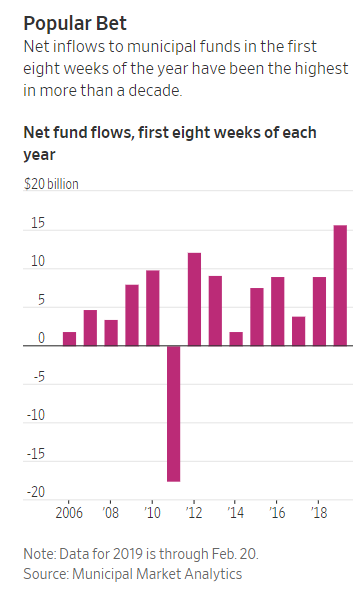

1.Net Inflows into Muni’s Highest in a Decade.

Muni Bonds Enjoy Historic Run Despite Tax Overhaul

Investors this year have poured the most money into municipal bond funds in at least 13 years

MUNI ETF

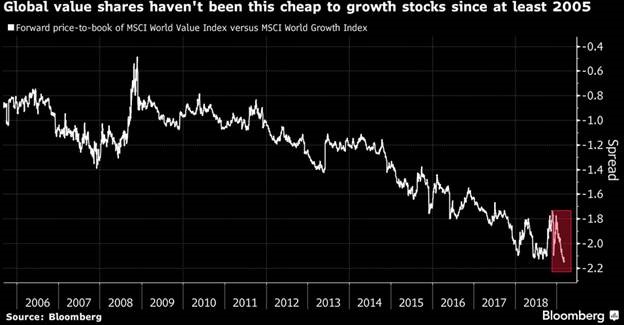

2.Another Growth vs. Value Chart….Forward Price to Book Cheapest Since 2005

Time to rotate into Value? Unreal MSCI ratio

Dave Lutz at Jones Trading

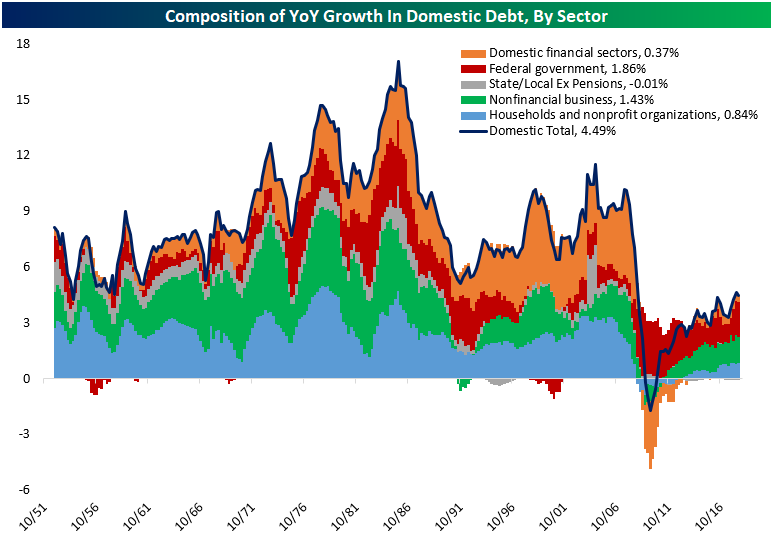

3. Despite An Uptick, Debt Growth Remains Slow Versus History

Mar 8, 2019

Yesterday the Federal Reserve updated quarterly sector debt levels for the US economy in its Z.1 Flow of Funds report. We discussed the full report in greater detail in The Closer last night, but we want to highlight a key observation. Below we show the YoY growth of debt for the United States by major sector. Each sub category sums to the total 4.49% YoY growth in debt.

While debt has been growing – and at a generally accelerating pace – since bottoming out in 2011, it’s been doing so at a pace much slower than anything seen since the 1950s. Even though Q4 2018 saw debt grow at the second-fastest YoY pace of the post-crisis period, only one quarter since 1951 saw debt grow at a slower pace than current. While government debt has grown relatively quickly in the post-crisis period, almost all other sectors have seen much slower contributions to total debt growth than has been typical historically. Corporate debt has been the exception, though even that sector has seen debt growth at the low end of the historical norm. State and local governments, households, and the financial sector have all seen extremely slow debt growth.

https://www.bespokepremium.com/think-big-blog/

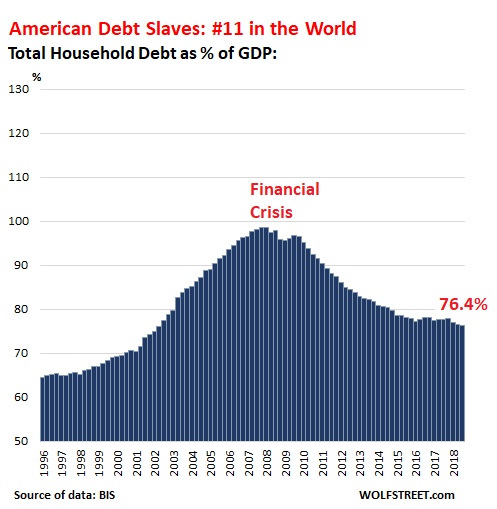

4.U.S. Household Debt 11th in World…Lowest Since 2002

US household debt inched down to 76.4% of GDP in the third quarter 2018, according to the newest batch of global data from the Bank for International Settlements. This was the lowest level since 2002. It put Americans in the inexplicably wimpy, and for the finance sector, insufferable 11th place:

State of the World’s Biggest Debt Slaves: Americans Wimp Out in 11th Placef

by Wolf Richter • Mar 9, 2019 • 113 Comments • Email to a friend

https://wolfstreet.com/2019/03/09/state-of-the-worlds-biggest-debt-slaves-americans-wimp-out-in-11th-place/

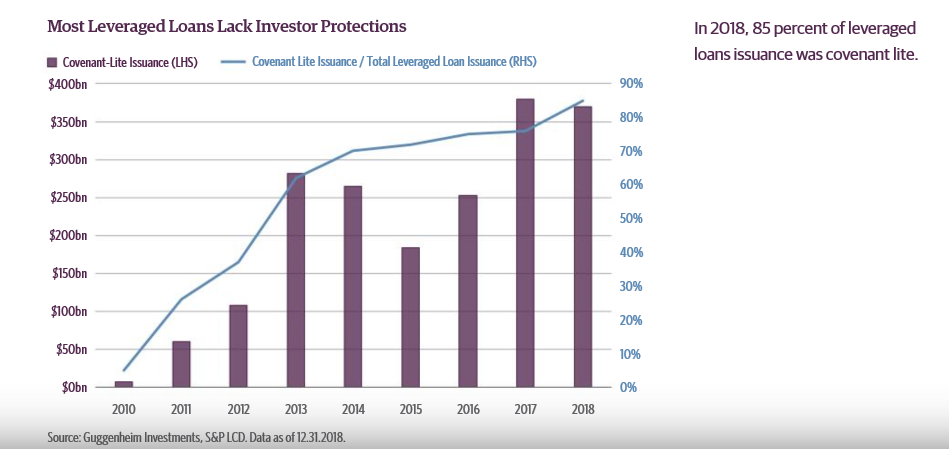

5.Update on Covenant Lite Loans

https://www.guggenheimpartners.com/perspectives

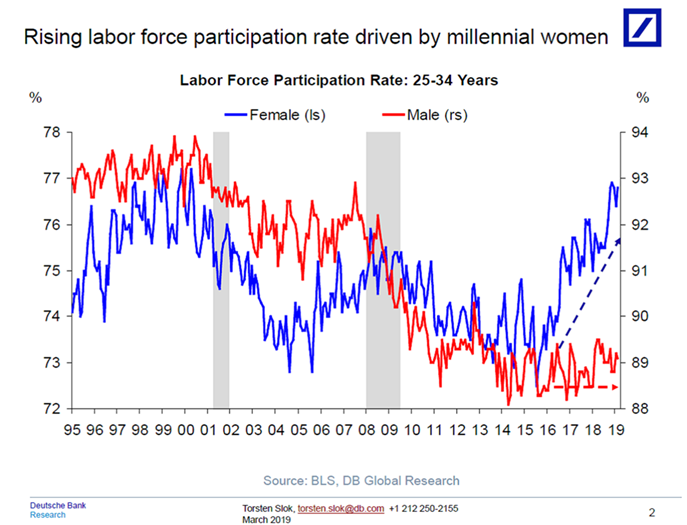

6.Rise of Millennial Women.

Torsten Slok

Deutsche Bank

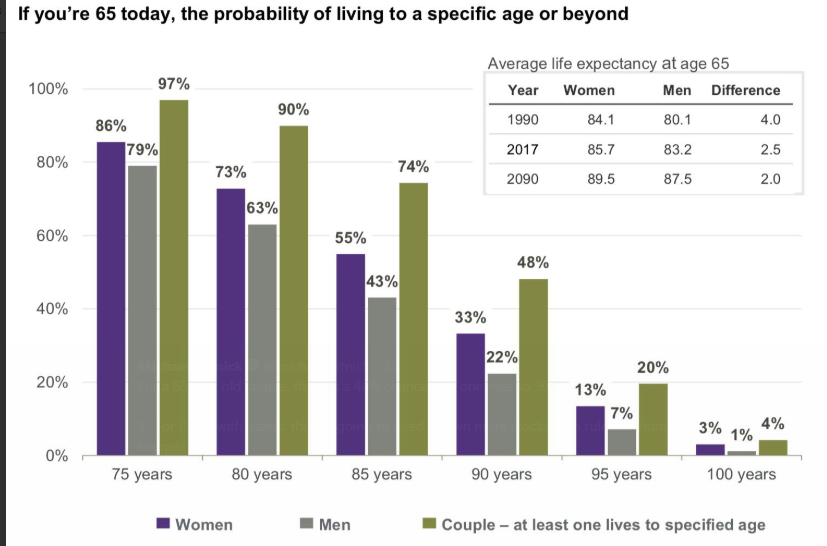

7. Longevity Probabilities

Michael Batnick https://twitter.com/michaelbatnick

8.Howard Marks: Controlling Risk

‘When you boil it all down, it’s the investor’s job to intelligently bear risk for profit’

March 07, 2019 | About: CBOE +0%

In our investing world, high returns get all the glory; as Howard Marks (Trades, Portfolio) explained, that’s why high-returning investors get their pictures in the papers.

But in his mind and in his book, “The Most Important Thing Illuminated: Uncommon Sense for the Thoughtful Investor,” he thinks high returns on their own are misleading and risk control is not properly appreciated. In fact, he thinks the great investors are those who take risks that are less than the returns they bring in. Great investors are those who achieve “moderate returns with low risk, or high returns with moderate risk.”

As to those who get their pictures in the papers for high returns, can they do it for many years? Marks’ point being that achieving high returns with high risks is meaningless without the ability to do it consistently, year after year.

Among the few who can do it consistently are Warren Buffett (Trades, Portfolio), Peter Lynch, Bill Miller and Julian Robertson (Trades, Portfolio). Not only did they have excellent returns, but they were relatively consistent and had no disasters. They controlled their risks and, while they may have a bad year or two, overall they have an above-average record.

Ironically, there are few awards for good risk control because risk is generally invisible. The obvious sign that risk was present is a loss, large or small. Still, just because no loss occurs does not mean there was no risk—it’s more likely risk was present, but no adverse events occurred to trigger a loss.

Marks goes on to argue the absence of loss does not mean a portfolio was safely assembled, it just means its manager was lucky. “Only a skilled and sophisticated observer can look at a portfolio in good times and divine whether it is a low-risk portfolio or a high-risk portfolio,” he wrote.

A good manager, then, is someone who can reduce risk for a given return. He cited Buffett’s saying, “You only find out who is swimming naked when the tide goes out.“ Those swimming naked are, of course, those who have not controlled their risks. More broadly, it means no one knows who is controlling and who is not controlling their risks during up markets or placid times.

The author also wrote, “When you boil it all down, it’s the investor’s job to intelligently bear risk for profit. Doing it well is what separates the best from the rest.” To explain the idea of intelligently bearing risk, he uses life insurance companies as an example:

- They know everyone dies eventually, so they know there is risk present.

- The risk of any one individual dying can be objectively analyzed, with a doctor’s assessment.

- Diversification is used to reduce risk by having a mixed group of policyholders.

- Policyholders will pay them well to take on this risk. And absent “black swan” events, the companies should make money.

For professional and amateur investors, risk can be controlled through the price paid. Marks wrote, “I’ve said for years that risky assets can make for good investments if they’re cheap enough.” This is another reason why Marks is considered a value investor.

Distinguishing between “risk control” and “risk bearing” is also on Marks’ agenda, as is the distinction between “risk control” and “risk avoidance.” Risk bearing is not something investors can avoid, it is an inherent part of investing. The ideal is to do it at the right time and to do it well.

Risk avoidance must be intelligently applied because it can turn into “return avoidance”. As the author wrote, “Risk control is the best route to loss avoidance.” In concluding chapter seven, he also said, “Skillful risk control is the mark of a superior investor.”

For a more pragmatic approach to risk control, we turn to Thomas Macpherson, a GuruFocus contributor and author of “Seeking Wisdom: Thoughts on Value Investing.” He uses a process he calls “breaking the investment case” to quantitatively assess a company’s risk. As the name suggests, he starts by developing a case for investing in a stock, but then deconstructs it using his own stress tests.

This starts with a series of potential black swan events that reduce revenue. He then applies revenue reductions of 10% to 70%. At some point in that series, the company will transition from surviving to expiring. In his words, it is “getting to zero.” He follows up by doing the same with free cash flow growth estimates, halving them and looking at the impact on valuation, financial strength and so on. After that, he halves it (free cash flow) again.

Macpherson explained, “Why do this? To me it’s a simple – and ruthlessly effective – tool in creating a scenario that tests the financial limits of a potential holding.” His example involved CBOE Holdings (CBOE). It had been growing its free cash flow by an average of 14.3% annually over the previous five years. What would happen if its cash flow growth dropped to 7.1%? Halve it again to 3.5% and review the impact; would it have enough financial strength to handle such catastrophic events?

He added there is more to breaking an investment case than just the numbers, writing, “breaking an investment thesis is as important as building one. I’ve found that I am far more receptive to data for having taken both sides. Cognitive dissonance is less, ego and bias’ impacts are reduced, and I see the company’s actions in a far different light.”

Theoretically and practically, if I am not mistaken, buying a company at a discounted price should also make it more robust, more able to withstand the rigors of stress testing. The mathematics of the price-sales and price-cash flow ratios should be favorably affected in both cases.

Two gurus, two ways to control risk. For Marks, it involves buying at the right (discounted) price, while for Macpherson, it involves stress testing a company’s revenues and free cash flows. Ultimately, they get to the same place: recognizing and controlling their risks.

(This article is one in a series of chapter-by-chapter digests. To read more, and digests of other important investing books, go to this page.)

https://www.gurufocus.com/news/829233/howard-marks-controlling-risk

9.A rise in discreet wealth is creating a new type of status symbol, and the elite are spending their money on 5 key lifestyle choices to keep up with it

A rise in discreet wealth has created new status symbols.

Leon Neal/Shutterstock

- Rich people are investing less in material goods and increasingly in habits and lifestyle choices as a new way to signify their status.

- This rise in discreet wealth is part of a turn toward inconspicuous consumption.

- The rich are conveying their wealth subtly through five investments: education, business, health and wellness, customization, and privacy and security.

Luxury goods are out, and luxury lifestyles are in.

Intangible concepts like health and wellness are replacing Louis Vuitton handbags and high-end education is replacing a fancy set of wheels.

That’s because the ultra-rich are investing in immaterial means instead of material goods as a new way to signify their status. It’s a result of the rise in “inconspicuous consumption,” a term coined by Elizabeth Currid-Halkett in her book “The Sum of Small Things: A Theory of an Aspirational Class.”

In an article last year, Currid-Halkett wrote that it’s a contrast to how the elite used to spend their money — through conspicuous consumption, which refers to the concept of using material items to convey social status.

“This new elite cements its status through prizing knowledge and building cultural capital, not to mention the spending habits that go with it,” Currid-Halkett wrote, adding, “Eschewing an overt materialism, the rich are investing significantly more in education, retirement, and health — all of which are immaterial, yet cost many times more than any handbag a middle-income consumer might buy.”

See what forms of discreet wealth are becoming new status symbols.

Education

Yana Paskova/Getty Images

According to Currid-Halkett, displays of knowledge — such as referring to New Yorker articles — expresses cultural capital, giving a person leverage to climb the social ladder and make connections.

But it’s not just knowledge for themselves that people are investing in: Parents are trying to reproduce their class position for their children, J.C. Pan wrote in The New Republic.

When it comes to education, they’re equipping their children “with every educational advantage, from high-end preschools to SAT tutors to Ivy League tuition,” he wrote. “In 2014, the top 1% spent 860% more than the national average on education.”

Consider the rich families who are spending millions to live within walking distance of the country’s best public elementary and secondary schools, or those paying as much as $60,000 for a college tour via private jet— they make such an investment in education in hopes of setting their children up for a successful, well-connected future.

Health and wellness

Supermodel Alessandra Ambrosio drinks a green juice in workout clothes.BG004/Bauer-Griffin/Getty Images

Vogue reported in 2015 that health and wellness had become a luxury status symbol.

The elite are investing in their well-being in a variety of ways: committing to pricey gym memberships like Manhattan’s $900-a-month Performix House and the $200-plus membership gym chain, Equinox; eating healthy, shopping for organic foods in pricey stores like Whole Foods, and drinking $10 green juices; opting for apartments with wellness amenities; and taking wellness inspired escapes, like the $10,000-per-week Golden Door spa retreat.

“Wellness is increasingly regarded as a modern embodiment of luxury, and accordingly, an array of spas and studios offering treatments like cryofacials, weeklong retreats, and vitamin IV drips are delivering those experiences,” Business Insider’s Lina Batarags wrote.

Parents are even buying boutique healthcare for their kids, Pan reported.

In an analysis last year, the Financial Times columnist Simon Kuper wrote that “the cultural elite splurges on exercise, because it thinks that bodies (like food) should look natural.”

“The thin, toned body expresses this class’s worldview: Even leisure must be productive,” Kuper continued. “Instead of trawling shopping malls, class members narrate their family hikes on Facebook.”

Travel

Shutterstock/IVASHstudio

The ability to invest in travel is an overarching status signifier — and it’s a multi-layered expression that extends far beyond the classic idea of a vacation.

Nowadays, the super-rich are taking months-long, multimillion-dollar trips to recharge or reconnect with family,Business Insider’s Katie Warren previously reported. Often, it’s because they’re burnt out from overworking. Luxury travel agency Original Travel saw these sabbatical trips spike in 2018. Many clients are “looking for an escape,” co-founder Tom Barber told the Guardian.

“For others, it’s ‘braggability,'” Barber said. “They want to use their money to open doors that normal people can’t and to tell their friends all about it.”

These trips range from extreme adventures to luxurious getaways, Warren reported. They can also take shape in wellness escapes and educational excursions. Rich parents take their kids on enriching trips to the Galápagos, according to Pan, thereby imbuing their travel with a subtly educational note.

And, on a not-so-discreet note, plenty of top-dollar, high-end boutique hotels are designed, as Business Insider previously reported, specifically to be photogenic — because taking to Instagram is the perfect way to display the access that wealth can buy.

Security and privacy

Drake has a house in Hidden Hills, California, which is blocked from Google Street View. Joe Scarnici/Getty Images

The rich are cutting back on flashy displays in the name of safety and privacy.

Instead of investing in open displays of wealth, they’re increasingly opting for “under the radar” living, reported Kate Allen of the Financial Times.

This involves blocking GPS from locating property with a jamming signal, removing homes from the grid, and hiring architects to conceal buildings — whether by designing an underground home or by using a “stealth concealment design” for aboveground properties, Allen reported.

Underground mansions can cost as much as $185 million. And some wealthy homeowners who live above ground are paying up to $500,000 to install luxe panic rooms, Business Insider’s Katie Warren previously reported.

The rich are also living in affluent neighborhoods that bar Google’s photography vehicles from entering — meaning their residences don’t show up on Google Street View — and spending more on home security systems, Allen reported.

“It is common for a successful, well-known executive to spend a million dollars a year — or much more — for a comprehensive security and privacy program,” Gary Howlin, the senior vice president at Gavin de Becker & Associates, previously told Business Insider.

Exclusivity and customization

flickr/PROPortoBay Hotels & Resorts

Many of these intangible displays of wealth play into a fifth status symbol: exclusivity and customization, which play important roles in the way luxury experiences are marketed.

“As the demand for luxury shifts away from goods and increasingly toward experiences, customers don’t just want any experience: They want personalized experiences that are either inherently unique or specifically tailored to them,” Business Insider’s Lina Batarags wrote.

Consider the customized homes the wealthy are building to ensure privacy, and the customized services and treatmentsthe wellness luxury market is offering.

The trend is particularly prevalent when traveling; the elite seek luxury hotels that offer personalized amenities and personalized attention like cocktail butlers who mix drinks in your room or drink trolleys in the hallways, Batarags reported.

Some hotels also offer exclusivity by making their most luxurious or expensive rooms “invisible” and available only to well-connected clients who heard about the room by word of mouth.

For the elite, the most desired vacation isn’t always the most lavish vacation — it’s the one not everyone can have.

10.The 7 Best Podcasts in Business and Finance-Barrons

Text sizeInterest in podcasts is surging, and for good reason. There’s never been a better time to dive into the audio podcast medium with its growing variety and depth of content.

Barron’s sifted through the clutter and found some of the best podcasts for our business and finance audience. Here are our top seven choices, in no particular order:

1) How I Built This with Guy Raz The NPR podcast focuses on the founders of successful companies, covering their highs and lows. Learn how some of the most famous entrepreneurs built their business empires and innovative startups from Dell Computer to Warby Parker.

2) Invest Like the Best Investor Patrick O’Shaughnessy talks to professional fund managers, executives, and venture capitalists on how they think about investing and life lessons. Some of the best episodes include conversations with the former General Manager of the Philadelphia 76ers Sam Hinkie and anonymous Finance Twitter star Modest Proposal.

3) Masters in Business Financial advisor Barry Ritholtz has conversations with some of the biggest names in finance, including hedge fund titans, celebrities, and veteran Wall Street strategists. Roger Lowenstein, Marc Andreessen, and Ed Thorp are among the best examples.

4) Capital Allocators Investor Ted Seides also interviews famous Wall Street strategists, investors and authors. Great episodes include the head of the Princeton endowment Andrew Golden and professional poker player and author Annie Duke.

5) Recode Media with Peter Kafka has substantive long-form interviews with the leading players in media and technology. Guests have included YouTube tech star Marques Brownlee, Twitter CEO Jack Dorsey, and the founder of Discord, the gaming communications platform.

Barron’s offers two podcasts: a daily audio news briefing called Numbers by Barron’s, and a weekly narrative-driven show named The Readback.

6) Numbers By Barron’s is a short two-minute podcast with three vital numbers to start your morning, hosted by Barron’s reporters.

7) The Readback is a deeper dive into our best reporting, hosted by disruption managing editor Alex Eule. Through conversations with Barron’s reporters and editors, the podcast builds on our stories with added context and insights. The latest episodes expand on our cover stories about the developing cold war in technology and the future of the marijuana industry.

We are interested in your feedback for our two Barron’s podcasts. Please email producer Mette Lützhøft at mettelutzhoft.jensen@barrons.com with any suggestions.

https://www.barrons.com/articles/the-7-best-podcasts-in-business-and-finance-51551621600