1.Buybacks Take International Stage.

We have mentioned PKW-U.S. buyback ETF for 3 years as a leader of bull market. As International takes the lead this year, a new buyback ETF goes on watch list.

2 Year Chart….IPKW +11% vs. EFA (developed International) -6.5%

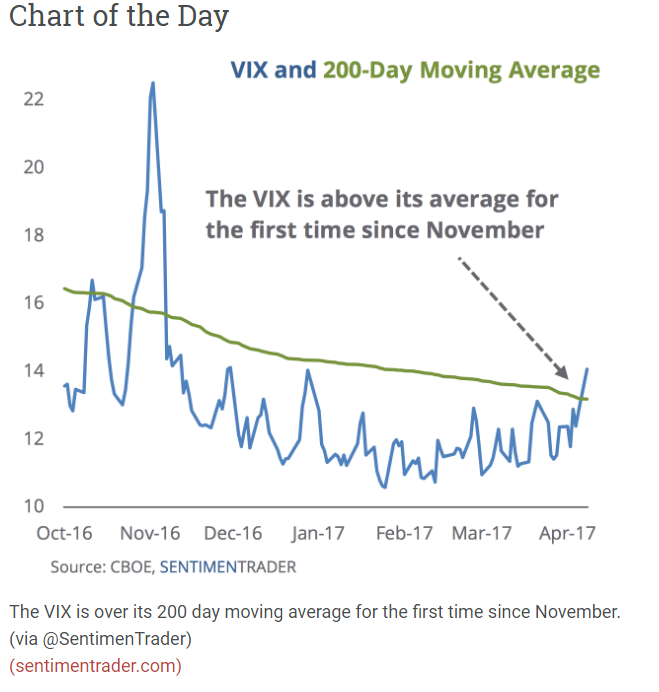

2.Volatility has been so Low…This Constitutes a Spike.

43% Jump in VIX …$11 to $15.77

From Abnormal Returns Blog www.abnormalreturns.com

From Abnormal Returns Blog www.abnormalreturns.com

3.Unemployment Rate Hits 4.5%.

By

HOWARDGOLD

There were 10 times since 1948 when the unemployment rate hit a cyclical low. The lowest unemployment rate ranged from 2.5% to 5.6%; the average low was 4.1%. Each time, the cyclical low unemployment rate was followed by a recession from one to 16 months later. The average gap between that cycle’s low unemployment rate and the onset of a recession was 9.2 months.

Bear markets also followed low unemployment rates regularly. The nasty bear market of 1973 ended the same month unemployment hit its cyclical low. In March 2000, the bear market began the same month unemployment hit its low of 3.8%. It took more than four years for a full-fledged bear market to follow the cyclical low unemployment rate of 2.5% in May 1953 (though a recession ensued a mere two months later and there were two corrections of nearly 15% in between, according to Yardeni Research). On average, it took nearly 15 months for a bear market to follow a recession, though there was much more variation here.

Recessions and bear markets follow low unemployment rates

| Date of cyclical low | Lowest | Date of onset of | Months to | Date of onset of | Months to |

| unemployment rate | rate | next recession | recession | next bear market | bearmarket |

| October 2006 | 4.4% | December 2007 | 14 | October 9, 2007 | 12 |

| April 2000 | 3.8% | March 2001 | 11 | March 24, 2000 | 0 |

| March 1989 | 5.0% | July 1990 | 16 | July 16, 1990* | 16 |

| May 1979 | 5.6% | January 1980 | 8 | November 28, 1980** | 18 |

| October 1973 | 4.6% | November 1973 | 1 | Bear market ended in October | 0 |

| September 1968 | 3.4% | December 1969 | 15 | November 29, 1968 | 2 |

| June 1959 | 5.0% | April 1960 | 10 | January 3, 1962*** | 31 |

| March 1957 | 3.7% | August 1957 | 5 | July 15, 1957 | 4 |

| May 1953 | 2.5% | July 1953 | 2 | July 15, 1957 | 50 |

| January 1948 | 3.4% | November 1948 | 10 | June 15, 1948 | 5 |

| Average | 4.1% | 9.2 | 14.8 | ||

| Sources: Bureau of Labor Statistics, National Bureau of Economic Research, Yardeni Research | |||||

| *The S&P 500 index declined 19.9% from July to October 1990, which Yardeni Research classifies as a correction | |||||

| **The S&P 500 also corrected 17.1% in February-March 1980. | |||||

| ***The S&P 500 also corrected 13.6% from August 1959 to September 1960. | |||||

4. Chinese Yuan….My Chart of the Year for 2016 is Having Nice Bounce Off Lows.

Trump needs China’s help with N. Korea…China moved 1500 troops to N. Korean border this week.

The yuan climbed to its biggest one-day advance vs. the dollar in nearly three months after President Trump abandoned his earlier pledge to name China a currency manipulator and said the dollar was too strong. China equities are higher, also enjoying a boost from news of stronger than expected growth in exports. But Japan’s Nikkei average lost as much as 1.3% to its lowest level since December, as the yen hit five-month highs against the dollar. European bourses also are lower in the early going as the euro strengthens vs. the dollar. www.seekingalpha.com

50 day going thru 200 day to upside.

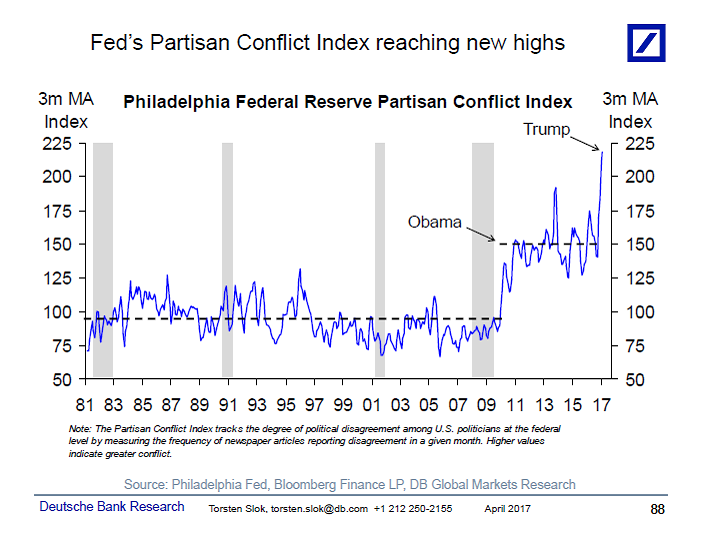

5.FED Partisan Conflict is High…Interesting Chart. Sideways for 30 Years then Spike.

The Fed has a Partisan Conflict Index and it currently shows an extreme degree of political divide, see chart below. The inventor of the index concludes that:

“…rising partisan conflict increases government deficits and significantly discourages investment, output, and employment. Moreover, these declines are persistent, which may help explain the slow recovery observed since the 2007 recession ended.”

These bearish conclusions are inconsistent with the significant improvements seen recently in the sentiment data.

For more discussion of the index see here: https://www.philadelphiafed.org/-/media/research-and-data/publications/working-papers/2014/wp14-19.pdf?la=en

———————————————–

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief International Economist

Managing Director

Deutsche Bank Securities

60 Wall Street

New York, New York 10005

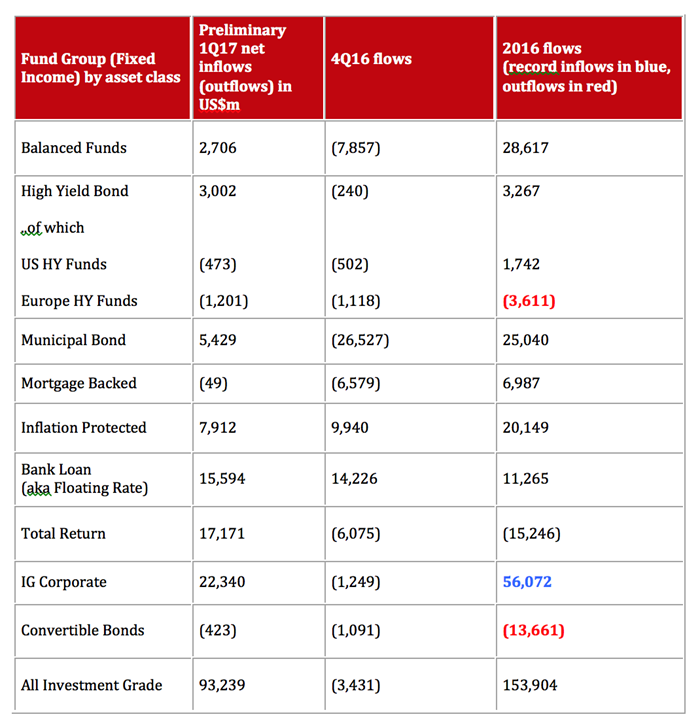

6.If the U.S. Stock Market is Close to a Top….It Would be One Strange Top with Bond Flows Taking in Largest Dollars Since 2012

FUND FLOWS: New Money Goes to Bond Funds

US bond funds take in largest quarterly inflows since 2012 as investors turn cautious toward US reflation story.

Cameron Brandt | Apr 10, 2017

Flows into EPFR Global-tracked Bond Funds during early April hit their second highest weekly total YTD, and third highest since the first week of 2H16, as investors took a more cautious view of the US reflation story.

Inflation Protected Bond Funds posted their first outflow since early December while flows into High Yield Bond Funds jumped to a 16-week high. At the geographic level, Global and Emerging Markets Bond Funds both absorbed around $2 billion for the third straight week and US Bond Funds closed the book on their biggest quarterly inflow since 3Q12 by taking in over $7 billion.

Bank Loan Funds did extend a run of inflows stretching back to early November and Total Return Bond Funds enjoyed another good week while investors grappled with the short-term direction of US monetary policy.

According to David Ader, Chief Macro Strategist for Informa Financial Intelligence, “The Fed’s assumption of three hikes by the year’s end [remains] in play, although the market continues to disagree — with good reason — with that total. Some of that skepticism is based on economic data (auto sales is the most recent example). But some is tied to the interplay between straightforward rate hikes and any reduction in the Fed’s balance sheet. This interplay is, of course, a huge uncertainty. And it’s that uncertainty which makes this hiking cycle different from all other hiking cycles.”

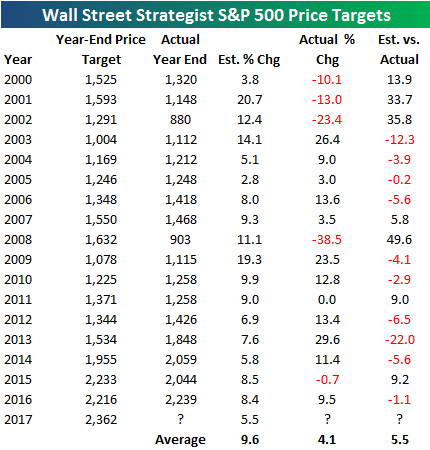

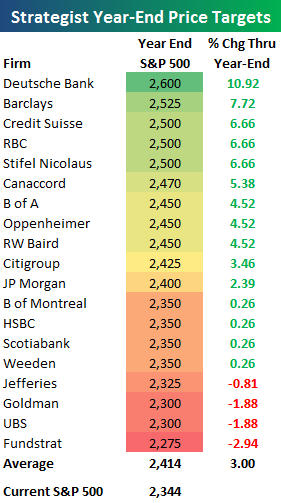

7.Wall Street Strategists are Not Super Bullish Like Previous Tops.

Wall Street Strategists Not Enthusiastic From Here

Apr 12, 2017

At the end of 2016, we published this post on year-end price targets for Wall Street strategists. For 2017, the average strategist projected the S&P 500 to post a gain of 5.5%. That’s actually bearish relative to the average annual projection going back to 2000. As shown below, on average, Wall Street strategists collectively project a gain of 9.6% each year. In 2016, strategists predicted the S&P would gain 8.4%, which ended up being just 1.1 percentage points away from the actual gain of 9.5% seen last year. That was the closest they’ve ever gotten to hitting the mark. Normally, they’re about 5.5 percentage points above the actual year-end change.

Bloomberg tabulates these year-end estimates from strategists throughout the year. As mentioned above, at the start of 2017, the average year-end price target for the S&P 500 was 2,362. That would have translated into a gain of 5.5% based on where the index began the year. So where do strategists stand now that we’re already into the second quarter? They’ve gotten slightly more bullish, but they’re still looking for hardly any gains. As shown below, the average Wall Street strategist currently sees the S&P 500 ending 2017 at a level of 2,414. That’s an additional gain of 3% from the S&P’s current level. Normally a sanguine bunch, strategists are currently rather apathetic.

https://www.bespokepremium.com/think-big-blog/

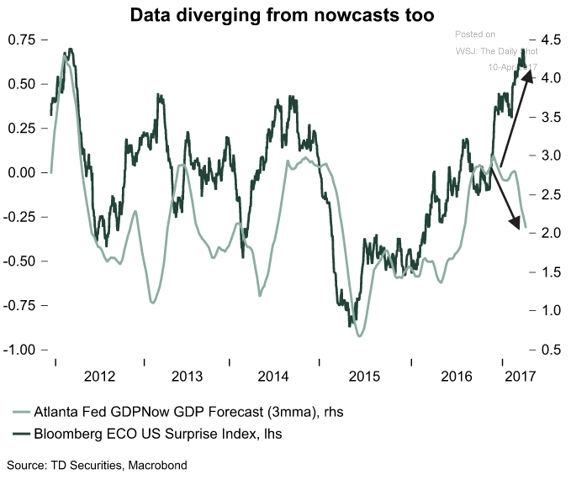

8.Interesting Chart…Sharp Divergence Between Bloomberg Economic Surprise Index and GDP.

This chart shows a sharp divergence between the Bloomberg economic surprise index and the Atlanta Fed GDP forecast (GDPNow). Something has to give here

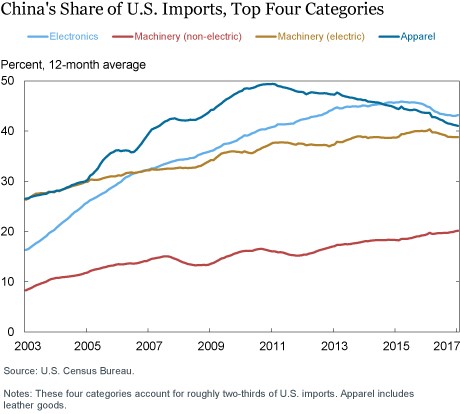

9.Read of the Day….The End of China’s Export Juggernaut

April 13, 2017 5:00am by Guest Author

The End of China’s Export Juggernaut

Thomas Klitgaard and Harry Wheeler

Liberty Street Economics, April 12, 2017

China has been an exporting juggernaut for decades. In the United States, this has meant a dramatic increase in China’s share of imports and a ballooning bilateral trade deficit. Gaining sales in the United States at the expense of other countries, Chinese goods rose from only 2 percent of U.S. non-oil imports in 1990 to 8 percent in 2000 and 17 percent in 2010. But these steady gains in U.S. import share have stopped in recent years, with China even losing ground to other countries in some categories of goods. One explanation for this shift is that Chinese firms now have to directly compete against manufacturers in high-skill developed countries while also fending off competition from lower-wage countries, such as Vietnam. This inability to make additional gains at the expense of other countries means that exports don’t contribute as much to China’s overall growth as they used to.

Taking the U.S. Market by Storm—And Then, Not so Much

The United States had a merchandise trade deficit of $350 billion with China in 2016, accounting for roughly half of the overall U.S. trade deficit. The import growth of goods from China has been impressive, with imports from China growing at an annual rate of 14 percent since 1990, while total U.S. imports were growing at an annual rate of only 6 percent. That is, China has had great success in selling to the United States by taking market share away from other countries.

A breakdown of U.S. imports into the four largest categories, accounting for roughly two-thirds of the total, demonstrates the source of this success. As seen in the chart below, China’s import shares for apparel, electronics, electric machinery, and non-electric machinery were all fairly high in 2002, the beginning of the data series used here, and continued to increase. In 2002, China accounted for 25 percent of all U.S. apparel imports and 15 percent of all electronics imports. By 2010, these shares were up to 50 percent and 40 percent, respectively. Market-share increases in general machinery and electrical machinery were less dramatic but still substantial over this period, rising by 8 percentage points (to 15 percent) and 11 percentage points (to 35 percent), respectively.

From Barry Rithotz at The Big Picture

http://ritholtz.com/2017/04/end-chinas-export-juggernaut/

10.13 THINGS YOU SHOULD GIVE UP IF YOU WANT TO BE SUCCESSFUL

FollowCedric Mezieres

World Class Clothier at Suave

13 Things You Should Give Up If You Want To Be Successful

”Somebody once told me the definition of hell:

“On your last day on earth, the person you became will meet the person you could have become.” — Anonymous

Sometimes, to become successful and get closer to the person we can become, we don’t need to add more things — we need to give up on some of them.

There are certain things that are universal, which will make you successful if you give up on them, even though each one of us could have a different definition of success.

You can give up on some of them today, while it might take a bit longer to give up on others

1. Give Up On The Unhealthy Lifestyle

“Take care of your body. It’s the only place you have to live.” — Jim Rohn“Take care of your body. It’s the only place you have to live.” — Jim RohnIf you want to achieve anything in life, everything starts here. First you have to take care of your health, and there are only two things you need to keep in mind:

- Healthy Diet

- Physical Activity

Small steps, but you will thank yourself one day.

2. Give Up The Short-term Mindset

“You only live once, but if you do it right, once is enough.” — Mae West

Successful people set long-term goals, and they know these aims are merely the result of short-term habits that they need to do every day.

These healthy habits shouldn’t be something you do; they should be something you embody.

There is a difference between: “Working out to get a summer body” and “Working out because that’s who you are.”

3. Give Up On Playing Small

“Your playing small does not serve the world. There is nothing enlightened about shrinking so that other people will not feel insecure around you. We are all meant to shine, as children do. It is not just in some of us; it is in everyone, and as we let our light shine, we unconsciously give others permission to do the same. As we are liberated from our fear, our presence automatically liberates others.” – Marianne Williamson

If you never try and take great opportunities, or allow your dreams to become realities, you will never unleash your true potential.

And the world will never benefit from what you could have achieved.

So voice your ideas, don’t be afraid to fail, and certainly don’t be afraid to succeed.

4. Give Up Your Excuses

“It’s not about the cards you’re dealt, but how you play the hand.”

― Randy Pausch, The Last Lecture

Successful people know that they are responsible for their life, no matter their starting point, weaknesses, and past failures.

Realising that you are responsible for what happens next in your life is both frightening and exciting.

And when you do, that becomes the only way you can become successful, because excuses limit and prevent us from growing personally and professionally.

Own your life; no one else will.

5. Give Up The Fixed Mindset

“The future belongs to those who learn more skills and combine them in creative ways.” ― Robert Greene, Mastery

People with a fixed mindset think their intelligence or talents are simply fixed traits, and that talent alone creates success — without effort. They’re wrong.

Successful people know this. They invest an immense amount of time on a daily basis to develop a growth mindset, acquire new knowledge, learn new skills and change their perception so that it can benefit their lives.

Remember, who you are today, it’s not who you have to be tomorrow.

6. Give Up Believing In The “Magic Bullet.”

“Every day, in every way, I’m getting better and better” — Émile Coué

Overnight success is a myth.

Successful people know that making small continual improvement every day will be compounded over time, and give them desirable results.

That is why you should plan for the future, but focus on the day that’s ahead of you, and improve just 1% every day.

7. Give Up Your Perfectionism

“Shipping beats perfection.” — Khan Academy’s Development Mantra

Nothing will ever be perfect, no matter how much we try.

Fear of failure (or even fear of success) often prevents us from taking an action and putting our creation out there in the world. But a lot of opportunities will be lost if we wait for the things to be right.

So “ship,” and then improve (that 1%).

8. Give Up Multi-tasking

“You will never reach your destination if you stop and throw stones at every dog that barks.” ― Winston S. Churchill

Successful people know this. That’s why they choose one thing and then beat it into submission. No matter what it is — a business idea, a conversation, or a workout.

Being fully present and committed to a task, is indispensable.

9. Give Up Your Need to Control Everything

“Some things are up to us, and some things are not up to us.” — Epictetus, Stoic philosopher

Differentiating these two is important.

Detach from the things you cannot control, and focus on the ones you can, and know that sometimes, the only thing you will be able to control is your attitude towards something.

Remember, nobody can be frustrated while saying “Bubbles” in an angry voice.

10. Give Up On Saying YES To Things That Don’t Support Your Goals

“He who would accomplish little must sacrifice little; he who would achieve much must sacrifice much; he who would attain highly must sacrifice greatly.” — James Allen

Successful people know that in order to accomplish their goals, they will have to say NO to certain tasks, activities, and demands from their friends, family, and colleagues.

In the short-term, you might sacrifice a bit of instant gratification, but when your goals come to fruition, it will all be worth it.

11. Give Up The Toxic People

“You are the average of the five people you spend the most time with.”

― Jim Rohn

People we spend the most time with, add up to who we become.

There are people who are less accomplished in their personal and professional life, and there are people who are more accomplished than us. If you spend time with those who are behind you, your average will go down, and with it, your success.

But if you spend time with people who are more accomplished than you, no matter how challenging that might be, you will become more successful.

Take a look at around you, and see if you need to make any changes.

12. Give Up Your Need To Be Liked

“The only way to avoid pissing people off is to do nothing important.” — Oliver Emberton

Think of yourself as a market niche.

There will be a lot of people who like that niche, and there will be individuals who don’t. And no matter what you do, you won’t be able to make the entire market like you.

This is entirely natural, and there’s no need to justify yourself.

The only thing you can do is to remain authentic, improve and provide value every day, and know that the growing number of “haters” means that you are doing important things.

13. Give Up Your Dependency on Social Media & Television

“The trouble is, you think you have time” — Jack Kornfield

Impulsive web browsing and television watching are diseases of today’s society.

These two should never be an escape from your life or your goals.

Unless your goals depend on either, you should minimize (or even eliminate) your dependency on them, and direct that time towards things that can enrich your life.