1.Global Farming Recession Over? John Deere Good Numbers.

How much is priced in??? DE +45% Since Sept. 2016

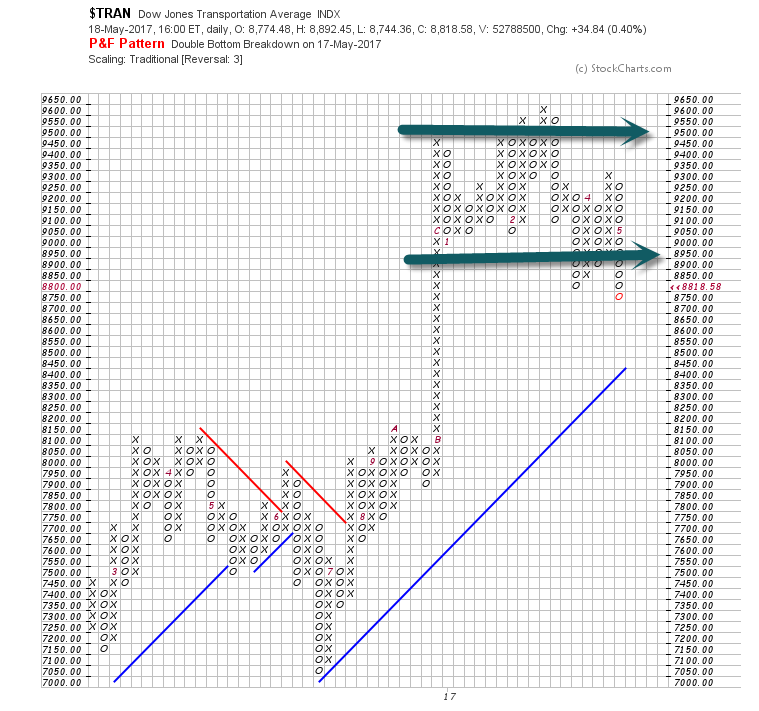

2.Regular Readers Know I Like to Watch the Transports….8% Correction Off Highs…Broke Thru Dec. 2016 Lows.

Transports break thru 2016 lows.

Transports over 8% correction from highs

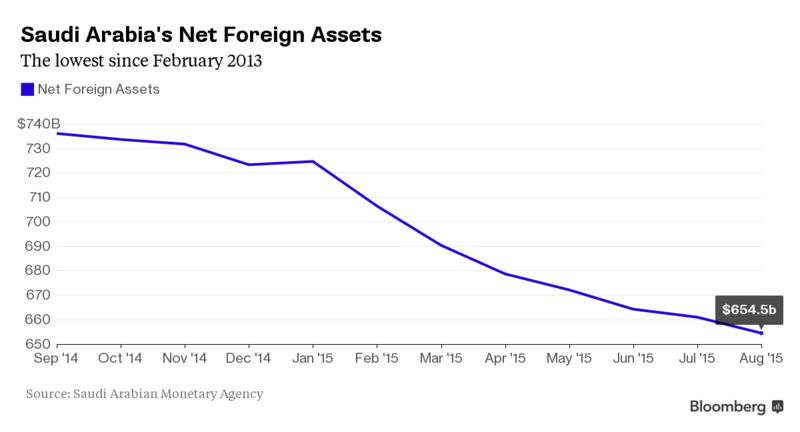

3.One Issue with Transports is Oil Back Over $50….Saudis Need $50+ for Aramaco IPO

The biggest Arab economy is showing signs of strain after oil prices tumbled about 50 percent over the past 12 months, pushing authorities to search for savings and sell bonds for the first time since 2007. The government, so far, has been short on specifics on how it will reduce spending, though planners are said to be considering measures long viewed as off-limits or unnecessary, including phasing out fuel subsidies and investing in renewable energy.

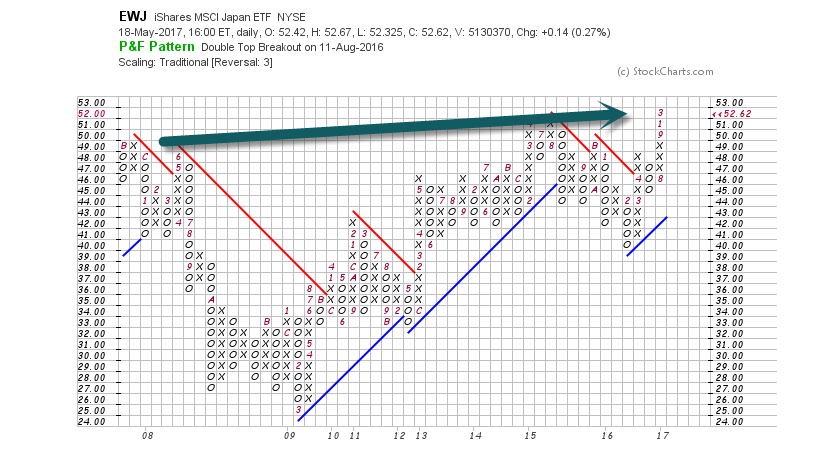

4.With All the Headlines on Emerging Markets and Europe ….Japan ETF Makes New All-Time Highs

This chart from Investing.com shows the trend in Japanese manufacturer sentiment over the last year:

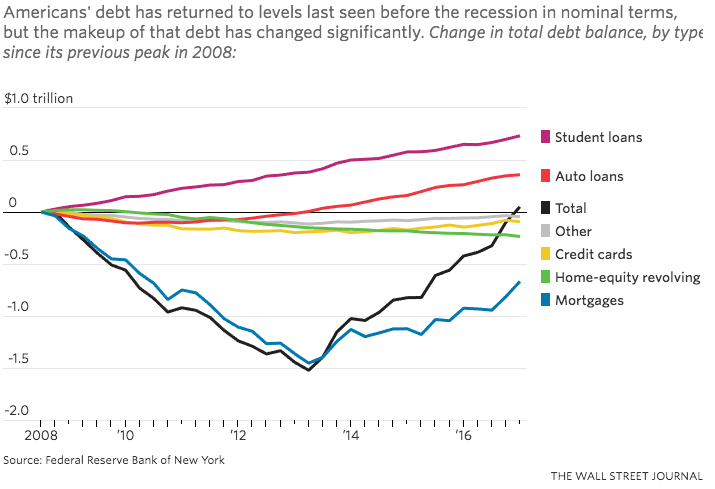

5.Follow up to this Week’s Debt Comments…The Big Household Debt Shift.

Household Debt

May 18, 2017 11:00am by Barry Ritholtz

Of all the charts I have seen recently on “peak debt,” this one provides some basis for evaluating the context as to what the debt components look like. (More on this shortly…)

U.S. Household Debt – 2008-2017

Source: Wall Street Journal

From The Big Picture

http://ritholtz.com/2017/05/household-debt-2/

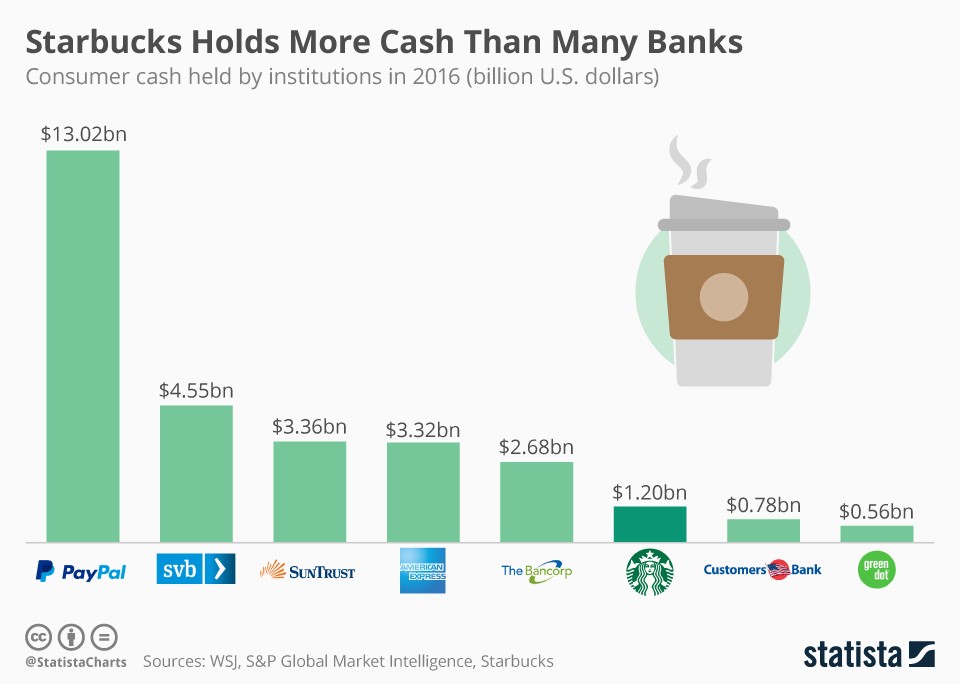

6.Starbucks Holding More Cash Than Many Banks.

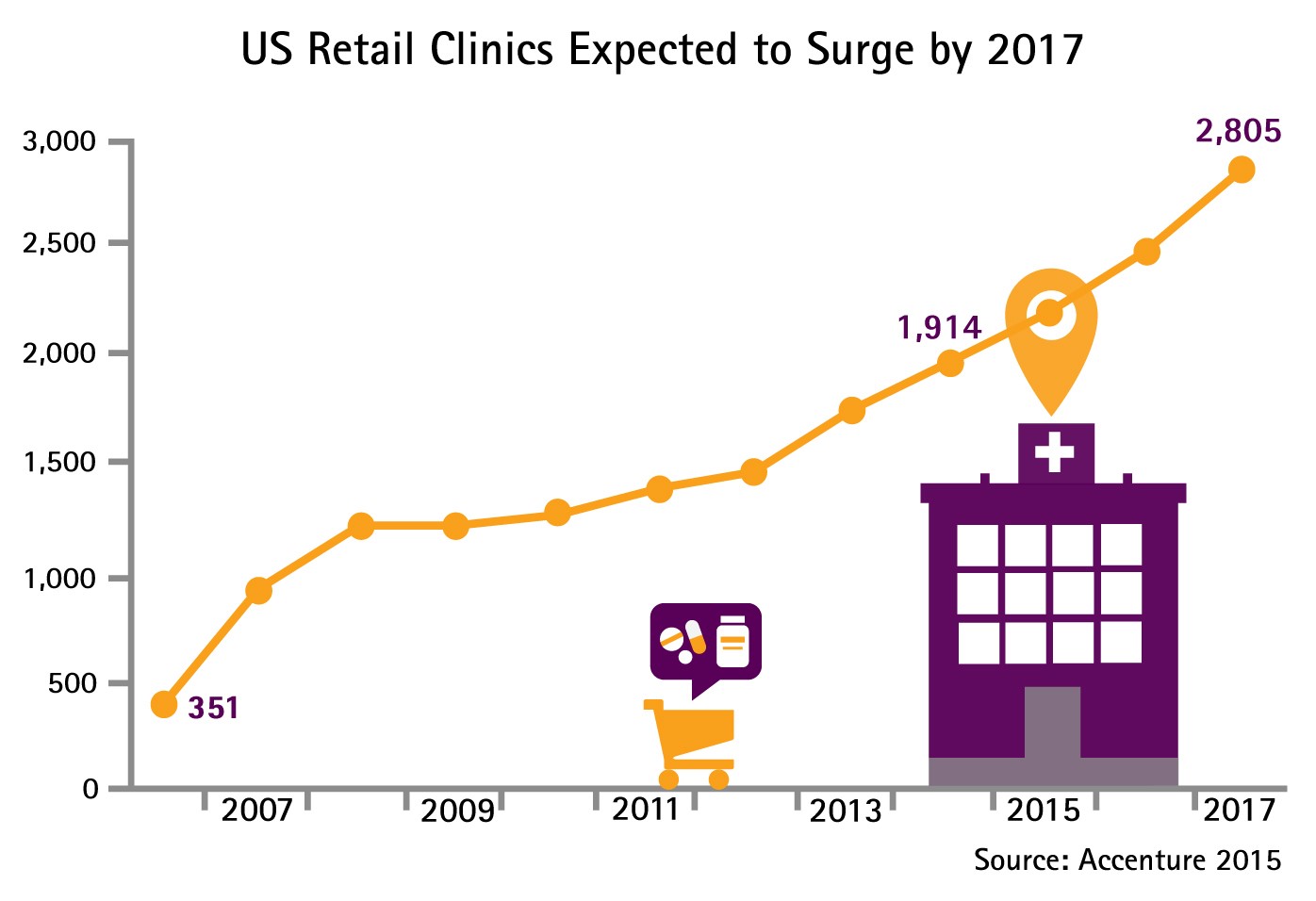

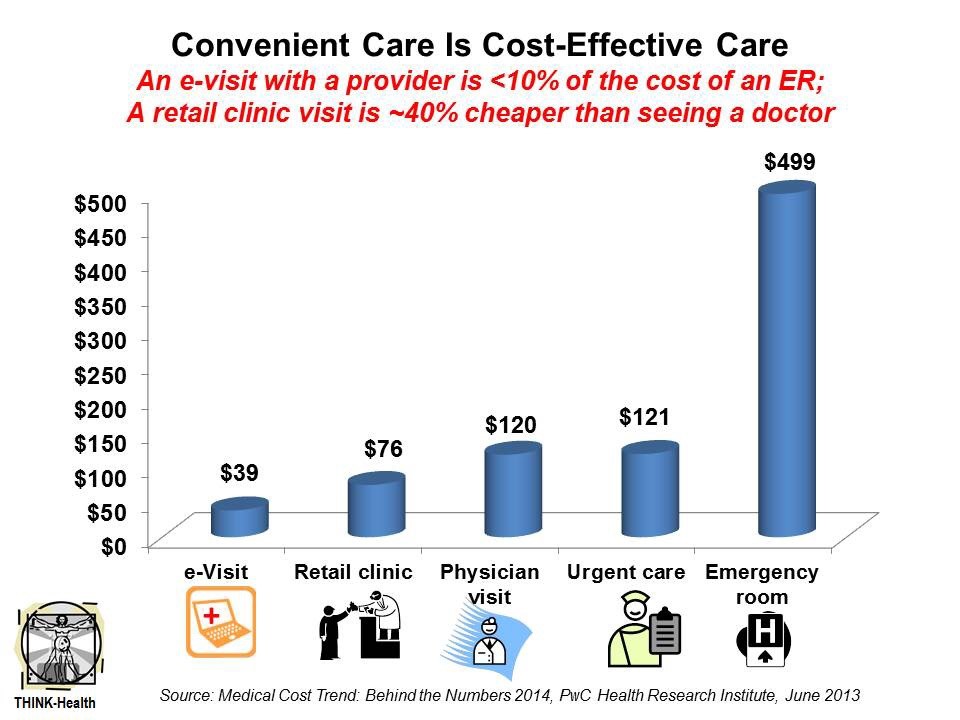

7.The Retail Health Clinic Explosion.

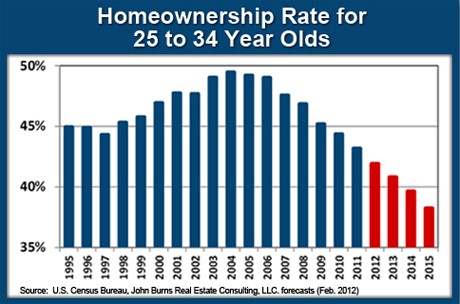

8.Move to 10% Down Payments would Fuel Coming Gen Y Housing Boom.

“Our goal – going back to regulatory reform – is should you move the down payment requirement from 20% to 10%? It wouldn’t introduce that much risk but would actually help a lot of mortgages get done,” Brian Moynihan told CNBC. BofA (NYSE:BAC) was the top U.S. mortgage lender ahead of the 2008 mortgage crisis, causing it to face greater losses, both from defaults and litigation, than any other bank.

www.seekingalpha.com

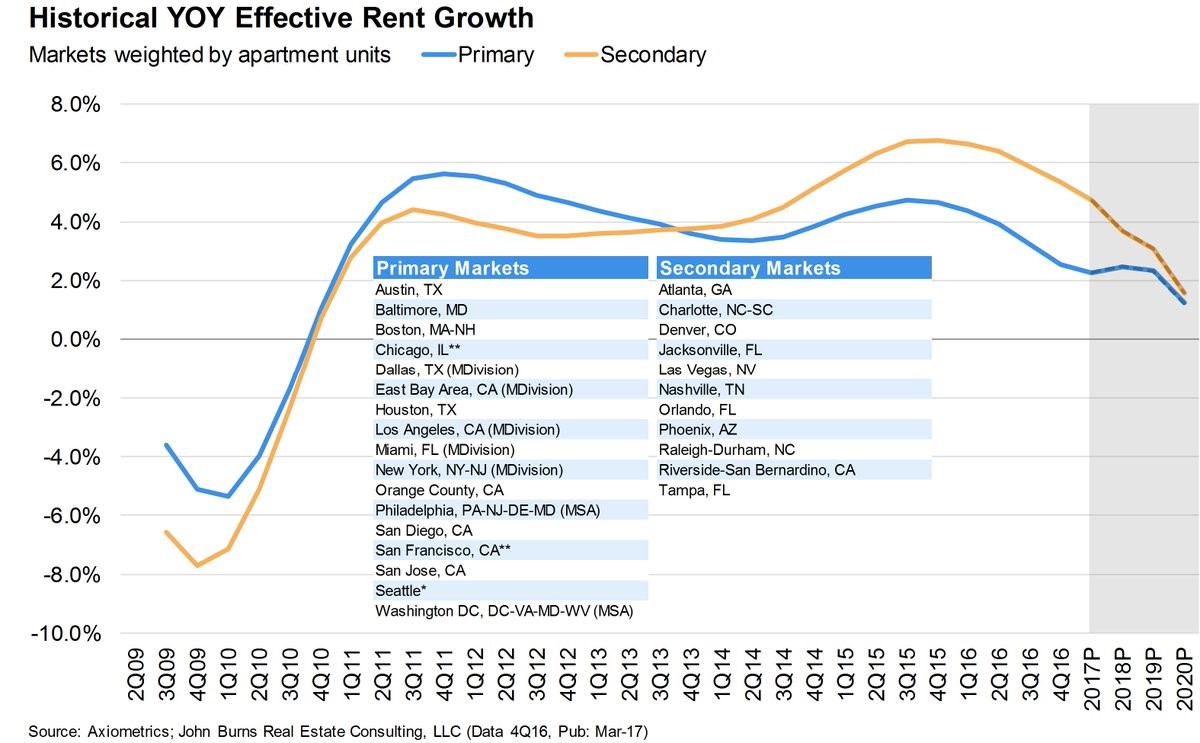

Demographic Driven Rent Booms Set to Rollover at End of 2016.

9.Read of Day….We have Discussed at Length the Shrinking of Listings in U.S. Stock Market…. the number of companies listed on global stock market exchanges has increased from about 23,000 in 1995 to 33,000 by the end of last year

Think Global to Avoid the Shrinking U.S. Stock Market

Posted May 17, 2017 by Ben Carlson

A lot has been written in finance circles in recent years about the shrinking number of publicly-traded U.S. corporations. In this piece I wrote for Bloomberg I discuss what it means for investors in a more globalized world and why it is likely not that big of a deal for diversified investors. I also think that a lot of the companies that went public in the 1990s were smaller companies that never should have IPO’d in the first place but I digress…

*******

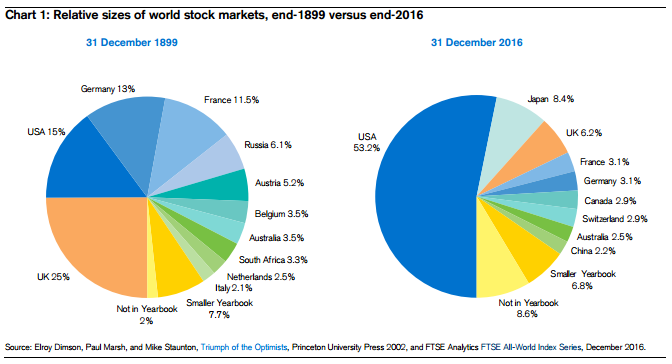

They say the winners get to write the history books. If we’re talking about the global stock market returns over the past 100-plus years then the U.S. gets exclusive rights to this story. Research from Dimson, Marsh and Staunton in their Global Investment Returns Yearbook 2017 show just how dominant the U.S. has been relative to other countries since the turn of the 20th century:

The U.S. has gone from making up 15 percent of the global stock market to more than 50 percent. However, as the U.S. stock market has grown relative to the rest of the world, it is actually getting smaller in other ways.

According to CRSP data, there were more than 9,100 U.S.-listed public companies in 1997. Today, that number is down to slightly more than 5,700. The Wilshire 5000, an index used as a proxy for all U.S. securities with readily available pricing data, holds just over 3,600 stocks as of the start of this year, down from more than 7,500 in 1998. So the number of stocks that trade on the exchanges has basically been cut in half over the past 20 years or so. There are a number of reasons for this change — increased regulations to go public, fewer IPOs, lax anti-trust laws, venture-backed companies staying private longer and a winner-takes-all marketplace in many industries.

Investors are worried that the shrinkage in the number of U.S. companies means that wealth and the markets themselves are becoming more concentrated in fewer and fewer hands. Fewer investment options could make it harder for investors to find adequate investment opportunities. For those investors who share these worries my advice would be to look abroad for more investment opportunities. While U.S.-listed companies have seen their ranks diminish since the 1990s, there are now more public companies than ever worldwide.

According to Dimensional Fund Advisors, the number of companies listed on global stock market exchanges has increased from about 23,000 in 1995 to 33,000 by the end of last year. So while the number of companies in the U.S. has shrunk the number of companies worldwide has exploded.

Emerging markets now account for greater than 50 percent of global gross domestic product but only around 10 percent of stock market capitalization. China makes up 15 percent of world GDP but just 3 percent of world stock market capitalization. India makes up around 1 percent of global stock market cap but accounts for more than 3 percent of worldwide GDP. The stock market is not the same thing as the economy, but this gives you an idea about how much room some of these markets may have to run in the years ahead if they can get their act together and make their equity markets more appealing to foreign or domestic investors.

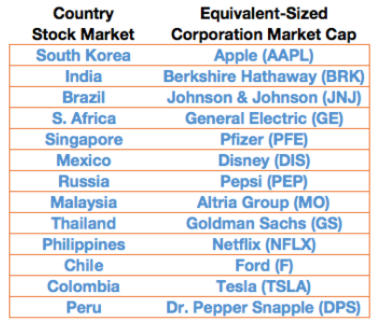

To get a sense of how small some stock markets around the globe really are, take a look at the following table which takes the market cap of a country’s stock market and matches it with a publicly traded company of similar size*:

Source: DFA

As a company, Apple is larger than any of these individual stock markets. The Mexican stock market is roughly the same size as Disney’s market cap. Goldman Sachs is larger than Thailand’s stock market.People tend to forget that the U.S. was once an emerging market that has become much more mature over time. One of the reasons these countries offer such a huge opportunity set is because many of these countries and companies have much more room to run since they’re so much smaller. Not only do foreign markets offer investors more securities to choose from but they’re also far cheaper than U.S. stocks at the moment.

Of course, there are legitimate reasons why the U.S. won the 20th century in terms of stock market performance. There are many structural advantages we have in place including a more dynamic economy, more wealth, better investor protections, more trust in our financial system, less corruption, the reserve currency, military strength, etc. But it would be silly to assume that the U.S. can expect to see the same type of relative growth to occur over the next century at its current size.

Originally published on Bloomberg View in 2017. Reprinted with permission. The opinions expressed are those of the author.

*After writing this piece for Bloomberg a few people wrote in to tell me some of the emerging market numbers (such as India) had to be off. The numbers I used were from a DFA research paper and DFA told me these market cap numbers were based on their investable universe of stocks in this countries based on things like market liquidity and availability of shares to trade in the public markets.

http://awealthofcommonsense.com/2017/05/think-global-to-avoid-the-shrinking-u-s-stock-market/

10.Why the Best Leaders Have Conviction

Dr. Travis Bradberry

FollowDr. Travis Bradberry

Coauthor EMOTIONAL INTELLIGENCE 2.0 & President at TalentSmart

Conviction in a leader is an incredibly valuable yet increasingly rare trait. It’s in short supply because our brains are wired to overreact to uncertainty with fear. As uncertainty increases, the brain shifts control over to the limbic system, the place where emotions, such as anxiety and panic, are generated.

This brain quirk worked well eons ago, when cavemen entered an unfamiliar area and didn’t know who or what might be lurking behind the bushes. Overwhelming caution and fear ensured survival, but that’s not the case today. This mechanism, which hasn’t evolved, is a hindrance in the world of business, where uncertainty rules and important decisions must be made every day with minimal information.

Craving Certainty

We crave certainty. Our brains are so geared up for certainty that our subconscious can monitor and store over two million data points, which the brain uses to predict the future. And that isn’t just a neat little side trick—it’s the primary purpose of the neocortex, which is 76% of the brain’s total mass.

Our brains reward us for certainty. If our nomadic ancestors were anxious about where their next meal was coming from, finding it would result in increased dopamine levels in their brains in addition to a full stomach. You get the same rush from listening to music that has a predictable repeating pattern or from completing a puzzle. Predictable activities satisfy our craving for certainty.

Great Leadership Requires Conviction

In business, things change so quickly that there’s a great deal of uncertainty about what’s going to happen next month, let alone next year. And uncertainty takes up a lot of people’s mental energy and makes them less effective at their jobs.

The brain perceives uncertainty as a threat, which sparks the release of cortisol, a stress hormone that disrupts memory, depresses the immune system, and increases the risk of high blood pressure and depression. These are things no leader wants her team to endure.

Leaders with conviction create an environment of certainty for everyone. When a leader is absolutely convinced that he’s chosen the best course of action, everyone who follows him unconsciously absorbs this belief and the accompanying emotional state. Mirror neurons are responsible for this involuntary response. They mirror the emotional states of other people—especially those we look to for guidance. This ensures that leaders with conviction put us at ease.

Leaders with conviction show us that the future is certain and that we’re all headed in the right direction. Their certainty is neurologically shared by everyone.

When leaders have conviction, people’s brains can relax, so to speak, letting them concentrate on what needs to be done. When people feel more secure in the future, they’re happier and produce higher quality work.

A leader who can demonstrate conviction will be more successful, and so will everyone she works with. Amplifying your sense of conviction is easier than you think. The following traits of leaders with great conviction will show you the way.

They’re strong (not harsh). Strength is an important quality in a leader with conviction. People will wait to see if a leader is strong before they decide to follow his or her lead. People need courage in their leader. They need someone who can make difficult decisions and watch over the good of the group. They need a leader who will stay the course when things get tough. People are far more likely to show strength themselves when their leader does the same.

A lot of leaders mistake domineering, controlling, and otherwise harsh behavior for strength. They think that taking control and pushing people around will somehow inspire a loyal following. Strength isn’t something you can force on people; it’s something you earn by demonstrating it time and again in the face of adversity. Only then will people trust that they should follow you.

They know when to trust their gut. Our ancestors relied on their intuition—their gut instinct—for survival. Since most of us don’t face life-or-death decisions every day, we have to learn how to use this instinct to our benefit. Often we make the mistake of talking ourselves out of listening to our gut instinct, or we go too far in the other direction and impulsively dive into a situation, mistaking our assumptions for instincts. Leaders with conviction recognize and embrace the power of their gut instincts, and they rely on some tried-and-true strategies to do so successfully:

They recognize their own filters. They’re able to identify when they’re being overly influenced by their assumptions and emotions or by another person’s opinion. Their ability to filter out the feelings that aren’t coming from their intuition helps them focus on what is.

They give their intuition some space. Gut instincts can’t be forced. Our intuition works best when we’re not pressuring it to come up with a solution. Albert Einstein said he had his best ideas while sailing, and when Steve Jobs was faced with a tough problem, he’d head out for a walk.

They build a track record. Leaders with conviction take the time to practice their intuition. They start by listening to their gut on small things and seeing how it goes so that they’ll know whether they can trust it when something big comes around.

They’re relentlessly positive. Leaders with conviction see a brighter future with crystal clarity, and they have the energy and enthusiasm to ensure that everyone else can see it too. Their belief in the good is contagious. While this might look natural, leaders with conviction know how to turn on the positivity when the going gets tough. Positive thoughts quiet fear and irrational thinking by focusing the brain’s attention on something that is completely stress free. When things are going well and your mood is good, this is relatively easy; when you’re stressing over a tough decision and your mind is flooded with negative thoughts, this can be a challenge. Leaders with conviction hone this skill.

They’re confident (not cocky). We gravitate to confident leaders because confidence is contagious, and it helps us to believe that there are great things in store. The trick, as a leader, is to make certain your confidence doesn’t slip into arrogance and cockiness. Confidence is about passion and belief in your ability to make things happen, but when your confidence loses touch with reality, you begin to think that you can do things you can’t and have done things you haven’t. Suddenly it’s all about you. This arrogance makes you lose credibility.

Confident leaders are still humble. They don’t allow their accomplishments and position of authority to make them feel that they’re better than anyone else. As such, they don’t hesitate to jump in and do the dirty work when needed, and they don’t ask their followers to do anything they aren’t willing to do themselves.

They embrace that which they can’t control. We all like to be in control. After all, people who feel like they’re at the mercy of their surroundings never get anywhere in life. But this desire for control can backfire when you see everything that you can’t control or don’t know as a personal failure. Leaders with conviction aren’t afraid to acknowledge what’s out of their control. Their conviction comes from an unwavering belief in their ability to control those things that they can. They don’t paint a situation as better or worse than it actually is, and they analyze the facts for what they are. They know that the only thing they really control is the process through which they reach their decisions. That’s the only rational way to handle the unknown and the best way to keep your head on level ground.

They’re role models (not preachers). Leaders with conviction inspire trust and admiration through their actions, not just their words. Many leaders say that something is important to them, but leaders with conviction walk their talk every day. Harping about the behavior you want to see in people all day long has a tiny fraction of the impact you achieve by demonstrating that behavior yourself.

They’re emotionally intelligent. The limbic system (where emotions are generated in the brain) responds to uncertainty with a knee-jerk fear reaction, and fear inhibits good decision making. Leaders with conviction are wary of this fear and spot it as soon as it begins to surface. In this way, they can contain it before it gets out of control. Once they are aware of the fear, they label all the irrational thoughts that try to intensify it as irrational fears—not reality—and the fear subsides. Then they can focus more accurately and rationally on the information they have to go on. Throughout the process, they remind themselves that a primitive part of their brain is trying to take over and that the logical part needs to be the one in charge. In other words, they tell their limbic system to settle down and be quiet until a hungry tiger shows up.

They don’t ask, “What if?” “What if?” questions throw fuel on the fire of stress and worry, and there’s no place for them in your thinking once you have good contingency plans in place. Things can go in a million different directions, and the more time you spend worrying about the possibilities, the less time you’ll spend focusing on taking action that will calm you down and keep your stress under control. Leaders with conviction know that asking “what if?” will only take them to a place they don’t want, or need, to go to.

They’re willing to take a bullet for their people. Leaders with conviction will do anything for their teams, and they have their people’s backs, no matter what. They don’t try to shift blame, and they don’t avoid shame when they fail. They’re never afraid to say, “The buck stops here,” and they earn people’s trust by backing them up. Leaders with conviction make it clear that they welcome challenges, criticism, and viewpoints other than their own. They know that an environment where people are afraid to speak up, offer insights, and ask good questions is destined for failure.

Bringing It All Together

Conviction assures people that their work matters. They know that if they focus all their energy and attention in a determined direction, it will yield results. This belief does more than put people at ease—it creates a self-fulfilling prophecy of success.

Have you ever worked for a leader with conviction? Did it bring out the best in you? Please share your thoughts in the comments section below as I learn just as much from you as you do from me.

ABOUT THE AUTHOR:

Dr. Travis Bradberry is the award-winning co-author of the #1 bestselling book, Emotional Intelligence 2.0, and the cofounder of TalentSmart, the world’s leading provider of emotional intelligence tests and training, serving more than 75% of Fortune 500 companies. His bestselling books have been translated into 25 languages and are available in more than 150 countries. Dr. Bradberry has written for, or been covered by, Newsweek, TIME, BusinessWeek, Fortune, Forbes, Fast Company, Inc., USA Today, The Wall Street Journal, The Washington Post, and The Harvard Business Review.