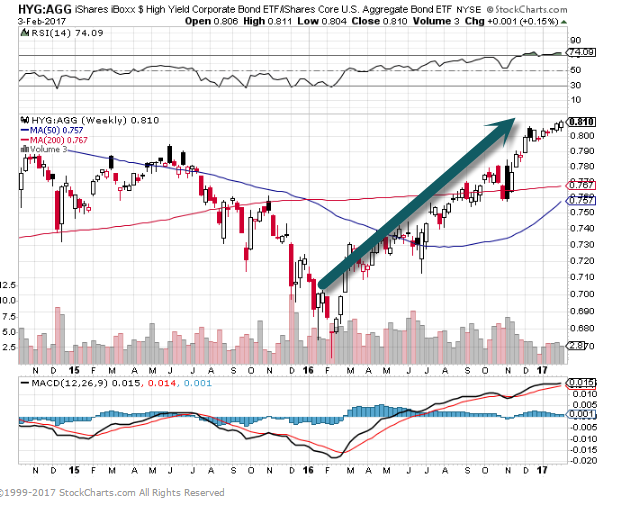

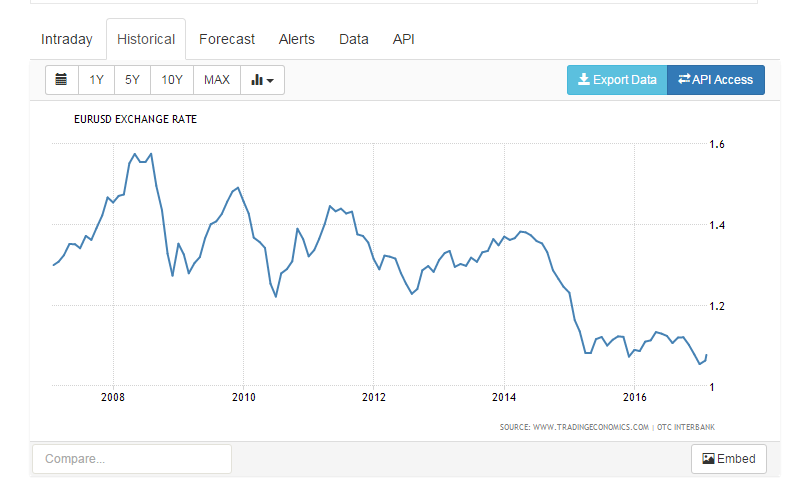

2.Netflix+4100% vs. Comcast +130%…NFLX Trades at 134x Earnings vs. Comcast 10x Earnings.

Here’s how it looks when we chart each company’s U.S. subscriber base over the past few years. No surprises here: we’ve long seen that pay TV subscriber bases are staying pretty static (and sometimes falling), and Netflix’s growth is a matter of record.

https://cordcutting.com/netflix-has-twice-as-many-u-s-subscribers-as-comcast/

3.Post Trump Election….RSX Russian ETF up 3x U.S.

This is Russia vs U.S. Post Election

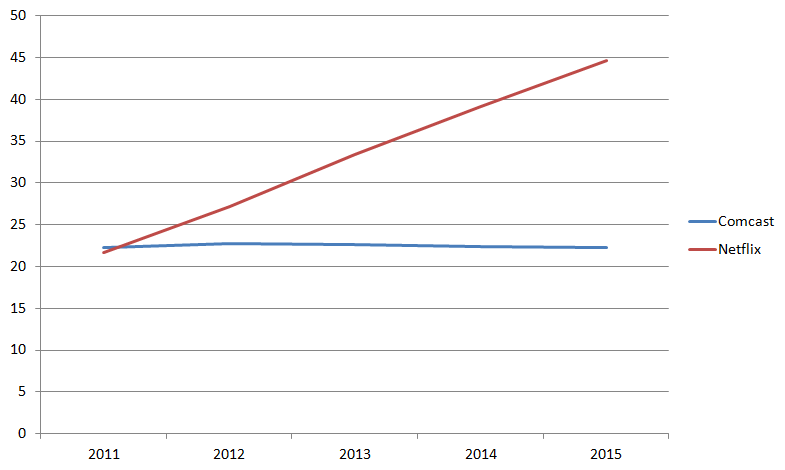

4.Dollar has Rallied 40% Since 2008 Bottom…..

IN 2008, WHEN THE FED slashed rates and the dollar plummeted, we argued that the dollar’s requiem was premature (see “The Dollar Looks Ready to Rally,” April 28, 2008). The dollar index has since rallied about 40%. Today, however, the herd has migrated firmly over to the bullish camp. But while news coming out of Europe is getting increasingly shrill, what with Brexit, flailing Italian banks, and 2017 elections that could test the euro zone’s cohesion, each euro is still worth about $1.08, no worse than an early-2015 low near $1.05, and a sign the market may have priced in the euro’s dour outlook.

Expect the dollar to be volatile in the short term, especially with Trump unveiling his budget on Monday, and Janet Yellen testifying to Congress in mid-February and deliberating on rates in mid-March. Lindahl, for one, thinks the dollar’s long bullish cycle is turning and the euro could rise around 50% over the next three years—an admittedly aggressive projection. Gave also questions the assumption that the dollar will melt up this year. “In fact, unless U.S. growth massively surprises to the upside, the dollar will finish lower in 2017,” he says.

Read Full Story at Barrons.

http://www.barrons.com/articles/why-the-dollar-is-likely-to-fall-this-year-1486189556

Euro to U.S. Dollar Exchange Rate 10yr.

http://www.tradingeconomics.com/euro-area/currency

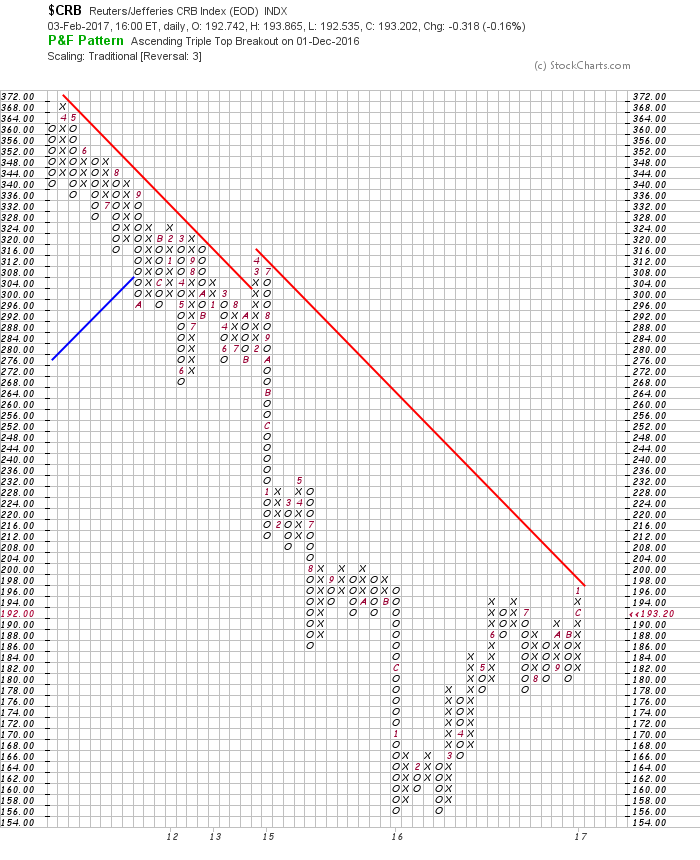

5.CRB Commodities Index is Closing in on Downtrend Line Going back to 2008 Crisis.

See Red Downtrend Line

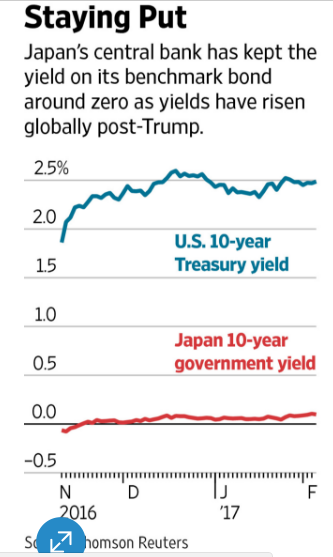

6.Bank of Japan Snaps into Action on Early Rate Move.

TOKYO—Japan’s central bank boosted its government-bond purchases by more than $6 billion on Friday, sending a message to investors that it wants to buck a global tide of rising rates.

The move was prompted by an unusually sharp bond selloff—which took the yield on the benchmark 10-year government bond to a year high of 0.150% from 0.110% within the space of minutes—after an earlier bond purchase by the Bank of Japan was unexpectedly small. That made investors question the bank’s ability to cap the yield at around zero, as it has said it would.

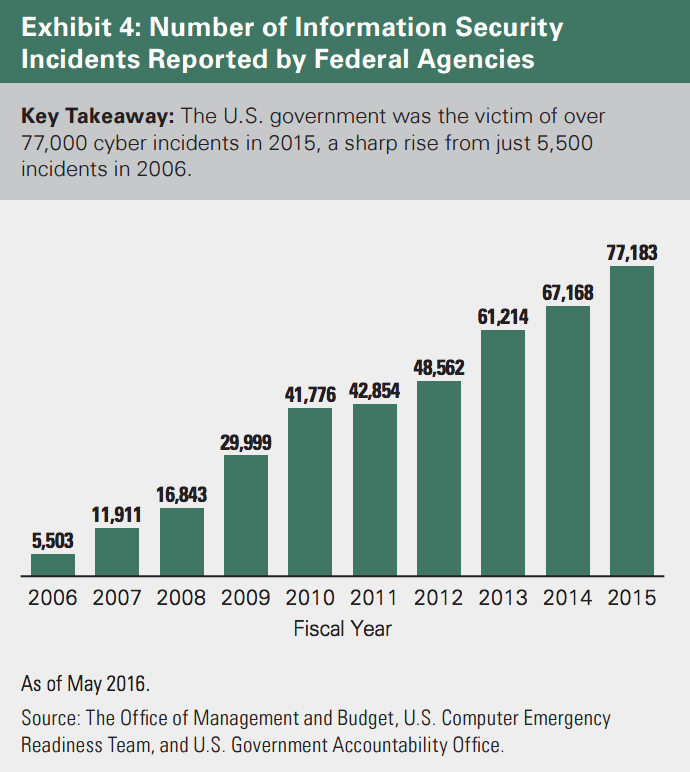

7.The U.S. Government is Under Cyber Attack.

Source: Bessemer Trust

From Barry Ritholtz Big Picture Blog

http://ritholtz.com/2017/02/weekend-reads-257/

8.Services Driving Inflation…Plus Wage Pressure?

9.Read of the Day…..Americans Moving Less.

America the Stuck

The Census reports that a record-low share of Americans are moving. A recent paper

Our ability to move to opportunity—our mobility—is a key factor in our own and our nation’s economic success. But the mobility of Americans has reached record lows, according the latest data from the U.S. Census.

Just slightly more than one in ten Americans (11.2 percent) moved between 2015 and 2016, almost half the 20.2 percent rate back in 1948, when the Census began tracking American mobility. Mobility was once the cornerstone of the American Dream, but today Americans move less often than Canadians, and only a bit more than Finns or Danes.

Both longer and shorter moves have declined over this period. Just 6.9 percent of Americans made shorter moves within the same county, down from 13.6 percent in 1948. The mobility rate for these types of moves plummeted between 1998 and 2008 (with the economic crisis) as the chart below shows, and has declined more slowly ever since.

Longer moves between counties declined from 6.4 percent in 1948 to just 3.9 percent today over the same period.

Why are Americans moving less?

What made this once-restless nation of dreamers and searchers so immobile? There are several reasons.

Our “house passion,” to quote economist Edmund Phelps, is one. Especially in the wake of economic crisis like 2008, people got locked in their homes, unable to sell them and move to economic opportunity.

But that’s not the whole story: The moving slump has also affected renters. Their mobility rate has also declined over the last 30 or so years.

Also, America’s job opportunities have converged in many places, meaning for many Americans it is less likely they will have to move for a job.

But, according to Yale Law Professor David Schleicher, government policy plays a bigger role in American’s declining mobility than we think. In his new study, “Stuck In Place: Law and the Economic Consequences of Residential Stability,” Schleicher identifies several types of policies that limit Americans’ mobility and hold back the economy.

Homeownership subsidies

The first set of policies are the tremendous subsidies the federal government confers to homeowners through the mortgage tax credit—a direct subsidy of roughly $200 billion a year. And it could run as high as $600 billion when indirect costs are taken into account.

As the Census report shows, homeowners are less likely to move than renters, and that has remained the case over the past several decades. Just 5 percent of homeowners moved in 2016, down from 9.5 percent in 1988. The share of renters who moved in 2016 was more than four times higher: 22.9 percent.

Schleicher argues it is high time that the government abandon this subsidy, which not only sacrifices needed tax revenues but inhibits American’s mobility and harms the economy more broadly, something other economists and I have long argued for.

Too many land use restrictions

Zoning laws, construction caps, and subdivision regulations limit the supply of housing in the most innovative and productive cities, ultimately driving up prices and making it unaffordable for people to move there.

The economists Chang-Tai Hsieh of University of Chicago and Enrico Moretti of the University of California at Berkeley estimate that these restrictions have cost the U.S. economy between $1.6 trillion and $2 trillion in lost productivity and output. These cities and metros are also the best opportunities for low-income families and their children to move up the economic ladder.

Schleicher joins a growing chorus of economists who argue it’s time to eliminate these restrictions that generate such large-scale costs for the economy and make large numbers of families worse.

A boom in occupational licensing

Occupational licensing is the third set of policies that restrict the ability of Americans to move. Lawyers, doctors, and a whole host of other professions are licensed at the state level. Schleicher points out that the share of the workforce that falls under some sort of licensing requirement has risen from 5 percent in the 1950s to almost 25 percent in 2008. Such licensing requirements make it hard for people in those professions to move from place to place, where wages are higher or where their services are more needed.

There are other occupational restrictions that limit the ability of workers to move. Public school teachers, for example, build up seniority in their home districts that does not transfer when they move. The differences between eligibility standards for public benefits and location-based subsidies discourage people from moving from one place to another. Place-specific benefits like pensions are another type of policy that discourages residents from packing up.

Lastly, policies like municipal bankruptcy limit the ability for cities to “shrink” gracefully. Schleicher argues that as a failing city’s private-sector workers leave, the needs of a city—to provide for recipients of public services, public sector workers, and pensioners—do not necessarily reduce their size. This mismatch leads a city to become insolvent, and the federal government has to respond by providing a bailout to a city that’s losing residents. This means more people that would have left actually stay in that economically failing city.

Why mobility matters

I’ve long made the point that residential mobility matters both to the economic prospects of individuals and the economic dynamism of our cities and nation as a whole. In my book Who’s Your City?, I argued that our ability to move was dividing Americans into three classes: the mobile, who derive the benefits of economic dynamism; the stuck, who are trapped in place and unable to move; and the rooted, who are strongly embedded in their communities and choose not to.

Schleicher opens our eyes to the very real policies that contribute to our declining mobility. Some argue that these policies have other benefits—that homeownership promotes retirement saving and community cohesion, or that occupational licensing protects certain professions. These mobility barriers are only likely to grow under a Trump administration, which has made elevating the status of declining industrial regions and their workers one of its policy priorities.

But Schleicher would counter the costs to individuals’ upward mobility and the dynamism and productivity of the economy writ large far outweigh these benefits. It’s time that federal, state and local governments eliminate these distortions and level the playing field and help encourage the mobility that lies at the heart of the American Dream.

http://www.citylab.com/housing/2017/02/american-mobility-has-declined/514310/

Found at www.abnormalreturns.com

10.Is Self-doubt Holding You Back?

Interview with Louisa Jewell

Posted Feb 05, 2017

When it comes to your work, are you sitting on a great idea? Perhaps it’s a question you think the business should be asking, or a new product or service your customers would love, or even a better way for you all to be working. So what’s stopping you from speaking up?

Let’s face it, due to the increasingly competitive nature of business today, most organizations are looking for ways to encourage their people to be more innovative at work. But even though your company might be encouraging you all to ‘fail fast, fail often’, the truth is that for many people their feelings of self-doubt and their fear of getting things wrong continues to undermine their ability to turn their thoughts into action.

So how can you develop the confidence to be truly innovative at work?

“Having the kind of confidence that gives you the courage to act in the moment when you have a great idea is really important for innovation,” explains Louisa Jewell a leading speaker and author on confidence and wellbeing, when I interviewed her recently. “It’s about overcoming your self-doubts by teaching your brain to say ‘yes’, even when it’s screaming ‘no’ at full force.”

Of course sometimes your brain may be saying ‘no’ to let you know that you’re not quite ready. In this case self-doubt can motivate you to ask more questions and fine tune your approach before you start sharing.

But when you find yourself constantly questioning your ideas, it’s likely that chronic self-doubt is undermining your ability to take action. After all your brain has discovered that failure hurts, with researchers finding that because you’re wired for social connectedness and belonging, the emotional pain from experiencing a social putdown or embarrassment can feel as real as any physical pain does.

So how can you teach your brain to say ‘yes’ when self-doubt and the fear of failure is actually holding you back?

Louisa suggests three ways to develop genuine confidence at work:

- Build your problem-solving muscles– while it can be tempting to take huge leaps to reach a goal faster, it can also set you up to fail and dampen your enthusiasm for future actions. Instead taking baby steps that help you to try new approaches and build your problem-solving muscles over time through incremental successes.

What’s the smallest action you could take today to help solve a problem your workplace is facing?

- Get comfortable with failure– practice a growth mindset by teaching your brain that failure is simply part of the learning process and nothing to feel ashamed or embarrassed about. We’re all failing some of the time, the only question is whether we’re growing from these mistakes or busy sweeping them under the rug or blaming others. Own your failures. Talk about what you’ve learned from the experience. Think about what you’ll do differently next time. Celebrate the fact that you were brave enough and confident to try something different.

How do you share and grow from your failures at work?

- Rally the support of others– overcome your chronic self-doubts by having people around you who can offer you encouragement, support, guidance and feedback. Let your work colleagues know that you are trying something new and you need their encouragement and support. Louisa suggests that if people understand what you’re trying to do, why you’re doing it, and that you may need their help, they are more likely to be considerate and empathetic if it doesn’t work out the way you had hoped.

Who in your workplace could provide you with guidance and feedback to make learning less lonely and painful?

For more ideas on improving your confidence at work visit www.positivematters.com and grab Louisa’s new book on teaching your brain to say ‘Yes’ in May 2017.

https://www.psychologytoday.com/blog/functioning-flourishing/201702/is-self-doubt-holding-you-back