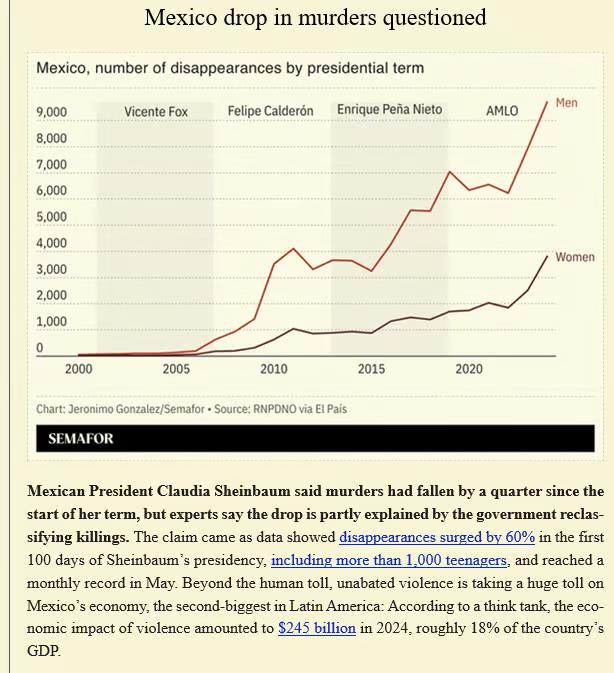

1. Historical Price to Sales S&P

The Irrelevant Investor

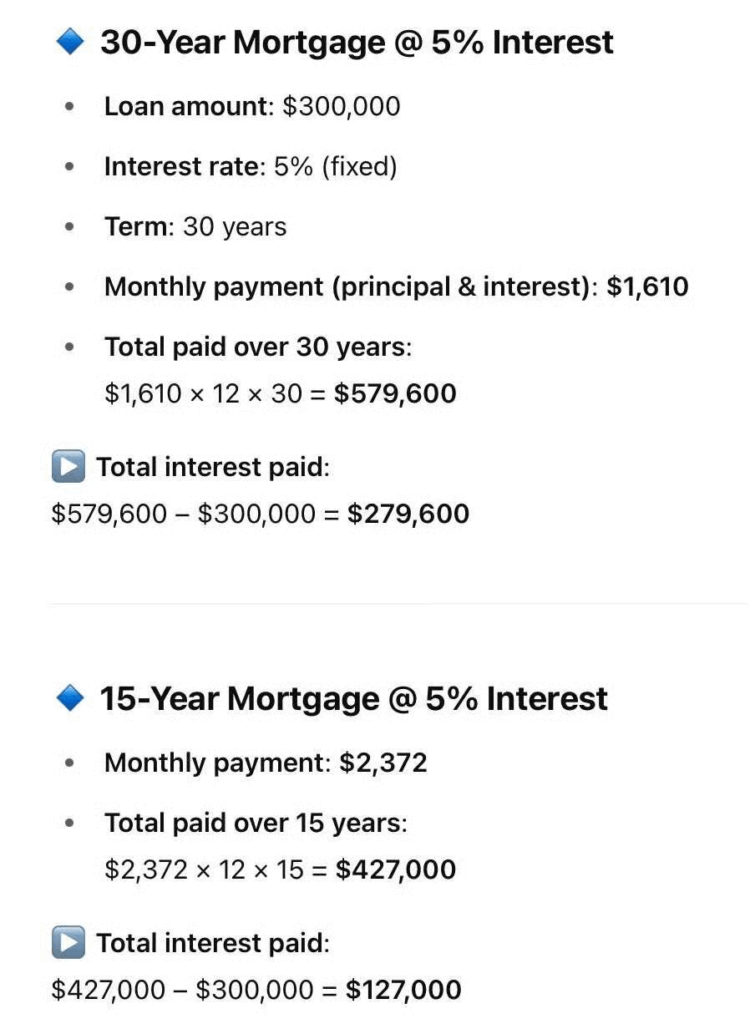

2. Most Crowded Trades Gold

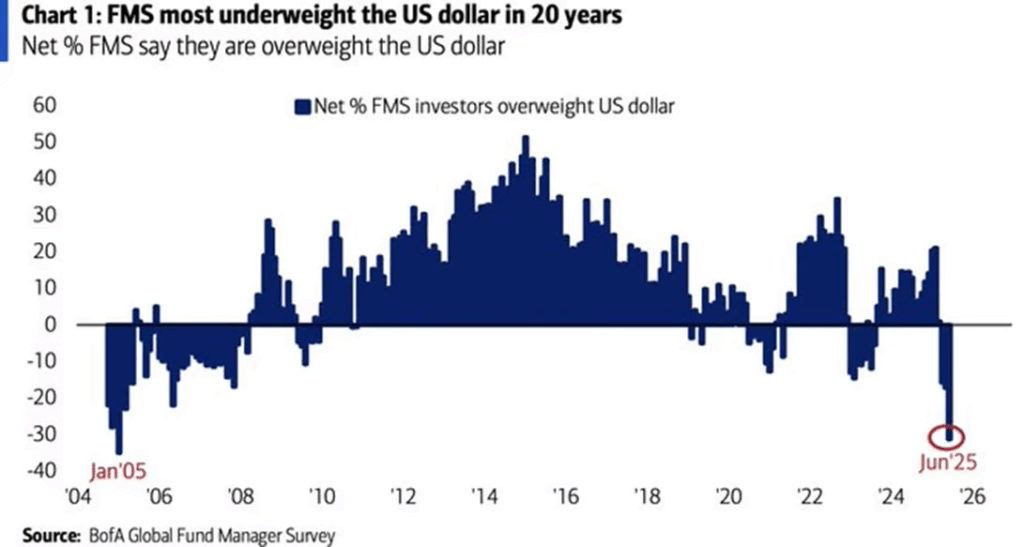

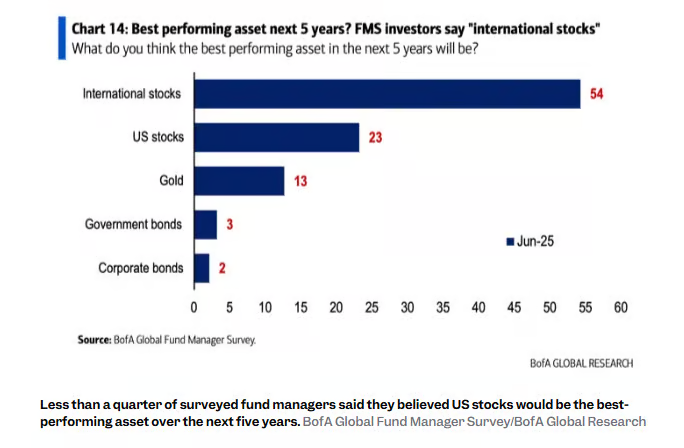

Crowded trades. ‘Long gold’ remains the most crowded trade (3rd consecutive month) followed by ‘Long Mag7’ and ‘Short USD’.

BofA via mikezaccardi

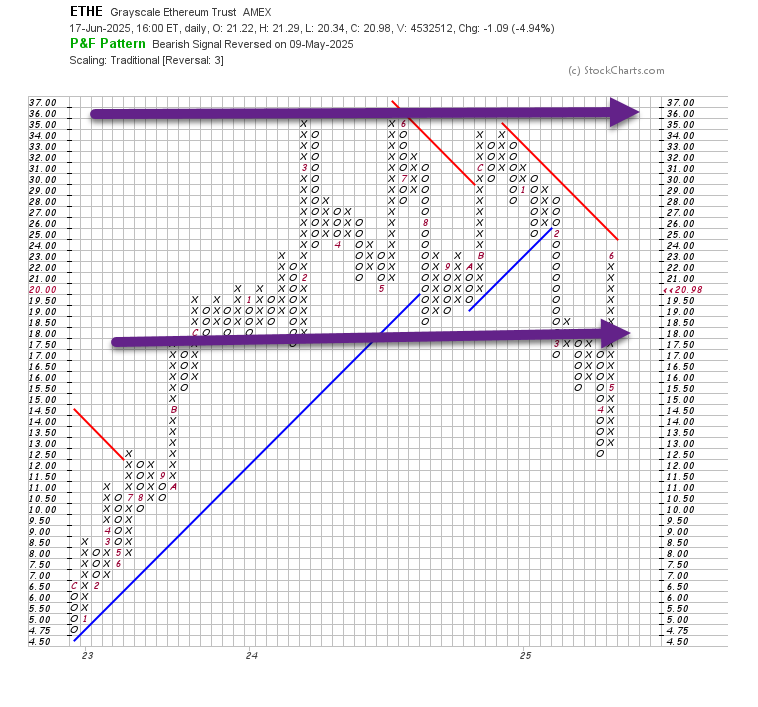

3. Ethereum ETF Big Rally Off Lows…Right Back into Range 2023-2025

StockCharts

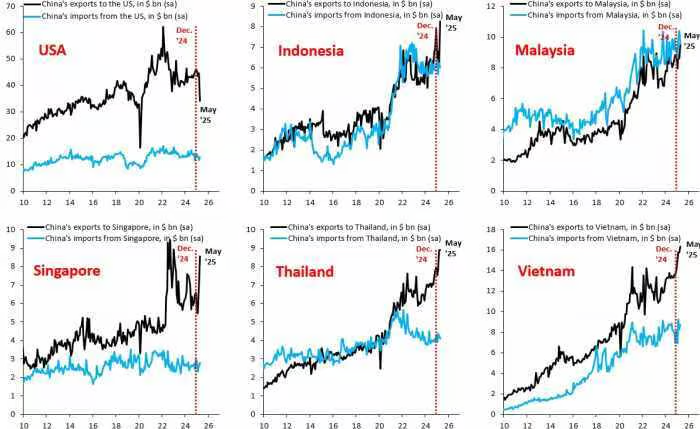

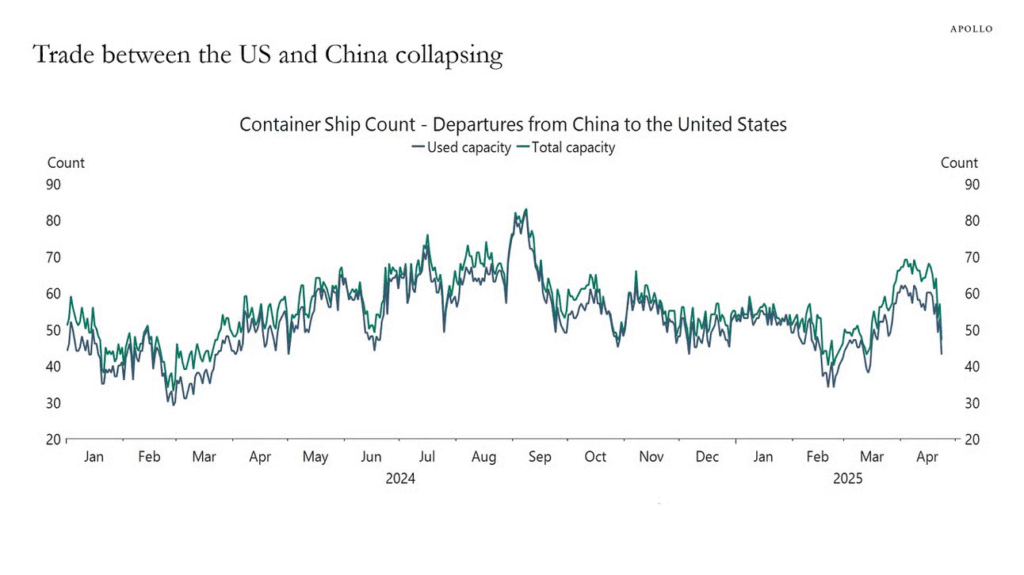

4. Trade Between U.S. and China Rolling Over Hard

Ritzholz

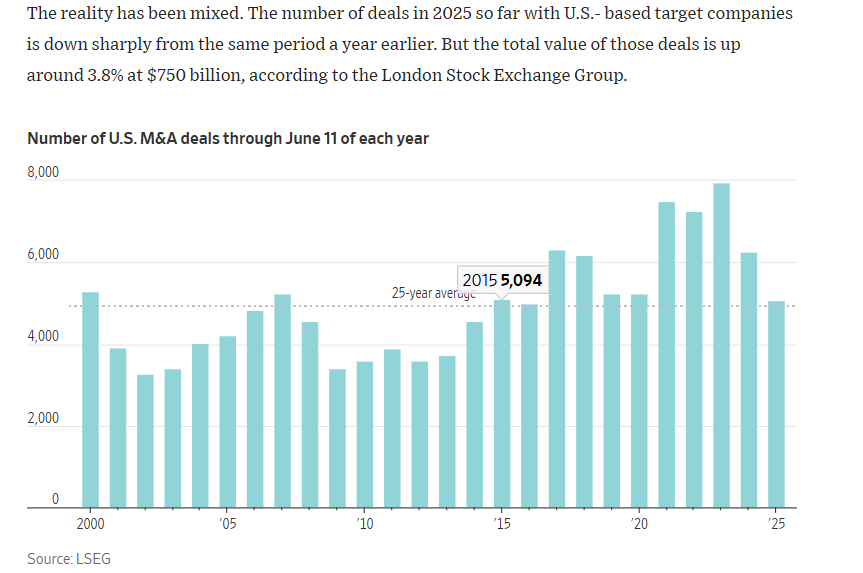

5. M&A Deals Down But Total Value +3.8%

FinChart

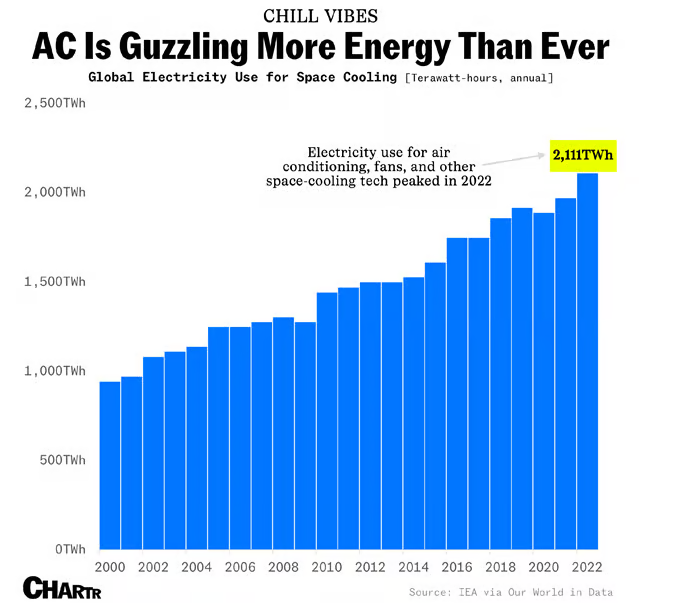

6. More Demand from Energy Grid…Summer AC Use at Records

Sherwood

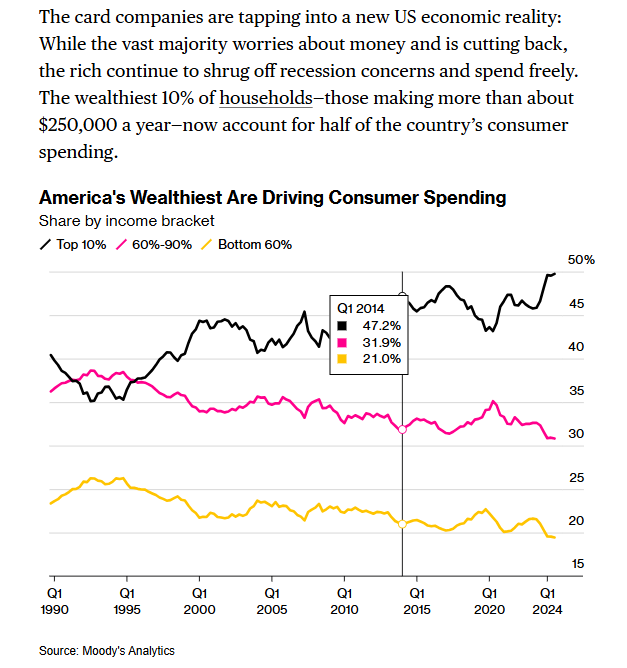

7. Wealthiest 10% Now Account for Half of U.S. Consumer Spending

Bloomberg

8. Credit Card Points are the World’s Third-Largest Currency

Point.Me

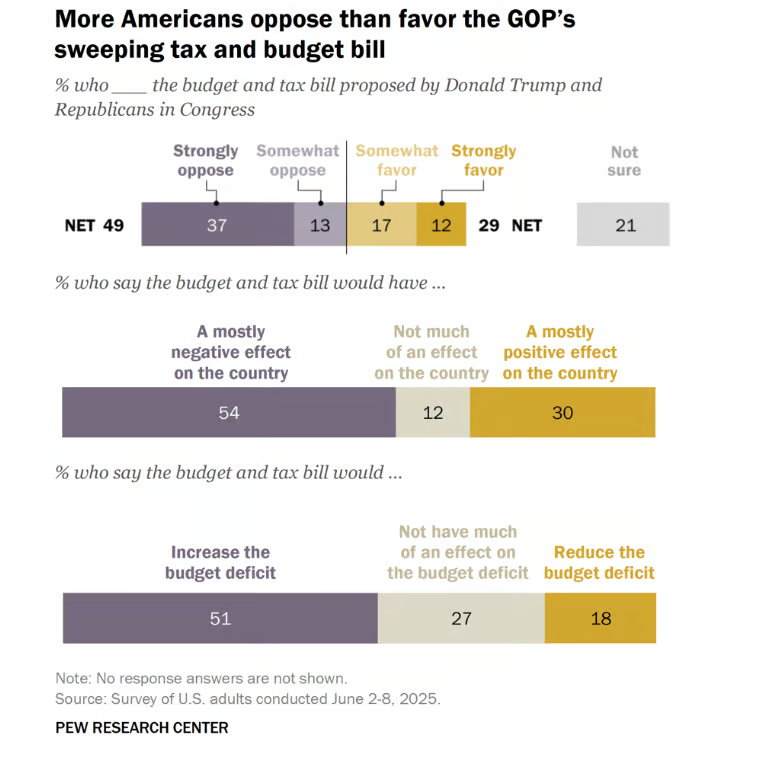

9. Pew Research on Budget Bill

Pew Research Center

10. Every Leader Should Be a Student of Psychology

To lead well, one must understand what drives and influences relationship.

Key points

- Leadership is inherently relational, not positional, and technical skills alone are not enough.

- Emotional intelligence is foundational to leadership success.

- The study of psychology should be a deliberate practice for leaders.

Via Psychology Today: There’s a pervasive myth that still lingers in leadership classrooms: the idea that good leaders are simply born with presence, confidence, and instinct. While those traits may help some individuals ascend to positions of authority, they are insufficient for navigating the human complexities that leadership demands. To be effective in today’s ever-evolving organizational landscape, leaders must be students of psychology (in both principle and practice) if they hope to lead effectively.

About Leadership

Three things matter in Leadership: Relationships, Relationships, and Relationships. Leadership is, at its core, a relational practice. It is not about authority (or positional power); it is about influence. And influence is rooted in an understanding of human behavior, motivation, emotion, and interaction. It is important that a leader understand the behavior of others as well as their own.

As I often remind students and colleagues alike, no matter how technically skilled a leader may be, their impact is limited if they cannot connect with, motivate, and adapt to the emotional and psychological needs of their teams. In the program I direct at Teachers College, Columbia University, we require students to take two foundational courses that emphasize this belief: Self-Awareness Training and Social-Emotional Learning.

Emotional Intelligence: Leadership’s Secret Ingredient

One of the most foundational psychological principles in leadership is emotional intelligence (EI), a concept introduced by Mayer and Salovey1 and later popularized by Daniel Goleman. Goleman’s research demonstrated that EI contributes more to workplace success than IQ, particularly in high-pressure environments2. Why is that the case? Emotionally intelligent leaders can perceive and regulate their own emotions (especially during stressful moments), empathize with others’ experiences, build trust, and de-escalate conflict.

A study conducted in Palopo, Indonesia, for example, revealed that school leaders with high EI had a direct and positive impact on teacher performance. This success stemmed from their capacity to recognize emotions, manage relationships, and create workplace harmony3.

In practical terms, when individuals feel seen, understood, and supported, their ability to perform and collaborate improves significantly.

Why This Matters

We are living in a time defined by constant change, social complexity, and new demands on leadership. Today’s teams are more diverse, geographically distributed, and dynamic than ever before. Leaders who understand the psychology of their people are more likely to foster positive cultures, reduce conflict, and increase performance/productivity4.

Those who use emotional intelligence and motivational theory to inform their leadership behaviors are not only better equipped to lead diverse teams but also more capable of sustaining organizational well-being over time. The most effective leaders going forward will not necessarily be those with the loudest voices or the most polished résumés. They will be those who understand how people think and feel, who communicate in ways that resonate, and who create environments in which people feel psychologically safe. These are not “soft skills” (as often labeled). They are critical survival skills for effective leadership through today’s challenges.

If you are in a leadership role (or aspire to be in one), consider this your invitation to become a student of psychology. Not for the sake of theory, but for the sake of better practice. Start by exploring the basics: emotional intelligence, motivational theory, and self-awareness. Read. Reflect. Ask better questions. Challenge your assumptions. And above all, lead with curiosity and compassion.

Leadership is not about you. It is about those you serve. And understanding the psychology of leadership may be one of the most powerful tools you can include in your box.