1.Longest Streak in 11 Years without a 1% Pullback

Days without a 1% pullback

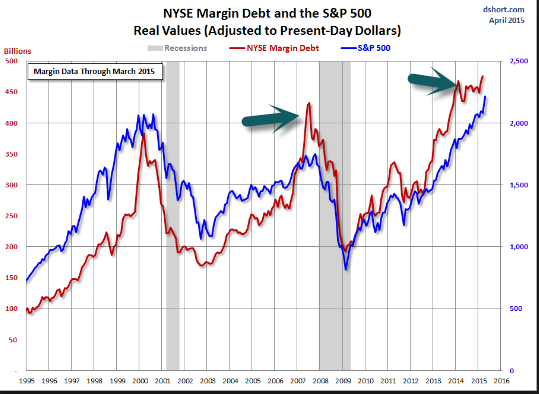

There have been 75 sessions (including Monday) without a 1% drop in the S&P, which marks the longest such streak in about 11 years, according to Krinsky. A period of sideways trading tends to suggest that the market has pent up momentum. And if history is any gauge, momentum may be leaning toward a downturn, given the market’s tendencies in February.

http://www.marketwatch.com/story/a-big-stock-market-selloff-in-february-looks-increasingly-likely-2017-01-30

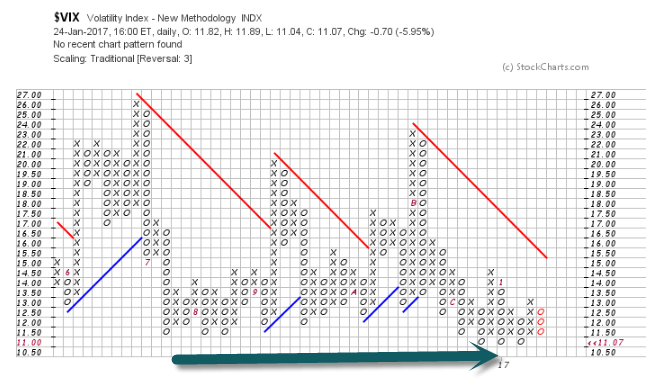

www.stockcharts.com

www.stockcharts.com

Clear Vision of Possible New Lows.

Clear Vision of Possible New Lows.

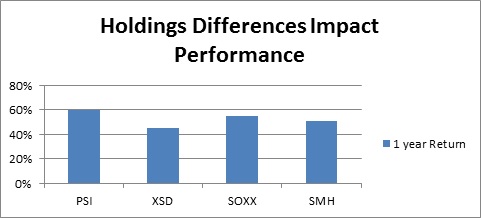

Semiconductor ETFs To Consider

Semiconductor ETFs To Consider