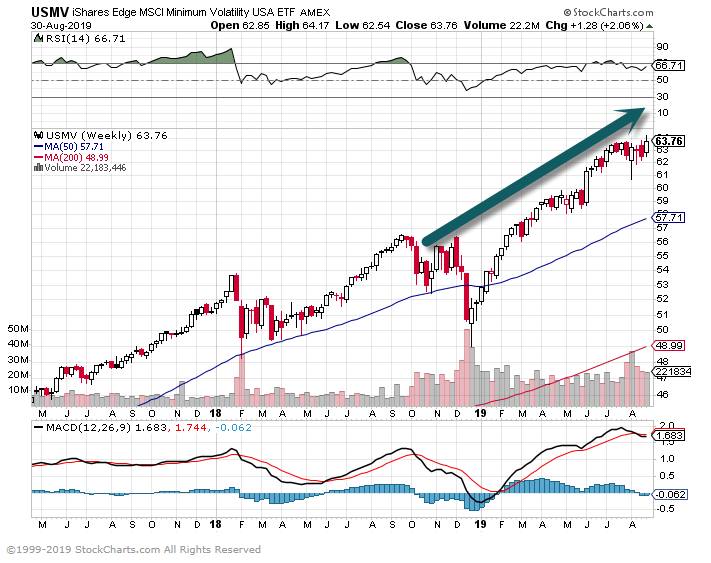

1.More Information on Low Volatility Funds.

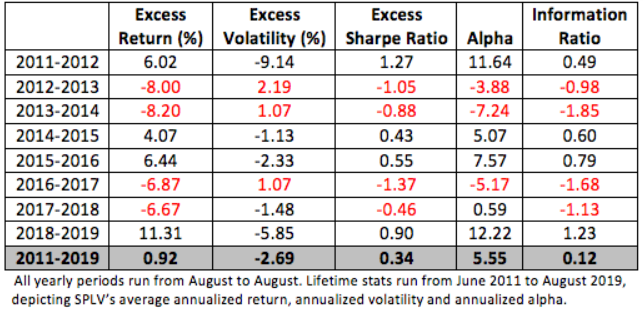

The table below details SPLV’s portfolio characteristics on a year-by-year basis versus SPY. Values in red denote underperformance by the low-vol portfolio. The fund’s lifetime numbers, shown in the gray row at the bottom of the table, are indeed impressive: a higher average annual return, lower volatility and a resultant higher Sharpe ratio, along with a positive alpha coefficient and information ratio.

Within that time span, however, there’s a lot of, um, volatility in the numbers. In those years when SPLV’s standard deviation was higher than SPY’s, there was a cascading and deleterious effect on returns and other portfolio metrics.

So, what’s the point of all this? Simply put, capture of the low-volatility anomaly is path dependent. Just because there’s a low-vol product available doesn’t mean you’ll always derive immediate benefit from its use. Look at the back-to-back underperformance in the 2012-2013 and 2013-2014 spans. Would you have been disappointed by SPLV back then? Would you have bailed from the low-vol strategy?

Many investors, in fact, did just that. Net outflows mounted in the 2013-2014 period and even spilled over into the subsequent period, just ahead of a couple of banner years. And in the 2016-2017 span, SPLV’s net outflows totaled $1.4 billion as the low-vol ETF significantly lagged SPY.

Good Full Read

When Low-Vol Is Not-Strategy may require some time to pay off. Brad Zigler | Sep 09, 2019

Continue reading