1.Short-Term Greed at Excessive Levels.

https://money.cnn.com/data/fear-and-greed/

Continue reading

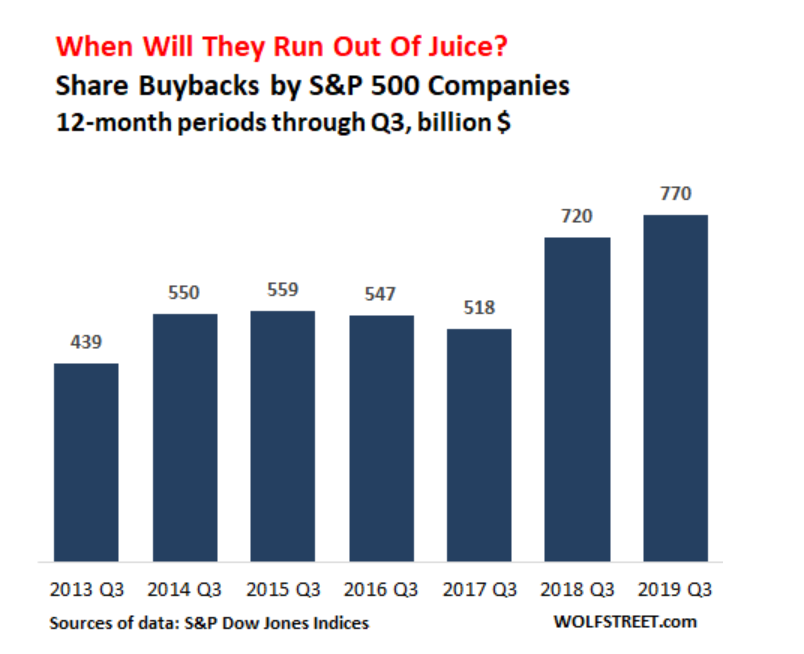

Four Banks & Three Tech Companies Blow $56 Billion in Q3 to Prop up Their Own Shares

by Wolf Richter • Dec 18, 2019 • 109 Comments

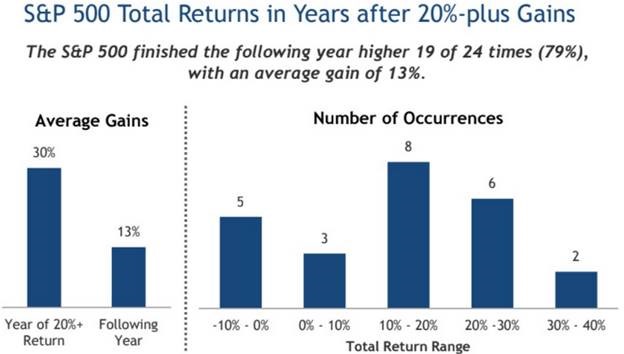

PAIN TRADE? – Bloggers note Big gains for stocks in 2020!

From Dave Lutz at Jones Trading.

Continue reading

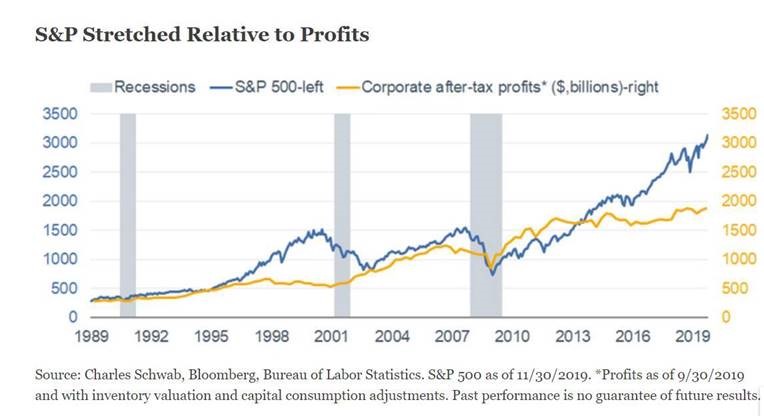

https://www.schwab.com/resource-center/insights/content/2020-us-market-outlook-ramble-on

Continue readingBarrons…That’s key, since continued low rates provide the ideal environment for equity investors, writes James Paulsen, chief investment strategist at the Leuthold Group, in a client note: “At least for the last 93 years, the opportunity to invest in stocks when the 10-year Treasury yield is below 3% has proved to be a ‘gift’.” (The benchmark note ended the week at 1.82%, down 0.02 of a percentage point.)

Adding equities to a portfolio when yields are under 3% sharply boosts returns without significantly increasing overall risk, Paulsen finds, based on the record from 1926 to 2019. The volatility of an all-equities portfolio is 40% lower when bond yields are below 3%, he further found, while future 12-month returns were negative only 18% of the time. When bond yields rise to 3% to 4%, however, the risk-reward trade-off for adding stocks is much less attractive, he says.

We Have a Trade Deal and Brexit Clarity. That’s Good News for Stocks.