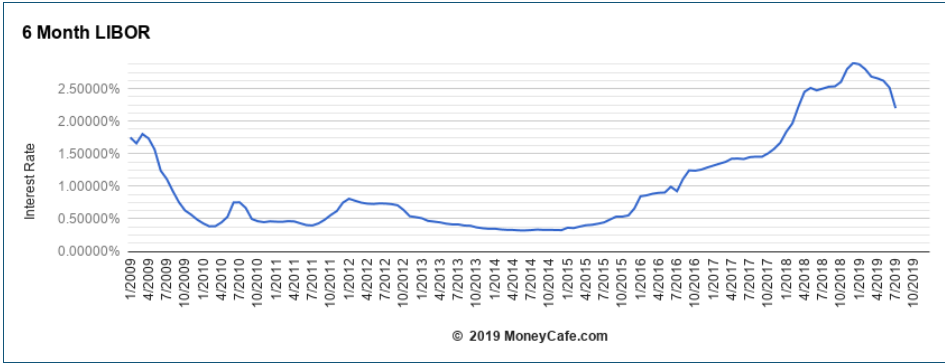

1.Libor Rolls Over with World Rates After Getting Above 2.5%

$200 trillion in loans based off libor…95% derivatives

Libor 6 Month Chart

https://www.moneycafe.com/6-month-libor/

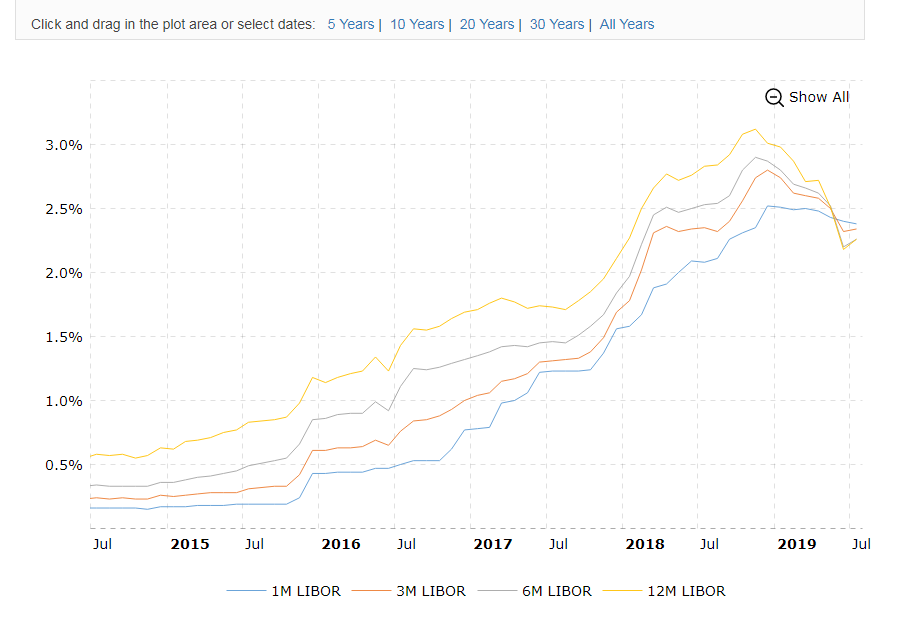

Libor 5 Year Chart

https://www.macrotrends.net/1433/historical-libor-rates-chart

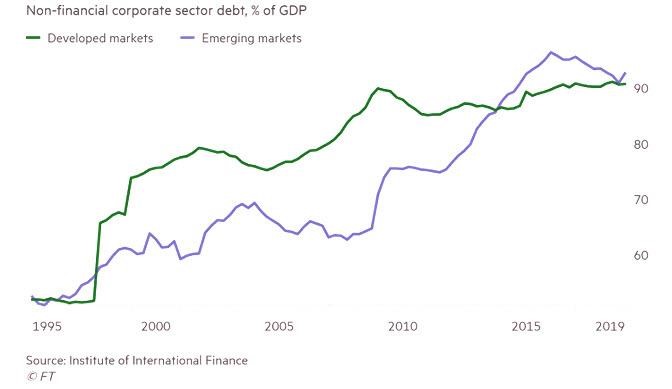

2.Global Debt $246 Trillion 320% of GDP.

Zerohedge

Global Debt Hits $246 Trillion, 320% Of GDP, As Developing Debt Hits All Time High by Tyler Durden

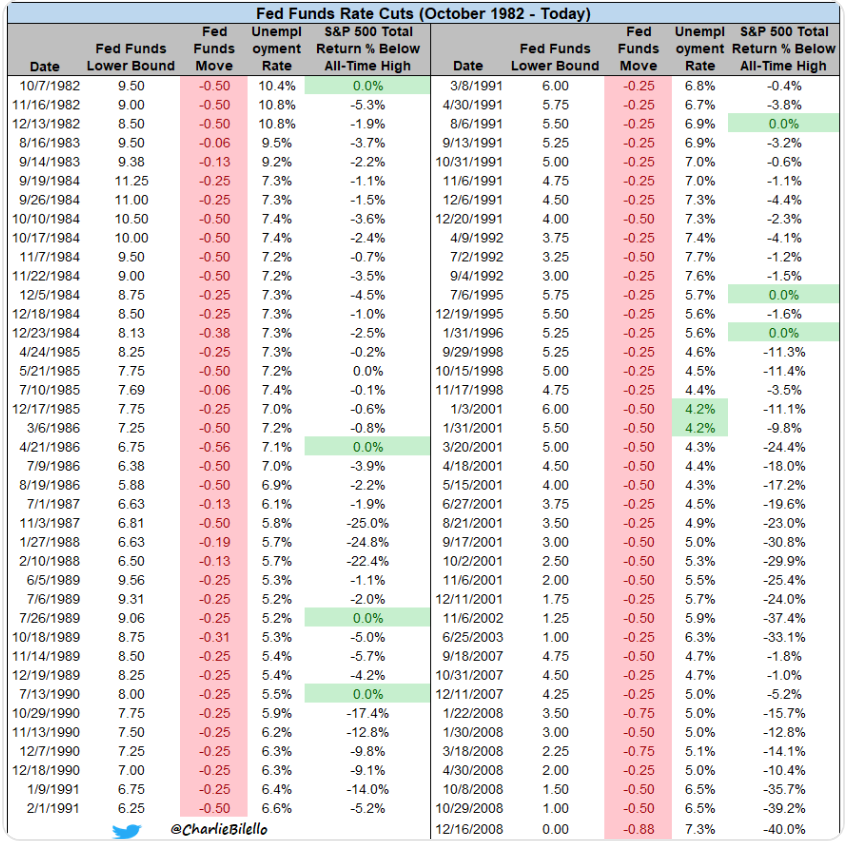

3.FED Has Never Cut Rates With Unemployment Below 4%.

Charlie BilelloVerified account @charliebilello

Since the Fed started specifically targeting the Fed Funds Rate in 1982… 1) It has cut rates w/ the S&P 500 at an all-time high 7 times, last in Jan 1996. 2) It has never cut rates w/ the Unemployment Rate below 4%. Lowest unemployment rate w/ a rate cut was 4.2% in Jan 2001.

4:16 AM – 11 Jul 2019

Rate cut with stock market at all-time highs? It’s been done before — but here’s what’s different

William Watts

4.NYSE Composite Still Has Not Hit New Highs

The S&P and Large Cap Growth Leading But Full Market Has Not Caught Up Yet.

What is the NYSE Composite Index

The NYSE Composite Index is an index that measures the performance of all stocks listed on the New York Stock Exchange. The NYSE Composite Index includes more than 1,900 stocks, of which over 1,500 are U.S. companies. Its breadth, therefore, makes it a much better indicator of market performance than narrow indexes that have far fewer components. The weights of the index constituents are calculated on the basis of their free-float market capitalization. The index itself is calculated on the basis of price return and total return, which includes dividends.

https://www.investopedia.com/terms/n/nysecompositeindex.asp

5.A Look at the Past 18 Months For Market.

Liz Ann Sonders

The past 18 months or so have kept stock market riders on the roller coaster. Each successive high in the S&P 500 has been slightly higher than the prior high, but with limited headway made overall, as you can see in the chart below. The latest new high for the S&P, as well as for the Dow Jones Industrial Average (Dow), crossed another pair of round number thresholds—3000 and 27,000, respectively (the NASDAQ crossed 8,000 last month). As for the limited headway, the S&P is less than 5% above its January 2018 high.

Source: Charles Schwab, Bloomberg, as of July 12, 2019.

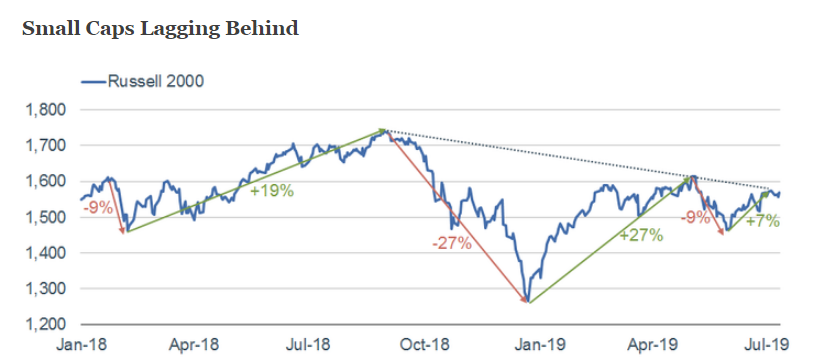

The story for smaller cap stocks is decidedly less compelling. Since peaking at the end of August last year, each successive peak in the Russell 2000 has been lower, as you can see in the chart below. It remains about 10% below its August 2018 peak. Although we may be getting close to a compelling valuation discount by small caps relative to large caps, for now we are sticking with the recommendation to overweight large caps at the expense of small caps.

Source: Charles Schwab, Bloomberg, as of July 12, 2019.

Round Here: Bulls Celebrate Round Numbers for U.S. Indexes

6.Earnings Season Kicks Off This Week.

Source: FactSet, Avalon Investment & Advisory as of July 15, 2019FactSet, Avalon Investment & Advisory as of July 15, 2019

Chart of the Week: Second quarter earnings season for the S&P 500 kicks off in earnest with 57 companies scheduled to report. Consensus is already expecting a second consecutive year-over-year decline in quarterly earnings with 1Q earnings finishing at -0.3% (see chart). Weakness in the global economy seems to be the primary culprit for the expected decline. Companies with greater non-U.S. sales have considerably lower expectations than those with a majority in domestic sales. This week brings a heavy dose of financial companies with the big banks reporting, but the schedule also includes other sectors including some big technology names like EBAY, IBM and MSFT. Despite the low expectations, this reporting period is not necessarily a headwind to stocks. Avalon expects 2Q earnings to beat expectations and may even squeak out a positive growth rate. In addition, stocks are clearly keying in on the probable “insurance” cuts from the Federal Reserve and the future outlook, so company guidance will also be key. Avalon still expects about 5% earnings growth for 2019 versus the consensus at 2.7%. This positive expectation relies on some improvement in the global economy in the second half of 2019 and stabilization in the trade war.

Bill Stone Avalon Advisors

http://avalonadvisors.com/wmg-7.15.2019.html

7.Mutual Funds Seeing Heavy Outflows as the S&P Hits New Highs.

Mutual Fund Flush

You won’t be disappointed! In last week’s Bespoke Report,

we looked at various measures of investor sentiment including flows into and

out of equity mutual funds. The table below provides a summary of mutual

fund flows through the latest reporting period last week showing actual flows

on the left and how those flows rank relative to history on the right. With

the stock market breaking out of its range to new all-time highs, you would

expect flows into equity mutual funds to be surging, and while there has been a

surge in mutual fund flows, the direction has been out of as opposed to into

stocks.

In the latest week, equity mutual funds saw nearly $17 billion in outflows,

bringing the four-week total of outflows to just under $44 bln. On a percentile

basis, those total outflows rank below the 2nd percentile relative to all prior

one-week periods in the last decade and below the 3rd percentile relative to

all other four-week periods. Not only has there been an exodus out of

equity mutual funds, but the declines have been broad-based across domestic and

global funds.

The fact that outflows have been so large just as the S&P 500 is hitting

new all-time highs is unique, to say the least. The chart below shows the

rolling four-week total of fund flows going back to the start of 2007. During

that time, there have only been eight other periods where the magnitude of

outflows from equity mutual funds has been more than $40 billion (as it is

now). If you look at the dates of each of those occurrences, more often

than not they were during periods of elevated volatility during a market

decline rather than in unison with an all-time high in the equity market.

https://www.bespokepremium.com/interactive/posts/think-big-blog/mutual-fund-flush

8.Amazon Prime Day Sales. +75% in 4 Years.

From Nasdaq Dorsey Wright

9.A major new study suggests it’s possible to avoid developing dementia — 5 ways to reduce your risk

The study was published Monday by scientists at the University of Exeter and presented at the Alzheimer’s Association International Conference 2019 in Los Angeles

Participants with high genetic risk and an unfavorable lifestyle were almost three times more likely to develop dementia versus those with a low genetic risk and favorable lifestyle.

Living a healthy lifestyle could help you reduce your risk of dementia, even if you have a genetic risk of the disease, a new study published in the peer-reviewed health journal JAMA found. The study analyzed data from 196,383 adults of European ancestry aged 60 and older. Of that sample, the researchers identified 1,769 cases of dementia over a follow-up period of eight years.

The risk of dementia was 32% lower in people with a high genetic risk if they had followed a healthy lifestyle, compared to those with an unhealthy lifestyle.

Here’s what they found: Participants with high genetic risk and an unfavorable lifestyle were almost three times more likely to develop dementia versus those with a low genetic risk and favorable lifestyle. However, the risk of dementia was 32% lower in people with a high genetic risk if they had followed a healthy lifestyle, compared to those with an unhealthy lifestyle.

“This research delivers a really important message that undermines a fatalistic view of dementia,” said co-lead author David Llewellyn, an associate professor at the University of Exeter Medical School and fellow at the Alan Turing Institute. “Some people believe it’s inevitable they’ll develop dementia because of their genetics.” This research, however, says that may not be the case.

Here’s what to avoid: The study, which was published Monday by scientists at the University of Exeter and presented at the Alzheimer’s Association International Conference 2019 in Los Angeles, looked at four main signs of a healthy versus unhealthy lifestyle. Those who were more likely to develop dementia reported eating an unhealthier diet higher in fat and sugar and salt, did not engage in regular physical activity, smoked cigarettes and consumed alcohol.

Drinking at least one artificially sweetened beverage daily was associated with almost three times the risk of developing stroke or dementia.

A 2017 study found a fifth item worth avoiding: Artificial sweeteners. “Drinking at least one artificially sweetened beverage daily was associated with almost three times the risk of developing stroke or dementia compared to those who drank artificially sweetened beverages less than once a week,” according to the study, published in the American Heart Association journal “Stroke.”

Beware of the medicine cabinet: Researchers also found a statistically significant association between dementia and exposure to anticholinergic drugs, especially antidepressants, anti-psychotic drugs, anti-Parkinson drugs, anti-epilepsy drugs and bladder antimuscarinics, which are used to treat urinary incontinence, according to another study in JAMA Internal Medicine.

Separate research published last month analyzed data from 284,343 patients in England aged 55 and up. They found “nearly a 50% increased odds of dementia” linked with exposure to more than 1,095 daily doses of anticholinergics over 10 years, “equivalent to three years’ daily use of a single strong anticholinergic medication at the minimum effective dose recommended for older people.”

“We found greater increases in risk associated with people diagnosed with dementia before the age of 80, which indicates that anticholinergic drugs should be prescribed with caution in middle-aged and older people,” the researchers wrote. Anticholinergic drugs block a neurotransmitter called acetylcholine in the nervous system.

One 2013 New England Journal of Medicine study found that the yearly dementia-attributable societal cost per person in 2010 was $41,689 to $56,290, depending on the calculation. Costs included nursing home care, out-of-pocket spending, home care and Medicare. A separate invited commentary also published this week in JAMA Internal Medicine praised the rigor of the new findings, but cautioned that more evidence was needed.

(Meera Jagannathan contributed to this story.)

10.6 Signs You’re Adaptable Enough to Succeed

Top leaders pivot like life is one fantastic salsa dance, so make change your friend.

By Wanda ThibodeauxCopywriter, TakingDictation.com@WandaThibodeaux

Few things in life are constant, except perhaps paradoxically, the need for change. And it is the ability to adapt, to modify what you do or think on the fly and over time, that arguably defines which leaders win the game and which ones get benched. This makes it critical to know the signs that you are adaptable enough.

1. You’re able to toss old data in favor of new information.

People who lack adaptability learn specific sets of knowledge and often become experts in applying that knowledge well. But when they are presented with something that challenges or dramatically builds on what they have learned, they reject it. If you can let go of what you’ve accepted before and rewrite your actions and beliefs according to new knowledge, this is a huge clue that you’re not stuck.

2. You don’t finish everything you start.

The “quitters never win, winners never quit” mentality is incredibly strong in business. But it’s rare to make a decision having 100 percent of the information you actually need–the best you usually can do is to use whatever data you’ve acquired until the moment where making a call isn’t optional anymore. Adaptable people know this and recognize that it’s going to lead to some failure. They do their absolute best but aren’t willing to waste their energy to save an already sinking ship. And if a better opportunity comes along, they’re totally willing to hand current projects off or sacrifice.

3. You don’t shy away from hypothetical scenarios.

It’s absolutely natural–and often even advisable–to turn to previous knowledge and experiences to problem solve. But if you’re asked a “what if” question and draw an absolute blank, it can be a signal that your attachment to previous methods or data is so strong that you can’t abandon it to imagine yourself in situations you’ve never been in. You might not yet have the ability to determine pros and cons of circumstances that haven’t happened to you.

4. You argue with civility.

Adaptable people will defend what they currently believe. But they also know they don’t know everything. They will ask questions and hear people out to determine whether their current data sets still are worth preserving, and they don’t get angry with others for introducing new concepts. And if they do lose a debate, they leave it with respect and even ask the winner to teach them.

5. You can give a lot of updates.

People with low adaptability don’t have much to say when catching up with old friends and colleagues, because they aren’t doing or achieving anything new to talk about. Your adaptability is probably high if you can share progress often or you’re surprising others with new accomplishments, pursuits or captivating stories.

6. You surround yourself with explorers.

People tend to hang around others who have similar beliefs, interests and behaviors. So adaptable people are the ones whose friends and colleagues are always searching, taking new opportunities and sharing the latest tidbit they’ve taken in. These individuals enjoy variety in their hobbies and daily schedule.

And if you score low after assessing yourself with these points? The good news is, like many other traits, adaptability is something you can learn to embrace. It all starts with just making teeny changes–for example, trying a new food, finding a new friend or reading a different genre of book–a little at a time. As your confidence grows, the changes you make can get bigger and more frequent. And if you can learn to pivot with purpose as you become more adaptable, you’ll be a force to reckon with.

PUBLISHED ON: JUL 16, 2019

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.