1.Turkey ETF -40% YTD

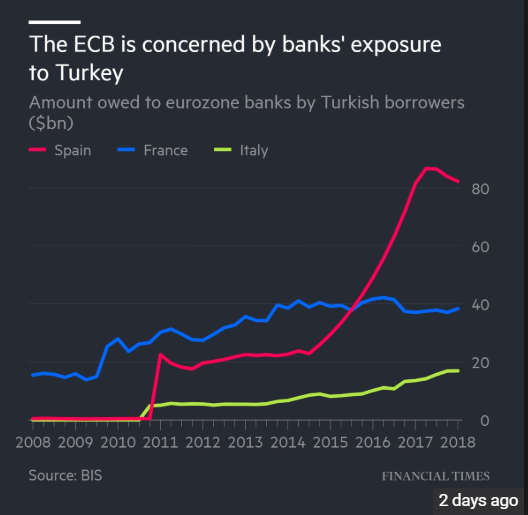

The roots of Turkey’s travails are no mystery. Erdogan pumped a congenitally volatile economy full of steroids in the election run-up, restraining interest rates and pushing a large guaranteed loan program through the banks. That jolted gross domestic product growth north of 7%, but fueled a vertiginous current-account deficit at 6% of GDP. Stress is focused on the banking system, whose clients owe $180 billion in short-term foreign-currency debt, figures Timothy Ash, senior emerging markets sovereign strategist at BlueBay Asset Management. That gets more expensive in lira by the day. “Turkey’s Achilles’ heel is that its banking system is used to intermediate large-scale foreign-currency borrowing,” says Robin Brooks, chief economist at the Institute for International Finance in Washington.

Erdogan compounded his problems by stumbling into conflict with President Donald Trump’s administration over Andrew Brunson, a U.S.-born, Turkey-based Protestant pastor arrested two years ago on charges of colluding with Kurdish terrorists.

Turkey Pays a Financial Price for Its Politics

By

Craig Mellow

https://www.barrons.com/articles/turkey-pays-a-financial-price-for-its-politics-1533916009