1.Bloomberg notes The S&P 500 Equal Weight Index is trouncing the cap-weighted version YTD, putting up a total return of about 7.5% against 5.2%. That ~230 basis point gap is the largest in 27 years.

From Dave Lutz at Jones Trading.

From Dave Lutz at Jones Trading.

After a record $53.4 billion in deals during 2018, M&A activity in 2019 has already broken that record, fueled by the $78 billion Bristol-Myers Squibb/Celgene deal and the $7.2B Eli Lilly/Loxo Oncology deal that are now likely to ignite further buyout speculation across the industry1

LINGLINGWEI

BEIJING– China’s economic expansion languished to its slowest pace in nearly three decades last year, as a bruising trade fight with the U.S. exacerbated weakness in the world’s second-largest economy.

The 6.6% growth rate for 2018 reported Monday is the slowest annual pace that China has recorded since 1990. The economic downturn, which has been sharper than Beijing expected, deepened in the final months of 2018, with fourth quarter growth rising 6.4% from a year earlier.

Adding to the gloom was the trade conflict with Washington. The uncertain outlook for Chinese exporters caused companies to delay investing and hiring and in some cases even to resort to layoffs–a practice that is often discouraged by China’s stability-obsessed Communist Party rulers. The official jobless rate ticked up to 4.9% last month from 4.8% in November.

In the southern technology and export-manufacturing center of Shenzhen, for instance, many private makers of electronics, textiles and auto parts furloughed workers more than two months before the Lunar New Year holiday, which begins in February, according to business owners and local officials. The neighboring city of Guangzhou saw growth slump to 6.5% last year–well short of the 7.5% annual target set by the city government–as trade tensions hit the city’s manufacturing sector hard.

Some economists and investors have said China’s economy is far more anemic than the government’s 6.6% rate of expansion for 2018. They note the government’s move on Friday, just ahead of Monday’s data release, to cut the 2017 growth rate to

“The economy faces downward pressure,” said Ning Jizhe, head of the National Bureau of Statics, at a news conference Monday. In particular, Mr. Ning pointed to “complicated and severe external environment.”

Write to Lingling Wei at lingling.wei@wsj.com

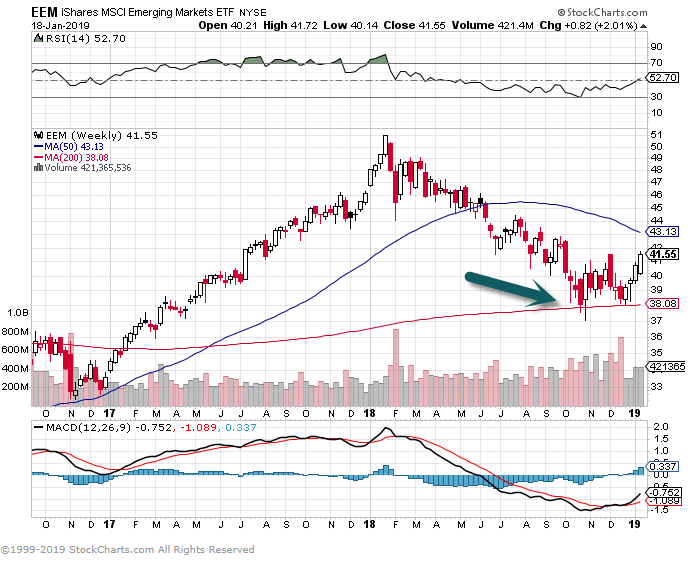

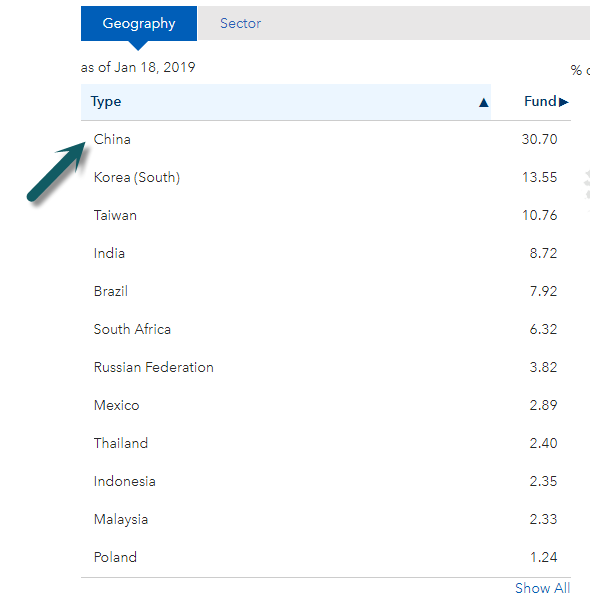

https://www.ishares.com/us/products/239637/ishares-msci-emerging-markets-etf

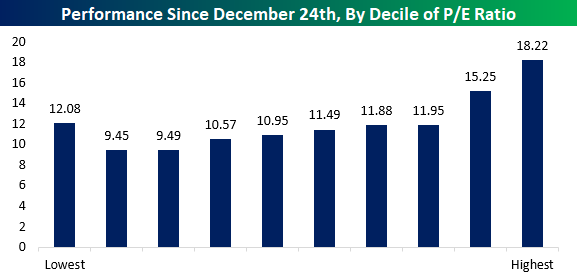

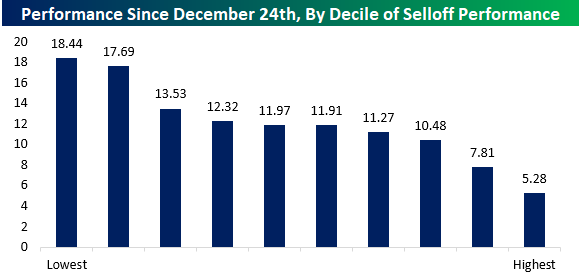

Bespoke

The first chart below shows the performance of S&P 500 stocks based on their valuations as of 12/24 with the most attractively valued (lowest P/E ratios) stocks to the left and the most expensive (highest P/E ratios) on the right. The best performing decile by far was the one containing the stocks with the highest P/E ratios, and for the most part, performance steadily declined as you moved left towards the more attractively valued stocks. The second chart shows performance since the lows based on stocks grouped according to how they performed during the market decline. Here, the best-performing stocks were the ones that were originally down the most, while the worst performing stocks were the ones that held up the best during the decline.

In both cases, these performance results make perfect sense. During market sell-offs, as investors become more risk averse it is typical to see stocks with the most aggressive valuations sell-off the hardest while more reasonably priced stocks hold up better. However, when the market turns around and investors become less risk-averse, they flock to the more aggressive high growth/high valuation stocks. Likewise, when the market shifts its tone from a defensive posture (during a sell-off) to a more offensive tone (rally) it is only natural that the stocks that held up the best during the defensive phase (like Utilities) underperform during the next more aggressive phase. Anything else would be contrary to the norm.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.