1.IOO ETF –Largest Cap International Companies Break-Out.

Why IOO?

- Exposure to a broad range of large international companies in developed and emerging markets

- Access to 100 of the largest global stocks in a single fund

- Use to diversify internationally and seek long-term growth in your portfolio

https://www.ishares.com/us/products/239737/ishares-global-100-etf

2.Best Opening Day Since 2008—A Veggie Burger.

Beyond Meat soars 163% in its first day of trading (BYND)

Rebecca Ungarino

Beyond Meat debuted Thursday afternoon on the Nasdaq under the ticker BYND.

- Shares ended the day up 163%.

- It was first public debut in a deluge of initial public offerings expected this month.

- Visit Market’s Insider’s homepage for more stories.

Beyond Meat, the decade-old plant-based meat-substitute company, soared by 163% on Thursday as it became the latest unprofitable, disruptive company to make its stock-market debut.

Shares, which trade under the ticker BYND, opened at $46 apiece after pricing at $25. That was up from a prior range of $19 to $21. The stock first traded up 84% before climbing to a high of $72.75. Shares closed the day at $65.75.

Beyond Meat issued 9.63 million shares, up from its initial target of 8.75 million shares, according to a filing with the Securities and Exchange Commission. That offering raised nearly $241 million.

“We hope investors join us as we seek to become the first generation of humans to separate meat from animals, unlocking the next era in the American story of innovation, disruption, and growth,” Beyond Meat’s CEO and founder, Ethan Brown, said in the company’s S-1 filing last month.

The high end of the company’s indicated price range placed its market value at $1.49 billion, up from a prior $1.21 billion valuation.

Read more: Beyond Meat raises the price range for its IPO

Beyond Meat faces fierce competition in the alternative-protein space, listing competitors as both makers of plant-based meat substitutes — like Impossible Foods, Gardein, and Field Roast — and traditional animal-product companies like Cargill and Hormel.

The US meat-processing giant Tyson Foods said last week that it sold its 6.5% Beyond Meat stake as it looked to develop its own line of meat alternatives.

Beyond Meat is also debuting as an unprofitable company, which is not all that uncommon for young firms aiming to ramp up growth. It has generated losses in each year since its 2009 founding, and its losses only slightly narrowed from 2017 to 2018.

The company lost $29.9 million in 2018, $30.4 million in 2017, and $25.1 million in 2016 as it “invested in innovation and growth.” Its sales have grown mightily over the same time, with net revenue of $16.2 million, $32.6 million, and $87.9 million in 2016, 2017, and 2018.

The debut comes amid a robust slate of initial public offerings this year.

Uber is expected to go public later this month, and Slack is expected to debut by way of direct listing this summer. Lyft and Pinterest have already gone public this year.

In last month’s filing, Brown tried to make it clear that he was not calling for people to “consume less meat.”

“My own children enjoy more, rather than less, of their favorite meat occasions (sausage breakfasts, burger dinners) as I am comfortably aware that Beyond Meat products are free of cholesterol and other aspects of animal protein that preoccupy public health debate,” he said. “As we rush to keep up with consumer demand for our products, my guess is that many families are having the same experience.”

Goldman Sachs, JPMorgan, and Credit Suisse were Beyond Meat’s lead underwriters. Jefferies was a joint bookrunner on the deal

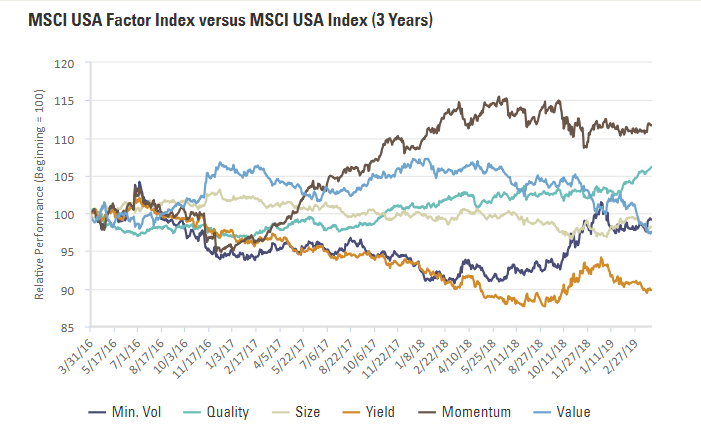

3.Factor Chart-Quality Making a Move Upward, Momentum Sideways, Value Still Big Lag.

Quality continues on its upward trajectory

If we pivot to US factor trends, we can see that quality continued on its upward trajectory in March, with performance ranking the top among all factors on a 3-month basis. Conversely, value continued rolling over and extended its underperformance trailing 12 months, and the size factor has started to reverse course and also trend south.

My take: Quality is extending its run as investors continue to focus on firms with quality balance sheets in this late-stage economic cycle. Value has historically underperformed at this stage in the cycle alongside a flattening yield curve, so its recent slump is consistent with this pattern. And size, as small-caps are more domestically oriented and economically sensitive, has begun its decline as a result of the deteriorating US growth outlook.

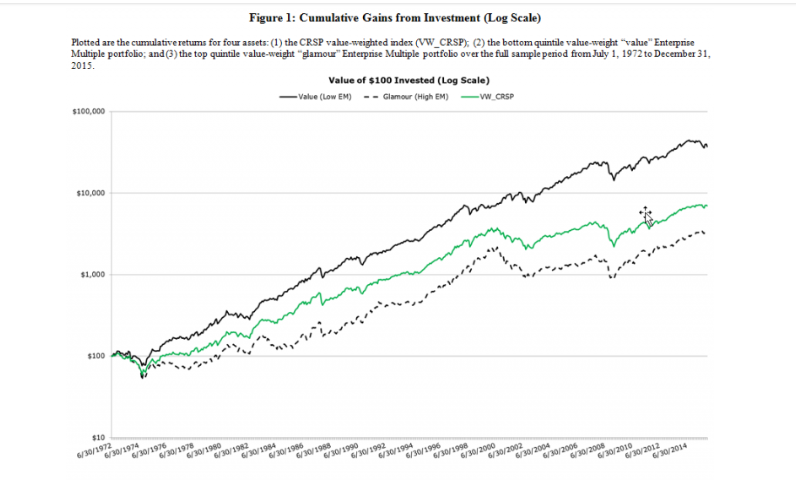

4.Alpha Architects Deep Dive into the Value Factor

By Larry Swedroe|May 2nd, 2019|Research Insights, Factor Investing, Larry Swedroe, Value Investing Research

The financial equivalent of the famous Miller Lite, “tastes great, less filling” debate is the debate between traditional financial economics which uses risk theories to explain asset pricing and the newer behavioral finance field that uses human behavior to provide the explanations. Unfortunately, there’s no consensus on which side of the debate is correct. My own view is that both have much to contribute to the discussion. In other words, the story isn’t all one sided — it’s not black or white, it’s some shade of grey. With that in mind, we’ll look into the research on the source of the value premium: Is it risk-based or behavioral-based?

Value investing refers to buying stocks of companies with low multiples relative to fundamental metrics such as book value, earnings, cash flow, EBITDA, and so on. It’s often referred to as buying what is cheap—as opposed to growth investing which buys companies with high prices relative to fundamental metrics, and, thus, referred to as expensive. There is no debate about whether value stocks have outperformed growth stocks, on average. Historically, cheaper stocks have earned higher returns than expensive stocks.

The only debate is why.

Stephen Penman and Francesco Reggiani contribute to the literature on the value premium with their study “Fundamentals of Value versus Growth Investing and an Explanation for the Value Trap” which appears in the 2018 fourth quarter edition of the Financial Analysts Journal. They sought to explain the source of the value premium by examining fundamental accounting data. They begin by noting that when buying a stock you are buying future earnings and price multiples imbed expectations of earnings growth—higher expected growth means higher P/E (lower E/P). Because there is risk that the forecasts may not be realized, the market also prices risk via the discount rate applied to the earnings estimates—greater risk means lower P/E (higher E/P). Markets price both risk and earnings growth. Thus, you can have an expectation of high earnings growth and a low price to earnings or price to book value because that earnings growth is viewed as being at high risk of not being realized. In other words, value stocks may be cheap (have a low P/E) because they are highly risky—hence the term “value traps”. Conversely, you can have an expectation of low earnings growth and a high price-to- earnings or price to book value because that earnings growth is viewed as being at low risk of not being realized. Penman and Reggiani summarize:

Click for Full Read

https://alphaarchitect.com/2019/05/02/deep-dive-into-the-value-factor%EF%BB%BF/

5.Brent Crude Up 30% YTD….Russell 3000 Oil Group Closes at 20 Year Low.

The performance of the energy sector has been one of most counterintuitive outcomes in the stock market this year given the rise in oil prices in 2019. West Texas Crude Oil is up 40% year-to-date, with Brent Crude rising 35%. There has been a pickup in merger activity in the group, with Chevron (CVX) and Occidental Petroleum (OXY) fighting over Anadarko Petroleum (APC). Yet in the face of these seemingly bullish developments, the energy sector’s performance has been abysmal.

Here is a chart of the Russell 3000 Energy Sector versus the Russell 3000Index. The monthly chart illustrates just how horribly energy stocks have performed. Just like a Slinky’s travels, each step downward is lower than the previous step. The energy sector closed at nearly a 20-year relative low, and has virtually “round-tripped” back to its 1999 Bear Market relative low. The Russell 3000 Energy index has returned just 37% during the past 20 years, while the Russell 3000 has returned more than 200%.

The Energy Sector Is Like a Slinky. Here’s What That Means for Oil Stocks

6.Tesla Shorts Watching for the Break Below the 2017 Levels of Box Below.

7.Bitcoin Rises from the Dead.

Fidelity: Institutional investment in cryptocurrency likely to grow

Mitchell Moos · 3 hours ago · 3 min read

Institutional investment in cryptocurrency is likely to increase over the next five years, according to research from Fidelity Investments. The firm surveyed 441 institutional investors—including pensions, hedge funds, and endowments—to determine the investment outlook for bitcoin and other cryptocurrencies.

Fidelity Investments is the world’s fifth-largest asset manager with $2.5 trillion in assets under management. On May 2nd, the firm released research which surveyed 441 US institutional investors, including—pensions, hedge funds, financial advisors, and endowments to determine their outlook on investing in crypto.

Institutional Investors Looking to Invest

Based on results from the survey, 22 percent of respondents have already purchased cryptocurrency. If the survey accurately represents institutional interest, this is a remarkable increase from near-zero institutional investment in 2016.

More promising is that four out of ten respondents are open to future investments in cryptocurrency within the next five years. If opinion remains unchanged, this means that institutional investors could increase by up to 18 percent over the next five years. Additionally, nearly half of institutional investors (47 percent) view digital assets as having a place in their investment portfolios.

https://cryptoslate.com/fidelity-institutional-investment-in-cryptocurrency-likely-to-grow/

8.Vanguard sees nearly half of all fund inflows in first quarter

Pursuit of low-cost, passive strategies sends $62 billion into Vanguard Funds, more than its three biggest competitors combined

If there was any doubt about the growing appeal of low fees and indexed investing, investors drove the point home in the first quarter by plowing $62 billion worth of net flows into funds managed by the Vanguard Group.

The quarterly total flowing into the fund complex known mostly for low-cost indexing strategies was more than the combined total net inflows of Vanguard’s three biggest competitors: American Funds, Fidelity Investments and iShares from BlackRock.

Vanguard, which holds a commanding 25% share of the total mutual fund and ETF market, was responsible for nearly half of the $136 billion in net flows into mutual funds and exchange-traded funds during the quarter.

“Honestly, it’s not that unusual to see Vanguard dominate like this, which is kind of astonishing,” said Morningstar Inc. analyst Kevin McDevitt.

The quarterly data, compiled by Morningstar, do not include money market fund assets.

Tom Rampulla, managing director at Vanguard, attributed the strong inflows to a system that is “built to deliver value to clients and is driving the price of products down.”

“There’s a big secular movement toward passive investing,” Mr. Rampulla said.

That secular movement, which tends to gain steam in extended bull markets like that one that has been running since 2009, is illustrated by the five funds that saw the biggest net flows for March.

Three of the top five are Vanguard funds, and four of the top five are domestic-equity index strategies.

The outlier among the top five is the Vanguard Total International Stock ETF (VXUS), a $12.3 billion fund that offers broad exposure to non-U.S. equity markets for a mere 9 basis points.

The focus on fees becomes even more evident when you conpare the fund with the sixth highest net inflows in March with the fund that led in net outflows.

The $63.4 billion iShares Core MSCI EAFA ETF (IEFA) had March net inflows of $2.7 billion, while the near-identical iShares MSCI EAFA ETF (EFA) led all funds in net outflows, with $2.2 billion exiting the fund in March.

The Core share class of the fund is up 13.7% this year through Wednesday but down 4.1% over the past 12 months. The older, original version of the strategy is up 13.5% this year and down 3.4% over the past 12 months.

The difference in their appeal comes down to an 8-basis-point expense ratio for the Core version, compared to 31 basis points for the older version of the strategy.

“Lower fees are exactly what’s going on there,” Mr. McDevitt said. “A lot of investors are just migrating to the cheaper share class.”

Todd Rosenbluth, director of mutual fund and ETF research at CFRA, called the pattern of asset flows “a continuation of the trend toward passive investing” but pointed out that Vanguard is uniquely positioned because the company has such a broad product lineup.

In March, for example, Vanguard’s active strategies experienced $187 million in net outflows, but the passive strategies carried the day with $22 billion in net inflows.

“Vanguard benefits from having low-cost ETFs, and by the fact they also have most of these products in mutual fund wrappers for investors who want that,” Mr. Rosenbluth said. “They are not being dragged down by the shift out of active.”

By comparison, Fidelity, which also has a diverse product lineup but is known for active management, experienced $3.6 billion worth of net outflows from its active strategies in March along with $10 billion in net flows into passive strategies.

The major outlier in the active management space in March was American Funds, which doesn’t offer ETFs or passive strategies but experienced more than $2 billion in net flows into its active funds.

“American Funds’ active inflows are impressive,” said Mr. Rosenbluth. “It’s impressive to see there is still a loyal following for those funds.”

Mr. McDevitt of Morningstar agreed that American Funds is benefitting from strong distribution and below-average fees for active management. He said the company also got a boost from a push into active fixed income over the past few months.

In fact, while all the broad active equity fund categories saw net outflows in March, the active bond categories were all positive.

“American Funds’ bond funds have done well, and that been a ballast for them,” Mr. McDevitt said.

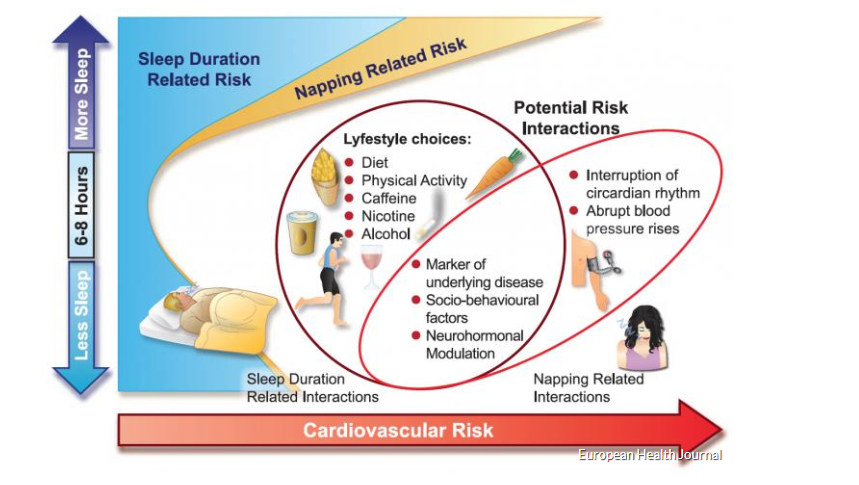

9. A cardiovascular doctor has a new theory on why too little sleep can lead to heart disease and death

A cardiovascular doctor has a new theory on why too little sleep can lead to heart disease and death

Decades of research has shown that chronic short sleep is associated with increased risk of clogged arteries, heart disease, and early mortality

Chronic short sleep is associated with increased risk of clogged arteries, heart disease, and increased morbidity and mortality.

Do you get enough sleep? If not, that could be a potentially fatal problem.

Decades of research has shown that chronic short sleep is associated with increased risk of clogged arteries, heart disease, and early mortality. A new study in the monthly peer-reviewed journal Experimental Physiology has a theory on why lack of sleep increases susceptibility to heart disease.

These findings could help doctors determine if someone who doesn’t get a full night’s sleep is also at a higher risk of potentially fatal heart disease.

Adults who regularly slept fewer than 7 hours per night have lower levels of certain “microRNAs,” molecules that influence the function of genes. These molecules play a key role in regulating vascular health and can be biological indicators of cardiovascular health.

This relationship between a lack of sleep and these molecules could help doctors determine if someone who doesn’t get a full night’s sleep is also at a higher, long-term risk of heart disease and, ideally. He or she could help them take preventative steps and avoid developing a serious illness.

Researchers tested sedentary, middle-aged adults without heart disease from metropolitan areas surrounding Denver and Boulder, Colo. The subjects were then asked to complete a questionnaire to accurately estimate their average nightly sleep and a small amount of blood was taken.

Jamie Hijmans, a cardiovascular physiologist in Denver and co-author of the study, said, “These findings suggest there may be a ‘fingerprint’ associated with a person’s sleep habits, and that fluctuations in miRNA levels may serve as a warning or guide to disease stage and progression.”

“The relationship between sleep and mood is complex, because disrupted sleep can lead to emotional changes, clinical depression or anxiety, but these conditions can also compound or further disrupt sleep,” according to the National Sleep Foundation.

Don’t miss: 5 ways lack of sleep could alter the course of your life

So people prone to depression and anxiety can also end up oversleeping. “If you find yourself sleeping too little or too much on a regular basis, it’s important to bring this up with your doctor so the two of you can look at your total physical and mental health picture,” the foundation says.

An individual that sleeps on average less than 6 hours per night has a 10% higher mortality risk than someone sleeping between 7 and 9 hours.

Research published last year suggests people should get between 6 and 8 hours sleep. Epameinondas Fountas, cardiology specialty registrar at the Onassis Cardiac Surgery Centre in Athens, Greece, said that’s a “sweet spot” and the most beneficial for a healthy heart.

President Donald Trump doesn’t get much more than 40 winks. The president gets 4 to 5 hours sleep a night. The late British Prime Minister Margaret Thatcher famously claimed to get 4 hours per night, bolstering her image as “The Iron Lady.” Some historians have cast doubt on that.

“An individual that sleeps on average less than 6 hours per night has a 10% higher mortality risk than someone sleeping between 7 and 9 hours,” according to separate research by RAND Health Quarterly. That risk falls to 4% for an individual sleeping between 6 to 7 hours per day.

Such are the health dangers associated with a lack of sleep that the Centers for Disease Control and Prevention describes it a “public health epidemic.” Those experiencing a prolonged lack of sleep are also more likely to suffer from hypertension, diabetes, depression, obesity and cancer.

10.Two Things You Can Do To Dramatically Enhance Your Career

The Wealth AdvisorContributor

April 30, 2019

(Forbes) — In the past few months, I’ve watched a few annual events on television that I usually enjoy very much – the Super Bowl, the NBA dunk contest and the Academy Awards.

And while I did have fun watching all of these once again this year, I noticed a theme that I found fascinating. Most of the commentary about each event was that they were “disappointing,” “boring,” or “not as good as they usually are.”

And while clearly sometimes a sporting event or awards show can be more (or less) exciting based on the nature of how it plays out, I also think in today’s world of instant feedback, social media chatter and computer-generated graphics, we’ve become more critical, negative and even spoiled, to our own detriment.

I remember something a mentor of mine said to me a while back. “Mike,” he said, “there are two things you can do that will dramatically improve the quality of your career and your life. They’re simple, just not that easy.”

He went on to say, “The first thing is to be easy to impress. Be in awe of people, talent, nature, art, technology, work and the world around you. Embrace a sense of wonderment, as a child does. There are so many extraordinary people and things around us all the time, we just don’t often stop to appreciate them and allow ourselves to be impressed.”

He continued, “The second thing, and this one is even harder, especially these days, is be hard to offend. In other words, don’t take things so personally and allow yourself to get offended so easily. Imagine, Mike, if you woke up tomorrow morning and said to yourself, ‘It’s going to take something enormous to offend me today.’ That would probably be a good mindset to take to work and out into the world, don’t you think?”

He then said to me, “Most of us, unfortunately, have these the other way around. Once we’ve lived a bit, gained some professional experience, or think of ourselves as somewhat sophisticated, we often get jaded. It takes something pretty remarkable to impress us. And, sadly, we get offended very easily and blame others for our stress, frustration, and disappointment.”

Then he challenged me, “Mike, I dare you to make a commitment to yourself to be easy to impress and hard to offend…and see what happens to your career and your life.”

I never forgot that conversation and his feedback. I think of what he said to me all the time, and try to follow his advice.

While this is a pretty simple concept, I do find that it’s not all that easy to practice in our world today.

However, as I travel around the country and the world working with people, leaders, teams, and organizations of all kinds, it’s clear to me how important this mindset can be. Unfortunately, we often justify our lack of being impressed and how easily we get offended, instead of realizing all the ways these things hold us back.

Moving forward successfully in our lives and careers has a lot to do with how we see ourselves, others and the world around us.

While it may be easy to get caught up in the drama, stress, and negativity of those around us, our environment, or the world we live in, ultimately, we have a choice. And, if we choose to be easily impressed and hard to offend, it will have a dramatic and positive impact on our career and our life.

Try it out…I dare you!