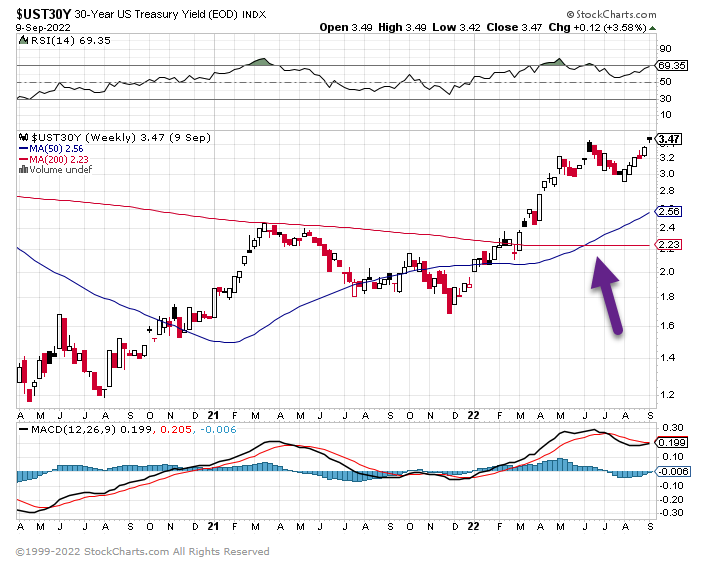

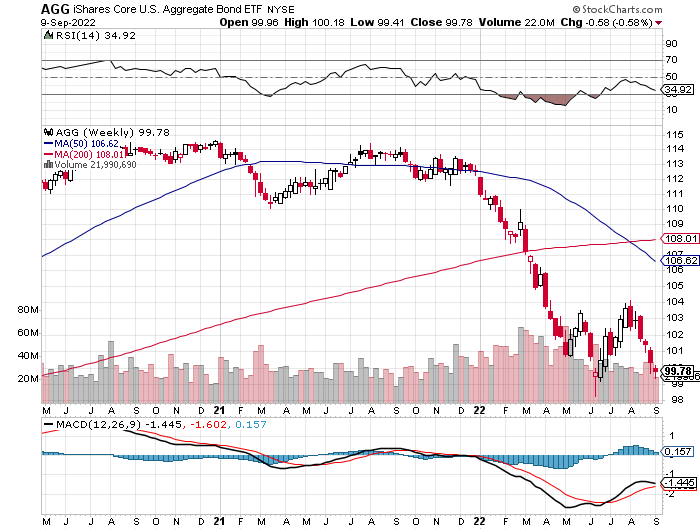

1. Ten-Year Treasury Yield Moves to Levels Last Seen in 2011

2. Stock/Bond Ratio Blows Past Modern Day Highs…S&P 500 divided by the U.S. Long-Term Treasury Bond Index

From Callum Thomas Chart Storm—Stock/Bond Ratio: Wild.

Kind of speaks for itself, but to spell it out: equities are extremely stretched vs bonds. I suspect this will reverse eventually, and most likely when recession hits, inflation falls, and bonds finally start to fight back.

Source: @AtlasPulse

3. One Short-Term Indicator Put/Call Ratio at Hit Extreme Levels

Sentiment continues to be the best feature of this market (for bulls). Friday’s equity put/call ratio $SPX got thru our threshold level, matched only by the levels seen at the June lows. Momentum and trends are not supportive, but positioning appears to be.

https://www.linkedin.com/in/jeffrey-degraaf-cmt-cfa/

4. Used Car Price Index Implodes Below Covid Levels….Another Inflation Easing Measure.

https://twitter.com/charliebilello

5. Energy Cost as a Percentage of GDP Europe and World

https://twitter.com/AndreasSteno

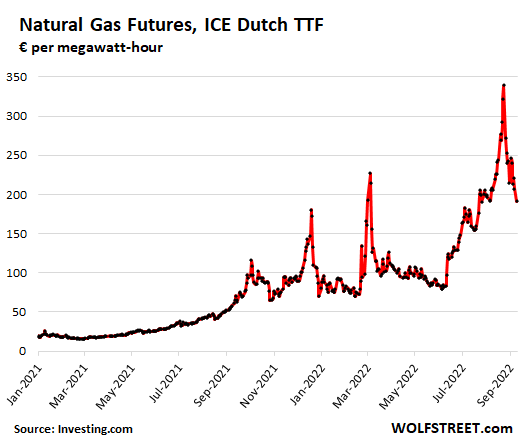

6. Germany Gas Storage 80% Full

Business Insider -Zahra Tayeb The race to shore up energy supplies looks to be going well, as German officials said the country’s natural gas storage has reached 80% full and is on track to meet its October storage targets early.

Germany lines up natural gas deals with Qatar and the UAE as it scrambles to replace Russian supplies

3 minutes ago

Germany is racing to secure natural gas before winter hits as Russian supplies dry up. LOIC VENANCE/Getty Images

- Germany is stacking up natural gas deals with Qatar and the UAE as Russia cuts off supply.

- It’s aiding the shift by releasing $2.5 billion of credit to inject into alternative gas supplies.

- “The gas offering is slowly broadening,” Germany’s economy minister told Reuters.

Germany is closing in on natural gas deals with Qatar and the United Arab Emirates as it seeks to replace Russian energy, according to media reports.

To facilitate such deals, the crisis-deep country released $2.5 billion to secure alternative gas supplies before winter hits, Bloomberg reported.

German utilities RWE and Uniper are nearing an agreement on long-term deals to buy liquefied natural gas (LNG) from Qatar’s North Field Expansion project, three sources familiar with the matter told Reuters.

The talks between Germany and Qatar have been riddled with differences over the length of contracts and pricing, but a settlement is expected to be reached soon, Reuters reported.

3 minutes ag

7. Improvement in Air Pollution Since 1990

Food for Thought: Lastly, here’s a look at declines in air pollution since 199

https://dailyshotbrief.com/the-daily-shot-brief-september-19th-2022/

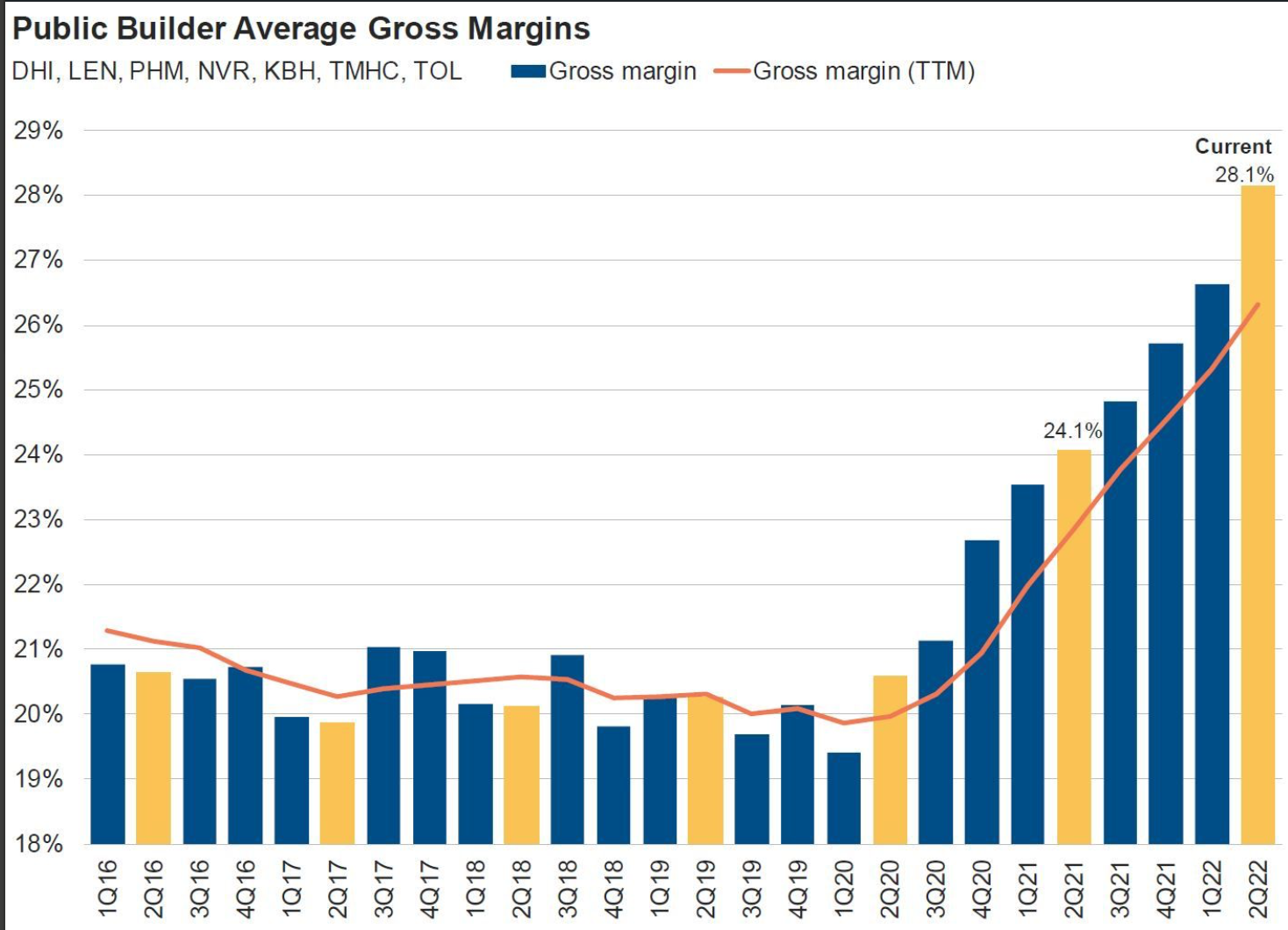

8. Wells Fargo Housing Market Index Hits 2006 Levels

Wolf Street Blog-The confidence of builders of single-family houses fell again in September, the ninth month in a row of declines, “as the combination of elevated interest rates, persistent building material supply chain disruptions, and high home prices continue to take a toll on affordability,” the NAHB report said.

With today’s index value of 46, the NAHB/Wells Fargo Housing Market Index is now below where it had been in May 2006, on the way down into the Housing Bust.

9. Quant Driven Home Buying Lost Money on 42% of Flips

Bloomberg-The slump has been especially harsh for Opendoor Technologies Inc., pioneer of a data-driven spin on home-flipping known as iBuying.

The iBuying model relies on acquiring homes, making light repairs and reselling the properties — often within a few months of the initial purchase. When home prices were skyrocketing earlier in the year, Opendoor banked easy profits. Then dwindling affordability and mortgage rates soaring toward 6% this spring finally pushed would-be buyers to the sidelines.

The company, which sells thousands of homes in a typical month, lost money on 42% of its transactions in August, according to research from YipitData. Opendoor’s performance — as measured by the prices at which it bought and sold properties — was even worse in key markets such as Los Angeles, where the company lost money on 55% of sales, and Phoenix, where the share was 76%.

By Patrick Clark and Elizabeth Kane https://www.bloomberg.com/news/articles/2022-09-19/home-flipper-opendoor-hit-with-losses-in-echo-of-zillow-collapse?srnd=premium&sref=GGda9y2L

10. The More Senior Your Job Title, the More You Need to Keep a Journal

by Dan Ciampa

Summary. Being a CEO can be a lonely job–there is no obvious person in whom to confide. Keeping a journal can fill that void, by giving a new leader a chance for structured reflection of recent past events and decisions, and mental rehearsal for future ones. Despite the…more

For leaders assuming the CEO title for the first time, taking time to learn and think translates into early successes. But the problem is there’s little time to do either. Information comes at them more quickly, more people than ever before demand their time, and they’re told that the myriad decisions piled in front of them are all important.

If hired from outside, there is a new culture to get used to and it’s not clear who to trust. Even when promoted from inside, the pace can be jarring compared to running a division in the same company. In both cases, any new leader must manage intense exposure (as it sinks in that top leaders have few places to escape to) and unrealistic expectations (of both self and others).

There is nothing new leaders can do to avoid these problems completely. All they can control is how they react to them. Because we tend to make mistakes when things speed up, especially when in unfamiliar territory, it can make all the difference to find ways to slow things down.

The French philosopher Blaise Pascal pointed out that “All of humanity’s problems come from man’s inability to sit quietly in a room alone.” He didn’t mean sitting quietly in front of a laptop responding to emails. The best thinking comes from structured reflection — and the best way to do that is keeping a personal journal.

I started keeping a journal when I took over a manufacturing research, software, and consulting firm. I was very young, we were in crisis facing a challenging market, and I wasn’t sure whom I could rely on. I kept a journal through my 12 years as chairman and CEO and have since recommended it to people moving into any senior position for the first time.

There’s strong evidence that replaying events in our brain is essential to learning. While the brain records and holds what takes place in the moment, the learning from what one has gone through — that is, determining what is important and what lessons should be learned — happens after the fact during periods of quiet reflection.

Also, when we slow things down and reflect, we can be more creative about solving seemingly inscrutable problems. Take, for example, a technique called the “second solution method” that I’ve used in the past. If a group was struggling to come up with options to solve a tough problem, we would brainstorm to identify a list of possible solutions. Before switching to prioritizing, making items specific, etc., we tried to identify all possible options. I found the best approach was to tell the group to take a break and when it reconvened to ask, “What else occurs to you?” Inevitably, this simple question resulted in about 50% more items, often of higher quality. By experimenting, I found that the break that took place between the first and second rounds was more important than the question. A journal is an effective, efficient, private way to take a similar break.

Journal entries should provide not only a record of what happened but how we reacted emotionally; writing it down brings a certain clarity that puts things in perspective. In other cases, it’s a form of mental rehearsal to prepare for particularly sensitive issues where there’s no one to talk with but yourself. Journals can also be the best way to think through big-bet decisions and test one’s logic.

While personality, style, and situation cause different approaches, some guidelines have proven useful for the best results. Notes should be made as soon as possible after an event from which one wants to learn—ideally the same day. Waiting more than 24 hours seems to sacrifice specificity about details that made the most difference and why they happened.

An entry should begin with the primary outcome — the headline that best captures the major result. Then, list the essential reason for that outcome; an always-subtle root cause made apparent by asking “why?” five times to peel back each layer, revealing what came before. (I remember reviewing my journal once and realized that several big-bet decisions turned on the right question asked at just the right point in the debates. Fortunately, my notes were in enough detail that they showed that the same subordinate asked the right question each time. I started listening to him much more closely). Third, recall the emotions that affected decision making and why they flared. Last, identify what you can learn from the whole experience and what you can do differently next time.

Many will opt to keep a journal on their computer or iPad. While that may be more efficient, the point of keeping a journal is not efficiency but to reflect and slow things down so that learning is maximized. For that purpose, handwriting may work better. The novelist Paul Theroux has said that he writes long-hand because, “The speed with which I write with a pen seems to be the speed with which my imagination finds the best… words.” He noted a 2011 Newsweek article that said, “Brain scans show that handwriting engages more sections of the brain than typing [and] it’s easier to remember something once you’ve written it down on paper.”

With so many benefits of keeping a journal, why do so few leaders do it?

- It takes time, a most precious asset. Because a journal requires reflection, it’s best done during quiet periods, which are rare for any leader.

- Sometimes, keeping a journal requires reliving something one would just as soon forget. Even though a vital step in learning, it’s unpleasant.

- Because many leaders prefer to rapidly move on to the next challenge, reflection is not high on their list of things they enjoy or have much experience with.

- Like any tool, it takes time to perfect the best way to use it. The methodology offered here did not happen right away, but came after many trials and errors.

These are minor drawbacks compared to the benefits. Slowing things down leads to better-thought-through, more effective judgement and to learning what to do more of and what to change. One result, as important as anything, is an increase in the satisfaction that should come from being in charge. A personal journal should be part of any leader’s toolkit.