1.Will Corporations Switch from Buybacks to Capital Spending in 2017?

Buyback ETF vs. S&P…New Trend?? Buybacks added fuel to this bull run.

Buybacks 4th qt. 2016 half the previous qt. and lowest since 2014

For years, American companies’ loved nothing more than using their cash to buy their own stock. But tastes may be changing.

But the data also suggest a shift is underway. In the fourth quarter, nonfinancial companies bought back a net $323 billion in equities, at a seasonally adjusted annual rate, half as much as in the previous quarter and the lowest amount since the second quarter of 2014.

And unlike the third quarter, companies’ capital spending surpassed their cash flows, which is a return to normal. Companies usually borrow to spend, betting the payoff from the investments more than pay off the debt.

https://www.wsj.com/articles/stock-buybacks-are-so-yesterday-1489088699

2.Regional Banks vs. S&P…After Massive Trump/Rising Rates Rally for Banks…Sideways Narrow Range Since Dec.

This chart compares KRE Regional Banks to S&P…See Sideways Box.

3.Follow Up to My Earlier Charts this Week on Large Cap Outperformance Versus Small Cap 2017..What Does it Mean?

Mark Hulbert Marketwatch

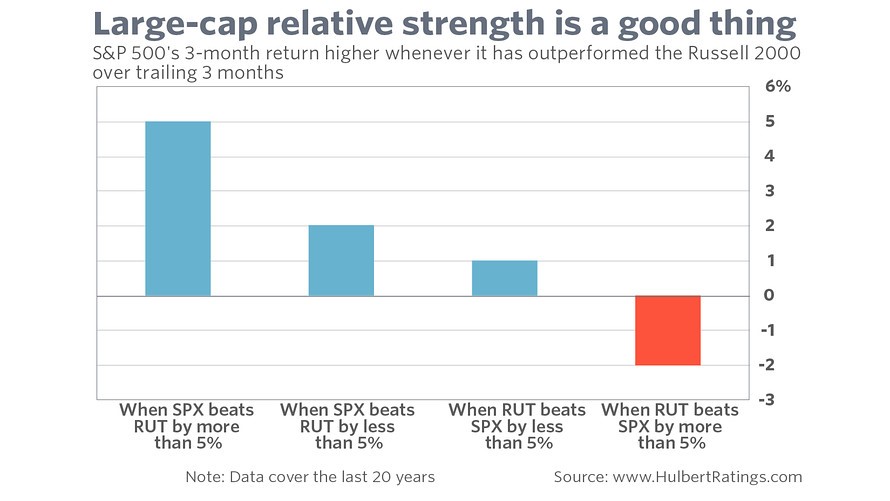

Take what I found upon entering into my PC’s statistical package 20 years of data for both the S&P 500 and the Russell 2000. I focused on how the former index performed relative to the latter, over periods as short as the trailing month to as long as the trailing 12 months. I then correlated these relative strength measures to how the S&P 500 performed subsequently over periods ranging from one month to a year.

In all cases, S&P 500 relative strength was a bullish omen. While not all of the correlations were significant at the 95% confidence level that statisticians use to determine that a pattern is genuine, many of them were. None of the correlations provided support for what conventional wisdom would have you believe.

Some of the most significant correlations existed at the three-month horizon, and they’re summarized in the table above. Notice that the S&P 500 on average gained more than 5% over the subsequent three months whenever, over the prior three months, it beat the Russell 2000 by more than 5% — as is the case since early December.

In contrast, the S&P 500’s average three-month return was a loss of more than 2% following periods in which it previously lagged the Russell 2000 by more than 5%.

Needless to say, these results don’t guarantee that the market will rise over the next three months. Large-cap relative strength is just one of many indicators that claim statistical significance, and not all of them are bullish right now.

But if you’re worried about the market because of the Russell 2000’s recent weakness, you can relax

http://www.marketwatch.com/story/this-bullish-indicator-has-investors-feeling-bearish-2017-03-17

4.Reasons for Small Cap Lag…

Nick Colas

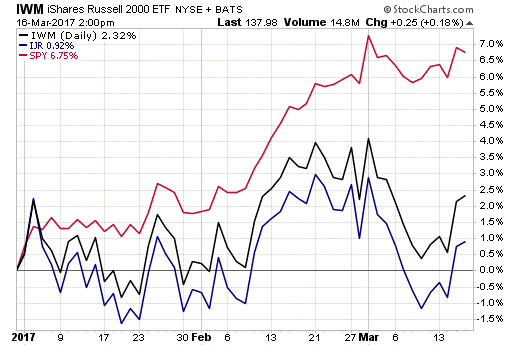

But look at the performance of the two largest small-cap ETFs, the iShares Russell 2000 ETF (IWM) and the iShares Core S&P Small Cap ETF (IJR)—each tracking a different small cap index—relative to the SPDR S&P 500 (SPY) year-to-date:

Chart courtesy of StockCharts.com

That lag, according to ConvergEx’s Nick Colas, could have “three perfectly reasonable explanations.”

First, it could be that small-caps are just waiting for large-caps to catch up. In 2016, IWM was up more than 21%, and IJR was up 26%, while SPY rallied only 12%. Maybe small-caps are just waiting for their larger-cap counterparts to reach them, he said.

Colas also said that small-caps are lagging notably because driving the S&P 500’s outsized gains this year are some of its largest names—Amazon, Google, Facebook. In other words, this has truly been a rally fueled by large-cap companies.

Finally, it could be due to sector weightings, which are very different between the S&P 500 and a small-cap index such as the S&P 600, he said: “Tech, industrials and consumer staples are all more than 500 basis points different in weighting” between the two benchmarks. That matters, because this year sector performance has been dispersed.

http://www.etf.com/sections/features-and-news/why-small-cap-etfs-are-underperforming?nopaging=1

5.China’s Continuing Credit Boom…China Accounts for One-Half of All New Credit Created Globally Since 2005.

Jeff Dawson, Alex Etra, and Aaron Rosenblum

Liberty Street Economics, Feb 27, 2017

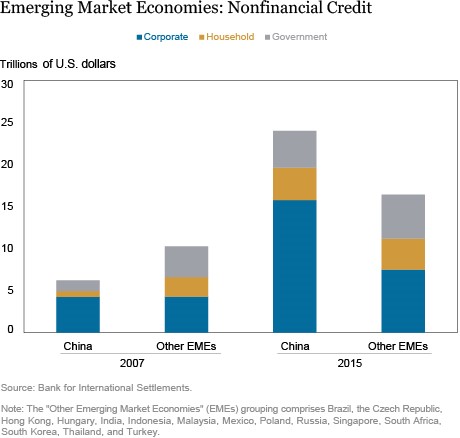

Debt in China has increased dramatically in recent years, accounting for roughly one-half of all new credit created globally since 2005. The country’s share of total global credit is nearly 25 percent, up from 5 percent ten years ago.

Nonfinancial debt in China has increased from roughly $3 trillion at the end of 2005 to nearly $22 trillion, while banking system assets have increased sixfold over the same period to over 300 percent of GDP. In 2016 alone, credit outstanding increased by more than $3 trillion, with the pace of growth still roughly twice that of nominal GDP

Credit Offers Less Boost to Growth

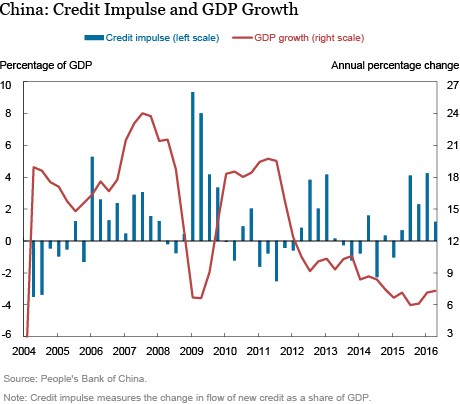

An interesting development is that credit appears to be providing less of a boost to Chinese GDP growth than it used to. As shown in the chart below, the credit impulse—the change in the flow of new credit as a percentage of GDP—appears to be providing less bang to output for each additional yuan of credit, underscoring questions over how much lending is going to unproductive “zombie” companies. Improving credit efficiency going forward will require reforms, such as hardening budget constraints at state-owned enterprises and local governments, reducing implicit and explicit guarantees in the financial system, and slowing aggressive balance sheet growth at smaller financial institutions.

Drivers of China’s Credit Growth

As seen in the chart below, rising nonfinancial sector debt was driven initially by a surge in corporate borrowing in response to the global financial crisis. This additional debt was comprised mostly of medium- and long-term corporate loans related to infrastructure and property projects.

Excellent full read on The Big Picture Blog

http://ritholtz.com/2017/03/chinas-continuing-credit-boom/

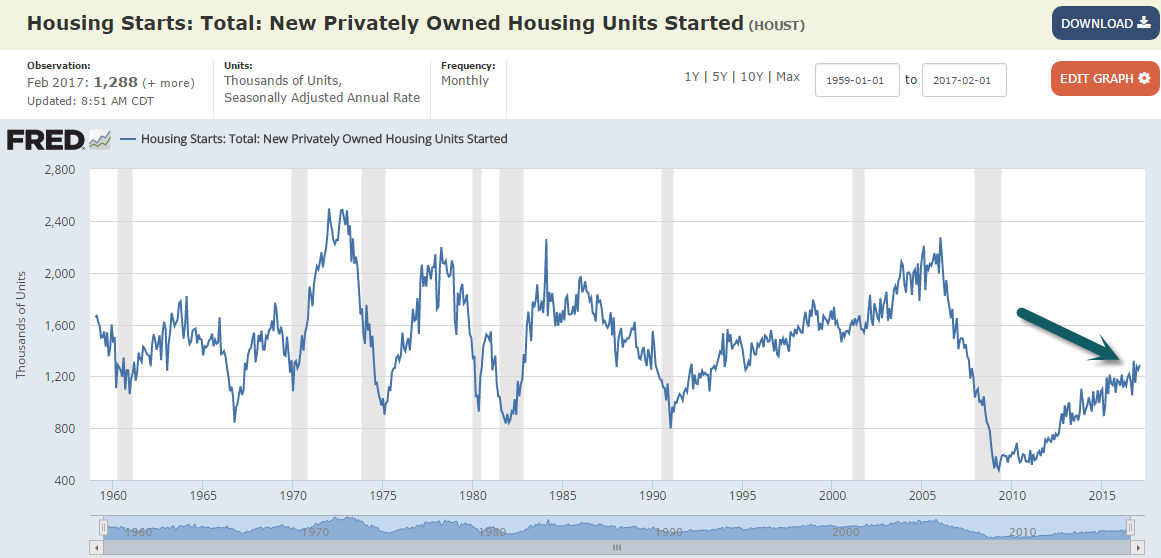

6.Single Family Housing Starts Come in Above Estimates….+6% Y over Y….Room to Run on Chart.

Housing Starts Privately-owned housing starts in February were at a seasonally adjusted annual rate of 1,288,000. This is 3.0 percent (±13.0 percent)* above the revised January estimate of 1,251,000 and is 6.2 percent (±10.4 percent)* above the February 2016 rate of 1,213,000. Single-family housing starts in February were at a rate of 872,000; this is 6.5 percent (±10.9 percent)* above the revised January figure of 819,000. The February rate for units in buildings with five units or more was 396,000

https://www.census.gov/construction/nrc/pdf/newresconst.pdf

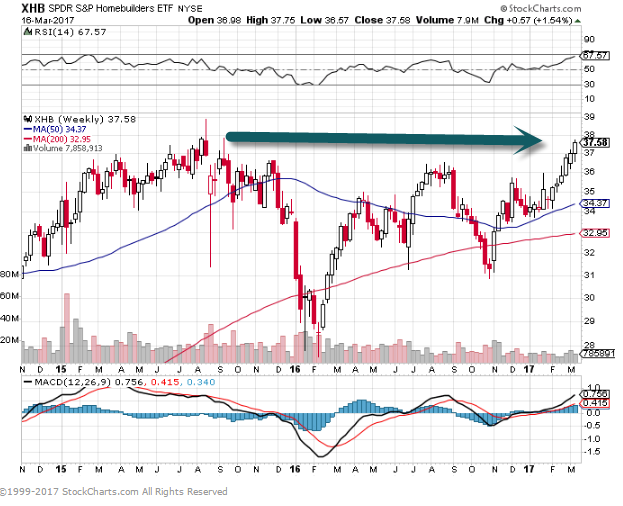

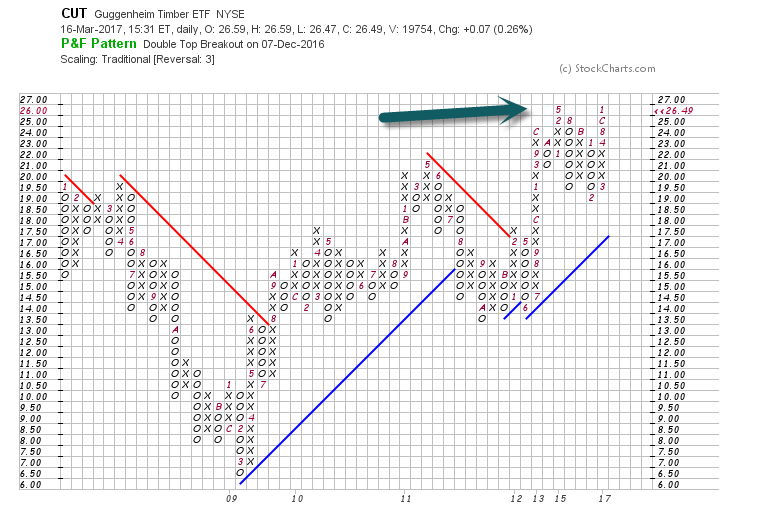

7.Homebuilders and Lumber About to Make New Highs….Homebuilders #1 Sub-Sector for Last 8 Weeks.

Lumber ETF About to Make New Highs.

8.What Can Trump Get Done? 3 Factions of Party?

The Undeniable Emergence of 3 Republican Parties

Talk last fall of a divided GOP wasn’t that off the mark, even with a Republican president.

By

GREG VALLIERE

March 15, 2017 1:09 p.m. ET

We wrote regularly last year about the potential breakup of the Republican Party, but that seemed moot after Donald Trump’s stunning upset. Surely Trump would unify a party looking for leadership — but it hasn’t happened, and now there are three distinct Republican factions, with major implications for policy.

1) THE CHAMBER OF COMMERCE FACTION: Paul Ryan is admired by Republicans who like free trade, business tax breaks and entitlement reform — but he’s loathed by the hard-core GOP base, which dismisses his “Obamacare lite” proposal.

The Breitbart alt-right regularly mocks him, as do many party activists. Once considered the party’s rising star, a good-guy brainiac and future president, Ryan and his faction are headed under the bus if the Obamacare replacement dies.

2) THE TEA PARTY REBELS: They made John Boehner’s life a living hell, and now they’re after Ryan. They don’t want federally subsidized health care, period. Many in the base love them, but at some point these House rebels have a responsibility to govern — and if you think they’re obstructionist now, just wait until the looming debt ceiling fight, which begins today. Default on federal debt? They’d love to!!

3) THE STEVE BANNON POPULISTS: This is the newest and most intriguing faction — fiercely populist and devoted to the white blue-collar workers that Hillary Clinton ignored. This faction hates free trade, doesn’t care much about the deficit, and wants to spend on highways, defense, job training, etc. This faction has no stomach for Ryan, to put it mildly, because he would curb entitlements and they would like to expand them.

Then there are the stumbling, predictable Democrats, still without much of a strategy other than obstructing. Democrats would like to work with Trump on infrastructure — and they don’t have a major beef with Supreme Court nominee Neil Gorsuch, who is headed for confirmation. This infuriates the Democrats’ base, which wants red meat and already is dreaming about Elizabeth Warren.

This bizarre mix needs a dynamic leader, and there’s one in the White House. But aside from one excellent speech to Congress, Trump has seemed tentative. He’s the greatest self-promoter in the history of American politics, but it’s starting to look like he cannot grasp the intricacies of policies like health reform, and he has a staff that has ties to all three GOP factions, which gives the impression that no one is in charge.

The markets have to pay attention because Trump may have picked the wrong horse (Ryan) on health reform, and he’s losing allies — not just John McCain and Lindsey Graham, they were gone from the get-go. But when Trump starts losing respected Senators like Rob Portman, that’s a big deal; it does not bode well for other legislative priorities.

Is this just a rough patch for the Republicans, or is this a party that’s incapable of governing and compromising? Trump has to step up and take charge — and as usual he may have to change the subject: Somali pirates, Iranian speedboats, or Kim Jong Un?

Valliere is the Washington-based chief global strategist with Horizon Investments

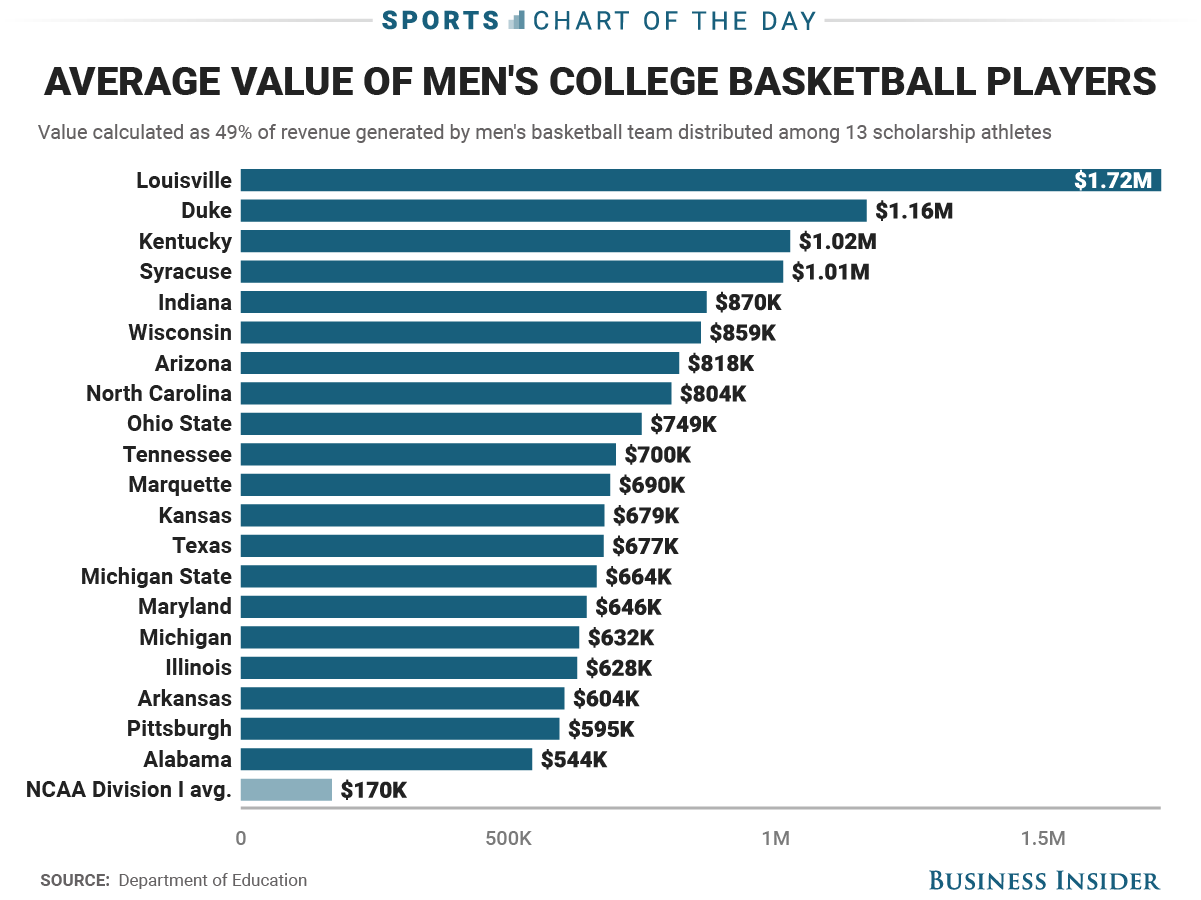

9.The average Division I men’s basketball player is worth $170,098 per year to his school

The average college basketball player at the University of Louisville would be worth $1.7 million per year if they were able to play in a free market system and receive compensation in a manner similar to that of the NBA.

We calculated the Fair Market Value of college basketball players at the 20 schools that bring in the most revenue from their men’s basketball program, according to data provided by the Department of Education. Using the NBA’s most recent collective bargaining agreement in which the players receive a minimum of 49% of all revenue, each school’s men’s basketball revenue was split between the school and the athletes with the players’ share divided evenly among the 13 scholarship players.

Using this method, we can estimate that the University of Louisville has the most valuable players at $1.72 million per year based on the program’s $45.6 million in annual revenue. Overall, the average Division I player is worth $170,098 per year with the 351 Division I basketball programs taking in more than 4.5 million in revenue on average each year.

Diana Yukari/Business Insider

http://www.businessinsider.com/college-basketball-player-value-2017-3

10.Where Are the Trustworthy Leaders?

Look for these six qualities backed by research.

Posted Mar 16, 2017

We need leaders, if only for the simple reason that we can’t do everything ourselves. The perils of giving power to someone whom we ultimately don’t trust—who can make our lives better or worse in large and small ways—seem ever present.

Research cautions us against trusting leaders simply because they agree with us. A leader who’s trustable for the long term must have qualities that transcend the immediate circumstances.

Here are some tips on what to look for in trustworthy leaders.

- They do what they say they will do.

This may seem like a bit of a truism. But decades of research in social psychology finds low correlations between one’s attitudes and behavior. In fact, it’s pretty easy for people to say one thing and do another. A trustworthy leader is mindful of this natural tendency. Gandhi said we experience happiness when what we think, say, and do are in harmony. Consistency in thoughts, words, and actions also make leaders more trustworthy.

- They are transparent in their decision making.

It requires special skill to be able to convey to others why you do what you do without being defensive or giving away your game plan. Trustworthy leaders have a knack for making us feel that we are working side by side with them. When they share their decision-making process so that we can understand their reasoning at each step, we trust them. And we often learn something in the process.

- They have a non-hostile sense of humor.

In the moment, it might be fun to laugh at someone’s expense. But when we are around someone with a tendency to do this, we may keep our guards up so that we aren’t the target their jokes in the future. It’s hard to relax when we don’t trust the leader to respond in a kind way. Abraham Maslow said one of the most important characteristics of a self-actualized person is a non-hostile sense of humor. Such people have the wisdom to know how to laugh at human nature and circumstances without being cruel about it.

- They listen.

Listening is more than simply saying “gotcha” at the end of the sentence. A trustworthy leader listens carefully and remembers what’s been said—and what hasn’t been said. They know how to put themselves in others’ shoes. They’re equally open to praise and criticism and look for the grain of truth in the criticisms. They know the value of having a devil’s advocate. They appreciate alternative points of view and welcome others’ input in decision-making processes.

- They have our best interest at heart.

This is different from having our interest at heart when that interest happens to align with theirs. The most trusted leaders are those who will forego personal gain to serve the interest of the group. In Simon Sinek’s book Leaders Eat Last, the author explains how leaders can build trust by creating an environment in which everyone feels safe. When people feel safe, meaning their jobs, homes, or basic sense of security are not being threatened—and the leader sends a clear signal that it’s a priority to maintain their safety—they are much more likely to trust the leader.

- They have self-awareness and they trust themselves.

A trustworthy leader is self-aware enough to notice and cultivate the qualities mentioned here. Self-trust comes from practiced self-awareness. It’s important to distinguish between phony self-trust, which is defensive and self-centered, and authentic self-trust, which involves listening to oneself with kindness and rigorous honesty. Self-awareness can be cultivated through a meditation or spiritual practice that provides tools for self-inquiry.

Copyright Tara Well, 2017, all rights reserved.

You’re invited to join my Facebook Group to discuss this blog and read more on developing self-awareness and trust in yourself and others. Also, visit The Clear Mirror to learn about the mirror meditation that reduces stress and increases compassionate self-awareness, follow me on Twitter and Instagram, and take the Mirror Meditation Challenhttps://www.psychologytoday.com/blog/the-clarity/201703/where-are-the-trustworthy-leadersge delivered daily to your inbox.

https://www.psychologytoday.com/blog/the-clarity/201703/where-are-the-trustworthy-leaders