Sorry…Missed last couple days due to travel.

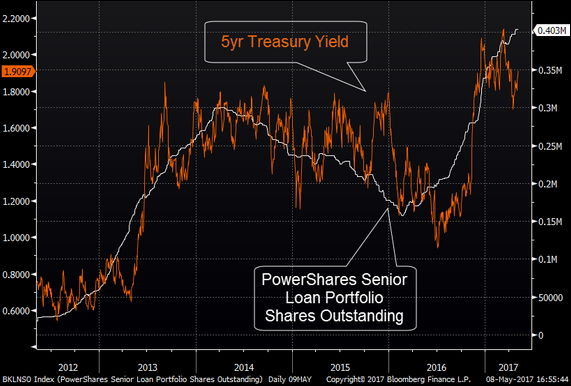

1.Advisors Betting on Bank Loans for Rate Rise.

Bank Loan ETF…Fixed Income Allocators Rushing to Plays on Rising Rates.

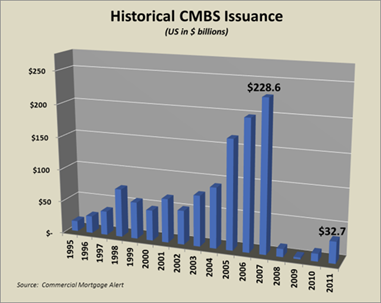

2.Banks Back in CMBS/MBS Game?

Wells Fargo is hoping to sell MBSs this year (without government guarantees) for the first time since the financial crisis, according to the head of the bank’s consumer lending division. “There’s been many many years since Wells Fargo (NYSE:WFC) has participated in any kind of private label market,” Franklin Codel told investors. We are trying to “see what we can do there to help bring confidence back.” www.seekingalpha.com

A mortgage-backed security (MBS) is a type of asset-backed security that is secured by a mortgage or collection of mortgages. The mortgages are sold to a group of individuals (a government agency or investment bank) that securitizes, or packages, the loans together into a security that investors can buy. The mortgages of an MBS may be residential or commercial, depending on whether it is an Agency MBS or a Non-Agency MBS; in the United States they may be issued by structures set up by government-sponsored enterprises like Fannie Mae or Freddie Mac, or they can be “private-label”, issued by structures set up by investment banks. The structure of the MBS may be known as “pass-through”, where the interest and principal payments from the borrower or homebuyer pass through it to the MBS holder, or it may be more complex, made up of a pool of other MBSs. Other types of MBS include collateralized mortgage obligations (CMOs, often structured as real estate mortgage investment conduits) and collateralized debt obligations (CDOs).[1]

https://en.wikipedia.org/wiki/Mortgage-backed_security

A Look At CMBS Collapse After Crisis.

3. JPMorgan tells banks to partner up

May 9, 2017 4:26 AM ET|By: Yoel Minkoff, SA News Editor

JPMorgan has some advice for regional banks: A deposit drain is coming, so merge while you can.

Those with $50B in assets or less could face a funding problem in coming years as the Fed goes about shrinking its massive balance sheet.

Bloomberg obtained a copy of the confidential presentation, which was entitled “Core Deposits Strike Back.”

Regional Bank ETF Big Trump Bump then Sideways

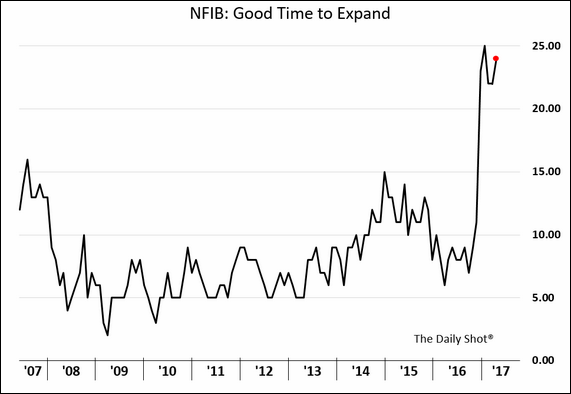

4.More Positive Small Business Data…..This is more juice for employment and wages.

The United States: More small businesses are saying that it’s a good time to expand. It’s unclear if this enthusiasm is in anticipation of lower taxes ahead. What happens if there is no substantial corporate tax cut over the next year?

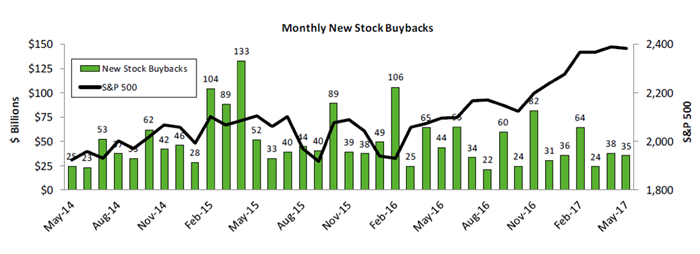

5.Buybacks and Margin Debt Update

Two source of support for U.S. equities—stock buybacks and margin borrowing—are kicking into higher gear, according to EPFR Global sister company, TrimTabs. In recent reports, TrimTabs CEO David Santschi noted that “Margin debt at New York Stock Exchange member firms soared to a record high for the third

consecutive month [in March]. Margin borrowing rose $8.8 billion, or 1.7 percent, to $536.9 billion. This uptrend bodes well for U.S. equities because margin debt tends to be a good longer-term indicator.”

Santschi added that a pickup in stock buyback volume is “encouraging because buybacks have been in a two-year downtrend.” Interim peaks have continued to decline since the volume reached a record $133 billion in April 2015.

Cameron Brandt is Director of Research for EPFR Global, an Informa Financial Intelligence company

6.The Biggest Tax Cut in History is Secular….The Drop in Gas Prices. Massive Supply Continues….

Chart of the Day

Today’s chart presents the current, long-term trend of West Texas Intermediate crude. Today’s chart illustrates how the price of crude oil had been confined to a steep downward sloping trend channel as a result of a tremendous increase in supply. Earlier this year, the price of oil peaked at over $54 per barrel as the oil hit resistance (see red line) of its six-year downtrend channel. Since that peak, oil has worked its way lower (now trades in the mid-forties) though still trades near resistance.

Notes:

Where should you invest? The answer may surprise you. Find out right now with the exclusive & Barron’s recommended charts of Chart of the Day Plus.

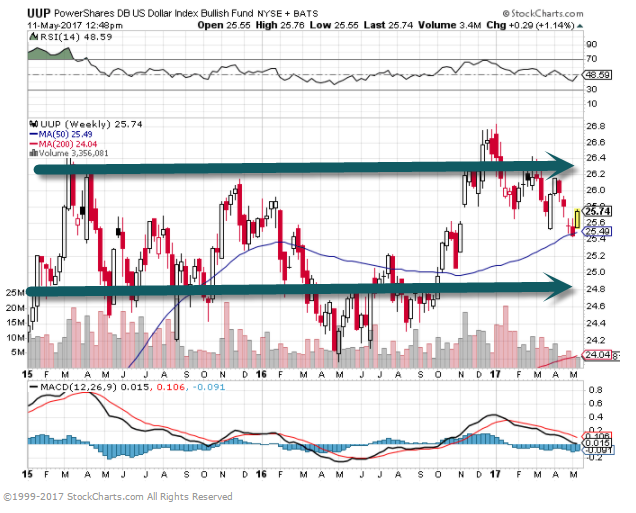

7.The Chart to Watch for Emerging Markets Equity is Dollar Bull ETF….Dips Back into 3 Year Range.

Dollar Down=Emerging Markets Up.

8.Follow Up to My Earlier in Week Comments on Credit Card Companies Breaking Down and Adding to Loan Loss Reserves….Watch the Retailers with Heavy Use of Store Brand CC.

Profits From Store-Branded Credit Cards Hide Depth of Retailers’ Troubles

By MICHAEL CORKERY and JESSICA SILVER-GREENBERGMAY 11, 2017

Macy’s in Herald Square in Manhattan last week. Branded credit cards accounted for 39 percent of the company’s profit last year, up from 26 percent in 2013 CreditJohn Taggart for The New York Times

Department stores and big name retailers are increasingly making the hard sell to sign up customers for credit cards at the register. The store cards promise deep discounts on clothing, furniture and electronics, and are tough for shoppers to resist.

For some retailers, those credit cards are not just a sales tool, but also an essential way to bolster their struggling businesses — a trend that has worrisome implications for the industry and its customers.

The store cards, with steep interest rates that are often twice that of the average credit card, generate a rich profit stream for retailers at a time when many of America’s traditional retailers are losing the battle for sales against Amazon and other e-commerce rivals. Those profits on plastic are helping obscure the true extent of the industry’s pain, a major pressure point for a piece of the economy that employs one in 10 Americans.

Weak consumer spending, digital competition and changing shopping habits have already roiled retailers. In recent months, the industry has shed tens of thousands of workers, making it one of the job market’s weakest links. Macy’s reported a sharp drop in earnings on Thursday, sending its stock spiraling and dragging down the rest of the industry.

But the businesses may be in worse shape than they appear, since store cards are a shaky foundation. If more consumers fall behind on their payments, the profits could dry up, intensifying retailers’ troubles.

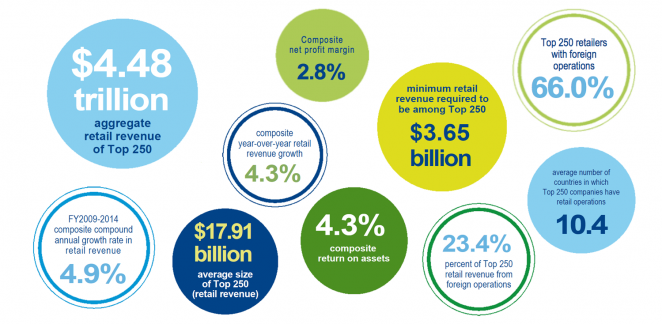

Last Year’s Top 250 in Retailers…..Composite net profit margin 2.8%….Composite Return on Assets 4.3%

2016 TOP 250 GLOBAL POWERS OF RETAILING

https://nrf.com/news/2016-top-250-global-powers-of-retailing

9.Americans will talk about sex and infidelity before they talk about this…

Here’s why you shouldn’t keep secrets

This woman, like many Americans, is keeping her finances a secret.

By JACOBPASSY

People are willing to dish some salacious details about their lives before they tell you how much money they make.

More than half of all people keep their finances a secret from those close to them, according to new research from Columbia Business School. Finances, such as the amount of money someone has, were the third most commonly kept secret, based on the survey of more than 5,000 people over the age of 18 across the U.S. The most-kept secret the study was having lied to someone followed by their romantic desires. Other secrets people frequently held were thoughts related to sexual behavior, infidelity and disliking a friend or being unhappy with their social life.

That so many people keep their finances private falls in line with other recent research. Nearly 25% of people between the ages of 18 to 34 admitted that they lied to a spouse about money, according to a 2011 study from Forbes and the National Endowment for Financial Education. And research from Ameriprise Financial found that roughly 80% of parents hid details regarding inheritance from their adult children.

This willingness to keep one’s personal finances under wraps stems from people’s embarrassment and/or social awkwardness around discussing money rather than something more nefarious, said Robert Finley, a certified financial planner and principal at Illinois-based advisory firm Virtue Asset Management. “For most people, flashing money is not what they want to do,” Finley said. “They feel it’s poor manners to talk about your money situation.”

But keeping finances a secret could have unintended consequences. While most spouses claim they don’t fight about money, not discussing it at all could fuel resentment and lead to financial problems. Indeed, financial troubles are one of the top causes of divorce — after basic incompatibility and infidelity — according to a recent survey conducted by the Institute for Divorce Financial Analysts. Children might struggle with their own financial planning if they don’t know what kind of inheritance awaits them, if any. And retirees risk leaving gaps in their will if they aren’t forthright about their investments and other financial matters, Finley said.

People shouldn’t be afraid to discuss their finance, Finley said. For those who can’t afford a financial adviser, they shouldn’t feel like they have to plan their financial life alone or, worse, neglect it. Friends and family could end up helping identify retirement and investment strategies or unnecessary fees someone is paying, he said. “It is a tragedy that people are not more transparent about their finances,” Finley said. “One of the best ways to learn in life is from other people’s experiences and their mistakes.”

Being too public about money matters has its own risks, ranging from being vulnerable to fraud to feeling social pressure. You might be expected to loan friends and family money, if you have a lot more money than they do, said Thomas Balcom, founder of Florida-based advisory firm 1650 Wealth Management. Balcom described instances where adult children took advantage of parents after being led to believe they had “plenty of money,” even at the expense of their parents’ own retirement.

Keeping secrets about financial difficulties can also be bad for a person’s mental and emotional health. Keeping a heavy secret is correlated with depression, anxiety and stress, which all can lower physical health, said Michael Slepian, a professor at Columbia Business School and co-author of the report. Most of these negative effects stem from people’s predisposition to think about the secret the last thing at night and the first thing in the morning, and not necessarily the fear of being exposed, he said. Seek help from someone else, Slepian said, such as a trusted friend, financial adviser or accountant. “You might gain a lot by talking to other people.”

10. 5 Distorted Thought Patterns and How to Change Them

We all have cognitive distortions.

Posted Apr 22, 2017

Life is all about how you think. Success or failure, however you define them, will only amplify your thought processes, especially unhealthy patterns of thinking. Right behind your thoughts are feelings. If your thinking is unhealthy, how you feel about yourself will most likely hold you down. And since emotions are more powerful than logic, so your feelings can overpower you and send you into a very deep ditch.

Most of us are so focused on getting somewhere or obtaining something that we forget that happiness lives in the way we see the world, our beliefs about ourselves, and the way we think. What you think and how you think will determine your path.

So — how you think. Cognitive distortions are simply ways that our mind convinces us of something that isn’t really true. These inaccurate thoughts are usually used to reinforce negative thinking or emotions — telling ourselves things that sound rational and accurate, but really only serve to keep us feeling bad about ourselves by playing broken records. There are many cognitive distortions. Here are what I believe are the most common cognitive distortions. See if any resonate with you.

1 Filtering

We take the negative details and magnify them, while filtering out all positive aspects of a situation. For instance, a person may pick out a single, unpleasant detail and dwell on it exclusively, so that their vision of reality becomes darkened or distorted.

Do you filter? If so, write it down. How does that type of thinking bring you anxiety? How do you act because of this distortion? How does it play out in your day to day?

2 Polarized (“Black and White”) Thinking

In polarized thinking, things are either “black or white”: We have to be perfect, or we’re a failure; there is no middle ground. You place people or situations in “either/or” categories, with no shades of gray or allowing for the complexity of most people and situations. If your performance falls short of perfect, you see yourself as a total failure.

Is your thinking polarized? If so, when? A lot of this happens in business and in sports. How does that type of thinking create anxiety?

3 Overgeneralization

This cognitive distortion involves coming to a general conclusion based on a single incident or piece of evidence. If something bad happens once, for example, we may expect it to happen over and over again. A person may see a single unpleasant event as part of a never-ending pattern of defeat. This happens a lot when we’re dating: She didn’t return my text within three minutes, so she must be dating someone else now.

Do you overgeneralize? If so, when? How does that type of thinking create anxiety? What’s your behavior because of this distortion?

4 Jumping to Conclusions

Without individuals saying so, we are sure know what they are feeling and why they are acting the way they do. In particular, we are able to determine how people are feeling toward us.

For example, a person may conclude that someone is reacting negatively toward them, but doesn’t actually try to find out if they are correct. Or a person may anticipate that things will turn out badly, and feel convinced that their prediction is already an established fact. This happens a lot in relationships and friendships.

Do you jump to conclusions? If so, when? How does that type of thinking create anxiety? What’s your behavior because of it?

5 Catastrophizing

This is also referred to as “magnifying or minimizing.” We expect disaster to strike, no matter what. We hear about a problem and then roll out what-if questions (e.g., “What if tragedy strikes?” “What if it happens to me?” “What if I starve?” “What if I die?”).

For example, a person might exaggerate the importance of insignificant events (such as their mistake, or someone else’s achievement). Or they may inappropriately shrink the magnitude of significant events until they appear tiny (for example, a person’s own desirable qualities or someone else’s imperfections).

Do you catastrophize? If so, when? How does it create anxiety? How does it play out for you day-to-day?