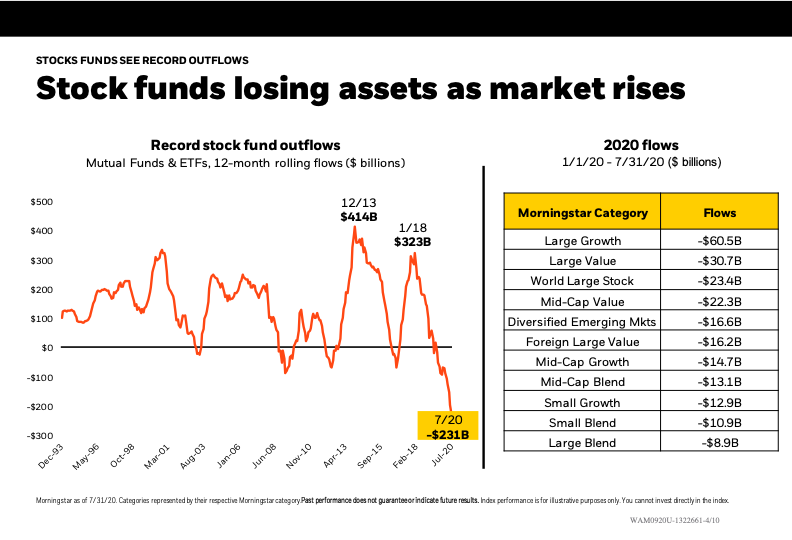

1. Stock Investors Selling Stocks on Rally

Blackrock

Barrons

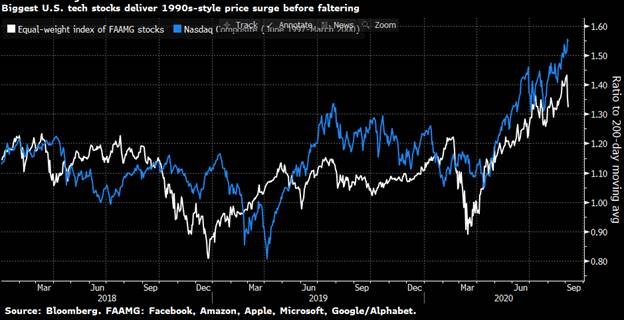

Inker’s thesis played out in markets just a few days later. On Sept. 4, as the tech-stock selloff got under way, the Nasdaq Composite sold off by as much as 5.1% to close with a 1.3% loss. And Treasury bond prices, which move opposite to yields, also sank. The 30-year Treasury yield rose 0.12 percentage point to 1.46%, in one of the largest single-day increases since the height of the pandemic panic. The 10-year yield jumped, as well, climbing 0.09 of a percentage point.

Treasuries Lose Some Haven Luster. Here Are Some Alternatives for Safety.-By Alexandra Scaggs

10 Year Treasury Yield….Will it go lower if stocks continue sell off?

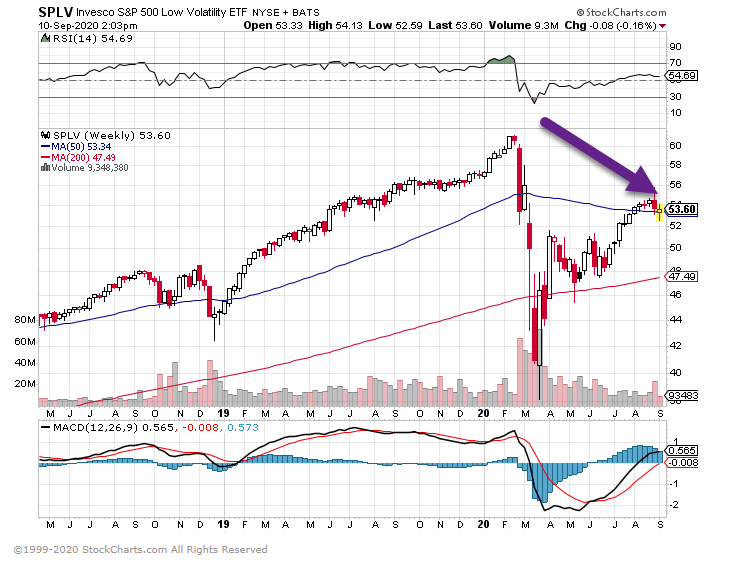

SPLV Well Below Highs….Did not protect against Covid volatility….Traded above 20x P/E

Bloomberg notes the Shares of the biggest U.S. technology companies were well on their way to mirroring the Internet-driven 1990s bull market before they faltered last week – Wild overlay

From Dave Lutz at Jones Trading

Continue reading