FED Backstopping Everything

On the policy side the day started with a bang as the Fed continues to try and do everything in its power to provide liquidity and support from a monetary perspective. First and foremost the new round of quantitative easing is effectively unlimited as Treasury and MBS purchases are open-ended from a previously announced $700bn. They also announced facilities to provide support for corporate bonds, asset-backed securities, and variable rate demand notes. The Fed also expanded the previously announced Money Market Mutual Fund Liquidity Facility and the Commercial Paper Funding Facility to include a wider range of eligible securities. The Fed also expects to announce the Main Street Business Lending Program that will support lending to eligible small and medium-sized businesses. The actions take the Fed across the line – joining the ECB – in buying corporate bonds and the Fed can now buy Fixed Income ETFs which will hopefully be a big stabilizing force in what has been a troubling segment of the market over the last few weeks.-Goldman Sachs

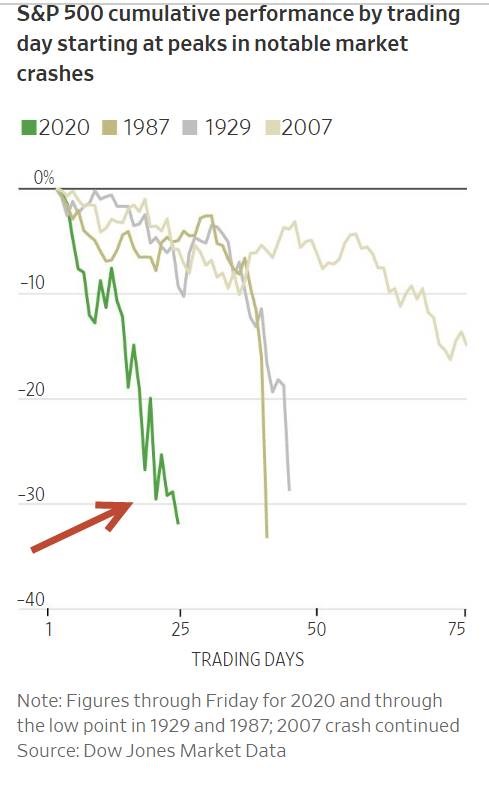

1.2020 Crash Equal to 1929 and 1987

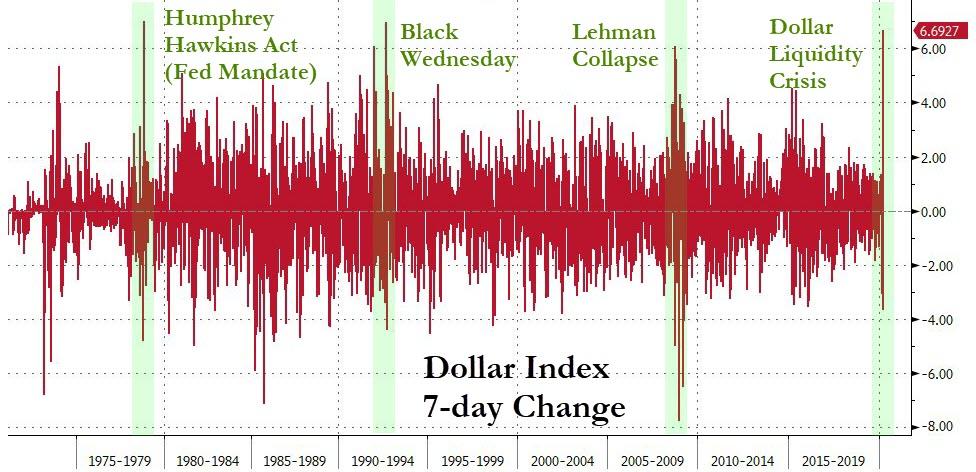

Stocks are falling faster than they did during the financial crisis, the crash of 1987 or the Great Depression. Investors are retreating from corporate bonds at the swiftest pace ever. An index of raw materials is at all-time lows. And funding shortages around the world have fueled a race for dollars, powering the U.S. currency to a nearly 18-year high.

By Amrith Ramkumar WSJ