1.Inflation?? Commodities Make New Lows for 2017

Jefferies commodity index 50 day thru 200day to downside…New 2017 low

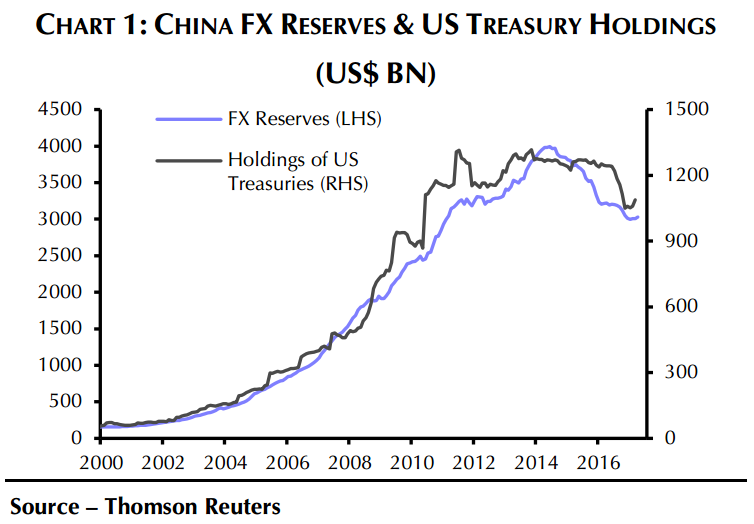

2.Follow up to my Earlier Comments Regarding Rates and Inflation…China Back as Net Buyer of Treasuries??

But Oliver Jones, an economist at Capital Economics, said expectations that China’s resumed purchases would help keep yields range-bound as it did during the Fed’s last tightening cycle were likely to be disappointed. At that time, the 10-year yieldTMUBMUSD10Y, +1.20% had barely budged between June 2004 and June 2006 even though the Fed hiked its benchmark short-term interest rate by 4.25%.

At that time, China had depressed the value of its currency to keep its exports competitive even as climbing export volumes applied pressure on the yuan to head higher. In doing so, it quickly racked up its holdings of U.S. Treasurys, and also drew the criticism of trade hawks eyeing the U.S.’s considerable trade gap.

3-4.2017=Large Cap and Tech Stocks.

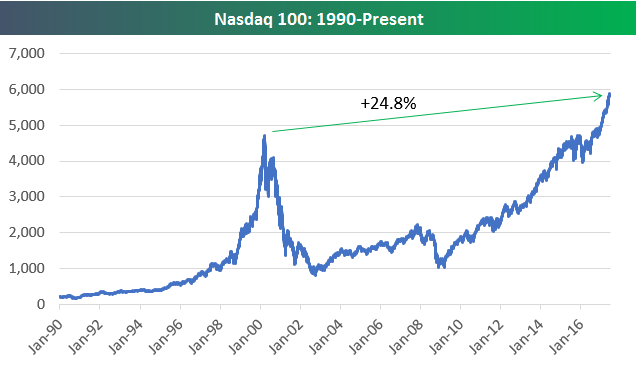

Nasdaq 100 Versus 2000 Dot Com Peak

Jun 7, 2017

The Tech-heavy Nasdaq 100 is up more than 20% year-to-date, and as shown in the chart below, the index is now 24.8% above its Dot Com bubble peak hit on March 27th, 2000. In the mid to late 2000s, there were plenty of investors that thought they wouldn’t live to see the Nasdaq take out its Tech-bubble highs, but the index’s surge over the last year has made it a reality.

While the Nasdaq 100’s chart looks pretty gorgeous right now, we can’t help but wonder when the next downturn will come. Remember, stocks do go down sometimes!

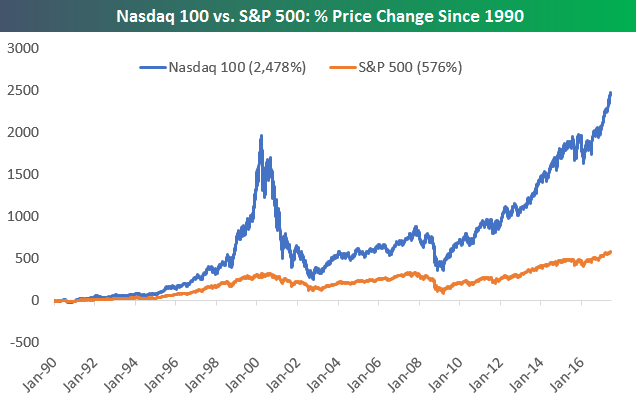

Since 1990, the Nasdaq 100 is up nearly 5x as much as the S&P 500 in terms of simple price appreciation. Talk about outperformance.

Below is a look at the best and worst performers in the Nasdaq 100 (current members) since the Dot Com peak on March 27th, 2000. One fifth of the index is up more than 1,000% since those prior highs, including names like Apple (AAPL), NVIDIA (NVDA), Amazon.com (AMZN), and Starbucks (SBUX).

Even more interesting to us is that 15 stocks in the index still haven’t taken out their Dot Com bubble highs. Stocks like Cisco (CSCO), Yahoo! (YHOO), and Intel (INTC) are all still 50%+ below their 3/27/00 price levels.

https://www.bespokepremium.com/think-big-blog/nasdaq-100-versus-2000-dot-com-peak/

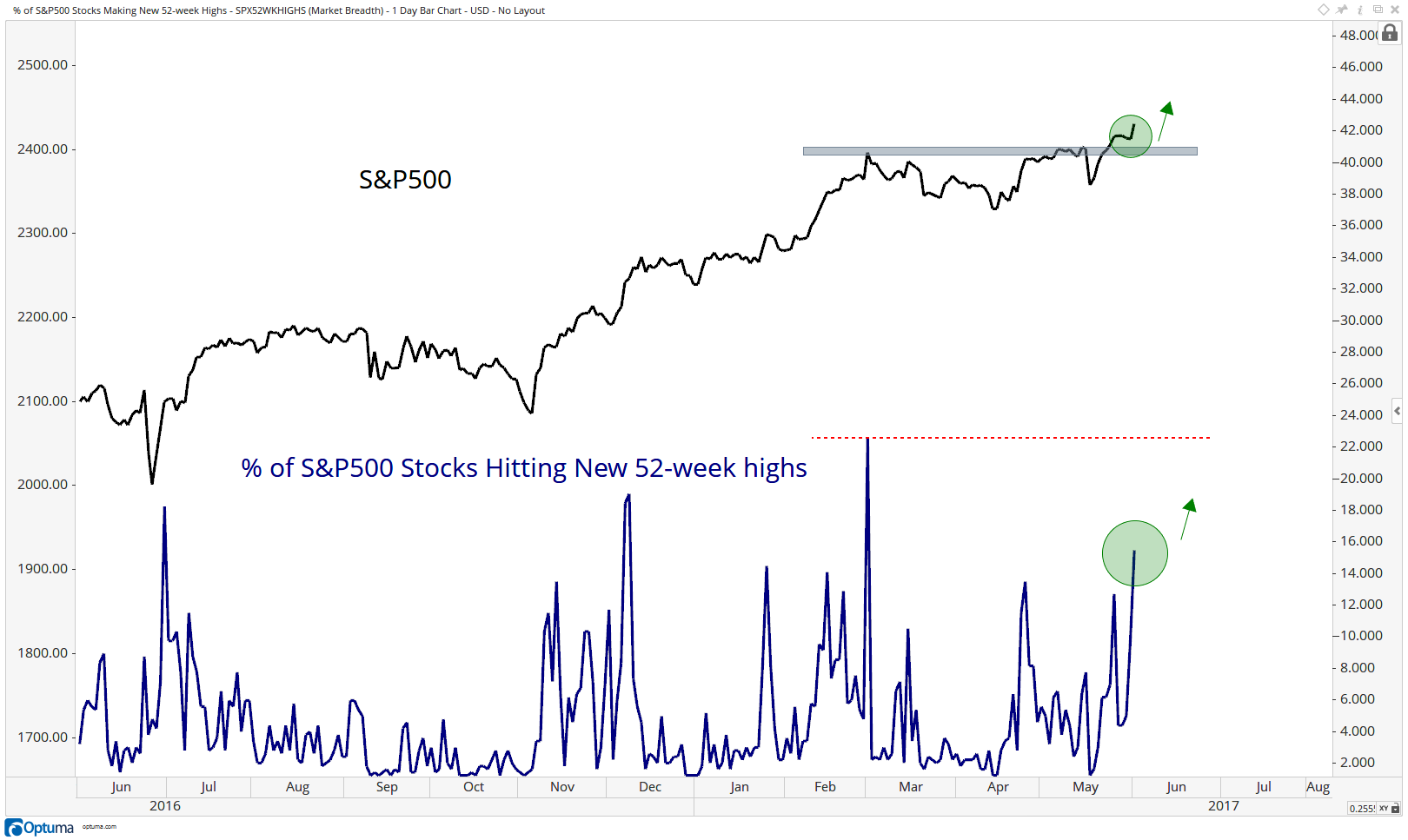

5. 52 Week Highs Break Out with Market….What Makes the New 52 Week High List So Important?

JUNE 2, 2017 BY JC

This concept of new 52-week highs can be somewhat confusing. I get it. How does it work? If we make new highs and the list of new highs doesn’t confirm, do we short everything? How do we know if and when the internals of the market have confirmed or diverged from whatever the price of the index itself is doing? These days, it seems like people have more questions than answers. So today we’ll take a look at what’s going on and see if we can try to work through it together.

This is a chart of the S&P500 going out on Thursday at new all-time highs. This was the highest daily closing price in the history of the S&P500 on the day after it had its highest monthly close in history. A lot of records were broken this week, which some might consider to be a positive. But you still have your frustrated bears out there trying to hang on to whatever self esteem they believe they have left. They point to the “internals” as the reason they “will” be right “one day”.

I’m not sure I see it as bearish though. We’re breaking out in the S&P500 above the upper end of this consolidation from the past 3 months. This is perfectly normal as consolidations tend to resolve themselves in the direction of the underlying trend, which in the case of the S&P500 is obviously up. Meanwhile, the list of stocks in the S&P500 also making new highs broke out yesterday to the highest level since those March highs:

http://allstarcharts.com/makes-new-52-week-high-list-important/

Found at www.abnormalreturns.com

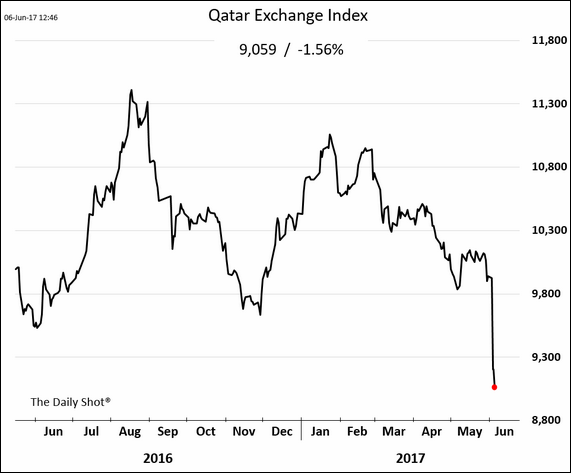

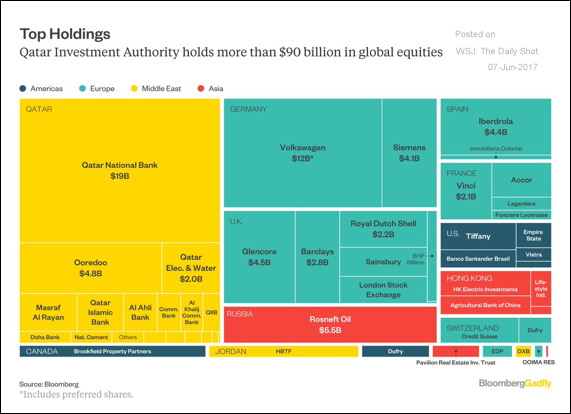

6.Middle East Countries Freezing Out Qatar…Large Sovereign Wealth Fund

Emerging Markets: Qatar’s market fell further, although some investors are hoping for a quick resolution of this conflict.

The Qatar sovereign wealth fund owns sizeable amounts of international shares. Will it be forced to sell some assets?

Source: @TimOBrien, @hecharts, @LionelRALaurent, @josephncohen; Read full article

www.thedailyshot.com

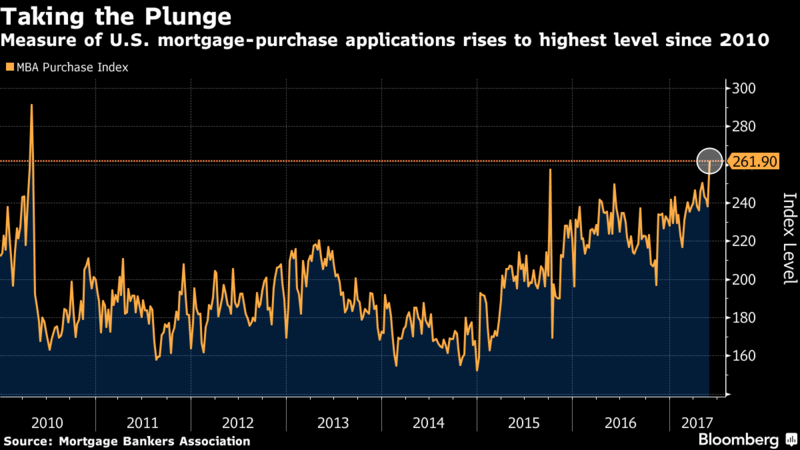

7.U.S. Mortgage Applications Surge to a 7-Year High

by

Jordan Yadoo

June 7, 2017, 9:04 AM EDT

More aspiring U.S. homeowners are signing on the dotted line. An index of applications for mortgages to buy homes rose 10 percent last week to the highest level since May 2010, according to data released Wednesday by the Mortgage Bankers Association. A combination of low borrowing costs and steady job growth is likely driving the increase, said MBA economist Joel Kan. At the same time, the number may reflect difficulty adjusting for the Memorial Day holiday. The average rate on a 30-year fixed mortgage slipped to 4.14 percent last week, the lowest since mid-November, continuing its retreat from a post-election surge.

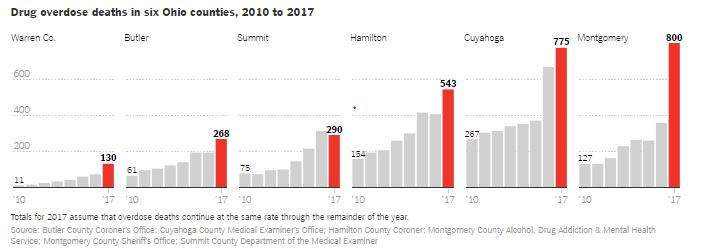

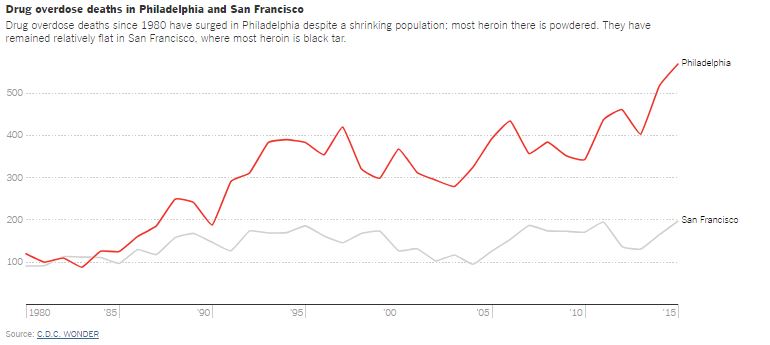

8. Drug Overdoses Now The Leading Killer Of American Adults Under 50

The opioid crisis that is ravaging urban and suburban communities across the US claimed an unprecedented 59,000 lives last year, according to preliminary data gathered by the New York Times. If accurate, that’s equivalent to a roughly 19% increase over the approximately 52,000 overdose deaths recorded in 2015, the NYT reported last year.

Overdoses, made increasingly common by the introduction of fentanyl and other powerful synthetic opioids into the heroin supply, are now the leading cause of death for Americans under 50. And all evidence suggests the problem has continued to worsen in 2017. One coroner in Western Pennsylvania told a local newspaper that his office is literally running out of room to store the bodies, and that it was recently forced to buy a larger freezer.

The initial data points to large increases in these types of deaths in states along the East Coast, particularly Maryland, Florida, Pennsylvania and Maine. In Ohio, which filed a lawsuit last week accusing five drug companies of abetting the opioid epidemic, the Times estimated that overdose deaths increased by more than 25 percent in 2016.

http://www.zerohedge.com/news/2017-06-07/drug-overdoses-now-leading-killer-american-adults-under-50

9.Read of the Day…How an aging population will affect the global economy

Jeff Desjardins, Visual Capitalist

With record-high amounts of student debt, questionable job prospects, and too much avocado toast in their bellies, many millennials already feel like they are getting the short end of the stick.

But here’s another economic headwind they face as they are coming of age: the percentage of the global population that is 65 or older will double from 10% to 20% by 2050.

As millennials enter their peak earning years, there will be 1.6 billion elderly people on the planet.

Someone has to pay the bill

Today’s infographic comes to us from Aperion Care, and it highlights how demographics are shifting as well as the economic challenges of a rapidly aging global population.

Which countries face headwinds?

While most countries face similar obstacles with aging populations, for some the problem is more severe.

The Potential Support Ratio (PSR), a measure of amount of working people (15-64) for each person over 65+ in age, is anticipated to fall below 5.0 in countries like Japan, Italy, Germany, Canada, France, and the United Kingdom. These countries will all have significant portions of their populations (>30%) made up of elderly people by 2050.

The United States sits in a slightly better situation with 27.9% of its population expected to hit 65 or higher by the same year – however, this is still analogous to modern-day Germany (which sits at 27.6%), a country that is already dealing with big demographic issues.

Click on Story for Images and Graphics

http://www.businessinsider.com/demographic-time-bomb-aging-2017-6

10.3 Scientifically-Proven Ways to Win Your Big Pitch

These three tactics can give your big pitch the push it needs to win over anyone.

While every proposal presents a different set of opportunities and challenges, almost all of your clients can be persuaded if you use tried-and-true selling principles for your big pitches.

For years, researchers have been studying the science behind persuasion tactics and the factors that make a person say “yes.”

When making a decision, it would be nice to think that people consider all the available information in order to reach the most logical conclusion. However, the reality is that different environmental, business, and personal factors have huge sway over influencing decisions.

There are a few principles of persuasion you should understand to put you at an advantage in a potential client’s decision-making process. So if you’re trying to win that big pitch, try working in these scientifically-proven ways to persuade the client to say ‘yes!’

1) The Principle of Reciprocity

The first principle is simple: people are more likely to give back to others in the form of behaviors, gifts, or services if they’ve received some first. For example, if a friend invites you to their party, there’s an obligation for you to invite them to your party in the future.

Consciously, we don’t pay much attention to this type of behavior, because the act of returning a kind favor is a social norm. But it can be a valuable tool in the world of sales. You scratch my back, I’ll scratch yours.

One of the best studies of reciprocity was conducted amongst restaurant waiters. The goal was to determine whether or not leaving a gift for the patron when the bill came would increase the number of tips. The study showed surprising insight on how people reacted to receiving something as simple as a mint at the end of their meal.

In the first part of the study, waiters that gave a mint saw a 3% increase in the tip. When two mints were laid down, the percentage of the tip quadrupled. And this is where it gets interesting. If the waiter leaves a mint, walks away, turns back and says, “You fine people look like you deserve an extra mint,” and left another, the tips grew another 23%.

Use It In Your Sales Pitch

The persuasion principle of reciprocity can give you a huge leg up in any sales pitch. Taking a potential client out to lunch? Pay for the bill, and offer to expense the taxi home. A lead or customer might not buy immediately after receiving your gift, but when they are ready to buy, it’s likely they’ll remember their obligation to the salesman who gave them something and be more open to the possibility of purchasing from them.

Another approach is to bring in product samples or demos for the potential customer to keep. Be the first to give and make sure that what you give is personalized and unexpected. Follow up your pitch with a thank you card and/or additional gift, like tickets to a sporting event you know they’ll appreciate.

2) Principle of Consensus

Especially when dealing with an uncertain mindset, rely on the fact that people will look to the action or behavior of others to influence their own. If you’ve ever stayed in a hotel, you may have noticed that there’s a small card in the bathrooms to encourage guests to reuse their towels. Most hotels do this by drawing the guests’ attention to the benefits reuse can have on environmental protection. This led to 35% compliance industry-wide.

Another study took it further, putting a sign that read, “75% of our guests reuse their towels, please do so as well.” This caused the compliance rate to raise 26%. One step further, the study posted a message that read, “75%of people in this room reuse their towels.” It turns out that changing even just a few words on the sign, a message that honestly points out what comparable previous guests have done, was the single most effective message, leading to a 33% increase in reuse.

Use It In Your Sales Pitch

When it comes to the principle of consensus, the science is showing us that rather than solely relying on our own ability to sell others on a proposal, we can already point to what others are doing, especially those in similar situations. If you’re trying to sell a service to a potential client, and you know that two of their competitors have already hired services in the same vein, make that a stand-out point in your presentation.

3) The Principle of Authority

You’ve probably heard of the Milgram experiments, in which volunteers were encouraged to deliver electric shocks to unseen subjects, even though they could hear (faked) screams of pain. All that was needed for people to continue administering the shocks was a man wearing a lab coat telling them to continue.

The point of the study was to show that people will listen to people as long as they think of them as an authority figure; in this case, the “scientist” wearing a lab coat. People are hardwired to respond to authority (or the appearance of authority), which is good news for your upcoming pitch.

Use It In Your Sales Pitch

While you can’t go around telling people how brilliant you are (although it doesn’t hurt to remind them from time to time), you can hire people to do it for you. For example, many companies hire celebrity spokespeople to appear in commercials, brochures, and other marketing materials, touting product benefits and providing their approval. While you might not be able to afford a celebrity appearance at every pitch, presenting marketing materials such as case studies or testimonials showing that you do have an endorsement will put your offer ahead of the rest.

Final Note

Each customer and company you meet with have a different set of problems they are trying to solve, yet most individuals can be persuaded with the same selling tactics. Let the above principles guide you as you prepare for your next big pitch, and use these scientifically proven tactics to convince your client to say yes!