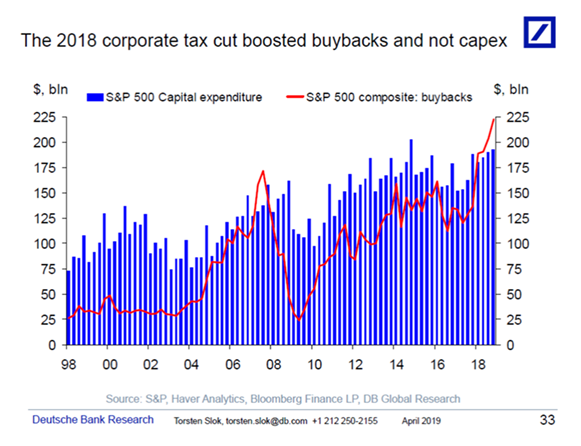

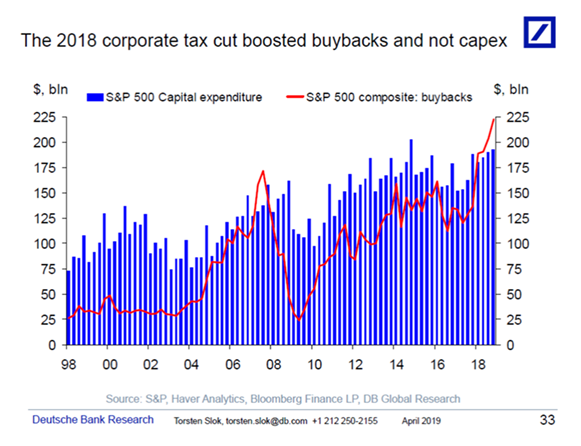

1.Corporate Buybacks Boosted by Tax Cut.

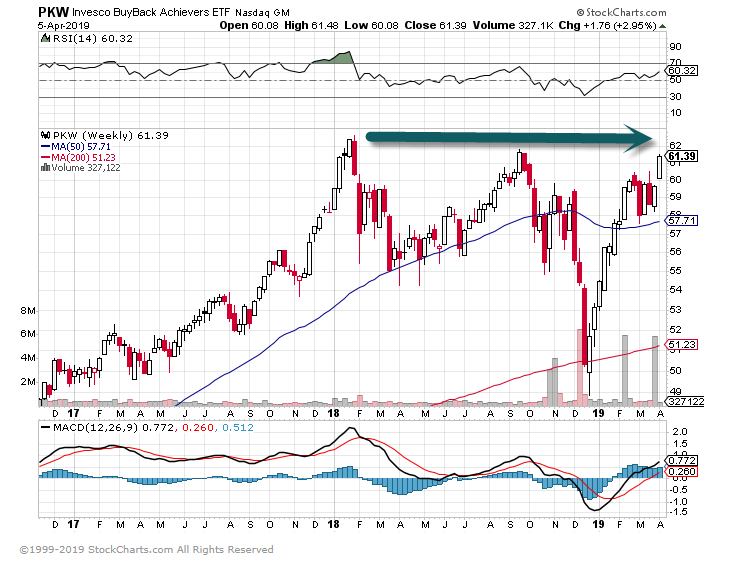

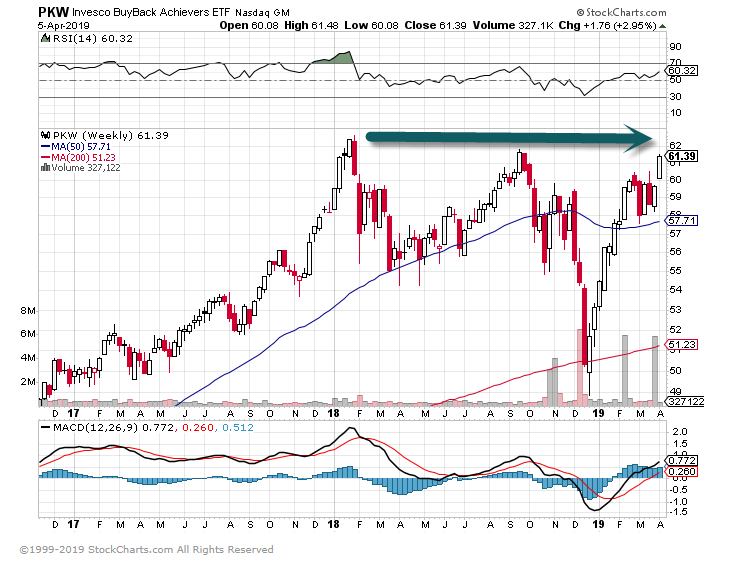

PKW-Corporate Buyback ETF-About to make new highs.

Tax Cut Boosted Buybacks Over Capex

Torsten Sløk, Ph.D.

Chief Economist

Managing Director

Deutsche Bank Securities

Torsten Sløk, Ph.D.

Chief Economist

Managing Director

Deutsche Bank Securities

by Jill Mislinski, 4/4/19

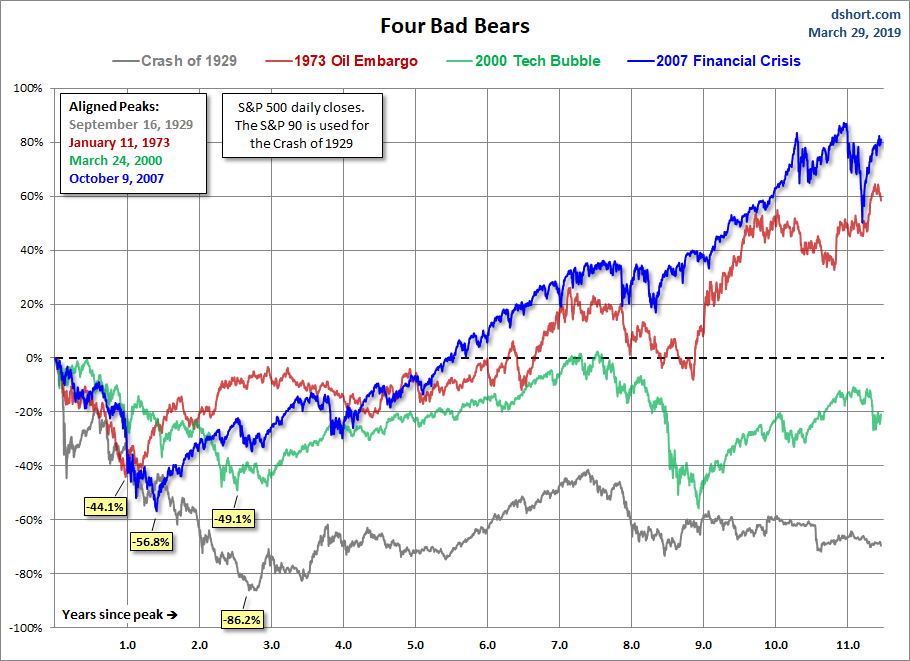

In response to a standing request, here is an updated comparison of four major secular bear markets. The numbers are through the Friday, March 29 close.

This chart series features an overlay of the Four Bad Bears in U.S. history since the equity market peak in 1929. They are:

The series includes four versions of the overlay: nominal, real (inflation-adjusted), total return with dividends reinvested and real total return. The starting point is the aligned peaks prior to the four epic declines. We’ve used an interval of 252 days for the x-axis as it is roughly the number of market days in a calendar year.

The first chart shows the price, excluding dividends for these four historic declines and their aftermath. As of the year-end close, we are now 2,887 market days from the 2007 peak in the S&P 500.

A risk tho – The “Pain Trade” is the VIX breaking north – The positioning in short VIX has turned super short again and even shorter than prior to both the February and October-December sell-offs From Dave Lutz at Jones

Holger Zschaepitz @Schuldensuehner Mar 30

Mad world. While Stocks have gained $9tn in mkt cap, global bonds have gained a whopping $1.8tn in value in Q1 2019 as cheap money from the central banks have inflated all assets. Part of this crazy world is that bonds in a volume of $11tn have negative yields.