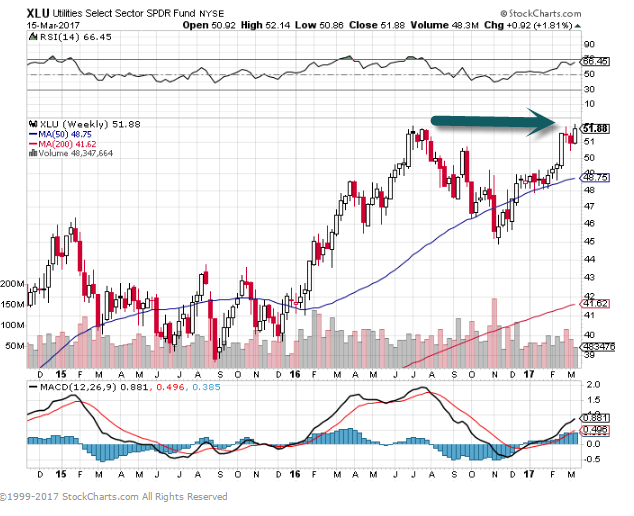

1.Rate Sensitive Utilities?? Utes About to Make New Highs.

XLU Utilites ETF on New Highs.

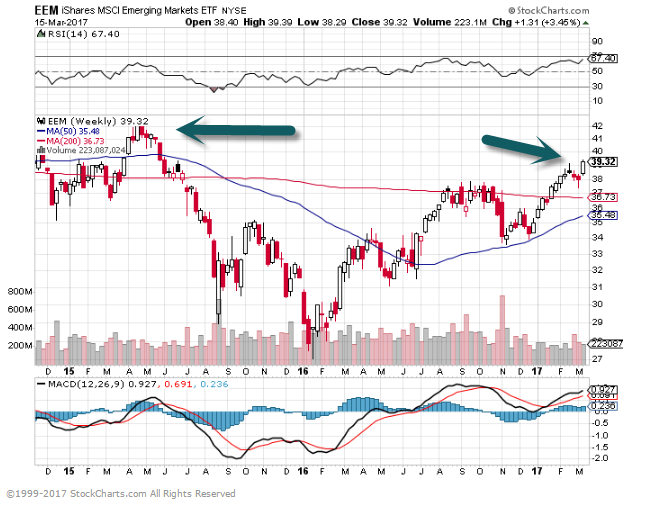

2.Europe Rallying Overnight After Dutch Elections…

EFA-Ishares Europe—Making a Run at 2015 Highs.

Emerging Markets Going for 2015 Highs.

3.On Back of International Charts….Materials ETF +50% Off 2016 Lows….Global Growth? Inflation?

4.Treasurys surge after the Fed hikes?

US Treasury bonds are soaring after the Federal Reserve hiked its key interest rate to a range of 0.75% to 1% at Wednesday’s meeting. The rate hike is the third by the Fed since December 2015 and has the central bank on a path to meet its target of three rate hikes by the end of the year.

“Hikes are generally bad for stocks, somewhat bad for the US dollar, and bullish for 10-year yields and commodities,” Tom Leveroni and Shourui Tian of Nautilus Research wrote in a note to clients sent out on Wednesday.

Aggressive buying across the complex is having the biggest impact on the belly of the curve, with yields there down as much as 12 basis points. Here’s a look at the scoreboard as of 3:53 p.m. ET:

- 2-year -7.3 bps @ 1.303%

- 3-year -9.4 bps @ 1.590%

- 5-year -12 bps @ 2.008%

- 7-year -11.8 bps @ 2.301%

- 10-year -10.2 bps @ 2.498%

- 30-year -6.0 bps @ 3.114%

Wednesday’s buying has pushed yields off their recent highs. The 10-year yield put in a high of almost 2.63% on Tuesday, falling just 1bp below its December 15 peak.

Interestingly, the rate hike is causing the yield curve to steepen with the 5-30-year spread wider by 6 bps at 110.5 bps.

Investing.com

http://www.businessinsider.com/bond-market-update-after-the-fed-rate-hike-march-15-2017-2017-3

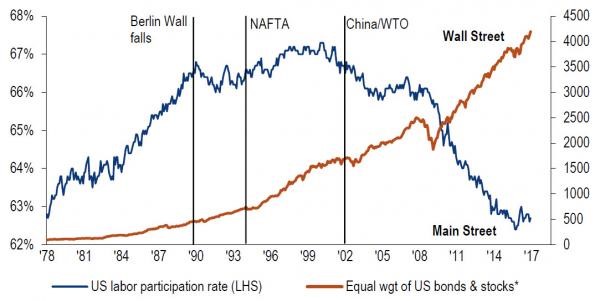

5.Populism?

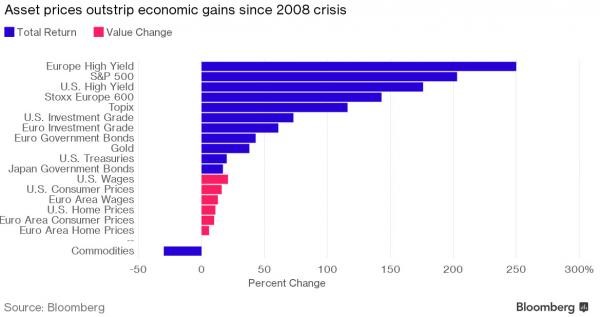

While wages would never show swings on par with the likes of high-yield bonds, Bloomberg notes that the chart above illustrates how well financial markets recovered from the 2007 to 2009 meltdowns. By contrast, consumer price inflation, incomes and other such gauges of the “real” economy have put in muted performances.

“We don’t know how effective QE has been because we don’t know what would have happened without it,” said Peter Oppenheimer, chief global equity strategist at Goldman in London.

Falling interest rates supported most financial assets, while for the economy “QE has been effective to prevent downside risk,” he said.

Economic growth and wage increases have disappointed in recent years, depressed by poor productivity gains and historically low labor-force participation — dynamics that lie outside the purview of central banks. Now that monetary policy makers are leaving the onus on governments to address growth, and contemplating the easing off of stimulus, the big question for investors is how resilient markets will be. For now, optimism prevails – everything from corporate-bond premiums to emerging-market bonds are flashing confidence.

Read Full Story at Zerohedge.

http://www.zerohedge.com/news/2017-03-15/wall-street-vs-main-street-settling-debate-over-real-reason-qe

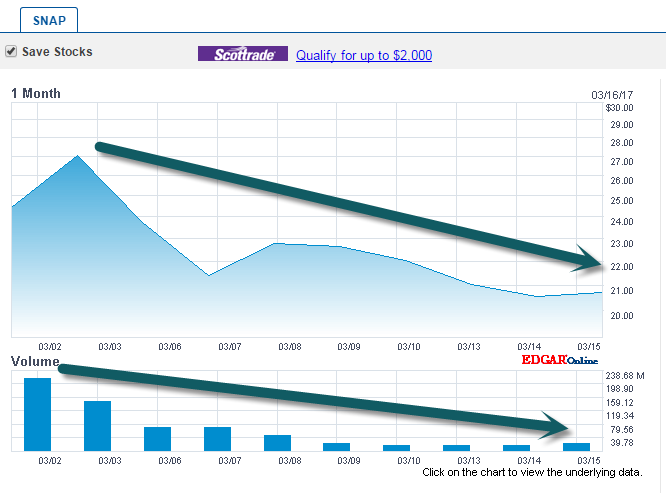

6.SNAP Goes the Unicorns….Look for Less Private Money Paying Up for Huge Valuations.

Snap Chart

Snap’s $3.4 billion initial public offering opened the gates for other tech unicorns and smaller beasts alike. All are expanding, yet losing money. These highly valued private start-ups need more cash, and investors are desperate for growth. Both sides have most likely decided that a marriage of convenience, if not of love, is the best they can hope for.

The Snap deal showed that public investors demand little of a company with potential. Snap’s shares do not have voting rights. The company was valued at a premium to Facebook’s valuation when it went public despite Snap’s burning about $1 billion over the last two years and its rapidly slowing user growth.

Others have taken note. Easy money allowed private companies to raise funds at high prices in 2014 and 2015. Over 60 private firms surpassed the $1 billion valuation threshold — making them unicorns in Silicon Valley parlance — in those two years, according to CB Insights. That spigot is shutting, however. Only a dozen joined the club last year, and established firms found it harder to raise new funds. Rising markets since the election are increasing public appetite for riskier assets.

Several are taking the public-market plunge. MuleSoft, a producer of software that allows companies to connect different applications, is the best of the lot. Underwriters estimate it is worth $2 billion. The company lost $59 million last year. It has about $100 million in the bank, and much of its costs are related to equity compensation. But it could use more cash. Okta and Yext cannot wait. The cloud-based security company and the smaller firm, which makes sure clients’ information appears correctly on third-party sites, are suffering accelerating losses.

While public investors now lack self-esteem, tech firms are not filled with joy either. Happiness is relative, and they look wistfully at the rapidly rising private valuations of a few years ago. Snap’s valuation per share when it went public was not much higher than its last private fund-raising round. Alteryx, which makes data-analytic software, has tentatively priced itself at around $800 million, close to where it was valued privately two years ago.

Snap’s fall since its I.P.O. — it trades nearly 15 percent below its first-day closing price — may make it even harder for private companies to raise more money than they had previously. It is over to public investors to roll over or resist. Past performance indicates they will choose the former.

https://www.nytimes.com/2017/03/15/business/dealbook/unicorn-investors-ipos.html?ref=dealbook&_r=0

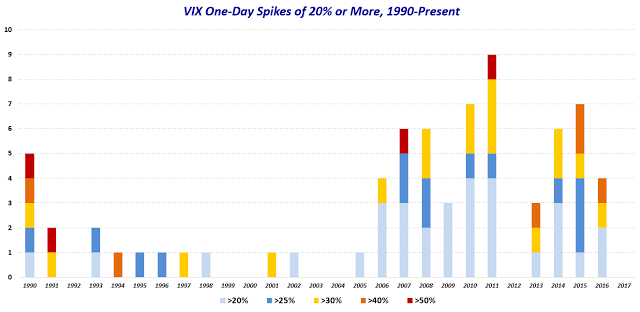

7.Ten Years Since the Biggest VIX Spike Ever

Ten years ago today, we witnessed that largest one-day VIX spike in the nearly three decade history of the VIX. On that day, the VIX rallied from a prior close of 11.15 to 18.31 – a 64.2% gain. The move came in conjunction with a 3.5% decline in the SPX (large, but nothing like what would follow during the next two years) and followed overnight concerns related to the Chinese government raising interest rates to discourage speculation. The fears in China were largely responsible for a 8.8% loss in the Shanghai Composite Index and a 9.9% loss in the FTSE/Xinhua China 25 index that is the basis for the popular Chinese ETF, FXI.

In retrospect, the biggest VIX spike of all was a short-lived phenomenon whose fundamental and technical underpinnings turned out to pose no lasting threats. As is often the case, traders who faded this move (and keep in mind there were no VIX ETPs available at that time) and bet on mean reversion cleaned up on that trade.

So, did this move in 2007 provide a hint as to what would follow in 2008? As I see it, the timing was merely a coincidence.

It may not be a coincidence, however, that the biggest VIX spike in history helped to usher in the golden era of VIX spikes, with 15 of the top 22 one-day VIX spikes of all time having occurred during the past decade, as is reflected in the graphic below. Of course, most of the spike in VIX spike activity was the result of the Great Recession and some of the “disaster imprinting” that followed such a severe shock to many investor psyches.

[source(s): VIX and More]

[source(s): VIX and More]

Some may look around at a VIX that is not too much different now than it was a decade ago and wonder what it might take to trigger another 64% jump in the VIX. Certainly there is a huge policy uncertainty overhang at the moment, lots of political (and related economic) uncertainty in Europe and there are always some black swans lurking just out of our sightlines.

For now, however, will just have to live with that eerie, unsettling feeling that often accompanies low volatility and wait for another bump in the night before we reassess the volatility landscape.

http://vixandmore.blogspot.com/

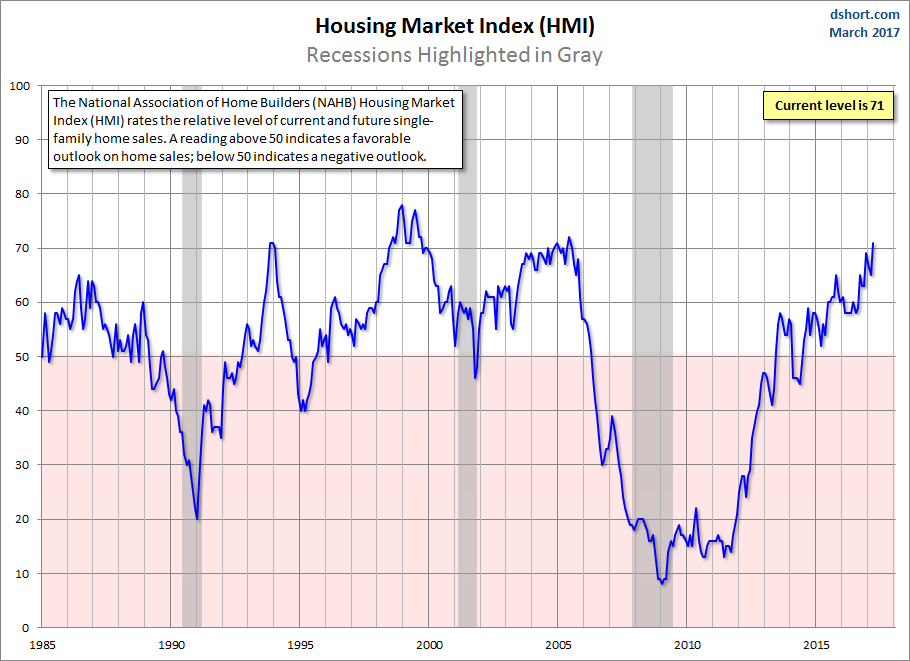

8.NAHB Housing Market Index: “Builders Confidence at 12 Year High”

by Jill Mislinski, 3/15/17

The National Association of Home Builders (NAHB) Housing Market Index (HMI) is a gauge of builder opinion on the relative level of current and future single-family home sales. It is a diffusion index, which means that a reading above 50 indicates a favorable outlook on home sales; below 50 indicates a negative outlook.

The latest reading of 71, up 6 from last month, came in above the Investing.com forecast of 65 and is currently at a 12-year high.

Here is the opening of this morning’s monthly report:

Builder confidence in the market for newly-built single-family homes jumped six points to 71 on the NAHB/Wells Fargo Housing Market Index (HMI). This is the highest reading since June 2005.

“Builders are buoyed by President Trump’s actions on regulatory reform, particularly his recent executive order to rescind or revise the waters of the U.S. rule that affects permitting,” said NAHB Chairman Granger MacDonald. [link to report]

Here is the historical series, which dates from 1985.

9.Read of the Day Ben Carlson…Some Lessons For Living From Older Generations

Posted March 14, 2017 by Ben Carlson

The Guardian recently ran a piece written by 94-year-old Harry Smith. Smith waxed poetic on his description of what growing old has meant to him:

People should not look at their approaching golden years with dread or apprehension but as perhaps one of the most significant stages in their development as a human being, even during these turbulent times. For me, old age has been a renaissance despite the tragedies of losing my beloved wife and son. It’s why the greatest error anyone can make is to assume that, because an elderly person is in a wheelchair or speaks with quiet deliberation, they have nothing important to contribute to society. It is equally important to not say to yourself if you are in the bloom of youth: “I’d rather be dead than live like that.” As long as there is sentience and an ability to be loved and show love, there is purpose to existence.

All of you, when young, will make your own history: you will struggle, you will betray some and others will betray you. You will love and lose love. You will feel profound joy and deep sorrow and during all of this you will grow as an individual. That’s why it is your duty when you get old to tell the young about your odyssey across the vast ocean of your life. It is why when death does come for me – even if it mauls me with decrepitude before it takes me – I will not lament either my old age or my faded youth. They were just different times of the day when I stood in the sun and felt the warmth of life.

After reading Smith’s piece I was reminded of the book 30 Lessons For Living: Tried and True Advice from the Wisest Americans. It’s been a few years since I read it but the ideas have stuck with me. Professor Karl Pillemer interviewed thousands of people over the age of 65 to glean some wisdom on all sorts of life lessons on things from kids to careers to marriage, money and much more. I found my notes on the book and really liked his passage on what this group didn’t say about their experiences:

No one – not a single person out of a thousand – said that to be happy you should try to work as hard as you can to make money to buy the things you want.

No one – not a single person – said it’s important to be at least as wealthy as the people around you, and if you have more than they do it’s real success.

No one – not a single person – said you should choose your work based on your desired future earning power.

Now it may sound absurdly obvious worded this way. But this is in fact how many people operate on a day-to-day basis. The experts did not say these things; indeed almost no one said anything remotely like them. Instead they consistently urged finding a way of earning enough to live on without condemning yourself to a job you dislike.

These ideas do seem obvious but it’s not easy to think this way when others around you put so much value on money or material possessions.

Everyone has regrets about things they wish they would have done differently if given the opportunity to go back and do things over again. Pillemer listed five things he learned from this group about regret reduction that can be applied to young people:

- Always be honest. Avoid acts of dishonesty, both big and small. Most people suffer from serious regret later in life if they have been less than “fair and square.

- Say yes to opportunities.When offered a new opportunity or challenge, you are much less likely to regret saying yes and more likely to regret turning it down.

- Travel more.Travel while you can, sacrificing other things if necessary to do so. Most people look back on their travel adventures (big and small) as highlights of their lives and regret not having traveled more.

- Choose a mate with extreme care.The key is not to rush the decision, taking all the time needed to get to know the prospective partner and to determine your compatibility over the long-term.

- Say it now.People wind up saying the sad words “it might have been” by failing to express themselves before it’s too late. Don’t believe the “ghost whisperers” – the only time you can share your deepest feelings is while people are still alive.

One of the best ways to plan ahead for the future, financial or otherwise, is to ask people who are older than you what they wish they would have done at your age to better prepare for what’s to come. Looking back on it now, what do you wish you would have done differently in your 20s, 30s, 40s, etc? I’m still relatively young but my short list includes things like saving for retirement at an earlier age, avoiding negative friendships, taking a few more career risks early on, not wasting my time on the last three seasons of Shameless and not stressing about things that were out of my control.

Some of the other timeless advice I’ve received over the years includes the following: time is more important than money, autonomy at work is highly underrated as is being nice to people, almost everything in life is a tradeoff, you have to have balance and splurge every once and a while, quit worrying so much about the past and the future at all times and try to enjoy the present.

It can be difficult to think this way in the heat of the moment. I know that’s true for me. But these types of lessons and wisdom provide a nice reminder to put things into perspective.

Sources:

Don’t Dread Old Age (Guardian)

30 Lessons For Living

http://awealthofcommonsense.com/2017/03/some-lessons-for-living/?curator=thereformedbroker&utm_source=thereformedbroker

10.Copying the Habits of Millionaires…

Today’s infographic from StocksToTrade.com skips the silver bullets and “get rich quick” tricks to show the real habits of millionaires that have led to wealth accumulation over time.

Many of these habits are not particularly glamorous, but remain essential for the long-term success of entrepreneurs and investors. They tend to fall in categories such as: hard work, persistence, passion, acquiring self-knowledge, associating with the right people, and staying healthy.

Here are the most important statistics to consider:

- 88% of the rich devote 30 minutes or more each day toself-education or self-improvement.

- 76% of the rich aerobically exercise for 30 minutes or more, every day.

- 86% of the rich who likedwhat they did for work made $3.4 million in 32 years

- 7% who lovedwhat they did made $7.4 million in 12 years.

- 92% of rich say good luck had nothing at all to do with their wealth. They just never gave up.

- 88% of millionaires believe relationships are critical to financial success.

- 94% of wealthy individuals read current events every day.

- 88% of the rich people say that saving money was incredibly important to their success.

- 93% of the self-made millionaires attributed their wealth to their mentors’ help.

- 86% of wealthy, successful people associate with other success-minded people.

- 79% of the rich read educational, career-related material.

In other words, it’s not a simple idea or plain old luck that leads to success.

http://www.valuewalk.com/2017/03/top-10-habits-millionaires-building-wealth-infographic/