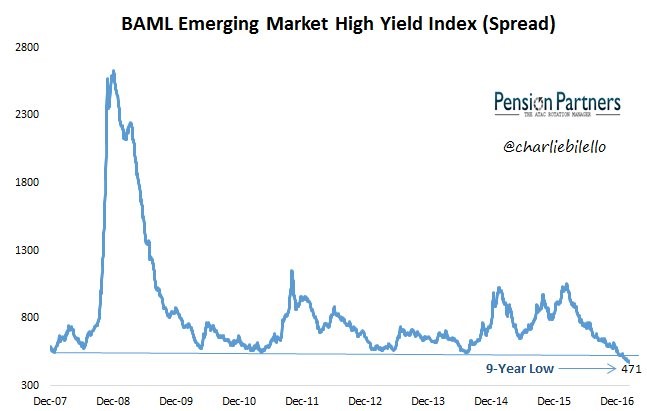

1. 9-year low in emerging market high yield credit spreads.

Yield Spread and Risk

Typically, the higher risk a bond or asset class carries, the higher its yield spread. When an investment is viewed as low-risk, investors do not require a large yield for tying up their cash. However, if an investment is viewed as higher risk, investors demand adequate compensation through a higher yield spread in exchange for taking on the risk of their principal declining. For example, a bond issued by a large, financially healthy company typically trades at a relatively low spread in relation to U.S. Treasuries. In contrast, a bond issued by a smaller company with weaker financial strength typically trades at a higher spread relative to Treasuries. For this reason, bonds in emerging markets and developed markets, as well as similar securities with different maturities, typically trade at significantly different yields.

Read more: Yield Spread Definition | Investopedia http://www.investopedia.com/terms/y/yieldspread.asp#ixzz4YeksCSSR

Found on abnormal returns hot links

2.Small Cap Volatility Sideways for One Year

S&P Long Streak without a 1% Move…Small Cap has Moved +/- 1% 3 times in Feb.

When we look at the intraday action (so, measuring the movement between intraday high and low prices), the SPX has not moved more than +/- 1% since December 14, 2016. So, what do all these streaks mean for us and how do we use them? Well for starters, we get the idea that Large Caps have experienced dampened volatility for some time now. Meanwhile, to put this in perspective, Small Caps, as defined by the Russell 2000 Index RUT, haven’t been as quiet. On multiple occasions on a close to close basis, the RUT has moved more than +/- 1%, and on an intraday basis, RUT has moved more than +/- 1% three times just within the month of February (thru 2/8/17)

From Dorsey Wright

https://oxlive.dorseywright.com/research/bigwire/2017/02/10/02-10-2017

Russell 2000 Volatility Sideways After Jan. 2016 Correction

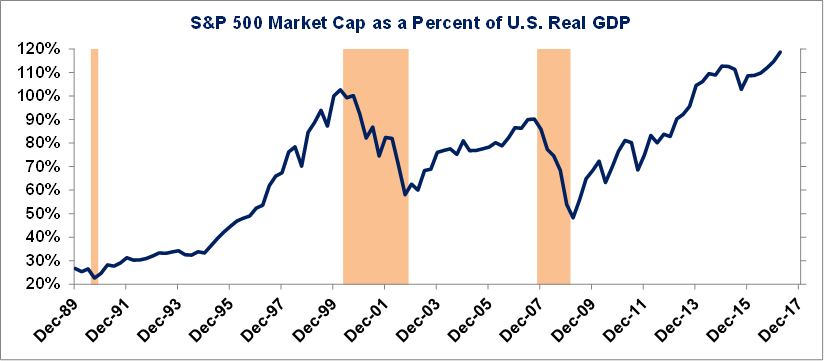

3.S&P Market Cap as a Percentage of GDP is Highest on Record.

Sam Stovall, chief investment strategist at CFRA Research

For now, one consideration is how the market’s current valuation stacks up against U.S. gross domestic product. Stovall says that the U.S. stock market valuation as a share of GDP is at its highest level since the data series began in 1989 (see chart below).

http://www.marketwatch.com/story/trumps-phenomenal-stock-market-rally-is-annihilating-bears-2017-02-13

4.Retail Investors Still not Showing Confidence in the Rally.

Interesting Trends in Yale Investor Confidence Surveys

Feb 13, 2017

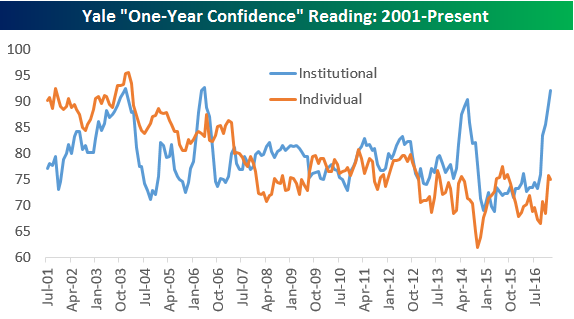

Two of the most widely followed stock market sentiment indicators come from Investors Intelligence and the American Association of Individual Investors. The Yale “Stock Market Confidence” indices are much lesser known, but they provide key insights into investor sentiment trends nonetheless.

The Yale School of Management has been surveying both individual and institutional investors for nearly two decades now, and below we provide historical charts that track the four survey questions they ask investors each month.

The first survey highlighted below is Yale’s “one-year confidence” reading which asks investors if they think the stock market will be up one year from now. As shown, for institutional investors this reading had been trending lower for years now, but we’ve recently seen a massive spike in expectations. At the same time, sentiment on the part of individuals has only seen a minor pickup. In this regards, it appears that institutional investors have turned significantly more bullish since the election, while individual investors simply aren’t sold.

Start a 14-day free trial to see more of our investor sentiment research.

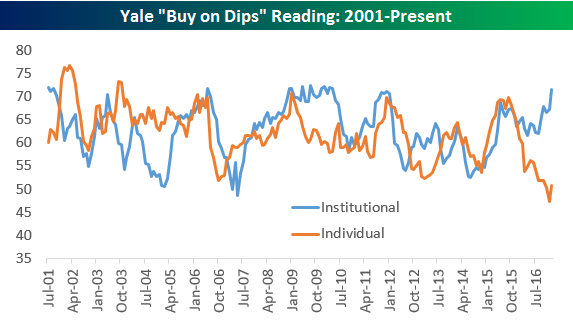

The second survey question asks investors how confident they are that the market will rise the day after a sharp fall. Yale calls it the “Buy on Dips” measure. Similar to the “One-Year Confidence” reading, we’ve seen a big divergence between institutional and individual investors for the “Buy on Dips” measure. Institutional investors have gotten very confident to buy on dips, while the reading for individual investors just recently hit new lows.

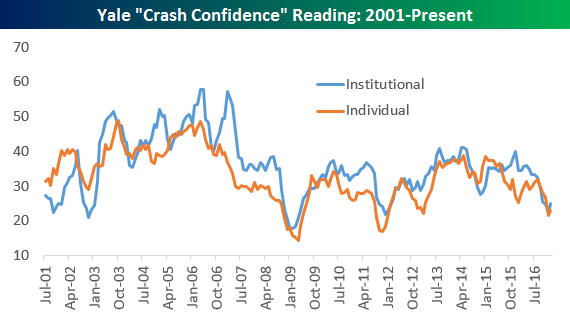

The third survey question asks investors how confident investors are that there will not be a stock market crash in the next six months. For this reading, the lower the number, the more concerned investors are about a crash, and vice versa. Interestingly, both individual and institutional investors have become less confident that there won’t be a stock market crash in the coming months. It’s not surprising to see the reading where it is for individual investors, but it is surprising to see that institutional investors are just as concerned about a stock market crash even though they’re much more bullish on the stock market based on the readings above.

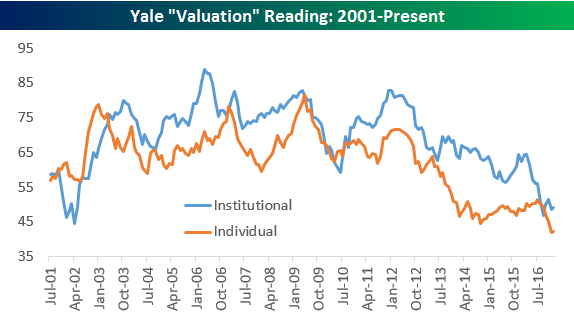

The final question asks investors how confident they are in the valuation of the market. Here, low readings mean investors don’t think the market is attractively valued, and vice versa for high readings.

As shown below, both individual and institutional investors have become less and less confident in the valuation of the market over the years, and the reading keeps hitting new lows for individual investors. The reading for institutional investors is extremely low as well.

Based on all four readings, individual investors seem less than enthusiastic about stocks, even after the election. For institutional investors, they’re bullish on the market, but at the same time, they don’t think it’s attractively valued and they’re relatively concerned about a crash. To us, it seems like institutional investors are basing their bullishness on hope.

5.The U.S. is at Full Employment….Job Opening Exceeding Hires.

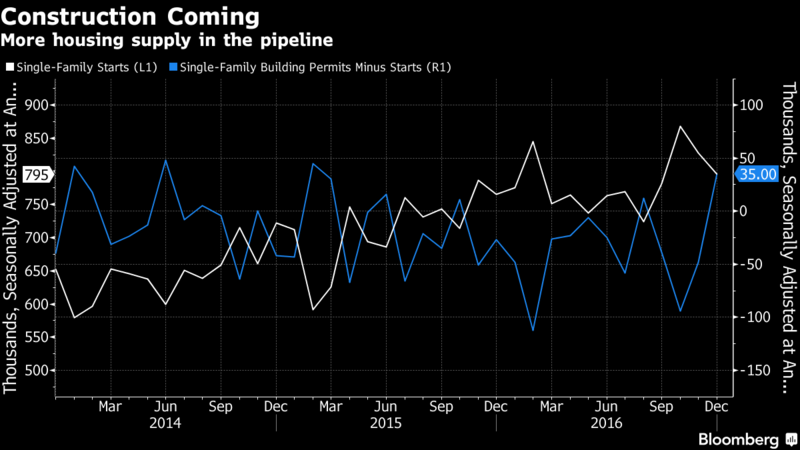

6.Housing…Permits Running Ahead of Starts….Months Supply for Sale at Historical Lows.

6.Housing…Permits Running Ahead of Starts….Months Supply for Sale at Historical Lows.

Constructive Housing

A pick-up in housing activity is poised to buoy the U.S. expansion in the coming months, given the extent to which starts have trailed permits.

“The last time permits ran this far ahead of starts, back in February 2015, single-family starts went on to grow by 140,000 units over the next six months with residential investment growing at a solid clip,” Dutta noted.

https://www.bloomberg.com/news/articles/2017-02-06/here-comes-the-economic-growth-that-confidence-data-s-predicting

https://www.bloomberg.com/news/articles/2017-02-06/here-comes-the-economic-growth-that-confidence-data-s-predicting

http://www.barrons.com/articles/u-s-homeownership-rate-hit-the-skids-post-recession-1486792467

http://www.barrons.com/articles/u-s-homeownership-rate-hit-the-skids-post-recession-1486792467

https://fred.stlouisfed.org/series/MSACSR

https://fred.stlouisfed.org/series/MSACSR

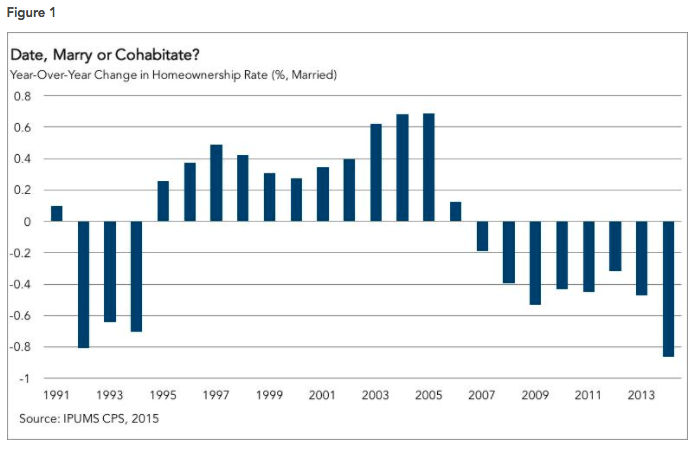

7.Marriage, Children and Housing.

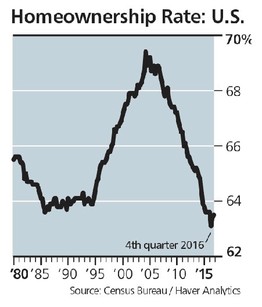

Here’s why homeownership is plunging in the US

· Mark Fleming, First American Financial Corporation

According to analysis in our Homeownership Progress Index (HPRI), the homeownership rate is 30 percent higher among married couples than other households. If married households are more likely to be homeowners, and marital rates are falling, how much of the decline in homeownership is due to the changing attitudes toward marriage, our proxy for love?

Figure 1 shows the correlation between the change in the homeownership rate and the change in the rate of marriage, when all other lifestyle and demographic factors are held equal [1]. Because the marriage rate was increasing between 1995 and 2005 as Generation X got hitched, marriage was a net contributor to the growing overall homeownership rate, but from 2005 to 2014 the declining marriage rate alone has reduced the homeownership rate by 3.5 percentage points.

First American

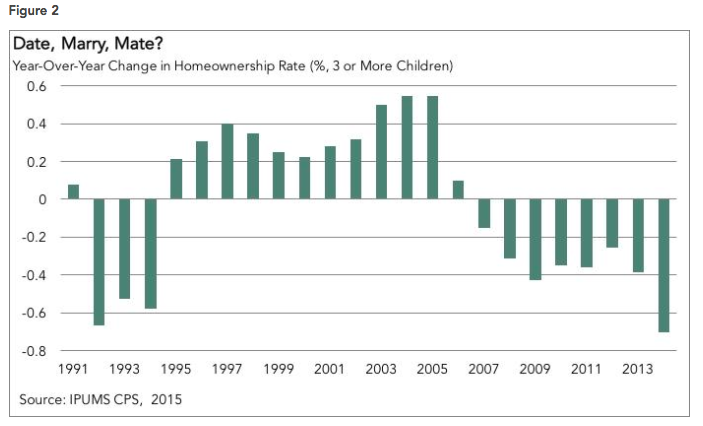

In our analysis, we find that just as the decision to marry influences the decision to own, so does the decision to have children. As one might suspect, the more children in a household, the more likely the household will decide to own versus rent. The homeownership rate is 1.7 percent higher for households with one or two children compared to households with no children, it is 5.4 percent higher for households with three or more children.

First American

Figure 2 shows, all other factors being equal, the change in the homeownership rate over time when correlated with the change in the number of households with three or more children. Similar to the influence of marriage on homeownership, as the number of households with three or more children increased from 1995 to 2006, the homeownership rate also increased. Since then, the declining number of households with children has driven the homeownership rate down. In fact, from 2006 to 2014 the homeownership rate declined 2.9 percent due to the decline in the number of households with three or more children.

Read Full Story at Business Insider

http://www.businessinsider.com/why-homeownership-is-plunging-in-the-us-2017-2

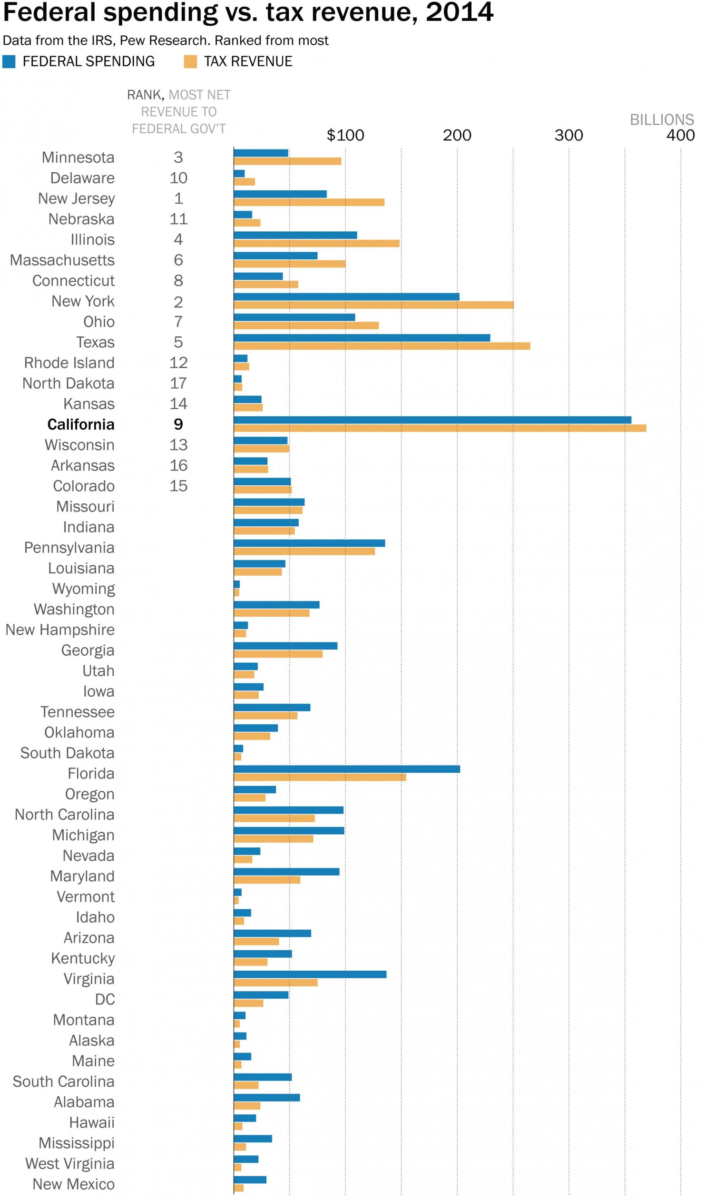

8.Federal Spending vs. Tax Revenue.

From Barry Ritholtz Blog

http://ritholtz.com/wp-content/uploads/2017/02/spendingvtax.png

9.Countries with the Most Immigrant Inventors….U.S. Dominates.

10.The 4 Primary Principles of Communication

Tune in to these elements to dramatically improve your communication skills.

Posted Feb 13, 2017

Effective communication is a connection between people that allows for the exchange of thoughts, feelings, and ideas, and leads to mutual understanding. This exchange is evidenced when a speaker sends a message to which a listener responds. It seems simple, but it isn’t.

People tend to take the communication process for granted. We generally figure that the communication between two or more people is no big deal. It just works. However, the reality is very different—the process of communication is actually impressively complex.

There are many factors that ultimately determine whether a particular communication experience is likely to be successful or not. There are internal factors that affect each person participating in the communication process individually, interactional factors that affect how information is sent and received between two or more people, and external factors that affect the extent to which the physical environment is conducive to effective communication.

There are also certain principles inherent in the communication process, as well as skills people can learn and practice. When people are aware of these principles and apply this information, they significantly decrease the likelihood of misunderstanding and conflict and increase the chances of successful and skillful communication.

There are four primary principles of communication:

1. The message sent is not necessarily the message received.

2. It is impossible to not communicate.

3. Every message has both content and feeling.

4. Nonverbal cues are more believable than verbal cues.

The message sent is not necessarily the message received.

We often assume that just because we said something (or thought or intended something) that, when another person doesn’t understand what we mean, it’s their fault. After all, the person who sends the message knows exactly what he or she meant. However, what the person on the receiving end of the message hears and understands may be quite different. In contrast to being anyone’s “fault,” this is simply one of the ways the communication process can go off track.

The message sent may not be the message received because it must pass through a filtering system of thoughts and feelings—for both the sender and the receiver. As a result, when an adult comes home frustrated or angry about his or her workday, he or she may communicate anger or impatience to his or her partner or children, even though that isn’t his or her intent. The message must also pass through the listener’s own filter of thoughts and feelings. If a partner or child expects the sender of the message to be angry or impatient, he or she may hear neutral or even positive statements as harsh or angry.

article continues after advertisement

There is considerable room for misunderstanding between what the speaker intends to say, what he or she actually says, and what the listener hears. The less conscious attention the speaker and/or the listener is paying (the more distracted they are by internal or external stimuli) when the message is sent and the more emotionally charged the subject is, the more likely it is that there will be a disconnect between what the speaker intends to say, what he or she actually says, and what the listener hears.

The only way to be certain that the message you send is the same one the other person receives is through the process of feedback. This is more critical when what your communication is of special importance or you sense from the other person’s reaction—whether verbal or nonverbal—that he or she is unclear.

Checking out the accuracy of your communication involves literally asking what the other person heard you say. If what he or she reports hearing does not match up with what you intended, you can then clarify your message by sharing—specifically—what it was you intended to say. Then you can again ask for feedback, checking out what he or she heard this time. This process may seem cumbersome, but it results in more clear and accurate communication. Sometimes this process may go through two or three rounds to ensure the speaker and listener are on the same page. The more matter-of-fact this process is the more successful it will be.

It is impossible to not communicate.

All actions—both intentional and unintentional—communicate certain messages. For example, deliberately ignoring someone is not “not communicating.” Quite the contrary (as you know if you’ve been on the receiving end), this action sends a strong message. Moreover, verbal communication (the words used) is only one part of the larger communication process that includes body language, facial expression, tone of voice, and voice volume.

article continues after advertisement

Every message has both content and feeling.

Every message consists of content and feeling. The content is what the message is about based on the words used. The feeling connected to the content is expressed through nonverbal cues—body language/gestures, facial expression, tone of voice/inflection, and voice volume.

Whenever there are discrepancies between a message’s content and feeling, confusion is created for the listener—especially if the content and feeling seem to contradict each other. A classic example of this is when one person tells another “I’m not mad at you” (the content) in a loud angry voice (the tone of voice/feeling). Such communication cannot help but result in a certain degree of confusion.

Electronic communication—via email, text, and other forms of instant messaging—can be so challenging and easily misinterpreted precisely because the words used are isolated from any and all of the nonverbal cues that provide essential information and clarification.

Nonverbal cues are more believable than verbal cues.

Whenever there is a discrepancy between the content (verbal) and feeling (nonverbal) of a message, the person on the receiving end will almost always give more weight to the feeling. In other words, if the words a speaker uses don’t match up with his or her tone of voice, facial expression, body language, and other nonverbal cues, the listener will pay more attention to and believe the nonverbal behavior.

Consider how you react when someone gives you what sounds like a compliment: “You look great”, but with a tone of voice that you perceive as sarcastic. Are you more likely to believe the verbal (words used/content) or the nonverbal (tone of voice/feeling)?

These four qualities of the communication process are universal—whether the topic is the post-election political economy, Valentine’s Day planning, or simple sharing of the events of one’s day with others. Paying conscious attention to these four aspects of the communication process—regardless of whether you are on the sending or receiving end—will improve the quality of your communication by making it more skillful, effective, and successful.

Copyright 2017 Dan Mager, MSW

Author of Some Assembly Required: A Balanced Approach to Recovery from Addictionand Chronic Pain and Discover Recovery: A Comprehensive Addiction Recovery Workbook (available April, 2017).

https://www.psychologytoday.com/blog/some-assembly-required/201702/the-4-primary-principles-communication