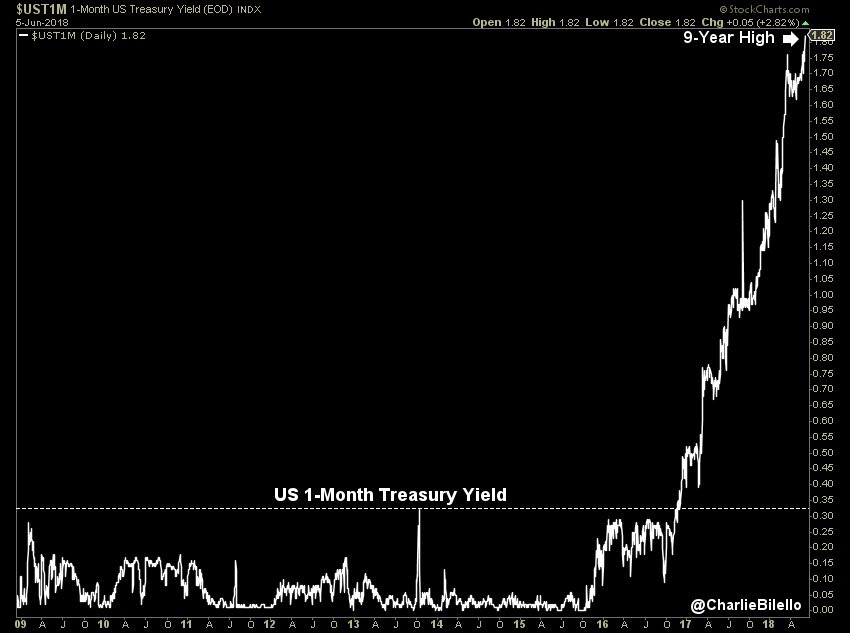

1.Hockey Stick One Month Treasury Yields.

https://twitter.com/charliebilello

2.Hedge Funds Short Volatility Again.

https://twitter.com/TheStalwart

VIX back in 3 year sideways box

3.Germany Leader in Europe-Some Technical Updates.

DAX German ETF…50day thru 200day to downside.

Weekly chart closes below 50 day

4.AMZN Responsible for 27% of S&P Gains This Year.

YTD-AMZN +40% vs. S&P +2%

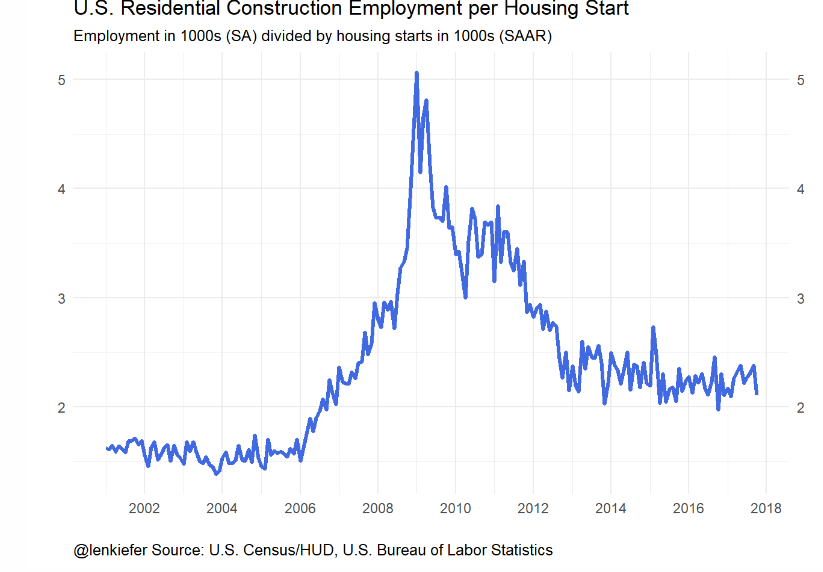

5.Housing Toll Brothers 25% Off Highs.

TOL Chart…Labor more expensive and tough to find.

This plot shows that there are about two residential construction workers per housing start (at an annual rate) in the U.S. recently. The ratio was as high as 5, but prior to the housing boom and Great Recession averages closer to 1.5.

This plot shows that there are about two residential construction workers per housing start (at an annual rate) in the U.S. recently. The ratio was as high as 5, but prior to the housing boom and Great Recession averages closer to 1.5.

http://lenkiefer.com/2017/11/28/housing-construction-and-employment/

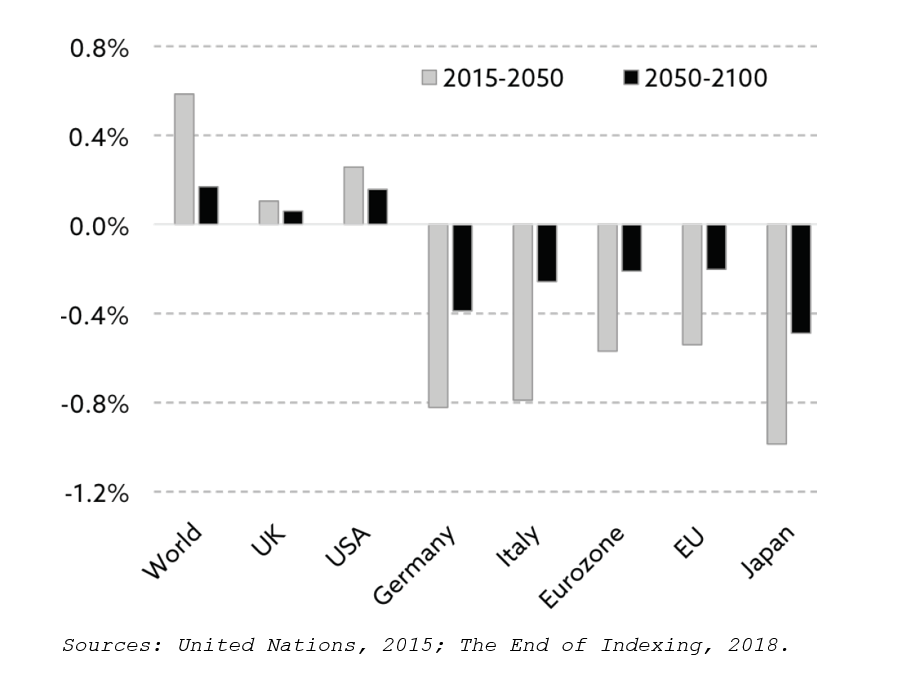

6.Workforce Demographics Will Contract for Most of the Developed World Going Forward.

GDP = Workforce + Productivity

In plain English, the equation states that economic growth equals the sum of workforce and productivity growth. Now to the critical point: The workforce will shrink in many countries between now and 2050. In the worst-affected country, Japan, it will shrink by no less than 1% per annum (see chart, below).

Sources: Unite

d Nations, 2015; The End of Indexing, 2018

Estimated annual workforce growth in selected countries (%)

By

NIELSJENSEN

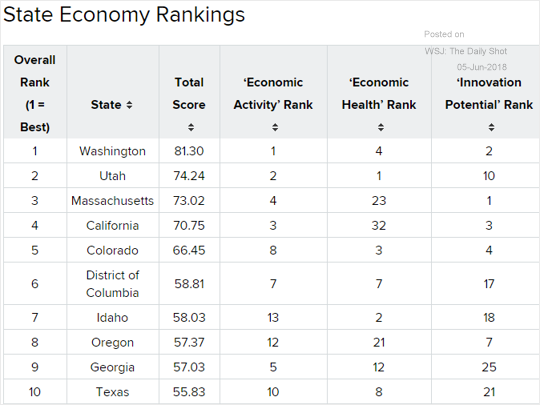

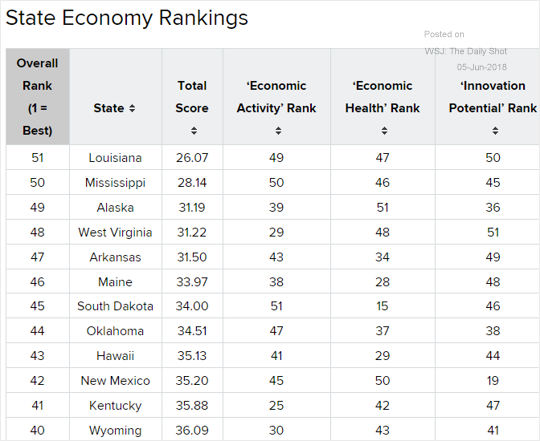

7.Top and Bottom Ranked State Economies.

Food for Thought: The strongest (table below) and the weakest (second table below) state economies.

Source: WalletHub Source: WalletHub

https://blogs.wsj.com/dailyshot/

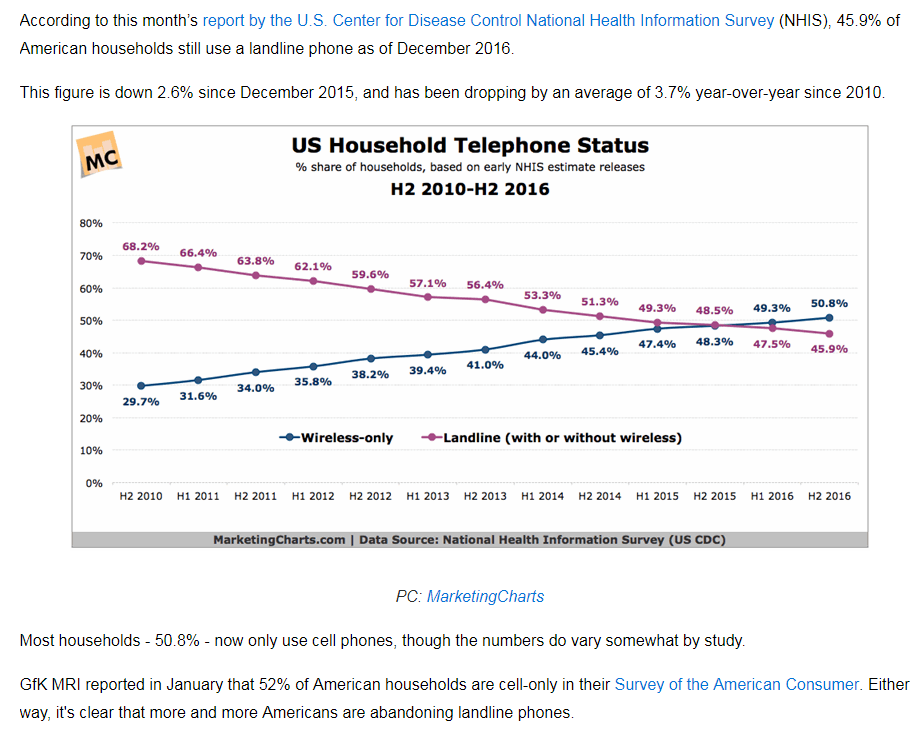

8.46% of Americans Still Use Landline….Dropping 3.7% year-over-year since 2010.

https://www.textrequest.com/blog/how-many-people-still-use-landline-phone/

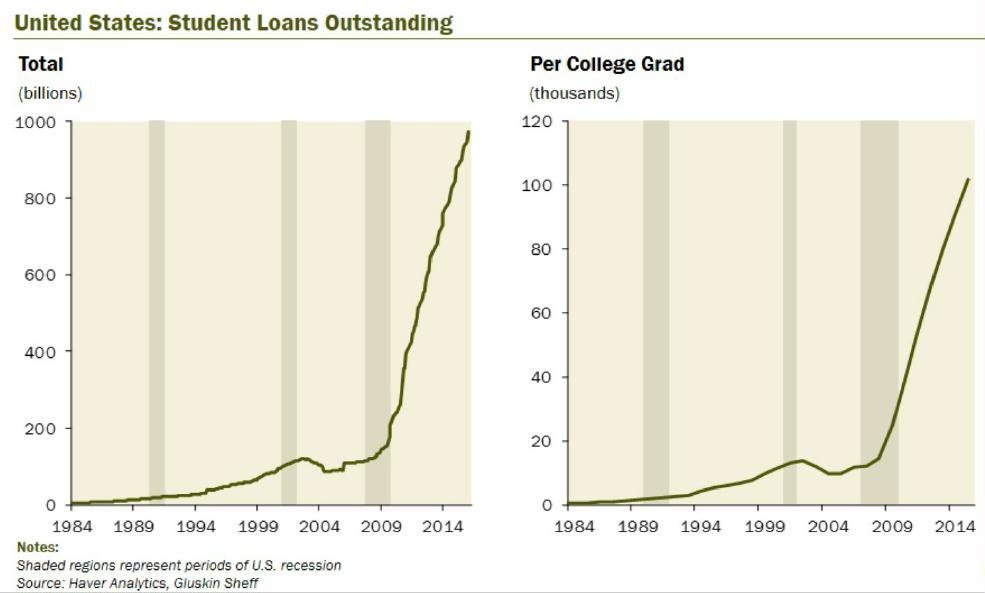

9.Student Loans Breakdown.

Student Loans: It’s Time to Empty that Piggy Bank

All of those happy hour Orange Crushes were worth it…right?…Right?

Maybe. But lately, the cost of higher education has sent student loan debt jumping to $1.5 trillion. Here’s how it breaks down by the numbers:

$28,400—How much debt the average new grad owes. That number was $22,100 in 2001 (adjusted for inflation).

20%—Borrowers who are late on payments.

66%—Student loan debt held by women. Typically, more women attend some form of higher education than men.

For perspective…

$1.2 trillion—U.S. auto loan debt.

More than $1 trillion—U.S. credit card debt.

The Hockey Stick Hits With Millennials Hitting College Years.

https://www.theautomaticearth.com/tag/student-loans/

10.3 Easy Steps to Make Your Salespeople More Effective

Need to build a sales team for your business? Here’s what you need to know.

By Bill GreenAuthor and CEO, LendingOne@allinbillgreen

As a founder, your job is to give every team member the tools and resources they need to be successful on their own.

For sales teams, especially, founders are notorious for giving them very little resources and expecting them to carry the cashflow of the company. “Why aren’t you closing more deals?” tends to be the standard question, rather than, “What can we do to help you close more deals? What do you need in order to be successful on your own?”

Ensure that your team members actually believe in the product they’re selling.

Tools and software, sales scripts, conference passes and company cards to wine-and-dine clients all come second. First, each and every salesperson needs to “drink the company Kool-Aid.” They have to know why they are part of the team, why their role matters, and that what they’re selling is going to improve the lives of their customers in some way, shape, or form.

Which means, as a founder, it’s your job to instill this belief from the get-go.

I have always been a fan of Bill Belichick, the head coach of the New England Patriots, and his ability to inspire every single player on that team. He has a way of getting players to believe in themselves, and see the value of the attitude they bring to the table.

Building a company is no different. And in a role like sales, attitude is everything.

Train your team using a two-step process.

Training your salespeople comes with two very different challenges.

The first is getting them up to speed on the product. How well do they know what they’re selling. Here at LendingOne, we sell real estate investor loans. So part of getting people trained means making sure they know everything there is to know about the loans they’re selling: how long they take to close, leverage ratios, interest rates, etc. Every single detail of the product needs to become second nature so that when a customer asks a question, they don’t sit there frozen without an answer.

Those moments are how you lose deals.

The second part has less to do with the product and more the technique of the sale.

Are you selling over the phone? Door to door? Ads and Internet marketing funnels? Inbound?

Every company has their own methods for generating leads, and every method comes with its own best practices for selling. The way you sell over the phone is very different than how you sell face to face. Which means part of your training needs to explain, in detail, how to approach your customers based on the sales method you use most. I share some of my earliest sales stories in my book, All In.

Training is one of the most important things a founder and company can do for each and every employee–and it’s not something you do for just an afternoon or two. All of our salespeople go through at least a month of full-time training before they speak with a customer. And even once they’re let loose, managers (or sometimes I will) follow up and listen in on certain calls, provide feedback, and continuously help them improve.

I live by the phrase, “People don’t do what is expected–they do what is inspected.” Which means, as a founder or even a manager, it’s your job to continue to check up on how people are performing.

Take a look at the technology they’re using, and see how you can better equip them to sell at scale.

Just because a salesperson is meeting their quota for clients closed that month, doesn’t mean that is their ceiling. In most cases, salespeople level out because there are processes nobody bothers to iron out and make more efficient–a big one being the technology they use.

Nowadays, there are so many helpful tools out there to help salespeople keep track of their leads, keep tabs on their progress, set alerts to follow up a few months later, and ultimately move them through to the point of close. Without some of these tools, it would be impossible (or terribly inefficient) to keep tabs on every prospect manually.

Another great technology piece to put in place are tools that allow salespeople to monitor their metrics. We actually developed a tool internally called “The Commission Module,” which allows a sales rep to see how many deals he’s closed that month, how far he is from meeting his quota, and how much he’s anticipating making in commissions. Something like this can go a long way for keeping sales reps engaged and meet company sales objectives.

Don’t underestimate (or forget) that the art of selling consists of a lot more than just picking up the phone and regurgitating a sales script. There are steps that can be taken to close a lot more deals, faster and more effectively.