1.AGG U.S. Aggregate Bond Market Lost 2.37% in November….It’s Worst Monthly Performance in 12 Years.

AGG Chart November Rollover.

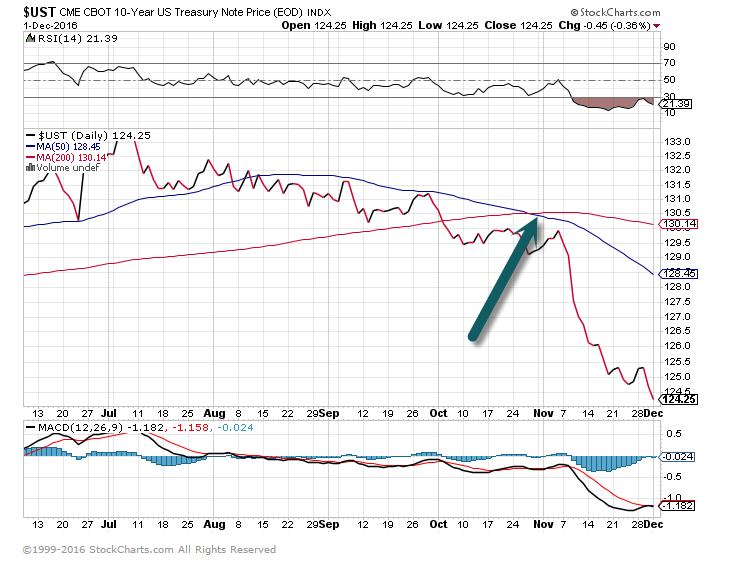

2.Treasurys has their Biggest Drop Since January 2009…Losing 2.67%.

10 Year Treasury 50day thru 200day to Downside.

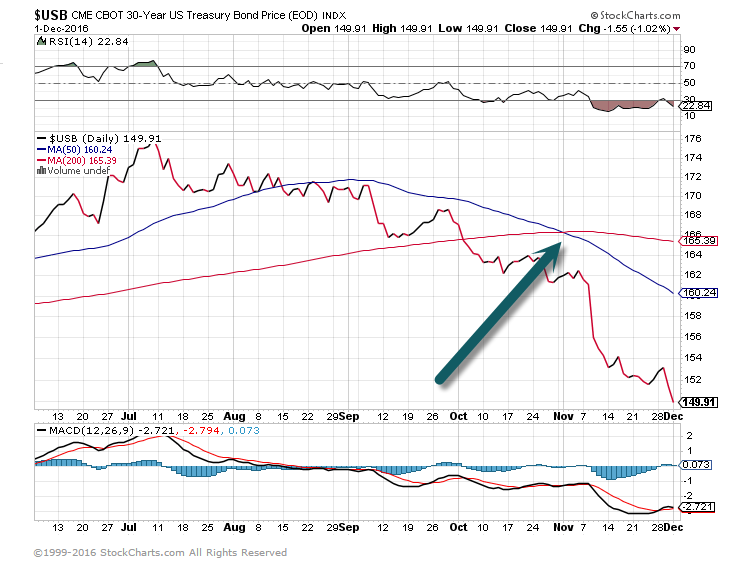

30 year treasury 50day thru 200day to downside…-7.42% in Nov.

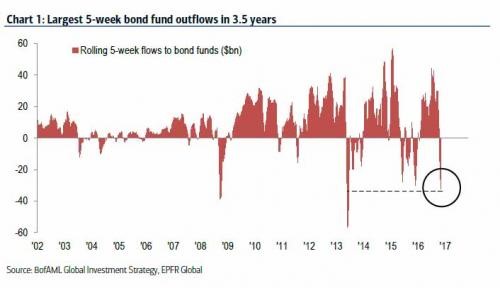

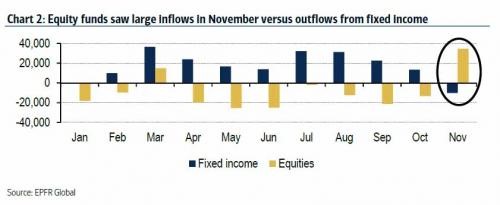

3.Largest 5 Week Bond Outflow in 3 ½ Years.

“A Watershed Month” – November Sees Greatest “Asset Rotation” Since 2013

by Tyler Durden

Dec 2, 2016 8:20 AM

The final November fund flow numbers are in, and as BofA’s Michael Hartnett puts it, November, it was a “watershed” month for fund flows with the largest 5-week bond outflows in three and a half years at $10 billion…

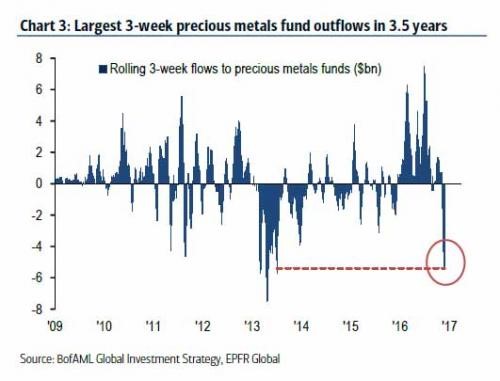

… the largest 3-week precious metals outflows in 3.5 years…

… and the largest 5-week equity inflows since October 2013 at $34.5 billion.

http://www.zerohedge.com/news/2016-12-02/watershed-month-november-sees-greatest-asset-rotation-2013

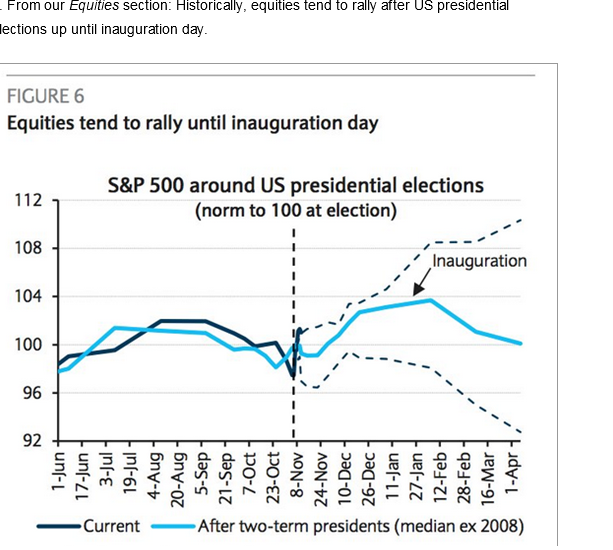

4.U.S. Equities Rally into Inauguration?

From The Daily Shot

http://dailyshotletter.com/

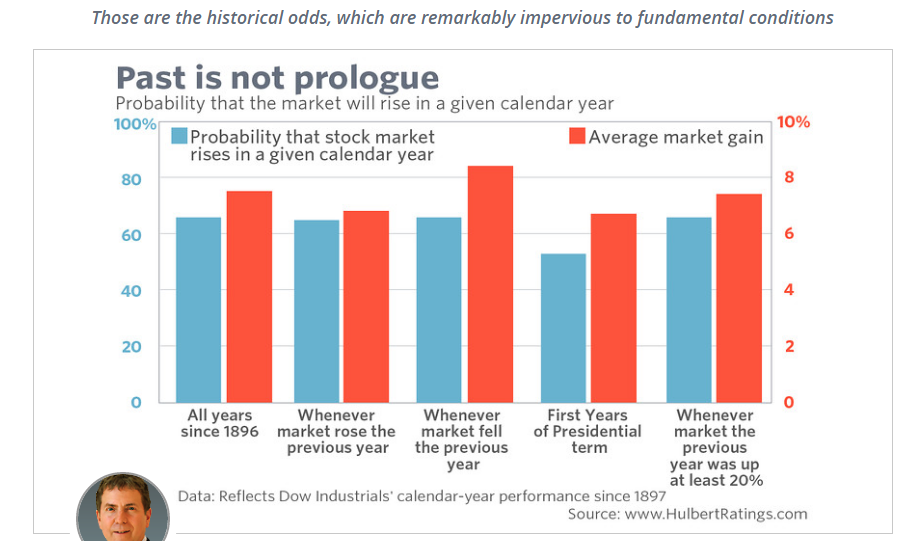

5.Probabilities of Market Rising in 2017

CHAPEL HILL, N.C. (MarketWatch) — There’s a 65.5% chance that the U.S. stock market will rise in 2017. If you’re like most investors, that’s welcome news.

Given the advanced age of the economic expansion, an overvalued stock market by virtually any measure and the uncertainty surrounding a new president, a two-out-of-three chance of turning a profit seems almost too good to be true.

Still, before you make too much of those odds, know that they would not be meaningfully better or worse if conditions were different. That’s because the stock market looks forward, not backward. Current conditions are already reflected in stock prices. The stock market trades higher or lower at any given time to settle on whatever level that results in it being higher a year later two out of three times (on average).

Over the 119 calendar years since the Dow Jones Industrial Average was created in the late 1800s, for example, it has risen 78 times, or, 65.6% of the time. Whenever the market rose during a given year, its odds of rising the next year were a virtually identical 65.4%. Following years in which the market fell, in contrast, its odds of rising the next year were 65.9%. (See the accompanying chart.)

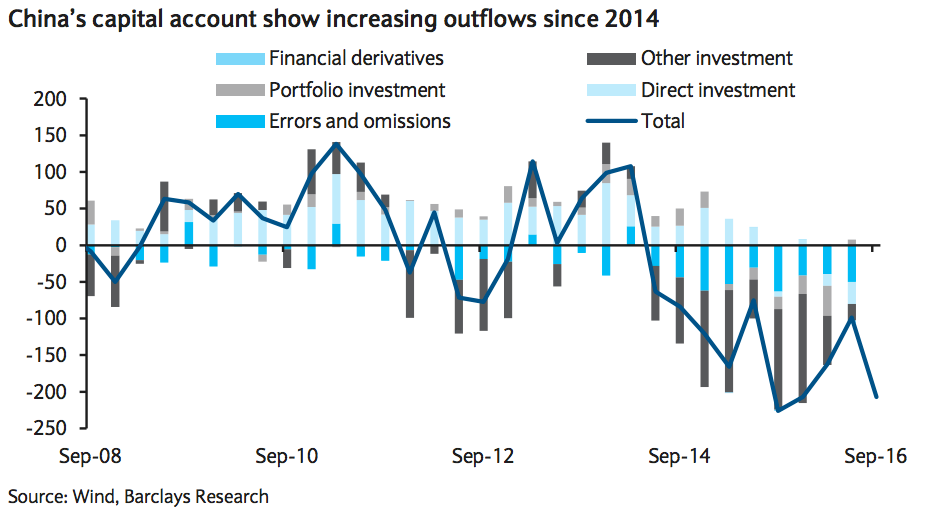

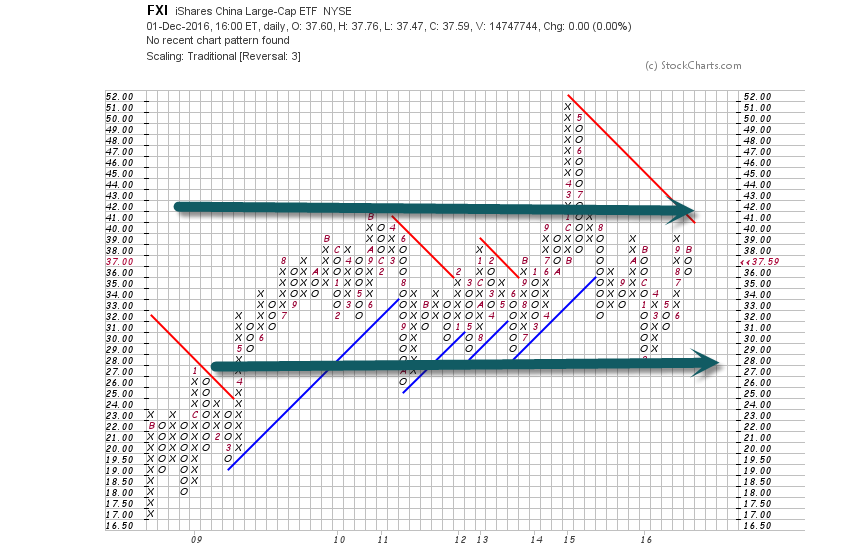

6.China Seeing Record Capital Outflows….“a near-record net capital outflow” of $207 billion in the third quarter this year, according to a note from Barclays.

China FXI ETF—A 7 Year Sideways Move.

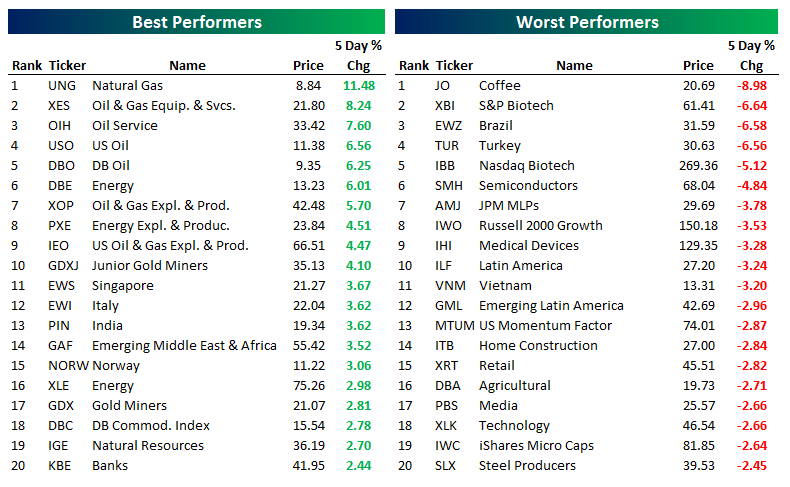

7.ETF Performance Short-Term

ETF Trends: US Indices & Styles – 12/1/16

Dec 1, 2016

Natural gas, crude oil, and anything related to Energy has surged over the last few days thanks to OPEC’s decision to cut output. Italy, Singapore, and gold miners have also performed pretty well while banks are up over 2% over the past couple of weeks. Performing poorly: biotechs, semis (a recent leader) and growth stocks. Micro Caps (which exploded higher after the election) have also performed fairly poorly over the last few days.

https://www.bespokepremium.com/think-big-blog/

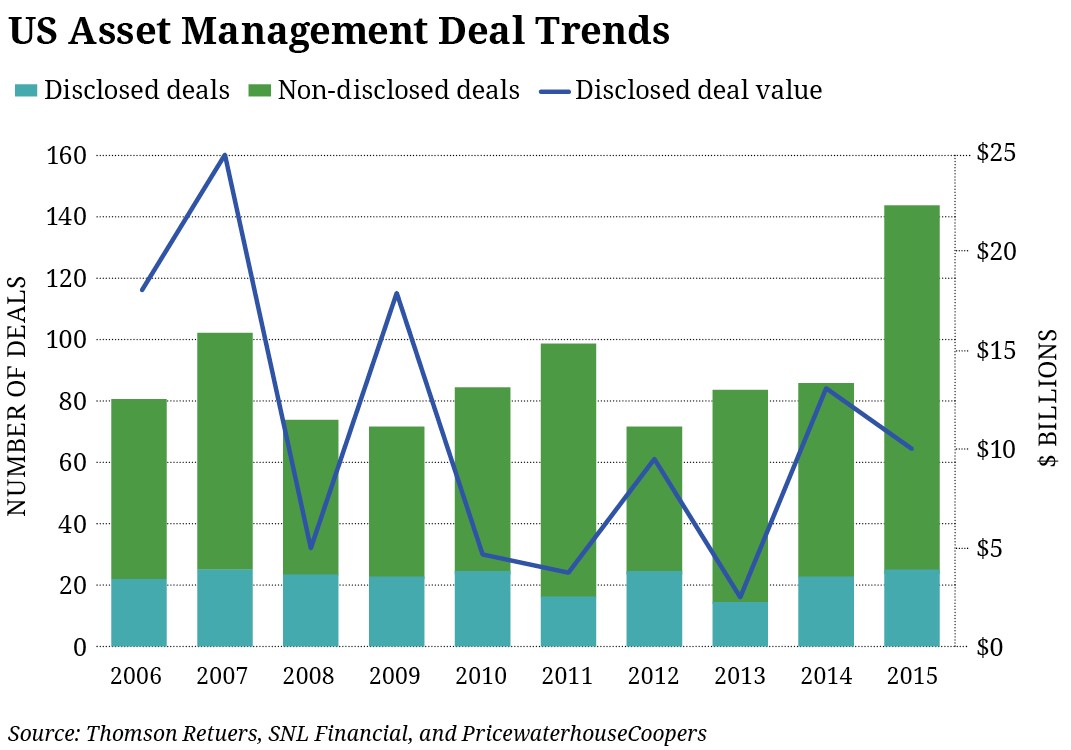

8.Asset Management Consolidation-A Huge Trend Going Forward?? Pressure on Fees, ETF Competition, Fewer Listed Stocks, etc.

The Great Asset Management Consolidation of 2016

With more than $9 billion in asset manager M&As already underway in 2016, consolidation has become—pun intended—quite a big deal.

2015 was the biggest year for asset manager mergers and acquisitions in a decade—and in 2016, M&A activity has hardly slowed down.

In March, four MassMutual boutiques and their combined $260 billion in assets merged to become Barings. In May, Ares Capital acquired American Capital for upwards of $3 billion, growing its asset base to $13 billion. And in October, Janus Capital Group and UK-based Henderson Group joined $300 billion in assets under management to create Janus Henderson Global Investors.

Read Full Story

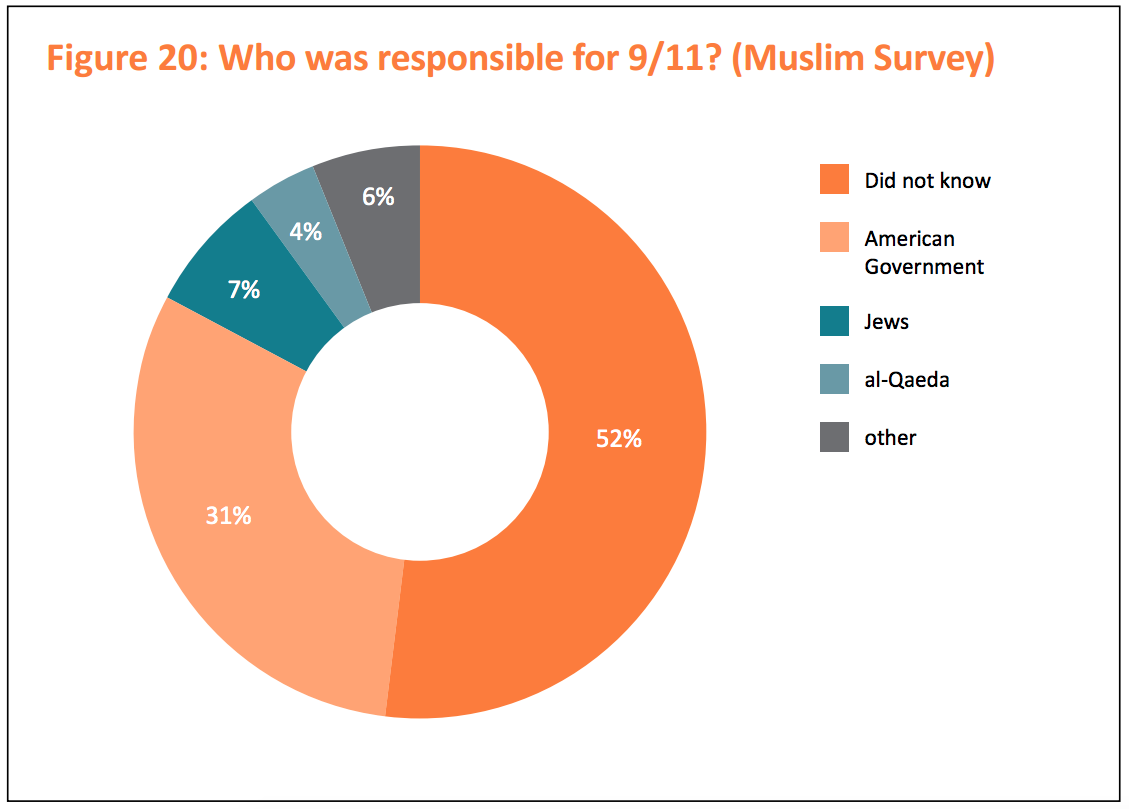

9.Read of Day….Only 4% of British Muslims believe Al Qaeda planned 9/11

The survey — of 3,000 British Muslims from a variety of towns — also said:

- Only 4% of British Muslims can correctly identify who was responsible for the September 11 attack on the World Trade Center, according to a survey of conducted by centre-right think tank Policy Exchange, a non-profit education think tank.

- 43% support the introduction of some forms of Sharia law.

- 44% believe schools should be able to insist on “a hijab or niqab” as part of the uniform.

- 15% believe art or music should not be taught in school (artistic representations of humans are regarded as idolatry in some forms of Islamic belief).

- 10% would not ban tutoring that “promotes extreme views or is deemed incompatible with fundamental British values.

But the biggest point survey results show that more UK Muslims believe Jews perpetrated the 9/11 attacks than believe Al Qaeda planned it:

“Policy Exchange Read Full Story at Business Insider

http://www.businessinsider.com/policy-exchange-survey-muslim-attitudes-beliefs-911-september-11-2016-12

10. 10 Important Career Lessons Most People Learn Too Late In Life

FollowBernard Marr

Keep your head down and your nose to the grindstone. That’s what a lot of us were taught to believe about work. But is it really the best strategy?

I’ve gathered up my top 10 lessons you should take to heart now, before it’s too late!

- Life is short. Here’s the thing: Life is too short to put up with a job you hate, a boss who demeans you, or a company with no soul. Many people convince themselves that they can put up with a job or career situation that makes them unhappy because they need the income, because they don’t know if they can find another job, or for some other reason. But the truth is none of us knows how long we have on this earth, and spending too much of it in a bad situation will only make you miserable and regretful. If you’re in this situation, take a step today — no matter how small — toward a better situation.

- Social networks matter. You might think that networking events are dull, that it’s boring to chat with coworkers around the watercooler, or that you’re simply a born introvert, but study after study confirms that social networks are vital to our success. In fact, the most successful people tend to have the broadest and most diverse social networks. The more time and effort you put into nurturing your social networks, the more successful you are likely to be.

- Sacrificing your health for success or wealth isn’t worth it. Many driven, successful people have a hard time creating work/life balance and can end up burning out or developing serious health problems from stress and overwork. The truth is, it’s much easier to stay healthy than to heal from a problem or disease — and no amount of success or money can replace your health. Don’t take your health for granted and take steps to mitigate stress that could cause problems later.

- None of the best moments of your life will take place looking at a screen. In our connected world, it’s tempting to let all the little screens we have access to dictate our lives. But you’ll never reach the end of your life wishing you’d spent more time checking email on your phone. Disconnect regularly and experience real life.

- Never stop learning. With the rate at which technologies are changing today, if you decide that you are “done” learning, you will be left behind within a matter of years, if not sooner. The idea that you can’t teach an old dog new tricks is blatantly false, and you will never wake up and regret having invested in your mind by learning something new.

- Diversify. Hand in hand with learning, if you stick to only doing what you know, or what you are good at, you may quickly find that you’re only good at one thing. We need to be agile, nimble, and interested in many different things. Otherwise, you could get stuck in a job or career you don’t love, or that goes with the times. Think of the taxi driver threatened by Uber or the customer service person replaced by a chatbot.

- You can go fast alone, but you can go farther together. In other words, teamwork makes the dream work. Many people claim they don’t like to work in teams, but the ability to work well in teams is vital if you want to succeed. The idea of the solo auteur is a myth; every big idea needs a team to make it happen.

- Worrying doesn’t achieve anything. The antidote to fear and anxiety is action and hustle. If you’re wasting time because you’re afraid to pursue an idea, speak up, or are worried what others will think of you, you won’t achieve your goals. If you push through the worry and the fear, however, and take action, you’ll almost always find that you were worried about nothing.

- Failure is not an end. If you give up when you fail, you’ll never learn anything. Instead, look at failure as an opportunity, as the beginning of a new journey. If you do, you’re much more likely to try again and succeed at something else.

- Happiness is a journey, not a destination. So many people put off their happiness; they think, “I’ll be happy when I get that job, when I lose that weight, when I’m in a relationship, when I’m out of a relationship…” and so on. But we can choose to be happy. Happiness is a habit and a choice. No matter what your situation, if you can approach it with an attitude of happiness, you will be more successful.Thank you for reading my post. Here at LinkedIn and at Forbes I regularly write about management, technology and Big Data. If you would like to read my future posts then please click ‘Follow‘ and feel free to also connect via Twitter, Facebook, Slideshare, and The Advanced Performance Institute.

- You might also be interested in my new and free ebook on Big Data in Practice, which includes 3 Amazing use cases from NASA, Dominos Pizza and the NFL. You can download the ebook from here: Big Data in Practice eBook.

- What other advice would you add to this list? I’d be interested in hearing your thoughts in the comments below.

I find that people often take this sort of advice to heart — and then learn too late in their careers that there’s more to life (and success) than just keeping busy.

Best-Selling Author, Keynote Speaker and Leading Business and Data Expert