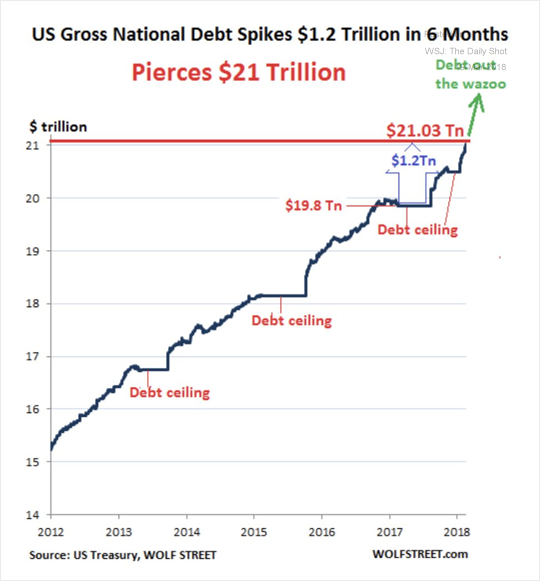

1.The United States: The federal debt has jumped $1.2 trillion since the debt ceiling has been lifted.

Source: @trevornoren; Read full article

From The Daily Shot

2.As the Debt Increases-Bonds Breaking Some Long-Term Technical Levels…TLT is Popular ETF.

Twits Note how TLT has smashed below long-term support – A more hawkish Fed via an upshift in their dot plot — or official estimates of borrowing costs in the coming years — is seen maintaining momentum for a flatter yield curve, an important measure of expectations for US growth and inflation and one that is actively traded in the bond market, says FT

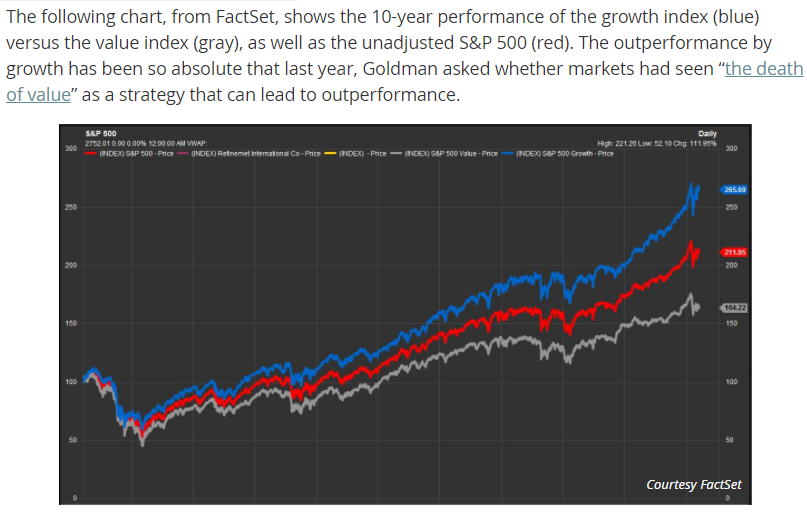

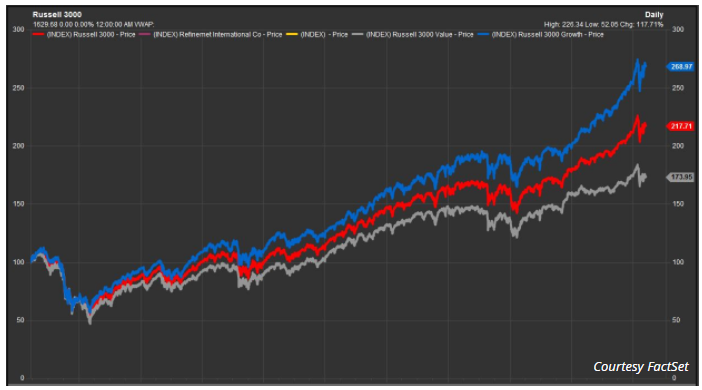

3.Growth vs. Value Spreads Widen.

The outperformance of growth can also be seen in the economy’s smallest stocks. The Russell 3000 index RUA, -1.35% of small-capitalization shares is up about 3% on the year, while the Russell 3000 Growth index RAG, -1.53% is up 6.1%. The Russell 3000 Value index RAV, -1.15% is down about 0.2%. Again, this is a trend that has been pronounced for a decade. (Growth is in blue, while value is in gray.)

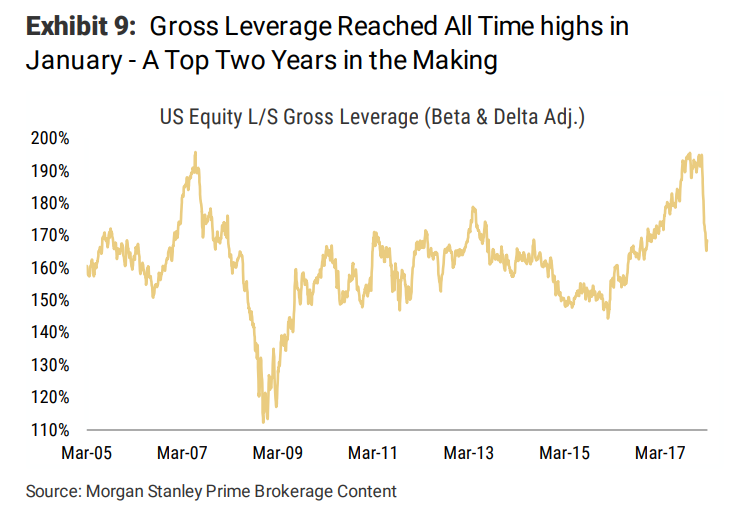

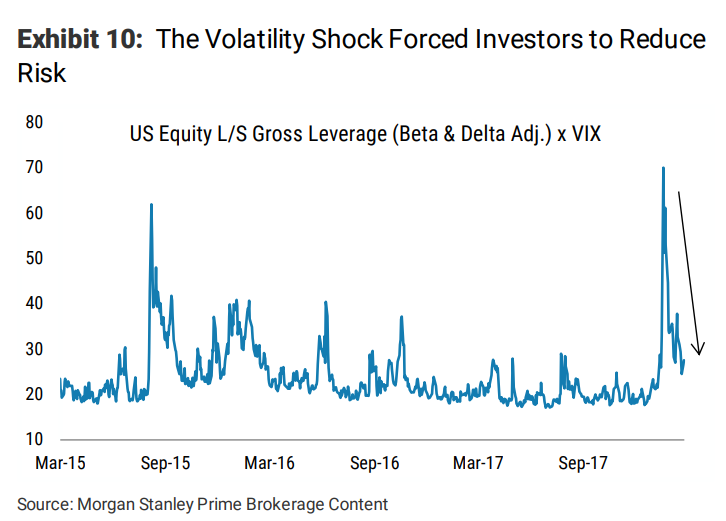

4.Gross Hedge Fund Leverage Hit 2007 All-Time Highs During January Rip Higher.

One key point in Wilson’s thesis is that gross leverage by Morgan Stanley’s hedge fund clients hit an all-time high in January. Gross leverage, according to the strategist, is a good measure of investor willingness to assume risk.

Morgan Stanley

The record was also set right before the early February “volatility shock” forced investors to scale back their exposure to risk and Wilson does not expect gross leverage to return to January levels any time in the near future.

The stock market meltup is over: Morgan Stanley

By Sue Chang

https://www.marketwatch.com/story/the-stock-market-meltup-is-over-morgan-stanley-2018-03-19

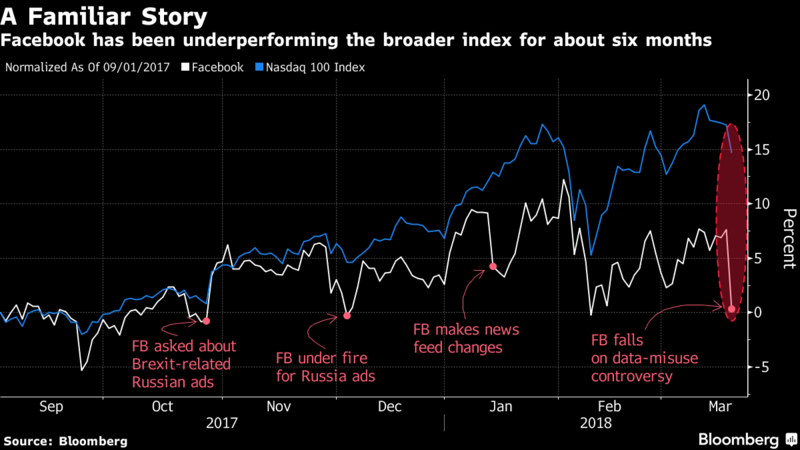

5.Facebook has been Underperforming Versus Tech for 6 Months.

Matt Maley, chief strategist at Miller Tabak, points out that Facebook has already been under pressure from the lawmakers in the U.S. and Europe, and the latest development doesn’t bode poorly for the broader tech sector.

FB Closes Below 200 Day on Huge Volume.

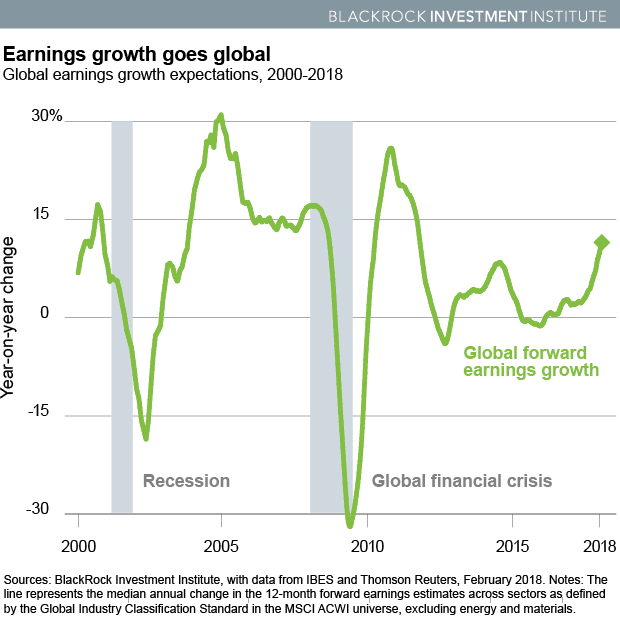

6.Momentum and Global Earnings Growth.

Blackrock Blog

Earnings growth goes global chart below.

The trend is poised to accelerate in 2018, with forward earnings estimates rising at the fastest pace since 2003 (excluding 2010 again). Looking at MSCI indexes, we find: U.S. earnings growth of 11% in 2017 was the strongest since 2011. The outlook for 2018? Nearly 20%, with tax cuts providing a boost and lifting earnings growth prospects by 7%. Earnings growth was 26% in emerging markets (EM) Asia last year, with an outlook for more than 13% in 2018. Markets have followed. U.S. equities soared 15% and EM Asia 30% in the past 12 months, a period that includes the early February stock swoon. Solid earnings prospects for 2018 could bode well for momentum here.

Is momentum’s moment over?Kate Moore is BlackRock’s chief equity strategist, and a member of the BlackRock Investment Institute. She is a regular contributor to The Blog.

https://www.blackrockblog.com/2018/02/26/is-momentum-over/

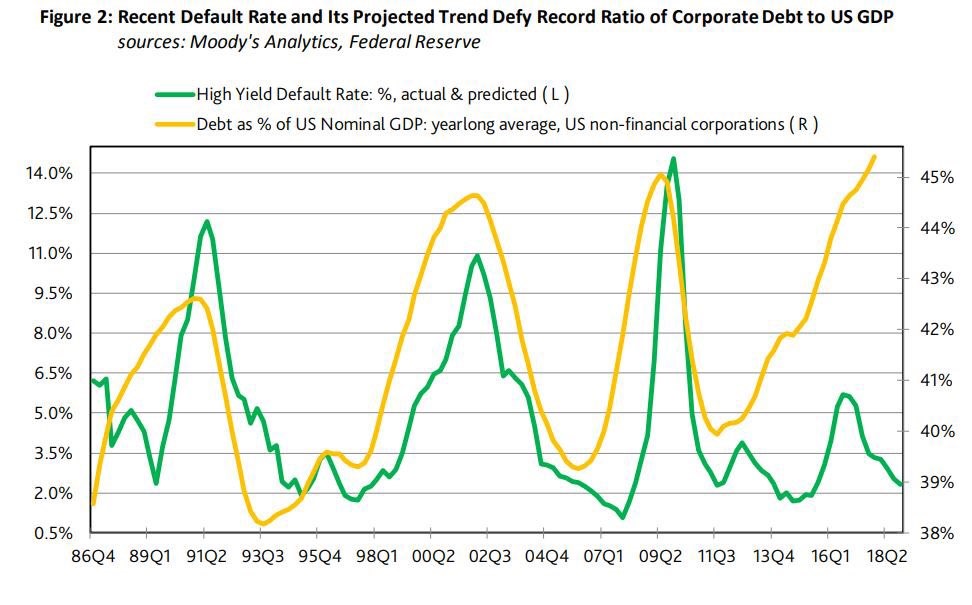

7.Increasing Corporate Debt vs. Decreasing Default Rate.

Jesse Felder @jessefelder 20h20 hours ag

‘The massive divergence between debt levels and defaults is worrying to some analysts who feel rising corporate indebtedness will eventually catch out unwary investors and deflate the junk-bond market.’ http://www.marketwatch.com/story/heres-why-default-rates-are-subdued-even-as-corporate-debt-levels-hit-records-2018-03-16 … ht @trevornoren

https://twitter.com/jessefelder?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Eauthor

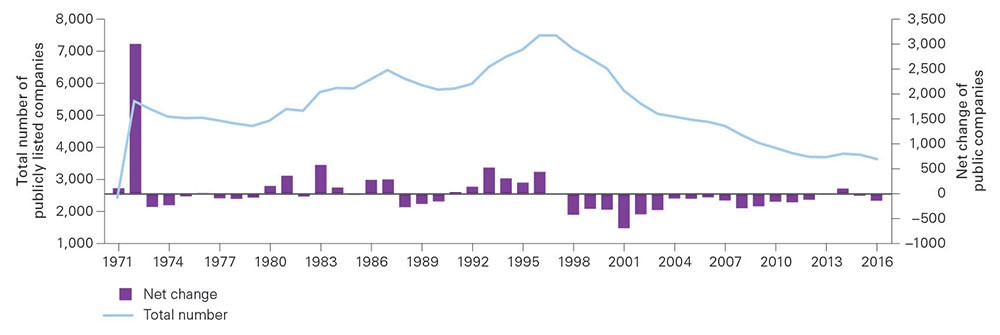

8.Topic of the Decade for Stock Market….The Number of Listed Companies has Fallen by 50% in 20 Years.

Vanguard: Market Trends That Are Influencing The Decreasing Number Of Public Companies

March 19, 2018

[This ETF industry perspective is sponsored by Vanguard.]

■The number of publicly listed U.S. companies has fallen by about 50 percent in the last 20 years. But focusing solely on this decreasing number masks some important trends.

■A closer look at these market and regulatory trends reveals that microcap companies account for most of the decline.

■We find that the shrinking number of public companies has not materially changed the concentration and diversification of the investable U.S. market.

In 1996, the number of publicly listed U.S. companies exceeded 7,000. By the end of 2016, that number had dropped below 3,800.1 There is conjecture that burdensome regulations impede companies from going public and obtaining funding.2 However, the declining number alone doesn’t tell the whole story.

In this article, we show that the decline appears to be largely limited to micro-cap companies and that the focus on the number of companies—rather than market capitalization—does not fully measure the equity market’s health. Our research suggests that despite the decrease, the concentration and diversification in the investable U.S. equity market has not materially changed. However, while our research reviews potential causes of the decrease, it does not intend to draw conclusions regarding the economic effects of the decrease.

To what extent is the number really shrinking?

Although it is true that the number of public companies has been falling since 1996, the headline number, if accepted at face value, is misleading. Figure 1 shows that the severity of the trend depends on the time horizon of the analysis. When viewed relative to 1996, it appears that the number of publicly listed companies has fallen by more than half.3However, the number of public companies in 1996 could very well be viewed as a high point, rather than a normal amount, because of the economic boom in the 1990s leading up to the tech bubble. When viewed relative to 1972, the decline shrinks to one-third. Moreover, the spike in the number of publicly listed companies in 1972 occurred because NASDAQ went public and the 3,000-plus companies that previously traded over the counter became publicly listed.

From ETF.com Well Worth the Full Read

9.Read of the Day….China’s New Central Banker Is Just as Important as the Fed’s

By ESWAR PRASADMARCH 19, 2018

Yi Gang, who has just been named the new head of the People’s Bank of China.CreditFred Dufour/Agence France-Presse — Getty Images

The recent appointment of Jerome Powell as chairman of the Federal Reserve was the subject of intense scrutiny. After all, the Fed’s every action reverberates in international financial markets. The announcement on Monday of Yi Gang as the new governor of the People’s Bank of China, China’s central bank, received somewhat less notice.

The world should pay more attention. This choice is as important as any Fed nomination. It isn’t simply that China is the world’s second-largest economy, a crucial market for everything from American aircraft and soybeans to German cars. Its monetary and financial policies affect the whole world.

The central bank’s previous governor, Zhou Xiaochuan, engineered significant reforms. He freed up banks to set deposit and loan rates based on market conditions rather than by decree and also allowed capital to start moving more freely into and out of China. After a 15-year tenure, Mr. Zhou is turning over the keys to China’s economy to Mr. Yi, his trusted deputy, and leaving him with a great deal of unfinished business.

Unlike the Fed, China’s central bank is not independent. Major policy decisions are made by an elite government committee, and China’s president has to sign off on them. But President Xi Jinping came to trust the central bank under Mr. Zhou’s leadership and has given it a lot of leeway in setting and carrying out policies in key areas of the economy.

The People’s Bank of China sets short-term interest rates (like the Fed) and tries to control bank lending to support growth while keeping inflation low. It also determines how freely the Chinese currency’s exchange rate can move and manages restrictions on the flow of money in and out of China. Last week, the government increased the central bank’s oversight responsibilities, putting it in charge of drafting key banking regulations.

What Mr. Yi will do with all this power matters for the whole world.

China’s mostly state-owned banking system is burdened with bad loans to state-owned enterprises, many of which are unprofitable, and the pet projects of powerful provincial leaders. Mr. Yi must push these banks to clean up their books. Otherwise, depositors might eventually lose confidence and pull out their savings. China’s banks manage investments and make loans in many other countries, so turbulence in those banks could infect financial markets worldwide.

10.Why It’s So Hard to Step Outside Your Comfort Zone

These 5 roadblocks explain how fear can get in the way of courage Andy Molinsky Ph.D.

Stepping outside your comfort zone in a meaningful and consequential professional situation can be very challenging to do. But this is the reality at work for most of us: as we grow and learn and advance in our jobs and in our careers, we’re constantly faced with situations outside our comfort zones where we need to adapt and adjust our behavioral styles. As IBM CEO Ginni Rometty has said: “”Growth and comfort don’t co-exist. That’s true for people, companies, nations,” Here’s what I’ve learned are the top 5 challenges of stepping outside your personal comfort zone.

The first is the Authenticity Challenge. This is the idea that acting outside your comfort zone can feel fake, foreign, and false. Imagine for example a young, first-time entrepreneur stepping into a Shark Tank-like situation to pitch his ideas to a much older and experienced group of VC’s, and perhaps putting on his “grown up voice” when doing so.

The second challenge is the Competence Challenge. This the idea that in addition to feeling inauthentic, you also may feel incompetent – whether it’s speaking up at a meeting… or giving a speech… or pitching your ideas. And that can make you feel like a real imposter.

Challenge #3 is the Resentment Challenge: feeling frustrated or annoyed about the very fact that you feel you have to do this task outside your comfort zone in the first place. For example, as an introvert, you might feel deeply resentful that networking and small talk seem to matter as much – or even more – than the quality of your work.

Challenge #4 is the Likability Challenge. Here, we worry people won’t like this version of ourselves when we step outside our comfort zones. A poignant example from my research comes from a frustrated employee who desperately wanted to confront a condescending jerk who was making her life miserable, but just couldn’t shake the worry that he wouldn’t like her if she confronted him (when, of course, he was clearly the unlikable one).

Finally, Challenge #5 is the Morality Challenge. Sometimes people have legitimate concerns about the ethical nature of the behavior they’re about to perform – like when delivering bad news or performing a layoff.

Of course, few of us will experience all five of these challenges when we consider adapting behavior and stepping outside our comfort zones. But even one of them can make things tough. Have you ever experienced any of these challenges when stepping outside your comfort zone? If so, I can promise you’re certainly not alone.

Visit here(link is external) to receive my free guide to 10 cultural codes from around the world(link is external), and here for my very best tips on stepping outside your comfort zone (link is external)at work.

Andy Molinsky(link is external) is the author of Reach and Global Dexterity.