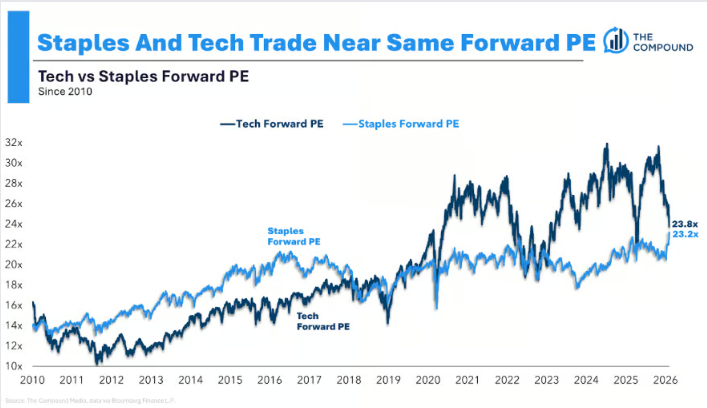

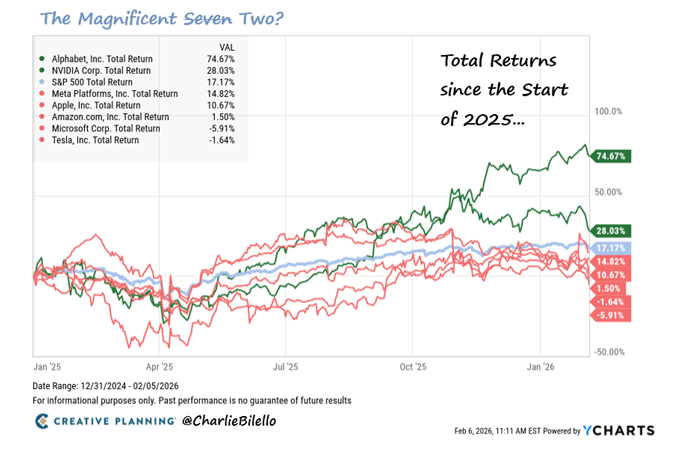

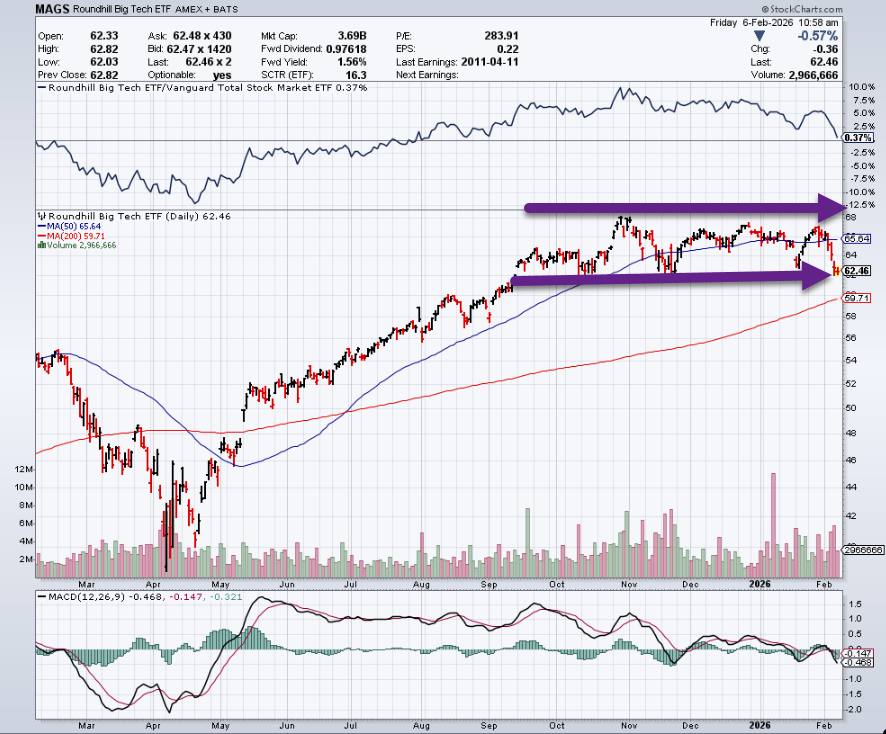

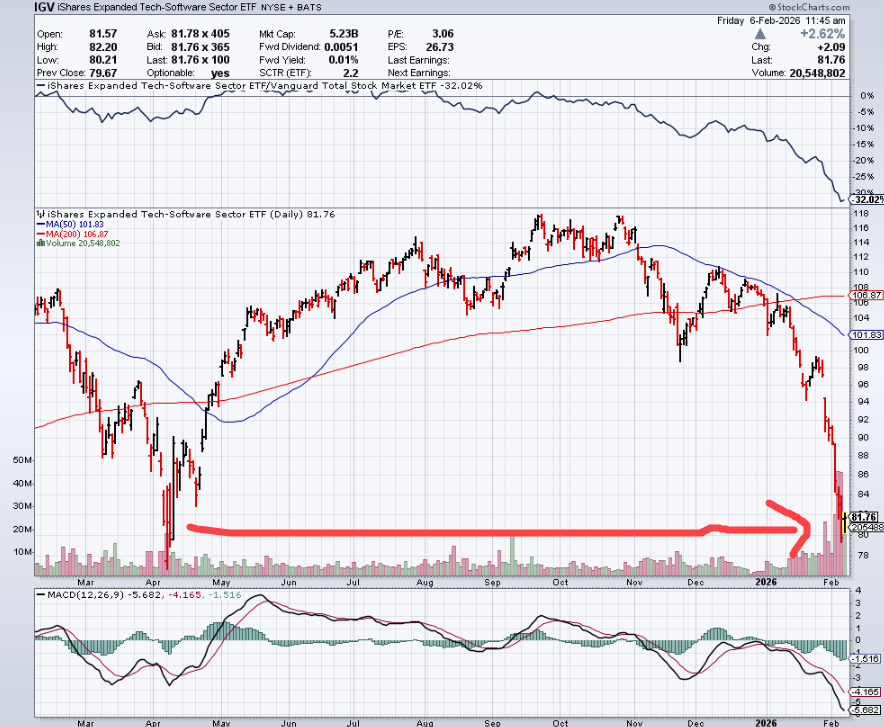

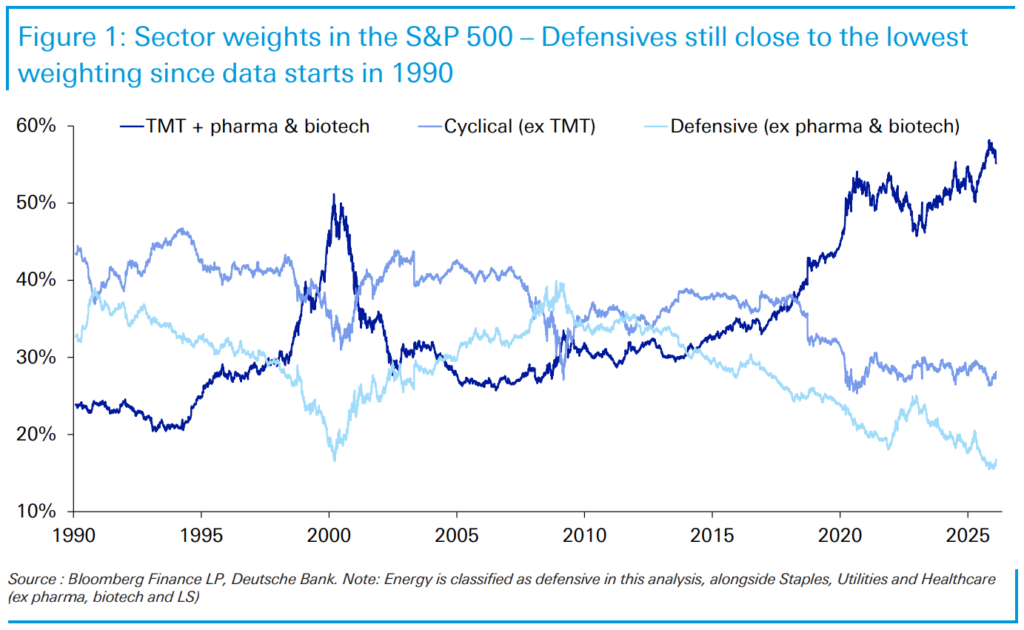

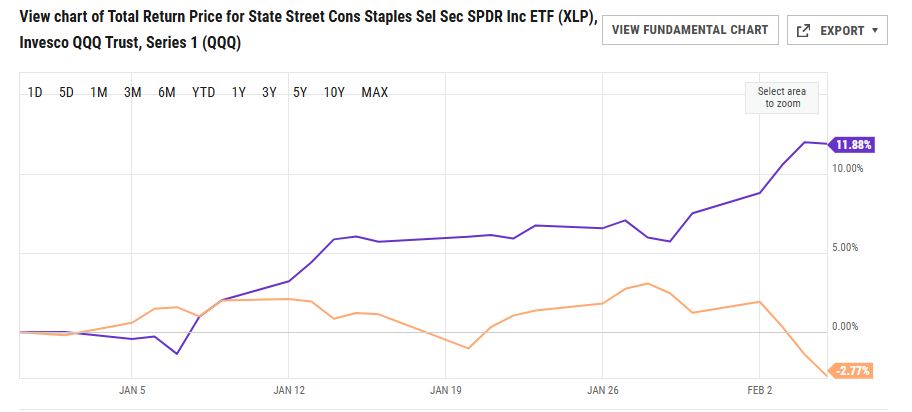

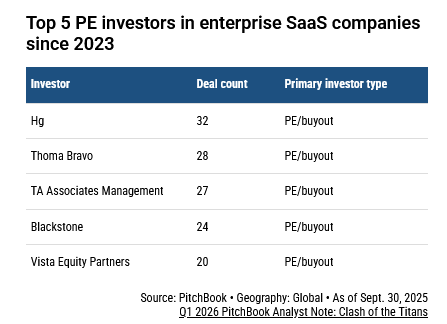

1. Tech vs. Non-Tech Stocks

Tech Top (Relative Terms): on a relative basis US tech stocks have not only peaked but broken sharply lower vs non-tech stocks.

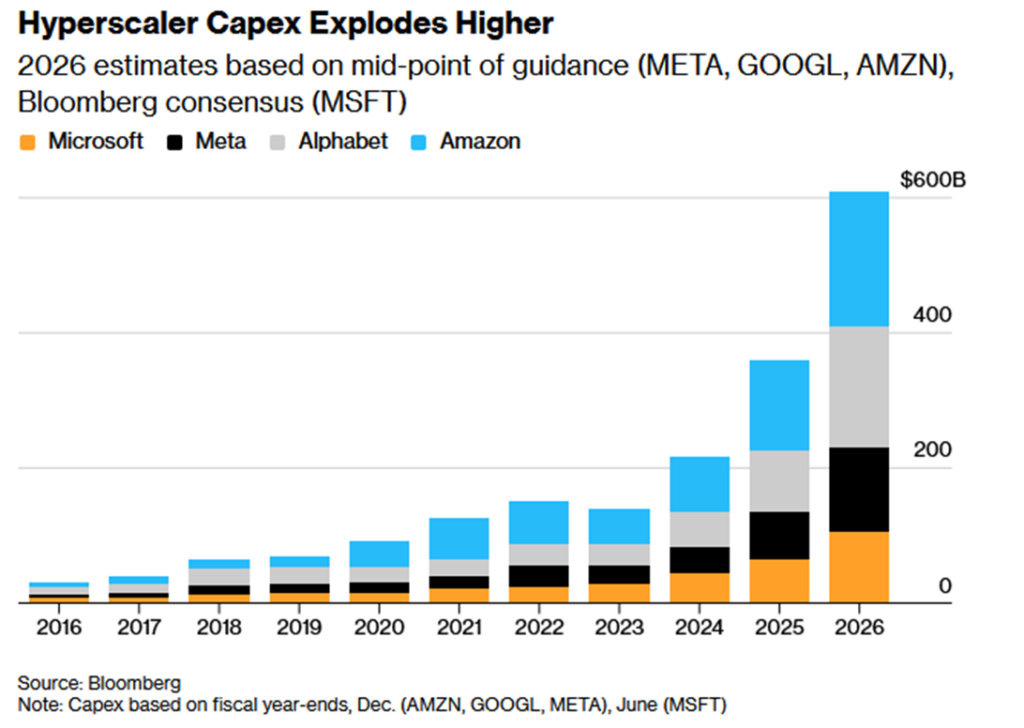

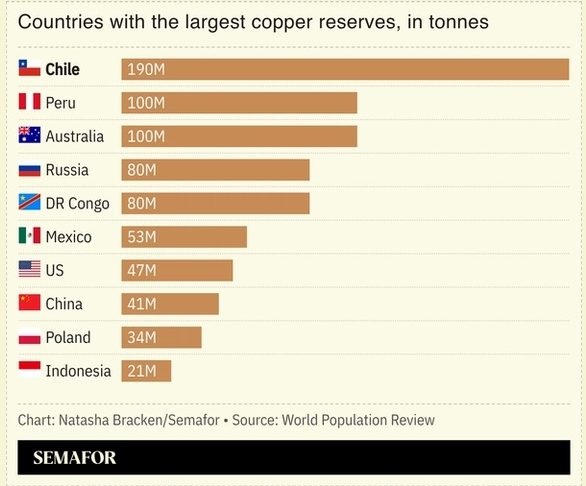

2. S&P Companies Replacing Stock Buybacks with Capital Spending

Kalani o Māui

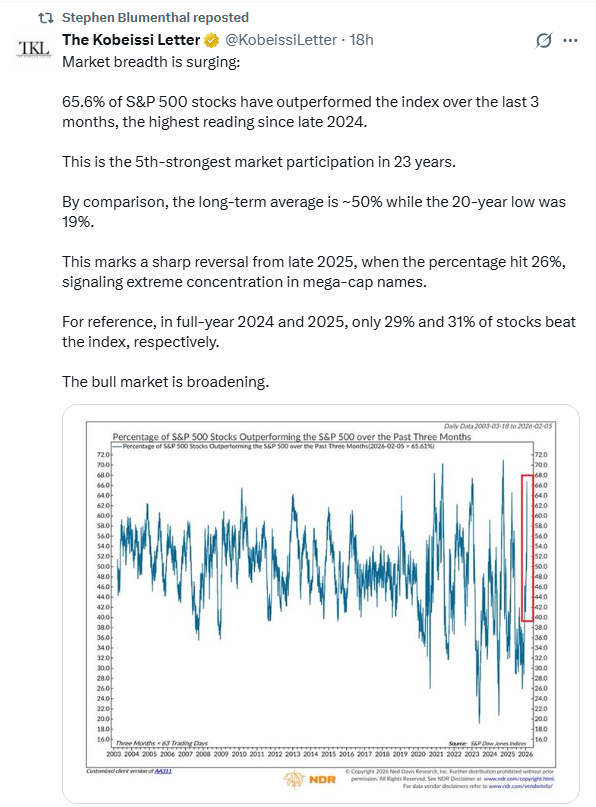

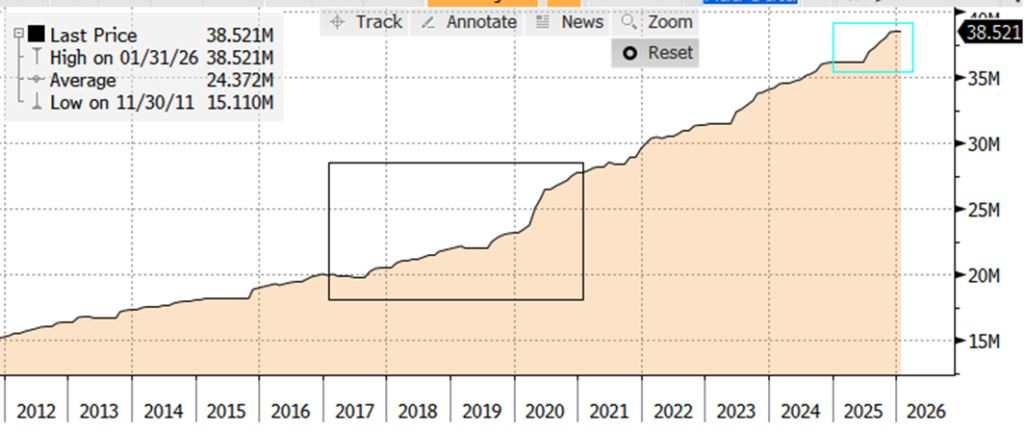

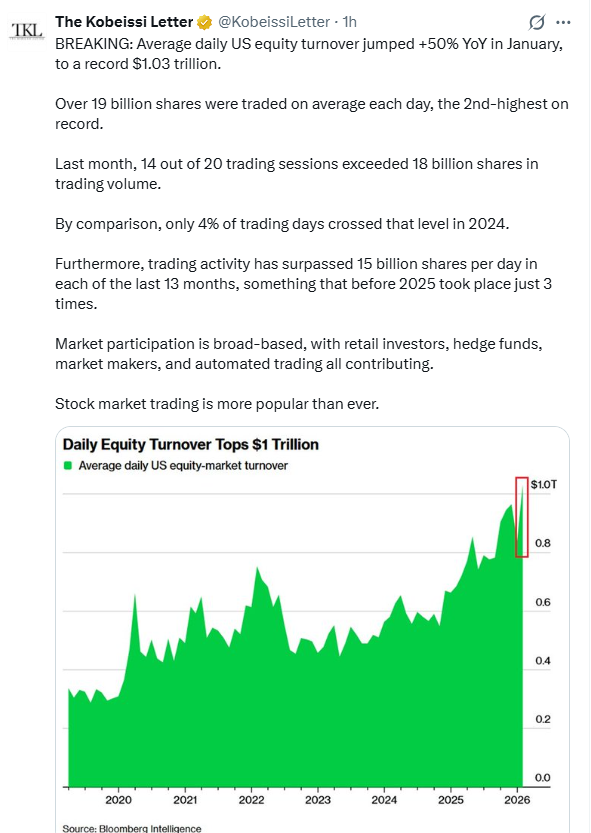

3. Stock Trading Daily Turnover $1 Trillion

The Kobeissi Letter

4. Robinhood -34% 2026….. 4th Quarter Crypto Trading Revenues Decreased -38%

Google Finance

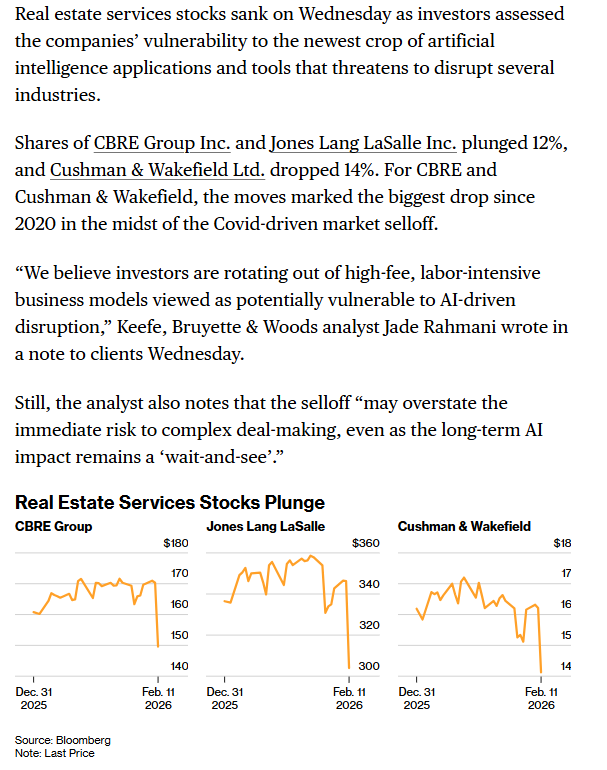

5. Rolling Mini-Bear Markets in Sub-Sectors Due to AI Disruption

Real Estate Services Stocks Sink in Latest ‘AI Scare Trade’-Bloomberg

By Janet Freund and Arvelisse Bonilla Ramos

Bloomberg

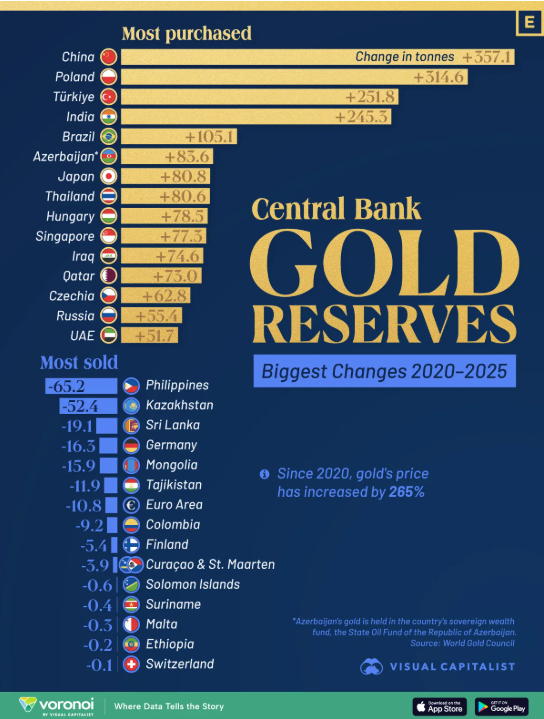

6. Central Banks Buying and Selling Gold 2020-2025

Visual Capitalist

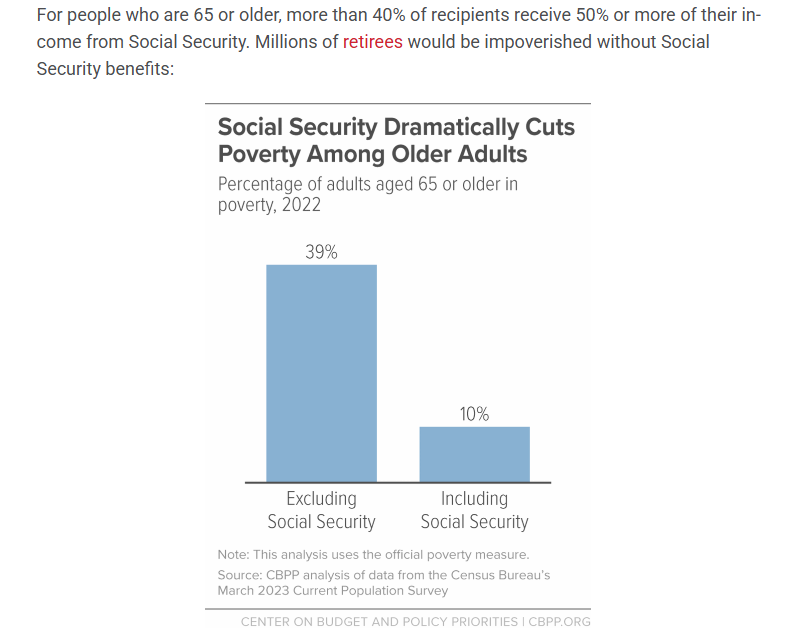

7. Social Security and Poverty-Ben Carlson

A Wealth of Common Sense

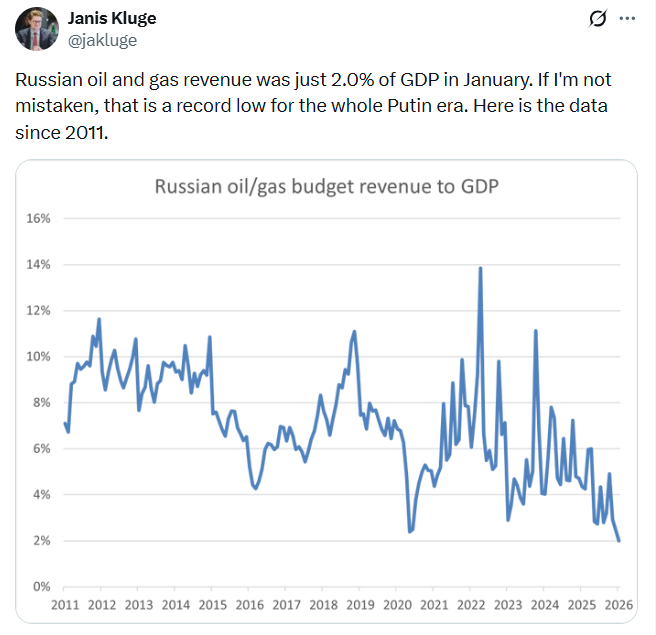

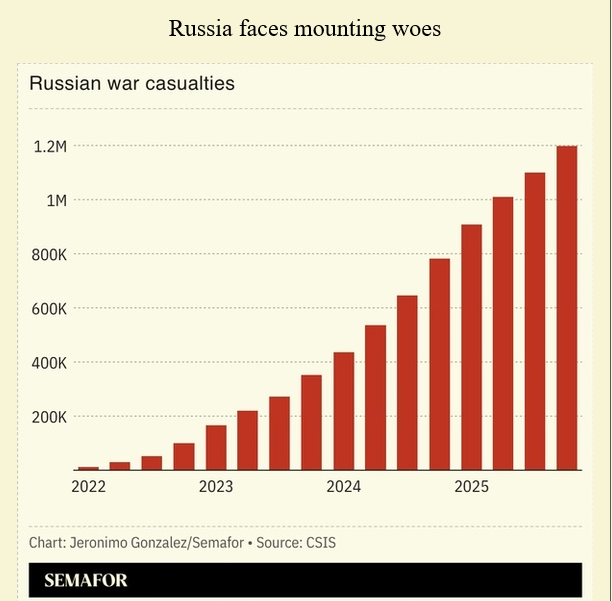

8. Russia Running Out of Soldiers

Semafor

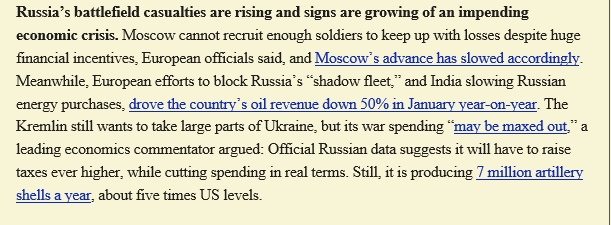

9. Majority of Americans Low Confidence in Journalists to Act in Public’s Best Interest

Pew Research Center

10. 26 Rules to Be a Better Thinker in 2026

What follows is my advice for what you’re going to need more than ever in this brave new world—26 rules for becoming a better thinker.

– Take another think. The problem with our thoughts is that they’re often wrong—sometimes preposterously so. Nothing illustrates this quite like what’s called an “eggcorn,” words or expressions we confidently mishear and then contort to match our misperception. “All for not” instead of all for naught. “All intensive purposes” instead of all intents and purposes. But the greatest eggcorn is doubly ironic: people who say “you’ve got another thing coming” are, in fact, proving the point of the actual expression, “you’ve got another think coming.” We need to be able to slow down and use a second think. Especially when we’re sure what we think is right. (And by the way, at least 50% of the time I have to ask ChatGPT to think again because it’s answers are obviously wrong).

– Take walks. For centuries, thinkers have walked many miles a day—because they had to, because they were bored, because they wanted to escape the putrid cities they lived in, because they wanted to get their blood flowing. In the process, they discovered an important side-effect: it cleared their minds and made them better thinkers. Tesla discovered the rotating magnetic field—one of the most important scientific discoveries in modern history—on a walk through a Budapest park in 1882. Hemingway took long walks along the quais in Paris whenever he was stuck and needed to think. Nietzsche—who conceived of Thus Spoke Zarathustra on a long walk—said: “It is only ideas gained from walking that have any worth.” I have never taken a walk without thinking, after, “I am so glad I did that.”

– Embrace contradiction. F. Scott Fitzgerald said, “The test of a first-rate intelligence is the ability to hold two opposing ideas in mind at the same time and still retain the ability to function.” The world is complicated, ambiguous, paradoxical. To make sense of it, you must be able to balance conflicting truths.. F. Scott Fitzgerald said, “The test of a first-rate intelligence is the ability to hold two opposing ideas in mind at the same time and still retain the ability to function.” The world is complicated, ambiguous, paradoxical. To make sense of it, you must be able to balance conflicting truths.

– But don’t confuse complexity with nonsense. Stupid people are especially good at having a bunch of contradictory thoughts in their head at once. So the first-rate mind Fitzgerald described isn’t just about tolerating contradiction—it’s really about the ability to examine and interrogate it. It’s asking, Does this actually make sense?

– Go to first principles. Aristotle taught that one must go to the origins of things, go all the way to the primary truth of the matter, instead of just accepting common observation or belief. Don’t just blindly accept what everyone else seems to say or believe. Go to first principles. Instead of engaging with an issue from a headline, a tweet, or a take, go to the beginning. Break things down and build them back up. Put every idea to the test, the Stoics said. The good thinker approaches things with a fresh set of eyes and an open mind.

– Think for yourself. Generally, people just do what other people are doing and want what other people want and think what other people think. This was the insight of the philosopher René Girard, who coined the theory of mimetic desire. He believed that since we don’t know what we want, we end up being drawn—subconsciously or overtly—to what others want. We don’t think for ourselves, we follow tradition or the crowd.

– Don’t be contrarian for contrarian’s sake. Peter Thiel, widely considered a “contrarian,” (and a big fan of Girard) once told me that being a contrarian is actually a bad way to go. You can’t just take what everyone else thinks and put a minus sign in front of it. That’s not thinking for yourself. So in fact, if you find yourself constantly in opposition to everyone and everything (or most consensuses) that’s probably a sign you’re not doing much thinking. You’re just being reactionary.

– Ask good questions. When Isidor Rabi came home from school each day, his mother didn’t ask about grades or tests. “Izzy,” she would say, “did you ask a good question today?” This doesn’t seem like much, and yet it is everything. After all, questions drive discovery. The habit of asking questions turned Rabi into one of the greatest physicists of his time—a Nobel Prize winner whose work led to the invention of the MRI. Questions are the key not just to knowledge but to success, discovery, and mastery. They’re how we learn and how we get better. And they don’t have to be brilliant, probing, or incisive. They can be simple: “What do you mean?” They can be inquisitive: “How does that work?” They can aim for clarity: “Sorry, I didn’t understand, can you explain it another way?” The point is to stay curious. To never stop asking questions.

– Watch your information diet. When I’m not feeling great physically — tired, irritable, sluggish — usually it’s because I’m eating poorly. In the same way, when I feel mentally scattered and distracted — I know it’s time to focus on cleaning up my information diet. In programming, there’s a saying: “garbage in, garbage out.” Aim to let in the opposite of garbage. Because that leads to the opposite of garbage coming out.

– Go deep. I thought I knew a lot about Lincoln. I’d read biographies, watched documentaries, interviewed scholars, visited the sites. I’d even written about him in my books. So when I sat down to write about him in Part III of Wisdom Takes Work, I thought I was set. I wasn’t even close. So I went deeper. I read Hay and Nicolay. Doris Kearns Goodwin’s 944-page Team of Rivals. Michael Gerhardt’s 496-page book on Lincoln’s mentors. David S. Reynolds’s 1088-page Abe. David Herbert Donald’s 720-page Lincoln. Garry Wills’s Pulitzer Prize-winning book on the Gettysburg Address. I spoke with the documentarian Ken Burns about him, and Doris too. I read Lincoln’s letters and speeches. I went, multiple times while writing the book, to the Lincoln Memorial. In the end, I spent hundreds of hours reading thousands and thousands of pages on the man. Basically, I “dug deeply,” as Lincoln’s law partner once said of Lincoln’s own approach to learning, in order to get to the “nub” of a subject. This is a skill you need. Whether you’re an author, politician, lawyer, entrepreneur, scientist, educator, parent—you have to be able to pursue an idea, a question, a thread of curiosity until you’ve gotten to the nub and wrapped your head completely around it.