1.You Call This A Bull Market?-Bespoke Investment Group

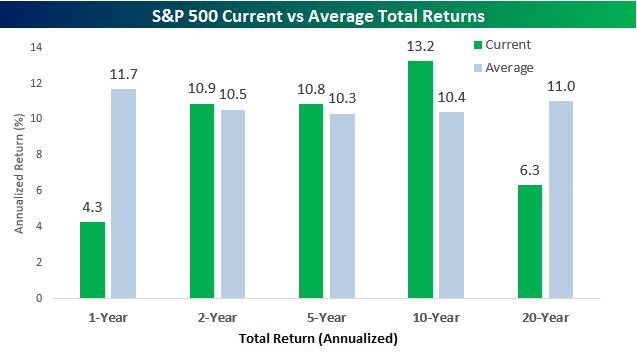

By just about all accounts, investors have been spoiled over the last ten years as the S&P 500 has rallied more than 13% on an annualized basis. However, when you compare returns for the market over the last one, two, five, ten, and twenty years, current returns are hardly at any sort of historical extreme. The chart below compares the S&P 500’s annualized performance on a total return basis to the average annualized return for all similar time frames. Looking just at the last year (through 9/30), the S&P 500’s total return is 4.3%, which is less than half of the historical average one year total return of 11.7%. Looking at two and five-year annualized performance figures, current returns are just modestly above their historical average. While the ten-year annualized return is almost three percentage points above the historical average, the current 20-year annualized gain of 6.3% is well below the S&P 500’s historical average of 11.0%.

https://www.bespokepremium.com/interactive/posts/think-big-blog/you-call-this-a-bull-market

Continue reading