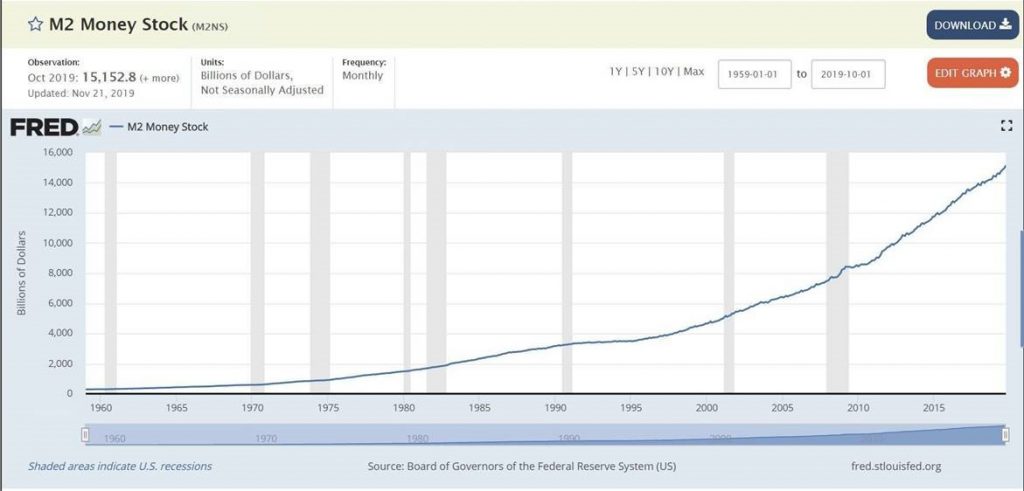

1.M2 Money Supply Growing at 10.4% Clip Over Last 3 Months.

“Jason DeSana Trennert, who runs Strategas Securities, notes that the M2 money measure—cash, checking, savings deposits, small certificates of deposit, and money-market funds—has been growing at a rapid 10.4% annual clip over the past three months.

Supporting that growth has been the rapid expansion of the Federal Reserve’s balance sheet, which has climbed at a 31% yearly rate over that span. While the Fed says its monthly buying of $60 billion of Treasury bills doesn’t represent quantitative easing—the central bank’s past rounds of securities purchases to stimulate the economy—Trennert calls it a “distinction without difference for owners of risk assets,” such as stocks. The expansion has been international, adds Evercore ISI, which points out that the balance sheets of the European Central Bank and the Bank of Japan also are headed higher.”

M2 money supply monthly chart

https://fred.stlouisfed.org/series/M2NS

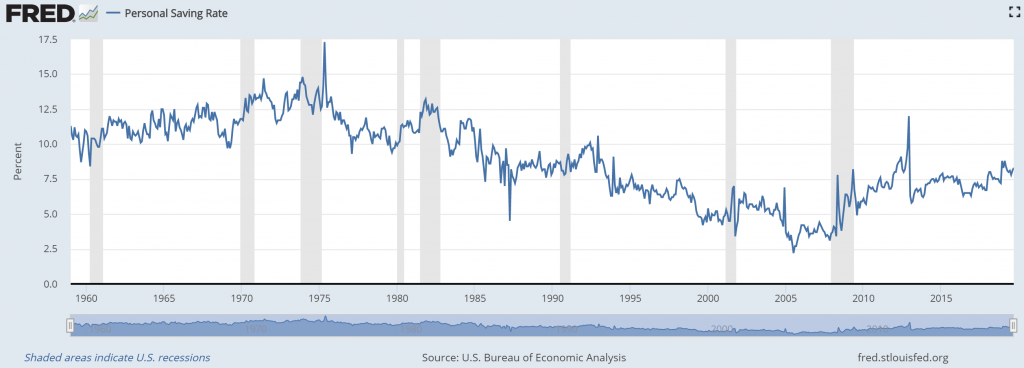

2.Bad News: Americans Are Saving Again

By DataTrek Researchin Blog\

Saving money is good for individuals but bad for the economy as a whole. That is the “paradox of thrift” mentioned everywhere from the Bible (Proverbs 11:24) to Keynes’ economic theories still in use today. Modern developed economies have gotten around some of the problem by insuring bank deposits and developing money markets, at least ensuring that “savings” circulate back into the system. Cash and gold, both still popular savings options, are two exceptions of course.

That makes a nation’s savings rate something to watch; here is the historical BEA data for the United States back to 1959:

And here is what we see in that data:

- From 1959 to 2007, US savings rates broadly followed interest rates.

- During the period when rates rose (1959 – 1981) so did the percentage of consumer’s disposable income that went into savings (i.e. not spent).

- When rates declined (1982 – 2007), savings rates fell. From the 10% – 15% of disposable income saved during the period of rising rates, the savings rate fell to a trough of 2.2% in mid 2005.

- The Great Recession-and-after period (2008 – present) breaks the connection between interest rates and savings. Savings rates have generally risen, and now stand at 8.3% – the same level as the late 1980s when 2-year Treasuries yielded over 5% rather than today’s 1.6%.

Takeaway: American savings rates are structurally higher right now than at any point since the early 1990s, and it’s not because interest rates are better (the old relationship) but likely due to a variety of new factors:

- An aging population, with a higher propensity to save rather than spend.

- A younger generation (millennials) that despite their reputation are actually saving what they can and deferring consumption.

- Broad concern about the state of the US economy being late in the current cycle.

- While overall savings rates may be higher, the aggregate data may simply reflect incremental propensity to save among higher income households.

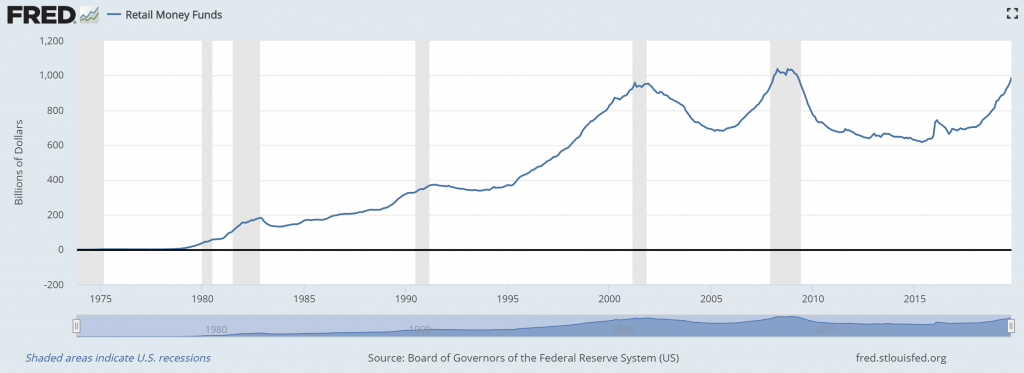

US retail money market fund balances support that final point – that much of the boost to savings rates post-Crisis originates from the balance sheets of wealthier households:

The increase in MMF balances over the last 3 years totals $353 billion, a 55% increase. That is a much greater increase than what we see in US commercial bank savings account deposits, which are only 11% higher over the same period. To the degree that this crude comparison captures general savings (banks) versus that of wealthier, more financially savvy individuals (MMFs), it does help explain why US savings rates are on an upswing.

3.For Now Liquidity Trumps Uncertainty.

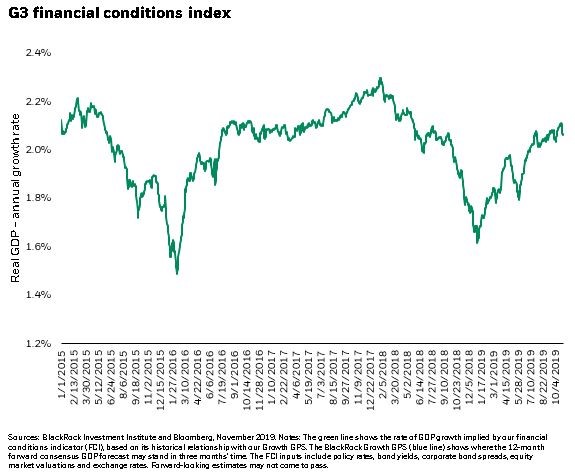

Today I would make the same argument: Liquidity is likely to beat uncertainty, or at least until early 2020. I would cite three reasons in favor of this scenario: some easing of geopolitical risk, accelerating liquidity on the back of expanding central bank balance sheets and the likelihood that better liquidity will lead to economic stabilization.

- For now, geopolitical uncertainty is receding. Geopolitical risk appears to be fading, at least from the summer peak. The BlackRock Global Risk Index has fallen by around 20% since August.

- Global liquidity is improving. While the Federal Reserve may take a break from cutting rates, most measures of financial conditions are improving. In particular, central banks are once again buying assets. The European Central Bank (ECB) has resumed its quantitative easing program and the Fed, partly as a response to recent dislocations in the money markets, is once again expanding its balance sheet. As a result, the cumulative balance sheet of the Fed, ECB, Bank of Japan and Bank of England is rising for the first time since 2017.

- Better liquidity suggests stabilizing growth. The improvement in global liquidity should lead to improving, or at least more stable, growth. Looking at the BlackRock Financial Conditions Index suggests growth estimates are likely to accelerate during the next quarter (see Chart 1).

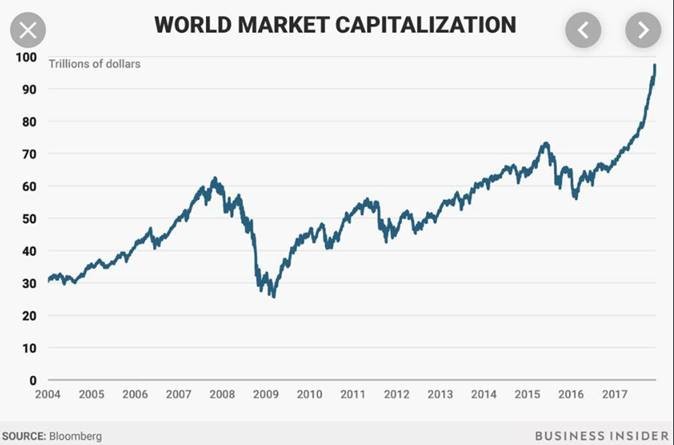

4.40,000 Investable Stocks Worldwide

World Market Capitalization Broke Out in 2017

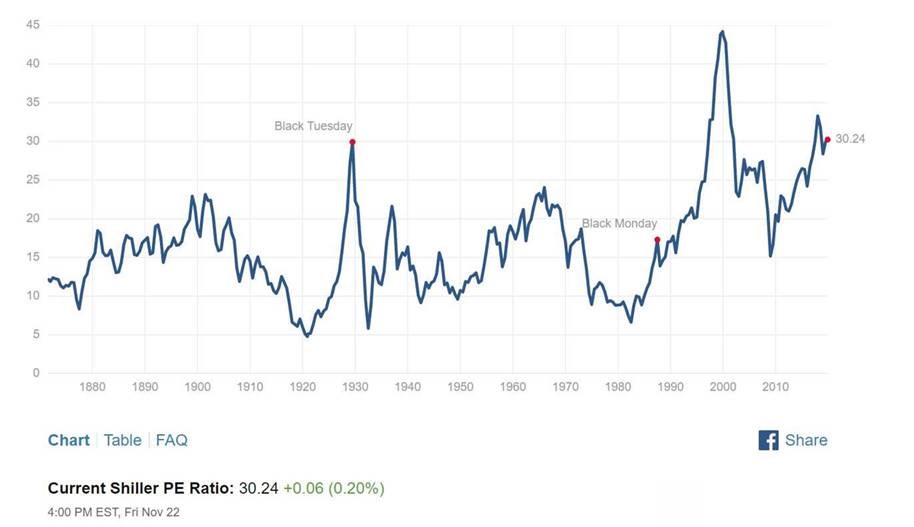

5.No Bull Market Has Ever Started With Case Shiller Above 30

https://www.multpl.com/shiller-pe

What of stocks? The S&P 500 Shiller Price-to-Earnings Ratio is 30.2 which implies a -2% compound annual return over the coming 8yrs to return the ratio to its 17.0 mean. But not all things return to mean.

If the Shiller P/E is 50% above mean in 8yrs, it implies a nearly +3% annualized S&P 500 return. And if it falls 50% below mean, stocks annualize at roughly -10% for the coming 8yrs.

There is no mathematical equation using even the most optimistic of those returns which produces +7.5%, even playing the leveraged private equity game.

Of course, it’s possible a new bull market has begun. But in 150yrs, only secular bear markets have started with the Shiller P/E above 30 (secular bulls all began with the Shiller P/E between 5-10).

The thoughtful guys at GMO estimate the following 7yr forward annualized real returns: US large cap equity -3.9%, US small caps -1.0%, Int’l large caps -0.1%, Int’l small caps +1.7%, EM equity +4.7%, EM value equity +9.3%, US bonds -2.2%, Int’l bonds (hedged) -3.9%, EM debt -0.1%, US TIPS -1.7%, US cash +0.1%.

Zerohedge

Hedge Fund CIO: “We Are Playing The Game Called Institutional Investor”

by Tyler Durden

https://www.zerohedge.com/markets/hedge-fund-cio-we-are-playing-game-called-institutional-investor

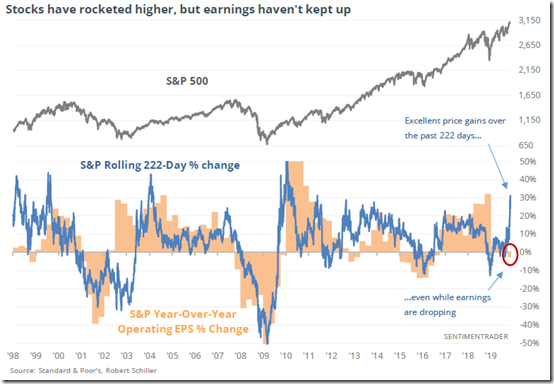

6.S&P Moving Higher Without Increased Earnings.

Callum Thomas @Callum_Thomas · Nov 23

8. S&P500 rebound leaving earnings behind, but then markets are supposed to be forward looking not backward looking… h/t @jmanfreddi

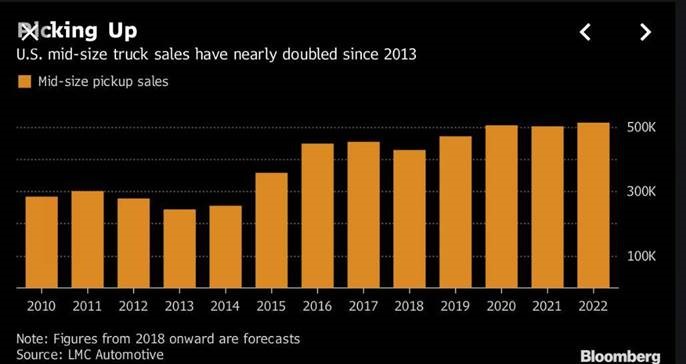

7.Pickup Truck Sales Generating 70% of Profit for North American Carmakers.

Large trucks accounted for 36% of Ford’s North America unit sales last year, while those trucks generated 70% of the region’s profit, Barclays PLC said. That is, in part, because auto makers are able to charge so much more for these vehicles, with customers paying for performance features and creature comforts.

8.Personal loans are ‘growing like a weed,’ a potential warning sign for the U.S. economy

Heather Long, The Washington Post

A monitor displays Equifax Inc. signage on the floor of the New York Stock Exchange (NYSE) in New York, U.S., on Friday, Sept. 15.

Americans are hungry for personal loans that they can use as quick cash to pay for anything from vacations to credit card debt, a potential red flag for the economy.

Personal loans are up more than 10% from a year ago, according to data from Equifax, a rapid pace of growth that has not been seen on a sustained basis since shortly before the Great Recession. All three of the major consumer credit agencies — Equifax, Experian and TransUnion — report double-digit growth in this market in recent months.

Experts are surprised to see millions of Americans taking on so much personal loan debt at a time when the economy looks healthy and paychecks are growing for many workers, raising questions about why so many people are seeking an extra infusion of cash.

“Definitely yellow flares should be starting to go off,” said Mark Zandi, chief economist at Moody’s Analytics, which monitors consumer credit. “There’s an old adage in banking: if it’s growing like a weed, it probably is a weed.”

Personal loans are unsecured debt, meaning there is no underlying asset like a home or car that backs the loan if someone cannot repay. The average personal loan balance is now $16,259, according to Experian, a level that is similar to credit card debt.

Personal loan balances over $30,000 have jumped 15% in the past five years, Experian found. The trend comes as U.S. consumer debt has reached record levels, according to the Federal Reserve Bank of New York.

The rapid growth in personal loans in recent years has coincided with a FinTech explosion of apps and websites that have made obtaining these loans an easy process that can be done from the comfort of the living room couch. FinTech companies now account for nearly 40% of personal loan balances, up from just 5% in 2013, according to TransUnion.

Over 20 million Americans now have these unsecured loans, TransUnion found, double the number of people that had this type of debt in 2012.

“You can get these loans very quickly and with a very smooth, sleek experience online,” said Liz Pagel, senior vice president of consumer lending at TransUnion. “We haven’t seen major changes like this in the financial services landscape very often.”

Total outstanding personal loan debt stood at $115 billion in October, according to Equifax, far smaller than the auto loan market ($1.3 trillion) or credit cards ($880 billion). Economists who watch this debt closely say personal loans are still too small to rock the entire financial system in the way that $10 trillion worth of home loans did during the 2008-09 financial crisis.

But personal loan debt is now back at levels not far from the January 2008 peak, and most of the FinTech companies issuing this debt were not around during the last crisis, meaning they have not been tested in a downturn.

“The finance industry is always trying to convince us that there are few risks to borrowing and overleveraging is not a problem,” said Christopher Peterson, a University of Utah law professor and former special adviser to the Consumer Financial Protection Bureau. “Overleveraging yourself is risky for individuals and for our country.”

The U.S. economy is powered by consumer spending, and debt helps to fuel some of the purchases. Economists are watching closely for signs that Americans are struggling to pay their bills, and personal loans could be one of them.

The most common recipient of a personal loan is someone with a “near prime” credit score of 620 to 699, a level that indicates they have had some difficulty making payments in the past.

“The bulk of the industry is really in your mid-600s to high 600s. That’s kind of a sweet spot for FinTech lenders,” said Michael Funderburk, general manager of personal loans at LendingTree. “We see a lot of consumers that have been doing perfectly fine in their financial life. They are gainfully employed. They have a family. They have a mortgage, but something happened. They lost a job. Or a medical emergency…the net result of that is they missed a bill or ended up with a little bit more credit card debt than they wanted.”

The vast majority of customers go to FinTech providers like SoFi, Lending True, Lending Club and Marcus by Goldman Sachs for debt consolidation, the lenders say. People run up debt on multiple credit cards or have a medical bill and credit card debt and they are trying to make the payments more manageable. Some seek a lower monthly payment, similar to refinancing a mortgage. Others want to pay off the debt in three years to clean up their credit score.

FinTechs say they are helping people make smarter financial choices. While a credit card allows people to keep borrowing as long as they are under the credit limit, a personal loan is for a fix amount and must be paid off over a fixed amount of time, generally three or five years. Some online lenders allow people to shop around for the best rate, and most of the main players cap the interest rate at 36% to ensure they are not offering any payday loan products.

But there is concern that some Americans get personal loans to tide them over and then continue to take on more credit card or other debt.

Credit card debt has continued to rise alongside personal loans, according to the latest data from the Federal Reserve Bank of New York. TransUnion has recently noticed an uptick in retailers offering personal loans when someone comes to the cashier to buy furniture or holiday toys.

“I have fixed feelings about personal loans. They are superior to credit cards because the payments are fixed,” said Lauren Saunders, associate director of the National Consumer Law Center. “The problem is many people still have their credit card and end up running up their credit card again, so they end up in a worse situation with credit card debt and installment loans on top of it.”

Saunders also notes that these loans are mainly regulated by state law, and the rules and watchdog capabilities vary widely by state.

FinTechs say they are trying to help people make better choices. One of their big innovations is giving people who take out personal loans a discount if they transfer the cash they get from the loan directly to pay off their bills instead of sending it to their bank account first.

“This has been one of the most successful products we have ever launched. People are trying to do the right thing and they’re getting offered a lower rate if they do balance transfer and direct deposit,” said Anuj Nayar, financial health officer at LendingClub, a peer-to-peer lender that offers personal loans up to $40,000.

Despite the rapid growth in personal loans lately, borrowers appear to be able to pay back the debt. The delinquency rate for personal loans is 4.5%, according to Equifax, a low level by historical standards and well below the 8.4% delinquency rate in January 2008.

But as the number of Americans with one of these loans grows, so does the potential for pain if the unemployment rate ticks up and more people find themselves strapped for short-term cash.

https://www.mysanantonio.com/business/article/Personal-loans-are-growing-like-a-weed-a-14852251.php

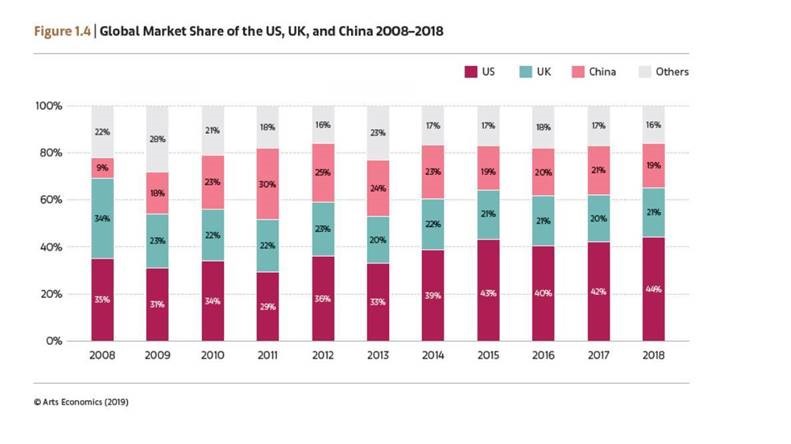

9.Global Market Share of Art….U.S. UK and China Dominate.

The Global Art Market Reached $67.4 Billion in 2018, up 6%

Benjamin Sutton

https://www.artsy.net/article/artsy-editorial-global-art-market-reached-674-billion-2018-6

10.Make These 10 Commitments to Live a Truly Accountable Life

By Sam Silverstein | November 19, 2019 | 0

Accountability means being accountable to ourselves first—and that requires a special kind of commitment. There are certain elements of mindfulness and presence that make the kind of commitment I am talking about possible. We can think of this in terms of what I call choice points.

All day long, you and I make choices. What is the choice we make when someone cuts us off in traffic, or says something mean to us, or steps in front of us in line? What is the choice we make when we see someone drop a bag of groceries, or when we get a text from a friend or loved one who needs emotional support? Whether we realize it at the time or not, these choices we make define us.

Are we on autopilot? Or are we being purposeful as we respond to the situation in front of us? Are we really PRESENT? Are we truly aware of what we are doing? Are we making conscious choices, based on the specific commitments we have made to ourselves about the kind of person we are choosing to be?

Autopilot is easy. Maintaining conscious presence at each and every one of these moments as our day moves forward is sometimes a struggle.

Responding in accordance with our own commitments can be a struggle. Stepping away from our own force of habit is a struggle. The struggle is good. The struggle is necessary. If it is not a struggle, it is not a choice point!

The kind of commitment that delivers the best possible response to each and every choice point does not just happen. It is the work of a lifetime, and it takes steady practice. That may sound intimidating. What I want you to notice now, though, is that the long-term practice we are discussing always involves presence in the moment that you are experiencing right now.

The very best personal accountability practice involves your present-tense awareness of 10 specific, personal commitments to yourself and others:

COMMITMENT #1: COMMIT TO DISCOVER AND REALIZE YOUR POTENTIAL…AND TO HELP OTHERS REACH THEIRS

COMMITMENT #2: COMMIT TO THE TRUTH

COMMITMENT #3: COMMIT TO THE VALUES

COMMITMENT #4: COMMIT TO “IT’S ALL OF US”

COMMITMENT #5: COMMIT TO EMBRACE FAULTS AND FAILURES AS WELL AS OPPORTUNITIES AND SUCCESSES

COMMITMENT #6: COMMIT TO SOUND FINANCIAL PRINCIPLES

COMMITMENT #7: COMMIT TO A SAFE SPACE

COMMITMENT #8: COMMIT TO “MY WORD IS MY BOND”

COMMITMENT #9: COMMIT TO STAND STRONG WHEN ALL HELL BREAKS LOOSE

COMMITMENT #10: COMMIT TO A GOOD REPUTATION

I believe these 10 INTERRELATED commitments can help us notice and respond effectively to the most critical choice points at the moment they arise. They can help us pause, become fully engaged in the moment, and make the choice that is truest to our best selves. It is only in the choice points that we make the decision to live out the commitments that define us. Only in that moment can we exercise our free will and live out those commitments.

These 10 specific commitments are the commitments that people who live truly accountable lives make to themselves… resolve to take on in their relationships with others… and renew constantly during the day as they encounter their own choice points.

Making these 10 commitments to yourself is the first, essential step in building an accountable life and an accountable world—the step without which nothing happens. Action always follows belief. If you develop a strong personal belief in the importance of these commitments, and if you begin acting on those beliefs, you will benefit from them. If you do not, you will not. It is that simple. If you do not believe it, you will never do it.

From the

book: I Am Accountable

Copyright © 2019 by Sam Silverstein

Published by Sound Wisdom