1.Where Does This Bull Market Rank? Second Largest and Second Longest.

Posted by lplresearch

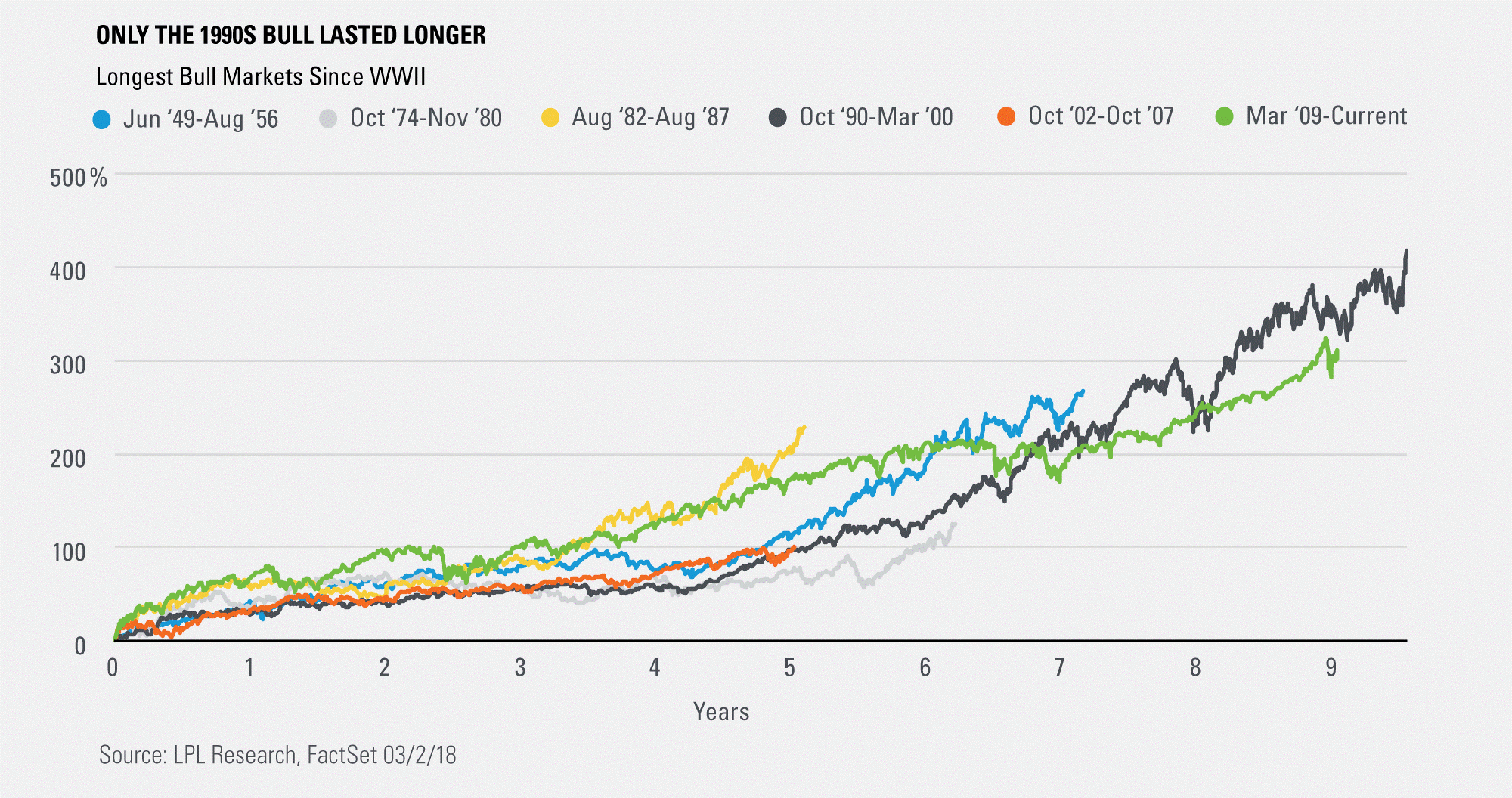

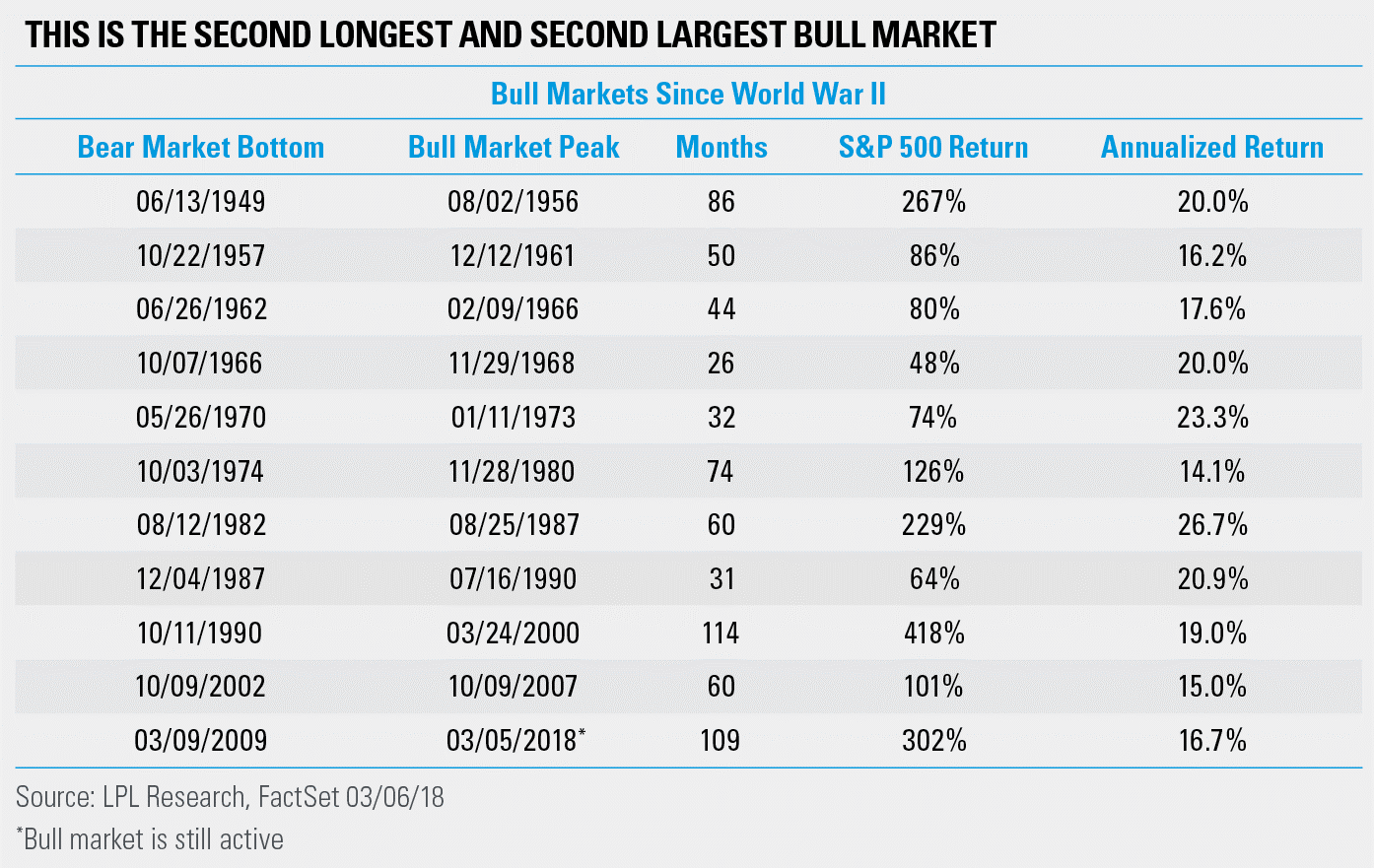

We shared the following chart in our latest Weekly Market Commentary, “The Bull Is 9, Can It Make 10?”, which shows that this is the second largest and second longest bull market ever—with only the ‘90s bull standing in the way of the record books.

https://lplresearch.com/2018/03/07/where-does-this-bull-market-rank/

2.Mid-term election year stock market performance – chart

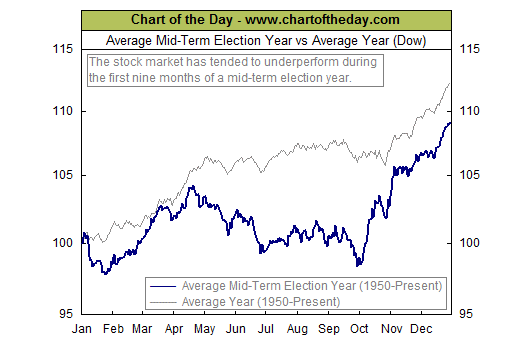

This chart illustrates how the stock market has performed during the average mid-term election year. Since 1950, the first nine months of the average mid-term election year have tended to be subpar, which was then followed by a significant year-end rally. Today’s chart illustrates how the stock market has performed during the average mid-term election year. Since 1950, the first nine months of the average mid-term election year have tended to be subpar (see thick blue line). That subpar performance was then followed by a significant year-end rally. One theory to support this behavior is that investors abhor uncertainty. To that end, investors tend to pull back prior to an election when the outcome is unknown. Beginning in early October, however, the outcome of the election becomes increasingly apparent and investors respond by positioning their portfolios accordingly.

Source: Chart of the Day

http://www.thebahamasinvestor.com/2014/mid-term-election-year-stock-market-performance-chart/

3.Best and Worst S&P 500 Stocks of the Bull Market

Mar 11, 2018

To commemorate the nine-year anniversary of the bull market, in an earlier post, we highlighted the best and worst performing stocks of the bull market that began on 3/9/09. The first list below highlights the 25 top performing current members of the S&P 500 since the bear market low in March 2009. The best performer of them all has been GGP. On 3/9/09, the stock closed at $0.28 and was for intents and purposes, on its way to zero. This past Friday, the stock closed at $21.13. Not a very high dollar price, but still enough for a gain of over 7,400%! Bill Ackman has been criticized for a number of high profile bets that didn’t go his way, but GGP was one where he literally made billions! Other stocks on the list of biggest winners are probably familiar to a lot of readers as Netflix (NFLX), Ulta Beauty (ULTA), Align Technology (ALGN), NVIDIA (NVDA), Booking (BKNG), and Amazon.com (AMZN) have all rallied more than 2,000%.

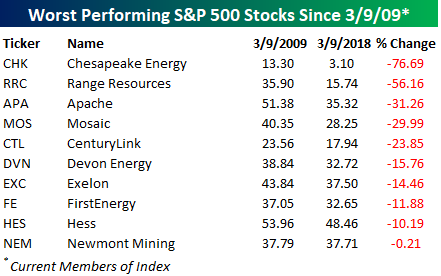

On the downside, just ten current members of the S&P 500 have lower share prices now than they did on 3/9/09, and a number of them are from the Energy sector. Chesapeake (CHK) has lost over 75% of its value, while Range Resources (RRC) is down by more than half. Newmont Mining (NEM) is just barely down since the bear market low, but when you consider that the S&P 500 has more than tripled, that’s still pretty pathetic. Ten years from now, a number of these companies will likely be out of business, but who knows, maybe one or two of them will end up on the list of biggest winners.

https://www.bespokepremium.com/think-big-blog/

4.Real Short-Term Rates are Positive for the First Time in a Decade.

Real Short-Term Rates Are Close to 0%

Posted by Eddy Elfenbein on March 7th, 2018 at 3:00 pm

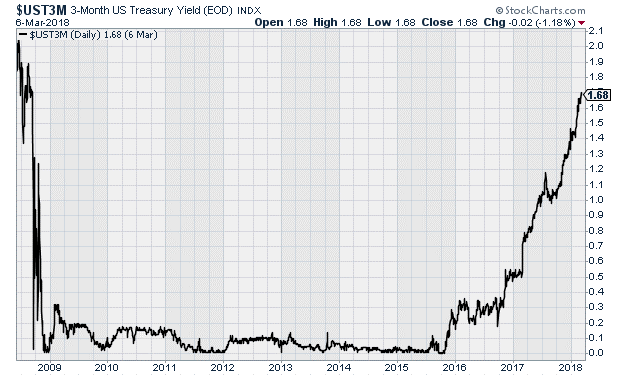

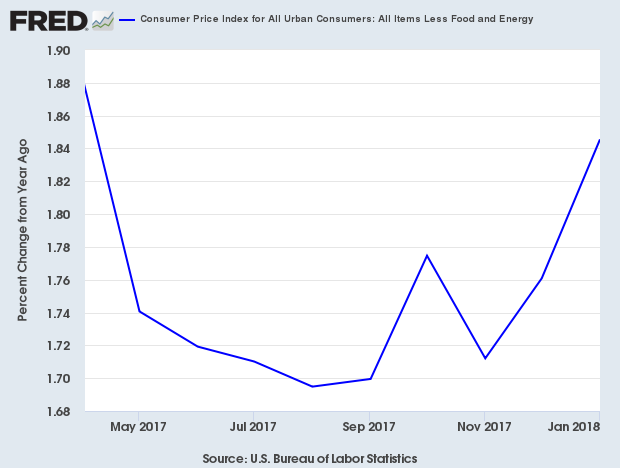

On Tuesday, the yield on the three-month Treasury closed at 1.70%. That’s the highest since September 2008. It’s also very close to the rate of inflation.

This means that real short-term interest rates might actually be positive for the first time in a decade.

I don’t know exactly what the inflation rate is at the moment since the CPI reports come out the following month. However, trailing core CPI has been running close to 1.7% for the last few months. It’s at 1.85% through January. We’ll get the February report on March 13.

http://www.crossingwallstreet.com/

5.Size and Sector Breakdowns of New All-Time Highs.

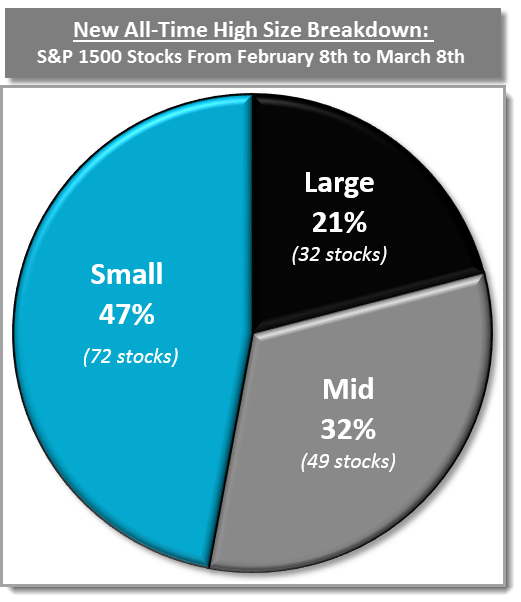

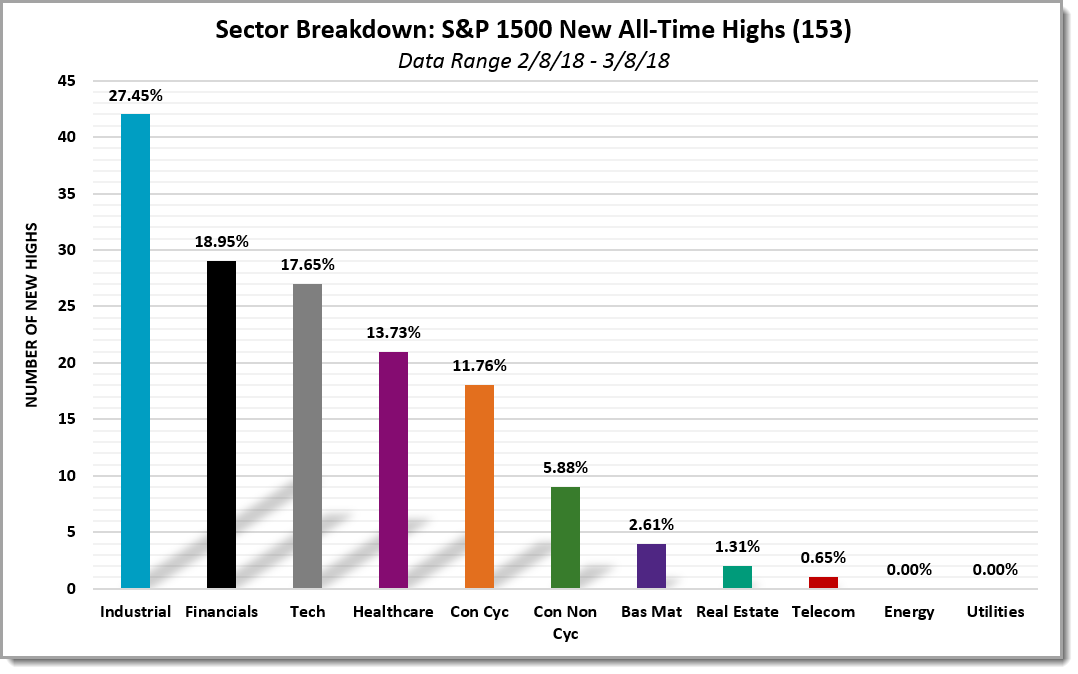

So in terms of pure performance, the Small Caps have had the strongest bounce. Over the past month (Feb 8th to Mar 8th), there have been 153 stocks (10.2%) in the S&P 1500 that have moved to new highs. Small Caps have been the clear winner, not only by performance, but also by headcount, accounting for 72 of the 153 stocks (47%) moving to new highs. Mid Caps are next in line with 49 stocks (32%), followed by Large Caps with 32 stocks (21%).

From Nasdaq Dorsey Wright.

www.dorseywright.com

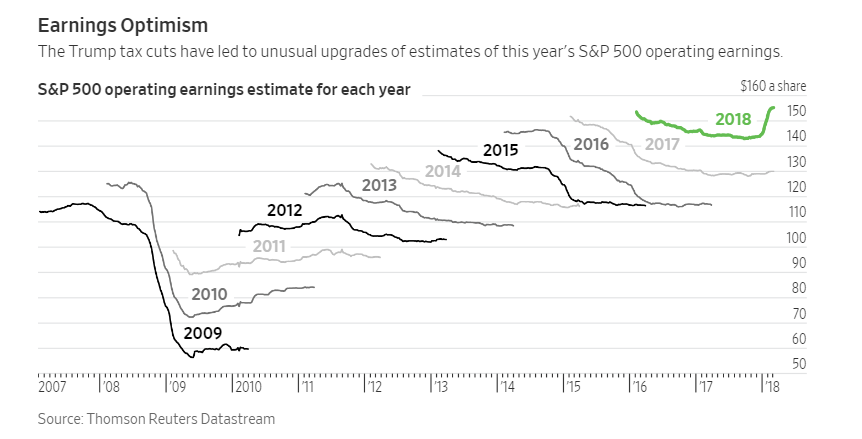

6.S&P Earnings from $60 to $160 Per Share.

The selloff might have been a lot worse if it hadn’t been for soaring earnings forecasts on the back of the corporate tax cut. Analyst estimates of S&P 500 earnings over the next 12 months in January jumped 8%, for their biggest monthly gain since Thomson Reuters IBES data began in 1985. Tax cuts are nice for shareholders but only lift shares once.

After Nine Years, How Long Can This Bull Live?

Some easy assumptions are being challenged, and that could threaten the most popular stocks

James Mackintosh

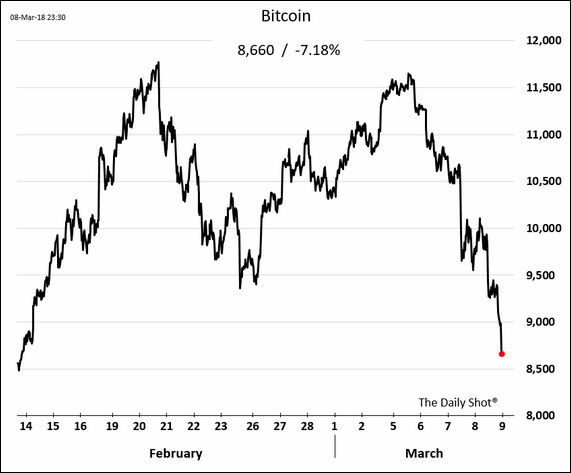

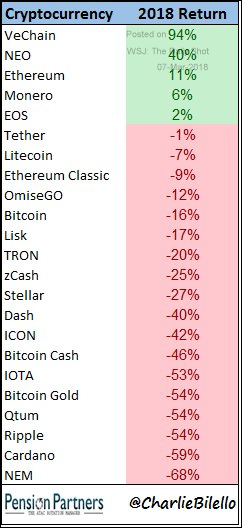

7.Bitcoin Back to 2014 Levels.

Cryptocurrencies were down sharply on Thursday evening in New York, with Bitcoin dipping below $9k again on rising regulatory pressures. PayPal’s CEO said that cryptocurrency regulations “need to be sorted out” and Bitcoin is “an experiment” with no clear direction. Below we have Bitcoin.

Source: The Daily Shot

Cryptocurrencies: Below are the year-to-date returns across the crypto markets.

Source: @charliebilello

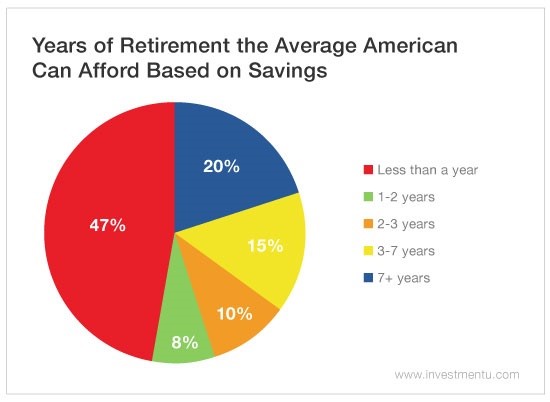

8.Half of Americans Can’t Even Afford One Year of Retirement

by Amanda TarltonSaturday, March 3, 2018

Most of us go to work every morning so that one day we won’t have to anymore. We dream of less stress, fewer emails and less time sitting in rush-hour traffic.

But retirement isn’t all golf outings and margaritas on the beach. You still have to juggle medical bills, taxes, daily expenses and more – and it adds quickly.

In fact, according to a recent study, the total cost of retirement has risen to $738,400.

Ouch.

Compare that with the average American’s 401(k) balance – a mere $24,713 – and you can see why headlines everywhere warn of a pending retirement crisis.

9.Read of the Day…..This is what your smartphone is doing to your brain — and it isn’t good

- Scientists aren’t sure if technology is destroying our brains, but they’re pretty confident it’s addictive and can lead to depression.

- It’s also slowing down our thinking processes.

- And some tasks are better done off the phone, research suggests.

- This is an installment of Business Insider’s “Your Brain on Apps” series that investigates how addictive apps can influence behavior.

All day long, we’re inundated by interruptions and alerts from our devices. Smartphones buzz to wake us up, emails stream into our inboxes, notifications from coworkers and far away friends bubble up on our screens, and “assistants” chime in with their own soulless voices.

Such interruptions seem logical to our minds: we want technology to help with our busy lives, ensuring we don’t miss important appointments and communications.

But our bodies have a different view: These constant alerts jolt our stress hormones into action, igniting our fight or flight response; our heartbeats quicken, our breathing tightens, our sweat glands burst open, and our muscles contract. That response is intended to help us outrun danger, not answer a call or text from a colleague.

We are simply not built to live like this.

Garry Knight/Flickr (CC)Our apps are taking advantage of our hard-wired needs for security and social interaction and researchers are starting to see how terrible this is for us. A full 89% of college students now report feeling “phantom” phone vibrations, imagining their phone is summoning them to attention when it hasn’t actually buzzed.

Another 86% of Americans say they check their email and social media accounts “constantly,” and that it’s really stressing them out.

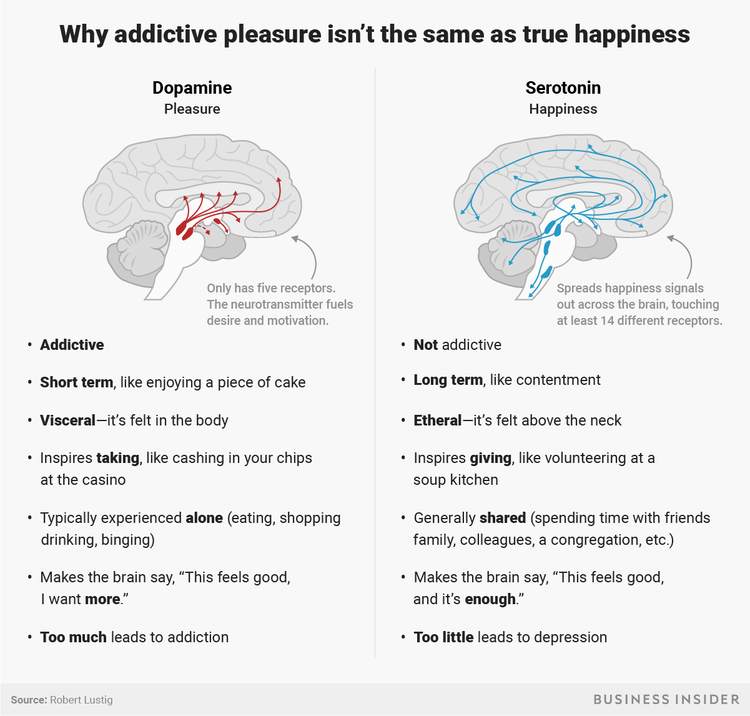

Endocrinologist Robert Lustig tells Business Insider that notifications from our phones are training our brains to be in a nearly constant state of stress and fear by establishing a stress-fear memory pathway. And such a state means that the prefrontal cortex, the part of our brains that normally deals with some of our highest-order cognitive functioning, goes completely haywire, and basically shuts down.

“You end up doing stupid things,” Lustig says. “And those stupid things tend to get you in trouble.”

Your brain can only do one thing at a time

Scientists have known for years what people often won’t admit to themselves: humans can’t really multi-task. This is true for almost all of us: about 97.5% of the population. The other 2.5% have freakish abilities; scientists call them “super taskers,” because they can actually successfully do more than one thing at once. They can drive while talking on the phone, without compromising their ability to gab or shift gears.

Samantha Lee/Business InsiderBut since only about 1 in 50 people are super taskers, the rest of us mere mortals are really only focusing on just one thing at a time. That means every time we pause to answer a new notification or get an alert from a different app on our phone, we’re being interrupted, and with that interruption we pay a price: something called a “switch cost.”

Sometimes the switch from one task to another costs us only a few tenths of a second, but in a day of flip-flopping between ideas, conversations, and transactions on a phone or computer, our switch costs can really add up, and make us more error-prone, too. Psychologist David Meyer who’s studied this effect estimates that shifting between tasks can use up as much as 40% of our otherwise productive brain time.

Every time we switch tasks, we’re also shooting ourselves up with a dose of the stress hormone cortisol, Lustig says. The switching puts our thoughtful, reasoning prefrontal cortex to sleep, and kicks up dopamine, our brain’s addiction chemical.

In other words, the stress that we build up by trying to do many things at once when we really can’t is making us sick, and causing us to crave even more interruptions, spiking dopamine, which perpetuates the cycle.

More phone time, lazier brain

Our brains can only process so much information at a time, about 60 bits per second.

The more tasks we have to do, the more we have to choose how we want to use our precious brain power. So its understandable that we might want to pass some of our extra workload to our phones or digital assistants.

But there is some evidence that delegating thinking tasks to our devices could not only be making our brains sicker, but lazier too.

The combination of socializing and using our smartphones could be putting a huge tax on our brains.

Researchers have found smarter, more analytical thinkers are less active on their smartphone search engines than other people. That doesn’t mean that using your phone for searching causes you to be “dumber,” it could just be that these smarties are searching less because they know more. But the link between less analytical thinking and more smartphone scrolling is there.

We also know that reading up on new information on your phone can be a terrible way to learn. Researchers have shown that people who take in complex information from a book, instead of on a screen, develop deeper comprehension, and engage in more conceptual thinking, too.

Brand new research on dozens of smartphone users in Switzerland also suggests that staring at our screens could be making both our brains and our fingers more jittery.

In research published this month, psychologists and computer scientists have found an unusual and potentially troubling connection: the more tapping, clicking and social media posting and scrolling people do, the “noisier” their brain signals become. That finding took the researchers by surprise. Usually, when we do something more often, we get better, faster and more efficient at the task.

But the researchers think there’s something different going on when we engage in social media: the combination of socializing and using our smartphones could be putting a huge tax on our brains.

Social behavior, “may require more resources at the same time,” study author Arko Ghosh said, from our brains to our fingers. And that’s scary stuff.

Flickr/André-Pierre du Plessis

Should being on your phone in public be taboo?

Despite these troubling findings, scientists aren’t saying that enjoying your favorite apps is automatically destructive. But we do know that certain types of usage seem especially damaging.

Checking Facebook has been proven to make young adults depressed. Researchers who’ve studied college students’ emotional well-being find a direct link: the more often people check Facebook, the more miserable they are. But the incessant, misery-inducing phone checking doesn’t just stop there. Games like Pokemon GO or apps like Twitter can be addictive, and will leave your brain craving another hit.

Getty Images/Spencer PlattAddictive apps are built to give your brain rewards, a spike of pleasure when someone likes your photo or comments on your post. Like gambling, they do it on an unpredictable schedule. That’s called a “variable ratio schedule”and its something the human brain goes crazy for.

This technique isn’t just used by social media, it’s all over the internet. Airline fares that drop at the click of a mouse. Overstocked sofas that are there one minute and gone the next. Facebook notifications that change based on where our friends are and what they’re talking about. We’ve gotta have it all, we’ve gotta have more, and we’ve gotta have it now. We’re scratching addictive itches all over our screens.

Lustig says that even these kinds of apps aren’t inherently evil. They only become a problem when they are given free reign to interrupt us, tugging at our brains’ desire for tempting treats, tricking our brains into always wanting more.

“I’m not anti technology per se,” he counters. “I’m anti variable-reward technology. Because that’s designed very specifically to make you keep looking.”

Lustig says he wants to change this by drawing boundaries around socially acceptable smartphone use. If we can make a smartphone addiction taboo (like smoking inside buildings, for example), people will at least have to sanction their phone time off to delegated places and times, giving their brains a break.

“My hope is that we will come to a point where you can’t pull your cell phone out in public,” Lustig says.

http://www.businessinsider.com/what-your-smartphone-is-doing-to-your-brain-and-it-isnt-good-2018-3

10.Qualities Of A Brilliant Salesperson Who Actually Closes Deals.

I’ve spent the last ten years analyzing sales people and what separates the good, from the uninspiring, worn out, no good sales person that is toxic to any sales culture.

I’ve also worked in sales for a long time myself. These qualities are what have worked for many other high performing sales people I’ve worked with and me.

Here are the qualities of a brilliant salesperson:

They’re humble as F*#K.

They’re not the person trying to tear everyone else down.

They don’t think they’re the best.

They want to train the junior sales people.

They aspire to be a leader.

Humble salespeople do all of these things because they know that if they didn’t have access to those same tools, they’d never be where they are. Bragging is ugly and eventually, it will reflect in your sales performance.

No salesperson is ever going to be on top of the leaderboard forever.

That’s why it pays to be humble in sales.

They get that relationship is everything.

If someone doesn’t like you, they probably aren’t buying from you. We all buy from people we like.

A relationship with a client is built with the following tools:

– Respect

– Vulnerability

– And Rapport

If you nail those three tools, then you’ll have a genuine relationship with the client. A relationship is another word for trust. Once you’re trusted, you’ll get all the business.

“All the snake oil salesman in the world can’t take a client from you when you are the most trusted sales person they are dealing with”

They worship the power of referrals.

The religion of a salesperson who knows their craft is one word: referrals.

Referrals come from doing a good job and delivering on what you say you will. That quality is so rare and that’s why many salespeople don’t get referrals. If you want to compound your results, you must do your best to over deliver.

This doesn’t mean underselling so that you can deliver what the client actually paid for; over delivering is delivering more value than should normally be expected from the same product or service in the marketplace.

They have gone all in on social media.

Everyone Google’s everyone nowadays.

“If a customer Googles you and you appear nowhere, then you become a commodity. Unfortunately, that translates to a heavy bias towards price”

When someone looks you up, they should see a professional social media profile like LinkedIn, they should see at the very least some content from you about your industry, and some reviews or references from people you’ve previously sold too.

A strong social media presence allows brilliant salespeople to have warm prospects approach them rather than having to go looking for them. A brilliant salesperson can turn a “Hi, how are you Tim Bob?” into a “Yes let’s meet next week for coffee to discuss X business opportunity.”

They take the complex and make it simple.

That’s why we fell in love with Apple. They took hundreds of menus and turned them into a few beautiful app icons. Life is complex enough and a brilliant salesperson can help us take a load off by giving advice to us in easy to understand language.

This method of communication requires the “less is more approach,” no acronyms, no industry jargon and a step-by-step process that can easily be followed.

They tailor to the audience.

Corporate pitch? Better put a suit on.

Seeing a new, cool, funky startup? Probably best to wear a t-shirt and take a backpack.

First-time users of the product or service? Stick to the why and 2-3 useful takeaways.

They capture your attention.

Not by using PowerPoint decks, closing techniques and fancy catch phrases: by using their infectious personality and sense that they care about the needs of the customer.

They avoid overthinking.It’s easy to procrastinate in sales and try and predict every move that a customer will make. In the end, the client will use mostly emotion to make a decision. Quit trying to overthink the outcome of a business opportunity and focus on going all in.

Give it everything you have and then if you lose the sale, it’s all gravy. Move on to the next business opportunity.

They make actual decisions.Sales is hard which is why there are incentives. If it were easy, we’d all have the job title of “sales.”

Sales requires many consecutive and challenging decisions one after another. You have to convince not only the customer, but also the internal stakeholders such as the product and operational areas.

This process is a series of lots of small decisions that match the urgency of your customer. If you take too long, you lose the sale. If you overpromise, you’ll burn the client. If you don’t offer a competitive price, they may go elsewhere.

All of these are decisions and brilliant salespeople make them daily, and do so efficiently.

They always use deadlines.

Without a date to work too, we all get lost in the busy trap. Either you become too busy or the client does. This is not about hard sell techniques or fake offers that expire. If you can genuinely help your client, then you should want them to have that benefit as quickly as possible.

They are aware of their ego.Ego is the enemy. If you think you’re some hot shot sales person, your prospective clients will run. Too much confidence and an inflated ego are usually a mask of a salesperson who’s covering something up. In other words, someone who lies for a living.

Humbleness, kindness and humility are how a brilliant salesperson attracts customers. Too much ego does the opposite.

They use discipline to their advantage.

As I said, sales is hard work. To be good at it, you need to be disciplined.

You can’t help everyone.

You only have so much time to prospect.

You have to make the calls, respond to emails and see clients to make target.

If you don’t do the basics, you can’t be a brilliant salesperson. Kobe Bryant put in the hours to become a great basketballer. He went to the gym, did the practice shots and ran until he passed out. Phone calls, emails and prospecting meetings are the exercises used in the sales world.

The more you do the exercises and stick to the plan, the closer you’ll get to Kobe’s success in the basketball world. We’re lazy by nature though, so discipline is key in sales.

They listen.

Too many salespeople talk your head off but don’t actually listen. Listening in sales is how you understand the customer and deliver a message that will allow them to make a buying decision. You’ll learn more from listening than talking. Phenomenal salespeople recognize this.

If you want to increase your productivity and learn some more valuable life hacks, then join my private mailing list on timdenning.net