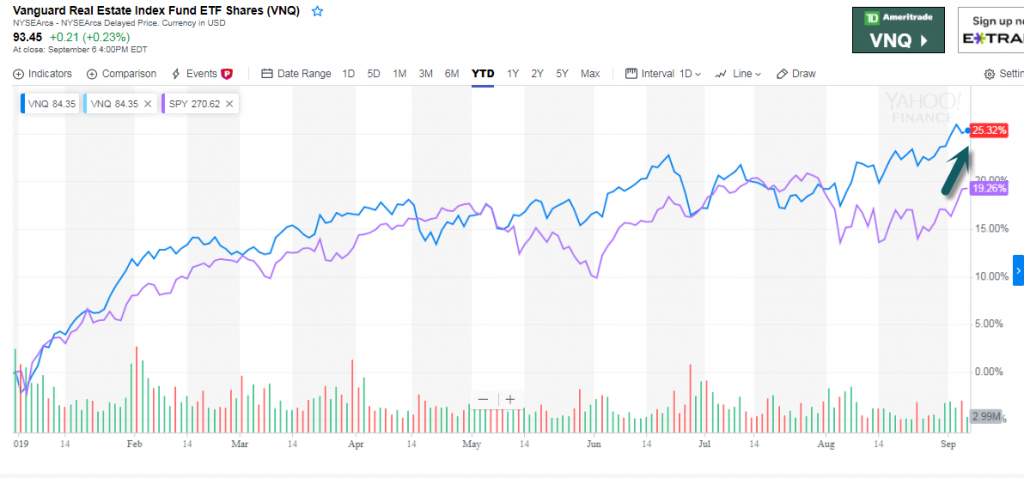

1.REIT Index +25% vs. S&P +19%

VNQ vs. S&P

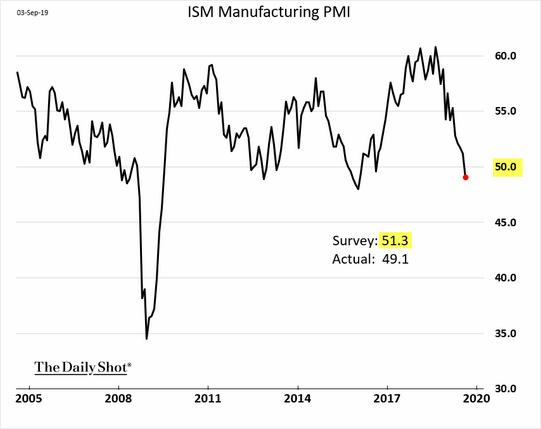

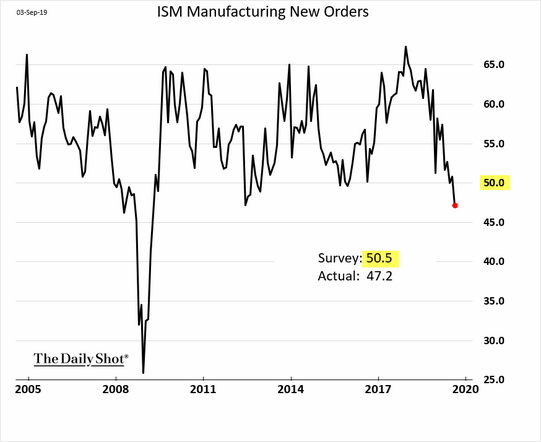

The August ISM Manufacturing PMI report unexpectedly dipped below 50, which indicates a contraction in factory activity.

https://blogs.wsj.com/dailyshot/

Continue readingBarrons

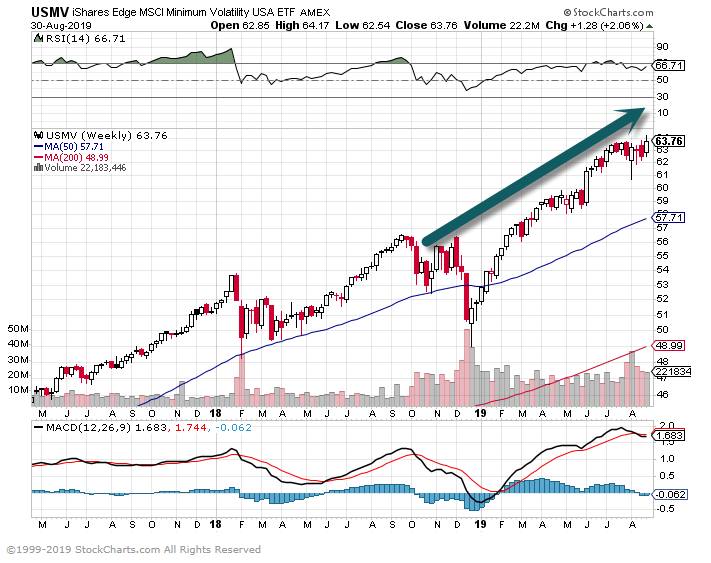

The iShares Edge MSCI Min Vol U.S.A. ETF (ticker: USMV) has attracted nearly $9.5 billion this year, second only to the broader and much better known Vanguard S&P 500(VOO). The iShares ETF has swelled 42% in the past eight months to $32 billion

The average stock in the iShares ETF trades for 24 times trailing 12-month earnings, versus 19 for the S&P 500; the ETF overall trades at a 17% premium to its MSCI benchmark. A recent study from Leuthold Group found that low volatility stocks, relative to their higher volatility peers, are 99% more expensive than they have been over time, going back to 1990.

2 Big Volatility ETFs Have Very Different Approaches

By Stephen Gandel

https://www.barrons.com/articles/how-to-choose-a-volatility-etf-51567200240?mod=past_editions