1. Foreign capital is flocking back to emerging markets in Asia

David Scutt, Business Insider Australia

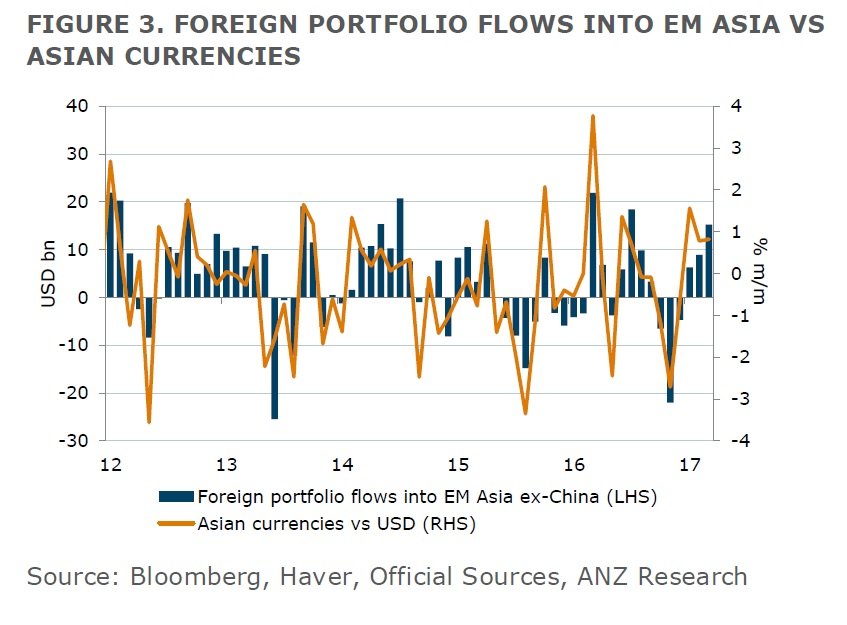

Foreign capital is flooding back to emerging markets across Asia, particularly for stocks.

According to new research released by ANZ today, capital inflows to the region rose to $US15.3 billion in March, the largest one-month increase since the middle of last year.

It was the third consecutive month that net inflows were recorded, all but unwinding similarly large outflows seen in the final three months of last year.

As this excellent chart from ANZ demonstrates, continued weakness in the US dollar against currencies in the region was probably a contributing factor behind the pickup in capital flows to the region.

http://www.businessinsider.com/foreign-capital-is-flocking-back-to-emerging-markets-in-asia-2017-4

Dollar Weakens and Emerging Markets Strenghten….Dollar (UUP) -1.36% YTD vs. Emerging Markets +12%

www.yahoofinance.com

2.Where Has All The Volatility Gone?

Posted April 5, 2017 by Ben Carlson

Financial markets can play mind games with you because even periods of relative calm can turn out to be a problem when they cause investors to become complacent. Volatility can be a tricky concept because most investors confuse it with risk downside risk but it can occur on the upside as well. Here’s a piece I wrote recently for Bloomberg talking about both short- and long-term volatility in the markets and how investors can think about its meaning.

*******

Markets have been eerily calm. It’s now been 40 trading days since the last move of 1 percent in the S&P 500, and that was an up day. Stocks haven’t had a down day of 1 percent in more than 80 trading days — and that was in early October.

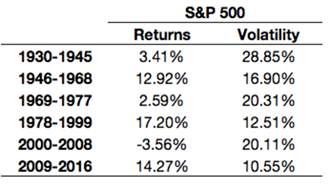

This period of subdued volatility extends beyond the past few months. Volatility in stocks has been below average in the past few years. The annualized volatility of the daily returns on the S&P 500 from 1930 to 2016 is around 19 percent. In 2008, this number shot up well above 40 percent, which was the highest level of volatility we’ve seen since the Great Depression. Volatility continued to be above average in 2009 and 2011. Since then, however, there’s been a severe drop-off every year.

From 2012 to 2016, the average annual volatility was less than 13 percent on the S&P 500, about 30 percent lower than average. And even though it may not feel like it to some investors, this has been an extremely low volatility rally in stocks. We’ve been in a sweet spot of a combination of above average returns and below average volatility.

Investors just need to remember that volatility and performance in stocks can be very cyclical over time. The opposite of the sweet spot that we’re in is lower-than-average returns with higher-than-average volatility. In fact, that’s what investors experienced before this bull market took off in 2009. You can see from the following table that there have been very distinct volatility regimes over time in the stock market:

Read Full Story from Ben Carlson

http://awealthofcommonsense.com/2017/04/where-has-all-the-volatility-gone/

3.Money Managers Loading Up on Insurance.

Are Traders Creating a Bizarre New Feedback Loop… Feedback Loop… Feedback Loop?

Money managers’ growing use of insurance against sharp market moves is keeping volatility near historic lows, according to one theory

By

JON SINDREU and

CHRISTOPHER WHITTALL

What if selling insurance against tornadoes made tornadoes occur less frequently? Something like that may be behind the incredible calm in global financial markets.

The theory, advanced by several money managers, bankers and analysts, describes a type of feedback loop in which calm markets make selling insurance against sharp swings in asset prices profitable, which makes the markets more calm, which then makes selling insurance yet more attractive. And on and on.

Behind the loop is a danger: If a giant shock—a big tornado—does materialize, the loop could suddenly run in the other direction, amplifying big moves rather than damping them.

https://www.wsj.com/articles/are-traders-creating-a-bizarre-new-feedback-loop-feedback-loop-feedback-loop-1491557400?tesla=y

Selling Insurance Bets in Market is a Lucrative Business….Derivatives Market Reflection.

4.American Investors’ “Fear” Highest Since Before Trump’s Election

![]()

by Tyler Durden

Apr 10, 2017 1:59 PM

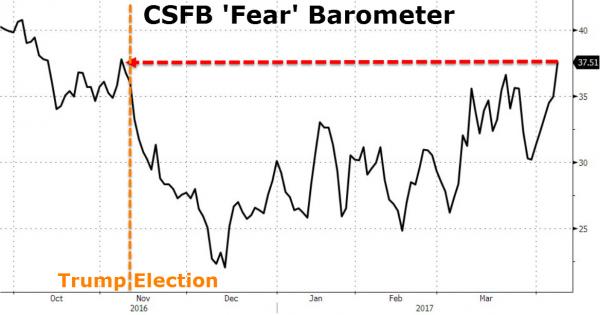

While US stocks were relatively stable last week (amid death-feying BTFD rips), investors are paying the most for equity protection since before the U.S. presidential election in November.

As Bloomberg reports, Credit Suisse’s Fear Barometer, which measures the cost of bearish to bullish three-month options on the S&P 500 Index, has climbed for six straight days, its longest streak since August.

The CBOE Volatility Index has rebounded 25 percent since its low in January and hovers around its highest level of the year as traders wait to see whether Donald Trump will be able to push through his economic policies.

http://www.zerohedge.com/news/2017-04-10/american-investors-fear-highest-trumps-election

5.Another Look at the Trump Trade Going Sideways.

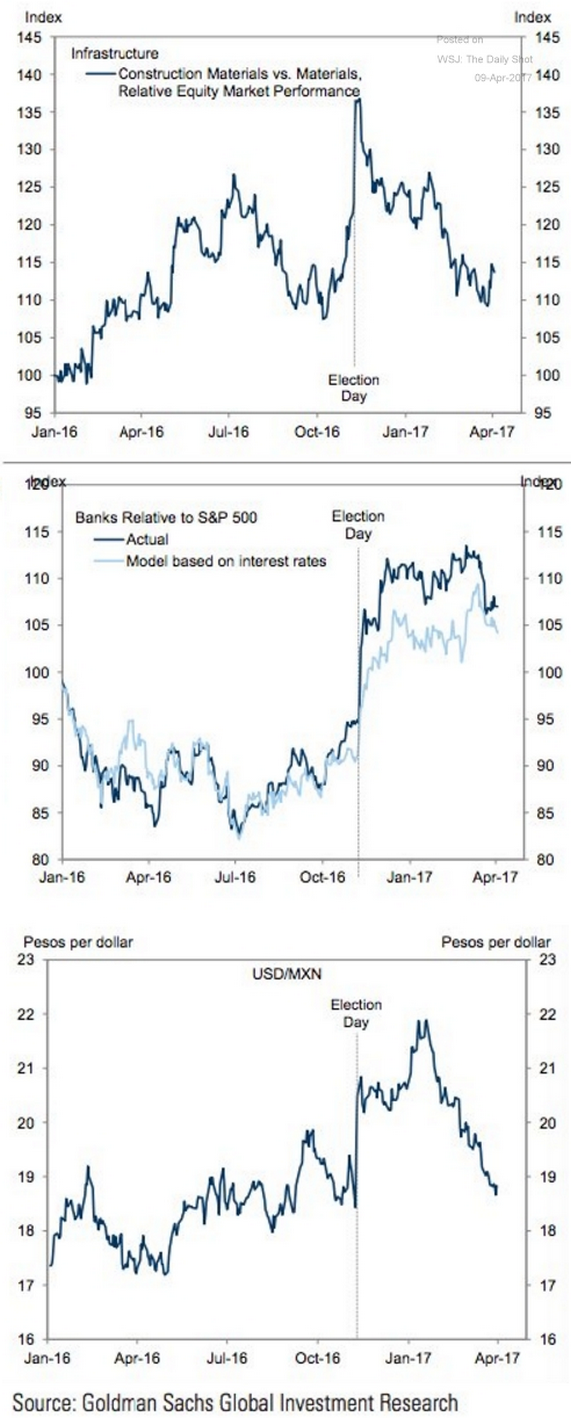

Equity Markets: The markets are becoming less convinced about some of President Trump’s policy agenda: a boost in infrastructure spending, bank deregulation, and a border tax against Mexico.

Source: Goldman Sachs, @joshdigga

www.thedailyshot.com

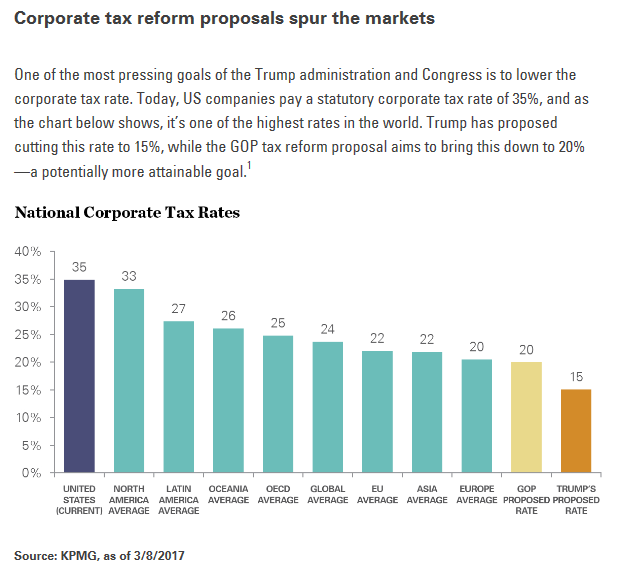

6.The Best Shot? Some Middle Road on Corporate Tax Reductions.

SPDR BLOG

From the markets’ perspective the bigger the tax cut the better. Expectations of reduced corporate tax rates have played a large role in the post-election stock market rally as well as the increase in business and consumer confidence.

This optimism hinges on the belief that corporate tax cuts will provide a significant boost to corporate earnings. As of July 2016, 56% of S&P 500® Index earnings were domestic. At the current 35% tax rate, S&P 500 companies are paying an effective rate of 23.4%2 and leaving approximately $2.5 trillion in cash parked overseas.3 A cut in the statutory tax rate to 20% would imply over an 8% reduction in the effective corporate tax rate, lowering it to 15%.

http://blog.spdrs.com/post/corporate-tax-reform-how-policy-proposals-are-driving-the-stock-market?WT.mc_id=em_SPDRInsider42017_Apr2017

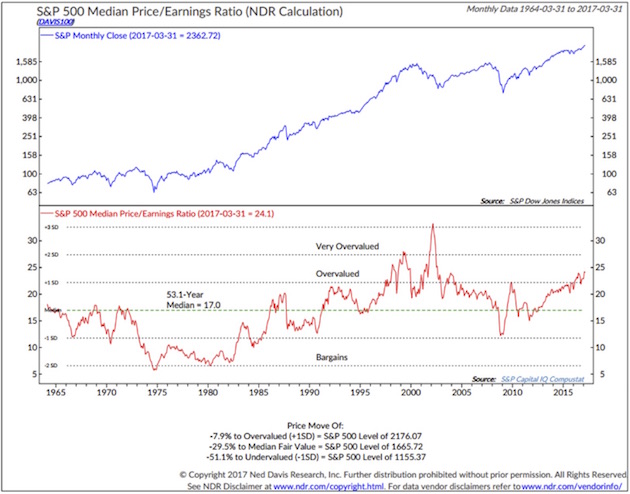

7. The green dotted line is the 52.8 year median P/E. So a P/E of 17 is the historical “fair value.”

Here is how you read the following chart (from Ned Davis Research):

• Median P/E is the P/E in the middle, meaning there are 250 companies out of 500 that have a higher P/E and 250 that have a lower P/E. Using the median number eliminates the effect that a few very richly valued companies have on the average P/E, which is what you normally see reported in the media and presentations.

• The red line in the lower section shows you how P/Es have moved over time.

• The green dotted line is the 52.8 year median P/E. So a P/E of 17 is the historical “fair value.” Simply a point of reference.

• You can see that over time the red line moves above and below the dotted green line.

• If you remove the 2000–2002 period (the “great bull market”), we currently sit at the second most overvalued point since 1964. (Note: 1966 marked a secular bull market high, to be followed by a bear market that lasted from 1966 to 1982.)

• In the lower section of the chart you also see the labels “Very Overvalued,” “Overvalued,” and “Bargains.”

One last comment on the chart. At the very bottom of the chart, Ned Davis states that the market is now 7.9% above the level at which it is considered to be overvalued.

• That means the market would need to decline from the March 31 S&P 500 Index level of 2362.72 to 2176.07 to get back down to the “overvalued” threshold.

• It would need to decline to 1665.72 to be get to “fair value” (the median). That’s a drop of 29.5%.

• Also note “undervalued,” which we could see in a recession (now -51.1% away).

So fair value for your company is $34 per share (that’s your $2 per share in earnings times the “fair” P/E of 17). I’m thrilled if your stock is selling for $10, because my forward returns will likely be outstanding. Let’s see what that looks like next.

https://www.advisorperspectives.com/commentaries/2017/04/08/stock-market-valuations-and-hamburgers

John Mauldin

8.Trump $3.5 B in Real Estate vs. $16.8B if he Indexed His Inheritance. Plus He would have Avoided 4000 Lawsuits.

How? Just owning the stock market.

Assume Trump inherited $1 in 1974, right on Jan. 1. If he had invested that dollar in the broad stock market and reinvested all dividends, by the end of 2016 he would have had $84.11.

Scaled up, the $200 million in “starter” money from his father today would be worth $16.8 billion. That’s a far cry from $3.5 billion.

Compounding power

Wait a minute, you might say, if he invested $200 million in 1974 and has $3.5 billion today, that’s a return (over 43 years) of 6.9% per year. Not too shabby!

Ah, but here’s the magic of common stock investing using low-cost index funds. Because of reinvested dividends, the adjusted growth rate of stocks over all those years was 10.9% per year.

That seemingly small difference, the gap between 6.9% and 10.9%, explains the huge difference in outcomes. The power of compounding creates a gain that’s close to five times more money.

If Trump had just bought the market and played golf, instead of being ranked 544 on the Forbes World’s Richest List, he could have been at 54, rubbing shoulders with the likes of Ray Dalio and Carl Icahn.

What’s more, he wouldn’t be spending so much time in court, nor would he have risked a massive, career-ending personal bankruptcy case along the way.

Less “excitement” and more money. It’s an easy decision, yet like Trump so many retirement investors remain determined to take risks they don’t need to take.

Investing is easy. It’s risk that’s hard to measure. Understanding that is the key to retiring with more.

http://www.marketwatch.com/story/donald-trump-could-have-been-five-times-richer-2017-04-06

9.Read of the Day…..What’s Become of the American Dream?

Part of the problem is definitional. It isn’t just about houses, cars and material prosperity.

PHOTO: TIME LIFE PICTURES/GETTY IMAGES

By

PEGGY NOONAN

April 6, 2017 7:27 p.m. ET

I want to think aloud about the American dream. People have been saying for a while that it’s dead. It’s not, but it needs strengthening. We should start by saying what it means, which is something we’ve gotten mixed up about. I know its definition because I grew up in the heart of it and remember how people had long understood it. The American dream is the belief, held by generation after generation since our beginning and reanimated over the decades by waves of immigrants, that here you can start from anywhere and become anything. In America you can rise to the heights no matter where and in what circumstances you began. You can go from the bottom to the top.

Behind the dream was another belief: America was uniquely free, egalitarian and arranged so as to welcome talent. Lincoln was elected president in part because his supporters brought lengths of crude split-rails to the Republican National Convention in Chicago in 1860. They held the rails high and paraded them in a floor demonstration to tell everyone: This guy was nothing but a frontier rail splitter, a laborer, a backwoods nobody. Now he will be president. What a country. What a dream.

This distinguished America from old Europe, from which it had kicked away. There titles, families and inherited wealth dictated standing: If you had them, you’d always be at the top. If you didn’t, you’d always be at the bottom. That static system bred resentment. We would have a dynamic one that bred hope.

You can give a dozen examples, and perhaps you are one, of Americans who turned a brilliant system into a lived-out triumph. Thomas Edison, the seventh child of modest folk in Michigan and half-deaf to boot, filled the greatest cities in the world with electric light. Barbara Stanwyck was from working-class Brooklyn. Her mother died, her father skipped town, and she was raised by relatives and foster parents. She went on to a half-century career as a magnetic actress of stage and screen; in 1944 she was the highest-paid woman in America. Jonas Salk was a hero of my childhood. His parents were Jewish immigrants from Poland who settled in East Harlem—again, working-class nobodies. Naturally young Jonas, an American, scoped out the true facts of his time and place and thought: I’ll be a great lawyer. His mother is reported to have said no, a doctor. He went on to cure polio. We used to talk about him at the public school when we waited in line for the vaccine.

· Mistakes, He’s Made a Few Too Many

In America so many paths were offered! But then a big nation that is a great one literally has a lot of paths.

The American dream was about aspiration and the possibility that, with dedication and focus, it could be fulfilled. But the American dream was not about material things—houses, cars, a guarantee of future increase. That’s the construction we put on it now. It’s wrong. A big house could be the product of the dream, if that’s what you wanted, but the house itself was not the dream. You could, acting on your vision of the dream, read, learn, hold a modest job and rent a home, but at town council meetings you could stand, lead with wisdom and knowledge, and become a figure of local respect. Maybe the respect was your dream.

Stanwyck became rich, Salk revered. Both realized the dream.

How did we get the definition mixed up?

I think part of the answer is: Grandpa. He’d sit on the front stoop in Levittown in the 1950s. A sunny day, the kids are tripping by, there’s a tree in the yard and bikes on the street and a car in the front. He was born in Sicily or Donegal or Dubrovnik, he came here with one change of clothes tied in a cloth and slung on his back, he didn’t even speak English, and now look—his grandkids with the bikes. “This is the American dream,” he says. And the kids, listening, looked around, saw the houses and the car, and thought: He means the American dream is things. By inference, the healthier and more enduring the dream, the bigger the houses get, the more expensive the cars. (They went on to become sociologists and journalists.)

But that of course is not what Grandpa meant. He meant: I started with nothing and this place let me and mine rise. The American dream was not only about materialism, but material things could be, and often were, its fruits.

The American dream was never fully realized, not by a long shot, and we all know this. The original sin of America, slavery, meant some of the oldest Americans were brutally excluded from it. The dream is best understood as a continuing project requiring constant repair and expansion, with an eye to removing barriers and roadblocks for all.

Many reasons are put forward in the argument over whether the American Dream is over (no) or ailing (yes) or was always divisive (no—dreams keep nations together). We see income inequality, as the wealthy prosper while the middle class grinds away and the working class slips away. There is a widening distance, literally, between the rich and the poor. Once the richest man in town lived nearby, on the nicest street on the right side of the tracks. Now he’s decamped to a loft in SoHo. “The big sort” has become sociocultural apartheid. It’s globalization, it’s the decline in the power of private-sector unions and the brakes they applied.

What ails the dream is a worthy debate. I’d include this: The dream requires adults who can launch kids sturdily into Dream-land.

When kids have one or two parents who are functioning, reliable, affectionate—who will stand in line for the charter-school lottery, who will fill out the forms, who will see that the football uniform gets washed and is folded on the stairs in the morning—there’s a good chance they’ll be OK. If you come from that now, it’s like being born on third base and being able to hit a triple. You’ll be able to pursue the dream.

But I see kids who don’t have that person, who are from families or arrangements that didn’t cohere, who have no one to stand in line for them or get them up in the morning. What I see more and more in America is damaged or absent parents. We all know what’s said in this part—drugs, family breakup. Poor parenting is not a new story in human history, and has never been new in America. But insufficient parents used to be able to tell their kids to go out, go play in America, go play in its culture. And the old aspirational culture, the one of the American dream, could counter a lot. Now we have stressed kids operating within a nihilistic popular culture that can harm them. So these kids have nothing—not the example of a functioning family and not the comfort of a culture into which they can safely escape.

This is not a failure of policy but a failure of love. And it’s hard to change national policy on a problem like that.

http://www.wsj.com/itp/20170408/us/opinion

10.3 Rituals For Virtual Overnight Success

Originally published in The Startup Magazine

Have you ever finished a day wishing you had gotten more done? Have you ever felt like the day got so jammed with busy work that you weren’t able accomplish the BIG things that really mattered in moving your business forward?

We’ve all had days like that, when it felt as though we were running around like a chicken with its head cut off. Now don’t worry. That happens to the best of entrepreneurs. However, it doesn’t happen that often, because highly successful CEO’s, sales people, and thought leaders stick to a small set of simple, but powerful rituals to help them get more done every day.

Today you’re going to get every single one of these insider success secrets. I first discovered them when my business growth was accelerating at such a rapid pace that it contributed to my severe anxiety attacks. Looking on it from the outside, you’d have to think that superfast sales growth is hardly a problem. But all the opportunity in my life left me overwhelmed. It was during my struggles with anxiety that I realized I needed more structure in my life. Not only did this lead to a further 10X in business growth, but it also gave me true freedom, the freedom that allows me to work from wherever I want in the world today.

My health scare set me off on a journey of both self-discovery and a deep dive into the automatic success rituals of the most productive entrepreneurs, writers, and thinkers of history. What I found were common threads across almost every industry, from architects to authors, and from artists to CEO’s. Here are the 3 most important success strategies that you can implement immediately to get a head-start on your competition and start dominating your days.

1. Focus for 15 Minutes in the Morning

Lee Iacocca, the former CEO of the Chrysler Motor Company, once complained that he didn’t even have fifteen minutes per workday to focus on the big issues. You probably feel the same way. As soon as you get to the office (or go online from your desk at home) your team members are on you for help with their emergencies. Your schedule is packed with meetings and calls. When are you supposed to do the big thinking that can generate more sales?

The answer is to get up just fifteen minutes in the morning and go down to your kitchen table to work on your number one priority in your business. Work with a pen and paper only, no electronics, and you’ll make incredible progress. You’ll be joining some of the greatest minds in history.

Frank Lloyd Wright, the famous architect, would often create his sketches at 4 a.m. “My mind’s clear,” he said, “so I get up and work.”

Hemingway, despite his legendary hangovers, would write at 6 a.m., because as he said, “There is no one there to disturb you.”

Even Beethoven composed at dawn.

There’s creative power in the first fifteen minutes of the morning where no one else is awake to bother you and when your mind is clear.

2. Find, Protect, and Leverage Your Magic Time

The second most productive time in the day is what is known as your magic time. Everyone has it. It’s the time of day when you are most creative, productive, and efficient. It’s when you have the best energy for your sales calls. It’s when you can write 1,500 words of sales copy (that would take you three times as long at any other point of the day).

My magic time is at 5 a.m. That’s when I sit and write one thousand word essays or book chapters in under an hour. It’s when I script my YouTube videos (some of which have been viewed over 2 million times.

But it’s not early morning for everyone. A coaching client of mine, J.M., runs a $115 million supplement company during his magic time of 11 p.m. to 2 a.m. He’s a biological night owl, and no amount of trying could shift his magic time to earlier in the day.

That’s why you have to use my time journal (Link to www.CraigBallantyne.com/freegift) to identify your Magic Time. When you do, ruthlessly protect it from all distractions, and leverage it into creating million dollar ideas for your business.

3. Start Tomorrow at the End of Today

One of the biggest mistakes most entrepreneurs make is waiting until the morning to begin planning their day. But Andrew Carnegie, the famous steel magnate of the early 1900’s, knew that you should finish each day listing your top 3-5 tasks for tomorrow before you want home at night. Doing this has two benefits. First, it tells your subconscious mind to work on these problems while you sleep (and when you wake up, you focus your fifteen minutes in the morning on turning your overnight ideas into moneymaking solutions). Second, it allows you to get off to a fast start in the morning, rather than wasting time getting organized.

Success is simple. It’s not easy, but it’s simple. You have to do the work, but the steps to success have been laid out for centuries. Do what these great thinkers have done and implement these three rituals immediately for virtually overnight success.

Craig Ballantyne is the author of The Perfect Day Formula and owner of the success newsletter at EarlyToRise.com. His straightforward, sometimes “politically-incorrect” advice has helped millions of people transform their lives both physically and financially. His secret weapons for success include his personal commandments, his 5 pillars, and his Perfect Life Workshops. Click here to learn more from Craig so that you can get more done, make more money, and live the life of your dreams.