1.Big European Banks not Worried About Italian Referendum??

Italy is preparing to take a €2B controlling stake in Monte dei Paschi di Siena (OTCPK:BMDPY), which the bank hopes will attract private investors to fill the gap in rescue funding. According to Reuters, the government plans to buy junior bonds to boost its stake to 40%, making it the biggest shareholder by far. Questions whether this amounts to state aid will surely arise in Brussels.

www.seekingalpha.com

DB 60% off October Lows.

UBS-50day thru 200day to upside.

CS-50day thru 200day to upside.

Credit Suisse +4% premarket after the Swiss bank lowered profit targets at its asset management business and ramped up its cost cuts amid challenging conditions in key Asian markets. The move will slash over 6,000 jobs and result in more than 1B Swiss francs in extra cost cuts as Credit Suisse (NYSE:CS) CEO Tidjane Thiam looks to adjust his turnaround plan.

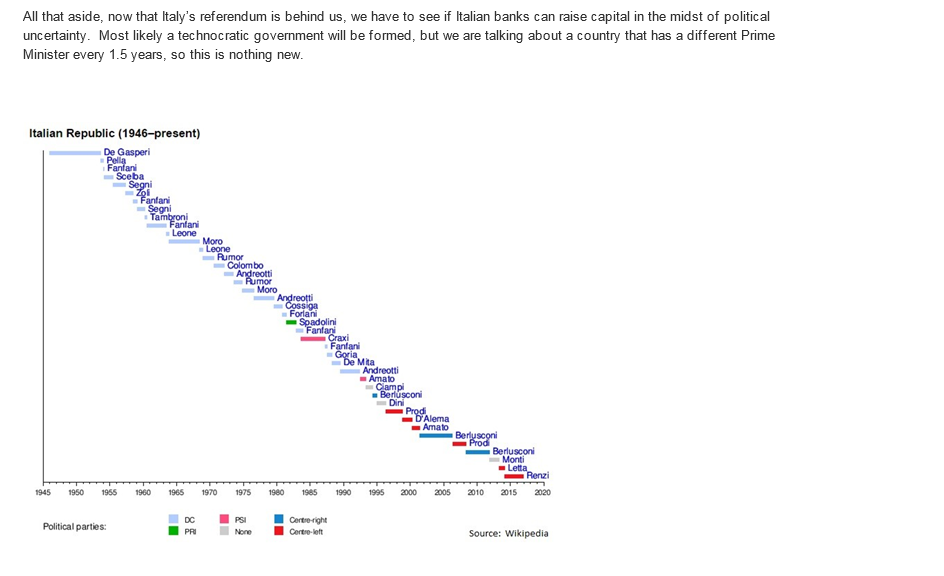

2.Why Should They Be Worried? Italian Prime Ministers Turn Over Every 1 ½ Years.

Italian Prime Ministers 1946-Present.

Chart From Rich Farr, Chief Market Strategist

Jim McGovern, Market Strategist

info@bluestonecm.com

3.Rising Rates Positive for Euro Banks U.S. Business…..TBF-Most Popular Short Treasury ETF.

TBF–50day thru 200day to upside

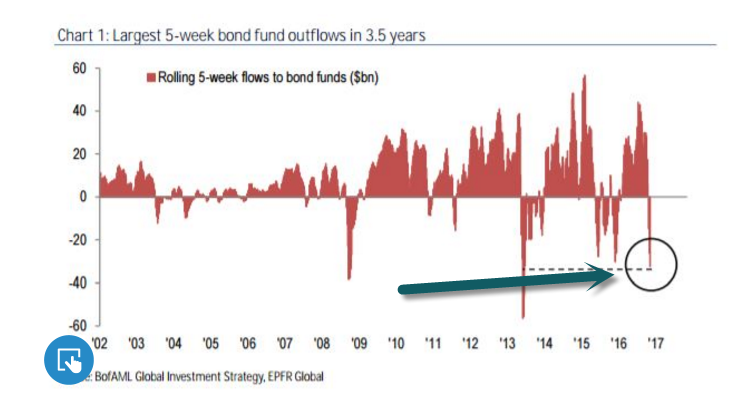

Largest 5 Week Bond Outflow in 3.5 Years.

http://blogs.wsj.com/moneybeat/2016/12/06/bond-fund-withdrawals-renew-chatter-about-great-rotation/

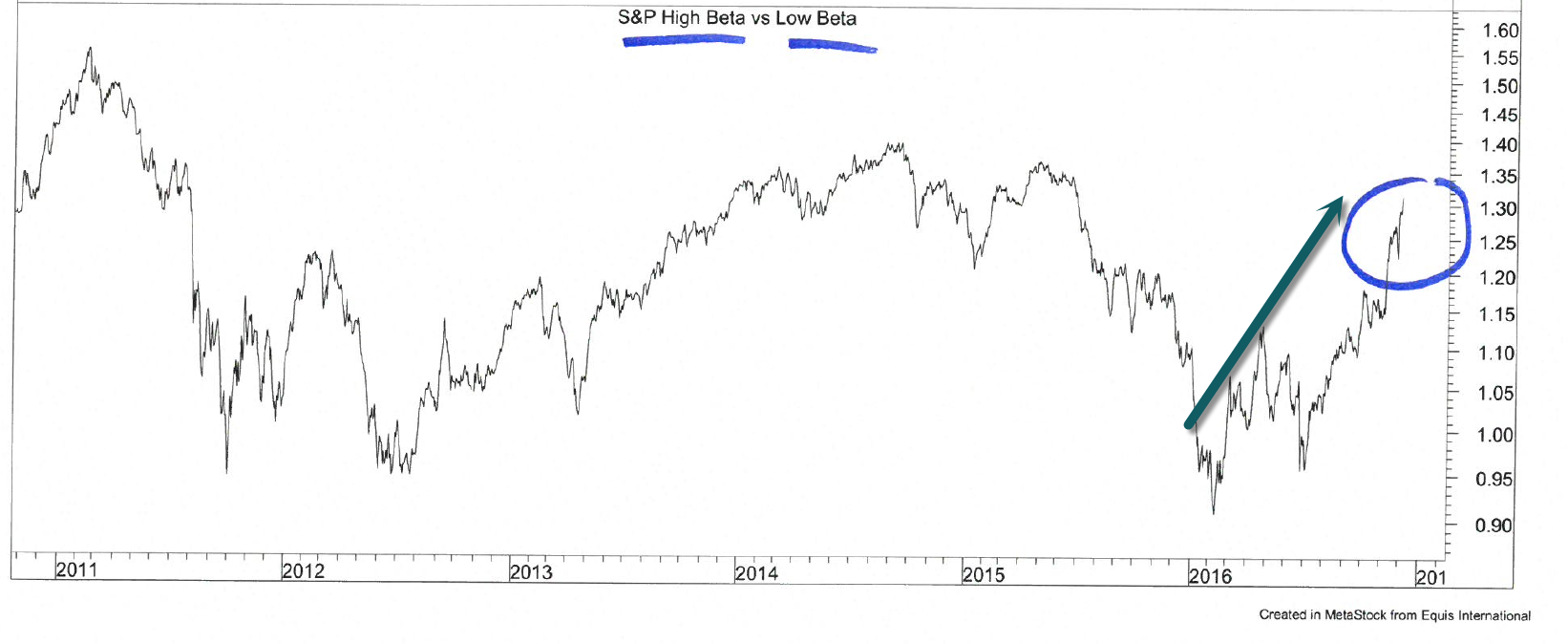

4.Defensive Stocks Continue to Lag as High Beta Surges.

DEFINITION of ‘High Beta Index’

An index composed of companies with high betas trading on the NYSE.

BREAKING DOWN ‘High Beta Index’

Beta is a measure of a stock’s volatility in relation to the market as a whole, and the high beta index takes account of those stocks considered to have higher volatilities.

Read more: High Beta Index Definition | Investopedia http://www.investopedia.com/terms/h/highbetaindex.asp#ixzz4S9OI3oAK

Chart Compares High Beta Stocks to Low Beta Stocks.

Chart from Jeff DeGraff

www.renmac.com

EBoucher@renmac.com

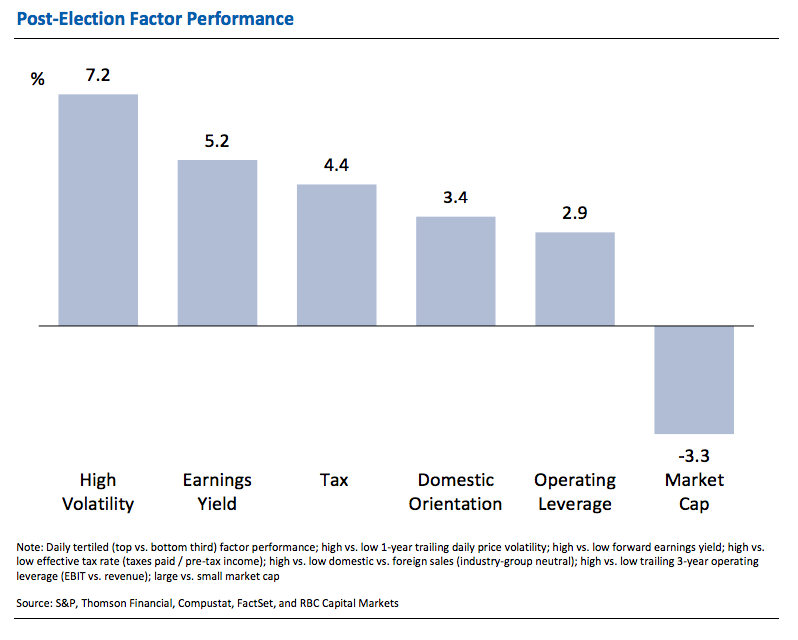

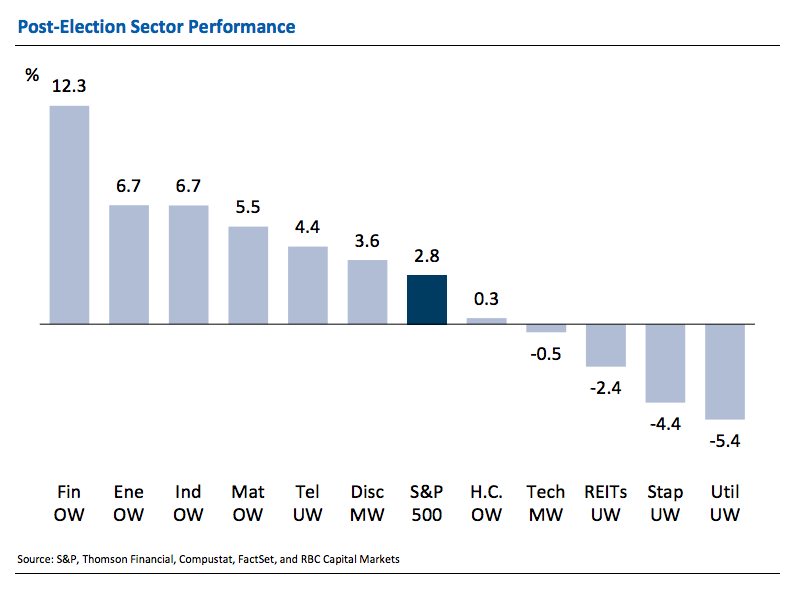

5.Another Similar Look From Jonathan Golub at RBC.

Post Trump Election Factor Performance.

Golub says the rotation to more cyclical, US focused financial stocks and cyclically sensitive, smaller cap companies is still in the early innings. He notes that, overall, the S&P 500 is only up 3% since the election, despite all the commotion. Here’s two tables illustrating what’s gone on so far, he thinks these trends continue:

Financials, Energy and Industrials Leading Sectors.

http://thereformedbroker.com/2016/12/05/welcome-to-trumptopia/

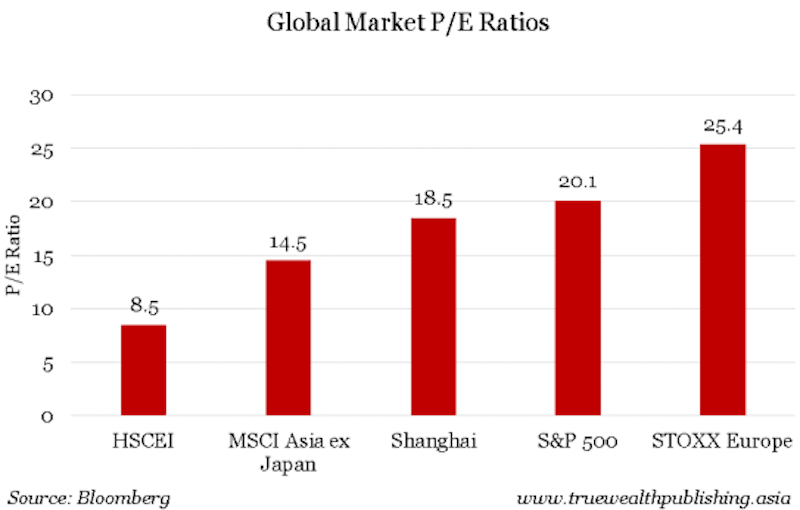

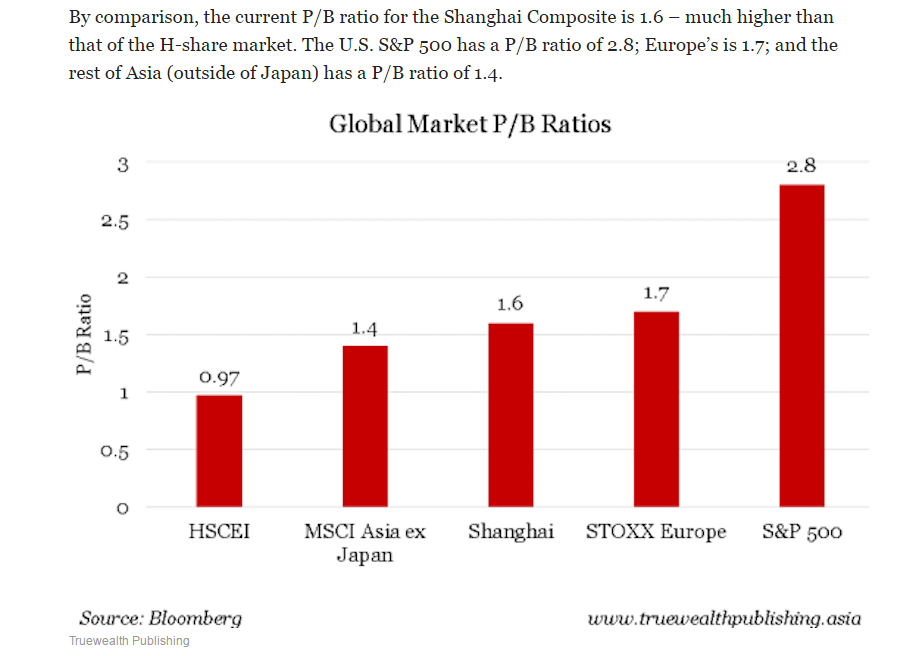

6.Hong Kong Listed Shares of Chinese Companies….Cheapest in World on P/E and P/B Basis?

H-shares are the Hong Kong-listed shares of Chinese companies. They fall under the jurisdiction of Chinese law, but are denominated in Hong Kong dollars and are traded just like any other stock traded on the Hong Kong exchange.

(They’re kind of like American Depository Receipts (ADRs) traded on the New York Stock Exchange – which are the shares of non-U.S. companies, but they’re traded just like a U.S.-based company on the NYSE.)

There’s an index for H-shares on the Hong Kong Exchange, too. It’s called the Hang Seng China Enterprises Index (HSCEI).

The P/E ratio for the HSCEI is 8.5. By comparison, the Shanghai Composite’s – where A-shares trade – current P/E is 18.5.

European stocks, as measured by the STOXX Europe 600 Index, have a P/E ratio of 25.4. And the rest of Asia, excluding Japan, has a P/E of 14.5.

By this measure, Hong Kong’s H-share market is much cheaper than mainland China’s A-share market – and among the cheapest in the world.

Truewealth Publishing

Read Full Story at BI.

http://www.businessinsider.com/chinas-h-shares-among-cheapest-stock-markets-in-the-world-2016-12

7.Intermediete Term Volatility Making Another All-Time Low.

VXX Volatility Index Plummets in 2016.

8.5 big real-estate trends to watch in 2017

A surprising twist toward the end of 2016 with the election of real estate magnate Donald Trump as president is likely to presage some dramatic changes in 2017 for the housing industry, which saw healthy increases in values this year, thanks to factors including low interest rates, lower gas prices, stronger wage growth and millennials getting off the fence and entering the market.

Still, as demonstrated by the Nov. 8 presidential election, anything can happen. Here are five things to watch for in real estate in 2017 — don’t get blindsided:

1.Not ‘mixed-use’ but ‘surban’

The way to San Jose. The Silicon Valley capital is one of several cities adopting a “surban” model

There’s been plenty written about the move from suburban-style sprawl — marked by McMansions and strip malls — to more dense communities of different housing arrangements, such as town houses, apartments and single-family homes, together in the same neighborhoods. In 2017, look for a new name for it: surban.

“Existing suburban neighborhoods are adding urban amenities so that there’s an environment where people can live, work and play right outside of the core part of the city,” said Peter Burley, a real-estate executive in Oak Park, Ill., an urbanized inner-ring Chicago suburb.

“These developments are more than simply mixed-use,” said Danielle Leach, a senior consultant at John Burns Real Estate Consulting in Chicago, who as a single mom lives in such a community in St. Charles, Ill., with two teen boys. “Surban living is becoming a new way of life for many: where the blend of urban and suburban living provides the best of both worlds,” she said. With surban living, it’s possible to walk to work, like in a city, as well as enjoying pedestrian access to groceries, entertainment and youth- and sport-friendly parks — plus reliably strong public schools.

John Burns Consulting expects nearly 80% of residential growth to occur in suburban communities over the next 10 years — up from 71% from 2010 to 2015 — compared to just 15% for “urban” areas through 2025.

Surban neighborhoods are designed to be inclusive, rather than exclusive, said Bill Endsley, of the International Real Estate Federation, a Washington, D.C.–based international real-estate consulting group, making them affordable to teachers, firefighters, police and janitors.

“The more we go down the road of exclusive development, the more problems we have,” including traffic congestion, air pollution and sprawl, Endsley said. He cited a rundown mall site in San Jose, Calif., which was turned into “Santana Row,” a booming destination in the high-priced Silicon Valley, that includes affordable housing.

2.Forget the starter home, millennials want the move-up property

Hiding out in Mom’s basement has apparently worked — millennial buyers have more money to spend on down payments now.

More millennials — roughly, those born between the early 1980s and the late 1990s — are expected to buy a first home in 2017, according to the Washington, D.C.–based National Association of Realtors.

Many of those buyers have saved enough to go with something more than a condo unit or a starter home, said Jessica Lautz, managing director for research at NAR. And with the markets doing so well, and interest rates as low as they are, millennials who have paid down their student debt and built up their cash may be in a position to buy more house than real-estate agents might think, she said.

Indeed, the NAR noted that in 2016, 17% of buyers under 35 were able to save enough for a down payment for a home within a year, compared with 14% of all age groups. And though it was lower than all other age groups, 37% of buyers under 35 said they were able to save enough for a down payment within six months, compared with 46% of all other buyers, the NAR said.

To be sure, student debt still is seen as one of the top factors that will influence, in the coming year, whether the millennial generation will buy a home. The NAR noted that 44% of Generation Y buyers had a student-loan debt balance of at least $25,000. And perhaps also worrisome, the baby boom generation is also deep in debt, with the highest median debt balance of $29,100. And it isn’t just their own debt, according to the NAR. “This may be due to not only their personal educational loans but accumulating debt from their children’s education loans,” Lautz said.

3.How Trump’s shocking win could change real estate

Donald Trump’s win stunned the financial world, the media and, perhaps, real-estate markets.

The conventional wisdom just a few weeks ago foresaw a solid electoral win for former Secretary of State Hillary Clinton and a smooth passing of the baton from the Obama administration, along with a gentle increase in interest rates in December by the Federal Reserve. No more.

Last week in Orlando, Fla., just before most voters went to the polls, Dennis Lockhart, president of the Federal Reserve Bank of Atlanta, said only “election turmoil” could force the Fed to hold back on an interest-rate hike in December.

“You can never rule things out post-election,” Lockhart said. “We may end up with enough turmoil around the election to create a different set of conditions,” he said during a news conference at the National Association of Realtors annual convention.

Indeed, fears of recession could grow with a likelihood that Trump would cut government spending dramatically in his first year, and stock-market uncertainty increasing over just how his presidency will begin. As such, another year of low interest rates could be in the cards.

“I don’t believe that there will be any significant changes to interest rates, at least in the near term, since the underlying fundamentals that have led us into a low-interest-rate environment haven’t changed,” said Rick Sharga, executive vice president of Ten-X, formerly Auction.com, a real-estate auction site.

Sharga sees a Trump presidency being good for the housing and mortgage markets in the long term, he said. “He seems committed to bringing regulatory relief — and regulatory certainty — to the financial-services industry, which should make more credit more available to average home buyers who have been locked out of the market by today’s extraordinarily tight credit standards,” he said.

As a result, home buying should remain strong in 2017, which is good news for a market starved of inventory. “This is absolutely a seller’s market and has been for quite some time, and we do not feel Donald Trump’s win will negatively affect the market for those looking to sell,” said Nancy Dennis, a vice president at American Financing Corp., an Aurora, Colo.–based mortgage lender.

Down the road, interest rates could begin rising faster, especially if Trump’s economic-growth plans ignite inflation. “The accelerated economic growth and ensuing inflationary pressure could prompt a quicker pace of rate hikes that are potentially more aggressive than exhibited over the past year,” wrote John Chang, first vice president of research services at Marcus & Millichap MMI, +2.12% , the largest U.S. real-estate brokerage firm, in a note to investors this week.

4.Start thinking about Generation Z

\These teens could be buying homes very soon. No really.

The millennial generation might grab all the headlines, but it won’t be long before Gen Z reaches the market. They’re teenagers now, but Generation Z is almost on the cusp of being able to buy homes, with the first Gen Z–ers reaching their 18th birthdays in 2017. Gen Z, according to the National Association of Realtors, is a lot different from the predecessor generation that came of age in the midst of recession, war, terrorism and a stock-market collapse, and was burned by the housing downturn and crushing student-loan burdens.

Gen Z will come of age with low interest rates, better job prospects and higher wages to help cushion the high costs of college education, said NAR research director Lautz.

“It might sound a little traditional, especially when compared to what we’ve seen with millennials, but this is a generation that values homeownership,” said Sherry Chris, chief executive of Parsippany–Troy Hills, N.J.–based Better Homes and Gardens Real Estate.

In fact, 97% of the Gen Z age group wants to own a home, she said. “I want a big house,” said Cayman, a 17-year-old interviewed by NAR. “I want a room for each of my kids, a master bedroom, a few guest rooms, a movie room. I want a lot of space.”

9.Read of the Day…Investing Like Life is All About Discipline….Have a System that Removes Emotion.

The Best Investors In The World Aren’t Special And Neither Are You

Posted on December 6, 2016

by Andrew Thrasher, CMT

One of the great things about investing is the many ways that people approach it. Throughout history it’s been shown that hundreds (if not more) ways have been used to turn a profit within the stock market…. Whether you use fundamentals, technicals, astrology, or hire a monkey to throw a dart. However, one commonality among those that have risen to the top of our field have had one thing in common: They follow a process. The Market Wizard series by Jack Schwager has countless examples of this, with many of the investors echoing each other in their adherence to following a defined discipline.

I came across another great example of this while reading a Bloomberg article on Renaissance Technologies, which likely holds the title for being the best performing hedge fund in history. Ren Tec has produced 40% annual returns (after fees!), compare that to what Warren Buffett who has produced 20% annualized returns and is considered one of the greatest investors of our time. They now only manage employee assets in their Medallion Fund and employ 90+ Ph.Ds with expertise in astrophysics and string theory.

A firm that produces double-digit returns year in and year out would likely elicit some confidence from those within, creating an ethos of investing elitism with magic flowing through their fingers into their trades, right? Nope. They just follow their process. They don’t shoot from the hip. They don’t rely on an instinct to sniff out profits. They don’t override their system because they think they know better. Their trading just before the eye of the 2008 Financial Crisis storm provides a great example of this….

In August 2007, rising mortgage defaults sent several of the largest quant hedge funds, including a $30 billion giant run by Goldman Sachs, into a tailspin. Managers at these firms were forced to cut positions, worsening the carnage. Insiders say the rout cost Medallion almost $1 billion—around one-fifth of the fund—in a matter of days. Renaissance executives, wary that continued chaos would wipe out their own fund, braced to turn down their own risk dial and begin selling positions. They were on the verge of capitulating when the market rebounded; over the remainder of the year, Medallion made up the losses and more, ending 2007 with an 85.9 percent gain. The Renaissance executives had learned an important lesson: Don’t mess with the models.

A firm that employs some of the brightest minds in fields that expand beyond financial markets, having produced returns unmatched by any competitor still had the obedience and humility to trust their process and follow their models. They know they aren’t special. They know magic doesn’t flow from their fingertips. They believe in the scientific method and apply that method to trading and creating models that work.

So what’s it tell you when one of the best, if not the best, investment firm in the world knows they can’t outsmart their investment process or allow their own emotions to take over? It’s the overwhelming importance for the average and professional investor alike to have a system, to have a strategy, to have some kind of method they can rely on when times get tough and chaos flows down Wall Street that can be followed and trusted, leaving emotion at the door.

Source: Inside a Moneymaking Machine Like No Other (Bloomberg) Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer. Connect with Andrew on Google+, Twitter,and StockTwits.

http://www.athrasher.com/best-investors-world-arent-special-neither/

10.The Psychology of Decision Making.

Michael Lewis Most Recent Book Covers Same Topic

I took a class on human behavior at the No. 1 college in the US — and now I know how hard it is to make a ‘rational’ decision

It’s only been six years since I graduated from college, but sitting there in Robertson Hall, I felt ancient.

Nearly every student who’d showed up to the Princeton University lecture that day was clacking away on a laptop — I’d come non-ironically armed with a legal pad and Bic pen.

And while I’d done all (okay, most) of the assigned readings for that day, the material was still hard to understand. When, later that day, I looked over my notes, there were more than a few question marks indicating where I got totally lost.

That sunny November morning, I was sitting in on a session of “The Psychology of Decision Making and Judgment,” a Princeton University psychology course open to juniors and seniors, and taught by professor Eldar Shafir. I was there to interview Shafir, and I asked if I could sit in on one of classes to see firsthand what the academic experience there is like. After all, Business Insider ranked Princeton as is the top college in the US.

The lecture that day focused on prospect theory, which describes how people make decisions under risk.

Shafir explained that prospect theory emerged about 40 years ago and was developed by Nobel Prize-winning psychologist Daniel Kahneman and the late psychologist Amos Tversky. Other researchers have since contributed to the theory.

The main thing to know about prospect theory is that it poses a challenge to the longstanding assumption that humans are “rational agents.” For example, a rational agent wouldn’t change her preference or belief when the same exact decision is described in a slightly different way. (I’ll say more about that below.)

But a human would, and prospect theory aims to describe what everyday humans do, at least most of the time.

One of the best ways to understand prospect theory — at least in my opinion — is to think about what you would do in a given situation and then think about why. Here are three such thought experiments Shafir discussed during the lecture.

Risk aversion and risk seeking

1a. Would you prefer a sure gain of $100 or an equal chance of winning $200 or nothing?

1b. Would you prefer a sure loss of $100 or an equal chance of losing $200 or nothing?

As for 1a, most people prefer the sure gain of $100 — even though, technically, the probability of winning $100 is the same in both options. That’s because people are risk-averse when it comes to gains.

And as for 1b, most people prefer the gamble, or the equal chance of losing $200 or nothing — even though the probability of losing $100 is again the same in both options. That’s becausepeople are risk-seeking when it comes to losses.

This finding is in contrast to “expected utility theory,” or standard economic theory, which posits that people make decisions based on their final states of wealth. If that were true, people wouldn’t show a preference between a sure loss/gain and a gamble, if the probabilities were the same. Instead, people make these decisions based on gains and losses relative to their reference point.

The endowment effect

2a. You’re given a mug emblazoned with the name of your university. You’re asked if you would sell it for a price between $0 and $9.50. How much would you sell it for?

2b. You’re asked to choose between a mug emblazoned with the name of your university and the same amount of cash, somewhere between $0 and $9.50. How much is the mug worth to you?

These were two of the conditions in an experiment published by Kahneman, along with the behavioral economists Richard Thaler and Jack Knetsch. As it turns out, the median selling price was about $7 and the median “choosing” price was $3.50. In other words, participants valued the mug twice as much when they owned it.

This psychological phenomenon is known as the endowment effect. As Shafir wrote in one of his slides for the lecture: “People do not value having a mug. They value getting or giving up “their” mug.”

The endowment effect is one example of loss aversion: People are more sensitive to losing something they own than to gaining something new. In real life, having a $100 bill fall out of your pocket would probably upset you more than finding a $100 bill on the street would delight you.

Framing effects

We can be perplexed by our own decisions.Mikhail Goldenkov/Strelka Institute/Flickr

3a. Imagine that an unusual disease will kill 600 people. You can enact program A, and 200 people will be saved. Or you can enact program B, and there will be a one-third chance that 600 people will be saved and a two-thirds chance that nobody will be saved. Which program do you choose?

3b. Imagine that an unusual disease will kill 600 people. You can enact program C, and 400 people will die. Or you can enact program D, and there will be a one-third chance that nobody will die and a two-thirds chance that 600 people will die. Which program do you choose?

When faced with the situation in 3a, most people choose program A. But when faced with the situation in 3b, most people choose program D. Logically, this doesn’t make a lot of sense, since people have equivalent probabilities of people surviving under programs A and C.

The fact that people choose differently depending on how the decision is described is evidence of what psychologists call a framing effect. As Kahneman and Tversky explain in a 1984 paper, the reference points in problems 3a and 3b are different.

In 3a, the reference state is that 600 people die of the disease, and the outcomes are possible gains measured by the number of lives saved. In 3b, the reference state is that no one dies of the disease and the alternatives are possible losses measured by the number of deaths.

Kahneman and Tversky write that this effect “is as common among sophisticated respondents as among naive ones, and it is not eliminated even when the same respondents answer both questions within a few minutes.”

That observation calls to mind something Shafir told me when we met after the lecture: Even people who know everything there is to know about human decision-making still fall prey to cognitive biases. Being smart and educated doesn’t necessarily leave you immune.

If it didn’t quite inoculate me against flawed decision-making processes, learning about these psychological phenomena did help me appreciate how relatively little we understand about ourselves — and how much we have left to learn.

http://www.businessinsider.com/psychology-class-princeton-university-2016-11