1.CAGR S&P 20 Years…5.52%

It’s Been a Rough 20 Years for Stocks. The Next 20 Should Be a Lot Better

Vito J. Racanelli

A higher-than-expected December payrolls number helped push the market up 3.4% on Friday. Yet stocks had their worst first two days of the year since 2000. Where the market will be in a year has little to do with where it is now. Twelve months ago, stocks were coming off a 22% return in 2017 and feeling fine, thank you very much—until September. Then, the wheels fell off.

Ironically, there is more certainty in picturing the market’s next 10 or 20 years. That’s the time frame investors should use. They rarely examine the trailing returns of past decades, but they should. There’s one number that explains a lot of things: 5.52%. Over the 20 years ended 2018, that’s been the nominal compound annual growth rate (CAGR) of the S&P 500.

It might not feel like it after a decade-long bull market, “but we are coming off 20 of the worst years for compounded returns since the Great Depression,” says Nicholas Colas, co-founder of DataTrek Research. The average trailing 20-year market CAGR since 1928 is 10.7%. Blame the two negative-35%-plus bear markets since 2000.

This low return has given birth to, among other things, the rise of passive investing and the growth of exchange-traded funds. It has forced commissions down and encouraged the use of automation to further reduce broker expenses. Institutional investors, pension funds, and sovereign-wealth funds have taken on more risk—shoveling money to venture capital and private equity—to make their required rates of return, typically 7% to 10%, Colas says.

It is hard to imagine our most recent big winners, theAmazon.com s (ticker: AMZN), Alphabet s (GOOGL), andApple s (AAPL) of the world doubling their market capitalizations in the next 10 years (a 7% CAGR). To start seeing better long-run returns, the market needs lots of new blood, he says, a fresh crop of disruptive tech companies, to come public. The good news is that some, like Uber Technologies and Lyft—and potentially Airbnb and others—are preparing to do so.

The best thing about sitting at the low end of a historical range is that mean reversion should start to kick in, Colas says, and the next 10 to 20 years from here will likely be pretty good. Happy now? As for 2019, tell me if there will be a recession, and I’ll tell you where the market is going

S&P 20 Year Chart…2 35% Drawdowns.

https://www.macrotrends.net/2324/sp-500-historical-chart-data

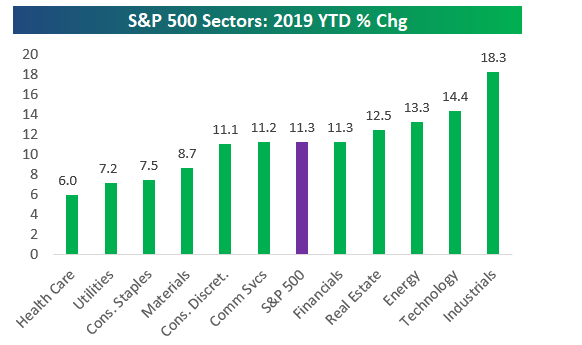

2.S&P YTD Sector Changes

https://www.bespokepremium.com/think-big-blog/

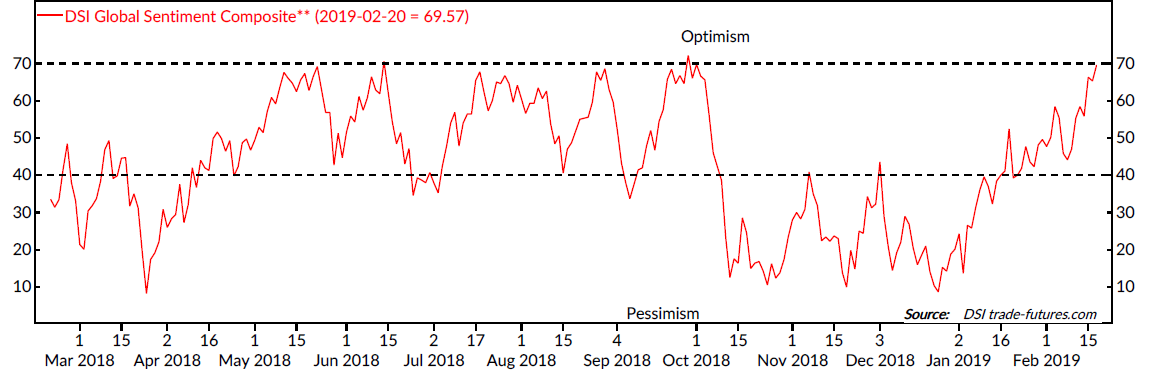

3.Global Optimism Hits Highs.

Ned Davis Research

Ned Davis

www.ndr.com

4.ETFs 20% of Vanguard’s Assets and 35% of Company’s Net Cash Flow

Vanguard, SoFi Lead the Latest Charge to Cut Fund Fees

ByCrystal Kim

https://www.barrons.com/articles/vanguard-sofi-lead-the-latest-charge-to-cut-fund-fees-51551493212

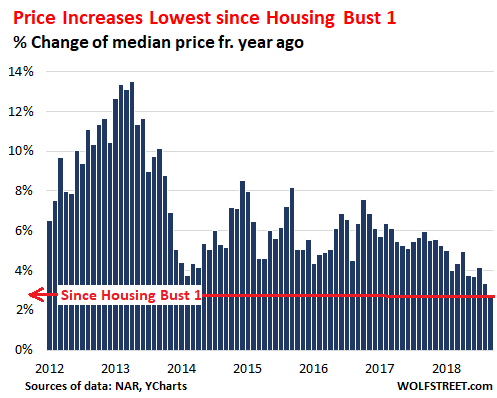

5.Year Over Year Price Changes for Homes….Lowest Since Bubble Burst.

The median price in January, at $247,500, was still up 2.8% from a year earlier, the lowest year-over-year increase since 2012, with house prices rising 3.1% and condo prices remaining flat. This chart shows the year-over-year price changes in percentage terms (data via YCharts):

The US Housing Market Begins to Feel the Pain

by Wolf Richter

https://wolfstreet.com/2019/02/21/the-us-housing-market-begins-to-feel-the-pain/

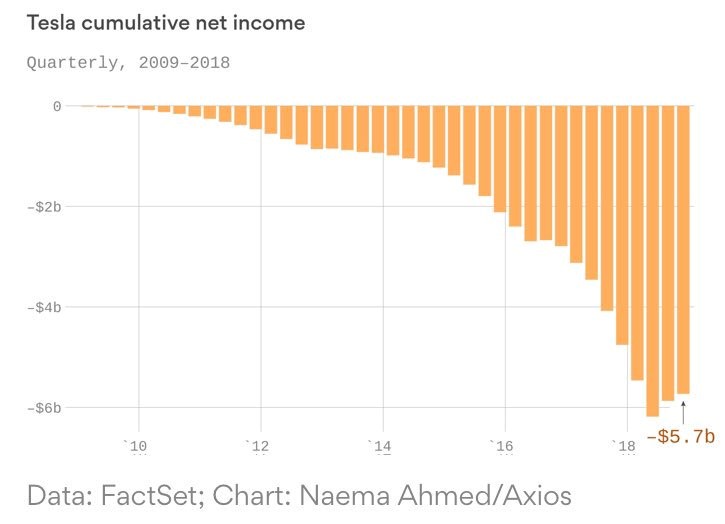

6.Tesla Losses.

Holger Zschaepitz

@Schuldensuehner

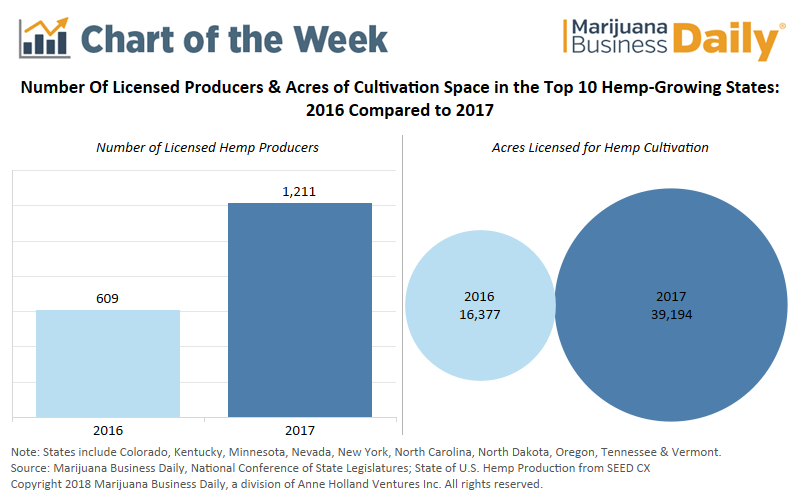

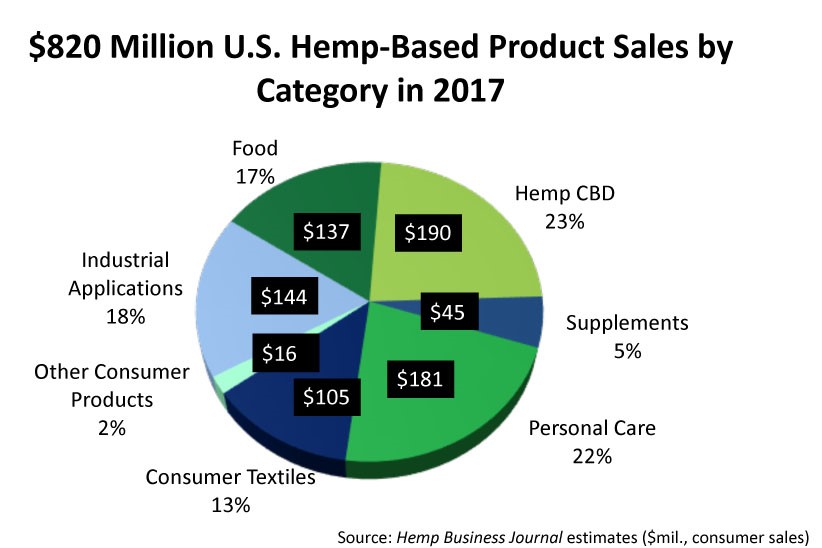

7.New Farm Bill…Hemp Removed from Federal Narcotics Prohibitions.

Hemp is the cannabis cousin that contains cannabidiol, or CBD, but not the stuff that makes you high, THC. In December, President Donald Trump signed a bill that removed hemp from federal narcotics prohibitions and allows states to regulate it. That cleared the way for consumer products containing CBD, which has analgesic and relaxing effects, but no buzz.

No other U.S. crop offers the return available from CBD, says Cowen agricultural analyst Charlie Neivert. “We would thus expect the country’s two largest crops, corn and soybeans, to lose some acreage to CBD hemp.” CBD could initially appear in cosmetics and toiletries. Canada-listed Green Growth Brands recently announced a deal to open more than 100 kiosks selling CBD products in Simon Property malls.

Cannabis Makers’ New $16 Billion U.S. Opportunity-—Bill Alpert

https://www.barrons.com/articles/cannabis-makers-new-16-billion-u-s-opportunity-51551490099

https://mjbizdaily.com/chart-us-hemp-production-soars-2017/

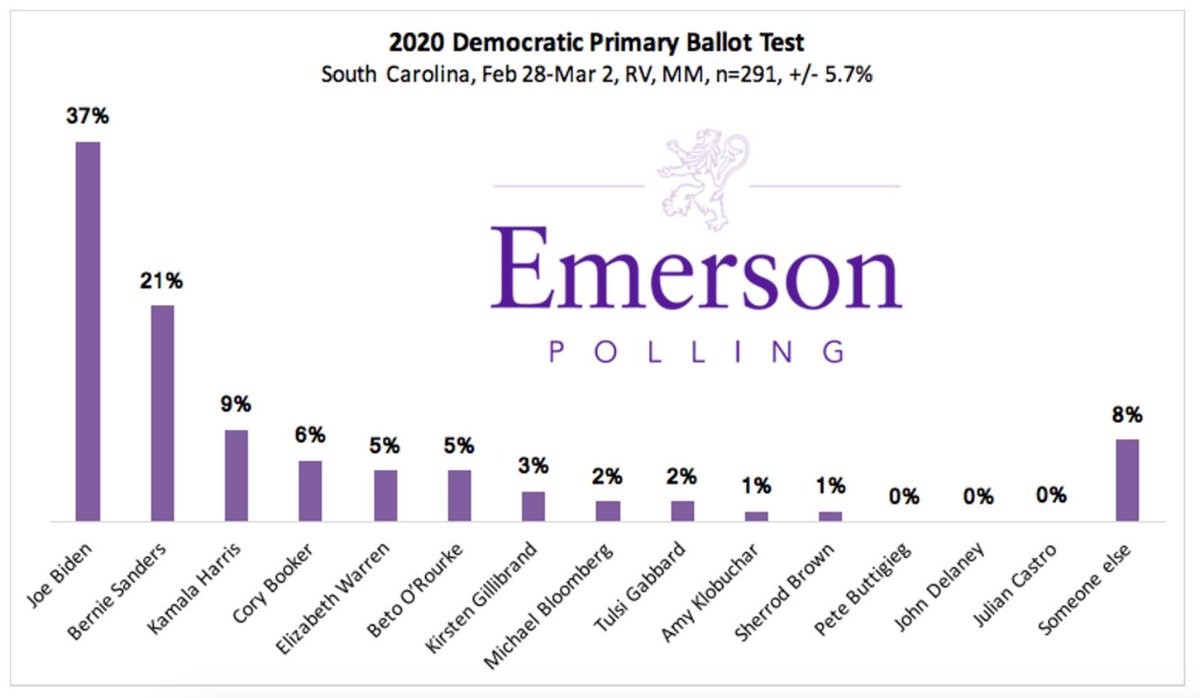

8.South Carolina Democratic Primary Poll Test.

https://twitter.com/nosunkcosts

9.Lessons From Buffett’s Letter

The old Buffett letters are the best. His recent letters have mellowed in a way to be more suitable for a broader shareholder base.

Of course, that’s not a bad thing. Buffett understands his audience well enough to recognize the need to shift. But for the diehards hoping for a glimpse of the old letters in the new ones, we might be out of luck.

If you’ve been living under a rock, his latest letter — the 2018 version — was released last Saturday to the usual fanfare and excitement. As is tradition, I put off reading it until Monday morning and did my best to ignored the Twitter hot-takes till then.

If you’re forced to only read one section, the section on “The American Tailwind” is it. Read it. It’s worth it.

As far as letters go, lessons were sparse. So to mix things up this year, I added some hot-takes from the CNBC interview Buffett does every Monday following a letter release.

Let’s get to it:

Annual Letter

On stock buybacks.

All of our major holdings enjoy excellent economics, and most use a portion of their retained earnings to repurchase their shares. We very much like that: If Charlie and I think an investee’s stock is underpriced, we rejoice when management employs some of its earnings to increase Berkshire’s ownership percentage… When earnings increase and shares outstanding decrease, owners – over time – usually do well.

On the impact of corporate tax rate changes to intrinsic value.

Like it or not, the U.S. Government “owns” an interest in Berkshire’s earnings of a size determined by Congress. In effect, our country’s Treasury Department holds a special class of our stock – call this holding the AA shares – that receives large “dividends” (that is, tax payments) from Berkshire. In 2017, as in many years before, the corporate tax rate was 35%, which meant that the Treasury was doing very well with its AA shares. Indeed, the Treasury’s “stock,” which was paying nothing when we took over in 1965, had evolved into a holding that delivered billions of dollars annually to the federal government.

Last year, however, 40% of the government’s “ownership” (14/35ths) was returned to Berkshire – free of charge – when the corporate tax rate was reduced to 21%. Consequently, our “A” and “B” shareholders received a major boost in the earnings attributable to their shares.

This happening materially increased the intrinsic value of the Berkshire shares you and I own. The same dynamic, moreover, enhanced the intrinsic value of almost all of the stocks Berkshire holds.

On paying too high a price.

On occasion, a ridiculously-high purchase price for a given stock will cause a splendid business to become a poor investment – if not permanently, at least for a painfully long period. Over time, however, investment performance converges with business performance.

On the American tailwind and investor headwind.

On March 11th, it will be 77 years since I first invested in an American business. The year was 1942, I was 11, and I went all in, investing $114.75 I had begun accumulating at age six… Nevertheless, in 1942, when I made my purchase, the nation expected post-war growth, a belief that proved to be well-founded. In fact, the nation’s achievements can best be described as breathtaking.

Let’s put numbers to that claim: If my $114.75 had been invested in a no-fee S&P 500 index fund, and all dividends had been reinvested, my stake would have grown to be worth (pre-taxes) $606,811 on January 31, 2019 (the latest data available before the printing of this letter). That is a gain of 5,288 for 1. Meanwhile, a $1 million investment by a tax-free institution of that time – say, a pension fund or college endowment – would have grown to about $5.3 billion.

Let me add one additional calculation that I believe will shock you: If that hypothetical institution had paid only 1% of assets annually to various “helpers,” such as investment managers and consultants, its gain would have been cut in half, to $2.65 billion. That’s what happens over 77 years when the 11.8% annual return actually achieved by the S&P 500 is recalculated at a 10.8% rate.

Interview

On the stock doesn’t know you own it.

The thing to remember is, you know, how the stock doesn’t know you own it. You pay $10 for a stock, it goes to $8, and you think, “If it ever gets back to $10, I’ll sell it.” You know, and if it goes up $20, you say, “I can take– sell half of it and take all my money out.” All those things are nuts. But in business, if we paid $7 billion for Kraft, which is all it takes to run the business, it would still earn the same amount as if we paid the $100 billion premium. The stock– the business does not earn more just because you pay more for it.

On reevaluating a position after bad news.

The stock market is there not to instruct me. It’s there to serve me. So if there’s bad news and the stock goes down, the question I have is — is the long-term valuation changed? And– well, there was certainly bad news at GEICO when we bought it, for example. But there was bad news in American Express when I originally bought it back in the ’60s. It was the best investment the partnership ever made. So what you like is bad news about a fundamentally good business. And then you got to make sure that it’s still a fundamentally good business.

On politics and investing.

All my life I’ve been hearing half the country say that the person favored by the other half wins, things are gonna go to hell. And so I pointed out in my discussion, I’ve lived under 15 presidents; 14 of ’em I’ve invested under. I didn’t invest under Hoover, I was a little young then. But seven were Republicans, seven were Democrats… You do not wanna have a political view in investing. And most people put it through a political prism, they just can’t keep their politics out of it. They can keep their religion out of it but politics, they just have to look through those glasses. And if you’ve done that, if you’ve been a staunch Republican or a staunch Democrat through these 77 years you’d a missed out on a lotta the party.

On investments being good at one price, bad at another.

Almost anything, at a price, can be good. Not everything. But anything, at a certain price, can be bad. I mean, if you pay too much, you pay too much.

On the difference in investing today versus when he started.

It’s harder for two reasons, one of which is peculiar to us, is we’ve got a lot more money. So our universe of possible things to do has shrunk from thousands and thousands of things that I used to look at, when I had small amounts of money, to a relatively few things now…

Then the second thing is, I mean, obviously, you’ve got way more competition than when we started in 19 – well, really, when I took Ben Graham’s class in 1951. I mean, the whole world was my oyster because people were not going through the manuals. It’s easier to get the data now, for one thing. I mean, just with the internet, it’s far easier. I used to mail away for annual reports and go to the Interstate Commerce Commission, the Public Utility Commission, the Insurance Commission. I went to all those offices and dug through papers. And now, it takes five seconds for somebody to get the same information.

On investing 100 years from now.

The fundamentals won’t change. You’re not going to discover anything new about investments in the next 50 or 100 years. I mean, it’s buying a business. You have to know how to value the business. And you have to know something about how markets operate. But you don’t buy a business, unless you can value it. You have to learn how to value businesses and know the ones that are within your circle of competence and the ones that are outside. And that won’t change… Investing is laying out a dollar of purchasing power and getting more back in the future. And you try and figure out, you know, how much you’re willing to pay for that bird in the bush, compared to the bird in the hand.

Source:

https://novelinvestor.com/lessons-from-buffetts-letter/

10.What Will Matter – by Michael Josephson

I love to teach. I live to teach. I need to teach. So, in an effort to create a new platform for my teachings I recently created this new website called WhatWillMatter.com. I hope you’ll visit and subscribe and stay regularly engaged in the search for what matters.

The name of the website or blog comes from the title of a poem I wrote in 2003. This poem sums up my core philosophy.

\WHAT WILL MATTER by Michael Josephson (c) 2003

Ready or not, some day it will all come to an end.

There will be no more sunrises, no minutes, hours, or days.

All the things you collected, whether treasured or forgotten, will pass to someone else.

Your wealth, fame, and temporal power will shrivel to irrelevance.

It will not matter what you owned or what you were owed.

Your grudges, resentments, frustrations, and jealousies will finally disappear.

So, too, your hopes, ambitions, plans, and to-do lists will expire.

The wins and losses that once seemed so important will fade away.

It won’t matter where you came from or what side of the tracks you lived on at the end.

It won’t matter whether you were beautiful or brilliant.

Even your gender and skin color will be irrelevant.

So what will matter? How will the value of your days be measured?

What will matter is not what you bought but what you built; not what you got but what you gave.

What will matter is not your success but your significance.

What will matter is not what you learned but what you taught.

What will matter is every act of integrity, compassion, courage,

or sacrifice that enriched, empowered, or encouraged others to emulate your example.

What will matter is not your competence but your character.

What will matter is not how many people you knew but how many will feel a lasting loss when you’re gone.

What will matter is not your memories but the memories of those who loved you.

What will matter is how long you will be remembered, by whom, and for what.

Living a life that matters doesn’t happen by accident.

It’s not a matter of circumstance but of choice.

Choose to live a life that matters.