1.Big Rotation Last Week….Tech -2.32% vs. Energy +2.70%

XLK Tech ETF vs. XLE Energy ETF

click here for source: http://finance.yahoo.com

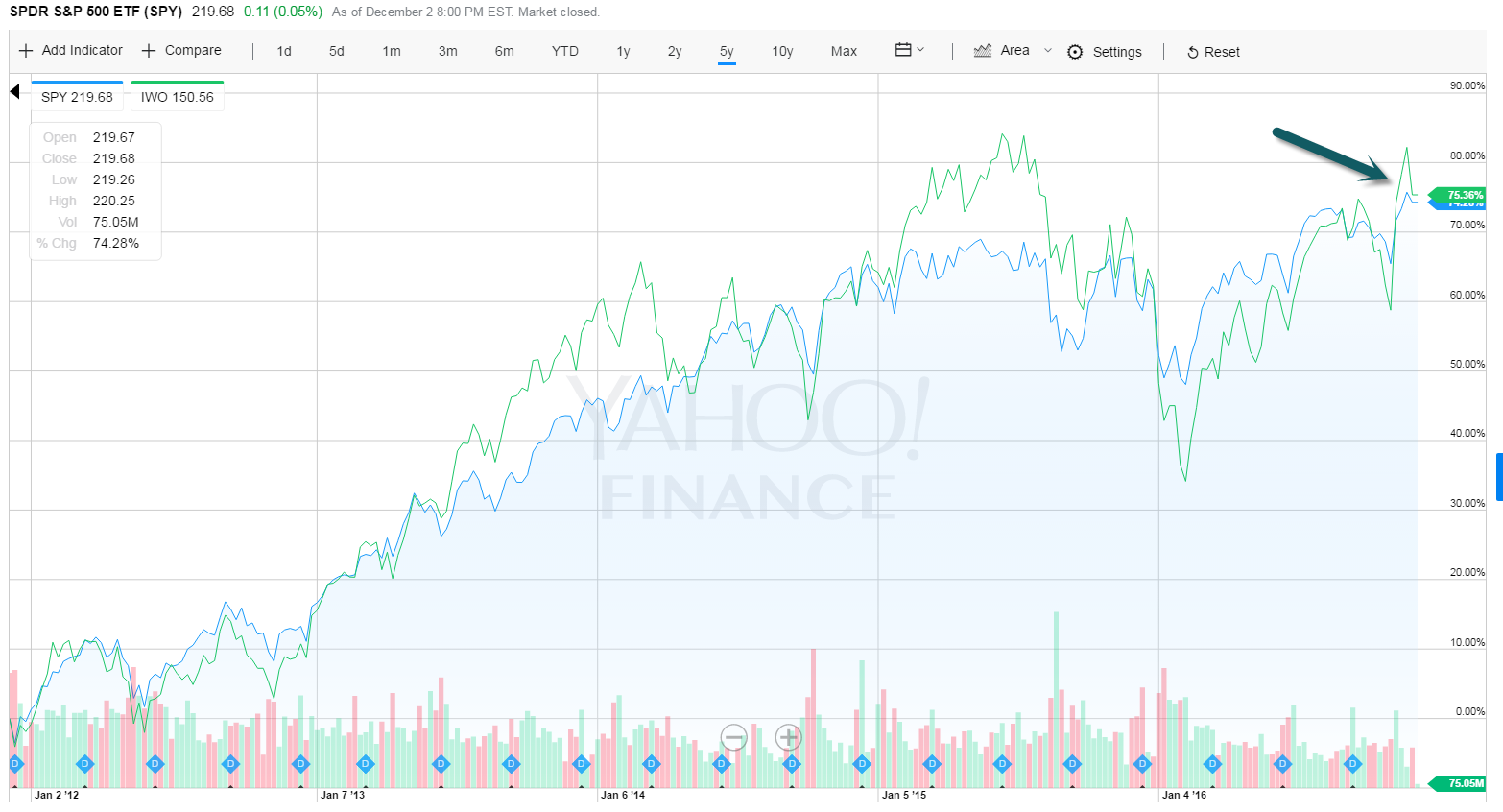

2.Small Cap Run Up…..Small Stocks Still Trailing S&P on 3 Year Basis.

According to Nili Gilbert and Stuart Kaye, portfolio managers at Matarin Capital Management in Stamford, Conn., small stocks are trading at 10.8 times the cash that their underlying businesses generate from operations, or slightly above their average since 1994. Big companies are valued even more richly, at 11.7 times their operating cash flow, also higher than their average over the past two decades.

The gap between those ratios is barely wider than normal, suggesting that small stocks remain relatively cheap even after their explosive rise in November, Ms. Gilbert and Mr. Kaye say.

Furthermore, small stocks badly lagged behind their larger brethren in 2014 and 2015. So, even after their torrid performance in November, the returns on both the Russell 2000 and the S&P SmallCap 600 indexes still trail the giants of the S&P 500 over the past three years.

http://www.wsj.com/articles/the-reasons-to-like-small-stocks-1480744512

5 Year Comparison S&P vs. IWO (small cap)…Almost Even for 5 Year Period.

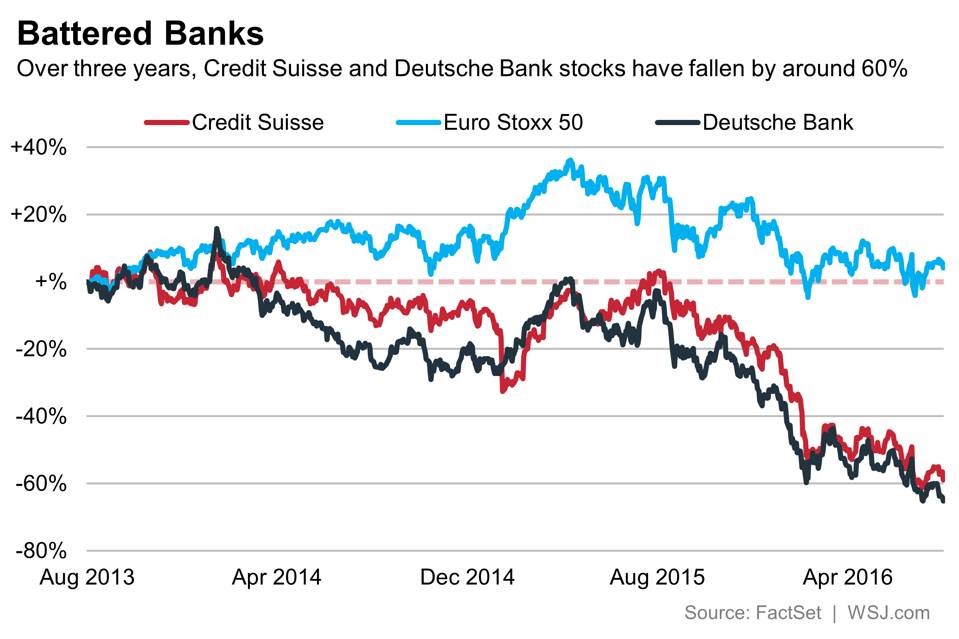

3.Sector to Watch Today….Europe Stoxx 600 Banks ….Most Trading Well Below Book Value

Italian PM Matteo Renzi’s referendum defeat on Sunday has left Italy facing political and economic uncertainty.

Mr Renzi announced he was stepping down after his constitution reform plan was rejected by voters.

He met President Sergio Mattarella and will offer him his resignation later. Mr Mattarella must decide whether to appoint a new PM or hold elections.

There are concerns the instability may trigger a deeper crisis for Italy’s already vulnerable banking sector.

A consortium organizing a possible bailout for one leading bank, Banca Monte dei Paschi di Siena, is meeting on Monday to consider whether to pursue the rescue bid.

http://www.bbc.com/news/world-europe-38204189

The bank subsector of the Stoxx Europe 600 index is down 19% year to date, and even some of the Continent’s perceived stronger institutions are trading well below tangible book value, the preferred measure for assessing their worth.

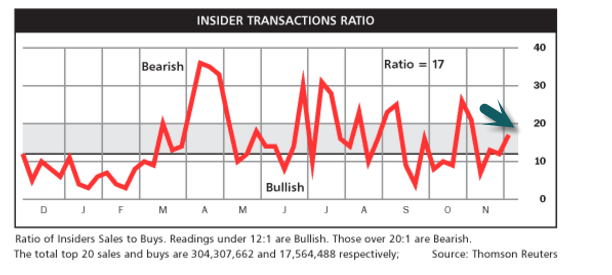

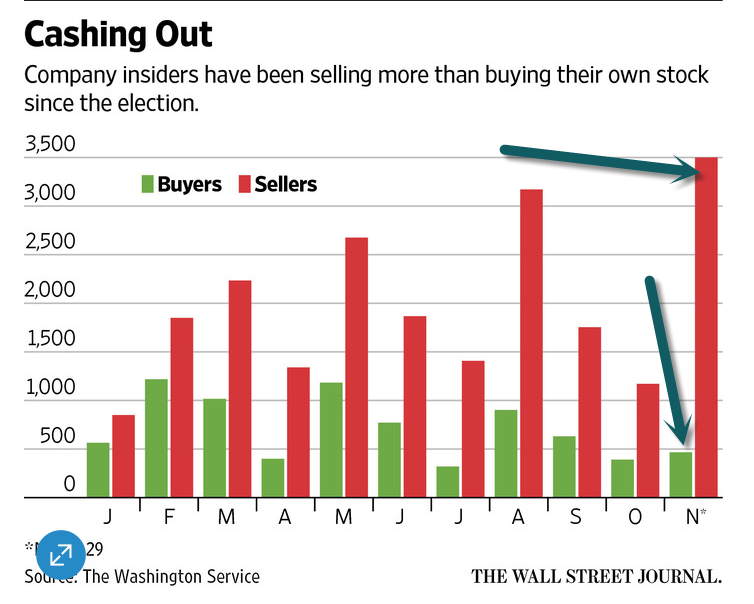

4.Insider Buying and Selling….In November, 3500 Insiders Sold and 467 Bought.

Barrons Insider Transaction Ratio Neutral

WSJ—Big Sellers November.

A total of 3,500 insiders at Russell 3000 companies have unloaded their own stock in the last three weeks, while 467 purchased shares, according to data from The Washington Service, a Bethesda, Maryland-based provider of insider trading data and news. The number of sellers was higher than the monthly average of 1,832 sellers this year through October. Sellers have also increased from the comparable year-ago period, and buyers have decreased.

“It reflects uncertainty over what the economic and regulatory landscape will look like next year,” said Ed Clissold, chief U.S. strategist at Ned Davis Research. “We’ll need to get clarity on what Trump will be able to implement.”

5.5 Year Forward Break Even Inflation Expectations Over 2% for the First Time in 2 Years.

This series is a measure of expected inflation (on average) over the five-year period that begins five years from today.

What level of inflation do market participants expect over the next 5, 10, or even 30 years? There are many methods of varying complexity that investors and policymakers use to estimate the level of expected inflation, but one relatively straightforward method is to examine the “breakeven” inflation rate which is the difference in interest rates between Treasuries and TIPS. This method has the advantage of being determined by market prices, so it reflects the views of investors who have money on the line.

https://fred.stlouisfed.org/series/T5YIFR

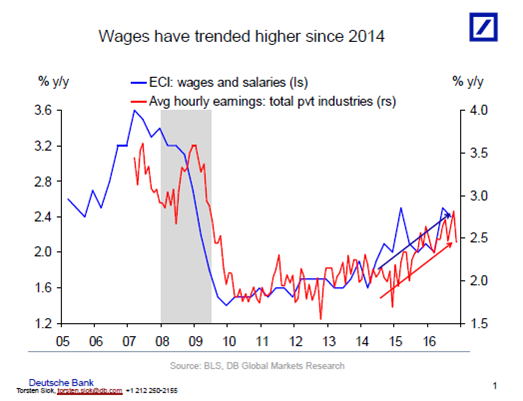

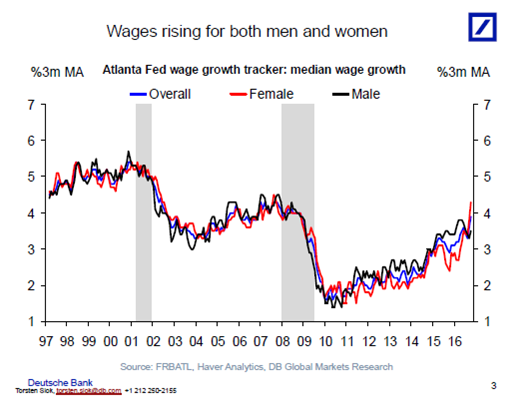

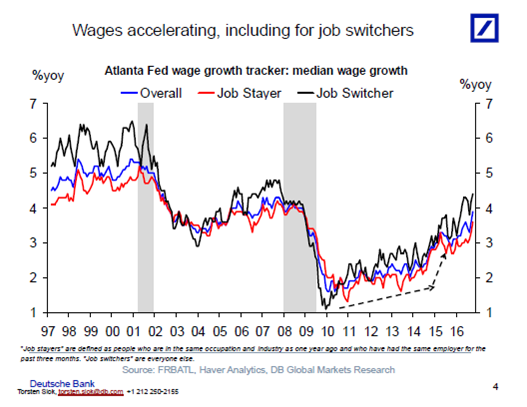

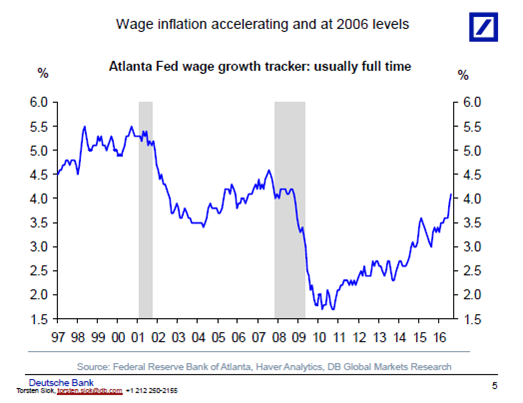

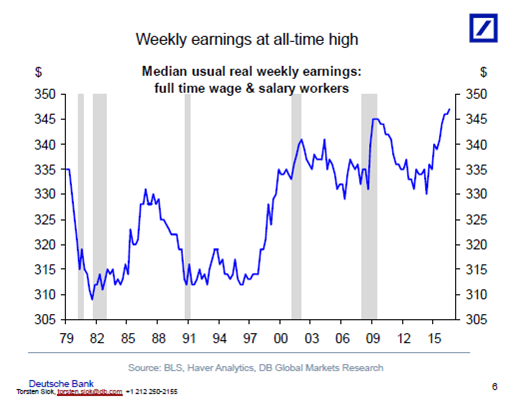

6.Wage Acceleration is Here to Stay…..

Don’t be fooled by the small move down in average hourly earnings growth in November, all measures of wages continue to trend higher, see charts below.

7.Are U.S. stocks cheap, expensive, or fairly valued?

December 1, 2016 9:00am by Guest Author

From Nick Colas, Chief Strategist at Convergex, discusses valuation:

Are U.S. stocks cheap, expensive, or fairly valued? Here are our 5 discussion points:

Point #1: At 16.8x a projected $131/share in earnings for the S&P 500, U.S. stocks are no one’s idea of “Cheap”. As FactSet points out in this week’s Earnings Insight, this is higher than the 5 year average of 15.0x and the 10 year average of 14.3x. Importantly, that 16.8x comes at a time when interest rates are rising rather than falling (as they generally have over the last 10 years). Higher interest rates lower the present value of future earnings, after all. And that should mean lower valuations.

The latest FactSet report is here (P/E analysis on page 6):https://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_11.25.16

Some of our readers also use the Shiller PE, a measure of long term (10 year average) earnings power. By that measure the S&P 500 trades for 27.6x earnings, the high end of its post-2000 stock bubble range. You can see the long term (1860 – present) chart here: http://www.multpl.com/shiller-pe/

Point #2: Trends in expected 2017 corporate earnings are helping the case for stocks, however. FactSet shows that top-down estimates (those made by strategists rather than single stock analysts) are starting to turn higher in the last few weeks, up about $1/share to that $131/share number we cited in Point #1.

Not to encourage you to stop reading, but this is pretty much all you need to know about the current rally in U.S. stocks. Investors are buying in to the notion that a Trump presidency/Republican Congress can move the needle on business and personal tax cuts, infrastructure spending, and reduced regulatory burdens across multiple sectors. All that adds up to greater earnings power, and that $1/share bump from the Wall Street strategist crowd is a nod to that belief.

Point #3: For a market used to dividend increases and stock buybacks to backstop valuations, this new world order will take some time to fully digest. A few highlights to expand on this statement:

- According to S&P, the companies of the S&P 500 are currently paying out 44.3% of their earnings in dividends. This is much higher than the 38.7% average back to 1988 and more akin to the payouts we see during recessions. The difference here is that profit margins (currently 10.0% according to S&P) are much closer to cyclical peaks than troughs. For a comparison, consider that payout ratios during the 2006-2007 cyclical peaks were 26-33%. If you want to see the whole time series, shoot us an email and we will send it over.

- FactSet’s Buyback Quarterly points out that 137 of the S&P 500 (27%) bought back more stock in the four quarters ending Q2 2016 than they generated in earnings. Factset also noted than in Q2 (most recent data available) some 350 companies in the index bought back stock (70%), down from 380 in Q2 2015. See here for more: http://www.factset.com/websitefiles/PDFs/buyback/buyback_9.20.16

- The intersection of earnings growth (Point #2) and stock buybacks/dividends is simple: if the U.S. economy is really going to accelerate in 2017, then public companies will likely choose (at the margin) to reinvest in their businesses rather than hand back cash to shareholders. That’s a big deal for an investor base that has grown accustomed to earnings that end up in their pocket rather than retained by management. Like Veruca Salt, this group tends to want it all. And they want it now.

Point #4: The next few quarters are setting up as a cyclical investor’s dream, but like all dreams they require some interpretation. The key sectors to watch are Financials (+9.7% on the year) and Industrials (+17.5% YTD). Both have underperformed the S&P 500 over the last decade, and both have caught a bid since President Elect Trump’s win.

The funny thing about cyclical stocks is that investors give them far more leeway than other sectors during an expected upswing. For those of you with graying muzzles, think back to the early 1990s U.S. equity market when auto, airline, industrial and banking stocks had multi-year runs. Markets discounted expected earnings that wouldn’t hit the tape for 4-8 quarters. For those of you accustomed to tech or health care stocks that swoon when they miss earnings by a penny or a dime, this is a whole new kettle of fish.

Point #5: For the most concentrated exposure to Industrials and Financials, look at the S&P 600 Small Cap index. These sectors make up 35% of the 600: Industrials at 18.1% and Financials at 17.0%. The S&P 500 Large Cap index is only 23% exposed to those same sectors: Financials at 13.3% and Industrials at 9.7%. You can check out the fact sheets here (free login required): https://us.spindices.com/indices/equity/sp-600

To summarize, let’s remember where we started: valuation, which is the analysis of investor expectations as they relate to asset prices. At first blush, the “Trump rally” feels like it has stretched U.S. valuations beyond reason. The simple math of a 17x PE in a rising rate environment is proof enough of that.

The truth is more nuanced, for in reality the whole framework of market expectations has shifted, and rapidly at that. Investors will have to adapt to a world where the companies they own do some investing as well rather than hand back all their earnings in buybacks and dividends. And sectors like Financials and Industrials, long forgotten, may once again show a cyclical resilience out of pace with their near term fundamentals.

One thing is for sure: the recent rally is more than just an uptick in asset prices.

From Barry Ritholtz Blog.

http://ritholtz.com/2016/12/u-s-stocks-cheap-expensive-fairly-valued/

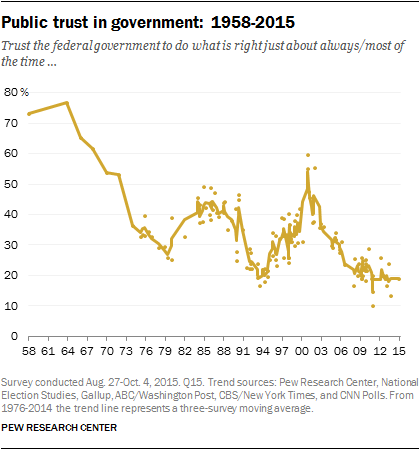

8.Trust in Government was at All-Time Low Going into 2016 Election.

According to a Pew October survey, the percentage of U.S. adults who say they have “a great deal of trust” in the media stands at just 5%—versus 33% for the military or 24% for medical scientists. The only groups that fared worse were business leaders (4%) and elected officials (3%).

http://www.barrons.com/articles/welcome-to-americas-newspeak-era-1480745905

Trust in government: 1958-2015

The public’s trust in the federal government continues to be at historically low levels. Only 19% of Americans today say they can trust the government in Washington to do what is right “just about always” (3%) or “most of the time” (16%).

According to a Pew October survey, the percentage of U.S. adults who say they have “a great deal of trust” in the media stands at just 5%—versus 33% for the military or 24% for medical scientists. The only groups that fared worse were business leaders (4%) and elected officials (3%).

http://www.people-press.org/2015/11/23/1-trust-in-government-1958-2015/

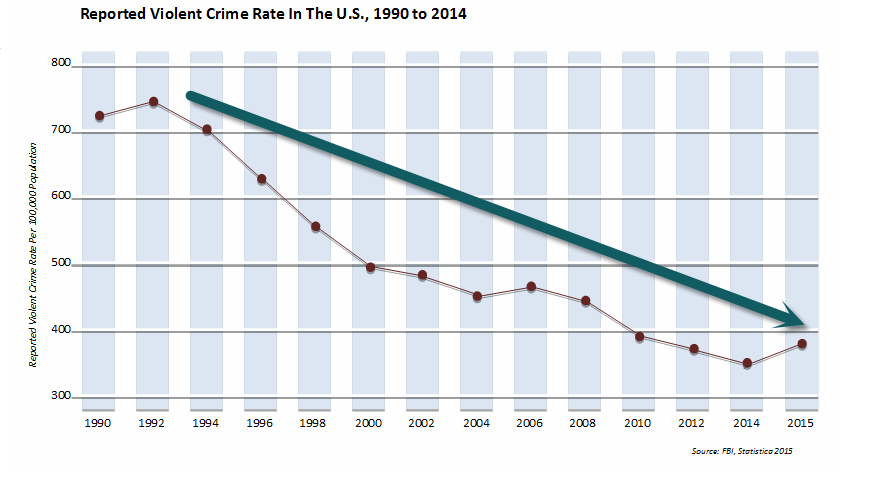

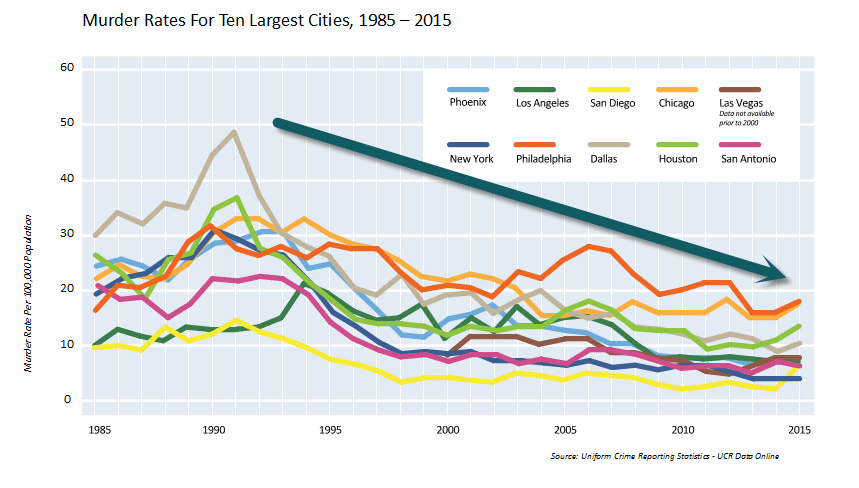

9.Read of Day…Violent Crime Peaked in 1992.

The first big issue in Trump’s law enforcement initiative will be his battle with sanctuary cities, something that may set a tone for the administration in the same way that Ronald Reagan set a tone by firing striking air traffic controllers. But before we address that, let’s look at overall crime data, the context for his pronouncements.

The chart below shows FBI statistics on reported violent crime during the past 25 years. Violent crime peaked in 1992 and fell steadily until 2014, with some upward movement since that time.

How about major American cities, where there is more media attention? The chart below shows murder rates in the 10 largest American cities going back to 1985. Again the trend is downward since the early 1990’s peak, with some upward movement over the past two years in a few cities.

Among American cities, the largest 10 are nowhere near the highest urban crime centers. That distinction belongs to smaller cities including Milwaukee, Detroit, Oakland, Kansas City, St. Louis, Memphis, and Baltimore. St. Louis, Baltimore, and Detroit are among the 50 most violent cities in the world with numbers that rival drug cartel and gang centers in Mexico, Brazil, and Honduras.

Read Full Story Jeremy Nowak

10.6 research-backed ways to live a happier and more exciting life

The author, Jon Levy, in Antarctica. Jon Levy

I have spent almost a decade trying to understand something that most people think doesn’t exist.

In the process, I have battled Kiefer Sutherland in drunken Jenga, crashed bachelorette parties for wild nights on the town, and been crushed by a bull during running of the bulls in Pamplona, Spain — all in order to understand what it takes to live a fun, exciting, and remarkable life. In other words, I study the science of adventure.

My research and wild stories are shared fully in my new book, “The 2 AM Principle: Discover the Science of Adventure,” which argues that adventures aren’t random. In fact, they are a process, and these six secrets will help you create your own and live a happier life.

- Surround yourself with people who inspire you

You know the old adage that says you are the average of your five best friends? Well, it turns out that this is completely true. Research by Nicholas Christakis and James Fowler has found that everything from obesity to voting behavior to divorce and even happiness is spread across our social networks up to four degrees away.

In other words, if you have an obese friend, your chances of obesity increase by 45%, your friends’ chances increase by 25%, your friends’ friends’ by 10%, and your friends’ friends’ friends’ by 5%. If you want to live an exciting and remarkable life, select your friends based on the values that you admire.

Who you choose to spend your time with will define your world. So choose them wisely. If you keep hanging out with a drama queen, you will be miserable, and it will be contagious like the plague. Instead of drama, find fun-loving people who encourage you to step out of your comfort zone and grow as a person.

- Say yes!

If something scares you but it won’t kill you, then do it. Instead of shying away from opportunities that put you out of your comfort zone, say yes. If you want to approach an attractive stranger, then strike up a conversation. If you think that bungee jumping looks fun but have always been nervous to try it yourself, take the leap.

Our brains respond to novel and exciting experiences. When we grow too familiar with locations or activities, they become boring. When we say yes to new opportunities, it can lead to more exciting experiences. You may not like everything you try, but taking on a yes attitude will give you a breadth of experience and can improve your life, relationships, and career.

- Make a commitment you don’t know how to fulfill

We are most productive and motivated when we are pursuing something that is new and challenging. But if something is too overwhelming, it creates a state of anxiety in which we lose motivation and productivity. Every year, I create a travel goal.

One year, I went to the most famous events in the world each month. No matter where it was, without knowing how to pay for it. Another year, I went to all seven continents. I went with Expedition Trips to Antarctica, and it was the most memorable experience of my life. If I didn’t set audacious goals, I’d never have to grow in order to achieve them.

- It’s not the juice, it’s the squeeze

Traditional thinking challenges us to ask: Is the result worth the effort? Is the juice worth the squeeze? But when it comes to adventurous living, the result of the experience and the stories we have are secondary. The true gift is who we become in the process. Because long after the experience and the memories fade, we’ll still have the capacity to grow and expand our comfort zones.

- Embrace discomfort

The scope of our life expands in direct proportion to how uncomfortable we are willing to be. When was the last time that you did something that scared you? If something scares you, that’s probably a great reason to do it. (Unless it is illegal or highly likely to kill you. Weigh the risks and use good judgment.)

Staying within your comfort zone may make you feel safe, but it won’t help you succeed. It won’t push you to grow, and it won’t lead to an adventure. Living an exciting and remarkable life happens at the edge of your comfort zone. You can’t grow without crossing that threshold. When you push boundaries, you come through the experience a different person than you were at the beginning. The gift of an adventure isn’t just the great memories and stories; it is the person that you become as a result.

- Finish strong

Research has proven that we don’t remember how long we enjoyed an experience. What we remember are the peaks of the experience and the end of the experience. Psychologist Daniel Kahneman dubbed it the peak-end theory. It explains why an otherwise enjoyable date will be remembered as a miserable one if in the last few seconds, your date sticks you with the bill, says something inconsiderate, or commits another hard-to-redeem offense.

When having a fun night out, people often want to extend it, hoping that it will get even better. However, it generally turns out deteriorating into something unremarkable. Many times, having an ending that spoils the whole experience makes you less willing to participate in the future. The key to remembering experiences positively is to end on a good note, which may mean ending it early. For more science-backed tips to live an exciting and fulfilling life and outrageous stories, pick up a copy of The 2 AM Principle: Discover the Science of Adventure, on sale now.

Read the original article on POPSUGAR Smart Living. Copyright 2016. Follow POPSUGAR Smart Living on Twitter.