Category Archives: Daily Top Ten

Topley’s Top Ten – February 28, 2019

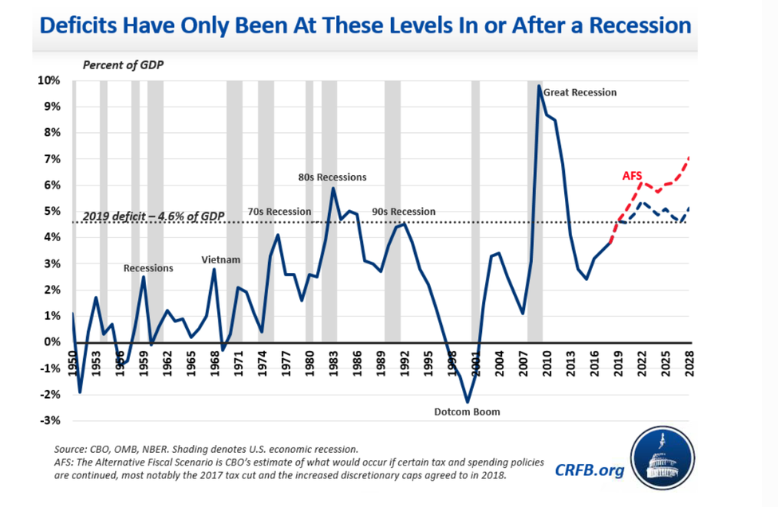

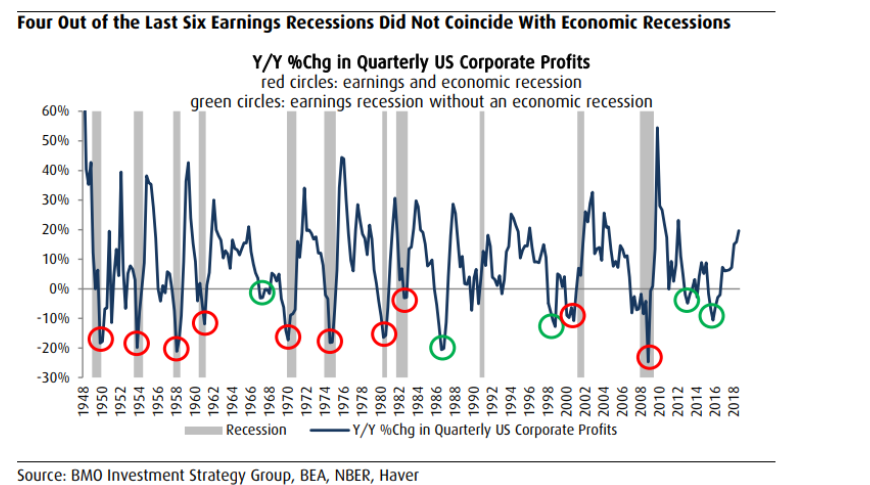

1.Earnings Recession Does Not Necessarily Mean Economic Recession

The idea is that an earnings recession would lead to a conventional economic downturn, with rising unemployment, falling consumption and even broader downward pressure on profits — but that’s not actually true, Belski said in an interview.

Indeed, an earnings recession has happened six times since 1987 — but a real recession has followed only twice, Belski said. That alone should mitigate any fears that an earnings slowdown would come back to bite the market, he said.

Furthermore, when earnings downturns happen and economic recessions don’t follow, the S&P has risen an average of 17.6% over the next year, he said, citing the five times this has happened since 1967

Opinion: What ever happened to that earnings recession?By Tim Mullaney

https://www.marketwatch.com/story/what-ever-happened-to-that-earnings-recession-2019-02-27

Topley’s Top Ten – February 27, 2019

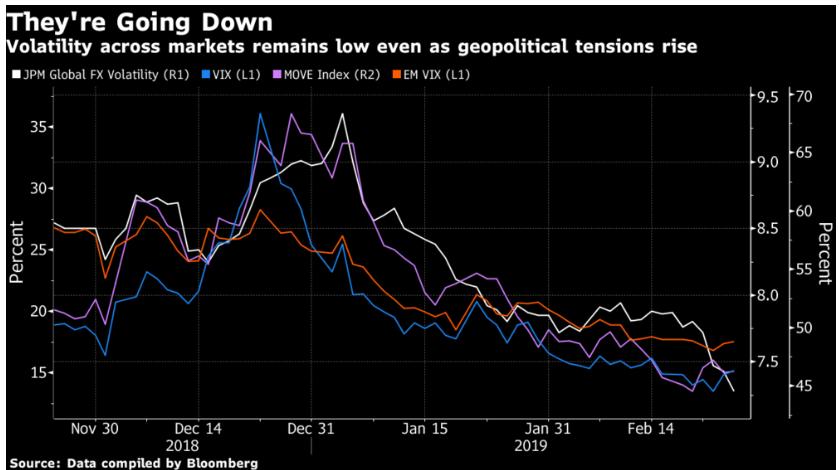

1.Volatility Across Markets Big Drop.

Five Things You Need to Know to Start Your Day Get caught up on what’s moving markets. By Lorcan Roche Kellyhttps://www.bloomberg.com/news/articles/2019-02-27/five-things-you-need-to-know-to-start-your-day-jsn4mcso?srnd=premium

Topley’s Top Ten – February 26, 2019

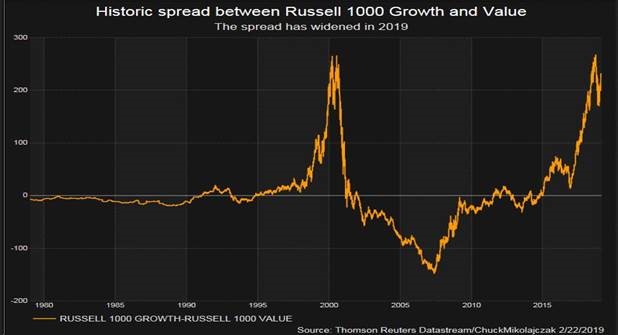

1.Spread Between Growth and Value Stocks Hits 1999 Bubble Levels.

Russell 1000 Growth vs. Russell 1000 Value.

The spread between the Russell 1000 growth and value indexes is again nearing levels hit during the end of the dot-com era

Topley’s Top Ten – February 25, 2019

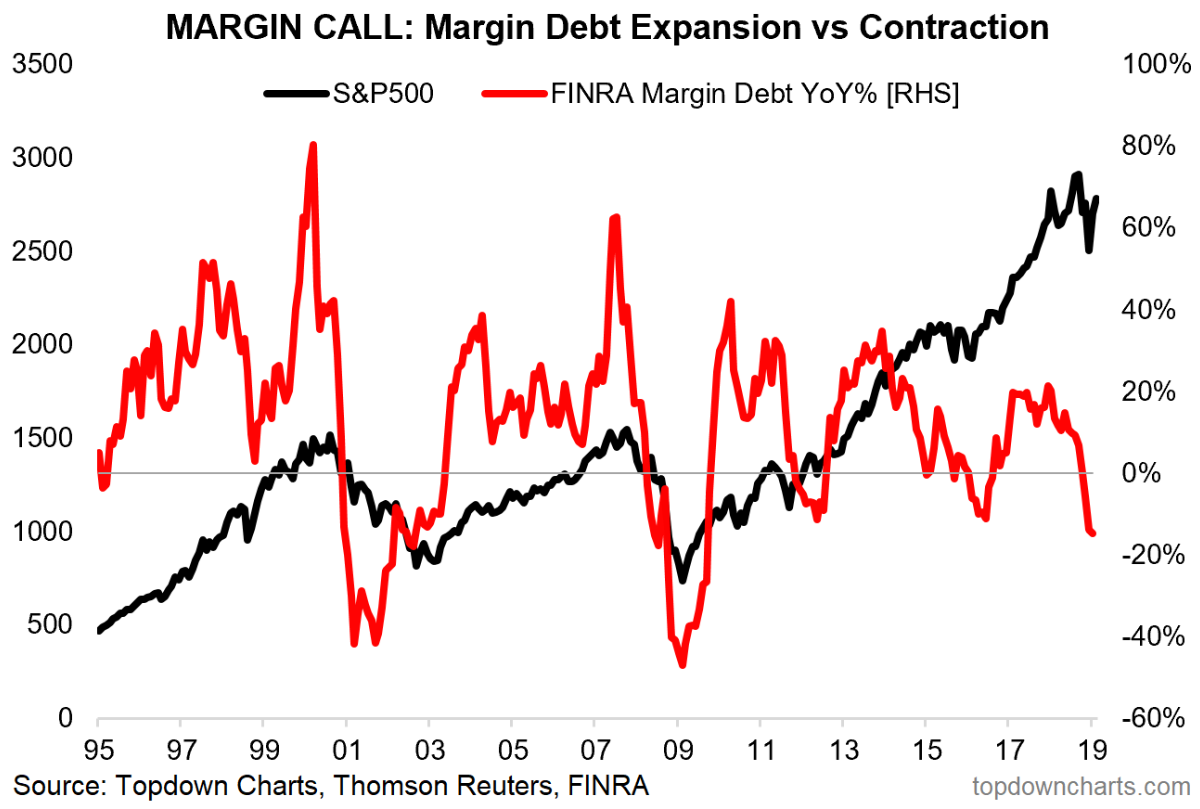

1.Historical Margin Chart.

| Margin Call — Margin Debt Accelerometer: Here’s an interesting chart, basically a bear market warning indicator; the year over year change in US margin debt [note it used to be called NYSE margin debt, but now FINRA publishes a broader set of data]. The basic concept is that when margin debt is contracting on an annual basis it can serve as a bear market warning signal (margin calls and lower risk appetite). Only thing I would add is that in the 2000 & 2008 experiences there was a substantial acceleration in margin debt growth before the contraction signal was triggered, so one might argue the lack of that acceleration weakens the signal this time around… |