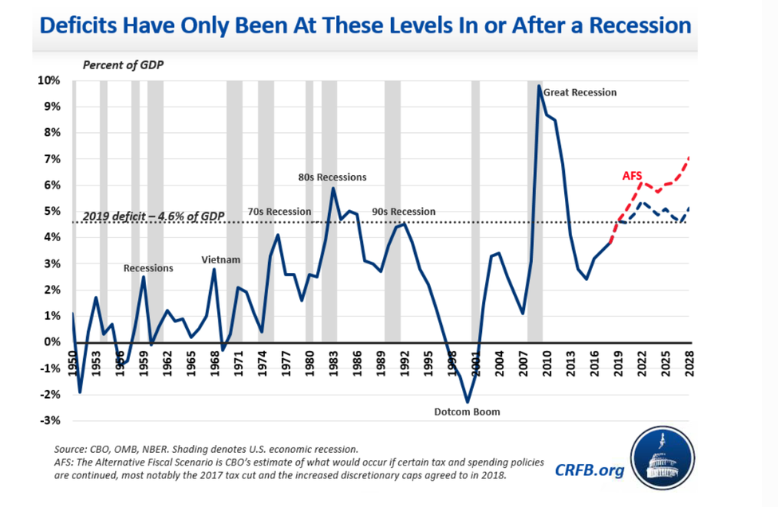

1.Deficits Have Only Been at These Levels In of After a Recession.

- At the projected 4.6% for fiscal 2019 it will the be largest in a non-recession year

- And the red line shows that it will only be worse

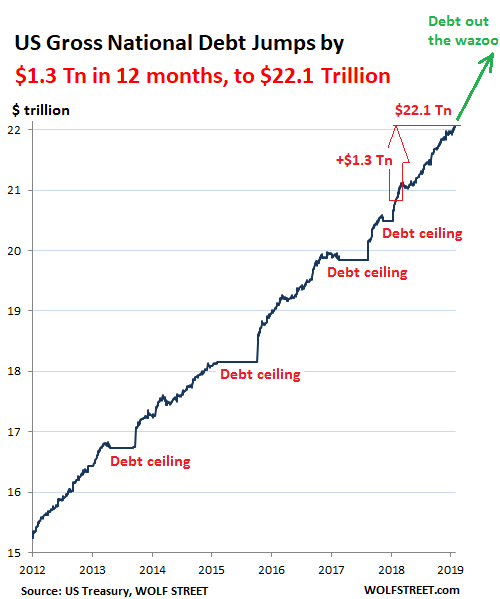

2. GDP Rose by $1.0 Trillion in 2018, US Gov. Debt by $1.3 Trillion

Wolf Street

Where do these dollars in GDP come from?

Limited as GDP measures are, they do not include where the dollars came from that were invested, spent, or blown. Governments play a large role in GDP. Just the federal government alone is a major contributor behind GDP. Everything it spends and invests in the US goes into the GDP formula. What does not go into GDP is where those dollars came from. Much of it came from tax revenues, fees, and other receipts. The remainder came from borrowing.

In the calendar year 2018, the federal government’s debt grew by $1.4 trillion, to end the year at $21.97 trillion. If you exclude the distortive effects of the last debt-ceiling fight, the increase in 2018 comes to around $1.3 trillion.

Most of the additional borrowing of $1.3 trillion was added to GDP and therefore to GDP growth. But GDP growth in current dollars totaled just $1.0 trillion. Without that additional federal borrow-and-spend, GDP growth would have been negative.

Even the BEA made reference to it when it listed “federal government spending” as one of the primary contributors to GDP growth. So I will leave you with this chart of one of our primary drivers behind GDP growth (updated through February 28, 2019):

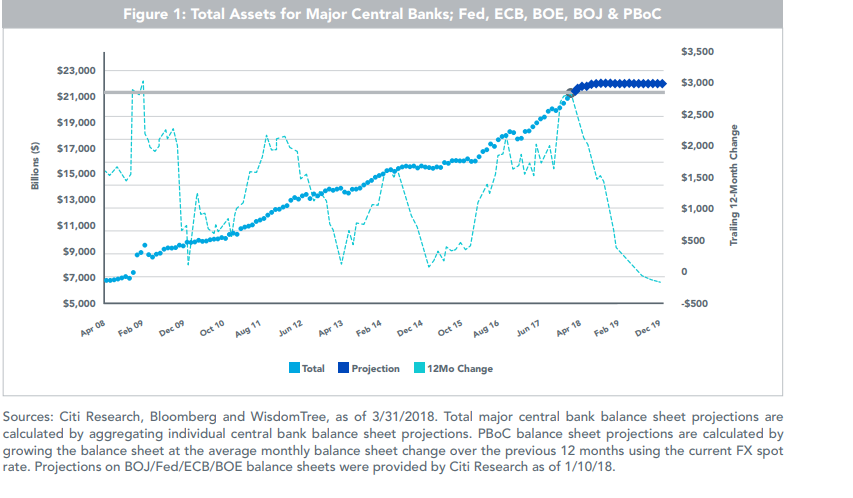

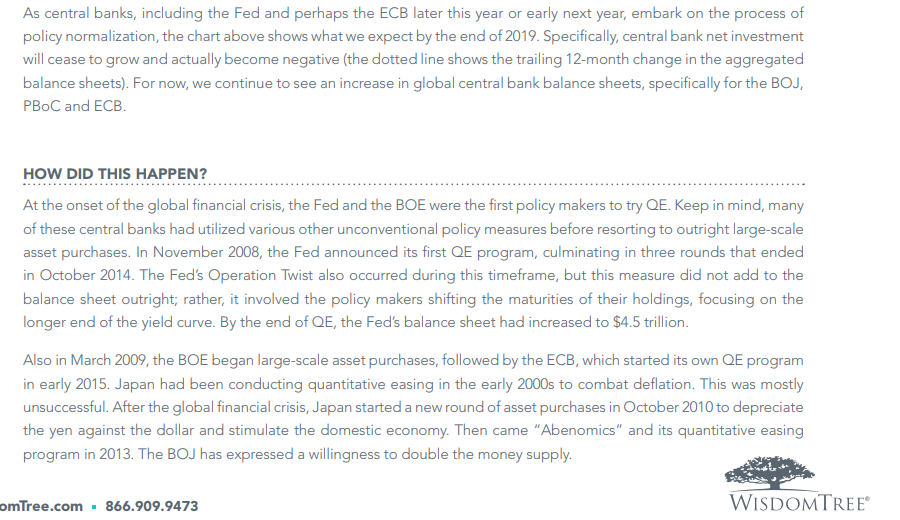

3.Total Assets of Central Banks to Come Down by 2019?

Kevin Flanigan and Josh Shapiro

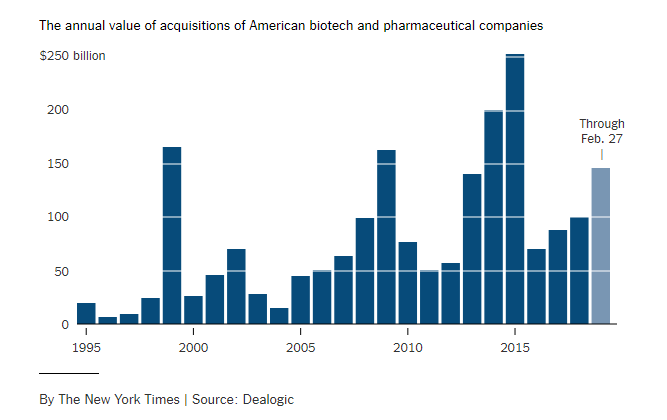

4.Biotech Consolidation.

Acquisitions of American biotech companies are surging, and so are the prices that buyers are willing to pay.

Just two months into the year, the value of deals for biotech and pharmaceutical companies in the United States has reached $146 billion, according to Dealogic. That is more than what was announced in all of 2018, 2017 or 2016, and it accounts for 40 percent of all takeover announcements in the United States so far.

Major drug makers are in a race to find their next blockbuster. As the complexity of drugs has increased, though, so has the cost to develop them. That has made buying a biotech company with a promising candidate an increasingly popular way in recent years for the largest pharmaceutical companies to replenish their drug pipeline.

Big Pharma’s Hunt for New Drugs Is Pushing Up Cost of Deals

https://www.nytimes.com/2019/02/28/business/dealbook/pharmaceutical-biotech-acquisitions.html

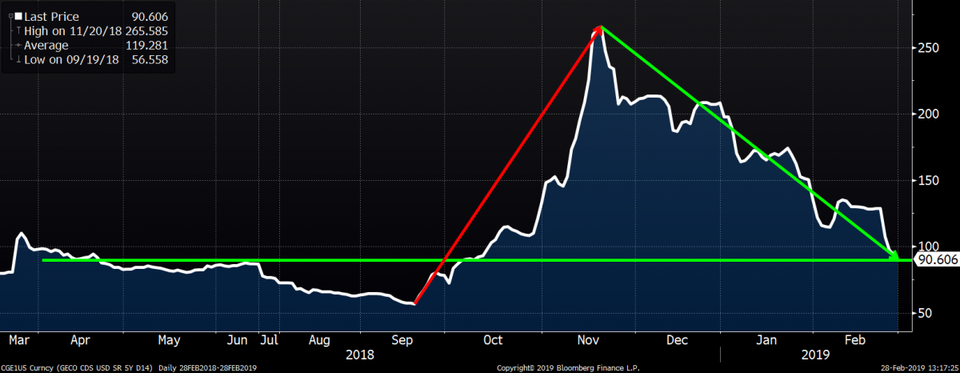

5.GE Credit Default Swaps Recede.

General Electric Bonds Continue To Do Well

While GE stock has stalled, the bonds have continued to perform well as GE has taken step after step to improve their balance sheet. I argued at the lows in November that the problems on the credit side were vastly overstated and could overcome relatively easily, at least in the near term (GE, the $100 Billion Credit in the Room). They have been able to accomplish that.

GE credit default swaps, which traded as high as 290 bps are back below 90 bps. Levels not seen since early October.

GE 5 Year CDSBLOOMBERG

That is impressive performance and should be encouraging to equity holders that the credit situation is getting under control.

All their dollar denominated bonds greater than $500 million in size trade above 98 cents on the dollar out to 2022 and most trade above 100 (their redemption price). That is an encouraging sign.

Their biggest bond deal, at $11.4 billion outstanding, the 4.418% bonds due 2035 are also trading above 90 cents on the dollar after dipping as low as 77 cents on the dollar on November 19th (according to Bloomberg). Since these bonds are longer dated it makes some sense that the bonds have stalled a bit, but it is impressive that the spreads have sustained these levels. It indicates to me that too many large bond investors were underweight this company and are deciding to buy to get back to something closer to a neutral position versus their benchmark indices.

One word of caution is the strength in the 5% Non-Cumulative Preferred Stock. These preferred shares are back to 95 cents on the dollar and are outperforming the 2035 bonds. While the enthusiasm for this security is interesting, I would be more cautious about owning Non-Cumulative Preferred stock here. They don’t have the upside of the equity, but will bear the brunt of another round of credit concerns.

The fear surrounding GE on the credit side and how easily it was rectified by the company are a good lesson to learn in this Year of the Debt Diet. The positioning in the market is not like it was ahead of the financial crisis. So, while it is good to be cautious on companies with too much debt, it can be just as bad for your portfolio to panic, especially when many of those spreading the panic have limited experience with corporate bonds.

6.Frontier Markets Bounce But Still Well Off Highs.

Frontier Market ETF—still -18.5% from highs.

7.Chinese Stocks Had Best Month in Years but Small Cap Still Well Below Peaks.

Chinese small cap stocks -16% from highs.

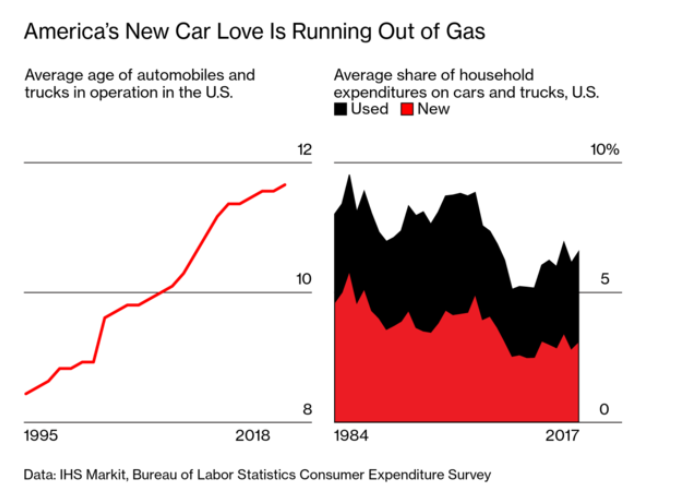

8.More on Peak World Autos.

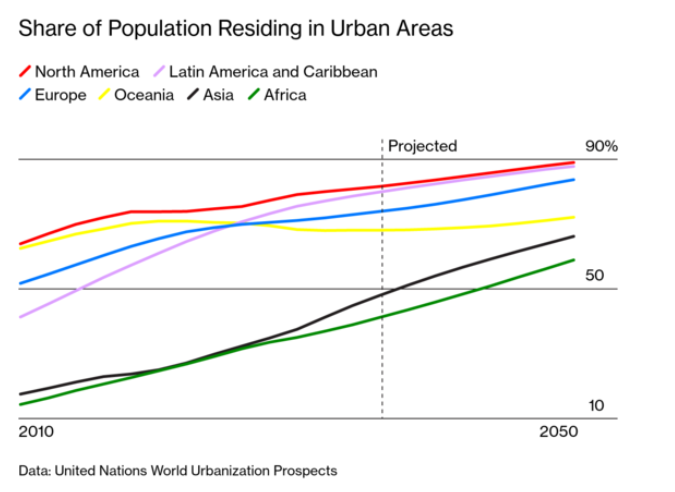

This Is What Peak Car Looks Like Keith Naughton David Welch February 28 2019, 5:00 AM February 28 2019, 2:07 PM (Bloomberg Businessweek) — After one too many snowstorms, Boston tech executive Larry Kim had had it with shoveling out his car and struggling to find parking. So in 2014 he ditched his Infiniti luxury sedan and began commuting by Uber and Lyft—at an annual cost of as much as $20,000.

The automobile—once both a badge of success and the most convenient conveyance between points A and B—is falling out of favor in cities around the world as ride-hailing and other new transportation options proliferate and concerns over gridlock and pollution spark a reevaluation of privately owned wheels. Auto sales in the U.S., after four record or near-record years, are declining this year, and

Read more at: https://www.bloombergquint.com/bq-blue-exclusive/this-is-what-peak-car-looks-like#gs.bsTW3Cyy

Copyright © BloombergQuint

9.We may finally know what causes Alzheimer’s – and how to stop it

HEALTH 23 January 2019 , updated 30 January 2019

Alzheimer’s disease has destroyed neurons in the right-hand brain above

By Debora MacKenzie

AFTER decades of disappointment, we may have a new lead on fighting Alzheimer’s disease. Compelling evidence that the condition is caused by a bacterium involved in gum disease could prove a game-changer in tackling one of medicine’s biggest mysteries, and lead to effective treatments or even a vaccine.

As populations have aged, dementia has skyrocketed to become the fifth biggest cause of death worldwide. Alzheimer’s constitutes some 70 per cent of these cases (see “What is Alzheimer’s disease”), yet we don’t know what causes it. The condition, which results in progressive loss of memory and cognitive function, usually over a decade or so, is devastating both to those who have it and to their loved ones.

The condition often involves the accumulation of two types of proteins – called amyloid and tau – in the brain. As these are among the earliest physical signs of the disease, the leading hypothesis since 1984 has been that the condition is caused by the defective control of these proteins, especially amyloid, which accumulates to form large, sticky plaques in the brain.

The bulk of research into understanding and treating Alzheimer’s has centred on this “amyloid hypothesis”. Huge sums of money have been invested in experiments involving mice genetically modified to produce amyloid, and in developing drugs that block or destroy amyloid proteins, or sometimes degraded tangles of tau.

It has become clear that this approach isn’t working. In 2018 alone, the US National Institutes of Health spent $1.9 billion on Alzheimer’s research. But according to a recent study, the failure rate of drug development for Alzheimer’s has been 99 per cent.

Some have begun to question the amyloid hypothesis. The lack of results has been compounded by the discovery that people – including some in their 90s with exceptional memories – can have brain plaques and tangles without having dementia. In a review of the research to date last year, Bryce Vissel at the University of Technology Sydney, Australia, concluded that there isn’t sufficient data to suggest that “amyloid has a central or unique role in Alzheimer’s”.

“The bacteria in the brain are not the result of Alzheimer’s, but they could be the cause”

In 2016, researchers discovered that amyloid seems to function as a sticky defence against bacteria. They found that the protein can act as an anti-microbial compound that kills bacteria, and when they injected bacteria into the brains of mice engineered to make Alzheimer’s proteins, plaques developed round bacterial cells overnight.

At the time, the team said it still believed that amyloid itself went on to cause the brain damage of Alzheimer’s, not bacteria. But a spate of subsequent studies have looked at microbes. Bacteria have been found in the brains of people who had Alzheimer’s when they were alive. But it hasn’t been clear whether the bacteria caused the disease or were simply able to enter brains damaged by Alzheimer’s.

Multiple teams have been researching Porphyromonas gingivalis, the main bacterium involved in gum disease, which is a known risk factor for Alzheimer’s. So far, teams have found that P. gingivalis invades and inflames brain regions affected by Alzheimer’s; that gum infections can worsen symptoms in mice genetically engineered to have Alzheimer’s; and that it can cause Alzheimer’s-like brain inflammation, neural damage and amyloid plaques in healthy mice.

10.3 Keys to Developing Daily Disciplines

February 21, 2019/Todd Duncan/No Comments

@alliecandice via Twenty20

If you struggle with managing your greatest resource, time, it is possible that you have not yet harnessed the power and leverage of creating daily disciplines. An ancient Proverb says, “He who neglects discipline despises himself.” The most powerful decision you will ever make in productivity is building rhythm and routine around doing what matters most. When you do that, you feel good about you and achieve at a higher level. Being a high performer is the result of your daily disciplines.

Time Management Is a Waste of Time

Sound crazy? For most people, time management is like raking water: lots of activity; limited results. We are limited not by time, but by how we use the time we have. Time management is life management. Time management is values management. Time management is activity management. You and I will never be clever enough to control our time, but we can choose the events with which to allocate our time. When those events are repeated through daily discipline, our productivity soars and our spirit is enlarged, and we develop unstoppable determination.

Related: How to Start a New Discipline

3 Keys to Developing Daily Disciplines

Key #1: Clarify your values.

If you don’t know what’s important to you, you will spend time doing what’s not. Ignored priorities will always become more important. To know what is important to you and to commit to those things as part of your “must do’s” is to create the ecosytem for a more effective use of your time.

When your activities are in alignment with what is significant to you, you suddenly know inner peace. High levels of inner peace reduce stress; it calms you throughout your day. We all need to have a full grasp of those things that mean the most to us. I suggest that we should spend at least 15 minutes a day in a quiet state of mind to see how we can discover fulfillment in any of our important value areas.

Roy Disney said, “When values are clear, decisions are easy.” The decision on what to do with your time should be an easy one if you are clear on your values and you spend time reviewing them on a daily basis. Knowing your values also helps you frame what not to do, which may be even more critical to your performance. Once your value areas are clear, you can then move from behavior to habit.

Key #2: Block the time.

Before a habit is formed, you must commit to repeated behavior. To create rhythm and routine is to decide in advance what your day and week will look like, and then to discipline yourself to live accordingly with the time allotted. The discipline comes from your values and living in accordance with them.

Managing time is not post-it notes. It’s not scribbled “to-do” checklists. It’s definitely not being “connected” all day long with unvetted technology. Effective time blocking, and then blocking interruptions that mess up the time block, is the key. Time blocks are planned segments of time that help you complete your most important predetermined activities—they are, at their core, disciplines that lead to achievement. They are “non-negotiables.”

For example, I have a Tuesday, Thursday and Sunday morning discipline of riding my bike 50 miles. My wife, Deb, and I have a Sunday night debrief where we get to tell each other what we did well over the previous week and plan accordingly for the upcoming week. Every day between 10:00 a.m. and 11:00 a.m., I call three decision-makers to connect and add value and advance relationships.

Key #3: Form the habits.

Why aren’t people as productive as they might be? Mostly because they miss the connection between “trying” to be productive and “committing” to being productive. There is a difference. Habits are only formed when the behavior attempted becomes permanent. Here are some ideas to help you stay focused on forming the habit of honoring your daily disciplines:

- Be proactive:The only alternative available is to be reactive. Everyone who moves toward a more productive life does not wait for life to come at them. They go out and make it happen. They know that everything has a proactive solution. You can hope that life will get better for as long as you like. However, unless you do something to back your greatest hopes, not much will change. Changemust come from within. Here’s a great question: If you continue on the path you are now on, will your life improve and take you to the level of your dreams? Life will give you what you tolerate and accept!

- Fight multitasking:Multitasking is the fast track to low performance. It gets in the way of your greatness! No one has ever received accolades from a manager congratulating them for being busy. The key question is, “Busy doing what?” High-performance people are not busy; they are productive. They master the art of “one thing thinking.” According to Harvard Business Review, “Multitasking leads to as much as a 40 percent drop in productivity, increased stress and a 10 percent drop in IQ.” UC Irvine says, “People spend an average of 11 minutes on a project before they are interrupted. It takes them on average, 25 minutes to get back to the point they were at before the distraction.”

- Practice “The 5-Minute Rule”:I learned an amazingly powerful discipline when I was 23 years old. I call it “The 5-Minute Rule.” I was studying high-performance sales people and was reading an article about an insurance agent who was making over $1 million a year in sales commissions. He was asked, “What is the best advice you could give any sales person?” He said, “Spend 5 minutes every hour evaluating how the last 55 minutes went, and correct.” I started using this rule. Amazingly, I learned all the things getting in the way of being productive. I learned how to fix and manage interruptions. I learned how to say “no,” which is the most powerful word when it comes to being productive. Within a year, I had increased my income by over 400 percent.

Whether you are doing business, life or both, the most important truth is, in the end, your life will be defined by your daily disciplines. The choices you make! The impact you have! The results you achieve! Your destiny is in your disciplines.

Related: How to Get More of Everything You Want

https://www.success.com/3-keys-to-developing-daily-disciplines/