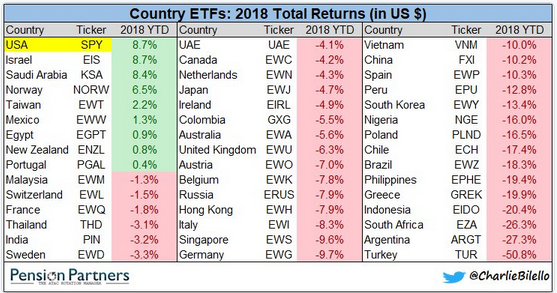

1.Global 2018 Returns Red

https://pensionpartners.com/

From Dave Lutz at Jones Trading

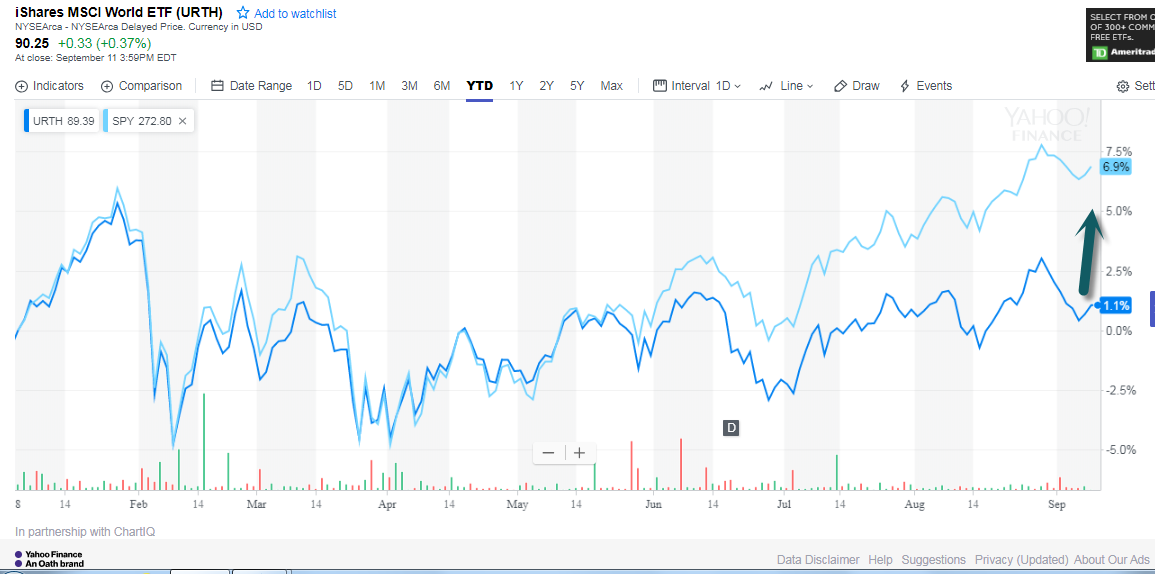

2.S&P Vs. MSCI World ETF.

3.See Huge Spreads in Returns- U.S. Growth vs. Value/Core.

http://news.morningstar.com/index/indexReturn.html

4.A Chart Measuring Intl Risk…Chinese Small Cap.

Chinese Small Cap Index -21%

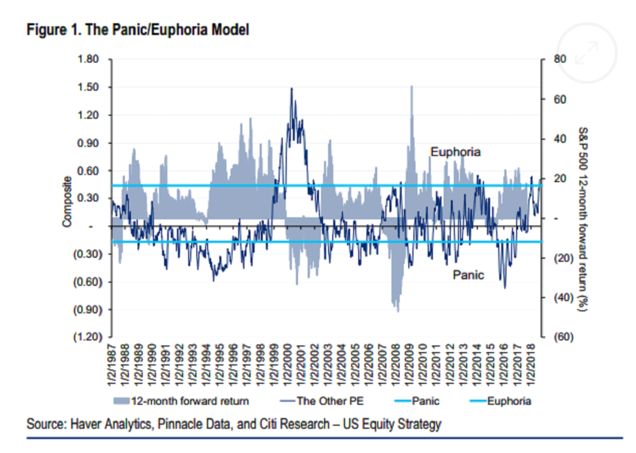

5.Goldman and Citi Out with Model Calls.

I am not familiar with history of either indicator.

Citi

Citi’s panic/euphoria model, tracking everything from margin debt to options trading and newsletter bullishness, just showed sentiment climbed to extreme levels for the first time since January. Such readings have preceded equity losses over the following 12 months 70 percent of the time since 1987, more than three times the random probability.

Goldman

“Typically, high valuations – or an extended level of this index – imply the risk of a bear market or a period of low returns over the next five years,” the strategists wrote in a note late Tuesday. “This time we think that lower returns are more likely than an impending sharp bear market.”

Goldman Sachs Joins Citigroup in Flashing Warnings on S&P 500

By

Lu Wang

https://www.bloomberg.com/news/articles/2018-09-05/citi-warns-of-5-equity-pullback-as-sentiment-creeps-to-euphoria

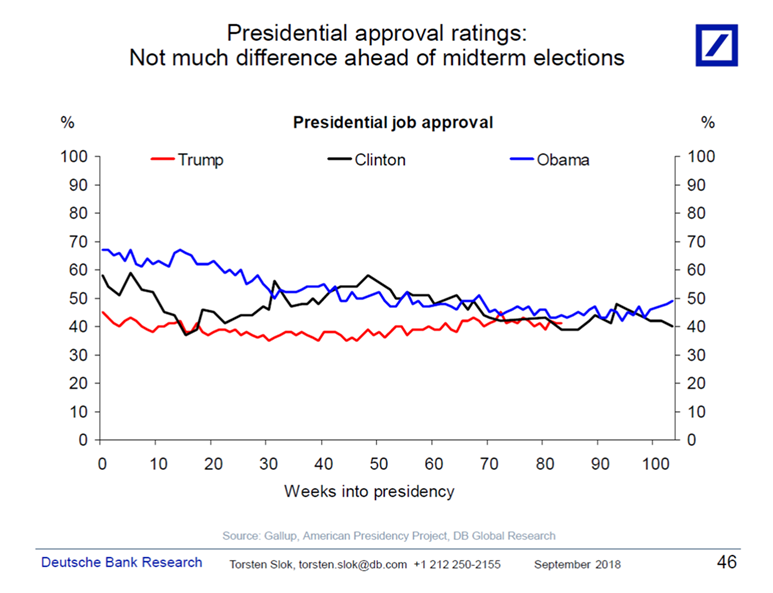

6.Presidential Approval Ratings Going into Mid-Terms.

I’m getting more client questions about midterm election scenarios for the economy and markets. For more, see also the piece Binky, Parag, and Christian did here and the piece Quinn and I did here.

———————————————–

Let us know if you would like to add a colleague to this distribution list.

Torsten Sløk, Ph.D.

Chief International Economist

Managing Director

Deutsche Bank Securities

60 Wall Street

New York, New York 10005

Tel: 212 250 2155

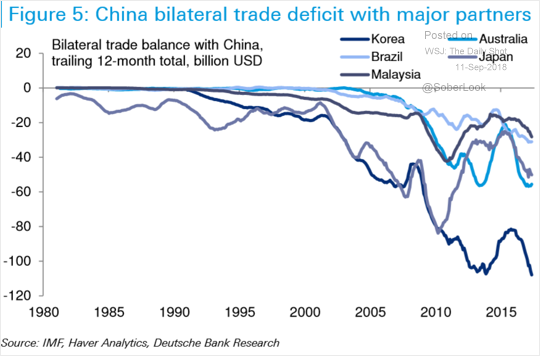

7.China Running Deficit with All Trading Partners Outside the U.S.

China: While China has a record trade surplus with the US, the nation runs a deficit with other major trading partners.

Source: Deutsche Bank Research

8. China Buying $1.2 Trillion in Planes From Boeing.

Boeing ups forecast for China’s new plane purchases over 20 years

- China is seen buying 7,690 new planes worth $1.2 trillion by 2037, according to Boeing.

- The planemaker also predicted that China will account for 18 percent of the world’s commercial airplane fleet by 2037,

- Boeing and its European rival Airbus have been jostling to increase market share in China, the world’s fastest growing aviation market, with both opening assembly plants in the country.

Daniel Slim | AFP | Getty Images

Passengers waiting to board a Delta airlines plane at La Guardia International Airport in New York.

Chinese airlines will buy 7,690 new planes worth $1.2 trillion over the next two decades to keep pace with booming consumer and business demand for air travel, Boeing said on Tuesday, raising a previous forecast.

The U.S. planemaker’s latest estimate for the period to 2037 is 6.2 percent higher than its previous prediction of 7,240 planes until 2036 made last year.

“The growth in China can be attributed to the country’s growing middle class, which has more than tripled in the last 10 years and is expected to double again in the next 10,” said Randy Tinseth, Boeing Commercial Airplanes’ vice president of marketing, in a statement.

Boeing and its European rival Airbus have been jostling to increase market share in China, the world’s fastest growing aviation market, with both opening assembly plants in the country.

The company has so far been mostly spared in an ongoing trade war between the United States and China. Large airplanes have been left out of China’s retaliatory tariff lists although U.S. President Donald Trump has threatened to slap tariffs on virtually all Chinese imports into the United States.

Boeing also predicted that China will account for 18 percent of the world’s commercial airplane fleet by 2037, up from 15 percent currently, and forecast that the country will need over $1.5 trillion in commercial services to support its fleet.

Three quarters of the 7,690 plane orders over the next 20 years will likely be for single-aisle aircraft while China’s widebody fleet will require 1,620 new planes, tripling the country’s current widebody fleet size, it added.

9.Is Big Tobacco Going to be Big Weed?

Mixing tobacco with marijuana

Here are the seven reasons why tobacco companies such as Altria, Phillip Morris International PM, -1.19% , British American Tobacco BTI, -2.34% , Turning Point Brands TPB, +2.99% , Alliance One AOI, +36.47% , Universal Corp. UVV, +0.42% , Vector Group VGR, -0.13% and Imperial Brands IMBBY, -3.28% are likely to get into the marijuana business in a big way.

- In many ways, the marijuana business is complementary to their existing tobacco business.

- Cigarette companies are facing declining sales, and they are looking for growth levers. Marijuana is likely to see explosive growth over the coming years.

- Even supposedly lower-risk tobacco products are beginning to increasingly come under attack for their health risks. In contrast, sentiment is building about the benefits of cannabis, and risks of cannabis are falling in the background.

- Tobacco companies are rich, and they have the money to get into the cannabis industry.

- Not too far in the distant future, branding will become a big part of the success in cannabis. Tobacco companies already know how to develop successful brands.

- Tobacco companies already have huge distribution networks. They can easily add cannabis to those networks down the road. Right now, regulations are not likely to allow this, but tobacco companies are experts at lobbying.

- Marijuana companies have to deal with a maze of regulations. Tobacco companies are already experts at handling regulations.

Opinion: Seven reasons Big Tobacco is likely to make a move on the marijuana industry

Published: Sept 11, 2018 9:02 a.m. ET

10.Why You Should Believe You Can Control Your Emotions

To lessen emotional distress, you first have to believe that you can.

Source: Kat Jayne

Do you try to manage your feelings? When you experience distressing or upsetting emotions such as anger, rejection, or disappointment, you basically have two options: You can wallow in the emotions and ruminate about them or you can try to regulate them and lessen their impact in the moment.

The term emotional regulation refers to strategies we employ, either consciously or unconsciously, to manage distressing emotions. One of the most common is distraction. We have an argument with our spouse, over text, in the middle of working on an urgent project at work so we push our irritation aside and refocus on the project in order to meet our deadline. By refocusing on our work and away from our distress, our irritation lessens (at least for the time we’re focused on our project) and we have successfully regulated our emotions in that moment.

Another common strategy is suppression. We simply shove down the feelings and try not to let them get to us. For example, we finally sit down to watch episodes of our favorite show and a friend calls us for the fifth time that week to talk about a recent breakup. Since our friend is already really upset, we can’t tell them we’re annoyed so we suppress our frustration and try to be there for them.

Both distraction and suppression tend to occur naturally in that we don’t make a conscious decision to regulate our emotions; we just engage in those strategies automatically. As such, distraction and suppression are the most common emotional regulation strategies we tend to use. However, they are also the least effective because the underlying distressing emotion is still there. Once we leave work and get home, our irritation with our spouse is likely to resurface and we’re also likely to still feel frustrated after the call with our friend because we now don’t have enough time to watch our show.

The most effective emotional regulation strategy is called reappraisal or reframing. What makes it effective is that it involves trying to change the underlying distressing emotion itself, say by changing our perspective of the situation or trying to finding a silver lining. For example, we might realize that the argument with our spouse is an opportunity to address a larger issue that has been on our mind for a while–how we communicate during work hours. By reframing the fight as an opportunity (to address a larger issue) we lessen the emotional impact of the specific argument.

In the case of the heartbroken friend, we might remind ourselves that we had been looking for something to look forward to over the weekend, and now that we have these episodes left, we can look forward to watching our favorite show. Finding the silver lining in the frustrating call will reduce the frustration we feel in the moments after our call.

In dozens of studies, reappraisal has been found to be the most effective strategy for regulating emotions because it beings about greater and longer lasting reductions in emotional distress. Since to employ it, we have to actively figure out how to think about our situation differently, we first need to believe that doing so will actually reduce our distress. In other words, we first have to believe our emotions are malleable and that our efforts to regulate them will make us feel better. The problem is many people don’t believe our emotions are malleable (even though that is a fact, as we all use emotional regulation techniques in our daily lives, even if just distraction and suppression).

Indeed, studies have found that people who view their emotions as more malleable tend to use more active emotional regulation strategies such as reappraisal, have greater motivation to use these strategies, expend more effort in doing so, and as a result, experience significantly lesser emotional distress in their lives.

A recent study examined how teenagers’ beliefs about the malleability of emotions impacted their use of effective emotional regulation strategies and found that teens who believe emotions aren’t malleable were significantly less like to use reappraisal in their daily lives and over time, they experienced more emotional distress and had significantly greater symptoms of depression.

article continues after advertisement

Therefore, the first step in reducing the emotional distress we feel in daily life is to realize that our emotions are almost always malleable to some degree. Once we accept that truth and realize that reappraisal is the most effective way to regulate emotions, we can start step two: Practicing reappraisal in our daily lives. When you find yourself in emotional distress, look for ways to reframe the situation or find a silver lining by asking yourself the following questions:

- What is the possible upside in this situation?

For example, I’m annoyed my partner just yelled at me for being inconsiderate but if I’m honest with myself, I have been preoccupied with work lately. So maybe I can think of their admonition as a good reminder to focus on the things that really matter to me like my family life and not ruminate about work once I’m home.

- How can I use the situation to further another goal I might have?

I’m frustrated that I can’t go running because it’s raining but I can use the time to look online for that treadmill I’ve been thinking of getting.

- In what ways is the situation not as distressing as it first seemed?

I’m disappointed that my potential date cancelled but I wasn’t that into them anyway so now I can focus on finding someone I’m more excited to meet.

- What would the situation look like if I took a different perspective?

article continues after advertisement

I’m worried that my teenager smoked and drank at a party but if I looked at it differently, I realize she was quick to admit what she did and that she tends to take responsibility for her mistakes far more often than I did at her age.

- What potential opportunities are there in the situation?

I’m sad to see how upset my 10-year-old is about not making the team but this provides a great opportunity for me to talk with them about how to bounce back from failure and give them a really important life lesson.

References

Ford, B. Q., Lwi, S.J., Gentzle,r A. L., Hankin, B., & Mauss, I. B., (2018). The cost of believing emotions are uncontrollable: Youths’ beliefs about emotion predict emotion regulation and depressive symptoms. Journal of Experimental Psychology. General. PMID 29620380 DOI: 10.1037/xge0000396